Q1 2012 RESULTS - Bic · Q1 2011 Q1 2012 Net Sales 58.9 60.1 In million euros Q1 2011 Q1 2012 IFO...

Transcript of Q1 2012 RESULTS - Bic · Q1 2011 Q1 2012 Net Sales 58.9 60.1 In million euros Q1 2011 Q1 2012 IFO...

Q1 2012 RESULTS

25 April 2012

2

Agenda

Mario Guevara

Group and category highlights

Group Q1 2012 key figures

* See glossary

Developed markets +10.7%

Developing markets +5.8%

Consumer business(86% of total sales) +10.6%

Advertising & Promotional Products

(14% of total sales)-0.7%

Consumer business 22.1%

Advertising & Promotional

Products-6.6%

Q1Q1 11

Net Sales: 445.0 million euros

+8.6%+7.1%

+9.0%

As reported At constantcurrencies*

On a comparativebasis*

20.0% 18.5%

IFO Margin

20.3%18.3%

20.8%

Normalized IFO Margin

24.0%

-0.4%

exc.

Sp

ecia

l Pre

miu

m

12 Normalized IFO

Normalized IFO

exc. Special Premium

Normalized* Income from Operations: 81.3 million euros

3

4

Group Q1 2012 Key figures

In euros In million euros

377.1

329.5

377.2

March 2011 December 2011 March 2012

1.121.22

Q1 2011 Q1 2012

EPS: +8.9% increase Net Cash Position

+6.6%

+2.0% +1.9%

+16.6%

+9.0%

+4.3%

+15.3%

+5.8%

5

Change on a comparative basis

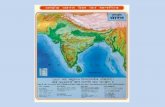

Q1 2012 net sales evolution by geographies

Q1 11

See appendix page 21 for main currency impact

Q1 12 Q1 11 Q1 11 Q1 11Q1 12 Q1 12 Q1 12

BIC in Q1 2012 Consumer business

+5.9%

+18.9%

+7.9%

Developing Markets

North America

Europe

Europe25%

North America

36%

Developing Markets

39%

384.9 million euros net sales

Change on a comparative basis Breakdown by geographies

+9.8% +10.6%

Q1 11 Q1 12

6

7

Stationery

In million euros Q1 2011 Q1 2012

IFO 22.1 23.2Normalized IFO 22.1 22.6

+9.4%+7.7%

Change in net sales on a comparative basis Normalized IFO margin

Developed marketsLow-single digit net sales growth in Europe and double digit increase in North America. • In both regions, strong success of new products such as the range

• Bold ball pens (Cristal®, Velocity and Atlantis™)• BIC® For Her™ range • 2-color / 4-color family with the color Grip, the Mini 4-color and the 4-color custom.

• In the U.S., benefit of strong promotional support, notably in Modern Trade and in the Office Product Supplier channel.

Developing marketsHigh-single digit net sales growth.

• Good back-to-school in Southern hemisphere countries such as Brazil (success of the launch of the BIC Evolution coloring range), Argentina, Australia and New-Zealand, all countries where we registered significant market share gains.

Q1 2012 Stationery normalized IFO margin: 16.3% compared to 17.3% in Q1 2011. Excluding the impact of the Special Employees Premium, Stationery normalized IFO margin would have been 18.5%, benefiting from the increase in net sales, better fixed cost absorption and geographical mix.

17.3% 16.3%18.5%

exc.

Sp

ecia

l Pre

miu

m

In millioneuros Q1 2011 Q1 2012

Net Sales 127.7 138.1

8

Lighters

In million euros Q1 2011 Q1 2012

Net Sales 122.9 136.7

In million euros Q1 2011 Q1 2012

IFO 50.2 51.0

Normalized IFO 50.2 51.1

Change in net sales on a comparative basis Normalized IFO margin

Developed marketsDouble digit growth in both Europe and North America. • Distribution gains • continued innovation in value-added sleeve design.

Developing marketsLow-single digit growth. • Strong performance of the Middle-east and Africa due to distribution gains and successful marketing programs.

Q1 2012 Lighters normalized IFO margin: 37.3% compared to 40.8% in Q1 2011• Excluding the impact of the Special Employees Premium, Lighters normalized IFO margin would have been 38.7%. The positive impact

of the increase in net sales was offset by an increase in production costs and brand support.

40.8%37.3% 38.7%

exc.

Sp

ecia

l Pre

miu

m+10.3%+9.3%

9

Shavers

In million euros Q1 2011 Q1 2012

Net Sales 76.7 92.6

In million euros Q1 2011 Q1 2012

IFO 15.5 15.1

Normalized IFO 15.5 15.1Developed marketsBroad-based growth with strong performance of our premium products, our core value products, and our new products. • High single digit growth in Europe

• The main contributors to the growth• Our Classic 3-blade product, BIC® 3; • A good second year start of our 2011 new product BIC® Flex 3; • Good acceptance of our 2012 new products, BIC® Flexi Lady and BIC® Flex Easy.

• Double digit growth In North America • Our core range continued to gain market share in the 1st Quarter; • Positive trend was supplemented by strong customer acceptance of our 2012 new products, BIC® Soleil Savvy for women and BIC®

Hybrid Flex 4 for men. Developing markets• High-single digit growth. Latin America leading contributor to this growth, and our 3-blade shavers top performers in the product portfolio.

Q1 2012 Shaver normalized IFO margin: 16.3% compared to 20.3% in Q1 2011. Excluding the impact of the Special Employees Premium, Shaver normalized IFO margin would have been 18.7%. Q1 2011 benefited from more favourable manufacturing cost absorption than Q1 2012.

+11.9%

+18.6% 20.3%16.3%

18.7%

exc.

Sp

ecia

l Pre

miu

m

Change in net sales on a comparative basis Normalized IFO

Other Products Consumer

10

In million euros Q1 2011 Q1 2012

Net Sales 23.7 17.5

+3.3%

+5.9%In million euros Q1 2011 Q1 2012

Normalized IFO -1.9 -3.5

Non-recurrent items - +0.8

IFO -1.9 -2.6

Phone cards distribution (39.5 million euros net sales in 2011) sold in February 2012 for a net proceed of +0.8 million euros (non-recurrent items)

2.9 million euros expenses related to portable fuel cell (compared to 0.9 million euros in Q1 2011)

Change in net sales on a comparative basis Normalized IFO

11

BIC APP

In million euros Q1 2011 Q1 2012

Net Sales 58.9 60.1

In million euros Q1 2011 Q1 2012

IFO -3.9 -4.2

Normalized IFO -2.9 -3.9

Positive timing impact on net sales. Signs of improvement in the U.S. – Europe remained weak

In Q1 2012, BIC APP’s reported IFO margin : -7.0% compared to -6.7% in Q1 2011• 0.3 million non-recurrent items related to the integration• Q1 2012 normalized IFO margin reached -6.6% compared to -4.9% in Q1 2011. Excluding the impact of the Special Employees

Premium, BIC APP normalized IFO margin would have been -0.4%.

-8.8%

-0.7%

-4.9%

-6.6%

-0.4%

Change in net sales on a comparative basis Normalized IFO margin

exc. Special Premium

12

Agenda

Q1 2012 consolidated financial figures

Jim DiPietro

Q1 2012: From Net Sales to IFO

BIC GroupIn million euros Q1 2011 Q1 2012 Change

Change at constant

currencies*

Change on a comparative

basis*

Net Sales 409.9 445.0 +8.6% +7.1% +9.0%

Gross Profit 211.2 233.4 +10.5%

Normalized* Income from Operations 83.1 81.3 -2.2%

Income from Operations 82.0 82.4 +0.5%

*: see glossary 13

Q1 2012 non-recurring items

14

In million euros Q1 2011 As % of sales Q1 2012 As %

of sales

Normalized* IFO 83.1 20.3% 81.3 18.3%

Restructuring costs -1.1 -0.4

Gains on disposals +0.8

Gain on Real Estate / others +0.7

IFO as Reported 82.0 20.0% 82.4 18.5%

*: see glossary

Q1 2012 Normalized* Income From Operations margin

+2.4

-0.3 -0.5-1.1

-2.5

Q1 2011Normalized IFO

margin

Gross Margin Brand support Increase in FuelCell Expenses

OPEX and others Normalized IFOmargin excluding

the impact ofspecial employees'

premium

Impact of thespecial employees'

premium

Q1 2012Normalized IFO

margin

18.3%20.3% 20.8%

15*: see glossary

Q1 2012 From IFO to Group Net Income

In million euros Q1 2011 Q1 2012

Normalized* IFO 83.1 81.3

Non recurring items -1.1 +1.1

IFO 82.0 82.4

Interest income 1.6 3.2

Finance costs -5.3 -1.5

Income before Tax 78.3 84.1

Income tax -26.0 -27.3

Tax rate 33.1% 32.5%

Income from Associates 1.6 0.8

Group Net Income 53.9 57.5

Number of shares outstanding net of treasury shares 48,181,386 47,171,050

EPS 1.12 1.22

Higher interest income in Q1 2012 compared to Q1 2011.

In Q1 2011, finance revenue was negatively impacted by -4.7 million euros of unfavorable monetary assets revaluation (USD vs. EUR).

*: see glossary 16

+ 52.2

- 19.3

+ 16.9 + 2.6

- 4.7

December 2011Net Cash Position

Q1 2012 cash fromoperating activities

Q1 2012 CAPEX Share buyback netof exercise of stock

options andliquidity contract (1)

Divestitures & realestate gaines

Others March 2012 NetCash Position

17

Net Cash Position

329.5

377.2

In million euros

(1): total Q1 2012 share buy-back: 3,078 shares – 0.2 million euros

18

Agenda

Full year 2012outlook

Mario Guevara

19

2012 outlook

For the full year, we expect net sales growth trends to slow-down compared to the strong Q1 2012 performance. While accelerating the pace of investment, we should maintain the level of Normalized IFO margin close to the 2011 level (excluding the impact of the special premium for employees).

Consumer business

BIC APP full year 2012 net sales should be flat to slightly declining on a comparative basis. Due to the benefits of the integration plan, we will be able to maintain normalized IFO margin level close to the 2011 level (excluding the impact of the special premium for employees).

Advertising and Promotional

Products

Investor Relations Department: +33 (0)1 45 19 52 26 www.bicworld.com

Appendix

21

Q1 2012 net sales – main exchange rate evolution vs. euro

Q1 2012 % of sales

Average rate Q111

Average rate Q112 % of change

US Dollar 35% 1.37 1.31 4.0%

Brazilian Real 14% 2.28 2.32 -1.9%

Mexican Peso 5% 16.45 17.00 -3.3%

Canadian dollar 3% 1.35 1.33 1.2%

Australian dollar 2% 1.36 1.24 8.8%

South African Zar 2% 9.57 10.16 -6.1%Non Euro European countries 5%

Sweden 8.86 8.85 0.1%Russia 39.85 39.48 0.9%Poland 3.94 4.22 -7.2%

British Pound 0.85 0.83 2.6%

22 22

Group Quarterly figures

* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q111 Q211 Q311 Q411 FY11 Q112

Net Sales 1,562.7 378.3 487.3 492.6 473.3 1,831.5 409.9 476.2 468.2 469.8 1,824.1 445.0

YoY actual changes +10.0% +22.7% +20.4% +18.7% +8.9% +17.2% +8.4% -2.3% -5.0% -0.7% -0.4% +8.6%

YoY changes at constant currencies*

+10.1% +21.6% +12.0% +8.7% +1.6% +10.1% +4.9% +3.5% +0.2% +0.3% +2.1% +7.1%

YoY changes on a comparative basis* -0.6% +8.8% +3.5% +9.6% +2.6% +5.9% +6.6% +4.7% +0.8% +0.6% +3.1% +9.0%

IFO 216.0 47.8 95.0 90.1 71.7 304.6 82.0 92.9 89.8 75.0 339.7 82.4

Normalized IFO* 239.6 53.7 88.7 92.2 80.3 314.9 83.1 102.1 91.0 86.2 362.4 81.3

IFO margin 13.8% 12.6% 19.5% 18.3% 15.2% 16.6% 20.0% 19.5% 19.2% 16.0% 18.6% 18.5%

Normalized IFO margin* 15.3% 14.2% 18.2% 18.7% 17.0% 17.2% 20.3% 21.5% 19.4% 18.3% 19.9% 18.3%

Income before tax 218.7 50.7 93.3 88.6 70.2 302.8 78.3 94.7 96.0 79.9 348.8 84.1

Net Income 151.7 35.4 64.3 61.1 46.6 207.5 53.9 64.6 65.4 54.0 237.9 57.5EPS 3.15 0.73 1.33 1.26 0.96 4.29 1.12 1.35 1.37 1.13 5.00 1.22

23 23

Group Consumer

* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 1,274.3 308.6 398.2 399.9 362.3 1,469.0 351.0 407.7 391.6 371.7 1,522.1 384.9

YoY actual changes +12.3% +12.9% +22.5% +13.1% +15.3% +13.8% +2.4% -2.1% +2.6% +3.6% +9.6%

YoY changes at constant currencies*

+10.3% +4.6% +12.2% +5.2% +7.9% +9.8% +8.0% +2.8% +4.1% +6.0% +8.4%

YoY changes on a comparative basis* +10.3% +4.6% +12.2% +5.2% +7.9% +9.8% +8.0% +3.3% +4.8% +6.3% +10.6%

IFO 192.1 56.4 84.8 81.3 54.6 277.2 85.9 92.4 83.6 58.3 320.3 86.7

Normalized IFO* 209.5 56.7 85.3 81.6 57.9 281.5 85.9 100.9 83.6 67.6 338.1 85.2

IFO margin 15.1% 18.3% 21.3% 20.3% 15.1% 18.9% 24.5% 22.7% 21.4% 15.7% 21.0% 22.5%

Normalized IFO margin* 16.4% 18.4% 21.4% 20.4% 16.0% 19.2% 24.5% 24.7% 21.4% 18.2% 22.2% 22.1%

24 24

Stationery

* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 509.6 112.6 173.4 166.8 128.0 580.7 127.7 170.2 160.8 129.7 588.5 138.1

YoY actual changes +12.5% +9.2% +24.2% +9.9% +14.0% +13.4% -1.8% -3.6% +1.4% +1.3% +8.1%

YoY changes at constant currencies*

-2.7% +10.7% +1.9% +14.1% +1.1% +6.7% +9.4% +3.4% +1.5% +4.0% +4.1% +7.7%

YoY changes on a comparative basis*

-2.7% +10.7% +1.9% +14.1% +1.1% +6.7% +9.4% +3.4% +1.5% +4.0% +4.1% +7.7%

IFO 43.3 7.7 28.8 27.6 5.2 69.3 22.1 30.7 21.3 9.3 83.5 23.2

Normalized IFO* 48.9 8.3 29.1 27.7 5.1 70.3 22.1 30.7 21.3 9.3 83.5 22.6

IFO margin 8.5% 6.9% 16.6% 16.5% 4.0% 11.9% 17.3% 18.0% 13.3% 7.2% 14.2% 16.8%

Normalized IFO margin* 9.6% 7.4% 16.8% 16.6% 4.0% 12.1% 17.3% 18.0% 13.3% 7.2% 14.2% 16.3%

25 25* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 398.9 107.0 119.3 123.5 131.1 480.8 122.9 125.1 124.0 138.9 510.8 136.7

YoY actual changes +5.9% +12.8% +22.3% +26.3% +20.6% +20.5% +14.9% +4.9% +0.4% +6.0% +6.2% +11.2%

YoY changes at constant currencies*

+5.3% +10.4% +11.0% +13.5% +11.4% +11.6% +10.3% +12.0% +5.7% +6.7% +8.6% +9.3%

YoY changes on a comparative basis*

+5.3% +10.4% +11.0% +13.5% +11.4% +11.6% +10.3% +12.0% +5.7% +6.7% +8.6% +9.3%

IFO 127.9 40.9 45.4 45.3 42.0 173.6 50.2 52.1 48.1 49.5 199.8 51.0

Normalized IFO* 135.7 40.7 45.4 45.4 42.6 174.0 50.2 52.1 48.1 49.6 199.9 51.1

IFO margin 32.1% 38.2% 38.1% 36.7% 32.0% 36.1% 40.8% 41.7% 38.8% 35.6% 39.1% 37.3%

Normalized IFO margin* 34.0% 38.0% 38.1% 36.7% 32.5% 36.2% 40.8% 41.7% 38.8% 35.7% 39.1% 37.3%

Lighters

26 26

Shavers

* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 268.8 66.4 79.2 84.3 77.8 307.8 76.7 85.2 84.4 81.8 328.2 92.6

YoY actual changes +1.7% +12.8% +11.6% +19.0% +14.3% +14.5% +15.6% +7.6% +0.1% +5.1% +6.6% +20.6%

YoY changes at constant currencies*

+2.4% +10.9% +3.3% +9.1% +7.7% +7.6% +11.9% +13.5% +5.1% +6.5% +9.1% +18.6%

YoY changes on a comparative basis*

+2.4% +10.9% +3.3% +9.1% +7.7% +7.6% +11.9% +13.5% +5.1% +6.5% +9.1% +18.6%

IFO 30.3 10.5 12.3 11.2 7.9 41.9 15.5 16.7 16.7 10.9 59.8 15.1

Normalized IFO* 33.5 10.4 12.4 11.3 9.6 43.6 15.5 16.7 16.7 10.9 59.8 15.1

IFO margin 11.3% 15.8% 15.5% 13.3% 10.2% 13.6% 20.3% 19.6% 19.8% 13.3% 18.2% 16.3%

Normalized IFO margin* 12.5% 15.7% 15.6% 13.4% 12.3% 14.2% 20.3% 19.6% 19.8% 13.3% 18.2% 16.3%

Shavers

27 27

Other Consumer Products

* see glossary

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 97.0 22.6 26.3 25.3 25.5 99.7 23.7 27.2 22.4 21.2 94.5 17.5

YoY actual changes +7.8% +3.3% +8.2% -6.4% +2.7% +4.9% +3.5% -11.6% -16.6% -5.1% -25.9%

YoY changes at constant currencies*

+5.4% 0.0% +5.2% -8.3% +0.1% +3.3% +4.3% -10.8% -16.2% -5.0% -26.1%

YoY changes on a comparative basis*

+5.4% 0.0% +5.2% -8.3% +0.1% +3.3% +4.3% -2.5% -7.8% -0.5% +5.9%

IFO* -9.4 -2.6 -1.7 -2.8 -0.5 -7.6 -1.9 -7.1 -2.5 -11.3 -22.8 -2.6

Normalized IFO* -8.5 -2.7 -1.6 -2.8 0.6 -6.4 -1.9 1.4 -2.5 -2.1 -5.2 -3.5

28 28* see glossary

Advertising & Promotional Products (BIC APP)

In million euros FY09 Q110 Q210 Q310 Q410 FY 10 Q1 11 Q211 Q311 Q411 FY11 Q112

Net Sales 288.4 69.7 89.1 92.7 111.0 362.6 58.9 68.4 76.6 98.1 302.0 60.1

YoY actual changes +107.0% +71.8% +4.6% -2.8% +25.7% -15.5% -23.3% -17.4% -11.6% -16.7% +2.1%

YoY changes at constant currencies*

+114.1% +62.8% -4.4% -8.7% +19.8% -16.6% -16.5% -10.9% -11.9% -13.7% -0.7%

YoY changes on a comparative basis*

-3.6% -4.1% -0.4% -5.1% -3.3% -8.8% -11.3% -10.0% -10.8% -10.4% -0.7%

IFO 23.9 -8.6 10.2 8.8 17.1 27.4 -3.9 0.4 6.1 16.7 19.3 -4.2

Normalized IFO* 30.1 -2.9 3.4 10.6 22.4 33.4 -2.9 1.2 7.4 18.5 24.3 -3.9

IFO margin 8.3% -12.3% 11.4% 9.5% 15.4% 7.6% -6.7% 0.6% 8.0% 17.0% 6.4% -7.0%

Normalized IFO margin* 10.4% -4.2% 3.8% 11.4% 20.2% 9.2% -4.9% 1.8% 9.7% 18.9% 8.1% -6.6%

29 29

Q1 2012 Net Sales breakdownby category

Stationery

Lighters

Shavers

Other Products

Advertising & Promotional

Products

31%

31%

21%

14%3%

30 30

Q1 2012 Net Sales breakdownby geography

Europe

North America

Developing Markets

25%

40%

35%

31

Miscellaneous

• Capital evolution:

– Authorized share capital at the end of March 2012: 48,108,778 shares

32 32

Glossary

• At constant currencies: Constant currency figures arecalculated by translating the current year figures at prioryear monthly average exchange rates. All net salescategory comments are made at constant currencies orcomparative basis.

• Comparative basis: at constant currencies and constantperimeter. Figures at constant perimeter exclude theimpacts of acquisitions and/or disposals that occurredduring the current year and/or during the previous year, untiltheir anniversary date.

• Normalized IFO: normalized means excludingrestructuring, BIC APP integration plan expenses, gain ondisposal of phone cards activity in France and real estategains..

33 33

2012 Agenda

All dates to be confirmed

2011 Shareholders’ Meeting May 10, 2012 Meeting (BIC headquarters)

2nd Quarter 2012 Results August 2, 2012 Conference Call

3rd Quarter 2012 Results October 24, 2012 Conference Call

34

Disclaimer

This document contains forward-looking statements. Although BIC believes itsexpectations are based on reasonable assumptions, these statements are subjectto numerous risks and uncertainties.A description of the risks borne by BIC appears in section “Risks and Opportunities”of BIC Registration Document filed with the French financial markets authority(AMF) on 27 March 2012.