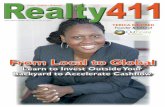

Realty411 - The ONLY Free Magazine for Real Estate Investors and RE Professionals

description

Transcript of Realty411 - The ONLY Free Magazine for Real Estate Investors and RE Professionals

Realty411 Realty411Print Online Networkwww.realty411guide.com | Vol. 3 No. 2 2010

A Resource Guide for Investors

Tips for Long-Distance

LANDLORDING

Turn-Key Rentals Around the NationCash Flow from the Comfort of HomeMathew Owens, CPA, owner of

OCG PROPERTIESBuys & RehabsRentals in Tennessee from Redondo Beach

Get the Deals DONELearn Creative Real Estate Techniquesfrom Dave Lindahl, Dolf de Roos, Bruce Norris, Bill Gatten & more!

Wealth Reports!

FREE

Look Inside

Celebrating the Largest Issue with More Pages & Opportunities than Ever!

photo by Sam Green

>7 Secrets from the Master! Dave Lindahl shares his latest tips for Investing Success 9 No Drama in Dayton Triple Net Houses Helps Investors Profit without Issues 11 California Living with Tennessee Cash Flow Mathew Owens, CPA, owner of OCG Properties, explains why he loves to invest out of state 14 Beware of the Investment Vampires by RBS Homes 16 Dolf & Carter: A Mastermind with Arizona Investors 19 Enjoy a Tropical Paradise with Phenomenal Returns Charity Walk and Gala 37 Join the Ultimate Bus Tour with MemphisInvest.com 39 Creative Financing Options with MMG Capital, LLC 40 Philbin Capital Discovers Deals in the Golden State 42 The Key to Success by Club Founder Sam Sadat

photo: Sam Green

In search of their latest gem in Nicaragua, Maverick Investor Group traveled the world 22 Investor Nation Shares their Blue-Chip Real Estate Strategy 2 5 G i n g e r M a c i a s T h r e e FREE Ways to find a Great Wholesale Deal 27 Creative Real Estate Techniques with Educator Bill Gatten 28 Matt Maloufs 10 Weeks to Massive, Passive Cash Flow 30 A Visit with Sensei at his 12 Rounds Club 35 Bruce Norris discusses the I Survived Real Estate 2010

45 Buy Bigger and Better Deals by Kathy Fettke 46 Alternative Economics Club Debuts in California 51 Stop the Gambling! Mike Woo, a Rich Dad, Poor Dad protg, advises clients 52 Is Your Mortgage Underwater? Perhaps a Short Pay Refinance is the Answer 55 Pay Off Your Rental House in Five Years with the Short Term Retirement Program

57 Whos On Your Team? Insights by 360 Investments

A Powerhouse Lineup of Top Industry Experts Presents the Insiders Edge on The State of REO 2010

Platinum Partners

The Norris Groups award-winning event returns September 17, 2010 to the Nixon Library in Yorba Linda, California. Were assembling an incredible line up of accomplished industry specialists to discuss the state of the REO market, on-going industry regulations, and the opportunities emerging for real estate professionals. New guidelines a ect every sector of our industry. In a climate ripe for both miscalculation and pro table advances, how are our colleagues and partners navigating an industry in continued transition? Our Whos Who Round Table Includes:

Bruce Norris President The Norris Group

Joseph Magdziarz Vice President Appraisal Institute

Tommy Williams 2008 President National Auctioneers Association

Christopher Thornberg Principal Beacon Economics

Sean OToole President Foreclosure Radar

Sarah Letts Director, Credit Loss Mgmt Fannie Mae

Daniel Phelan Mortgage Bankers Association

Peter Wayman Sr. REO Director Freddie Mac

MVT PRODUCTIONS

Last year, I Survived Real Estate 2009 focused on the dramatic shifts in regulation facing our industry. This year, our panel separates fact from ction as we delve into the health and sustainability of the current real estate market and the opportunities that lie ahead for hungry real estate professionals. To nd out how you can participate as an individual or potential sponsor, see the back of this yer or visit ISurvived2010. com for more information. Seating to this formal dinner event is limited, so go to the website or call our o ce today. Thanks you to all our Platinum and Gold Sponsors and friends for making this unique event a possibility.

www.ISurvived2010.com or 951-780-5856

Gold SponsorsBenton Group Delmae Properties Elite Auctions Entrust Inland Empire Investors Forum Keystone CPA Las Brisas Escrow Leivas Financial Services North San Diego Real Estate Investors Association (NSDREI) Personal Real Estate Investor Magazine Mike Cantu Realty 411 Magazine Rick & LeeAnne Rossiter Starz Photography Tony Alvarez theREOmentor.com Westin South Coast Plaza

SPONSORSHIP OPPORTUNITIESWe cant do this without your help! Businesses or individuals who are interested in participating have two options: 1. SPONSOR the I Survived Real Estate Komen Breast Cancer Walking Team in exchange for a seat (or table) at the event 2. JOIN the I Survived Real Estate Komen Walking Team and raise money in your network for the walk in Newport Beach September 26th. Every $200 gets you one seat to the event (while seats remain). All donations are made directly to our Susan G. Komen Breast Cancer Walk Team so 100% of the proceeds go to the Orange County A liate of Susan G. Komen for the Cure. This formal dinner event includes visitation to the Nixon Museum, appetizers, 3 course meal, and the live event. Additional bene ts are listed below for those that become platinum and gold sponsors (Please note all funds must be in place July 10th for gold and platinum sponsors to take advantage of initial radio spots).

Winner of seven communication, outreach, and fundraising awards.

SingleCost Tables (Seats) Received AdvertisingLogo on Event Website SEO-Optimized Pro le Logo on Flyers Digital Signage at Event Preferred Seating Event Program Ad Radio Show Mention (Intro - 15 total*) Radio Show Mention (Outtro - 15 total*) Event Video (Intro - Single Page) Event Video (Outtro) Press Release Mention Event Bag Marketing Oppotunity

Gold$2,000 1 (10)

Platinum$5,000+ 2 (20)featured

$200 (1) Seat

Name only featured featured 1/3 page 1/2 page

Call Diana Barlet at 951-780-5856 or visit ISurvived2010.com for more information and preferred seating.Note: All donations must be made through the I Survived Real Estate 2010 walk team to be eligible for advertising. July 10th is the deadline for all money to be in place to ensure radio spots include the selected sponsor. There may be more than 15 radio shows that are aired for the run of event.

Dont You have better things to do than deal with tenants and toilets?Yes, we know you do.This is why the Herrera Sindell Group developed a turn-key program, which provides investors HIGH RETURNS, without any management headaches. With nearly 20 property acquisitions per month, The Herrera Sindell Group offers a prime opportunity for busy professionals to prosper in this market.

The Herrera Sindell Group Offers: Cash-Flow Investment Properties in Southern California Strong Cash-on-Cash Returns with Long-Term Holds Excellent Return-on-Investment (ROI) within 30 to 90 days Options to Utilize Retirement Plans for Investment Properties Tenant-Occupied Properties in Our Local Market Property Management In Place, No Need to WorryAs featured in Realty411 Magazine

Is this opportunity right for you?Visit our ofce and see why so many investors are enjoying unbeatable returns and safety, all while buying the properties of their choice, in local markets and at deep discounts. Make an appointment to secure your nancial future with real estate today!The Herrera Sindell Group, Inc. 15060 Ventura Blvd., Ste. 100 Sherman Oaks, CA 91403 www.herrerasindell.com

Toll Free (877) 949-2772Disclaimer: This is not a public offering nor is it a REIT or hedge fund. This is not an offer or invitation to sell or a solicitation of any offer to purchase securities in the United States or any other jurisdiction. Any securities may only be offered or sold, directly or indirectly, in the state or states in which they have been registered or may be offered under an appropriate exemption.

Realty411Real Estate

published for Investors by Investors

WealthFOUNDER & EDITOR Linda Pliagas [email protected] EDITORIAL STAFF Lori Peebles Matt Malouf Carla Fischer Ginger Macias COPY EDITOR Lorie L. West PHOTOGRAPHERS Sam Green John DeCindis COLUMNISTS Dave Lindahl Charles Salisbury ADVERTISING Kelly Global Marketing [email protected] 310.439.1145 EVENTS & EXPOS Lawrence Ruano ruanoinvestments@gmail 805.791.5457 PRODUCTION Lori and Mike Hampton Emma Krull - The Dab Hand CALIFORNIA DISTRIBUTION Professional Distribution Solutions 1.877.418.6500 NATIONAL DISTRIBUTION KJ Banks: 805.377.6328 PUBLISHED BY Manifest Media Partners Nikolaos K. Pliagas - Chairman

&

A

by Dave Lindahl

s a successful real estate investor and top-selling author, Im on the road a lot presenting workshops across the county. I often start with a bit of personal history because when youre a multimillionaire like I am, people assume you were either born rich or had a wealthy mentor show you the inside track to making money. Thats not my story. Not by a long shot. Fifteen years ago, I was running my own small landscaping business in New England. I was a guy with a pickup truck and lawn mower. If you havent experienced a New England winter, let me simply say it

$5,000$10,000 or More Extra Monthly Cash Flow?means I was literally frozen out of work for a good part of the year. I spent winters doing odd jobs to scrape by. A friend asked if I wanted to repair a property that needed some TLC so it could be resold fast. The owner was looking for a quick fix and flip, and thus I was indoctrinated in the business of flipping properties before it became a national pastime and the subject of cable TV shows. But what attracted me to real estate was not the quick turn. It was the steady cash flow. The idea of checks from renters filling my mailbox month after month, regardless of the weather, really appealed to me. I wanted other people to pay my mortgages, creating huge equity in my buildings. I wanted to sit back and watch my buildings appreciate, making me wealthier and wealthier. I wanted to live off the positive cash flow that I received each month, so I wouldnt have to go to a job every day. No more daily grind. No more living paycheck to paycheck. Best of all, I liked that millionaire was the likely outcome if I did it right. Back then there was nobody teaching how to buy rental properties. The gurus focused on single family houses, just as they do today. So I had a big learning curve.Realty411Guide.com

Who Else Wants Up toWhat You Need to Succeed First and foremost, to succeed as a real estate investor you must be motivated. This business isnt for the undecided. You have to want it bad enough to take action. Because where theres a strong will, theres wealth. I was 100% determined to own real estate. I didnt let the fact that I had a less than $800 in the bank stop me from buying my first property, a three-unit building in my hometown. Sure, I was nervous doing that first deal. I had no direct experience. No track record. No personal wealth to use for collateral. But I didnt let any of that stop me. This is why I tell beginners everywhere that they can own real estate right now. I dont care if youre broke like I was. If youre motivated to succeed, real estate and all the personal wealth it can generate can be yours once you know how to find properties and structure the deal.How I Found My First Building I bought books and tapes on real estate, even though I didnt find much on apartments. I went to local investment clubs, networked with experienced investors, and started bird-dogging for them (findingContinued on pg. 60

Realty411 and Real Estate Wealth magazines are published in Los Angeles by Manifest Media Partners (mailing address: 4221 Neosho Ave., Los Angeles, CA 90066). Publishers are not responsible for unsolicited manuscripts, photographs and/or other materials. Copyright 2010. All Rights Reserved. Reproduction without permission is strictly prohibited. The opinions expressed by writers are not endorsed by the publishers and/or editorial staff. Before investing in real estate, seek the advisement of a trusted nancial adviser, attorney or tax consultant. Please invest responsibly.PRINTED IN THE USA. GOD BLESS AMERICA

INFO/FAX: 310.499.9545 Realty411Guide.com | reWEALTHmag.com Main email: [email protected]

Our Mission is to Educate & Inspire

Connect to our network @

PAGE 7 2010

reWEALTHmag.com

invest without dramaDo you have reservations about becoming a landlord? Triple Net Houses created a program to help investors prot from rental properties without ever having to deal with tenants!n 1903 The Wright Brothers made history in Dayton, Ohio, with their first power airplane flight. One hundred four years later, Peter Julian, CEO of Triple Net Houses, reflects on their short three-year revolutionary history that began in 2007 as a premiere provider of real estate management. Weve reinvented the way people invest in residential rental real estate, Julian says proudly. He then adds: Its kinda

I

by Carla Fischer

(www.triplenethouses. com) takes all the unknowns off the table. By purchasing a Triple Net rental, investors will know exactly what their cash flow is going to be for the next ten years. Julian explains: When Peter Julian we lease the house its a triple net lease, which means we pay taxes, insurance and maintenance. Basically we pay all the operating expenses, so theres nothing our clients have to pay. We man-

there. When we rehab a property we pretty much do everything so we know its going to be a maintenance-free property. When we finish, its almost like a new house. The companys record is impressive. In the year 2009, we collected 97.4 percent of our scheduled rent, Julian proudly states. It even amazes me! In Dayton, market rents range from $595 to $950. The company rents with a one year lease agreement. A typical scenario

If an investor buys a Triple Net House, they know exactly what their cash ow is going to be for the next 10 years. They never have to deal with tenants and never have to deal with or pay for maintenance.overcast. Were going to get some rain later on, which doesnt mean a thing for our investors who are from all over the country. The weather rarely has anything to do with our business, unlike the Wright Brothers. Julian shifts to business quickly explaining how he created a NNN (triple net) investing model, which is traditionally only found in commercial real estate transactions. Ive been a real estate broker for a little over 30 years. Ive worked with investors my entire career. When I talk to them, most like all the good things about real estate, like the cash flow, the tax write-offs, building-up equity, and potential appreciation. But when potential investors get to talking about managing, theyve all heard the horror stories about tenants, maintenance and all those kinds of things. So Julian and his team came up with a unique solution. Its basic and simple, even though it tackles a complicated concept. The Triple Net Houses programRealty411Guide.com

age the property so theres no management. Investors will never have to deal with a tenant and never have to deal with or pay for maintenance, Julian explains. The company offers a 10-year NNN (triple net) lease. If investors want to terminate early, all they have to do is provide a 60-day written notice. There is no penalty and the investor still owns the property. Its a turn-key investment. It pays a high yield and were able to buy houses at low cost and rehab them economically. We then pass that deal on to an investor, as a totally turn-key investment. Their total involvement after the investment is to collect a payment from us each month, which is electronically deposited into their checking account. Its a perfect storm. When asked how Triple Net Houses can provide guaranteed returns for investors, regardless of what is going on with their property, Julian replies: Were very careful in selecting properties in neighborhoods where we know the rents are going to bePAGE 9 2010

is this: A tenant occupies a three bedroom, one bath home, 1,100 square feet, with a one car garage, for $700 a month. Many homes are brick with full basements, some are ranch houses built in the late 50s. Dayton is home to the largest single site employer in the state of Ohio: Wright Patterson Air Force Base with 26,000 employees. The city also has two universities: Wright State University with an enrollment of about 18,000, including a medical school. Next is the University of Dayton, which enrolls over 10,000 students and also offers a law school program. As far as the financials, a Triple Net investor can realize up to 17% return on each house. If the investor pays cash then they will receive 9.1%. Julian explains further: For example, if they have a $60,000 house the investor will be receiving $5,460 a year, which is 9.1% of the purchase price.Continued on pg. 47reWEALTHmag.com

California Investors Specializing in the Memphis Market!

L

Tennessee Rentalsby Ginger Macias | photography by Sam GreenGinger: What did you do before you became a full-time real estate investor? What is your background? Mathew: Lets see, I grew up in the tiny town of Los Angeles and graduated from the University of California, Santa Barbara, with a degree in economics and an emphasis in accounting. Afterwards, I was able to achieve one of the accomplishments I am most proud of, passing all four parts of the CPA exam in one sitting, a feat only 10% of candidates have been able to do. After passing the exam, I worked as a CPA, auditor and business adviser, helping my corporate and individual clients increase their bottom line, helping them find fraud risk factors inside their business systems and auditing their accounting records. I guess that is why I am so good at doing due diligence on real estate transactions now. The accounting and due diligence skills are a perfect match for a real estate investor, I just had to adjust my personality to be more outgoing and personable, which most CPAs are not known to be. Being in the real estate industry as a full-time investor, I am finding it is rare to find a CPA who understands the tax and legal implications of investing and the real estate investment side in detail. Ginger: So tell us, how did you get your start in real estate? Mathew: I started investing about five years before I decided to take some real estate education courses and quit my corporate job cold turkey. I found that the skill sets I gained from working at CPA firms were hugely valuable, and I still hold the partners of those firms with the upmost respect for what they taught me, the ethics they instilled in me and the guidance they gave me. However, the skills that I have developed running my own company are unparalleled to anything I would have ever expected. While working for myself, I started flipping and holding properties >PAGE 11 2010reWEALTHmag.com

California Life

ast year, while working as a panelist at a local real estate investment club in Los Angeles, I had the pleasure of meeting Mathew Owens, a certified public accountant and owner of OCG Properties. I was so impressed by his experience and work ethic that I invited him to partner with me on syndicating real estate projects. Having worked closely with him for almost six months now, I can say that hes the real deal and youll be in for a treat if you get the chance to work with him. Mathew has many strengths that make him a great partner: integrity, organizational skills, and real estate and investment proficiency. Plus, hes very likable. I have met a lot of people in this business, and I expect great things from him in the coming years. I recently sat down with him to ask about his real estate investing strategies and the current projects hes working on out in Tennessee. Mathew has purchased, renovated, and sold or held more than 100 investment properties in the last three years alone. Below is a partial transcript of the interview I had with him. Ginger: Mathew, in your own words, what exactly does OCG Properties do? Mathew: In a nutshell, we help people invest in real estate. At OCG, we sit down and go over our clients financial situation and resources to help them find the best ways to invest and meet their individual goals. With good in-house management in place, you can hold for long-term growth and really get a great return on your money. On top of that, the price points are low enough that you can buy with cash and not even have to deal with financing. Talk about low risk! We help our clients achieve great returns on their money while doing all of the due diligence on every investment. We bring a ton of real estate experience to the table and help our investors every step of the way.

Realty411Guide.com

in Memphis. I got through my initial learning curve and kept striving for more deals with a magnificent obsession for real estate that only few can really understand. It was tough, but after getting through the struggles, you find yourself breaking through and finally achieving success. Working that much taught me multiple things. But one thing stuck more than anything else: Passive income is the goal! Ginger: You live in Southern California and invest in Memphis, Tennessee. Why do you invest so far away from where you live? Mathew: That is right, I live in sunny Redondo Beach and invest in Memphis. Most of the investors I meet ask me this exact question, and the simple answer is: I invest with logic and statistics, not based on what my emotions are telling me. Look at the economics in the Memphis market. It has one of the highest price-torent ratios in the nation! It did not take a huge dip like a lot of markets, it had an average annual appreciation of 4% per year over the past 20 years. Its a very stable market. The population is also expected to increase and you can pick up property that not only cash flows but gives you appreciation potential in the next 10 years, which is

that the current reported unemployment to go out and develop a team in every marrate is 12.8%, there is a $19.9 billion dollar ket, which is exactly what we did out in gap in the California budget, the California Memphis. We have in-house management mortgage delinquency is up almost 100% and a team on the ground there that helps year on year, 90% of us get all of the the Alt-A and Option Mathew Owens, his brother and little sister. information we ARM loans coming need to be sucdue are underwater in cessful. California, 1/3 of Option ARM loans are Ginger: What delinquent already, the team members California tax rate rose should one have from 9.3% in 2008 to when investing 9.55% in 2009, and it out of state? will rise again to cover Mathew: There the gap in the budget. are a number of On top of all that, team members people who are underyou need in order water in their homes to be a successand not in financial ful real estate hardship are starting investor. At the to walk away because top of the list it does not make finanfor any buy-andcial sense to hold them hold investor is a and hope they go up great, and I mean $200,000! G R E AT, p r o p e r t y m a n a g e r. Ginger: Im an outProperty manof-state investor too but other investors agement is the number one reason an inmay be skeptical about owning property vestment property will fail to produce posiso far away. tive cash flow, assuming you did your numbers correctly and did not buy in a ghetto. In addition, an investor needs lenders, REALTORS, inspectors, appraisers, attorneys, CPAs, IT consultants, marketing agents and the whole nine yards to really develop a good system. Each team member is crucial to your success, and that is why investing in real estate can be so difficult at times. Your team can make or break you, and you need to have reliable team members that communicate well with you to be successful. Ginger: What separates your company, OCG Properties, from the rest? Mathew: At OCG we have in-house property management, which is the key to our and your investment success. We also take an ethical and conservative approach to investing and do all of the right due diligence on every investment. We really care for our clients and care about their goals and what their interests are. We have a guaranteed tenant and renovation on every property, and put the properreWEALTHmag.com

A sample OCG Property.

not something I can say about California. California is a huge risk right now for buyand-hold investments. If you take a look at some of the economic indicators in the California real estate market, some of the things you will find areRealty411Guide.com

Mathew: They are really missing out! Ginger, we both know that with technological advances you can invest anywhere in the world now, and its as if youre investing in your own backyard. The reality is, everyone has the resourcesPAGE 12 2010

structuring and risk mitigation procedures in place on every investment. We also set up proper communication procedures for our management company to keep our investors frequently updated on the progress of their investment. Ginger: What due diligence is done on your investments? Mathew: Wow, where do I begin? I will give you the quick version. To start off, we do a complete neighborhood analysis on every property along with a market value analysis, which includes pulling comparable sales and getting an appraisal done before we close es-

exactly what the majority of men do. If you never quit, you will succeed no matter what adversity you face. Ginger: What is the first step someone needs to take to invest with you? Mathew: They need to call us and schedule a consultation. We look at each investors resources, financial situation and investment goals to make sure we help them invest the right way and surpass their individual investment goals. Once an investor schedules a consultation with us, we move them from sitting on the sidelines to developing a passive income stream to retire on as fast and safely as possible. Mathew: Do not give up, no matter what. Any business, any new venture or opportunity that you want to achieve, is 90% mental and 10% skill. If you never give up, you can never lose. Its best said in the book Ginger: Do you have anything else you would like to share with our readers? Mathew: Yes, thank you. I would just like to add that some people will make up every excuse in the book for why they do not or cannot do something. I am here to tell

With technological advances you can invest anywhere in the world now, and its as if youre investing in your own backyard.crow. We also do a rental analysis, cash flow analysis, profit analysis, renovation analysis and every kind of analysis a CPA can think of to protect ourselves and our investors. In addition, we get an inspection by a qualified inspector and compare it to the renovation bid. Each renovation bid comes with an item-by-item, room-by-room breakdown of the renovation costs, including materials and labor. This is extremely important so you know what your costs are going to be on future renovations. When leasing a property, it is important to get a qualified tenant. If you do not, you will be sorry later when you have to evict them because they cannot afford the rent. We qualify them similar to a home loan process. We look at their debt-to-income ratio and credit. We do a background check and really get a good assessment of their personality, which can tell you a lot. Ginger: What tips can you give to people who want to get started investing in real estate?Realty411Guide.com

Think and Grow Rich by Napoleon Hill: Before success comes in anyones life, one is sure to meet with much temporary defeat, and, perhaps, some failure. When defeat overtakes someone, the easiest and most logical thing to do is to QUIT. That is

you that you can do ANYTHING if you focus and take ACTION steps towards its achievement. Do not let your emotions tell you it cannot be done, even if you were not initially successful. Even if it is difficult to see how you are going to accomplish it, dont give up. There is always a way, but it comes down to taking action. Most people give up at the mere thought of difficulty, and your success in real estate, and in life, are going to be based on your ability to focus and take action. Also, a successful investor has to be completely dedicated. They must ignore all of the people who have an opinion but are less- educated about the subject. Ginger: Thanks, Mathew. I wish you continued success in your investments. Mathew: Youre welcome, Ginger. For more information, please visit: www.ocgproperties.com or email: [email protected] | OCG Properties can also be reached at: (424) 757-4680reWEALTHmag.com

Photograph of Mathew Owens by Sam GreenPAGE 13 2010

Investin YOUReal Estateth A ia ec Sp blish m 1 fro 41 on ty iti Real l Ed s of er e Pu

Investment Vampires for the Next Decade

Realty411 Realty411 Wealthwww.realty411guide.com | Vol. 3 No. 2 2010

Never Miss an Issue!A Resource Guide for InvestorsVol. 1 No. 1 2010

Tips for Long-Distance

LANDLORDING

Maverick Investor Group

Turn-Key RentalsCash Flow from the Comfort of Home

Around the NationMathew Owens, CPA, owner of

OCG PROPERTIESBuys & RehabsRentals in Tennessee from Redondo Beach

T

by Richard Barrett

Get the Deals DONELearn Creative Real Estate TechniquesLook Inside

Wealth Report!

FREE

from Dave Lindahl, Dolf de Roos, Bruce Norris, Bill Gatten and more!

Celebrating the Largest Issue with More Pages & Opportunities than Ever!

Serving the Needs of Accredited Investors - INSIDE: Information to Grow and Maintain Your Wealthphoto by Sam Green

16

Words of Wisdom from Masters of Real Estate

19

Maverick Investor Group Reveals the Next BIG Thing

35

Bruce Norris Prepares for Annual I Survived Real Estate Charity

2 Magazines, 1 Mission: To GROW Your Wealth

he ten years ahead of us will be extremely difficult for investors. Yield and growth will be scarce, but much worse will be the four vampires waiting to suck the life out of almost every investment you consider. In this article, we will meet each vampire individually, understand how they drain your investments dry and learn about some investing garlic that can keep them away. Ination: the First Investment Vampire. If you remember President Gerald Ford then you may remember his Whip Inflation Now campaign, created to fight inflation climbing over 10%. Eventually inflation reached over 14% annually in 1980, ushering in years of stagflationhigh inflation combined with high unemployment. In only five years the value of investments dropped by 50% and the dollar lost almost 75% of its purchasing power during that decade. This year, with unemployment and underemployment already approaching 25%, the nation is poised to see a replay of those difficult years. To estimate the curve of inflation in this new decade, we need a basic understanding of the causes of inflation. Noble Prize winning economist Milton Friedman said it best, Inflation is always and everywhere a monetary phenomenon. In other words, when the Federal Reserve prints more money than the economy can absorb, the economy catches a bad case of inflation in the next 12-24 months. The money supply exploded in 2009. It doubled in the space of a few months and then grew another 50% in the next year. Since the economy has not grown by 150% in the past two years, all this money is waiting in bank vaults to drive signifiPAGE 14 2010

cant inflation soon. Experts argue that deflation is the bigger risk. While that may be true, it does not make inflation any less destructive when it starts nibbling at your investments. Garlic to Protect Your investments from the Ination Vampire To protect against the corrosive power of inflation, you need investing vehicles with three specific features: Asset value that tracks inflation. Asset income that tracks inflation. Asset that has considerable leverage. Its no surprise that investment real estate has all three of these critical features. In general real estate values track inflation. That is, their value remains constant or appreciates even as the value of each dollar declines. Likewise, the income rentfrom investment property tends to track inflation. And finally, you can leverage your investment asset. But Not Just Any Real Estate! In truth, most real estate does not deliver these three critical features. The past few years, have seen crushing drops in the price of condos in Miami, almost any property in Detroit, suburban tract homes in Phoenix, plus office towers and shopping malls across the country. Buying investment property takes effort, considerable research and a team of experts working to assist you. With the right guidance and team in place, an investor will never have to worry about those evil investment vampires. Richard Barrett is CEO of RBS Homes (www.RBSHomes.com). With offices based in California and Texas, RBS Homes provide investment properties with these three critical factors in place.reWEALTHmag.com

Subscribers are Invited to Our VIP Networking Events& Receive POCKET Deals by Email

2 Years for Only $49Circle magazine of choice:

Realty411

RE WEALTH

_____________________________________ Name as it appears on credit card _____________________________________ Credit Card # (visa, mc, amex) _____________________________________ Expiration Date CVC code

_____________________________________ Signature Required _____________________________________ Mailing Address _____________________________________ City State Zip

_____________________________________Email Address or Phone (to join our network)

Go Green! Fax copy to: 310.499.9545or email: [email protected] Neosho Ave., Los Angeles, CA 90066

Questions? 310.994.1962Realty411Guide.com

HRDmoney.comWE PAY 10%BANKS, PAY YOU

Matts Foreclosure

Home Buying

ON SAFE INVESTMENTSPEANUTSWE, MAKE YOU

Secretspurchase online at: Write a testimonial and receive a complimentary FREE workbook on achieving your goals, great for any business... call to learn how!

mattsforeclosurebook.com

RICH!

2% INTEREST INVEST $100,000 YOU RECEIVE

10% INTEREST INVEST $100,000

A real estate training program that will include an investment property with the training!Only 7 investors who want to take action will be accepted.(mention code RP2R2010 to get an application)

NEW Investment Program...

$2,000

$10,000

YOU RECEIVE

562-443-7042Award Winning National Relocation SpecialistMost Outbound Referrals for Prudential CA. Realty 2009

JERRY ELKIND, Investment [email protected]

(310) 391-1153

Matt Malouf,SFR, RSPS, GREEN Lic # 01811908

investwithmatt.com

T

he world of real estate investing is a small one. Investors rub elbows at similar events, read industry publications and generally run in the same circles. Carter Froelich, an author, investor and CEO of The Property Ledger, recalls the time he met bestselling author and renowned educator Dolf de Roos, Ph.D. The two savvy Phoenix-based investors became friends after an introduction by Andrew Waite, publisher of the Arizona-based, Personal Real Estate Investor magazine. At the time, Froelich was busy developing The Property Ledger, his online software designed to analyze property holdings, store documents and forecast future returns. Once ready to launch, he asked de Roos to test out his creation. That was three years ago, and de Roos still uses the software to track his portfolio. Recently, Froelich welcomed de Roos home from his extended visit to Australia. The famed author of eight books, including the New York Times Best Seller Real Estate Riches, was visiting Down Under to raise private money for property investments in Arizona. It proved to be a wonderful opportunity for one master investor to interview another. Froelich enthusiastically took on our assignment and provided an outstanding interview. This indeed is a rare treat; prepare to learn from two of Arizonas top real estate investing giants. The EditorCarter: Hello, Dolf. Tell us about what youve been doing lately and give investors your perspective on the market. Dolf: Well, Carter, although the media repeatedly states this is the worst real estate market we have seen in decades, it is only

DolfreadersCarter & the latest giveInterview by Carter Froelich, CEO of The Property Ledger

Tips from AZ

Dolf de Roos

Carter Froelich

Dolf: I like being on the cutting edge of what is available. I have always done well with new technology. When fax machines came out, it saved us thousands of dollars a year in courier fees. Now, we dont fax; scanned attachments

... with the information stored in the cloud, you can access your portfolios details from any computer connected to the Web.the worst market if you are in the unfortunate position of being forced to sell. If you are in the fortunate position of being able to buy, then by definition, this is the best market we have seen in decades. With that said, there are still many who have trepidation about entering our current real estate market. This has forced me to go overseas. There are many countries right now experiencing the peak we saw a few years ago so they see the relative merits of bringing their money to the United States and investing here. Carter: Why did you become interested in The Property Ledger?Realty411Guide.com

are better quality, in full color and dont require an outdated phone system to get through to a recipient. When I come across people in the real estate industry who do not use email, and insist on using faxes exclusively, I think they must miss out on deals because of their aversion to new technology. I do not want to fall into that trap. The Property Ledger is cutting edge, extraordinarily useful and easy to use. Why would you not use it? Carter: What benefits are provided by The Property Ledger, which other products do not provide? Dolf: With the information stored in thePAGE 16 2010

cloud, you can access your portfolios details from any computer connected to the Web. Before long, most services will have that feature, but by then The Property Ledger will have innovated yet another area. Surfing is so much easier one foot ahead of the wave than one foot behind. Furthermore, having all the details of a property, including title documents, HUD1s, leases, management agreements, and the like, stored in one central repository is simply a great way to run your property investment business. Once you have experienced it, it is difficult to revert back. It would be like going back to using sliderules, or for those readers not old enough to remember what they are, the curly-paged and faded fax machine if they even remember that! Carter: Since you travel often, are the features of Electronic Library useful? Dolf: Absolutely. In fact, more and more companies are trending towards cloud computing. Clearly, it is convenient to be able to access all the relevant data on a property from anywhere and not have to be concerned with taking up space on your own computer, keeping data in sync, having the data concerned fall into strange hands in the event of a computer loss, inreWEALTHmag.com

stalling upgrades, etc. It is all done for the end user. Carter: Why is it important for investors to monitor the financial performance of their real estate portfolio? Dolf: Interestingly, it is important for investors in stocks and commodities to maintain a vigilant eye on their volatile investments so that they can jump ship if the ship starts to sink. With real estate being a much more stable investment, much of the interest in monitoring your portfolio is just that: interest. However, if you want to know when you can invest in yet another property, based on cash-reserve build-up, equity position, available collateral, etc.), then you want to have the up-to-date information available instantly. The Property Ledger provides just that when you need it. Carter: How often should an investor track the financial performance of their real estate portfolio? Dolf: As often as they feel comfortable. One of the advantages of real estate investing that I often tout is that unlike the stock market, where you have to monitor your

investments regularly, with real estate, you can buy a property and put the title in a bottom drawer, take a six-month cruise, and not worry if you should sell the property again. However, it is comforting to be able to put your finger on the pulse of how your investments are performing. Carter: What is your favorite financial calculation when analyzing your properties? And why? Here are the choices: Gross Rent Multiplier Cash-on-Cash Return on Investment After Tax Cash-on-Cash Return Internal Rate of Return Return on Equity Dolf: I like to analyze based on cash-oncash return. This calculation shows you how the cash you are putting up is performing. It is the prime indicator of how you can truly leverage your money. What other investment allows you to get a $100,000 asset for only $10,000 or $20,000 in cash? For most investors, you cant buy $100,000 worth of stock or gold or oil without coming up with the entire purchase price in full. When you put up all the money to buy an investment, the return is

simply the income divided by the investment. With real estate, since you only need to come up with a small portion of the purchase price in cash, the cash-on-cash return becomes very important and, dare I say it, interesting. It is an advantage inherent in real estate investing that is often overlooked by financial advisors. Carter: What type of investment do you favor right now and why? Dolf: When it comes to residential property, I prefer the single-family home. However, for the last two decades, I have personally focused on commercial real estate. That doesnt mean I havent invested in other sectors but the benefits of commercial real estate for the property owner are incredible. Here are just a few of the benefits: 1. The leases tend to be much longer anything from three to twenty years. They are generally secured by the business, with the owners offering a personal guarantee. 2. Commercial tenants tend to maintain the property better as the look and condition of the property is important to their business.Continued on next page

Dolf & Carter, pg. 17

Tenants often improve and upgrade the space with their own money. 3. With residential property, the landlord tends to pay the outgoings such as property taxes, insurance and maintenance. With commercial real estate, the tenants who are leasing the property, pay for those expenses. Carter: Were both located in Arizona; lets discuss the local market. Where is it heading? Dolf: Im optimistic. There was an article in the paper just three days ago stating Taylor Morrison Homes will begin construction in July of a master-planned community in Gilbert. There will be 17 phases developed over the next 12 years according to the report submitted to

the Gilbert Planning Commission. This is indicative of the long term. In the short term, things look pretty grim, again, if you are forced to sell. There is word on the street that there will not be a u-turn for years. Things go in cycles. When you get old enough to have experienced a few cycles, you learn to embrace them rather than fear them. There will be a turnaround. If you can buy real estate that cash flows now and have a great chance that long term the capital value will go up immensely, why would you not acquire some real estate? Learn more online about The Property Ledger, visit: www.thepropertyledger.com To reach Dr. Dolf de Roos, visit: www.dolfderoos.com

FREE e-Book Offer, For a Limited Time!http://thepropertyledger.com/buy/90-the-real-estate-wake-up-call-e-book-free

Download The Real Estate Wake Up Call Today

Best Investment PropertiesInterview by Linda Pliagas

Maverick Investor Group Scours the Globe for the

W

ith a name like Maverick, one immediately expects the unexpected. Real estate with a hip and a bit of a rebellious twist. Maverick Investor Group delivers all that and more. It is a real estate brokerage that caters to a community of sophisticated real estate investors and agents, all of whom are committed to using real estate as a vehicle for designing their lifestyles. The brokerage is licensed with its primary office in Las Vegas, but the Maverick principals all live in different states, work from laptops on rooftop pool decks, and travel the globe in search of premium buying opportunities for their exclusive clientele. Maverick negotiates directly with developers and owners for prices and terms that are not available to the public. The buying power of the Maverick community enables developers to move more properties in less time and save money on advertising, marketing and other normal overhead. This allows them to offer special prices and terms to buyers in the Maverick community that they could not offer to the general public. Indeed, the traditional brick-and-mortar neighborhood brokerage dedicated to farming a five-mile radius, driving buyers around and sitting at open houses seems like an archaic business model next to Maverick. Even more avant-garde than their business model is their corporate vision: To

Mark Solak

Valerie Schrock

Matt Bowles

Next Destination: The Hidden Tropical Paradise of...Nicaraguaradically improve peoples lives through real estate. And their radical approach to real estate is working. Even during 2009, in a single 90-day period, the company was able toRealty411Guide.com

close as many as 34 transactions and pay out nearly a quarter of a million dollars in buyer referral fees to real estate brokers in the Maverick Referral Network. Mavericks business model, includingPAGE 19 2010

the international component, is just a continuation of the global lifestyle enjoyed by its principals. The company was founded by Mark Solak, Valerie Schrock and Matthew Bowles real estate investors >reWEALTHmag.com

and licensed real estate professionals with formal, advanced degrees. Prior to joining forces, they led cosmopolitan lives, traveled the world and lived in foreign countries for extended periods of time. Recently, I caught up with the Maverick power trio to discuss their latest turn-key buying opportunitythe Seaside Mariana Spa & Golf Resort on the Pacific coast of Nicaragua.

worthy people I had ever met, all essential qualities for business partners. The three of us began pooling our skills, resources and creative energies to develop a cutting edge business model that could provide unparalleled advantages to real estate investors and real estate agents. In 2007, it was ready to be launched so we all quit our jobs, flew to Las Vegas and, while overlooking the Strip from a rooftop lounge, raised our glasses

we use. It was crucial for everyone to start with the vision of their own ideal lifestyle. Matt likes to work from his rooftop pool deck in LA, Mark likes to spend extended time in Europe each year, and I like to go skiing in Canada and spend part of the year in Phoenix with my parents. So we structured our real estate business to facilitate our dream lifestyles. But, more than that, Maverick has built an entire community

Seaside Mariana Spa & Golf Resort features the first Jack Nicklaus Signature Golf Course in Nicaragua.

Q: How did the three of you become business partners? Tell us a bit about how Maverick Investor Group formed? MB: Well, Valerie and I met in graduate school in 1999. We both got masters degrees in International Peace and Conflict Resolution and then worked in human rights advocacy in Washington, D.C., for several years. We started investing in real estate on the side, reading books about it and learning by experience. Soon we had millions of dollars in real estate holdings in states all over the country. I met Mark in 2005 when he sold me over $2 million worth of investment properties in Las Vegas. I was blown away by his customer service; it was the best I had ever seen in any industry. These were two of the most talented, ambitious, honest and trustRealty411Guide.com

and announced to the world that Maverick Investor Group was born! Q: The Maverick partners live in different states Matt is in Los Angeles, Valerie is in Washington D.C., and Mark lives between Chicago and Las Vegas. That is pretty incredible! How did you decide to structure your company like that and how does it affect your business? VS: We were intentional about structuring the company that way from day one, and the primary reason is freedom of mobility for the Maverick partners. Its all about lifestyle. We can live wherever we want and travel whenever we want for as long as we want, and no business falls through the cracks because of the systems and processes we have set up and the technologyPAGE 20 2010

of real estate investors and agents who are focused on using real estate as a vehicle for designing their dream lifestyles. We show our clients how to do what we do. You will notice that we have a section on our website that discusses real estate lifestyle design in great detail, down to the specific technology products we use. Real estate investing is only a means to an end its always important to keep your eyes on the larger prize. Money isnt very useful if you have lost touch with your dreams. How can real estate enable you to recapture your time, design your dream lifestyle and make enough money to finance it? Thats the big picture. Q: Maverick has always encouraged out-of-state investing, why are you nowreWEALTHmag.com

moving to international real ment in Nicaragua, making estate? it particularly friendly to forMS: For the same reasons, eign real estate investors. were just expanding the playFor example, as an interground. The reason why I national investor who lives would never limit myself to in the US, I can own freehold buying in my own city or state property in Nicaragua with is because there might be a bettitle insurance from a Northter market than the one I live American-based title comin. The failure to consider inpany, and when I sell it for ternational real estate markets a profit I will owe no capital produces the same restriction. gains tax in Nicaragua. PresI want my money in the best ident Ortega has personally market in the world no matter endorsed the Seaside Mariwhere I live, period. Maverick ana resort because it is anis opening up a private chanticipated that it will result in nel for real estate investors to an explosion of tourism and access unlisted properties in be a huge economic boon for premium global markets, with the country. So the governproperty management options ment is very supportive of in place and a variety of exit foreign investors coming in strategies. Buying through to buy real estate. Maverick has always meant Seaside Mariana Spa & Golf Resort sits on 2 kilometers of pristine beach front. getting exclusive prices and Q: What kind of deal terms terms that are not available to was Maverick able to negoup the coast is Nicaragua. It borders Costa the public. That has simply expanded to Rica and has the same weather, the same tiate at Seaside Mariana and how can our the international arena. beaches, the same sunsets, but a much readers get in on the action? lower cost of living and, at the moment, VS: As you know, our prices and terms Q: Why did Maverick choose Nicaragua? much lower property prices. Seaside Mari- are not available to the public, so I cannot And why the Seaside Mariana Spa & Golf ana will be Nicaraguas first luxury resort unveil any details here. I will tell you that Resort project in particular? with a five-star international brand hotel this is one of the most extraordinary deals MB: Over the last two years, the Maverick and a Jack Nicklaus signature golf course. I have ever seen and that we have a global partners have traveled throughout Europe, We are talking about a 923-acre resort on exclusive on the entire resortthe only the Middle East, the Caribbean and Central 2 kilometers of pristine beach front. Noth- way to buy a property at Seaside Mariana America to review real estate projects. In ing like it currently exists in Nicaragua. is through Maverick. our opinion, Nicaragua is one of the pre- This project will single-handedly take the For detailed information and private acmiere emerging markets on the world stage country to the next level as a tourist desti- cess to our special prices and terms, your today. When you look at a map of Central nation. When the number one golf course readers will need to become part of the America starting from the south, you be- designer in the world chooses to go into a Maverick community. Real Estate Invesgin with Panama, then Costa Rica both market for the first time, real estate inves- tors can apply to join our community of of which have already exploded as tour- tors should perk up their ears. It is exactly VIP Buyers and get access to unlisted deals ist destinations over the last 15 years and these types of seismic events that I look for like Seaside Mariana. Real Estate Agents have seen corresponding appreciation in when I choose where and when to invest can apply to join the Maverick Referral property values and the next country my own money. Network and make 3% every time their clients close on a Maverick Deal. We invite smart real estate investors and Q: What is the political and economic climate in savvy real estate agents to contact us today. We dont care if someone has a lot of exNicaragua right now? MS: Nicaragua has had perience, we care if they are serious about a democratic government using real estate to build their wealth and for the past 20 years and design their lifestyle. has had five transfers of power during that time. For information, contact Maverick Investor Recently, the government Group: www.maverickinvestorgroup.com or has been passing laws to email: [email protected]. encourage foreign invest-

Realty411Guide.com

PAGE 21 2010

reWEALTHmag.com

Blue-Chip Real Estate Strategyby Ryan Hinricher, co-founder of InvestorNation.com This article originally appeared on BiggerPockets.com

Fits Economic Climatewell-versed in Section 8 you can profit greatly in the lower-end homes. The median-priced home becomes the blue-chip property. The blue-chip home has lower levels of vacancy and rents that have been buoyed by average people being displaced from their primary residence via foreclosure. In the market where my company is located, average-priced homes are selling for around $115,000. Obviously with distressed inventory out there, one can purchase properties at lower prices than this, improve them and probably have equity that is more tangible than lower-priced homes. How can one possibly model a $115,000 home the same way as a $30,000 home? The $30,000 home (in most cases) will have significantly higher rates of vacancy and maintenance. If you go up a step to the higher-than-average priced homes, youll notice those homes might offer stable tenants, usually high-end professionals who will reliably pay the rents. The cash flows may look lower on the surface than other types of homes but these blue-chip homes perform more reliably on maintenance, vacancy, and valuations. Financing Financing on blue-chip homes tends to be much easier than most any other price point for a number of reasons. First because the prices are low enough you dont worry about jumbo loan pricing, rates, and restrictions. On the lower end not all lenders are lending on homes priced under $50,000 and at times have a different rate table. In and around the median price nearly every lender offers investor loan products. Ive also found the appraisal issues are fewer because normal sales activity exists at thisContinued on page 24reWEALTHmag.com

T

he housing recovery is limping along slowly leaving many real estate investors wondering where to invest their dollars. Some speculation is even returning to the market with new investors looking to purchase, renovate, and resale distressed properties for short term profits. Owning a real estate investment brokerage allows me to see a variety of transactions, including retail flips from speculators, investors buying $8,000 homes, renovating and placing tenants in them, and a higher quality purchase and hold homes closer to median home prices. The latter is a strategy that I believe right now is being overlooked by many investors. The Product There are many markets where you can purchase and hold homes at the median or even average home price and receive a positive cash flow with a traditional 20% down strategy. These homes, are out-performing many lower-priced homes from rental prices and home values perspective. Median-priced homes in most markets are three bedrooms, two bathroom homes, which offer good car storage. Usually this is the type of home most Americans desire to live in ensuring you always have both an available rental pool and an available buyer pool. This product offers real estate investors multiple exit strategies with the ability to sell it retail versus lower-end properties, which usually need to be sold to other investors. In addition, median-priced homes are usually in areas low in crime, close to schools, shopping, houses of worship, and with easy access to employment. The inverse of this is, of course, also true. I personally own properties at much lower price points as well. They took the hardest hit on rents and value. This is where Ive seen

a lot of investors get in trouble. The lower priced homes usually have households with limited to no savings or emergency fund. So when a tenant loses a job, the property owner feels that impact pretty quickly. Also lowerpriced homes tend to be in older areas givRyan Hinricher ing the owner a much higher rate of maintenance. The Numbers This is where investors usually make mistakes. The surface numbers can be very deceiving in real estate. When analyzing a real estate transaction many investors arent using vacancy and maintenance, or applying the same vacancy and maintenance numbers to homes that vary widely in price, age, neighborhood, size and city. This can cause a pretty big disappointment when the cheap property you purchase is affected by socio-economic issues leading to high tenant turnover, criminal element, slow-paying tenants and maintenance issues. Ive seen many people advertise proformas with high cash flow on smaller, older homes in areas with high crime, poverty, poor schools, and with low rates of home ownership. One can argue that these can be good investments structured correctly and by applying the right metrics to ensure a more accurate projection of cash flows is achieved. These lower-end properties have become the penny stocks of the real estate investment business. If you get the perfect tenant who doesnt feel the pains of the recession, maintains the home themselves and stays in the property for a long time, you could hit pay dirt. Similarly if yourePAGE 22 2010

Realty411Guide.com

Blue Chip Real Estate Strategy, pg. 22

price point. When you have a lot of normal sales, valuation tends to be (somewhat) stabilized. Exit Strategy Having an exit strategy is an essential part of your real estate plan. Some investors plan on never selling and while that can make sense to receive all the benefits of real estate, lives change. If you think back five years ago and how different things in your life were at the time, you might agree that having an exit strategy is important. With these blue-chip investment homes, youll find mul-

ida, which were impacted very little by the housing boom and bust. Many of these cities have a good economic future, affordable tax rates, net population growth, and high enough rents to achieve positive cash flow at the median home price. In Summary With distressed properties making up a large percentage of total sales, then it only makes sense to focus on buying bluechip homes at a discount today. In doing so, one can realize equity through quality renovation, placing a tenant and holding. These homes should provide you relative peace of

Having an exit strategy is an essential part of your real estate plan.tiple exit strategies. Medianpriced homes have the widest available buyer pool. Think about that for a minute: Lowerend homes typically are resold to investors. So imagine buying a home on the lower-end at 60 cents on the dollar and thinking you have a lot of equity. In fact if your future end buyer is an investor, do you think theyll pay 100 cents on the dollar? Time on the market is also another factor. At the medianhome price, time on the market is usually shorter than any other price point. So in planning your long-term strategy it seems to make sense to invest in homes that could be sold quickly, financed easily, and sold at or near market value? Where to Find There are many markets you can find these types of properties in today. Without going into much detail in this article, there are plenty of cities which lie in states outside of California, Nevada, Arizona and Flormind when compared to lower price points due to the lower socio-economic risk discussed earlier. These types of rentals are a good fit for people looking to diversify out of equities and accumulate a few properties. While they may offer stronger fundamentals than most properties they obviously arent bullet-proof. These are comparable to owning GE stock (GE registered no U.S. profit last year). While you can depend upon these homes most of the time, the downside risk is usually minor price depression during an economic recession. Lastly, in many markets this type of product and strategy simply wasnt an option when prices were higher. I doubt that very far into the future this opportunity will be as widely available again in as many markets as it is today. Ryan Hinricher is co-founder of Investor Nation, visit online: www.InvestorNation.comreWEALTHmag.com

Realty411Guide.com

PAGE 24 2010

3 FREE Ways to Find aGreat Wholesale Deal Today!

I

by Ginger Macias

just had a great call with one of my coaching students on how to get a deal signed up by the end of today. Times are tough, and although sending direct mail pieces is a great way to get leads, sometimes its just not possible to send them out especially if youre just starting out. So over the years, Ive learned some cheapskate ways of finding leads. 1. Online RSS: If youve been in real estate any amount of time, you probably already know that online sites such as Craigslist, Redfin, Backpage, Oodle, etc., can have some pretty amazing leads on For Sale By Owner (FSBO) properties. The only problem is that it takes tons of time to sort through all those sites to find a decent deal. Rhett Halsey, one of my good friends and an internet marketing guru for real estate investors, told me of a free feature offered by most websites: RSS or Real Simple Syndication. Instead of multiple searches for leads, the leads come to you in one spot. You can set up a Google Reader account and have all these leads sent directly to you, the minute they are posted on one of these sites. Its simply amazing how much time this saves. We have just implemented this in my office and within a few days got three properties under contract and sold them within a few hours. My new assistant was floored at how quickly an investor can get a deal under contract and sold! To set up your own RSS feed, go to your favorite FSBO site, Craigslist (www.Craigslist.com) for example. Do a search using motivated seller keywords like fixer, investor, etc., one word at a time. Once the search is complete, you can scroll to the bottom of the page and click on RSS or the little orange RSS icon. Set it up to point to your Google Reader, and youre done!

free emails. Its important to work with an agent who knows you want a smokin deal, and who will make lots of lowball offers on your behalf without flinching. For most listings, other than REOs, you can also try and make seller-financing deals. The point is to get your foot in the door and start negotiating with the seller. Another lead system you can set up on the MLS is expired listings. These listings have expired without anyone buying the property. This can mean youd be dealing with very motivated people! Set up a win-win situation with your agent where they can present your offer, and if the sellers dont like it, the agent may be able to pick up a new listing. 3. Other Wholesalers: One of my absolute

narrow down your search to REOs, probates, fixers or other criteria. You dont even need access to the MLS, just find an investorfriendly agent and let them know your criteria. They will set you up to receive

favorite ways to find deals is to ask other wholesalers what they currently have under contract and to market that property to my buyers list. Or, if youre a rehabber or landlord, you can pick up amazing deals without having to do all the leg work. Where do you find these wholesalers? If you see a We Buy Houses sign, call them. Youll likely be dealing with a wholesaler. Also visit your local REI meetings, Google wholesalers in your area, ask rehabbers who they recommend, and ... dont forget, ME! Im an active wholesaler in Southern California who loves working with other investors. (Shameless plug? Of course.) If you get a deal done and need to sell your property really quickly, let me know. Well, now there is no excuse for you not to find a deal today! Good luck and send me a brief email letting me know if you found this helpful. To contact Ginger Macias or learn about her speaking engagements and wholesale deals, visit: www.OCWholesalers.com

2. Multiple Listing Service: Your local MLS (Multiple Listing Service) offers a great way to find leads for free. You canRealty411Guide.com

PAGE 25 2010

reWEALTHmag.com

ets face it the country, the economy and the real estate market is just terrible. There are no more good deals. Lets all get out of the business. People are not building, buying or selling homes any more. There are so many overencumbered and foreclosed-upon cheap properties available for pennies on the dollar that nobody wants them anymore. After all, who can make a living in this ridiculous business these days? Oh yeah? And Michael Jackson faked his death, Elvis eats at Burger King, and the world ends in three years! Not that theyre needed anymore, but here are a couple solutions to these horrible problems facing real estate investors in this disastrous economy: 1. Stay in bed with a tinfoil hat on your head. 2. Go live with your parents and let them feed you until you win the lottery. 3. Go back to school on the government, and get a law degree so you can force people to pay you to stop suing them. OR... 4. You can capitalize on singularly the greatest money-making opportunity ever! And you dont even need a dollar or a dime to do it. SHORT SALES The short sale industry is burgeoning now and will probably continue to do so for three more years. New short sale millionaires are being made every day. There are billions upon billions of dollars (Remember when a billion dollars was a lot of money?) to be made in the transactional funding of compromised mortgage defaults loans that would otherwise be forced into expensive and time-consuming foreclosures, and sold by lenders at public auction. Def: Short Sale: The acquisition of real estate at a compromised (wholesale) payoff amount that is less than the balance of the mortgage obligation. Def: Transactional Funding: The twostage practice of using another persons

L

by Bill Gatten

money for a day or two at a high interest rate (but at a reasonable cost), with which to purchase a foreclosedupon property by means of an allcash offer prior to its scheduled public sale date. And then selling it on the day of closing, or soon thereafter, in a separate escrow settlement to an end-buyer who obtains his own loan and lives in and loves the property forever. This process is known as the A to B/B to C transaction. In other words, you, the investor are the B component; the current owner is A, and the end-buyer is C. In other words, B buys from A

A Brave New World in Compromisefor, or in advance of, services to be rendered, whether such services are actually performed or not. Another common violation has to do with sand bagging by attorneys, and many non-attorneys, who bill on a monthly basis for services (mostly loan modification schemes) while a short sale or loan modification process is presumably taking place. Instead, either there never was any such attempt or the attempt failed, and

...two REALTORS in Massachusetts were recently sentenced to ve years in prison each for having used this scheme several times.in one escrow closing process (taking full ownership of the property), and then sells the property to C at a reasonable profit in a wholly separate escrow process. It all sounds simple and it is! However, a thorough knowledge of all the rules and regulations concerning short sales, equitypurchasing, equity-stripping, foreclosure consulting, credit repair and mortgage lending is absolutely mandatory before becoming too far vested in the business of short sales. To date, hundreds of otherwise nice-guy and gal would-be investors have been severally sanctioned, shut down, heavily fined and/or sent to prison for violating the very stringent laws regulating short sales and foreclosure consulting in various states. In my own case, Ive spent my business as a fearless bull rider: but in this last Rodeo, Im sticking to riding milk cows. I wont set any records or win any prizes; but Im a lot less likely to get thrown of and have a horn poked up my rear end ( this, is, by the way, an analogy not a good one, I agree, but an analogy none-the-less). One of the most often violated of the many regulations being put on the books as of late has been that of taking money the client wasnt informed and was told, Were working on itbe patient, while the monthly payments continue. Another big one, and one that is probably most tempting but also most deadly for REALTORS, is the situation wherein the investor/REALTOR has already linedup a retail buyer who is ready to take the property at its true market value following the short sale acquisition by the investor. When the scheme comes to light, the contention by the lender in these cases is that if the property were worth more than they were told in the transaction, there would have been no need for a short sale and their resultant loss. They see such schemes as blatant bank fraud and have no sense of humor in such cases. As a matter of fact, two REALTORS in Massachusetts were recently sentenced to five years in prison each for having used this scheme several times. So the long and short of it iskinda like Henny Youngman was one to say: If its gonna hurt when you go like that for cryin out loud, dont go like that! Todays short sale market is burgeoning.Continued on pg. 29

by Ginger Macias odays estate environ real ment can seem a little tricky to navigate. So many possible ways to make money exist in this indus try, it can be overwhelming, especially for those who are just get ting started in real estate investing. There are many late-night television shows that claim to teach you how to be a multi-gazil lionaire by next week, but is there any truth to what theyre saying? Take a look around. Youll notice that there are a lot of successful real estate en trepreneurs, people who are making a killing today, in this down market. The ques tion is did they just start making lots of money by pure luck, or did they have men-

10 CA$H TWeeks to

tors, courses and systems to help them achieve their success? Those of you who are living the real dream, you know estate that luck had little to do with where you are today. It takes concrete actions, goals and guidance to get to your dreams. Well, for those of you starting out in real estate who are anxious to get going, there are wonderful ways to get into all this ac tion. Recently, I spoke with Matt Malouf about his new program, which helps inves tors bridge the gap from real estate dream to reality. And by reality, Im talking about actually owning your very own investment property at the end of the course! (More on that later.) Malouf is an investor-friendly real estate agent in California and been investing has

OW

with Matt Malouf since 2001. Over the years, he has special ized in wholesaling, owner financing and foreclosures. Malouf has developed a busi ness model that he describes as T.E.R.M. It is a model designed to efficiently minimize the investors time, energy, re sources and money in that order, he explains. To that end, his program is a 10-week course that walks investors through the exact steps needed to find, analyze and buy an investment property that cash flows from day one. Some topics include learning how to set up your property management team, screen tenants, how to hold title and financ ing options. The motivation to course create this came from Maloufs desire to meet the needs of investors who want to get educat-

ed and match them with the best available product in the real estate marketplace. This hybridization will enable beginning investors to buy a property that meets their criteria, after learning all the basic steps needed to acquire and manage that property. This is not just a course, Malouf explains. At the end of 10 weeks, theyre going to have a cash-flowing house, an asset to put in their portfolio. It is all- inclusive in the program.

people on the team. Malouf and his team then go out and find a property that meets the students needs. They send personalized updates, letting them know whats being done to find them a property. This program lays the foundation to successful real estate investing. Malouf gives this analogy: Its like building a skyscraper. You have to spend the time to set up a foundation and set it nice and deep, nice and strong. That way, it will

It takes concrete actions, goals and guidance to get to your dreams.Maloufs T.E.R.M model is ideal for someone who has a full-time job and wants to start building a real estate portfolio as part of their retirement plan. Over the course of 10 weeks, students receive the entire course through the internet, which includes 30 to 60 minute lessons by audio, video and text articles. Each student also receives the Million Dollar Rolodex, which gives the contact information of all the keyA Brave New World, pg. 27

stand through the good and the bad. Maloufs T.E.R.M program launched this summer and is available year-round to a limited number of people. Be sure to reserve your place today. Readers can contact Matt Malouf directly at (562) 4437042; mention the out-ofstate magazine special. Or visit: www.buysellwithmatt.com Enter the promo code Realty411 in the note section.

There really is no limit to the number of homes in foreclosure that lenders would like to get off their books in order to reduce their matching fund requirements and free up more cash to lend out. Millions of dollars are ready to be made by integrally involved entrepreneurs over the next few years. To miss out on any of it would be an out-and-out shame if not a crime. There are two sets of adages to live by that one must ponder and decide upon before jumping into the business: Set A - Strike while the iron is hot; He who hesitates is lost; The early bird gets theRealty411Guide.com

worm, and If everybody is doing it, its time to do something else. Or Set B - Haste makes waste; Look before you leap; and Wait until all the bugs are worked out before you jump in, or Wait until you see everyone else doing it, then jump in why take chances? My own: Successful people make quick decisions and are slow to change their minds, the unsuccessful are slow to commit and quick to change their minds. So, whats my advice regarding the current short sale market? OK, guess!PAGE 29 2010reWEALTHmag.com

elf-reliance, balance, integrity: these are just some important mantras in the martial arts world. Step into a monthly meeting at Black Belt Investors and youll soon discover these disciplines are in full force. With two locations in Southern California (Downey and Norco), Black Belt Investors provide a social network for both the novice and seasoned. It is a club where education is emphasized, deals are analyzed, and action is taken to reach goals. Ricardo Valencia, a national investor with holdings in four states (CA, TX, IN and MO), stressed the importance of attending monthly club meetings, as we were walking into a community center in Downey. We have a responsibility to teach those who are newcomers, he says with a smile, And, at the same time, you learn from those who are more advanced. Valencia, who travels throughout Los Angeles County to attend numerous real estate events, admits that the members of Black Belt Investors keep bringing me back ... its always nice to mix and mingle with them. What began as a casual meeting at a coffee house in 2000, by investor, martial arts expert and entrepreneur, Sensei Sean Gilliland has become an organized official club boasting two locations and filling the room with a strong following each month. Sensei chose to stake his claim in Downey, the city where he was raised. Next, he chose Norco, the city where he now lives with his wife, Annamaria, a licensed REALTOR, and their three children. The club meeting room, located inside a community center, was full and bustling in May. The sweet aroma of freshly brewed coffee and abundant smiles were inviting. The group, mostly in their 40s and 50s, was diverse in experience and background. They were master networkers, with busiRealty411Guide.com

S

[

Hitting the Club with Sensei at 12 Roundsby Linda Pliagas

ness cards in hand. Dressed in casual clothing, they chatted while munching on chocolate chip cookies. They discussed their latest deals, needs and goals. When the master approached the front, the students took their seats and settled down quickly, ready to start their lesson. Senseis cash and wealth system is pure

Sensei Spills His Top 5 Secrets to Land a DealCant seem to locate a distressed homeowner or unwanted property? Believe it or not, many people have real estate that they no longer need or want. (Yes, we first found this concept hard to believe Sensei Gilliland too!) Follow these five secrets from a master wholesaler, and youll soon have more deals than time to work them. #5: Code Enforcement: Many local government websites, such as Los Angeles County, offer online lists of distressed properties. This is an often overlooked treasure filled with potential gems. Continued on pg. 59