PV International 0185

-

Upload

privredni-vjesnik -

Category

Documents

-

view

217 -

download

2

description

Transcript of PV International 0185

S U P P O R T E D B Y T H E C R O A T I A N C H A M B E R O F E C O N O M Y

pvpvinternationalinternationalCroatian Business & Finance WeeklyEstablished in 1953Monday / 6th February / 2012Year V / No 0185www.privredni.hr

Interview: Snježana Španjol, Deputy Minister of AgricultureProduction development and increase is in the interest of everyoneINTERVIEW

PAGE 3

Food processing companies in search of a more satisfac-tory business framework

CEFTA and survival on the EU market are critical issuesFOOD INDUSTRY

PAGES 4-5

Agro-tourism: the right path towards improvementThe sea is not completely indis-pensable for higher revenuesTOURISM

PAGE 8

2008 20092010 2011

Boris Odorčić

T he club of chief econo-mists of the six largest banks in Croatia predict a

new wave of recession this year. According to the survey of the Croatian Banking Association ‘Don’t kill the messenger, Sec-ond Recession Wave’, real GDP will decrease by 1.3% this year. This outlook is strongly influ-enced by the pessimism of two banks that anticipate a relatively strong recession. The other four banks predict GDP will fall by 1% or less. It is worth mention-ing that four of the six econo-mists blame external factors (EU

crisis) as the main cause of an anticipated recession in 2012. Two give priority to local fiscal harmonisation. If the majority of them are right then the Croatian economic outlook might change for the better if we manage to avoid the European recession.

Little good newsFurthermore, the greatest opti-mist amongst the economists an-ticipates an unemployment rate of 13.1% at the end of 2012, and the greatest pessimist is convinced it will be 16.4%, according to the internationally comparable ILO method. Any further rise in unem-ployment should be interpreted in

the context of where the highest contribution for GDP fall is down to the continuous contraction of investment activities at an aver-age rate of 2.7%. If the predicted recession should become real-ity, this will inevitably debilitate more serious fiscal harmonisa-tion. Whatever the government does, poor budget replenishing will cause a relatively high fiscal deficit. The average state balance over 2012 is estimated at the ag-gravating -4.9%, where the dif-ferences in predictions are indica-tively small. The most optimistic anticipates -4.5%, and the most pessimistic -6% of GDP.

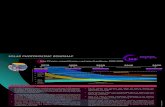

Stable exchange rateThe economists do not feel ex-ternal price shocks will generate recession since they predict aver-age inflation of 2.5%, with antici-pations of a relatively tight range between 2% and 3.2%. The cur-rent account balance of payments is in balance, which is fully in ac-cordance with recessionary out-

look. Logically, those economists who anticipate a stronger reces-sion also anticipate a surplus on the balance of payments (up to 1% of GDP), which should be in-

terpreted through decreased im-ports, albeit not increased export. The economists stand by their prediction of a stable exchange rate, similar to the current level: between HRK7.5 and HRK7.6 to €1. However, interest rates in the money market will slightly increase compared with 2011. Regarding the introduction of euro in Croatia, the anticipations are equal with the period in 2010. The most optimistic mentions 2018 with the pessimists men-tioning 2023, since they expect stricter criteria from Eurozone accession.

CHIEF ECONOMISTS CLUB OF SIX LARGEST BANKS IN CROATIA

BANKERS ANTICIPATING A NEW RECESSION

Often criticised in the public as excessively conservative and pessimi-stic, chief economists of Croatian banks in the HUB analysis, published a year ago, anticipated GDP growth of 1% and 1.8% in 2011, growth in unemployment between 10.5% and 12.8%, and a kuna/euro exchange rate of between 7.3 and 7.45.The revision of the anticipations showed that last summer that they were excessively optimistic. Growth projections decreased to 0.2% or 1%; the anticipated unemployment rate increased between 13% and 13%, and the anticipated exchange rate ranged between HRK7.4 and HRK7.5 / €1 by the end of the year. Allegedly overly pessimistic, the economists ac-tually turned out to be overly pessimistic at the beginning of last year.Even though we do not own many of the statistics for end 2011, it turns out the pessimism of chief economists represented a significant fra-mework for the future. In other words, last year’s pessimism came true.

Pessimists were right

Economists do not think external price shocks will generate recession

Avoiding European recession might change Croatian economic outlook for the better

2

U rgent fiscal consolida-tion, stronger competi-tiveness and benefits

from EU accession are the three significant economic challenges for the Croatian government, stated World Bank Director, Pe-ter Harrold, recently in Zagreb.

According to European regula-tions, fiscal consolidation must gravitate towards a 3% GDP deficit. However, the deficit can-not be reduced to zero since it would cause severe shock. Ex-penditure should be reduced to create room for financing growth and to protect vulnerable groups. According to the World Bank, stronger investment is required for Croatian more stable growth and it should be enhanced by reducing bureaucratic proce-dures. It is important to develop the prerequisites for accepting money from future structural

funds. He pointed out that he had noticed greater optimism in Croatia compared with last year. EU accession will present many opportunities for Croatia. Many countries used this as generator for development. Croatia has a new government that started its work under difficult conditions. However, if reforms are quickly implemented, the situation might turn in favour of development, pointed out Harrold. Budget

cuts are one of the elements for evaluating the seriousness of the implementation of reforms. Increased investment and other measure could turn around nega-tive GDP rates. However, Har-rold added, Croatia will still have the support of the World Bank re-garding stabilisation and speedier development. (I.V.)

Privredni vjesnikYear V No 0185

IMPRESSUM:

Privredni vjesnikKačićeva 910000 Zagreb+385 1 [email protected]

www.privredni-vjesnik.hr/subscription

FOR PUBLISHERNikola Baučić+385 1 [email protected]

EDITOR IN CHIEFDarko Buković+385 1 [email protected]

EXECUTIVE EDITORSAndrea Marić[email protected] Antonić[email protected]

IMC MANAGERDea Olup +385 1 [email protected]

TRANSLATIONLučana [email protected] [email protected]

INTERNATIONAL OPERATIONS Ray [email protected]

Nikola Marinković, Director, Eurus, Split

It is better in the energy sectorDuring the next few years, construction might fall into a deeper crisis which is why we turned to projects in the energy sector

T he primary activity of Eurus is planning and development of civil and

building construction as well as energy. The crisis has had a seri-ous impact on construction. It is estimated that the level of work plummeted by 70%. The con-struction industry might well fall into a deeper crisis and face seri-ous consequences over the next few years.This is why we turned to projects in the energy sector, where we are recognised as a quality and reliable partner of a big global holding company that is develop-ing a series of energy projects in Croatia. At first glance it is noticeable that excellent potential inves-tors often encounter problems, since they cannot find reliable partners in Croatia with experi-ence and professional enough to develop their projects and obtain the required permits. I must say

it is not true that it is difficult to obtain the Study on Environ-mental Impact; an expert knows how to do it since the rules are fully transparent. However, what impedes investors in finalising their projects, on the side of the state, is the problem of a lack of capacity, that is, a quota for con-necting to the electro-energy sys-

tem. Part of this capacity or quota has been taken over by profiteers who had no intention of investing in energy. They rather intended to resell the location and connection to other potential investors. Even though there was an attempt to put a stop to this with time lim-its, they still manage to postpone deadlines for obtaining permits. Regarding the administrative obstacles in the development of energy projects, in addition to the lack of quota, a further aggravat-ing circumstance is the complex procedure for changing spatial plans. Despite the promise of the representative bodies authorised for making decisions regarding such plans, these promises have not been fulfilled, which makes investors nervous and sends a negative message. This is a shame, since Croatia has great potential in developing projects and attracting investment into re-newable energy resources.

Optimism is growing in Croatia

World Bank Support

Croatia has great potential in renewable

energy resources

DECREASE DEFICIT,SPEED UP INVESTMENT

A large share of planned state investment, in total some €1.1 billion, will

be realised this year through public/private partnership (PPP). This will mean hundreds of new schools and sports halls as well as cultural and justice facilities and student homes, announced Vice-President of the govern-ment and Minister of Economy, Radimir Čačić, at the opening of

the conference on private/public partnership, organised by the Ca-nadian Embassy. Another area, where Čačić sees an opportunity for PPP, is in energy. There is al-ready experience with the power plant Plomin, which is a good base for the Plomin 3 Project, worth between €800 million and €1 billion, which could also be realised through PPP. The gov-ernment welcomes all interested in public/private partnership, says Čačić. He is convinced that during the following four years Croatia will realise the biggest investment in PPP in this part of Europe, not only proportional to its size, but also to its absolute amount. (D.Ž.)

Conference on public-private partnership

NEW SCHOOLS AND STUDENT HOMES PAID WITH PRIVATE MONEY

www.privredni.hrBusiness & Finance Weekly 3

Krešimir Sočković

T he new governmental structure in the Ministry of Agriculture found emp-

tied accounts and debts twice as large as expected. Agricultur-ists will certainly worry about the announced cuts in subsidies. At the same time the Common Agricultural Policy is marking its 50 years of existence and is preparing for serious reform that will also impact on Croatia. Privredni vjesnik discussed these topics with the Deputy Minister of Agriculture Snježana Španjol.

A short analysis of the state of the Ministry of Agriculture after the new government as-sumed power revealed debts

higher than expected. Were you surprised by these figures? I must admit we did not expect such a state. Instead of starting with reforms and realising plans with which we won the elections, we will lose a few more weeks analysing the current state. The interest of all agriculturists is to make use of the subsidies in a

short period of time. However, I fear it will take some time to re-duce debts to a reasonable sum in order to start clearing them.

Is there any money for subsidies? The Ministry of Agriculture will try to maintain the same level of subsidies as in 2011. Reorganisation and restructuring in the Ministry and institutions that accompany this sector (Agricultural Land Agency, Paying Agency for Agriculture,

Croatian Agricultural Agency and others) should maximally reduce expenses. In this way there would be more subsidies for farmers. Our programme is savings and rational use. We cannot promise higher subsidies since we cannot promise what we cannot deliver.

Will the control of using subsidies increase? Our strategy and priority is to bring control to the level of other institutions. Until now all these institutions played a passive role, at the same time being considerable users of budget funds. All these agencies, institutes and centres should monitor the producers, help them prepare projects and inform them of their rights and options according to laws and regulations. However, it is necessary they also monitor production. Production development and increase is in the interest of everyone. We will do everything to encourage all institutions to perform quality monitoring of agricultural producers in addition to the agricultural inspections.

Croatia is a small country, on the level of a “statistical error” of the entire EU. How can we protect our interests?Although we are small, we are very interesting for the European Union. We have already held meetings with the representatives of neighbouring countries at the initiative of our colleagues. We maintain good relations with Polish colleagues, and the presiding Danish president gave us support, and announced they would represent our interests even before we gain the right to vote. Croatia has a lot of potential even though it is a small country, and we find everything to be a great challenge. We can achieve a lot in the EU if we are optimistic, especially with our special features. Originality and branding of our products may show our diversity from the Adriatic to central Croatia and Slavonia. We really do have a lot of potential and we should turn the tables and present more creative ideas. We can do a lot if we join forces and offer it to Europe.

INTERVIEW: SNJEŽANA ŠPANJOL, DEPUTY MINISTER OF AGRICULTURE

Production development and increase is in the interest of everyoneOur programme is savings and rational use. We cannot promise higher subsidies as we cannot promise what we cannot deliver

We can achieve a lot in the EU if we are

optimistic

The EU is marking 50 years of common agricultural policy. How much can a small country like Croatia participate in drafting this policy? Since the signing of the Accession Agreement, we will proceed to work with groups of the European Council and Commission. Our colleagu-es from the Ministry of Agriculture will actively participate in the work groups and they will be entitled to share their opinion. They will monitor everything relating to the reforms prepared by the EU – Common Agri-cultural Policy, reform of the market for agricultural products, reform of direct payment and reforms of the fisheries policy. From the very start, they will participate in making changes to the existing regulations and they will be able to signal to our colleagues the direction of the reforms so we can prepare ourselves and forward the information to all agricultu-rists and the general public.

Small, but active

4 Privredni vjesnikYear V No 0185

Igor Vukić

In the forthcoming week Croatian food processing companies are planning to

continue discussions on the situ-ation they will face following Croatian EU accession. On 1st July 2013 the CEFTA agreement, which fostered their favourable

market positioning on Eastern markets, will be terminated. The largest Croatian companies participated in the first meet-ing: Agrokor, Adris, Podravka, Franck, Vindija, Zvečevo, Dukat, Badel 1862, Gavrilović, Pivac, Atlantic and Granolio, as well as Croatian Chamber of Economy representatives.The companies are planning to complete the “final preparations for the future of Croatian econo-my in the EU” adopting an open dialogue approach. It has been

agreed that in the forthcoming fu-ture there will be a meeting at the Croatian Chamber of Economy with the government representa-tives and relevant ministries, where there will be a discussion on concrete expectations from the government and other state bodies. Irrespective of long term negotiations for Croatian EU ac-

The Immunology Institute and Belupo have started co-operating with Malay-

sian companies and the amount of contracted work could in-crease significantly, following a recent delegation visit to the Croatian Chamber of Economy. According to Darko Dvornik, Immunology Institute Board President, the company is plan-ning to invest in development and production facilities, where there is ample room for co-op-eration with Malaysian partners. The Institute of Naval Engineer-ing, as well as Rijeka-based JGL and Končar, Infotehna and other Croatian companies, have also found partnerships in Malaysia.The Malaysian delegation was headed by Yoke Heng Yean, Ma-laysian Ambassador to Croatia. He pointed out that his Embassy is willing to provide a plethora of information on business oppor-tunities for Croatian companies. The delegation members were from Perak province, with has achieved significant development in biotechnology, pharmaceuticals and the renewable energy sector.

Rapid energy sector growth Enis Arnaut, the Director of Per-ak Hi-Tech Industrial Park, and the Director of Nova Beta Tech-nologies, believes that Croatian and Malaysian companies can work on new product develop-ment through joint initiatives and sell them on the market. Arnaut

is originally from Bosnia and Herzegovina and has been work-ing in Malaysia for 17 years. He encouraged the co-operation be-tween the Immunology Institute, Belupo and Institute of Naval Engineering and Malaysian part-ners.

Askar Mohamad, the Chief Op-erating Director of SEDA, the re-newable and sustainable energy development authority, explained that Malaysia is attempting to boost energy sector growth with relatively high energy prices. So-lar power plant energy currently stands at €0.08 per kilowatt hour for up to 4 kilowatts. Their goal is to attract foreign investors since their plan is to use nearly 75% of renewable energy by 2050. The current value of trade be-tween Croatia and Malaysia stands at around $60 million, with Croatian exports around $1.7 million. According to Sunčana Skupnjak Kapić, the Di-rector for International Affairs at the Croatian Chamber of Econo-my, the recently held meeting is likely to boost co-operation and improve the Croatian balance of trade. (I.V.)

CROATIAN-MALAYSIAN CO-OPERATION

Croatian and Malaysian companies can develop new products through joint initiative

Pharmacists promoting Malaysian co-operationIn addition to the Immunology Institute, the Institute of Naval Engineering and Rijeka-based JGL, Končar and Infotehna other companies interested in co-operating with Malaysian partners

FOOD PROCESSING COMPANIES IN SEARC

CEFTA andmarket as tState needs to assist Croatian neighbours in speeding up thChamber of Economy

Irrespective of long term negotiations, EU

accession implies a plethora of uncertainties

for many

The Foreign Trade Chamber of Bosnia and Herzegovina has confirmed ha-ving received enquiries from several Croatian companies, mainly in the food processing sector, on opportunities to transfer production to Bosnia and Herzegovina. Whilst on the one hand foreign companies from Bosnia and Herzegovina are fearful that Croatian EU accession might halve their exports to Croa-tia, Croatian companies are concerned about exiting from CEFTA and un-certain about the outcome of their competitive edge with producers from the EU. In addition, Croatian companies are fearful of large European sho-pping chains penetrating the Croatian market and offering goods at more affordable prices. Kraš, Agrokor, Podravka, Zvečevo, Dukat, Gavrilović and Badel 1862 are some of the companies who have been enquiring about the transfer of production to Bosnia and Herzegovina or Serbia. (Z.L.)

Large Croatian companies are enquiring about production transfer to Bosnia and Herzegovina

www.privredni.hrBusiness & Finance Weekly 5

cession, many companies are faced with many uncertainties. Controversial information on al-terations in business activity fol-lowing an exit from CEFTA has caused considerable public reac-tion. During the meetings last year with exporting companies, the government claimed that, on several levels, there would be no significant change, as CEFTA countries are planning to gradu-ally reduce their trade barriers by the time Croatia has become a fully-fledged EU member. It was stated simultaneously that for Serbia this would take slightly longer, yet it would not exceed a six month period.

Higher customs dutiesIrrespective of the fact that the information is accurate regard-ing comprehensive exports, nev-ertheless several products could see higher customs duties with Bosnia and Herzegovina, Serbia and other CEFTA countries. Cus-

toms duties for industrial prod-ucts have been considerably low-ered and brought into line with the EU level, yet it is likely to see new customs duties for several agricultural, confectionery and tobacco products. Tobacco Factory Rovinj (TDR) has announced they will be faced with tripled cigarette export pric-es to Serbia, whilst in Bosnia cus-toms duties will increase to 15% from the current 0%. Exports duties on Kraš exports to Bosnia and Herzegovina will be 45% per kilo of biscuits. In addition, milk producers will become uncom-petitive, warned Alen Fontana, the Board President of Dukat.In accordance with EU regula-tions, Croatia is entitled to a requirement to maintain the cur-rent preferential status, regarding customs duties and quotas under CEFTA. Bulgaria and Romania have acted similarly upon their EU accession. Nevertheless, the problem is that the preferential

status with CEFTA countries will not be obtained exclusively by Croatian companies, but also by all EU companies. Hence, even in the case of Croatian companies succeeding in retaining the current customs duties under CEFTA, they will be faced with strong competition from EU companies under the same conditions. Consequently, food processing companies will by joint action attempt to negoti-ate with the government on busi-ness conditions in line with their European competitors. They will also require similar support in or-der to retain current production levels.

Survival methods According to Stipan Bilić, Direc-tor of Kondin, the confection-ery association, confectionery products imports have exceeded local production during the last several years, irrespective of a certain level of customs pro-

tection (ranging from 12% to 18%). Most Croatian exports are to CEFTA countries. “It is not merely a question of how to pre-serve CEFTA exports, but also a question of survival on the EU market”, pointed out Bilić.He warned that Croatian compa-nies are burdened by increasing energy prices, higher taxation, weaker bank support and scarcer raw materials. The country needs to define its objectives for local

agricultural and food processing industry and consequently adapt its relief and subsidy policy. Experts in customs issues claim there is no need to panic regard-ing alterations with CEFTA; nev-ertheless each exporting com-pany needs to be thoroughly in-formed on the ways that Croatian EU accession will impact on ex-port results. Information on cus-toms duty alterations for individ-ual goods will be available at the Croatian Chamber of Economy and can also be provided by the appropriate bodies and CEFTA countries Chambers of Economy. Agrokor acted accordingly two years ago, considering alterations following Croatian EU acces-sion. Irrespective of the fact that it has currently joined the confec-tionery association, it has estab-lished its market position in Ser-bia and Bosnia and Herzegovina by its takeover and the formation of companies in these countries.

Ample timeIn addition, there is the issue of assistance potential provided by the state to companies in the food processing sector. The European Union is not inclined towards state assistance to individual sec-tors, as it distorts market compe-tition. Nevertheless, something can be done with horizontal support and improvement in the framework for the use of EU funds. Yet, according to Nad-an Vidošević, President of the Croatian Chamber of Economy, it is primarily the responsibility of individual companies to pre-pare for the EU business frame-work. He believes that there has been ample time for adapting and the state needs to assist Croatian neighbouring countries in speed-ing up their EU accession in or-der to promptly abolish business barriers.

CH OF A MORE SATISFACTORY BUSINESS FRAMEWORK

d survival on the EU the critical issuesheir EU accession in order to abolish business barriers, according to Nadan Vidošević, President of the Croatian

Agrokor has established its position in Serbia and Bosnia and Herzegovina by founding its own companies and is able to operate there almost as a local player

6 WE PRESENT Privredni vjesnikYear V No 0185

Agro-tourism Roca, the House of Dalmatian pršut was opened in the sum-

mer of 2011. Irrespective of the fact that agro-tourism has been attracting an increasing number of tourists opting for local gas-tronomy and wines the main activity of the Roca family is Yorkshire, German Landrace and Duroc pig breeding and meat processing, plus traditional local production of top quality pršut. They currently own 200 pigs and meet European standards for pig

fattening in an enclosed system. The farm also has a dried meat processing facility with particu-lar emphasis on the traditional method of pršut dry curing, com-plying with hygiene and other HACCP standards. Visitors can taste various gastronomic prod-ucts in the Dalmatian wine cellar and olive grove. The project includes a shop with a wide range of Roca agro-tourism products and a comprehensive range of Dalmatian hinterland food products. The wide product range includes pršut, two types of sausages – Dalmatian red and Dalmatian rosemary - bacon, lard spread, dry chuck of pork and smoke-dried pork loin. The project

was conceived in the spirit of Dal-matian heritage and includes an ethnic house depicting Dalmatian family life from the past.

Without electricity or water supply“The idea of agro-tourism and a House of Dalmatian pršut was conceived six years ago after the purchase of an area of 8,000 m2. We planted an olive grove where there are currently 50 trees yield-ing around 1,000 kg of olives an-nually. The olive grove is also a terrace which can accommodate 150 people. Next to the olive grove there is a vineyard with 1,400 vines of three types: Dalmatian Debit, Marastina and Plavina”, ex-plained Ante Roca, the owner.“€1.4 million was invested in the project, mainly through loan fi-nancing and also using our own funds, whilst the Ministry of Agriculture and Zadar County subsidised a minor project. Velim is within an area of Special State Care, an agricultural area where there used to be no electricity or water supply. It has been recon-structed and modernised and can currently accommodate organ-ised groups of visitors or tour-ists throughout the year”, noted Roca.

The Buzet-based company Drvoplast produces differ-ent types of granules for

extrusion and injection which are used in their own production of plastic profiles and also sold on the market as a raw material.The company produces over 600 different plastic profiles such as seal profiles for all types of build-ing carpentry, aluminium facades and thermal bridges. Also includ-ed are PVC shutter lamella rang-ing from 37mm to 50 mm, profiles for the furniture industry (decora-tive profiles) and internal equip-ment profiles (housing contain-ers, camping trailers and prefab-ricated houses). Additionally the wide range of products includes profiles for boats and ships (boat fenders, vessel side shields, ves-

sel handrails and similar), traffic bollards and ‘snow-on-the road’ poles. In addition, there are vari-ous tubes and pipes and profiles for miscellaneous purposes (ce-ramic tile edge profiles, profiles for tents, awnings and tarpaulins, seal profiles for shower cubicles and basins, shelf price holders, edge profiles for tennis courts, sun shields for trams and rail carriages and optical cable profiles).

New product development is highly dictated by market de-mand. The company produces some 30 new products each year (plastic profiles and granules), exclusively for regular customers.

Employment rather than lay-offs Drvoplast flexibility in meeting customer requirements and needs is due to quality and its 40-year-long tradition, according to Božidar Kadoić, Board Member. Around 50% of products are ex-ported, mainly to Slovenia, Italy, Austria, Switzerland, Germany, France, the Czech Republic, Ser-bia, Latvia, Hungary and Bosnia and Herzegovina. Its’ products are present also in Swedish, Romanian and Polish markets through regu-lar customers. There have been no lay-offs in the last two years.Drvoplast saw turnover volume increase 46% in 2010 over 2009, whilst turnover volume for 2010 was continued into 2011. “We are anticipating a slight growth of 3% over 2011. In addition, we are planning to invest in modern pro-duction lines for the production of hard and soft plastic profiles which has a value of €350,000; this would slash our expenditure and foster the competitiveness of several existing products. We are also planning to launch several new products, which are currently under development”, pointed out Kadoić. (I.V.)

AGRO-TOURISM ROCA – HOUSE OF DALMATIAN PRŠUT DRVOPLAST, BUZET

Rich heritage attracting touristsProject conceived in the spirit of Dalmatian heritage including an ethnic house depicting Dalmatian family life from the past

30 new products each year

€1.4 million was invested in the project

Company producing over 600 different plastic profiles

Producing a range of PVC granules for extrusion and injection used in their own production as well as sold as raw material

www.privredni.hrBusiness & Finance Weekly 7CROATIAN FOREIGN CURRENCY MARKET

Source: HNB WEEK FEBRUARY 4, 2012

Currency Kuna exchange mid-rate

AUD 6,158527CAD 5,760629JPY 7,547737CHF 6,289885GBP 9,115568USD 5,752321EUR 7,578683

Last year, Croatian banks generated a total profit of €0.49 billion, according

to non-consolidated statistical report of the Croatian National Bank. In relation to 2011, profits are 3.3% lower.

Last year, bank assets increased to €54.5 billion or 4.3%. Total lend-ing increased by €1.7 billion, to €37.4 billion, or 4.86%. Corpo-rate lending increased by 7.94%, to €14.7 billion. State lending in-creased by slightly less than €0.2

billion (+17.52%), €1.33 billion. Other corporate lending exceeded €13.3 billion (+7.08%).

Mortgages in declineAccording to the report, €5.26 billion was lent to state and local administrations as well as the re-public funds, which is up 14.10% over 2010. Public lending stag-nated (+0.17%). At the end of 2011, it totalled €16.22 billion, €26.7 million more in relation to the end of 2010. Housing and non-purpose loans slightly in-creased, whereas mortgage, car and credit card loans declined. Housing loans increased by 2.33%, to €7.8 billion, whilst non-purpose loans increased by 1.73%, to €6.88 billion. Car fi-nance decreased by 27.36%, to

€0.61 billion. Credit card finance also decreased, by 6.5%, to €0.53 billion.

Lending at the same paceCompared with 2011, move-ments in monetary and credit ag-gregates will not change substan-tially during 2012. The growth of total bank lending should slow since the state will decrease its demand for financing after im-plementing fiscal consolidation, according to HNB Newslet-ter. The anticipated decrease in budget loss in 2012 and precon-ditions for long-term economic growth should gradually slow the rise in interest rates and thus the private sector demand for loans in 2013, according to the HNB Newsletter.

HNB: BANK PROFIT DROPS BY 3.3%

The growth of total bank lending should slow since the state will decrease its demand

Movements in monetary and credit statistics will not change substantially in 2012

GROWTH OF TOTAL GROWTH OF TOTAL LENDING SHOULD SLOWLENDING SHOULD SLOW

31.1. 1.2. 2.2. 3.2. 4.2

7.60

7.59

7.58

7.57

7.56

7.55

EUR 5.80

5.78

5.76

5.74

5.72

5.70

USD 6.31

6.30

6.29

6.28

6.27

6.26

CHF

31.1. 1.2. 2.2. 3.2. 4.2 31.1. 1.2. 2.2. 3.2. 4.2

An excellent January

Some 18 investment funds grew by over 5% in January, and three grew by over 10%. The results of all funds ranged between -3.16% and +12.28%. This year has had a positive start, and all important global indexes showed increases in value, growing around 4% on average up to almost 16%, as in the case of the Russian RTS index.

Podravka profit increase

According to unrevised data, in 2011 Podravka Group generated a total income increase of 3.8%, to €0.50 billion. Company nett profit increased by 44%, to €16.1 million; sales by value climbed to €0.49 billion, up 3% over 2010. Group operating profit stood at €33.56 million in 2011 (+23%).

Salaries risingIn November last year, average monthly nett salary per employ-ee in Croatian companies stood at €764, according to data pro-vided by the Central Bureau for Statistics. In relation to October, this was €28 higher. Compared with the average nett salary in November 2010, the average net salary was nominally 2.6% high-er. However, it remained at the same level in terms of real value. The highest salaries were paid in computer engineering (€1,364), and the lowest in clothing pro-duction (€376).

8 Privredni vjesnikYear V No 0185

Svetozar Sarkanjac

European agro-tourism experiences reveal sig-nificant differences. The

share of agro-tourism facilities in the total number of agricultural estates throughout France, Ire-land, and Germany is currently some 3%, with just 0.3% in Italy. Some 8% of farmers in Austria provide tourist accommodation. Nevertheless, in Europe there are some 100,000 such facilities with 1.3 million beds generating an-nual revenue of €12 billion. Croatian agro-tourism is of sig-nificant importance for two re-gions – Istria, which attracts tourists with its sea and the con-tinental region of Slavonia and Baranja. The percentage of farms within Istrian tourism is 1.6%, which might appear a modest fig-ure, yet has a significant econom-ic role. Istrian tourism revenue in 2010 stood at €6.7 million, gen-erated by 18,727 tourist visits.

Using Istrian experience“Istria has a long tourism tra-dition and can provide a huge amount of useful information”, stated Antonio Sobol, the Direc-tor of Tourism Office of Osijek-Baranja County Tourist Board.

“Nevertheless, we are talking about conceptually diverging ar-eas ranging from personal hab-its, geographical characteristics and primarily accessibility, since Istria is significantly closer to af-fluent markets. We need to learn from them, yet without copying them. Promoting tourism is im-perative, as well as the promotion of a wide range of events, enrich-ing the experience and attracting attention with quality and iden-tity”, he added. Robert Baćac,

Director of the Istria-based tour-ism consortium of agro and ru-ral tourism Ruralis and a UNDP agro-tourism national consultant, shares this opinion. “The poten-tial for Slavonia and Baranja is huge. I believe it even exceeds Istria with its depth of tradition, significant traditional products and active agriculture. The suc-cess of the Istrian tourism indus-try is due to significant support provided by the County some 15 years ago, a continuous focus on

human asset motivation, as well as permanent efforts to connect Istrian agro-tourism to other mar-kets. The initiatives in Slavonia and Baranja are competitive and of high quality and it is the appro-priate path to follow”, he added.

Agro-tourists not interested in the seaWorkers in Slavonia and Baranja-based tourism often claim that Istria has a huge advantage with its wealthy Italian and Slovenian neighbours. Nevertheless, their Istrian colleagues claim this is not entirely true. “The fact that Sla-vonia and Baranja do not have a coast line is not such a huge dis-advantage. Tourists visiting Istria for agro-tourism are not interested

in the sea and vice versa – tour-ists visiting Istria for its sea are not interested in agro-tourism. In addition, the fact that the neigh-bours of Slavonia and Baranja are not Italians or Slovenians is not such a disadvantage. The level of both Italian and Slovenian tourists in Istrian agro-tourism is virtually insignificant. Amongst Istrian tourists who are interested in agro-tourism these are mainly tourists from Germany, Great Britain, France, the Netherlands, as well as from Japan, USA and Australia”, explained Baćac. He believes that attractive tradition-oriented services, adequate infor-mation of the market and a wide initiative are of paramount impor-tance for the continental region.

Tourists visiting Istria for its sea and sunshine

not interested in agro-tourism

AGRO-TOURISM: THE RIGHT PATH TOWARDS IMPROVEMENT

Sea not indispensable for high revenuePotential for Slavonia and Baranja is huge even exceeding Istria suggests Robert Baćac