Renting vs. Owning Show

-

Upload

jafbey -

Category

Real Estate

-

view

307 -

download

0

Transcript of Renting vs. Owning Show

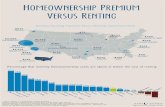

Renting vs Owning

Renting vs. Owning

1

IntroductionHousing Is the Largest ExpenditureAbout 1/3 of a persons income

Places to LiveHouse, Apartment, Condo, Duplex, Mobile Home, etc.

Two OptionsRentOwn

2

Renting TerminologyRentThe cost of using someone elses propertyTenant (Renter)The person who rents the property LandlordOwner of the rental property

3

Why Rent

Cant Afford a Home

Short-term Housing Option

Do Not Want to Own Home

4

Advantages of RentingLess ExpensiveNo down paymentCheaper monthly paymentFixed monthly expensesShorter commitmentLittle maintenance or repair workExtra amenitiesUtilities may be included

5

Disadvantages of RentingSubject To Lease TermRent may change with little noticeLess privacy and transient neighborsRestrictions on noise level Fewer decorating optionsNo equityNo tax deductionsProperty could be soldNo Pets

6

Home Ownership TerminologyHome ownership Buyer has purchased a housing unit as propertyEquityCurrent market value of a home minus the outstanding mortgage balance Down paymentAmount of money paid on the home at time of purchase 10 20% of the purchase price of the homeCollateral Item promised to the lender if the borrower does not pay back the loanUsually the home

7

Home Buying FactsMortgageHome loan90% of buyers take out a mortgageLargest financial decision

Recommended purchase price 2 times their annual household income

8

Advantages of OwnershipBuild Equity Use as collateral for other purchasesPride of ownershipMore privacyLarger living space and storageImprove credit ratingInvestment Free to make home improvements PetsIncome tax deductions

9

Disadvantages of OwnershipLarge down paymentMove-in costsInsurance costsCommitmenttime, money, and energyRepair and maintenance costsProperty taxes can raise substantiallyMoney is tied up in the homeRelocatesell time unknownPossible for property to decrease in value

10

Reasons for Making a Housing Choice$$Personal and financial goalsPersonal values, needs, and wantsCredit historyReal estate pricesLocation preferenceExpected length of stay in particular place

11

Costs of RentingMonthly rentSecurity depositAdvance payment to cover anything beyond normal wear and tear on the unitUtilities Electricity, Gas, Water, Trash Pick- up, etc.Renters insurance (optional)

12

Costs of OwnershipMonthly mortgage payments Down payment (one time cost)Closing costs (one time cost)Utilities electricity, water, garbage, etc.Homeowners insuranceReal estate property taxesMaintenance

13