Relocation Policy — Nonbargaining (EAS) Employees Handbook/F-15-A Relocation Policies...Handbook...

Transcript of Relocation Policy — Nonbargaining (EAS) Employees Handbook/F-15-A Relocation Policies...Handbook...

Handbook F-15-A Relocation Policy — Nonbargaining EAS Employees

February 2009

1

®

Relocation Policy — Nonbargaining (EAS) Employees Handbook F-15-A February 2009

iloP noitacoleR A-51-F koobdnaH cy — Nonbargaining EAS Employees

February 2009 2

Relocation Policy — Nonbargaining (EAS) Employees

9002 yraurbeF A-51-F koobdnaH

A. Purpose. Handbook F-15-A, Relocation Policy — Nonbargaining (EAS) Employees,incorporates and revises policy for nonbargaining (EAS) employees that was previously included in Handbook F-15, Travel and Relocation, Part 3.

B. Explanation. Handbook F-15 Part 3 for nonbargaining (EAS) employees was replaced to update relocation policy in keeping with the Postal Service’s strategic transformation initiatives.

C. Distribution.1. Online. Handbook F-15-A is available on the Postal Service Intranet.

a. Go to http://blue.usps.gov.b. Under “Essential Links” in the left-hand column, click on References.c. Under “Policies” on the right-hand side, click on PolicyNet.d. Click on HBKs.

D. Comments and Questions. Address any comments and questions on the content of this handbook to:

CORPORATE ACCOUNTING US POSTAL SERVICE 475 L’ENFANT PLAZA SW RM 8831 WASHINGTON DC 20260-5240

E. Effective Date. This handbook is effective immediately.

Lynn Malcolm Vice President, Controller

Handbook F-15-A Relocation Policy — Nonbargaining EAS Employees

February 2009

3

Contents

1 Introduction ................................................................................................................................................................. 1 1-1 Organization........................................................................................................................................................ 1 1-2 Setting Policy, Approving Relocation, and Related Travel .................................................................................. 1

1-2.1 Role of the Postal Service .............................................................................................................................. 1 1-2.2 Role of the Relocation Management Firm ...................................................................................................... 1 1-2.3 Role of the Approving Official ......................................................................................................................... 1 1-2.4 Authorizing Relocation Benefits...................................................................................................................... 2 1-2.5 Where to Submit Authorization Form ............................................................................................................. 2

1-3 Responsibilities of the Transferee....................................................................................................................... 2 1-3.1 Signing PS Form 178, Relocation Travel Order and Relocation Agreement .................................................. 2 1-3.2 Commitment to Move and Remain at the New Duty Station .......................................................................... 3 1-3.3 Liabilities ........................................................................................................................................................ 3 1-3.4 Planning Your Travel...................................................................................................................................... 3 1-3.5 Avoid Unnecessary Expenses........................................................................................................................ 3 1-3.6 Submitting Expense Reports.......................................................................................................................... 3 1-3.7 Detail Assignment .......................................................................................................................................... 4 2 Relocation Benefits..................................................................................................................................................... 5

2-1 What This Chapter Covers.................................................................................................................................. 5 2-1.1 Benefits .......................................................................................................................................................... 5

2-2 Definitions ........................................................................................................................................................... 6 2-2.1 Approving Official ........................................................................................................................................... 6 2-2.2 Benefits .......................................................................................................................................................... 6 2-2.3 Effective Date of Transfer............................................................................................................................... 7 2-2.4 External Hire Employee.................................................................................................................................. 7 2-2.5 Home Sale Assistance Program..................................................................................................................... 7 2-2.6 Household Goods........................................................................................................................................... 7 2-2.7 Immediate Family Members ........................................................................................................................... 7 2-2.8 Mobile Homes ................................................................................................................................................ 8 2-2.9 New Duty Station............................................................................................................................................ 9 2-2.10 Principal Residence........................................................................................................................................ 9 2-2.11 Relocation eMail Address............................................................................................................................... 9 2-2.12 Relocation Consultant .................................................................................................................................... 9 2-2.13 Relocation Management Firm ........................................................................................................................ 9 2-2.14 Report-to-Work Date ...................................................................................................................................... 9 2-2.15 Spouse Employed by the Postal Service...................................................................................................... 10 2-2.16 Transferred Employee.................................................................................................................................. 10

2-3 Eligibility for Relocation Benefits ....................................................................................................................... 10 2-3.1 Distance Requirements ................................................................................................................................ 10 2-3.2 Liabilities ...................................................................................................................................................... 12

2-4 Limitations on Relocation Benefits .................................................................................................................... 12 2-4.1 Maximum Time for Completing Your Relocation .......................................................................................... 13 2-4.2 Maximum Time for Beginning the Home Purchase Program ....................................................................... 13 2-4.3 Time Extension for Military Service .............................................................................................................. 13 2-4.4 Time Extension for Duty Outside CONUS.................................................................................................... 13 2-4.5 Declining the Transfer .................................................................................................................................. 13 2-4.6 Waiving Repayment of Relocation Expenses............................................................................................... 13 2-4.7 Owning A Residence at the New Duty Station ............................................................................................. 14

2-5 Relocation Leave and Related Travel Time ...................................................................................................... 14 2-5.1 Relocation Leave.......................................................................................................................................... 14 2-5.2 Advance Round Trip Travel Time................................................................................................................. 14 2-5.3 En Route Travel Time .................................................................................................................................. 15

Handbook F-15-A Relocation Policy — Nonbargaining EAS Employees

February 2009

4

2-5.4 Return Trip Travel Time to Former Residence ............................................................................................. 16 3 Expense Payments and Reimbursements .............................................................................................................. 17

3-1 What This Chapter Covers................................................................................................................................ 17 3-2 Lump Sum Allowance ....................................................................................................................................... 17

3-2.1 General Conditions....................................................................................................................................... 17 3-2.2 Authorizing the Lump Sum Allowance.......................................................................................................... 17 3-2.3 Lump Sum Allowance - Calculation and Payment........................................................................................ 18

3-3 En Route Travel Expenses ............................................................................................................................... 19 3-3.1 En Route Travel ........................................................................................................................................... 19 3-3.2 Use of a Privately Owned Vehicle (POV) for En Route Travel ..................................................................... 20 3-3.3 Claiming En Route Travel Expenses............................................................................................................ 20

3-4 Miscellaneous Expense Allowance ................................................................................................................... 21 3-4.1 Amount of Benefit......................................................................................................................................... 21 3-4.2 Requesting Payment .................................................................................................................................... 21

3-5 Use of Individually-billed Travel Card................................................................................................................ 21 3-6 Tax Assistance.................................................................................................................................................. 22

3-6.1 Explanation .................................................................................................................................................. 22 3-6.2 Relocation Expenses Subject to Income Tax ............................................................................................... 23 3-6.3 Relocation Expenses Not Subject to Income Tax Withholding..................................................................... 23 4 Movement and Storage of Household Goods......................................................................................................... 24

4-1 Making Shipping Arrangements ........................................................................................................................ 24 4-1.1 Policy............................................................................................................................................................ 24 4-1.2 RMF Services and Your Responsibilities ..................................................................................................... 24

4-2 Privately Owned Vehicle ................................................................................................................................... 25 4-2.1 What Is Included........................................................................................................................................... 25 4-2.2 Conditions for Shipping a POV..................................................................................................................... 25

4-3 Costs Associated With Moving a POV .............................................................................................................. 26 4-3.1 Driving a POV to the New Duty Station ........................................................................................................ 26 4-3.2 Costs of Shipping a POV Outside/Inside CONUS........................................................................................ 26

4-4 Receiving an Allowance to Move a Mobile Home ............................................................................................. 27 4-4.1 Computing Distances ................................................................................................................................... 27 4-4.2 Computing Benefits ...................................................................................................................................... 27 5 Residence Transactions and Lease Break.............................................................................................................. 28

5-1 Conditions and Requirements........................................................................................................................... 28 5-1.1 Settlement Expenses ................................................................................................................................... 28 5-1.2 Conditions for Reimbursement or Payment.................................................................................................. 28

5-2 Selling Your Home at the Old Duty Station ....................................................................................................... 29 5-2.1 General ........................................................................................................................................................ 29 5-2.2 Working with Real Estate Agents and Brokers............................................................................................. 30 5-2.3 RMF Marketing Assistance .......................................................................................................................... 31

5-3 RMF Home Sale Assistance Programs............................................................................................................. 32 5-3.1 General Explanation..................................................................................................................................... 32 5-3.2 Home Purchase Program............................................................................................................................. 32 5-3.3 Eligibility ....................................................................................................................................................... 32 5-3.4 Home Inspections and Disclosure Responsibility ......................................................................................... 33 5-3.5 Homes Ineligible for the Home Purchase Program ...................................................................................... 34 5-3.6 How the RMF Evaluates Your Home............................................................................................................ 36 5-3.7 Home Purchase Offer................................................................................................................................... 38 5-3.8 Costs Associated With the Home Purchase Program .................................................................................. 39 5-3.9 Receiving Equity........................................................................................................................................... 40 After you and the RMF execute the contract for the sale of your home, you receive the equity from your home, usually within seven (7) business days. ........................................................................................................................................... 40

5-4 Buyer Value Option Program ............................................................................................................................ 41 5-5 Home Finding Assistance and Mortgage Counseling........................................................................................ 41

5-5.1 Home Finding Assistance............................................................................................................................. 41 5-5.2 Home Mortgage Counseling......................................................................................................................... 42

5-6 Reimbursable and Nonreimbursable Expenses ................................................................................................ 42 5-6.1 Overall Limitations on Reimbursement......................................................................................................... 42 5-6.2 Real Estate Commissions ............................................................................................................................ 42 5-6.3 Other Advertising and Selling Expenses ...................................................................................................... 43

Handbook F-15-A Relocation Policy — Nonbargaining EAS Employees

February 2009

5

5-6.4 Costs of Selling or Buying a Home............................................................................................................... 43 5-6.5 Other Settlement Costs ................................................................................................................................ 46 5-6.6 Expenses of Lease Break ............................................................................................................................ 46

5-7 Submitting for Reimbursement of Real Estate Expenses.................................................................................. 47 5-7.1 How to Apply for Reimbursement and How to Document Expenses............................................................ 47 5-7.2 How Your Claim Will Be Reviewed and Paid ............................................................................................... 48

5-8 Loss on Sale ..................................................................................................................................................... 48 5-8.1 Definition .........................................................................................................Error! Bookmark not defined. 5-8.2 Eligibility ....................................................................................................................................................... 48 5-8.3 Requesting Consideration for Reimbursement............................................................................................. 48 5-8.4 Receiving Reimbursement ........................................................................................................................... 49 6 Requesting a Deviation From Policy ....................................................................................................................... 50 7 Completing Relocation Expense Reports ............................................................................................................... 52

7-1 Using the Expense Reports Online System ...................................................................................................... 52 7-2 Supporting Documentation for Expense Reports .............................................................................................. 52

7-2.1 Organizing Receipts ..................................................................................................................................... 52 7-2.2 Miscellaneous Receipts................................................................................................................................ 52 7-2.3 Receipts for Sale or Purchase of a Residence............................................................................................. 53

7-3 Submitting Expense Reports............................................................................................................................. 53 8 Completing PS Form 178.......................................................................................................................................... 54

8-1 General ................................................................................................................Error! Bookmark not defined. 8-2 Completing PS Form 178.....................................................................................Error! Bookmark not defined. Relocation Agreement (To be read by employee).......................................................Error! Bookmark not defined.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

1

1 Introduction

1-1 Organization

This handbook is organized to help you find information as easily as possible. In general, procedures follow the typical step-by-step relocation sequence, from receiving authorization of benefits to completing requests for reimbursement of expenses incurred.

1-2 Setting Policy, Approving Relocation, and Related Travel

1-2.1 Role of the Postal Service Title 39, United States Code, Section 410 gives the Postal Service the authority to establish its own relocation policy. Current policy is presented in this handbook. All Postal Service relocation activities for nonbargaining (EAS) employees, and equivalent grade positions in the Inspection Service and Office of Inspector General, must comply with the policies stated in this handbook.

1-2.2 Role of the Relocation Management Firm All relocation services have been outsourced to a relocation management firm (RMF) to ensure that employees receive uniform information on authorized relocation benefits. The RMF provides guidance and assistance to transferring employees on our policy and processes, on expense reimbursement to ensure prompt payment of reimbursable expenses, and assists with arrangements for movement and storage of your household goods.

1-2.3 Role of the Approving Official A Postal Career Executive Service (PCES) employee must be the approving official for relocation authorizations.

As an approving official, you must review this handbook thoroughly to discuss the need for relocation benefits when interviewing potential

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

2

candidates for vacant positions. You must be aware of your obligations and responsibilities, and that of your transferees.

1-2.4 Authorizing Relocation Benefits The appropriate approving official (PCES executive) at the relocating employee's new permanent duty station must authorize the relocation by signing the PS Form 178, Relocation Travel Order and Relocation Agreement.

The Form 178 must also be signed by the transferring employee.

Note: The approving official for an external hire is the vice president.

1-2.5 Where to Submit Authorization Form Submit the completed PS Form 178 to the ‘Relocation’ box in Outlook or fax it to 650-377-5357. Follow up the electronic submission of this form by mailing the original to the address listed on PS Form 178. Instructions for completion and submission of this form can be found in chapter 7.

Note: Relocation forms must be submitted at least 30 days prior to the transferring employee’s report-to-work date.

1-3 Responsibilities of the Transferee

Relocation benefits enable transferring employees to physically move their principal residence as quickly as possible and assume the responsibilities of their new position by assisting with duplicate housing expenses for a short period of time. You must use the same care and prudence as if you were relocating at your own expense.

Thoroughly review this guide to become familiar with your benefits and responsibilities.

1-3.1 Signing PS Form 178, Relocation Travel Order and Relocation Agreement

PS Form 178 lists relocation benefits you may be eligible to receive and is your service agreement. The appropriate approving official at the new duty station will indicate the benefits to be authorized and must sign this form before you can be reimbursed for any relocation expenses. See chapter 7 for an example of a properly prepared PS Form 178.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

3

1-3.2 Commitment to Move and Remain at the New Duty Station

By signing the PS Form 178, you are agreeing to:

• Physically move to the new duty station.

• Remain at the new duty station within the Postal Service for at least 12 months after the report-to-work date.

1-3.3 Liabilities If you utilize relocation benefits but decline to move to your new duty station, or do not complete your 12-month commitment, or leave the Postal Service before completing your commitment, you must repay all relocation expenses incurred by the Postal Service for you, including any relocation leave used. See section 2-4.4 - Declining the Transfer.

If you were authorized and receive benefits as an unqualified relocation in accordance with part 2-3.1.2, you must complete your 12-month commitment and move to the new community or repay all relocation expenses incurred by the Postal Service for you, including any relocation leave used. Distance moved is verified by Postal Service personnel.

1-3.4 Planning Your Travel Plan your itinerary to accomplish the relocation with minimal time and expense. Your travel schedule must be coordinated with approval from both old and new duty station officials. Select the least costly mode of transportation that provides adequate service.

1-3.5 Avoid Unnecessary Expenses Postal Service policy provides flexibility to relocating employees and will reimburse for allowable expenses. However, the RMF audits all expense reports submitted, and the Postal Service reserves the right to reduce what it determines to be excessive expenses.

1-3.6 Submitting Expense Reports Do not use eTravel to submit for relocation expense reimbursement. The RMF provides an electronic system to submit expense reports online, and you must use this system. An exception will be made for offices without Internet access to use paper vouchers supplied by the RMF.

Payments and reimbursements will be sent to you from the RMF. Your relocation consultant will discuss expense report submission and documentation with you. All relocation expenses are charged to the finance number of the new duty station listed on the Form 178. See chapter 6 for additional information.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

4

1-3.7 Detail Assignment If you are on a detail assignment that becomes your new duty station, regular travel benefits end on the day you are informed of the new permanent position. You should return home to make arrangements for your relocation move. If you remain in your new assignment and do not return home, your temporary quarters’ period begins the day following notification of the new position, and you will not be eligible for advance round trip and the en route travel trip. Your relocation cannot be delayed by a detail assignment as you must relocate according to Postal Service policy.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

5

2 Relocation Benefits

2-1 What This Chapter Covers

This chapter discusses relocation benefits available to eligible nonbargaining (EAS) employees of the Postal Service and equivalent grade employees of the Inspection Service and Office of Inspector General. The level of the targeted position that you are about to assume determines the benefits to which you are eligible.

2-1.1 Benefits You may be eligible to receive the following relocation benefits:

Benefit EAS Reference

Relocation leave1 5 days Part 2-5.1

Advance round trip travel2 8 consecutive calendar days

Part 2-5.2

En route travel to new duty station 3 Yes Part 2-5.3 and Subchapter 3-2

Return trip travel to former residence4 2 days Part 2-5.4

Lump sum allowance5 Yes Subchapter 3-3

Benefit EAS Reference

Miscellaneous expense allowance $2,500 Subchapter 3-4

Tax assistance — federal and state income tax

Yes Subchapter 3-5

Use of RMF for:

Household goods shipment Yes Chapter 4

Household goods storage6 60 days Chapter 4

Home marketing assistance Yes Subchapter 5-2

Buyer Value Option (BVO) Yes Subchapter 5-3

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

6

Home Purchase Program7 Level 19 and above Subchapter 5-4

Home finding assistance Yes Subchapter 5-5

Old home closing costs Yes Subchapter 5-6

New home closing costs Yes Subchapter 5-6

Loss on sale of home at old duty station8 Yes Subchapter 5-8

Notes:

1. Five (5) days of relocation leave is in addition to authorized travel time for advance round trip and return trip home. An actual physical move of the employee's household is a requirement for eligibility for relocation leave. Not applicable to external hires or if transferring from another government agency.

2. Travel time for one advance round trip, not to exceed eight (8) consecutive calendar days. Scheduled work days in this travel period are recorded as work hours. Your lump sum allowance is calculated to include advance round trip expenses. Not applicable to external hires or if transferring from another government agency.

3. Applicable to external hires if over 100 miles with VP approval. 4. The employee is authorized two (2) work days for return trip travel time. The remaining days of

the trip must be scheduled days off, annual leave or relocation leave. Your lump sum allowance is calculated to include return trip expenses. Not applicable to external hires or if transferring from another government agency

5. Lump sum allowance is a calculated allowance to help defray travel costs for advance round trip, return trip home and temporary quarters’ expenses. Certain restrictions apply to external hires. See 2-3.1.3.

6. Storage of household goods may be extended to a maximum of 75 days when authorized by the approving official.

7. Minimum grade level for Inspection Service is 17 (law enforcement personnel only). See 5-3.3.2 for eligibility requirements. Not applicable to external hires.

8. Not applicable to external hires.

2-2 Definitions

Unless otherwise specifically provided in these regulations, the following definitions apply to relocation:

2-2.1 Approving Official A Postal Career Executive Service (PCES) employee must be the approving official for relocation authorizations.

2-2.2 Benefits You may be eligible to receive the following relocation benefits:

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

7

2-2.3 Effective Date of Transfer The date your new position is effective as shown on the PS Form 50, Notification of Personnel Action (exception to SF 50).

2-2.4 External Hire Employee A new career employee hired from outside of the Postal Service or from another government agency.

2-2.5 Home Sale Assistance Program An optional part of relocation policy designed to facilitate a relatively fast, efficient means by which an employee may sell his/her home with a minimum of cost, usually accomplished by a relocation management firm.

2-2.6 Household Goods Household goods are personal property which may be transported legally in interstate commerce and which belong to you and/or your immediate family at the time you are notified of the transfer before shipment or storage begins. The term includes household furnishings, equipment and appliances, furniture, clothing, books, and similar property. You must use the RMF for movement and storage of your household goods.

It does not include items such as airplanes, recreational vehicles, camper trailers, boats over 14 feet, utility and boat trailers, storage sheds, hand guns, ammunition, pets, birds, livestock, building materials, or any collection of property such as a wine collection, classic or antique cars, food stores, any home office equipment intended for use in conducting a business, other commercial enterprise, or hobby.

2-2.7 Immediate Family Members Only those immediate family members who are a part of your household at the time you are notified of your assignment and are moving with you are eligible for relocation benefits. Your family member’s status determines eligibility for benefits. Family members may be any of the following shown in the table below:

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

8

Family Member(s) Details

Your spouse Refers to a person of the opposite sex who is a husband or a wife.

Note: Your spouse may be eligible for certain benefits as a result of your authorized relocation if employed by the Postal Service.

Common law: Spouses of common law are covered by the term “spouse” when the state they are moving from recognizes common law marriage, and verification can be provided that all requirements of the state have been met.

Same sex: Spouses of same sex marriages are not covered by the term “spouse” when used in relocation (Public Law 104-199, Defense of Marriage Act).

Separation and Divorce: If you are currently separating or divorcing and your spouse is not relocating with you, your spouse is not eligible for benefits. This status can also affect your eligibility to home sale assistance programs. For detailed information on eligibility for residence transactions, see chapter 5-1.

Fiancée: A fiancée is not eligible for benefits. If the marriage occurs during the relocation process, your spouse may be eligible for certain relocation activities that occur after the date of marriage.

Your children Refers to your natural offspring, stepchildren, adopted children, grandchildren, legal minor wards, or other immediate family member children who are under legal guardianship of you or your spouse. Each of these children must meet one of the following criteria:

Unmarried and under 21 years of age.

Physically or mentally incapable of supporting himself or herself, regardless of age.

An unmarried full-time student under 23 years of age.

A child born after your effective date of transfer is considered a part of your immediate family.

Your immediate family member parents

Refers to your parents or your spouse’s parents who are considered part of your immediate family and receive at least 51 per cent of their support from you or your spouse.

2-2.8 Loss on Sale Loss on sale reimbursement is a payment to help offset those losses if, due to market conditions, you sell your principal residence at your old duty station for less than you paid for it.

2-2.9 Mobile Homes A type of manufactured dwelling constructed on a metal frame, designed to be mobile, and used as a residence. Manufactured/mobile homes have metal frames that are not removed and may have a vehicle identification number (VIN). Where wheels, axles, towing mechanisms or related mobility hardware

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

9

features have been removed and the structure affixed to a foundation, it remains a mobile home.

Modular Homes

Not included in the mobile home category are modular or system-built homes that are built in a manufacturing facility in sections and then transported to a job site 70-95% complete. The sections are lifted onto the home's foundation by crane. Modular homes are not constructed on frames and are often considered higher quality than “stick-built” homes due to the controlled conditions at the factory.

2-2.10 New Duty Station The ‘permanently assigned location’ listed on the PS Form 50 where an employee regularly reports for work.

2-2.11 Principal Residence Principal residence means your main home. It does not include other homes that are owned or kept up by you or members of your immediate family. It does not include seasonal or second homes, such as a beach home. It is the old residence before leaving for the new job location. It is the new home within the area of your new job location.

2-2.12 Relocation eMail Address An email address used by transferring employees or hiring managers to obtain relocation information. You may contact the Relocation Unit by typing Relocation into the address line in Outlook or by typing [email protected] from an outside server. Relocation information may also be obtained by dialing 202-268-8700.

2-2.13 Relocation Consultant The RMF will assign a relocation consultant to assist you with your move. The relocation consultant will explain your available relocation benefits and answer questions relative to each phase of your relocation.

2-2.14 Relocation Management Firm The RMF is a firm contracted by the Postal Service to provide counseling on postal relocation policy and services for residential transactions, movement of household goods, and relocation expense reimbursements.

2-2.15 Report-to-Work Date The date an employee reports for duty at the new duty station.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

10

2-2.16 Short Sale A loss mitigation solution when you find yourself “underwater” or upside down on your mortgage, meaning your home is worth less than the amount you currently owe on your loan note to your mortgage lender(s).

2-2.17 Spouse Employed by the Postal Service If you are authorized for relocation benefits, and your spouse is also employed by the Postal Service, only you will be authorized for relocation benefits. Your spouse will be afforded advance round trip travel time and en route travel time if your authorization includes these benefits. The spousal travel benefits must be completed within your relocation time period.

2-2.18 Transferred Employee An employee transferred from one official duty station to another for permanent duty.

2-3 Eligibility for Relocation Benefits

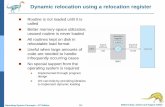

2-3.1 Distance Requirements To qualify for relocation benefits, you must meet the following distance requirement.

• The distance between your old residence and your new duty station must be at least 50 miles greater than the distance between your old residence and your old duty station. This is known as the IRS “50-mile rule.”

• The Postal Service also requires that you physically move your household to the new duty station. Distance moved is verified by Postal Service personnel using various mapping tools on the world-wide web and this determination is final. See the illustration and formula below to determine how the rule works.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

11

2-3.1.1 Exception to the Distance Requirement

As a transferring employee, if the district manager or area vice president requires that you move into your new community, you do not have to comply with the IRS’s 50-mile rule to be authorized relocation benefits. You must move to the new community since your move is considered “unqualified” by the IRS and all expenses paid to you or on your behalf are considered taxable income. See subchapter 3-6 for income tax withholding requirements related to an unqualified relocation move.

Note: A transferring employee must meet the distance requirement in section 5-3.3.2 (bullet item number 3) to be eligible for the home purchase program.

2-3.1.2 Eligibility of External Hires for Benefits

Employees hired from outside of the Postal Service must meet the IRS 50 mile rule. Benefits can only be authorized by the appropriate officer of the Postal Service. Eligibility to relocation benefits is not automatic.

Old residence

Old permanent duty station

New permanent duty station

New permanentduty station

3 Miles

38 Miles

Distance Test isNOT Met

38- 3

3535 is less than 50

Distance Test IS Met

58 - 3 55

55 is greater than 50

Formula:

Distance between old residence & new duty

station —

Distance between old residence & old

duty station

Miles from work

58Miles

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

12

If the move is within IRS guidelines but less than 100 miles, the officer may authorize any of the following benefits:

• Buyer Value Option (BVO) home sale assistance program (certain requirements must be met).

• Direct Reimbursement of costs associated with home sale.

• Reimbursement of new home closing costs.

• Movement of household goods by the RMF.

• Miscellaneous expense allowance.

If the move meets IRS guidelines and is greater than 100 miles, the officer may authorize any of the above benefits plus:

• En route travel to the new duty station.

• Advance round trip for house hunting purposes.

• Temporary quarters allowance while locating permanent housing.

Advance round trip and temporary quarters allowance will be paid as a calculated lump sum.

Note: Return trip home and the home purchase program are not available to external hires.

2-3.1.3 Requirement for Spouse Employed by the Postal Service

If you and your spouse are employed by the Postal Service, only you will receive full relocation benefits. Your spouse is eligible as a family member only if they are moving with you. The spouse is eligible for advance round trip travel time for the purpose of seeking a permanent residence and en route travel when leaving the former residence and traveling to the new duty station. Time spent for these trips are to be charged as work hours.

2-3.2 Liabilities If you do not meet the distance rule as required by policy or do not physically move your household to the new duty station, you are not eligible to receive relocation benefits. You must repay any relocation expenses incurred by the Postal Service for you, including any relocation leave used.

2-4 Limitations on Relocation Benefits

Relocation benefits are provided to help move you quickly to the new duty station to assume the responsibilities of your new position by assisting in offsetting duplicate housing expenses for a short period of time. It is to your advantage to complete your move as quickly as possible.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

13

2-4.1 Maximum Time for Completing Your Relocation The maximum time to complete your move and receive reimbursements is two years from the date you report to work. All allowable travel and residence transactions must be completed and reimbursed to you within two years from your reporting date to your new duty station. Relocation benefits must not be delayed.

2-4.2 Maximum Time for Beginning the Home Purchase Program

If you are eligible to participate in the Home Purchase Program, you must notify your relocation consultant within 45 days of your report-to-work date to begin the process. The 45 day period for this program will not be extended.

2-4.3 Time Extension for Military Service The period for completing your relocation may be extended for any time you spend in active military service.

2-4.4 Time Extension for Duty Outside CONUS If you are reporting for duty outside the continental United States (CONUS), the period may be extended for any time lost as a result of shipping restrictions.

2-4.5 Declining the Transfer If you decline the transfer after you receive relocation funds from the RMF or incur a relocation-related expense paid on your behalf by the Postal Service, you must repay it, including any relocation leave used.

2-4.6 Waiving Repayment of Relocation Expenses If you are transferred to a new duty station for the benefit of the Postal Service before completing your 12-month commitment, a letter waiving repayment of all expenses, including any relocation leave used, must be submitted by the gaining Area Finance manager or functional Headquarters manager to the manager, Corporate Accounting (Headquarters). An executed PS Form 178 signed by the functional vice president authorizing the new move must accompany the waiver letter. All current fiscal year expenses for the cost of the original move will be transferred to the gaining area office.

If you do not obtain a waiver, an employee receivable will be established for the repayment of all expenses associated with the previous move.

Note: If you are in the process of relocating and choose to accept a new position that requires a new move, any unused relocation benefits from the current relocation will end upon receipt of the authorization for new benefits.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

14

2-4.7 Owning A Residence at the New Duty Station If you are transferring to a new duty station and own a home there that will become your principal residence, relocation benefits will be limited.

2-5 Relocation Leave and Related Travel Time

If you are authorized for relocation benefits, relocation-related leave and travel may occur as follows.

2-5.1 Relocation Leave You are eligible for a maximum of up to five days of relocation leave (code 80). This leave is in addition to any other authorized travel time. It may be taken consecutively or as individual days but must be used by the time you settle into your new home. An actual physical move of the employee's household is a requirement for eligibility for relocation leave.

Your spouse may be eligible for relocation leave if the following conditions are met:

• Employed by the Postal Service.

• Moving with you.

• Awarded a position competitively.

• Successful candidate for a bid position at the new location if a bargaining employee.

Note: Not applicable to external hires or if transferring from another government agency.

2-5.2 Advance Round Trip Travel Time Advance round trip travel time to the new duty station is for the purpose of seeking a new residence at the new duty station. The approving official can authorize one trip, with a maximum of eight consecutive calendar days (including travel time and holidays/scheduled days off).

When circumstances warrant, the Postal Service reserves the right to consider the distances between old and new duty stations and the mode of transportation to be used. In no case may the Postal Service authorize a trip of more than eight consecutive calendar days for advance round trip.

The following conditions apply:

• You must take the trip before you report to your new duty station.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

15

• Time will be recorded as work hours for scheduled work days during the period of absence for the approved advance round trip and you will not be charged leave.

• Expenses for this trip are included in the lump sum allowance (subchapter 3-2).

• You may drive your POV, if the mileage is less than 300 miles. The most direct route must be taken so as to limit the amount of time in travel status.

• If your spouse is employed by the Postal Service and moving with you, the spouse may take this trip with you or instead of you. Your spouse will be paid work hours on scheduled work days while on the advance round trip and will not be charged leave. However, your spouse must take this trip before your family moves to the new duty station.

Note: Travel time for advance round trip is not applicable to external hires or if transferring from another government agency.

2-5.3 En Route Travel Time

The approving official may authorize en route travel time for a one-way trip from the former residence to the new duty station. Use the en route trip when reporting to work. The following conditions apply:

• Your travel schedule must be coordinated with both your old and new duty station officials.

• You will be in work status for scheduled work days while traveling en route, and you will not be charged leave.

• Employees obtain expense reimbursement by submitting an online expense report as described in subchapter 3-2. Do not submit for reimbursement for relocation benefits through the eTravel system.

• Use of a privately owned vehicle (POV) for traveling to the new duty station is encouraged, and is considered advantageous to the Postal Service. You are required to drive your POV when the mileage to the new duty station is less than 800 miles. The most direct route must be taken so as to limit the amount of time in travel status.

• You and your family must drive a minimum of 300 miles per day. If your travel time exceeds that which would be applied to the most direct route or you do not drive at least 300 miles per day, any additional travel time used will be charged to relocation leave or annual leave.

• If your actual travel involves departure and/or destination points other than the old and new residence, the travel time authorized for en route travel cannot exceed that which would be applied to the most direct route from the old duty station to the new duty station. Any additional travel time used will be charged to relocation leave or annual leave.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

16

• If your spouse is employed by the Postal Service and moving with you, your spouse will be in work status while traveling en route and will not be charged leave for scheduled work days.

Note: Only applicable for an external hire if distance is over 100 miles to new duty station with VP approval.

2-5.4 Return Trip Travel Time to Former Residence You may be authorized for one round trip from the new duty station to your former residence. Your travel schedule must be approved by your new duty station officials. The following conditions apply to the return trip:

• The trip must be used to conclude relocation-related business or to accompany your family to the new duty station when they vacate the old residence.

• The return trip to your former residence must be used by the time you settle into your new home.

• Two work days are authorized as travel time. The remaining days of the trip must be scheduled days off, annual leave or relocation leave.

• If driving, the most direct route must be taken to limit the amount of time in travel status.

• Expenses covered during return trip are for transportation only and are included in the lump sum allowance (subchapter 3-3).

• A spouse who is employed by the Postal Service may take this trip instead of you.

Note: Not applicable to external hires.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

17

3 Expense Payments and Reimbursements

3-1 What This Chapter Covers

This chapter explains the calculation and payment of the lump sum allowance, expense reimbursement for en route travel, payment of the miscellaneous expense allowance, and payment of tax assistance. It also covers use of the individually-billed travel card when utilized for relocation expenses.

3-2 Lump Sum Allowance

3-2.1 General Conditions If authorized, you will receive a calculated lump sum allowance intended to assist in offsetting expenses related to:

• one advance round trip for home finding purposes,

• a temporary quarters (TQ) allowance and

• one return trip to the old residence.

3-2.2 Authorizing the Lump Sum Allowance The approving official determines whether you receive each of the lump sum components listed on PS Form 178, Relocation Travel Order and Relocation Agreement:

• advance round trip,

• temporary quarters (TQ) allowance,

• and return trip to the former residence.

The decision to authorize a component can be influenced by a factor such as a prolonged detail to the new duty station.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

18

The advance round trip from the old duty station enables you and/or one of your immediate family members to locate permanent housing at the new duty station.

The TQ allowance enables you to obtain temporary lodging from commercial sources until you can move into your new residence.

A return trip to the old residence is provided to conclude relocation-related business.

3-2.3 Lump Sum Allowance - Calculation and Payment The lump sum calculation is based on the following factors:

• your family composition,

• whether you are a homeowner or non-homeowner at the old duty station,

• and the distance to your new duty station.

The lump sum amount is calculated and paid by the RMF based on the GSA travel rates published for your new duty station. Your PS Form 178 and PS Form 8059 must be received and processed by Accounting Services in San Mateo prior to payment. You must request payment of your lump sum allowance through the expense report online system on the RMF’s website

When authorized, your lump sum amount may include the following components:

a. Advance round trip component includes:

• per diem and lodging at 100 percent of the GSA rate at the new duty station for eight days/seven nights;

• per diem at 100 percent of the GSA rate at the new duty station for eight days/seven nights for one immediate family member (if moving with you);

• airfare for one round trip at the GSA city pairs rate;

• airfare for one round trip at the GSA city pairs rate for one immediate family member (if moving with you);

• car rental allowance at the government/military contract rate for eight days;

• child care expenses of $50 each day for each child under 17 years of age with a maximum of $150 per day

Note: If the new duty station is less than 300 miles from your old residence, you will receive an amount equal to round trip mileage plus 100 miles in lieu of the car rental allowance and airfare.

The per diem and mileage rates used are the current rate published on the GSA.gov website under Most Requested Links.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

19

b. Return trip component includes:

• transportation expenses to and from the terminals and airfare for one round trip at the GSA city pairs rate or

• round trip mileage at the current travel rate if the new duty station is less than 300 miles from the old location.

c. Temporary quarters’ component includes:

• 30 days per diem and lodging at 100 percent of the GSA rate at the new duty station if you are a non-homeowner in the old location or

• 60 days per diem and lodging at 100 percent of the GSA rate at the new duty station if you are a homeowner at the old duty station.

Note: The actual number of trips or days spent in TQ will not change the basis for the calculation of the lump sum allowance.

3-3 En Route Travel Expenses

3-3.1 En Route Travel En route travel occurs when you and/or your family leave your old residence to report to the new duty station. You must utilize the en route trip to report to work or to accompany your family to the new duty station when they vacate the old residence. Your family may travel with you or separately at a later date.

3-3.1.1 Expenses for Transportation, Lodging, and Per Diem

If authorized, you and your family are eligible for reasonable lodging expenses, POV mileage, coach air or train fare and, transportation to and from terminals, plus the following:

• For you: 75 percent of the daily per diem rate of your new duty station for the first and last day of travel. 100 percent of the daily per diem rate for all other days you are in a travel status.

• Your spouse: 75 percent of your per diem rate if traveling with you; or the same percentage as you of the daily per diem rate of your new duty station if traveling alone.

• For each of your other immediate family members: 75 percent of your per diem rate.

3-3.1.2 Exclusion for the 12-hour Rule

The limitation provision that disallows per diem for travel less than 12 hours does not apply to en route travel when the total distance traveled is greater than 100 miles.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

20

3-3.1.3 En Route Travel Completed in One Day

When en route travel is completed in one day, per diem will be applied as follows:

a. For you: 75 percent of the daily per diem rate of your new duty station.

b. For your spouse and immediate family members: 75 percent of your daily per diem.

c. If your spouse does not accompany you and travels alone: 75 percent of the daily per diem rate of the new duty station.

3-3.2 Use of a Privately Owned Vehicle (POV) for En Route Travel

3-3.2.1 Use of POV

Use of a privately owned vehicle (POV) for traveling to the new duty station is required if the distance from the old residence is less than 800 miles. The Postal Service will reimburse mileage at the same rates listed on the GSA.gov website.

3-3.2.2 Minimum Travel Distance Requirement

You must drive a minimum of 300 miles per day. You must use the most direct route when traveling from the old residence to the new duty station or residence. If you deviate from the most direct route, you will be responsible for any additional expenses or time incurred.

3-3.2.3 Computing Per Diem Rates Based on Minimum Driving Distance

The RMF calculates the maximum number of days allowed for travel by dividing your one way mileage by 300 miles. The per diem percentages in part 3-3.1.3 apply to the result.

3-3.2.4 Deviating From the Most Direct Route

If the actual travel involves departure and/or destination points other than the old and new residence, the mileage, lodging, and per diem reimbursement may not exceed the amount paid for the travel from the old duty station to the new duty station.

3-3.2.5 Use of Government or Postal Service Owned Vehicle

Use of a government or Postal Service owned vehicle for any relocation-related travel is not authorized.

3-3.3 Claiming En Route Travel Expenses Request reimbursement for expenses by submitting a claim using the expense reporting online system provided through the RMF. Do not use eTravel for reimbursement of relocation expenses.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

21

Your relocation consultant will discuss expense report submission requirements with you. Expense report submission and receipt requirements can be found in chapter 6 of this handbook.

3-4 Miscellaneous Expense Allowance

3-4.1 Amount of Benefit You may claim $2,500 as your miscellaneous expense allowance (MEA), regardless of marital or family status. This benefit is intended to cover any relocation-related expenses not otherwise covered by postal policy. No itemization is required when requesting reimbursement. However, the following criteria must be met:

3-4.2 Requesting Payment The following criteria must be met:

• Your SF Form 50 is processed by Human Resources.

• Accounting Services in San Mateo notifies the RMF that the SF Form 50 has been processed.

o One of the following triggering events has occurred:You have sold your old residence or broken your lease.

o You have completed a contract for the purchase or lease of a new residence at the new duty station.

o You have scheduled movement of your household goods.

• The RMF receives a request for payment of the MEA from the employee through the expense report online system.

3-5 Use of Individually-billed Travel Card

Do not use the eTravel system for reimbursements or payments of relocation-related expenses. If you use your individually-billed travel card to purchase meals, lodging or transportation, you are responsible for payment directly to the travel card issuer.

You must make your travel arrangements and those for authorized family members as you would if you were traveling for official Postal Service business. To obtain government rate air fares you must charge them to the individually-billed travel card.

Additionally, you may use your travel card for temporary quarters’ expenses pending occupancy of a permanent residence at the new duty station.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

22

You may not use your individually-billed travel card for any other non-travel related relocation expenses including

• residence transactions;

• any deposits, for lodging or otherwise, which will be returned to you;

• or shipment of household goods.

Note: Requests for reimbursement of relocation expenses are submitted through the RMF. Do not use the eTravel system. Once you receive reimbursement, you are responsible for payment directly to the travel card issuer.

3-6 Tax Assistance

3-6.1 Explanation For tax purposes, some reimbursements paid to you or payments made on your behalf for your relocation expenses are considered part of your taxable income.

Tax assistance is an amount the Postal Service pays directly to the Internal Revenue Service (IRS) for federal taxes, to the Social Security Administration and to your state of residence on your behalf as an estimate of the income tax you will owe for certain relocation expense reimbursements and payments.

Tax assistance is calculated based on your new annual salary and family status information provided on PS Form 178, Relocation Travel Order and Relocation Agreement. You are responsible for paying any additional tax owed that is not included in the estimated amount paid by the Postal Service.

The RMF must use the state tax code currently contained in your employee master file record in Eagan. Employees are responsible for maintaining their correct state code for state income tax purposes in their record by filing a PS Form 1198, Request for State Income Tax Withholding. Complete and mail the form to the following:

GREENSBORO HR SHARED SERVICES CENTER

7023 ALBERT PICK RD

GREENSBORO NC 27409-9900

The Postal Service does not assist for Medicare taxes, the home sale incentive bonus or local income taxes.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

23

3-6.2 Relocation Expenses Subject to Income Tax

3-6.2.1 Transactions Reported as Income

The Postal Service will report the following transactions related to relocation as income on your Form W-2:

• En route trip expenses for all meals and a percentage of the mileage reimbursement based on IRS guidelines.

• The lump sum allowance.

• Residence expenses involving the sale of your old residence and the purchase of your new residence that may be taxable, including the home sale incentive payment and lease break expenses.

• The miscellaneous expense allowance.

• The expense of storing household goods over 30 days

• All tax assistance.

3-6.2.2 Reporting Moving Expenses and Withholding Taxes

The RMF calculates and the Postal Service pays taxes at your estimated federal and state tax rate, rounded to the nearest dollar. You, the IRS, and your state tax authority determine your actual tax liability at the time you file your tax returns. Your relocation payments and all Postal Service-paid tax assistance will appear on your regular Form W-2, Wage and Tax Statement.

The RMF also provides a courtesy relocation summary package (RSP) itemizing all payments made to you or paid to a third party on your behalf at or around the time you receive your W-2 forms from the Postal Service.

3-6.3 Relocation Expenses Not Subject to Income Tax Withholding

If your move is considered a qualified relocation by the IRS, certain expenses are not subject to federal income tax withholding. They are:

• Expenses for moving household goods and personal effects from the former residence to the new residence at the new duty station.

• Expenses reimbursed for lodging and a portion of your POV mileage allowance that you and your immediate family incur while en route to the new residence.

• Expense for the first 30 days of household goods’ storage.

Note: These expenses are subject to income tax withholding if the relocation is considered to be unqualified by the IRS as described in Part 2-3.1.1.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

24

4 Movement and Storage of Household Goods

4-1 Making Shipping Arrangements

4-1.1 Policy You must use the services of the relocation management firm (RMF) for the transportation and storage of your household goods. Your relocation consultant will discuss with you what can and cannot be shipped or stored.

4-1.2 RMF Services and Your Responsibilities

4-1.2.1 RMF Services

The Postal Service has a contract with a RMF to provide relocation moving services to Postal Service employees. The Postal Service pays the cost for transporting your household goods in one lot from your old residence to your new residence at the new duty station.

The RMF will coordinate activities associated with the shipment of household goods to your new duty station, such as the following:

• Appointing a consultant to review procedures with the transferee and establishing a moving date.

• Selecting a qualified van line and/or agent.

• Determining appropriateness of what can and cannot be shipped or stored.

• Monitoring packing, loading, and arrival schedules.

• Resolving and processing any damage claims.

• Shipping household goods up to a total net weight of 18,000 pounds.

• Providing $180,000 (maximum) current replacement value insurance on household goods.

• Providing a $2,000 (maximum) allowance for crating and uncrating items requiring this service as identified by the RMF agent or van line.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

25

• Providing a $350 (maximum) allowance for disassembly and assembly of recreational items such as pool tables or game tables.

• Storing household goods up to 60 days, if necessary. The approving official may authorize up to 15 additional days. No additional extensions may be authorized.

4-1.2.2 Your Responsibilities

You are responsible for the following:

• Ensuring that only your immediate family’s personally-owned household goods are shipped.

• Paying for and making your own arrangements for shipping airplanes, collectible or antique cars, camper trailers, boats over 14 feet that do not fit in the moving van, utility and boat trailers, storage sheds, hand guns, ammunition, pets, birds, livestock, building materials, or any collection of property intended for use in conducting business, other commercial enterprise, or a hobby.

• Paying for additional insurance and for all excess charges and special packing, crating, and handling of weight additive or household goods items beyond the limits authorized by the Postal Service in section 4-1.2.1.

• Paying for and making your own arrangements for shipping any household goods obtained en route to the new duty station, or household goods that are not appropriate for shipping as identified by the RMF consultant or van line agent.

• Paying for an extra pick up or extra drop off of household goods within a reasonable distance to authorized departure/destination locations.

4-2 Privately Owned Vehicle

4-2.1 What Is Included A POV includes a passenger automobile, light truck, or other similar vehicle that is used primarily for personal transportation to and from work on a daily basis. Excluded is any vehicle intended for commercial or recreational use, including automobiles classified as ‘collectible’ or ‘classic.’

4-2.2 Conditions for Shipping a POV Authorization for shipping a POV by car carrier will be considered only if you owned the POV before you became aware that you would be assigned to a new duty station and the following conditions are met:

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

26

• one POV may be shipped by car carrier if the mileage from your old residence to your new duty station is over 800 miles

• two POVs may be shipped by car carrier if your mileage is over 800 miles and your immediate family moving with you has more than one licensed driver

• Under no circumstances will shipment by car carrier be authorized for more than two POVs.

If either the old or new duty station is outside the continental United States (CONUS) (i.e., Hawaii, Guam, Puerto Rico, U.S. Virgin Islands) a maximum of one POV may be authorized for shipment, regardless of the number of licensed drivers in your immediate family.

4-3 Costs Associated With Moving a POV

4-3.1 Driving a POV to the New Duty Station Use of a privately owned vehicle (POV) for traveling to the new duty station is required if the distance from the old residence is less than 800 miles. The most direct route must be taken when driving to the new duty station. When you or a member of your immediate family drives an authorized POV to the new duty station, mileage reimbursement for each authorized POV will be at the rate listed for vehicle type on the GSA.gov travel website.

An employee without immediate family moving with them may claim reimbursement for driving one POV to the new duty station.

An employee with immediate family moving with them may claim reimbursement for driving as many POVs as there are licensed drivers to the new duty station.

4-3.2 Costs of Shipping a POV Outside/Inside CONUS When it is necessary to ship a POV from outside CONUS to the mainland and vice versa, the Postal Service will allow all necessary and customary preparation expenses, including crating, packing expenses, shipping charges, and port charges for readying the POV to be shipped from the port of embarkation. Customary preparation expenses at the port of debarkation, including uncrating will also be allowed. If you must drive the POV to a port that is not your origin or destination point to deliver or pick up the POV, the Postal Service will authorize reimbursement of the one-way transportation costs or one-way mileage.

Note: Consideration will be given to the cost of shipping the POV vs the actual blue book value of the POV.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

27

4-4 Receiving an Allowance to Move a Mobile Home

If you are eligible for shipment of household goods, as an alternative you may choose to take an allowance for moving a mobile home for use as your new residence (within CONUS only). The RMF does not arrange for shipment of mobile homes. You must make your own arrangements. Benefits for moving mobile homes are in lieu of shipment of household goods and in addition to payment of en route travel.

Note: Before you can receive this allowance, your PS Form 178 must reflect that you (and your immediate family) will live in the mobile home at your new duty station.

4-4.1 Computing Distances In the event you choose to move a mobile home either by commercial carrier or by towing it with a POV, your mileage reimbursement will be calculated based on the mileage via the most direct route from your former residence to your new residence.

4-4.2 Computing Benefits

4-4.2.1 How Much You May Claim

The total amount authorized for reimbursement for moving a mobile home will be no more than the maximum amount that would have been allowed for moving up to 18,000 pounds of household goods and storing them for a maximum of 60 days.

4-4.2.2 Non reimbursable Items

Benefits do not include costs of maintenance, repairs, storage, insurance for valuing the home above the carriers' maximum responsibility, or certain charges designated in the tariffs as "Special Service." (These would include such special services as packing and unpacking, which are necessary or desirable but which, unlike pilot cars required by state law, are not essential to transporting a mobile home from point to point.)

4-4.2.3 Transportation by Other Than Commercial Carrier

If, instead of using a commercial carrier, you tow the mobile home with a POV, the Postal Service will pay 11 cents per mile above the IRS mileage rate to cover all transportation costs for the mobile home. Thus, you would not claim fares for, bridge, road, tunnel tolls, ferries, and other charges as separate expenses. If you have not already been paid for en route travel to your new duty station, you may claim the standard mileage rate for the POV in addition to the 11 cents per mile for the mobile home.

4-4.2.4 Mixed Method Transportation

If you use a commercial carrier and towing for transportation, you must follow the rules in sections 4-4.2.1 and 4-4.2.2 for determining reimbursement.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

28

5 Residence Transactions and Lease Break

5-1 Conditions and Requirements

5-1.1 Settlement Expenses Postal Service policy allows for reimbursement of the following authorized settlement expenses:

• Certain fees for selling your principal residence at your old duty station.

• Certain fees for buying or constructing your principal residence at your new duty station (in association with obtaining financing only).

• Certain fees for breaking a lease for your principal residence at your old duty station.

• Certain fees for obtaining rented quarters as your principal residence at your new duty station (certain high cost metropolitan areas as determined by the Postal Service).

5-1.2 Conditions for Reimbursement or Payment To be eligible for reimbursement or payment on your behalf, you must satisfy all of the following conditions:

• The title to the residence (which may be a mobile home) at the old or new duty station, or the interest in a cooperatively-owned dwelling or an unexpired lease, meets one of the following criteria:

(1) Is in your name alone.

(2) Is jointly in your name and in the name of one or more members of your immediate family.

(3) Is solely in the name of one or more members of your immediate family.

• The title cannot be held in a trust.

• For disposition of property at the old duty station, you or your immediate family must have acquired the title or interest in the property before you were informed of the transfer.

Handbook F-15-A Relocation Policy — Nonbargaining Employees

February 2009

29

• For acquisition of property at the new duty station, you or your immediate family must acquire title or interest after you were informed of the transfer.

• The expenses of selling or of settling the lease are for your principal residence at the time you were informed of your transfer to your new duty station.

• The settlement dates for the sale and purchase, or for terminating the lease, are not later than two years after your report-to-work date at your new duty station.

• The expenses were actually paid by you and you occupied the home.

• If the residence is a multiple-occupancy dwelling and you occupy only part of it, your expenses will be reimbursed or paid on a prorated basis. In addition, your expenses will be limited to a reasonable amount required for the residence site.

• Expenses will not be reimbursed or paid for the purchase and/or sale of more than 5 acres.

Note: Noncompliance with the above conditions may result in an adjustment to your reimbursable settlement costs.

5-2 Selling Your Home at the Old Duty Station

5-2.1 General If you elect to sell your home at your old duty station due to relocation, there are three options offered to affect the sale.

Buyer Value Option Program (BVO) – This is a home sale assistance program available to all levels of nonbargaining employees but does not provide you with a “guaranteed buyout.” You must list the home and find a buyer on your own. You verbally negotiate an acceptable offer with the buyer then turn it over to the RMF to close the sale. DO NOT SIGN THE PURCHASE OFFER PRESENTED BY THE PROSPECTIVE BUYER. Notify the RMF immediately. The RMF will purchase your home from you based on the terms you have negotiated, resulting in a non-taxable transaction to you, similar to an amended sale. This program is described in detail in section 5-4.