Rare Earth Peer Comparison Mkt Cap ($m) Lynas Corp … of reported uranium, gold and base metal...

Transcript of Rare Earth Peer Comparison Mkt Cap ($m) Lynas Corp … of reported uranium, gold and base metal...

Territory Uranium (TUC)

Page 1 of 22

Territory Uranium (TUC)

Page 1 of 27

OVERVIEW Territory Uranium (ASX Code: TUC) currently holds a

tenement package of 17,000km2 across nine projects. As of 30 September 2010, TUC had 40 100%-owned tenements

in the NT; including 13 granted and 27 applications. Most granted tenements are around the midpoint of an extendable 6-year tenure. TUC listed on the ASX on 26 April 2007. The Company’s flagship project is the Quantum Rare Earth and Uranium Prospect, which is located on the western

margin of the Pine Creek basin and is surrounded by a number of uranium mines and prospects, including Thunderball, Fleur De Lys and Rum Jungle.

Rare Earth Potential

Quantum Rare Earth Prospect Further RC drilling at Quantum confirmed the presence of a

larger mineralised system with multi-commodity potential, with a 5-12 metres thick uranium-rare earth (REE)-gold mineralised zone intersected in a major shear zone. The intersection confirmed the presence of a newly-interpreted

mineralised fault zone located approximately 1.5 kilometres east of reported uranium, gold and base metal mineralisation, including the results from hole FEND10. Intersections reported above returned Total Rare Earth Oxide (TREO) grades of up to 11.61%. Significant results include:

Hole TDD8: 33m @ 2.09% TREO from 246 metres,

including:

a) 12m @ 4.51% TREO from 246 metres b) 6m @ 7.79% TREO from 248 metres c) 3m @ 10.38% TREO from 249 metres d) 1m @ 11.61% TREO from 251 metres

REO grades are comparable to global REO deposits.

Based on an analysis of intersections at two holes (TDD8 and TDD9), the elemental breakdown of the intersected REEs compare favourably with global Rare Earth Deposits, including Mountain Pass (US), Baiyunebo (China), Nolans Bore (Aust) and Mt Weld (Aust). Please refer to Tables 1 & 2 on page 10 for further details.

0

TERRITORY URANIUM COMPANY LTD (TUC)

UUrraanniiuumm && RRaarree EEaarrtthh FFooccuuss

SPECULATIVE

18 February 2011

Share Trading Info

ASX Code TUC

Current Share Price (cps) 39.0

Trading Low /High (Rolling Year) 6.5c - 41c

Mkt Captalisation (undiluted) $m 48.4

Current Cash on Hand $m (approx.) 8.0

Board of Directors*

Peter Harold Non Executive Chairman

* Further details on Page 26

Major Shareholders

Stanley Resources P/L 11.0%

Australian Heritage Group P/L 7.0%

JP Morgan Nominees (Aust) Ltd 6.7%

HSBC Custody Nominees (Aust) Ltd 4.5%

A Harold 4.0%

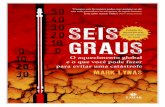

Rare Earth Peer Comparison Mkt Cap ($m)

Lynas Corp (ASX Code: LYC) 3208.6

Arafura Resources (ARU) 463.6

Greenland Minerals & Energy (GGG) 419.8

Alkane Resources (ALK) 320.0

Peak Resources (PEK) 135.5

Navigator Resources (NAV) 88.4

Territory Uranium (TUC) 48.4

Global Metals & Mining (GBE) 31.8

Orion Metals (ORM) 15.1

Ronald Stanley Non Executive Director

Michael Britton Non Executive Director

Ian Bamborough Managing Director

0

5,000

10,000

15,000

20,000

25,000

6.0

11.0

16.0

21.0

26.0

31.0

36.0

41.0

17-Feb24-Jan29-Dec2-Dec9-Nov15-Oct22-Sep30-Aug

Price (cps)Volume ('000)

TUC 6-month Price Chart

Price

Volume

Important Disclosure Investors should be aware that Territory Uranium Ltd is a

corporate client of Alpha and that Alpha will receive a consultancy fee from Territory Uranium Ltd for compiling this research report.

Territory Uranium (TUC)

Page 2 of 27

TUC have not made a tonnage estimate for Quantum, however a four kilometre strike length of similar geological and geophysical characteristics has been identified for further

exploration. Initial observations of Quantum mineralogy suggest a reasonable chance of mineral processing options being successful (subject to test work). Analysis of 11 drill samples at the Quantum REE Prospect show high concentrations of minerals recognised from well-known REE deposits, such as Mountain Pass (US) and Hoidas Lake

(Canada).

The Company is currently progressing with the next

phase of drilling at Quantum. An additional five pre-collars (920 metres) have been drilled, with six diamond tails currently anticipated (for 1,800 metres). The drilling is designed to add additional significant intersections, confirm

interpreted folded geometry of the mineralised system prior to planned step-out drilling and to test for further interpreted mineralised positions.

Energy Prospect A re-sampling program was recently undertaken at Energy to

test for the presence of rare earth mineralisation. The

sampling program highlighted a significant zone of yttrium (Y) mineralisation in association with uranium mineralisation and minor rare earth enrichment.

STRONG DEMAND PROFILE EXPECTED FOR REEs

China, which supplies around 97% of the world‟s rare eath metals, has implemented a series of quota reductions in 2010 on the exports of rare earth metals, with further reductions expected. There is growing concern that the world may soon face a shortage of REEs. According to Reuters, worldwide demand for REEs is expected to exceed supply by some 40ktpa in several years unless

major new production sources are developed. Alternative production sources include Australia, Brazil, Canada, South Africa, Greenland, and the US. The resulting impact of China squeezing supply is that prices for

REEs have skyrocketed (see REE Price Index on page 24), a trend further supported by REEs becoming increasingly important in the

manufacture of sophisticated products including flat-screen monitors, electric-car batteries, wind turbines and aerospace alloys. Interestingly, announcements of REE projects worldwide have accelerated over the last six months, coinciding with higher REE

prices.

TUC’s Attractiveness as a Uranium Play Quantum Uranium Prospect TUC commenced drilling at Quantum with the intention of

testing for potential uranium mineralisation. Significant high-grade uranium results were returned in two holes, approximately four kilometres apart, the best results being at the re-sampled hole FEND10 (0.5m @ 0.42% U3O8 from 497.5 metres).

Territory Uranium (TUC)

Page 3 of 27

Daly River Uranium Project TUC‟s Daly River Uranium Project tenement package has been

identified with both vein-style uranium mineralisation and

sandstone style uranium mineralisation.

The most advanced uranium prospects at Daly River are the Green and Energy Prospects. At Green, three high-priority uranium targets have been identified over an 8-kilometre strike length, of which two have been drilled to test for

unconformity-related uranium mineralisation. Further drilling will target shallow mineralisation potential and an untested unconformity related target within the strike length.

TUC consider that there is a large amount of hidden potential

at depth beneath the Energy Prospect. The Company plan to test two exploration theories in order to improve the resource

profile. In addition, a number of significantly larger radiometric anomalies remain to be tested. Significant results from RC drilling include:

Hole TURC74: 2m @ 973 ppm U3O8 including 1m @ 1,061 ppm within 7m @ 567 ppm;

Hole TURC64: 2m @ 506 ppm U3O8 and 3m @ 461

ppm within 9m @ 336 ppm; Hole TURC70: 2m @ 445 ppm U3O8 within 10m @

313 ppm within 9m @ 336 ppm;

Hole TURC71: 3m @ 404 ppm U3O8 within 6m @ 333 ppm;

Funding TUC has adequate funding available to further advance its exploration activities. Three recent capital raisings (via placements) have enabled the Company to undertake further testing of REO mineralisation at its Quantum prospect, with TUC outlining an initial drilling program (5-6 holes for 2,500 metres) in

order to further test dip and strike extensions to REO mineralisation. The current cash balance is over $8 million and has been boosted by two placements undertaken in January 2011 (~$4.58 million @

30 cents per share and ~$2.2 million @ 32 cents per share). These two placements are in addition to one completed in

November 2010, which raised $1.84 million @ 23 cents per share. Estimated expenditure for the March 2011 quarter is $1.05 million (approximately 70% on exploration). The balance sheet is debt free.

Capital Structure

The share register is not widely dispersed. As at 18 February 2011, the top 20 shareholders accounted for ~50.1% of the ordinary shares on issue. Notably, there is a strong alignment of interests with the

Company‟s directors and shareholders, with directors (including

associated entities) collectively holding ~20% of the ordinary share on issue.

Territory Uranium (TUC)

Page 4 of 27

* There are 2.0 million out-of-the-money options

Map of TUC Projects in the Northern Territory

Million Expiry

Date

Total Ordinary Shares 124.0

Unlisted Options

- Exercise Price 15c 0.35 30-Jun-11

- Exercise Price 15c 1.00 30-Jun-12

- Exercise Price 15c 0.04 30-Jun-12

- Exercise Price 20c 0.50 30-Jun-12

- Exercise Price 25c 0.50 30-Jun-12

- Exercise Price 40c 0.50 30-Jun-12

- Exercise Price 48c 0.50 30-Jun-12

- Exercise Price 56c 0.50 30-Jun-12

- Exercise Price 64c 0.50 30-Jun-12

Total Unlisted Options* 4.39

Total Issued Securities 128.4

Shares/Options on Issue

= TUC Granted Tenements

= TUC Tenement

Applications

Tennant Creek

Calvert

Litchfield Pine Creek

Woolner

Arnhem Land

Daly

NE Arnhem Land

McArthur River

Territory Uranium (TUC)

Page 5 of 22

Territory Uranium (TUC)

Page 5 of 27

11.. SSUUMMMMAARRYY OOFF TTUUCC PPRROOJJEECCTTSS

Pine Creek Daly Calvert Arnhem NE Arnhem Bluebush Litchfield McArthur Woolner

TUC Interest 100% 100% 100% 100% 100%JV w ith Panoramic

Resources100% 100% 100%

Project Area 697km2 2,613km2 681km2 2,101km2 482km2 3,429km2 1,159km2 7,112km2 93km2

Key Prospects Quantum, Wildcard Energy, Green - East Alligator River - - - - -

Product/s Uranium & REE Uranium Base Metals, Gold,

Uranium

Prospective for

Uranium

Bauxite Tennant Creek style

IOCG mineralisation

Uranium, Coal, Base

Metals

Base Metals;

Prospective for

Uranium

Prospective for

Uranium

Work Completed/

in progress

Drilling/follow -up

drilling at Quantum to

confirm uranium & REE

mineralisation

RC drilling intersected

uranium; re-sampling

program recently

undertaken to test for

REE mineralisation

Mapping and ground

gechemistry

highlighted multiple

targets

Land access

meetings

progressing; TUC

hoping to secure

expl'n grant in 2011

- Initial drill program

undertaken Nov-Dec

2009; 2nd phase

drilling recently

completed

Aw aiting decision

on consent to

negotiate on one

tenement (527km2).

Other ELs in

moratorium

Land access

negotiations

continuing (access

expected 2011/12)

-

Upcoming Activities Diamond drilling at

Quantum to commence

Jan/Feb 2011

Further drilling of 1 key

target at Green;

Testing of tw o expl'n

theories at Energy to

improve resource

Planned drilling

May/June 2011

Consent given by

Traditional

Aboriginal Land

Ow ners for access

(expected in 2012)

Work program

planned for bauxite

exploration (under

terms of option

agreement w ith RIO

Assay results from

2nd phase drilling not

encouraging. Work

planned on new

tenement for

phosphate in early-to-

mid 2011

- - RC drilling planned

in 2011

Project/Asset

Projects in Focus (In order of Importance) Projects in Developments

Territory Uranium (TUC)

Page 6 of 22

Territory Uranium (TUC)

Page 6 of 27

22.. KKEEYY PPRROOJJEECCTTSS

2.1 Pine Creek

In July 2009, TUC completed a high resolution airborne radiometric and

magnetic survey over a significant portion of its Pine Creek holdings, in particular immediately to the east of the Adelaide River uranium mine (historical production of ~3,500t @ 0.5% U3O8) and North West of the Fleur De Lys uranium mine (historical production of ~122t @ 0.22% U3O8). The aim of the survey was to reveal any previously-hidden

opportunities within the area, which is highly-prospective for uranium

mineralisation. First-pass rock chip sampling (results ranged from 10 to 45.5 ppm) to follow up on the radiometric anomalies delineated in the airborne survey were located on major fault zones and in association with the uranium prospective unconformity line and rock units. Further geochemical sampling work was undertaken in order to follow up on

some of these anomalies and many targets are now drill ready, as illustrated in Figure 1.

Territory Uranium (TUC)

Page 8 of 27

2.1.1 Quantum Rare Earth & Uranium Prospects

2.1.1.1 Outline

The Quantum Prospect is located on the western margin of the uranium-rich Pine Creek basin. The area is known for its historic uranium mines such as Rum Jungle (historical production 1.28mt @ 0.36% U3O8) and also it has a more recent discovery history, with

Thundelarra‟s discovery at the Thunderball high-grade uranium prospect in late 2008. According to Thundelarra (ASX Code: THX), drill results from Thunderball are amongst the highest grade uranium intercepts reported in Australia and include: 11m @ 3.4% U3O8, 15m

@ 1.5%, 12m @ 0.62%, 5m @ 0.76% and 3m @ 0.66%.

The Quantum Prospect shares some common geological elements with other nearby uranium deposits, as illustrated in Figure 2. In particular,

1. Uranium-prospective rocks extend from Thunderball to the Fleur De Lys historic uranium zone and SW to Quantum.

2. The Hayes Creek Fault trend underpins the uranium mineralisation at Thunderball. The fault extends SW to the

Quantum Prospect and also through TUC‟s Spectre Prospect (within Pine Creek).

Figure 2: Geological Elements – Quantum and Other Uranium Deposits (Source: TUC)

Territory Uranium (TUC)

Page 9 of 27

Historical drilling was undertaken in the 1990s by a Company targeting gold mineralisation associated with magnetic rocks. The radiometric anomaly or major faults were not tested in the historical drilling. In

addition, analysis of historic drill logs and core photography indicated further potential for uranium mineralisation. Samples of available core (partial core from three holes) were selected by TUC for analysis based on geological characteristics. Significant high-grade uranium results were returned in two holes, approximately

four kilometres apart. The best intersection was at the re-sampled hole FEND10 (adjacent to a significant radiometric anomaly): 0.5m @ 0.42% U3O8 from 497.5 metres. Uranium was noted in all rock types

throughout a 225-metre section of hole FEND10 - other notable intersections on FEND10 were 0.7m @ 0.083% U3O8 from 405.7 metres and 1.2m @ 0.06% U3O8 from 279.1 metres.

To follow up on the initial re-sampling results, TUC completed a downhole gamma logging program on seven of the historic drill holes in the area, confirming the presence of several additional target zones. FEND10 presented multiple gamma peaks over a 12- metre anomalous zone from 175 metres, highlighting a target zone for follow up drilling. Sampling by TUC showed hole FEND8, located four kilometres north of

FEND10, highlighted the extent of the mineralised system. Further, the Pine Creek district is considered to have a common association between gold and uranium mineralisation. This was noted in hole FEND10.

Historical gold assay results in FEND12 suggest the potential for more uranium mineralisation approximately 800 metres to the east.

2.1.1.2 Drilling Program

TUC planned for a total of 6-8 RC holes for 1,500-2,000 metres as an initial test, with approximately 400-500 metres follow-up diamond drilling also planned for the more promising areas. RC drilling commenced in September 2010 at Quantum, with the aim of following

up on the reported intersections at FEND10 and results from a 6.8-metre wide zone of gold-silver-bismuth and zinc mineralisation that is in association with uranium mineralisation. Results include 3.4m @ 4.84% Zn from 485.4 metres, including 0.9m @ 15.6% Zn from 487 metres and 1.4m @ 0.07% Bi from 484 metres.

RC drilling confirmed the presence of a larger mineralised system with

multi-commodity potential, with a 5-12 metres thick uranium-rare earth (REE)-gold mineralised zone intersected in a major shear zone. The intersection confirmed the presence of a newly-interpreted mineralised fault zone located approximately 1.5 kilometres east of reported uranium, gold and base metal mineralisation, including the results from hole FEND10. The best initial analysis using a first pass REE screen from the RC drilling included:

Hole TDD8: 5m @ 1.09% REE from 248 metres; 7m @ 55 ppm U3O8 (including 1m @ 100 ppm U3O8) from 246

metres; 12m @ 0.52g/t Au from 246 metres; 10m @ 2.1g/t Ag from 246 metres.

Significant transported uranium halos (including 5m @ 117 ppm U3O8 from 105 metres) were noted in the cover sequence above the U-REE-Au mineralisation.

Territory Uranium (TUC)

Page 10 of 27

Further analysis of the intersections reported above returned Total Rare Earth Oxide (TREO1) grades of up to 11.61%. Significant results include:

Hole TDD8: 33m @ 2.09% TREO) from 246 metres, including

b) 12m @ 4.51% TREO from 246 metres

c) 6m @ 7.79% TREO from 248 metres

d) 3m @ 10.38% TREO from 249 metres

e) 1m @ 11.61% TREOE from 251 metres The mineralisation is associated with sulphides and fluorite and an initial review of the TREE grade and the relationship with both sulphide

and fluorite mineralisation suggests that the Quantum Prospect could be more amenable to mineral processing and favourable metallurgical

recovery, but this is subject to the results of further test work. Mineralisation remains open down-dip and along +4 kilometres of totally untested prospect strike length. Table 1 highlights the REE elemental breakdown for various intersection widths in TDD8 in comparison with global Rare Earth Oxide (REO) deposits. Based on these intersections, the Quantum Prospect

compares favourably. Table 1: Mineral Breakdown for TDD8 intersections in comparison to known REE deposits (% REO)

A similar comparison of intersections from diamond drilling in hole TDD9 also compare favourably with REO deposits around the world (see Table 2).

Table 2: Mineral Breakdown for TDD9 in comparison to known REE deposits (% REO)

* 2.3m @ 2.75% TREO

Subsequent diamond drilling at Quantum confirmed significant REE mineralisation, with an intersection of 2.3m @ 2.75% Total Rare Earth Oxide (TREO) being returned 100 metres down dip of previously reported zones. In addition, TDD8 extended a previously-reported broad intersection to a total zone of 50m @ 1.55% TREO from 245

metres2. Mineralisation was identified on a footwall structure in TDD8, with assays returning 32m @ 0.38% TREO from 389 metres. Continuity of mineralisation is evident, as all significant assays across a geological cross section recorded significant intersects on the same geological

structure approximately 100 metres apart.

1 Total Rare Earth Oxide (TREO) refers to the rare earth elements in the Lanthanide series plus yttrium.

2 Extension of the previously-reported broad intersection at TDD8 of 33m @ 1.76% REE from 246 metres

Baiyunebo Mountain Pass Dong Pao

(China) (US) (Vietnam) 18m (from 246m)10m (from 248m)6m (from 248m) 37m (from 246m)

Ce + La 77.0 82.0 83.0 83.0 83.0 84.0 81.0

Nd + Pr + Dy 21.0 16.0 15.0 15.0 15.0 15.0 16.0

Sm + Eu + Gd + Y 2.0 1.0 1.0 2.0 2.0 1.0 3.0

Quantum - TDD8 Intersections

Nolans Bore Mt Weld Baiyunebo Mountain Pass Dong Pao Quantum TDD9

(Aust) (Aust) (China) (US) (Vietnam) Intersect*

Ce + La 67.0 71.0 77.0 82.0 83.0 83.2

Nd + Pr + Dy 27.0 24.0 21.0 16.0 15.0 14.9

Sm + Eu + Gd + Y 5.0 4.0 2.0 1.0 1.0 1.6

Territory Uranium (TUC)

Page 11 of 27

TUC’s confidence in the mineralised system is supported by the strong continuity in mineralisation style between drill holes and differing rock types (shale in TDD8 and dolerite in TDD9).

Figure 3 TDD9 core highlights the strong sulphide-fluorite mineralisation and mineral alteration associated with the reported REO grades.

2.1.1.3 Confidence to Proceed with Mineral Processing Test Work

Mineralogical analyses of 11 drill samples at the Quantum REE Prospect show high concentrations of minerals recognised from well-known REE deposits, such as Mountain Pass (US) and Hoidas Lake (Canada). In particular, the samples showed high concentrations of allanite crystals,

variably altered to secondary high-grade REE minerals such as

bastnasite, synchysite and other REE-rich carbonate minerals. TUC plans to proceed with further and ongoing metallurgical test work.

2.1.1.4 Current Activities TUC is progressing with the 2nd phase of drilling at Quantum. An additional five RC pre-collars (920 metres) have been drilled, with six

diamond tails currently anticipated (for 1,800 metres). The drilling is designed to add additional significant intersections, confirm interpreted folded geometry of the mineralised system prior to planned step-out drilling and to test for further interpreted mineralised positions. Figure 4 highlights the additional target position based on RC pre-collar

drilling. Diamond drilling is expected to commence in February 2011.

Territory Uranium (TUC)

Page 12 of 27

Figure 4: Additional Exploration Targets (Source: TUC)

2.1.2 Wildcard Prospect

The Wildcard Prospect within the Pine Creek region is geographically close to the Cosmo Howley gold mine and Fleur De Lys uranium mine, Thundelarra‟s Thunderball Prospect and the rare earth and uranium discoveries at Quantum.

Aircore drilling at Wildcard commenced in November 2010. A total of 28 AC holes were completed for 1,674 metres to test radiometric anomalies and interpreted fault positions. The AC holes confirmed the

presence of uranium-prospective basement rocks beneath cover rocks (depths of cover ~40 metres). Also, geochemically anomalous

signatures for uranium, platinum, gold and base metals were noted on the basement. Results from AC drill holes at Wildcard include:

Hole TRB2: 1m @ 85 ppm Pb from 70m; 1m @ 22 ppm Mo

from 70m; 1m @ 120 ppm Cu from 70m; 1m @ 320 ppm V from 70m;

Hole TRB7: 1m @ 245 ppm Cr from 53m;

Hole TRB12: 1m @ 110 ppm Cr from 60m; Hole TRB24: 1m @ 125 ppm Ni from 66m; 1m @ 70 ppm Co

from 66m.

Territory Uranium (TUC)

Page 13 of 27

Figure 5: Recent Sampling with uranium results at Wildcard

2.2 Daly River Uranium Project

2.2.1 Outline

The Daly River area (encompassing Exploration Licenses EL 25222, and

EL 25223) is prospective for Alligator River Uranium Field (ARUF) unconformity uranium mineralisation. A number of common geological themes including similar host rocks, geological unconformity, common

fault trends and proximity to Achaean granites extend into the Companies Daly River tenements from the World Class ARUF uranium province where uranium mines such as Ranger and Narbarlek are located.

Territory Uranium (TUC)

Page 14 of 27

The tenement package has been identified with both vein-style uranium mineralisation and sandstone style uranium mineralisation. An

association of uranium with gold is noted in the region. The Company‟s rationale is to explore in areas of little or no previous uranium exploration, under areas of thinner cover sequence, where it is thought that major unconformity related deposits could remain hidden. While TUC has multiple prospects fitting this criterion, the more

advanced uranium prospects in the Daly River Project region are the Energy Prospect and the Green Prospect. Figure 6 highlights the location and regional geology for both prospects.

Figure 6: Location & Regional Geology for Green and Energy Prospects (Source: TUC)

Territory Uranium (TUC)

Page 15 of 27

2.2.1.1 Energy Prospect

RC drilling at the Energy Prospect (located 50 kilometres from the Green Prospect) intersected continuous, flat lying, uranium mineralisation up to 10 metres wide. Drilling has also intersected sandstone hosted uranium mineralisation over a 2.5 kilometre trend of radiometric and geochemical uranium anomaly discovered by TUC in 2008. Significant results include:

Hole TURC74: 2m @ 973 ppm U3O8 including 1m @ 1,061 ppm

within 7m @ 567 ppm;

Hole TURC64: 2m @ 506 ppm U3O8 and 3m @ 461 ppm within 9m @ 336 ppm;

Hole TURC70: 2m @ 445 ppm U3O8 within 10m @ 313 ppm within 9m @ 336 ppm;

Hole TURC71: 3m @ 404 ppm U3O8 within 6m @ 333 ppm; TUC consider that there is a large amount of hidden potential at depth beneath the Energy Prospect. The Company plan to test two exploration theories. In addition, a number of significantly larger radiometric anomalies remain to be tested, particularly in TUC‟s application tenement ELA27151.

A re-sampling program was recently undertaken to test for the presence of rare earth mineralisation. This highlighted a significant

zone of yttrium (Y) mineralisation in association with uranium mineralisation and minor rare earth enrichment. Notable intersections (illustrated in Figure 7) include:

7m @ 1% Y+TREO (73% Y-oxide) from surface 2m @ 0.77% Y+TREO (70% Y-oxide) from 1 metre 2m @ 0.57% Y+TREO (78% Y-oxide) from 5 metres 3m @ 0.55% Y+TREO (69% Y-oxide) from 1 metre 3m @ 0.499% Y+TREO (68% Y-oxide) from surface

The significance is that uranium mineralisation and yttrium mineralisation are found together in many uranium deposits. And intersections, such as those referred to above, upgrade the exploration potential of the Energy area. Further work is planned this year to test for additional potential around the sandstone-style deposit (+400 ppm

U3O8).

Territory Uranium (TUC)

Page 16 of 27

Figure 7: Significant Yttrium (Y) Zone and significant Y+TREO resample results at Energy Prospect

2.2.1.2 Green Prospect The Green Prospect is situated on the southern bank of the Daly River. The area is thought to be underlain by a series of Achaean granites. This is evidenced by outcrop in the Rum Jungle complex 80 kilometres to the north-northeast. Similar granites are interpreted to sit at depth

beneath the western side of the Daly Basin. A 2,000 km2 gravity survey undertaken in 1986 by a Total Energy/PNC Joint Venture provided information towards the interpretation of buried granites from gravity lows. Using this interpretation and interpretation of other available gravity data TUC have hypothesised a north south corridor of Archaean

basement or other granites at depth under the EL 25222 and EL 25223

Daly tenements. Exploration activity by TUC including airborne radiometrics and magnetics, airborne electro-magnetics, mapping and geochemical sampling have highlighted the Green Prospect as a significant target. Exploration activity by TUC commenced in June 2008 with the completion of a ~7,000 line kilometres (200 metre line spacing)

airborne radiometric survey across a portion of EL 25222 and EL 25223. This area was considered most prospective in terms of depth to the Mid-Proterozoic unconformity, proximity to existing uranium occurrences and strong structural architecture. This survey highlighted three areas for follow up work. One of these areas was the Green prospect, where two isolated responses eight

kilometres apart were noted to coincide with the Dorris Vale fault zone. Subsequent helicopter-based rock chip sampling of these radiometric anomalies returned significant ground scintillometer readings and uranium analysis results at the Green Prospect, including 95 ppm U and 158 ppm U. These are highlighted in Figure 8.

Territory Uranium (TUC)

Page 17 of 27

Three high-priority uranium targets have been identified over an 8-kilometre strike length, of which two have been drilled to test for

unconformity-related uranium mineralisation. The results were inconclusive and geological analysis is in progress based on key stratigraphic horizons intersected in the drilling. Further drilling will target shallow mineralisation potential and an untested unconformity related target within the strike length, at depth

beneath a younger cover sequence3. Historic drill intersections of gold in the cover sequence and nearby geothermal hot spring, are a good indication that uranium mineralisation may lie at depth beneath the

cover sequence and geochemical anomaly Previous rock chip samples of 157 ppm U have also been recorded at the Green Prospect.

Figure 8: Ground Checking and Rock Chip Sampling Results at Green Prospect (Source: TUC; 2008)

Project Access and Surrounding Infrastructure The project area is located approximately 150 kilometres south of Darwin. The area is relatively remote in relation to existing

infrastructure but not economically remote if infrastructure needs to be extended. Access is via the sealed Dorat Road turnoff at Adelaide River before turning on to the sealed Daly River Road. Access to the field area is only possible during the dry season due to the height of the Daly River at Beeboom crossing making vehicular access impossible.

3 ~500 metres of RC drilling is initially planned.

Territory Uranium (TUC)

Page 18 of 27

2.3 Calvert Base Metal Project

2.3.1 Overview

The Calvert Project (EL25397) is situated approximately 120 kilometres SE of Borroloola, near the southern coast of the Gulf of Carpentaria and

close to the Queensland border. The Calvert River bisects the tenement and runs NE-SW. Access to the area is via a gravel road linking Borroloola to Doomadgee in Queensland, the tenement boundaries can only be accessed via four wheel drive or helicopter. The Calvert region is known for its copper potential and the area is

known for the Redbank copper mine. TUC plans to explore under a

similar geological model along strike of Redbank and other similar deposits. This is highlighted in Figure 9. In addition, early stage exploration by TUC highlighted other base metal and gold potential. Areas in the tenement have been explored in the past for breccia-hosted copper mineralisation of the style similar to that found further

south at Redbank, and though surface sampling has been carried out, no drilling has ever proved or disproven any of the anomalous results. Most of the exploration in the area has focussed on the Stanton/Running Creek prospects, outside of EL25397 and further to the south.

Figure 9: Redbank to Stanton North to South Mineralisation

Territory Uranium (TUC)

Page 19 of 27

2.3.2 Exploration Activities Undertaken by TUC Recent exploration by TUC commenced in 2007 with a thorough examination and compilation of all existing historic data for the region. Broad-basin stream sediment sampling completed by Rio Tinto/CRA had defined a number of sporadic geochemical anomalies (results up to 175 ppm Cu), however their origin remained unclear.

In 2008, TUC completed a thorough stream sediment sampling program over the entire tenement, with the aim of augmenting and assessing the historic data. In order to trace upstream to the source of

the anomalies, all of the basins and catchments were mapped within the tenement and elemental concentrations plotted within each basin and it was discovered that many of the anomalous results were

obtained from streams which originated from or near to a number of unidentified 20-500 metre circular features, first recognised during geological mapping. More of such features have now been documented in the tenement from TUC's hyper-spectral scanning survey and satellite imagery. The number of circular silica/potassic circular alteration features which

cluster around pipe targets strongly suggests the presence of hydrothermal activity as the features have the characteristics of barren silica capping features associated with some epithermal gold fields.

2.3.2.1 HyVista In 2008, an airborne hyper-spectral survey (HyVista) was flown over

the entire tenement with the aim to map extents of the Gold Creek Volcanic (GCV), structures, and any alteration characteristics in the terrain. Results of the survey were used to successfully interpretively map subcrop extents of GCV (known to host mineralisation in southern regions), zones of hematite alteration, and to aid in differentiating a quantity of linear features which have been interpreted as faults. The

survey was also able to identify a number of previously unnoticed circular pipe features further south in the tenement due to the presence of nontronite as an alteration product. These features also showed an alignment with newly identified major east-west structures and were not notable in any visible spectra.

Hematite alteration was shown to cluster around previously identified

and field-observed pipe-like features and silica/potassic alteration features. Results of all these processes are shown in Figure 10. The proximity and similarity of geological setting to the Redbank cupriferous breccia deposits further south and the obvious geochemical signatures make these pipe-shaped alteration features an excellent base metals target.

Territory Uranium (TUC)

Page 20 of 27

Figure 10: HyVista Mapping

A follow-up stream sediment sampling program focussed on anomalous results from the first program and the pipe like nontronite alteration features identified from the airborne HyVista survey. Several of the

pipes were identified as being prospective gold and base metal targets as a result of the sampling. Importantly, geochemical results were shown to cluster immediately around the alteration features providing a very strong argument for

drilling.

In addition, an auger program was performed over several of the pipes, proving elemental zoning across the features. This is illustrated in Figure 11.

Territory Uranium (TUC)

Page 21 of 27

Figure 11: Auger Assay Results from Calvert River

2.3.3 Future Plans TUC has only recently received a certificate from the Aboriginal Area Protection Authority allowing work to commence at Calvert and the

Company is aiming to complete a drilling program by May/June 2011.

Territory Uranium (TUC)

Page 22 of 27

33.. RRAARREE EEAARRTTHH EELLEEMMEENNTTSS

3.1 What are REEs?

Rare earth elements (REEs) or rare earth metals are a collection of 17 chemical elements in the periodic table that belong to the lanthanide family of elements, beginning with lanthanum and ending with lutetium. The REE group includes 15 lanthanide elements: lanthanum,

cerium, praseodymium, promethium (does not occur naturally), neodymium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, and lutetium. Scandium and

yttrium are also grouped with the lanthanide family because of their similar properties, bringing the total to 17 REE„s. There are two categories of rare earth elements - light rare earths and

heavy rare earths - based on their atomic weights and location in the periodic table.

Light Rare Earths include Lanthanum, Cerium,

Praseodymium, Neodymium, Promethium and Samarium. Heavy Rare Earths include Europium, Gadolinium, Terbium,

Dysprosium, Holmium, Erbium, Thulium, Ytterbium, Lutetium.

Although heavy rare earths are not as abundant as light rare earths, the term rare earth is actually a misnomer, given that they can be

found in almost all massive rock formations. Because the concentration of rare earth elements in the earth's crust ranges from 10-500 ppm by weight, the real challenge is finding them in high enough

concentrations to be economically mined and processed. REEs are so called because most of them were originally isolated in the 18th and 19th centuries as oxides from rare minerals. Because of their reactivity, the REEs were found to be difficult to refine to pure metal. Furthermore, efficient separation processes were not developed until the 20th century because of REEs‟ chemical similarity. Table 3: The 17 REEs and Symbols

Yttrium Y

Lanthanum La

Cerium Ce

Praseodymium Pr

Neodymium Nd

Promethium Pm

Samarium Sm

Europium Eu

Gadolinium Gd

Terbium Tb

Dysprosium Dy

Holmium Ho

Erbium Er

Thulium Tm

Ytterbium Yb

Lutetium Lu

Element Symbol

Territory Uranium (TUC)

Page 23 of 27

3.2 Why are REEs Important?

Rare earth metals are important because of their specificity, versatility and unique properties (catalytic, chemical, electrical, metallurgical, nuclear, magnetic and optical). The range of applications in which they are currently used is extraordinarily wide, from the ordinary (automotive catalysts, petroleum cracking catalysts, lighter flints, glass and ceramic pigments, polishing compounds) to the highly specialised

(miniature nuclear batteries, superconductors, lasers repeaters and powerful miniature magnets). From relative obscurity, they are now important economically, environmentally and technologically. Some prominent applications of REEs are listed.

These metals are also critical to many of our industrial giants in the

latest cutting-edge technologies: Think Apple and its iPhones and iPads; GE and its wind turbines; and GM and its hybrid cars.

Table 4: Some REE uses and applications by industry

Automotive Catalysts for pollution control; catalytic converter catalyst substrate; rechargeable batteries; fuel cells; coloured plastics

Ceramics Oxygen sensors; structural ceramics for bearings; jet engine coatings; investment moulds; refractories; pigments

Chemicals Oil refinery fluid cracking catalysts; pharmaceuticals; water treatment; catalysts; moisture control, dryers, and detection

Defence Lasers; missile guidance and control; visual displays; radar; electronic countermeasures; communication; shielding

Electronics Capacitors; cathodes; electrodes; semiconductors; thermistors; travelling wave tubes (TWTs); radio frequency circulators and toroids; yttrium iron garnet (YIG) ferrites

Medical Contrast agents; magnetic resonance imaging (MRI); positron emission tomography (PET); radioisotope tracers and emitters

Metallurgy Alloying agents in aluminium, magnesium, iron, nickel, and steel alloys; superalloys; pyrophoric alloys; lighter flints; armaments

Phosphors Cathode-ray tubes (CRTs); fluorescent lighting; radar and cockpit displays; x-ray intensifying screens; temperature sensors

Other Simulated gemstones; textiles; magnetic refrigeration; hydrogen fuel storage; lubrication; photography; nuclear uses

3.3 Mining Process for REEs

As compared to mining gold, it is more complicated and costlier to extract rare earth metals from their ores. Most of the market value of

rare earth metals is added in the refining process and, before they can even be used in an application, rare earths need to be put through the following processing stages.

1. Mining rare earth ore from the mineral deposit 2. Separating the individual rare earth oxides from the ore 3. Refining the rare earth oxides into metals with different purity

levels 4. Forming the rare earth metals into alloys

5. Manufacturing the rare earth alloys into components, such as permanent magnets, used in commercial and defence applications

Territory Uranium (TUC)

Page 24 of 27

Figure 12: Global Rare Earth Metal Oxide Production from 1950 to 2006 (‘000t)

Source: Bloomberg

3.4 Supply and Demand Factors

New demand has recently strained supply, and there is growing concern that the world may soon face a shortage of the REEs. According to Reuters, worldwide demand for REEs is expected to

exceed supply by some 40ktpa in several years unless major new production sources are developed. China supplies around 97% of the world‟s rare earths, partly because of

its willingness to tolerate low cost, high polluting mining methods. The more common light rare earths come from the Bayan Obo mine in Inner Mongolia, which accounts for 40% of global production. The much rarer heavy earths come almost exclusively from clay pits in Southern China, many of which are unlicensed and unregulated. Presently, REEs are mined in Inner Mongolia, Shangdong, Jiangxi,

Guangdong, Hunan, Guangxi, Fujian, Sichuan and other regions throughout China. China has initiated a series of quota cuts on its first-half exports of rare

earth metals. In July 2010, China announced a 40% reduction in annual exports to ~30Kt (around 15-20kt less than the estimated consumption by non-Chinese producers) and in December 2010,

further cut its first half 2011 quota to ~14kt. As a result of the increased demand and tightening restrictions on exports of the metals from China, searches for alternative sources in Australia, Brazil, Canada, South Africa, Greenland, and the US are ongoing.

The resulting impact of China squeezing supply is that prices for REEs have skyrocketed (see Figure 13), a trend further supported by REEs becoming increasingly important in the manufacture of sophisticated products including flat-screen monitors, electric-car batteries, wind turbines and aerospace alloys.

Figure 13: Rare Earths Price Index (2002-2010)

Source: Kaiser Bottom Fish

Territory Uranium (TUC)

Page 25 of 27

Figure 14: REO Global & China Demand/Supply Forecasts (Source: Arafura Resources)

3.5 Non-China Production Expected to Accelerate

It is interesting to note that with the higher REE prices, announcements of REE projects worldwide have accelerated over the last six months. One example is the Mountain Pass project in California, owned by

Molycorp (NYSE Ticker: MCP).

The mine closed in 2002, in response to both environmental restrictions, lower prices for REEs and competition from China. The mine has been mostly inactive since 2002, though processing of previously mined ore continues at the site. In July 2010, Molycorp raised US$394 million in an IPO and now plans

to to invest US$500 million to reopen and expand the mine. Current plans are for full mining operations to resume by the second half of 2011 in response to increased demand for rare earth metals. In December 2010, Molycorp announced that it secured all the environmental permits needed to begin construction of a new ore processing plant at the mine; construction will begin in January 2011,

and is expected to be completed by the end of 2012. In Australia, Greenland Minerals and Energy Ltd (ASX Code: GGG), a mineral exploration and development Company is primarily focusing on rare earth elements (REE) in southern Greenland. The Company„s current focus is on the Kvanefjeld project, a multi-element deposit (rare earth elements (REEs), uranium and zinc) located near the

southwest tip of Greenland. According to the evaluative study performed by Danish Atomic Energy Agency and Greenland, the Kvanefjeld deposit has high concentrations of REE elements and is the 6th largest uranium deposit in the world. Arafura (ASX Code: ARU) aims to have Rare Earths plant approvals for its Nolans Project by 4th quarter 2011.

Territory Uranium (TUC)

Page 26 of 27

44.. BBOOAARRDD OOFF DDIIRREECCTTOORRSS

DIRECTOR

INTEREST

IN TUC

BACKGROUND

Peter Harold Non Exec Chairman

5.0m ord shares

Mr Harold is a process engineer with over 20 years corporate experience in the minerals industry, specialising in financing, marketing, business development and general corporate activities. He has extensive experience with the development and operation of resource projects having been the Managing Director of Panoramic Resources Limited since May 2001 and previously responsible for metals marketing and various corporate functions relating to the Cawse nickel laterite project and the Silver Swan and Mt Keith nickel sulphide projects.

Ian Bamborough Managing Director

197,500 shares; 4m unlisted

options

Mr Bamborough has extensive mining industry

experience in various geological leadership roles including Greenfield's exploration, underground and open cut mine production, near mine exploration and technical services. He holds a Masters in Geology and an MBA. He was Principal Exploration Geologist at Newmont Australia's Tanami Operations in the Northern Territory and the Jundee Operations in Western Australia. Prior to joining TUC in late 2007 Ian also worked as part of a multidisciplinary corporate advisory team with Newmont Mining Corporation in the USA providing consultations on multi commodity exploration business development, M&A activities and operational support and audit initiatives.

Ronald Stanley Non Exec Director

13.975m ord shares

Mr Stanley has 49 years experience in mining exploration and mine feasibility with more than 26 years experience in the Northern Territory. He has owned and operated a highly successful drilling Company for thirty three years.

Ron was a founding Director of Sipa Resources International Ltd, a public listed mining Company on ASX and remained a Director for over a decade. For a number of years, Mr Stanley was Chairman of Mt Grace Gold Mining Ltd, also an ASX-listed Company. He is currently Chairman of several private companies involved in mining investments and property development.

Michael Britton Non Exec Director

478,146 ord

shares

Mr Britton has 15 years experience in accounting and finance and has been a principal of an accounting firm for the last eight years. Michael spent two years working in London in investment banking for Banque National de Paris and Schroder Investment Management.

Territory Uranium (TUC)

Page 27 of 27

DIRECTORY – ALPHA SECURITIES Corporate

George Karantzias

0401 670 620

Research Analyst

John Haddad

[email protected] 0407 219 222

Disclaimer This document has been prepared (in Australia) by Alpha Securities Pty Ltd ABN 94 073 633 664

(“Alpha”), who holds an Australian Financial Services License (License number 330757). Alpha has made every effort to ensure that the information and material contained in this report is accurate and correct and has been obtained from reliable sources. However, Alpha makes no representation and gives no warranties about the accuracy or completeness of the information and material, including any forward looking statements and forecasts made by Territory Uranium Ltd to Alpha, and it should not be relied upon as a substitute for the exercise of independent judgment.

Except to the extent required by law, Alpha does not accept any liability, including negligence, for any loss or damage arising from the use of, or reliance on, the material contained in this report, or as

a result of errors or omissions on the part of Alpha or by any of their respective officers, employees or agents. This report is for information purposes only and is not intended as an offer or solicitation with respect

to the sale or purchase of any securities. The securities recommended by Alpha carry no guarantee with respect to return of capital or the market value of those securities. There are general risks associated with any investment in securities. Investors should be aware that these risks might result in loss of income and capital invested. Neither Alpha nor any of its associates guarantees the repayment of capital. This report and any communication transmitted with it are confidential and are intended solely for the

use of the individual or entity to which they are addressed. If you have received this email in error please notify the sender. If you no longer wish to receive communication from Alpha, please contact Alpha requesting to be unsubscribed from future communications.

General Advice Warning

This report may contain general securities advice or recommendations, which, while believed to be accurate at the time of publication, are not appropriate for all persons or accounts. This report does not contain specific securities advice and does not take into account particular investment objectives, financial situation and needs of any particular person. You should carefully assess whether such information is appropriate in light of your individual circumstances before acting on it.

Disclosure

Alpha, its Directors and associates declare that they may have a relevant interest in the securities mentioned herein. This position can change at any time. Alpha also receives fees for advisory services.

Alpha does and seeks to do business with companies covered in its research reports and investors should be aware that Alpha received a consultancy fee from Territory Uranium Ltd for compiling this research report.