RENEWABLE ENERGY & 2019 ENERGY EFFICIENCY PROGRAMS … · RENEWABLE ENERGY & ENERGY EFFICIENCY...

Transcript of RENEWABLE ENERGY & 2019 ENERGY EFFICIENCY PROGRAMS … · RENEWABLE ENERGY & ENERGY EFFICIENCY...

2019REF

RHODE ISLANDRENEWABLE ENERGY ampENERGY EFFICIENCY PROGRAMS

eBook

1

The Commerce Corporation Renewable Energy Fund (REF) is dedicated to increasing the role of renewable energy throughout the state The REF hopes to develop an integrated organizational structure for RI and its citizens to reap the full benefits of the cost-effective renewable energy development from diverse sources

Mission Statement

2

Disclaimer

The information contained within this eBook is strictly for educational purposes This eBook contains information that is intended to help the readers be better informed about the current Rhode Island programs available within renewable energy and energy efficiency It is presented as general surface level information on programs available Please be advised that this may not contain all programs and program requirements Programs are continuously subject to change Please consult directly with the program providers for further details of the programs availabilities and requirements

TA B L E O F C O N T E N T S

Mission Statement

How It Works

Key Terms

Residential

Commercial

Farm-Agriculture

Municipal-State-Fed

Institutions-Nonprofits

Community Solar Programs

2

4

5

6

9

12

15

18

21

REF

Click on icon to link to sector

3

How It Works

The purpose of this eBook is to provide Rhode Islanders with basic information on the types of Renewable Energy and Energy Efficiency Programs available in Rhode Island

bull Each sector will have its own icon (as presented on the Table of Contents page) Programs shown under each sector icon have offerings for the indicated sector

bull There are logos presented on the programs to illustrate the providers of the program

bull Information including the providers incentives eligibilities deadlines etc is shown next to each program

bull Click on the logo near any program to be directed to the programrsquos website

Icon indicating sectorName of

Program

Energy Efficiency

Renewable Energy

Click on logo to link to the providers website

Program Information

4

Key Terms

A government grant is a financial award given by the federal state or local government to an eligible grantee Government grants are not expected to be repaid and do not include technical assistance or other financial assistance such as a loan or loan guarantee an interest rate subsidy direct appropriation or revenue sharing

(FIT) is a policy mechanism designed to encourage the adoption of renewable energy sources It typically includes three key provisions 1) guaranteed grid access 2) long-term contracts for the electricity produced and 3) purchase prices that are methodologically based on the cost of renewable energy generation Under a feed-in tariff an obligation is imposed on regional or national electricity utilities to buy renewable electricity from all eligible participants

A billing mechanism that credits solar energy system owners for the electricity they add to the grid For example if a residential customer has a PV system on the homersquos rooftop it may generate more electricity than the home uses during daylight hours If the home is net-metered the electricity meter will run backwards to provide a credit against what electricity is consumed at night or other periods where the homersquos electricity use exceeds the systemrsquos output

An action or something that incites or tends to incite to action or greater effort as a reward offered for increased productivity sharing

Act of giving money property or other material goods to another party in exchange for future repayment of the principal amount along with interest andor other finance charges

(PBI) are incentives that are paid based on the actual energy production of the solar system Typically these are paid based on an energy ($kWh) basis over a period of time This is different from the approach where a one-time rebate is provided Feed-in tariffs (FIT) are a common type of PBI

Rebate

Tax Credit

Loan

Performance-Based

Incentive

Tiered Campaign

Incentive

Feed-InTariff

Net Metering

A campaign in which the more people who sign up for a program the lower the cost is for everybody

An amount of money a taxpayer is able to subtract from taxes owed to the government

Money that is returned to you after you pay for goods or services done in order to make the sale more attractive

Click on word to link to source

Grant

5

Virtual net metering (VNM) is a bill crediting system for community solar It refers to when solar is not used on-site but is instead externally installed and shared among subscribers In this case you receive credits on your electric bill for excess energy produced by your share of a solar garden

VirtualNet

Metering

R E S I D E N T I A L

01

6

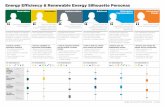

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull National Grid

National Grid performs energy assessments for Rhode Island residents to become more energy efficient

Website httpswwwnationalgriduscomRI-HomeEnergy-Saving-ProgramsHome-Checkups-Weatherization

bull Free bull Building owner must sign up for audit

bull NA

bull National Grid

National Grid provides customersrsquo rebates for various energy efficiency installationsPlease visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

bull NA

bull National Grid

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

bull NA

bull National Grid

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

bull NA

bull National Grid

National Grid provides information and rebates to Rhode island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

bull Rebate bull Available for qualifying Energy Star appliances

bull NA

bull US Federal Government

The Investment Tax Credit (ITC) is currently a 30 federal tax credit claimed against the solar installation to reduce the income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have them installed on their homes In the case of the Section 48 credit the business that installs develops andor finances the project claims the creditWebsite httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 (2023)

RE

SID

EN

TIA

L

7

HomeEnergyAssessment

Energy EfficientHeating Systems

Energy EfficientCooling Systems

Energy EfficientLighting

EnergyEfficientAppliances

The FederalInvestment Tax Credit(ITC)

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommunity-renewables

bull Virtual Net Metering ndash Grant

bull National Grid customers with an A60 or A16 rate code

bull Low to Moderate Income Housing sector- per qualification

bull All other sectors must be approved by REF staffrdquo

bull Open on a rolling basis until funding is reached

bull National Grid

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In-Tariff bull Residential customers or their developers may apply for the RE Growth Program on a first come first served basis

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

RE

SID

EN

TIA

L

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

8

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

CommunityRenewables

RenewableEnergy GrowthProgram

REF

Small ScaleProgram

REF

02

C O M M E R C I A L

9

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

National Grid provides customersrsquo rebates for various energy efficiency installations Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Available for qualifying Energy Star appliances and heating and hot water systems

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull NA

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Island|Elec-tric|Lighting

bull NA

bull NA

bull NA

bull NAbull Rebate

bull Rebate

bull Rebate

bull Rebate

bull Rebate

National Grid provides information and rebates to Rhode Island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systemsNatural gas availability automatic repowering cooling system and a central boiler plantspace heating

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Available for qualifying Energy Star appliances

bull 120 + rooms

CO

MM

ER

CIA

L

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull US Federal Government

The Investment Tax Credit (ITC) is currently a 30 federal tax credit claimed against the solar installation to reduce the income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have them installed on their homes In the case of the Section 48 credit the business that installs develops andor finances the project claims the creditWebsite httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 after 2023

bull Available for qualifying high-efficiency heating and hot water systems

bull Available for qualifying Energy Star lightbulbs

10

Energy Efficient Heating Systems

Energy Efficient Cooling Systems

Energy Efficient Lighting

Energy Efficient Appliances

Combined Heat amp Power

The FederalInvestmentTax Credit(ITC)

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

bull Loan bull Commercial property owners in a participating municipality

bull Commercial property owners include office retail hotel industrial manufacturing non-profit amp multi-family (5+) properties

bull Rolling

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-Profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Businessesbull Institutionsbull Non-profitsbull Municipalitiesbull State Facilities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Rhode Island Infrastructure Bank (RIIB)

11

bull National Grid bull Feed-In-Tariff bull Residential customers may apply for RE Growth Program on a first come first served basis

RI Commercial Property Assessed Clean Energy (C-PACE)

Small ScaleProgram

CommercialScale Program

RenewableEnergy Growth Program

CO

MM

ER

CIA

L

C-PACE enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 yearsWebsite httpri-cpacecom

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff term REF funded projects are non-eligibleNon Residential customers may apply for RE Growth Program through three open enrollments per calender year Enrollment will use an online application that will be open for two weeks

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

REF

REF

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

03

F A R M - A G R I C U LT U R E

12

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull United States Department of Agriculture (USDA)

Provides loan financing and grant funding to agricultural producers and rural small businesses to purchase and install renweable energy systems or make energy efficiency improvements Grant Incentive = up to 25 of the total project costMin RE Grant =$2500Max RE Grant $500000Min EE grant = $1500Max EE Grant =$250000Loans provide financing up 75

Website httpswwwrdusdagovprograms-servicesrural-energy-america-program-renewable-ener-gy-systems-energy-efficiencyri

bull Grantbull Loan Guarantee

bull Agricultural producersbull Rural small businesses

bull RI Dept of Environmental Management

bull RI Resource Conservation amp Development Area Council

bull RI Office of Energy Resources

The Rhode Island Agricultural Energy Program is a competitive grant program for the implementation of agricultural projects that improve energy efficiency andor facilitate renewable energy

Minimum Grant Request $2500 Maximum Grant Request $20000

Website httpwwwrifarmenergyorgfundinghtm

bull Grant bull Agricultural Operation

bull RI Office of Energy Resources

The Rhode Island Office of Energy Resources in collaboration with National Grid offers free energy efficiency audits for farms Incentives and rebates are available for many energy efficient measures To get started please call 1-800-322-333 and identify yourself as a farm

Website httpwwwenergyrigovdocumentsfarmFarm20Energy20Efficiency20Program20Flyerpdf

bull Free energy assessment incentives for recommended efficiency improvements

bull National Grid customers that own or rent a farm in Rhode Island

bull Rhode Island Infrastructure Bank (RIIB)

bull Loan bull Commercial property owners in a participating municipality

bull Commercial property owners

Rural Energy for America Program(REAP)

Rhode Island Agricultural Energy Program (RIAgEP)

Farm Energy Efficiency Program

Rhode IslandCommercialPropertyAssessed Clean Energy (C-Pace)

C-PACE enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 years

Website httpri-cpacecom

bull 33118 (All size)bull 103118 (less than

$20000 only)bull Loan guarantees

funded monthly

bull March 29 2019 bull October 18 2019

bull Ongoing

bull Rolling

FA

RM

- A

GR

ICU

LTU

RE

13

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-Profitsbull State Facilities

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Businessesbull Institutionsbull Non-Profitsbull Municipalitiesbull State Facilities

bull National Grid

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff term

REF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff

bull Residential customers may apply for the RE Growth Program on a first come first serve basis

bull US Federal Government

ITC is a 30 federal tax credit claimed against the solar installation to reduce income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have installed on their homes In the case of the Section 48 credit the business that installs develops or finances the project claims the credit

Website httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

RenewableEnergyGrowthProgram

The FederalInvestment Tax Credit

Small ScaleProgram

CommercialScaleProgram

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds ldquo

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 after 2023

FA

RM

- A

GR

ICU

LTU

RE

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

14

REF

REF

04

M U N I C I PA L - S TAT E - F E D

15

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

National Grid provides customersrsquo rebates for various energy efficiency installations Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medi-um=radio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medi-um=radio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

National Grid provides information and rebates to Rhode Island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

bull Rebate bull Available for qualifying Energy Star appliances

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull National Grid

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systems

bull Natural gas availability automatic repowering cooling system and central boiler plant space heating

bull Avg electricity rate over $010 kWhhour

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Rebate bull 120 + rooms

EnergyEfficientAppliances

CombinedHeat amp Power

Energy Efficient Lighting

bull NA

bull NA

bull NA

bull NA

bull NA

Energy Efficient Heating Systems

Energy Efficient CoolingSystems

MU

NIC

IPA

L-S

TA

TE

-FE

D

16

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull RI Office of Energy Resources

bull Rhode Island Infrastructure Bank (RIIB)

The Efficient Buildings Fund (EBF) provides attractive long-term financing to municipalities and quasi-public agencies for the completion of energy efficiency and renewable energy projects EBF seeks to finance energy retrofits in public buildings that will result in electric and heating savings greater than 20 across all properties receiving improvements

Website httpswwwriiborgebf

bull Loan bull Local government unitsbull Municipalitiesbull Public Schoolsbull Quasi-state agencies

bull Ongoing ndash please check website for details

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Net Metering ndash Grant

bull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Feed-In Tariff bull Residential customers or their developers may apply for the Program on a first come first served basis

MU

NIC

IPA

L-S

TA

TE

-FE

D

bull Please check website for current enrollment periods

bull All non-residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

bull National Grid

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

17

Small ScaleProgram

CommercialScaleProgram

Renewable Energy Growth Program

Efficient Buildings Fund Programs (EBF)

REF

REF

05

I N S T I T U T I O N Samp N O N - P R O F I T S

18

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull National Grid

The RE Growth Program enables customers to sell their generation output underlong-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligibleWebsite httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff bull Residential customers or their developers may apply for the program on a first come first served basis

bull National Grid

National Grid provides customersrsquo rebates for various energy efficiency installationsPlease visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

bull NA

bull National Grid

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

bull NA

bull National Grid

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

bull NA

bull National Grid

National Grid provides information and rebates to Rhode island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates20sfrne20listed20S20website

bull Rebate bull Available for qualifying Energy Star appliances

bull NA

bull National Grid

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systems

bull Natural gas availability automatic repowering cooling system and central boiler plant space heating

bull Avg electricity rate over $010 kWhhour

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Rebate bull 120 + rooms bull NA

RenewableEnergy Growth Program

EnergyEfficientAppliances

CombinedHeat amp Power

Energy EfficientCooling Systems

Energy EfficientHeating Systems

EnergyEfficientLighting

INS

TIT

UT

ION

S amp

NO

N-P

RO

FIT

S

bull Please check website for current enrollment periods

bull All non-residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

19

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull Rhode Island Infrastructure Bank (RIIB)

Enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 years

Website httpsri-cpacecom

bull Loan bull Commercial property owners in a participating municipality

bull Rolling

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Net Metering ndash Grant

bull Businessesbull Instituationsbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

Small ScaleProgram

CommercialScale Program

Rhode IslandCommercialPropertyAssessed Clean Energy (C-Pace)

INS

TIT

UT

ION

S amp

NO

N-P

RO

FIT

S

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

20

REF

REF

06

C O M M U N I T Y S O L A R P R O G R A M S

21

22

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

1) Allows commercial and municipal sectors to receive net metering credits from remote systems sharing credits to spread solar benefits 2) Limit on value of credits 3) Competitive price under a different higher ceiling price 4) Separate classes for CRDG facilities 5) Monetizes credits 6) 6MW 2017 Program Year allocationWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull National Grid

1) Small and Medium Scale Solar installation customers may share bill credits with other nearby electric service accounts 2) Provides flexibility for locating arrays owner-tenant situations multifamilymulti- business buildings corporate campuses etc 3) Monetizes credits 4) Small Scale choice of 15-20 year tariff 5) Medium Scale 20 year tariffWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff bull Residentialbull Commercial

bull Small Scale on going enrollment first come first served basis

bull Medium ndash Non-competitive during open enrollment

bull National Grid

1) Expands net metering credits from remote systems to include residential customers 2) No one qualified generation system can exceed 10mW capacity 3) Establishes 30MW community remote net metering pilot (CNMP) which will be administered until Dec 31 2018 4) Allows for third Party Ownership of net metered systems

Website httpswww9nationalgriduscomnarragansettbusinessenergyeff4_net-mtrasp

bull Net Metering bull Residentialbull Individual LMI rate code

also eligible

bull Rolling

1) Compliments National Gridrsquos CNMP 30MW Pilot Program 2) Funds community solar projects incentivizing residential offtakers to adopt solar renewable energy systems 3) Creates renewable energy accessibility for the LMI communities4) Rate code and Flat bill credit grant a) LMI- rate code A-60 $500host customer b) Basic residential ndash rate code A-16 $300host customerWebsite httpcommercericomfinance-businessrenewable-energy-fundcommunity-renewables

bull Net Meteringbull Grant

bull National Grid homeowner or rental customers only

bull Not eligible to renters in multi-family developments

bull Stand alone individual account holders only are elibible

bull Rollingbull (Aligns with CNMP

Pilot 30MW)

Community Net Metering Pilot (CNMP)

Community Renewables

bull National Grid bull Feed-In Tariff bull Small Scale Commercialbull Large Scale Commercialbull Residential

bull Three 2 week Open enrollments per year (check website link)

bull National Grid

Allows all eligible sectors to receive net metering credits from remote off-site qualified generation systemsWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_net-mtrasp

bull Net Metering bull Municipalbull Public Housingbull State Entitiesbull Quasi-publicbull Educational Institutionsbull Hospitalsbull Non-profitsbull Federal Governmentbull PublicPrivate Partnerships

bull Rolling

Virtual Net Metering

Community Remote Distributed Generation(CRDG)

Shared Solar

CO

MM

UN

ITY

SO

LA

R P

RO

GR

AM

S

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

REF

United States Department of Agriculture (USDA)

Rhode Island Farm Energy

Rhode Island National Grid

The USDA Rural Development are committed to helping improve the economy and quality of life in rural America Through our programs we help rural Americans in many ways We offer loans grants and loan guarantees to help create jobs and support economic development and essential services such as housing health care first responder services and equipment and water electric and communications infrastructure We promote economic development by supporting loans to businesses through banks credit unions and community-managed lending pools We offer technical assistance and information to help agricultural producers and cooperatives get started and improve the effectiveness of their operations We provide technical assistance to help communities undertake community empowerment programs We help rural residents buy or rent safe affordable housing and make health and safety repairs to their homes

The Rhode Island Farm Energy Program (RIFEP) is a project of the Rhode Island Resource Conservation and Development Area Council Inc that serves as a resource on energy as it relates to agriculture in Rhode Island The Rhode Island Farm Energy Program provides agriculture Producers and agriculture-based Small Businesses with current information on energy grant opportunities and supportive events

ldquoHere with you Here for yourdquo At National Grid we are committed to delivering safe and reliable energy to the customers and communities we serve

We are one of the largest investor-owned energy companies in the world ndash covering Massachusetts New York Rhode Island and the UK

We are at the heart of one of the greatest challenges facing our society ndash delivering clean energy to support our world long into the future Every day we work with stakeholders to promote the development and implementation of sustainable innovative and affordable energy solutions

We are proud of the contributions our work and our people make to the prosperity and well-being of our customers communities and investors

In Partnership WithClick on logo to view website

23

EMAIL DISTRIBUTEDGENERATIONNATIONALGRIDCOMWEBSITE WWWNGRIDCOMSAVE

EMAIL RIRCD2283GMAILCOMWEBSITE HTTPWWWRIFARMENERGYORGFUNDINGHTM

EMAIL JONATHANBURNSMAUSDAGOVWEBSITE HTTPSWWWRDUSDAGOVPROGRAMS-SERVICESRURAL-ENERGY-AMERICA-PROGRAM-RENEWABLE-ENERGY-SYSTEMS-ENERGY-EFFICIENCYRI

In Partnership With (cont)

Rhode Island Office of Energy Resources (OER)

Rhode Island Infrastructure Bank (RIIB)

Commercial Property Assessed Clean Energy (C-PACE)

The Office of Energy Resources (OER) is Rhode Islandrsquos lead state agency on energy policy and programs The mission of OER is to lead Rhode Island to a secure cost-effective and sustainable energy future

OER works closely with private and public stakeholders to increase the reliability and security of our energy supply reduce energy costs and mitigate price volatility and improve environmental quality Rhode Islanders spend over $3 billion per year on energy to light their homes keep the heat on and fuel their vehicles Fossil fuels such as natural gas fuel oil and gasoline supply the vast majority of these energy needs By developing and implementing smart energy policiesmdashsuch as those that promote energy efficiency and renewable energymdashOER helps reduce Rhode Islandrsquos dependence on these out-of-state fuels advancing our State as a national leader in the new clean energy economy

Established in 1989 Rhode Island Infrastructure Bank works collaboratively with public and private capital providers to develop and deploy solutions that support and finance investments in the Statersquos infrastructure and green energy initiatives Our innovative loan programs for municipalities quasi-public agencies and private property owners accelerate investments that create jobs promote economic development and enhance the environment

C-PACE enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 years

Click on logo to view website

EMAIL ENERGYRESOURCESENERGYRIGOVWEBSITE HTTPWWWENERGYRIGOV

24

EMAIL INFORIIBORGWEBSITE WWWRIIBORG

EMAIL INFORI-CPACECOM WEBSITE HTTPRI-CPACECOM

In Partnership With (cont)Click on logo to view website

Rhode Island Renewable Energy Fund (REF)

The Commerce Corporation Renewable Energy Fund (REF) is dedicated to increasing the role of renewable energy throughout the state The REF hopes to develop an integrated organizational structure for RI and its citizens to reap the full benefits of the cost-effective renewable energy development from diverse sources

REF provides grants for renewable energy projects with the potential to make electricity in a cleaner more sustainable manner while stimulating job growth in the green technology and energy sectors of Rhode Islandrsquos economy Using funds from the ldquosystem benefit chargerdquo on electric bills and Alternative Compliance Payments the Commerce Corporation funds renewable energy projects in Small-Scale solar Commercial Scale and Community Renewables

REF

EMAIL REFCOMMERCERICOMWEBSITE HTTPCOMMERCERICOMFINANCE-BUSINESSRENEWABLE-ENERGY-FUND

Renew Energy Initiative (REI)Vision To make southern New England the place to be for sustainable and prosperous living Mission To promote the expansion of alternative energy and energy-efficiency in organizations throughout Southern New England As a nexus to industry experts policy information and innovative technologies REI seeks to increase corporate competitiveness boost energy efficiency and advocate for alternative energies

EMAIL INFOREITEAMORGWEBSITE HTTPWWWREITEAMORG

25

ANY QUESTIONS

REF 21718 26

REF

- Button 5

- Button 4

- Button 6

- Button 7

- Button 8

- Button 9

- Button 10

- Button 1

- Button 3

The Commerce Corporation Renewable Energy Fund (REF) is dedicated to increasing the role of renewable energy throughout the state The REF hopes to develop an integrated organizational structure for RI and its citizens to reap the full benefits of the cost-effective renewable energy development from diverse sources

Mission Statement

2

Disclaimer

The information contained within this eBook is strictly for educational purposes This eBook contains information that is intended to help the readers be better informed about the current Rhode Island programs available within renewable energy and energy efficiency It is presented as general surface level information on programs available Please be advised that this may not contain all programs and program requirements Programs are continuously subject to change Please consult directly with the program providers for further details of the programs availabilities and requirements

TA B L E O F C O N T E N T S

Mission Statement

How It Works

Key Terms

Residential

Commercial

Farm-Agriculture

Municipal-State-Fed

Institutions-Nonprofits

Community Solar Programs

2

4

5

6

9

12

15

18

21

REF

Click on icon to link to sector

3

How It Works

The purpose of this eBook is to provide Rhode Islanders with basic information on the types of Renewable Energy and Energy Efficiency Programs available in Rhode Island

bull Each sector will have its own icon (as presented on the Table of Contents page) Programs shown under each sector icon have offerings for the indicated sector

bull There are logos presented on the programs to illustrate the providers of the program

bull Information including the providers incentives eligibilities deadlines etc is shown next to each program

bull Click on the logo near any program to be directed to the programrsquos website

Icon indicating sectorName of

Program

Energy Efficiency

Renewable Energy

Click on logo to link to the providers website

Program Information

4

Key Terms

A government grant is a financial award given by the federal state or local government to an eligible grantee Government grants are not expected to be repaid and do not include technical assistance or other financial assistance such as a loan or loan guarantee an interest rate subsidy direct appropriation or revenue sharing

(FIT) is a policy mechanism designed to encourage the adoption of renewable energy sources It typically includes three key provisions 1) guaranteed grid access 2) long-term contracts for the electricity produced and 3) purchase prices that are methodologically based on the cost of renewable energy generation Under a feed-in tariff an obligation is imposed on regional or national electricity utilities to buy renewable electricity from all eligible participants

A billing mechanism that credits solar energy system owners for the electricity they add to the grid For example if a residential customer has a PV system on the homersquos rooftop it may generate more electricity than the home uses during daylight hours If the home is net-metered the electricity meter will run backwards to provide a credit against what electricity is consumed at night or other periods where the homersquos electricity use exceeds the systemrsquos output

An action or something that incites or tends to incite to action or greater effort as a reward offered for increased productivity sharing

Act of giving money property or other material goods to another party in exchange for future repayment of the principal amount along with interest andor other finance charges

(PBI) are incentives that are paid based on the actual energy production of the solar system Typically these are paid based on an energy ($kWh) basis over a period of time This is different from the approach where a one-time rebate is provided Feed-in tariffs (FIT) are a common type of PBI

Rebate

Tax Credit

Loan

Performance-Based

Incentive

Tiered Campaign

Incentive

Feed-InTariff

Net Metering

A campaign in which the more people who sign up for a program the lower the cost is for everybody

An amount of money a taxpayer is able to subtract from taxes owed to the government

Money that is returned to you after you pay for goods or services done in order to make the sale more attractive

Click on word to link to source

Grant

5

Virtual net metering (VNM) is a bill crediting system for community solar It refers to when solar is not used on-site but is instead externally installed and shared among subscribers In this case you receive credits on your electric bill for excess energy produced by your share of a solar garden

VirtualNet

Metering

R E S I D E N T I A L

01

6

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull National Grid

National Grid performs energy assessments for Rhode Island residents to become more energy efficient

Website httpswwwnationalgriduscomRI-HomeEnergy-Saving-ProgramsHome-Checkups-Weatherization

bull Free bull Building owner must sign up for audit

bull NA

bull National Grid

National Grid provides customersrsquo rebates for various energy efficiency installationsPlease visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

bull NA

bull National Grid

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

bull NA

bull National Grid

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

bull NA

bull National Grid

National Grid provides information and rebates to Rhode island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

bull Rebate bull Available for qualifying Energy Star appliances

bull NA

bull US Federal Government

The Investment Tax Credit (ITC) is currently a 30 federal tax credit claimed against the solar installation to reduce the income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have them installed on their homes In the case of the Section 48 credit the business that installs develops andor finances the project claims the creditWebsite httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 (2023)

RE

SID

EN

TIA

L

7

HomeEnergyAssessment

Energy EfficientHeating Systems

Energy EfficientCooling Systems

Energy EfficientLighting

EnergyEfficientAppliances

The FederalInvestment Tax Credit(ITC)

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommunity-renewables

bull Virtual Net Metering ndash Grant

bull National Grid customers with an A60 or A16 rate code

bull Low to Moderate Income Housing sector- per qualification

bull All other sectors must be approved by REF staffrdquo

bull Open on a rolling basis until funding is reached

bull National Grid

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In-Tariff bull Residential customers or their developers may apply for the RE Growth Program on a first come first served basis

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

RE

SID

EN

TIA

L

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

8

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

CommunityRenewables

RenewableEnergy GrowthProgram

REF

Small ScaleProgram

REF

02

C O M M E R C I A L

9

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

National Grid provides customersrsquo rebates for various energy efficiency installations Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Available for qualifying Energy Star appliances and heating and hot water systems

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull NA

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Island|Elec-tric|Lighting

bull NA

bull NA

bull NA

bull NAbull Rebate

bull Rebate

bull Rebate

bull Rebate

bull Rebate

National Grid provides information and rebates to Rhode Island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systemsNatural gas availability automatic repowering cooling system and a central boiler plantspace heating

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Available for qualifying Energy Star appliances

bull 120 + rooms

CO

MM

ER

CIA

L

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull US Federal Government

The Investment Tax Credit (ITC) is currently a 30 federal tax credit claimed against the solar installation to reduce the income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have them installed on their homes In the case of the Section 48 credit the business that installs develops andor finances the project claims the creditWebsite httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 after 2023

bull Available for qualifying high-efficiency heating and hot water systems

bull Available for qualifying Energy Star lightbulbs

10

Energy Efficient Heating Systems

Energy Efficient Cooling Systems

Energy Efficient Lighting

Energy Efficient Appliances

Combined Heat amp Power

The FederalInvestmentTax Credit(ITC)

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

bull Loan bull Commercial property owners in a participating municipality

bull Commercial property owners include office retail hotel industrial manufacturing non-profit amp multi-family (5+) properties

bull Rolling

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-Profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Businessesbull Institutionsbull Non-profitsbull Municipalitiesbull State Facilities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Rhode Island Infrastructure Bank (RIIB)

11

bull National Grid bull Feed-In-Tariff bull Residential customers may apply for RE Growth Program on a first come first served basis

RI Commercial Property Assessed Clean Energy (C-PACE)

Small ScaleProgram

CommercialScale Program

RenewableEnergy Growth Program

CO

MM

ER

CIA

L

C-PACE enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 yearsWebsite httpri-cpacecom

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff term REF funded projects are non-eligibleNon Residential customers may apply for RE Growth Program through three open enrollments per calender year Enrollment will use an online application that will be open for two weeks

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

REF

REF

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

03

F A R M - A G R I C U LT U R E

12

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull United States Department of Agriculture (USDA)

Provides loan financing and grant funding to agricultural producers and rural small businesses to purchase and install renweable energy systems or make energy efficiency improvements Grant Incentive = up to 25 of the total project costMin RE Grant =$2500Max RE Grant $500000Min EE grant = $1500Max EE Grant =$250000Loans provide financing up 75

Website httpswwwrdusdagovprograms-servicesrural-energy-america-program-renewable-ener-gy-systems-energy-efficiencyri

bull Grantbull Loan Guarantee

bull Agricultural producersbull Rural small businesses

bull RI Dept of Environmental Management

bull RI Resource Conservation amp Development Area Council

bull RI Office of Energy Resources

The Rhode Island Agricultural Energy Program is a competitive grant program for the implementation of agricultural projects that improve energy efficiency andor facilitate renewable energy

Minimum Grant Request $2500 Maximum Grant Request $20000

Website httpwwwrifarmenergyorgfundinghtm

bull Grant bull Agricultural Operation

bull RI Office of Energy Resources

The Rhode Island Office of Energy Resources in collaboration with National Grid offers free energy efficiency audits for farms Incentives and rebates are available for many energy efficient measures To get started please call 1-800-322-333 and identify yourself as a farm

Website httpwwwenergyrigovdocumentsfarmFarm20Energy20Efficiency20Program20Flyerpdf

bull Free energy assessment incentives for recommended efficiency improvements

bull National Grid customers that own or rent a farm in Rhode Island

bull Rhode Island Infrastructure Bank (RIIB)

bull Loan bull Commercial property owners in a participating municipality

bull Commercial property owners

Rural Energy for America Program(REAP)

Rhode Island Agricultural Energy Program (RIAgEP)

Farm Energy Efficiency Program

Rhode IslandCommercialPropertyAssessed Clean Energy (C-Pace)

C-PACE enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 years

Website httpri-cpacecom

bull 33118 (All size)bull 103118 (less than

$20000 only)bull Loan guarantees

funded monthly

bull March 29 2019 bull October 18 2019

bull Ongoing

bull Rolling

FA

RM

- A

GR

ICU

LTU

RE

13

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-Profitsbull State Facilities

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Businessesbull Institutionsbull Non-Profitsbull Municipalitiesbull State Facilities

bull National Grid

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff term

REF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff

bull Residential customers may apply for the RE Growth Program on a first come first serve basis

bull US Federal Government

ITC is a 30 federal tax credit claimed against the solar installation to reduce income taxes that a person or company claiming the credit would otherwise pay the federal government The Section 25D residential ITC allows the homeowner to apply the credit to hisher personal income taxes This credit is used when homeowners purchase solar systems outright and have installed on their homes In the case of the Section 48 credit the business that installs develops or finances the project claims the credit

Website httpwwwseiaorgpolicyfinance-taxsolar-investment-tax-credit

bull Tax Credit bull Homeownersbull Commercial Propertiesbull Utility Investors in Solar

energy property

RenewableEnergyGrowthProgram

The FederalInvestment Tax Credit

Small ScaleProgram

CommercialScaleProgram

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds ldquo

bull 30 (2019)bull 26 (2020)bull 22 (2021)bull 0 residential amp

permanent 10 after 2023

FA

RM

- A

GR

ICU

LTU

RE

bull Please check website for current enrollment periods

bull All non residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

14

REF

REF

04

M U N I C I PA L - S TAT E - F E D

15

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

National Grid provides customersrsquo rebates for various energy efficiency installations Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medi-um=radio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medi-um=radio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

National Grid provides information and rebates to Rhode Island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates sfrne listed S website

bull Rebate bull Available for qualifying Energy Star appliances

bull National Grid

bull National Grid

bull National Grid

bull National Grid

bull National Grid

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systems

bull Natural gas availability automatic repowering cooling system and central boiler plant space heating

bull Avg electricity rate over $010 kWhhour

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Rebate bull 120 + rooms

EnergyEfficientAppliances

CombinedHeat amp Power

Energy Efficient Lighting

bull NA

bull NA

bull NA

bull NA

bull NA

Energy Efficient Heating Systems

Energy Efficient CoolingSystems

MU

NIC

IPA

L-S

TA

TE

-FE

D

16

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull RI Office of Energy Resources

bull Rhode Island Infrastructure Bank (RIIB)

The Efficient Buildings Fund (EBF) provides attractive long-term financing to municipalities and quasi-public agencies for the completion of energy efficiency and renewable energy projects EBF seeks to finance energy retrofits in public buildings that will result in electric and heating savings greater than 20 across all properties receiving improvements

Website httpswwwriiborgebf

bull Loan bull Local government unitsbull Municipalitiesbull Public Schoolsbull Quasi-state agencies

bull Ongoing ndash please check website for details

The RE Growth Program enables customers to sell their generation output under long-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligible

Website httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Net Metering ndash Grant

bull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Feed-In Tariff bull Residential customers or their developers may apply for the Program on a first come first served basis

MU

NIC

IPA

L-S

TA

TE

-FE

D

bull Please check website for current enrollment periods

bull All non-residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

bull National Grid

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

17

Small ScaleProgram

CommercialScaleProgram

Renewable Energy Growth Program

Efficient Buildings Fund Programs (EBF)

REF

REF

05

I N S T I T U T I O N Samp N O N - P R O F I T S

18

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull National Grid

The RE Growth Program enables customers to sell their generation output underlong-term tariffs at fixed prices Prices depend on the size of the project and tariff termREF funded projects are non-eligibleWebsite httpswwwnationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff bull Residential customers or their developers may apply for the program on a first come first served basis

bull National Grid

National Grid provides customersrsquo rebates for various energy efficiency installationsPlease visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency heating and hot water systems

bull NA

bull National Grid

Please visit their website for more details

Website httpswwwnationalgriduscomenergy-saving-programsutm_source=campaignamputm_medium=ra-dio-print-billboardsamputm_campaign=energyeffsave

bull Rebate bull Available for qualifying high-efficiency electric cooling and hot water systems

bull NA

bull National Grid

National Grid provides information and rebates to Rhode Island customers on energy efficient lighting

Website httpswwwnationalgriduscomServices-Rebatesfilters=For20Homeowners|Rhode20Is-land|Electric|Lighting

bull Rebate bull Available for qualifying Energy Star lightbulbs

bull NA

bull National Grid

National Grid provides information and rebates to Rhode island customers on energy efficient appliances

Website httpswwwnationalgriduscomServices-Rebates20sfrne20listed20S20website

bull Rebate bull Available for qualifying Energy Star appliances

bull NA

bull National Grid

National grid provides a financial incentive for large facilities with consistent electrical and thermal needs to install a combined heat and power (CHP) generation systems

bull Natural gas availability automatic repowering cooling system and central boiler plant space heating

bull Avg electricity rate over $010 kWhhour

Website httpswww1nationalgriduscomCombinedHeatAndPower

bull Rebate bull 120 + rooms bull NA

RenewableEnergy Growth Program

EnergyEfficientAppliances

CombinedHeat amp Power

Energy EfficientCooling Systems

Energy EfficientHeating Systems

EnergyEfficientLighting

INS

TIT

UT

ION

S amp

NO

N-P

RO

FIT

S

bull Please check website for current enrollment periods

bull All non-residential projects must be constructed and operational within 243648 months ndash depending on renewable technology

19

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

bull Rhode Island Infrastructure Bank (RIIB)

Enables owners of Eligible Commercial amp Industrial Buildings to finance up to 100 of Energy Efficiency Renewable Energy Water Conservation Environmental Health and Safety Eligible Improvements Financing is provided by private Capital Providers at competitive rates with repayment terms consistent with the useful life of the improvements generally up to 25 years

Website httpsri-cpacecom

bull Loan bull Commercial property owners in a participating municipality

bull Rolling

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

bull Net Metering ndash Grant

bull Residentialbull Businessesbull Affordable Housingbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

bull Net Metering ndash Grant

bull Businessesbull Instituationsbull Non-profitsbull State Facilitiesbull Municipalities

bull January 28 2019bull June 3 2019bull September 9 2019bull November 18 2019

Subject to availibility of funds

Small ScaleProgram

CommercialScale Program

Rhode IslandCommercialPropertyAssessed Clean Energy (C-Pace)

INS

TIT

UT

ION

S amp

NO

N-P

RO

FIT

S

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

Eligible technologies Solar PV Solar Domestic Hot Water

REG projects are not eligible

Website httpcommercericomfinance-businessrenewable-energy-fundsmall-scale-projects

The Rhode Island Commerce Corporation will award grants based on the rated DC capacity of a renewable energy project

REG projects are not eligible

Please visit the REF webpage for more information on eligible technologies such as solar PV and others

Website httpcommercericomfinance-businessrenewable-energy-fundcommercial-scale-projects

20

REF

REF

06

C O M M U N I T Y S O L A R P R O G R A M S

21

22

PROVIDER INCENTIVE DEADLINE ELIGIBILITY

1) Allows commercial and municipal sectors to receive net metering credits from remote systems sharing credits to spread solar benefits 2) Limit on value of credits 3) Competitive price under a different higher ceiling price 4) Separate classes for CRDG facilities 5) Monetizes credits 6) 6MW 2017 Program Year allocationWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull National Grid

1) Small and Medium Scale Solar installation customers may share bill credits with other nearby electric service accounts 2) Provides flexibility for locating arrays owner-tenant situations multifamilymulti- business buildings corporate campuses etc 3) Monetizes credits 4) Small Scale choice of 15-20 year tariff 5) Medium Scale 20 year tariffWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_dist_genasp

bull Feed-In Tariff bull Residentialbull Commercial

bull Small Scale on going enrollment first come first served basis

bull Medium ndash Non-competitive during open enrollment

bull National Grid

1) Expands net metering credits from remote systems to include residential customers 2) No one qualified generation system can exceed 10mW capacity 3) Establishes 30MW community remote net metering pilot (CNMP) which will be administered until Dec 31 2018 4) Allows for third Party Ownership of net metered systems

Website httpswww9nationalgriduscomnarragansettbusinessenergyeff4_net-mtrasp

bull Net Metering bull Residentialbull Individual LMI rate code

also eligible

bull Rolling

1) Compliments National Gridrsquos CNMP 30MW Pilot Program 2) Funds community solar projects incentivizing residential offtakers to adopt solar renewable energy systems 3) Creates renewable energy accessibility for the LMI communities4) Rate code and Flat bill credit grant a) LMI- rate code A-60 $500host customer b) Basic residential ndash rate code A-16 $300host customerWebsite httpcommercericomfinance-businessrenewable-energy-fundcommunity-renewables

bull Net Meteringbull Grant

bull National Grid homeowner or rental customers only

bull Not eligible to renters in multi-family developments

bull Stand alone individual account holders only are elibible

bull Rollingbull (Aligns with CNMP

Pilot 30MW)

Community Net Metering Pilot (CNMP)

Community Renewables

bull National Grid bull Feed-In Tariff bull Small Scale Commercialbull Large Scale Commercialbull Residential

bull Three 2 week Open enrollments per year (check website link)

bull National Grid

Allows all eligible sectors to receive net metering credits from remote off-site qualified generation systemsWebsite httpswww9nationalgriduscomnarragansettbusinessenergyeff4_net-mtrasp

bull Net Metering bull Municipalbull Public Housingbull State Entitiesbull Quasi-publicbull Educational Institutionsbull Hospitalsbull Non-profitsbull Federal Governmentbull PublicPrivate Partnerships

bull Rolling

Virtual Net Metering

Community Remote Distributed Generation(CRDG)

Shared Solar

CO

MM

UN

ITY

SO

LA

R P

RO

GR

AM

S

bull RI Commerce Corp ndash Renewable Energy Fund (REF)

REF

United States Department of Agriculture (USDA)

Rhode Island Farm Energy

Rhode Island National Grid

The USDA Rural Development are committed to helping improve the economy and quality of life in rural America Through our programs we help rural Americans in many ways We offer loans grants and loan guarantees to help create jobs and support economic development and essential services such as housing health care first responder services and equipment and water electric and communications infrastructure We promote economic development by supporting loans to businesses through banks credit unions and community-managed lending pools We offer technical assistance and information to help agricultural producers and cooperatives get started and improve the effectiveness of their operations We provide technical assistance to help communities undertake community empowerment programs We help rural residents buy or rent safe affordable housing and make health and safety repairs to their homes

The Rhode Island Farm Energy Program (RIFEP) is a project of the Rhode Island Resource Conservation and Development Area Council Inc that serves as a resource on energy as it relates to agriculture in Rhode Island The Rhode Island Farm Energy Program provides agriculture Producers and agriculture-based Small Businesses with current information on energy grant opportunities and supportive events