PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

-

Upload

ehli-hibre -

Category

Documents

-

view

215 -

download

0

Transcript of PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

-

7/27/2019 PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

1/4

Is a full internalmodel a step too far?

www.pwc.com/solvencyII

Countdown to

Solvency II

Making the right choice

for your company

July 2011

With the deliberations over the final Solvency IIrules and implementation date continuing,firms have a fresh opportunity to consider the

approach they use for meeting the Pillar Icapital requirements.

All firms should regularly review theirapproach to make sure it continues to meet thebest interests of their organisation as theirbusiness profile and the market landscape

evolve. While new applications to use aninternal model for calculating solvency capitalmay not get approval before Solvency II goes

live, choosing whether to opt for an internalmodel or adopt the standard formula is still animportant and relevant consideration. Thedecision will not only have a strong influenceon your capital requirements, but also affectthe way the company is run and engages

Whether to opt for an internal model, the standard formula or one of the options inbetween is one of the most crucial decisions within Solvency II. It not only affects yourfirm's capital requirements, but also the way the business is managed and perceivedby stakeholders. With the decision not always being clear-cut and also subject topossible change over time, what are the key strategic, capital management and cost-benefit considerations that can help you to make the right choice for your company,both now and in the future?

-

7/27/2019 PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

2/4

Typically, firms quickly put themselvesinto either the standard formula orinternal model camp. This decision isoften based on existing resources orhistorical practices rather than aconsidered long-term view of the costs

versus benefits and potential strategicimpact. Firms that have selected thesimplest approach of using the standardformula should ask themselves if thereare benefits to doing more. Equally, firmsthat have selected the generally morecomplex approach of applying for internal

model approval should ask themselveswhether they have gone too far.

The standard formula is agood fit, should I go further?

Standard formula drawbacksThe standard formula may not be quite asstraightforward as some might assume.As last years quantitative impact study(QIS 5) highlighted, the standard formulacontains many ambiguous and possiblycontradictory requirements. These

anomalies may not be resolved until thecurrent deliberations over the rules arecomplete, or indeed may never besatisfactorily closed off. In addition, therecould be further recalibration of theparameters in the standard formula as

practical experience evolves.

Variations on a themeOpting for any of the more risk-sensitivevariations of the standard formulacould help a company to develop anapproach that better reflects its risk

PwC Countdown to Solvency II

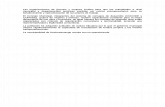

No No No No

No

Review your decision over time

Is the

standard

formula with

simplifications a

good fit?

Is the

standard

formula a

good fit?

Is the

standard

formula with

undertaking

specific

parameters agood fit?

Is a partial

internal model

a good fit?

Use full

internal

model

Are there

benefits to

doing more?

Use simplified

standard

formula

Use

undertaking

specific

parameters

Use partial

internal modelUse standard

formula

Do the benefits

of doing more

outweigh the

costs?

Do the benefits

of doing more

outweigh the

costs?

Do the benefits

of doing more

outweigh the

costs?

Do the benefits

of doing more

outweigh the

costs?

Are there

benefits to

doing more?

Are there

benefits to

doing more?

Are there

benefits to

doing more?

No No No

No No No No

Yes Yes Yes Yes

Yes Yes Yes YesYes Yes Yes Yes

Which model is the best fit for your business?The key considerations are Does this option best fit my risk profile?; Does it optimise my statutory capital requirement?;Have I appropriately allowed for the cost, benefit and effort entailed (proportionality)?

with stakeholders. The right choice for aparticular firm could also vary over time(e.g. internal model approval may not beessential in the first wave, but it may be alonger term or strategic aim).

For some, the decision is fairly clear-cut.For others, the balance between theadvantages and disadvantages is harderto judge, particularly given the variousoptions in between the standard formula

and the internal model. In this paper weexplore the main pros and cons that willhelp determine the right choice for yourorganisation.

-

7/27/2019 PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

3/4

PwC Countdown to Solvency II

profile and help address some of theambiguity and uncertainty within thestandard formula approach. For example,combining the standard formula witheither undertaking specific parameters(USPs) or a partial internal model mayprovide a significantly improved fit to aparticular risk profile, while limiting someof the costs associated with full internal

model approval.

Internal model advantagesThe development of an internal model(full or partial) can provide a solutionthat not only better reflects the companysrisk profile, but again, removes some ofthe ambiguity and uncertainty related tousing the standard formula.

Reputational issuesBeyond the regulatory capitalrequirement, an internal model could alsoprovide a catalyst for a more informedand organisationally-embedded approachto risk management. The absence ofinternal model approval (either throughapplication failure or not applying) couldaffect the credibility of the businessin the eyes of its supervisor,policyholders, shareholders and ratingagencies.

Supervisor insists on internal modelIn exceptional circumstances, regulatorsmay decide that the standard formula isnot an appropriate approach to assessing

and managing the unusual nature of acompanys risk profile and hence insist onthe construction of an internal model forsome or all of the risks.

What are the potentialpitfalls of going further?The key consideration is the cost versusthe benefit of doing more. The principleof proportionality applies across SolvencyII and its application is more importantthan ever here. We have outlined thepotential advantages of going furtherthan the standard formula, but do thesebenefits outweigh the inevitable costs?Is a full internal model a step too far?

Risk of refusalThere is a very real risk that companiesexpend a lot of resources and effortdeveloping an internal model over atime-constrained period, only to seetheir application for use turned down.If day-one approval is not essential,management may consider delaying theapplication until they can be more certain

of getting the right result through betterpreparation and a better understanding ofthe requirements as they bed down.

Overestimating the capital benefitsIt is important to consider whether thepotential improvement in the capitalefficiency of the business is worth the costand calls on human resources. The capitaladvantages of an internal model may beoverstated if the capital actually held isgeared to meeting other, typically higher,targets (e.g. economic capital or rating

capital).

Uncertainty of partial modelapplicationFor some firms, a partial model approachmay offer an attractive solution that fitstheir risk profile while keeping costsdown. There is however still considerableuncertainty over how to aggregate therisks from the internal model and therisks from the standard formulacalculation. This uncertainty may make itdifficult for firms to make this decision, atleast for the time being.

Called to accountThe considerable analyst interest in theresults of QIS 5 suggests that the standardformula could emerge as a market-widebenchmark for assessing capitalrequirements. So even if an organisationis using an internal model it may still needto evaluate its capital demands under thestandard formula. Companies will alsoneed to be able to explain why the resultsdiffer from their internal model capitalassessment.

Strategic issuesWhile lack of alignment between acompanys standard formula and its riskprofile may lead to a higher cost ofcapital, an internal model is not theonly way to resolve this. Scaling back

or withdrawing from certain portfoliosor locations might be more effectiveafter consideration of the cost versus thebenefit of continuing within that lineof business.

ConclusionThe choice of approach and the timingfor implementation should be subject toongoing deliberation and review. Ifdirectors and management are unsureabout whether or not to opt for aninternal model, the introduction of thetransitional measures means that there isstill time to decide and make anynecessary preparations before the fullweight of the Directive comes into force.There is only a limited amount of time,however. The firms going through thefirst wave of internal model approval havedemonstrated that model developmentand integration is no small feat.

We encourage firms to make the most ofthis fresh opportunity and review theirapproach to calculating their Pillar Icapital requirements now. Indeed thedecision you make can critically impactthe long-term outlook of your firm, thecost and resource implications and mostimportantly the reputation and

perception of your organisation.

Bryan Joseph

Partner PwC (UK)+44 (0) 207 213 [email protected]

Anne HagenManager PwC (UK)+44 (0) 207 804 [email protected]

Bas van de PasPartner PwC (Netherlands)+31 (0) 88 792 69 [email protected]

Giving you the edgePwC is helping a range of insurers toget to grips with Solvency II. If youwould like help in judging whether aninternal model, standard formula orone of the options in between is rightfor your company, please contact:

Indeed the decision you make can now critically impact thelong term outlook of your firm, the cost and resource

implications and most importantly the reputation andperception of your organisation.

-

7/27/2019 PwC_Countdown_to_SII_-_Is_a_full_internal_model_a_step_too_far_July_11.pdf

4/4

PwC Countdown to Solvency II

www.pwc.com/solvencyIIThis publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the

information contained in this publication without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy orcompleteness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers does not accept or assume any liability,

responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any

decision based on it.

2011 PwC. All rights reserved. Not for further distribution without the permission of PwC. PwC refers to the network of member firms of PricewaterhouseCoopers

International Limited (PwCIL), or, as the context requires, individual member firms of the PwC network. Each member firm is a separate legal entity and does not act as

agent of PwCIL or any other member firm. PwCIL does not provide any services to clients. PwCIL is not responsible or liable for the acts or omissions of any of its

member firms nor can it control the exercise of their professional judgment or bind them in any way. No member firm is responsible or liable for the acts or omissions of

any other member firm nor can it control the exercise of another member firms p rofessional judgment or bind another member firm or PwCIL in any way.

![H20youryou[2] · 2020. 9. 1. · 65 pdf pdf xml xsd jpgis pdf ( ) pdf ( ) txt pdf jmp2.0 pdf xml xsd jpgis pdf ( ) pdf pdf ( ) pdf ( ) txt pdf pdf jmp2.0 jmp2.0 pdf xml xsd](https://static.fdocuments.net/doc/165x107/60af39aebf2201127e590ef7/h20youryou2-2020-9-1-65-pdf-pdf-xml-xsd-jpgis-pdf-pdf-txt-pdf-jmp20.jpg)