Pulses - CM DASHBOARD...2019/07/12 · mid-day meal and other welfare schemes. It may support...

Transcript of Pulses - CM DASHBOARD...2019/07/12 · mid-day meal and other welfare schemes. It may support...

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Pulses Today’s developments:

No new developments today. Recent Developments that are still Influencing Markets:

(11th July-2019) Chana may trade steady to slightly firm as buyers are expected to return to market at lower price. Arrival has not been up to the market while festival season is about to start. Nafed sales remain restrictive. In Delhi market chana is being traded at Rs 4400-4425 and it may move up to the level of Rs4500-4550.Basically, chana cash market is unable to get support from futures.If Nafed restricted auction at lower price and festive demand starts, chana may move up by Rs 100 from current level.

(11th July-2019) Area coverage under kharif moong is considerably lower this year and planting season may end with 20 to 255 lower area coverage this year. Almost half time of sowing is over and farmers would not be able to cover the short fall in area. If weather condition turns rough in coming weeks, moong price may get support. Moong futures is trading firm. Under normal condition moong may move north ward once again. In Jaipur market moong is being traded at Rs 6300-6350.

(11th July-2019) Tur market trades steady at Rs5700 in Gulberga market. It may move down by Rs 100 as demand from mills is weak right now. Besides, stockiest are releasing old stock as they fear that 4 lakh MT import and 2 lakh MT sale from central pool may cap uptrend despite lower area coverage so far.

(10th July-2019) As per market source all pulses stock except chana is decreasing and supply side may be tight in the fourth quarter. Even Nafed has decreased chana stock in MP by 3.39 lakh MT. Its really surprising. Market experts are assuming that some of stocks have been shifted for PDS, mid-day meal and other welfare schemes. It may support pulses market in coming months.

(8th July-2019) NCDEX has launched Moong futures on8th July-2019.The moong traded on this exchange is unprocessed. The exchange has selected Merta City as main delivery centre while Nokha, Jodhpur and Sri Ganganagar would be other centres. In the beginning the contract would be for Aug, Sep-2019.

(5th July 2019) Over all kharif pulses area is lagging behind by 71.55 % to 7.94 lakh ha as on 5th -20119.Arhar area is down by 75.33 % to 2.45 lakh ha so far while normal as on date is 10.99 lakh ha. Even urad area is down by 73.06 % to 1.86 lakh ha against normal of 5.70 lakh ha till date. Moong area is down by 73.95 % to2.16 lakh ha against the normal of 7.88 lakh ha till date. Kulthi sowing has just started while other pulses coverage is 47.24 % down to 1.42 lakh ha against normal of 2.48 lakh ha .However, with monsoon advancing in growing regions, sowing activities is likely to pick up in coming weeks.

(4th July 2019) DGFT has removed the condition of adv. authorization for pulses import. This means now importers need not to have adv. authorization letter from DGFT for pulses import. DGFT has already increased tur import quota from 2 lakh MT to 4 lakh MT. Importers have to import 2 lakh MT before Oct. It has already impacted tur price in domestic market.

(03rd july 2019) Govt .has increased MSP of pulses for kharif season 2019-20.Increase is considered marginal. Kharif pulses include tur,moong and urad. For arhar, the increase was 2.2 per cent (RS125

Daily Price Monitoring Report 12th July, 2019

27/09/2017

per qtl.) from Rs 5,675 a quintal to Rs 5,800 per quintal. The MSP of moong was increased by 1.07 per cent (Rs 75 per qtl) from Rs 6,975 to Rs 7,050 a quintal while that of urad was increased by 1.78 per cent (Rs100 per qtl) from Rs 5,600 to Rs 5,700 a quintal.

(28th June 2019) DGFT has started issuing license to importers. Some applicants have already received it and the rest are in process of getting it soon. There is a condition for importers that they have to import it before Oct-2019.This means supply of Tur, Urad & Moong would increase in Aug, Sept and from October new crop (especially urad and moong) would start hitting the market amid continuous sale by Nafed. So any spike in pulses market is unlikely. Even pulses demand in monsoon season weakens.

(14th June,2019) Tur import quota increased to 4 lakh MT from 2 lakh MT. Besides, govt decided to sell 2lakh MT tur from buffer stock. Besides, 1.75 lakh MT tur would be imported through G2G basis in current MY. All these developments have impacted cash market price during last one week. Apart from this govt. has instructed importers to import 2 lakh MT tur before Oct-2019.

(11 June ,2019) Govt. increased tur import cap from 2 to 4 lakh MT.Besides,2 lakh MT would be sold from buffer stock in open market. It would be imported through G 2 G basis. Govt. has a close eye on pulses market and may take all possible action to control tur price.

Price & Arrival: Urad

State/District Market

Modal Price (Rs/Qtl)

Change

Arrivals (Qtl)

Change Source 11 July 2019

10 July 2019

11 July 2019

10 July 2019

Andhra Pradesh Guntur(Gota

Branded) 7900 7900 Unch NA NA - Agriwatch

Andhra Pradesh Vijaywada 5900 6000 -100 2000 1500 500 Agriwatch

Tamil Nadu Villupuram 5690 5429 261 6 2 4 Agmarknet

Tamil Nadu Chennai 4500 4500 Unch NA NA - Agriwatch

Tur

State/District Market

Modal Price (Rs/Qtl)

Change

Arrivals (Qtl)

Change Source 11 July 2019

10 July 2019

11 July 2019

10 July 2019

Andhra Pradesh Yemmiganur NA NA - NA NA - eNAM

Andhra Pradesh Kurnool 4698 5269 -571 61 14 47 eNAM

Maharashtra Akola NA NA - NA NA - eNAM

Andhra Pradesh Vijayawada 5300 5250 50 NA NA - Agriwatch

Moong

State/District Market

Modal Price (Rs/Qtl)

Change

Arrivals (Qtl)

Change Source 11 July 2019

10 July 2019

11 July 2019

10 July 2019

Rajasthan Jodhpur NA NA - NA NA - eNAM

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Karnataka Gulbarga NA 5178 - NA 54 - Agmarknet

Madhya Pradesh Harda NA NA - NA NA - Agmarknet

Andhra Pradesh Vijayawada 6200 6000 200 500 200 300 Agriwatch

Chana

State/District Market

Modal Price (Rs/Qtl)

Change

Arrivals (Qtl)

Change Source 11 July 2019

10 July 2019

11 July 2019

10 July 2019

Andhra Pradesh Kurnool 4170 4138 32 61 14 47 eNAM

Andhra Pradesh Yemmiganur NA NA - NA NA - eNAM

Madhya Pradesh Indore 4200 4300 -100 900 1000 -100 Agriwatch

Rajasthan Bikaner NA NA - NA NA - eNAM

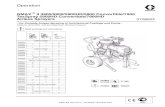

Chana at NCDEX

Contract Open High Low Close Change Volume O.Int

19-Jul 4300 4301 4240 4251 -49 15200 5030

19-Aug 4330 4340 4283 4293 -41 33150 139640

19-Sep 4360 4371 4220 4330 -42 4710 15240

As on 11th July - 2019 at 5 pm Rs/Quintal

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Groundnut Recent updates:

No significant updates for today.

Developments that are still Influencing Markets:

As per Agriculture department of Andhra Pradesh, 2.24 lakh quintals of Groundnut seeds in Anantapur district has been distributed to 1.96 lakh farmers since 15th June. 84% of the target has been achieved. However, the total target of 3 lakh quintals will be completed by 15th July. Moreover, out of 7.10 lakh hectares of kharif sowing 5.5 lakh hectares was expected to be groundnut and the rest will be Jowar, Castor, Red gram and Green gram.

As per the sources, Agricultural minister of Andhra Pradesh announced Rs.1500/qt to benefit

Groundnut farmers in addition to the current market price of Rs.5000/qt to Rs.6500/qt on birth

anniversary of former chief minister late YS Rajasekhar Reddy’s birth anniversary on July 8th as

Rythu Dinotsavam (farmers day).

As per recent released data by GOI, India has covered groundnut kharif sowing area at 15.58 lakh ha. as on 5th July 2019 higher by 6.88 lakh ha. from 8.70 lakh ha. in previous year during the same period of time. Farmers have sown 9.92 lakh ha. in Gujarat higher against 1.49 lakh ha., 0.24 lakh ha. in Karnataka lower against 0.92 lakh ha., 0.21 lakh ha. in Tamilnadu similar against 0.21 lakh ha., 0.108 lakh ha. in Uttar Pradesh, Rajasthan 4.12 lakh ha. Higher against 3.47 lakh ha. Last year. 0.171 lakh ha. in other parts of India unchanged from previous year record. However, normal monsoon expectation of IMD may support kharif crop sowing area.

(04.06.2019) As per the sources, A.P Oil fed has procured 17000 quintals of groundnut seeds from Karnataka. So far Agriculture department distributed 1.99 lakh quintals of groundnut seeds to farmers out of 2.12 lakh quintals, moreover Disbursement of 3 lakh quintals Groundnut seeds will be completed by 15th July. However, if monsoon fails to deliver sufficient rains for groundnut sowing, alternate crops like Ragi would be first priority followed by castor, gram etc.

(04.06.2019) According to the state agriculture department of Gujarat, as on July 1st 2019, total Kharif sowing in the state is reported as 28.24 lakh hectares about 33% of the three-year normal acreage of 84.76 lakh hectares. Sowing of groundnut saw a sharp jump of 14.35 lakh hectares covers about 63% to the normal sowing area of the crop. However, Pulses are least preferred although the gave good returns last year because of increased monsoon activity, brightened the groundnut and cotton sowing in the state.

(03.07.2019) As per SEA, the total Groundnut sown as on 28th June 2019 is about 9.18 lakh hectares has been reported compared to normal corresponding week is 4.40 lakh hectares. The major sowing area is reported from Gujarat 6.01 lakh hectares, Rajasthan 3.32 lakh hectares, Tamilnadu and Andhra Pradesh accounts 0.15 lakh hectares.

(28.06.2019) As on 27thJune 2019 Nafed sold total groundnut K-17 -3910MT. It has disposed total 9.74 lakh tonnes of groundnut K-17 and holds remaining balance at 0.70 lakh tonnes so far in Gujarat market only.

(25.06.2019) Area under cotton 10-15% is going to replace by groundnut due to delayed monsoon in Gujarat, moreover the state and central government policies for groundnut encouraged to cultivate more area under oilseeds.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

(25.06.2019) Nafed has sold total 2.84 lakh tonnes of groundnut K-18 and holds remaining balance at 4.18 lakh tonnes so far.

(12.06.2019) As on 11thJune 2019, Nafed has procured 5.81 MT of Groundnut (Rabi -2019) in the district of Malkangiri of Odisha state. It procured total 130.76 MT at MSP price Rs. 4890 per quintal from 55 farmers.

(07.06.2019) As per 3rd advanced estimates, ministry estimates lower Indian groundnut crop (Kharif and Rabi) at 65.02 lakh tonnes for 2018/19 season against 92.53 lakh tonnes in 2017/18. Kharif groundnut crop size during 2018-19 is estimated at 51.53 lakh tonnes which is 29.7% lower than 75.95 lakh tonnes in 2017-18. Less rainfall at initial stage of crop and lower acreage are the main reason to cut output of Groundnut.

(20.05.2019) Indian Oilseeds & Produce Export Promotion Council (IOPEPC) is planning to develop cluster-based production mainly for groundnut and sesame seed which will be pesticide-free. It is also targeting to cultivate other varieties of oilseeds to fulfil global demand as well. It focuses towards drip irrigation facilities so that monsoon dependency for better crop growth could be reduced. In the meeting, council can discuss the expected crop size of groundnut and sesame for Rabi 2019.

(30.04.2019) As per APEDA data, groundnut shipment reported lower by 3.13% to 488233 MT during April-March 2019 amounting total Rs. 3296 crores as compared to 504038 MT in last year during the same period of time. However, the shipment is higher by 26.290% as compared to 386594 MT in April to February 2019.

rainfall at initial stage of crop and lower acreage are the main reason to cut output of Groundnut.

Price & Arrival: Groundnut

State/District Market Variety

Modal Price (Rs/Qtl)

Change

Arrivals (Qtl)

Change Source 11th July 2019

10th July 2019

11th July 2019

10th July 2019

Andhra Pradesh

Adoni 6469 6773 -304 15 28 -13 NAM

Kadapa Local 4720 5590 -870 53 58 -5 NAM

Kurnool 7082 6589 493 61 14 47 NAM

Yemmiganur NA NA NA NA NA NA NAM

Rajkot NA NA NA NA NA NA NAM

Telangana

Nagarkurnool NA NA NA NA NA NA NAM

Suryapeta NA NA NA NA NA NA NAM

Wanaparthy Town

NA NA NA NA NA NA

NAM

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Onion Today’s Development:

In Andhra Pradesh as on 10th July (second week) 2565 ha of area is sown compared to last year’s 4652 ha. Normal sown area by this time is 5989. Total targeted kharif area is 27482 ha.

In Kurnool, last year 4390 ha was sown as compared to this year’s only 2341 ha area has been sown.

Recent Developments that are still influencing the Market: (3rd July 2019) In Andhra Pradesh as on 3rd July 741 ha of area is sown compared to last year’s

1955 ha. Normal sown area by this time is 4311. The total targeted kharif area is 27482.

(3rd July 2019) In Kurnool, last year 1711 ha was sown as compared to this year’s only 566 ha area has been sown.

(2nd July 2019) In A.P, Kurnool contributes about 80-85% of the total sowing area. So far 515 Ha of area is sown as compared to last year’s 1569 ha due to late onset of monsoon.

(1st July 2019) In Andhra Pradesh, as on 26th June (third week), 666 Ha of area is sown compared to last year’s 1723 Ha. Normal sown area by this time is 2813 Ha. Total targeted kharif area is 27483 Ha.

(29th June 2019) In Karnataka the onion crop is coming in market from local region & Maharashtra which are contributing approximately 30% and 70% respectively.

(29th June 2019)The Maharashtra onions are fetching higher prices in the Bangalore market. (25th June 2019) In Lasalgaon prices are trading approximately Rs.1220 as compared to last

month Rs.960 during same week.

(25th June 2019) In Andhra Pradesh, as on 19th June (third week), 635 Ha of area is sown compared to last year’s 692 Ha. Normal sown area by this time is 1550 Ha. Total targeted kharif area is 27483 Ha.

(21st June 2019) In Maharashtra & Andhra Pradesh, Sowing may pick up the pace as the monsoon is expected in the coming few days.

(16th June 2019) In Andhra Pradesh, normal kharif area is approximately 27482 Ha. This year transplanting is delayed because of water scarcity and lower level of Dam waters. Last year approximately 287 ha area has been sown during 2nd week of June.

Price and Arrivals in Major Markets Onion

State Market Modal Wholesale Prices (Rs/Qtl) Arrivals in Tons

Source 11-Jul-19 10-Jul-19 Change 11-Jul-19 10-Jul-19 Change

Gujarat Ahmedabad 1050 1050 Unch 588 588 Unch Agmarknet

Rajkot 1050 925 125 100 120 -20 Agmarknet

Karnataka Bangalore 1100 975 125 1805 1667 138 Agmarknet

Belgaum 1100 1100 Unch 371 371 Unch Agmarknet

Madhya Pradesh Indore 900 1000 -100 1079 1234 -156 Agmarknet

Maharashtra Lasalgaon 1315 1260 55 1899 329 1570 Agmarknet

Pune 1200 1200 Unch 827 916 -89 Agmarknet

Andhra Pradesh Kurnool NA NA - NA NA - Agmarknet

Rajasthan Jaipur 1200 1200 Unch 660 600 60 Agriwatch

Telangana Hyderabad 1500 1650 -150 600 693 -93 Agmarknet

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Potato Today’s Development:

According to the trade sources, as on 9th July in north Bengal total 19.03% unloading of potato has been done.

According to the trade sources, in Bihar potatoes are arriving from locally and Uttar Pradesh the prices are 800/ quintal and 850/ Quintal respectively.

Developments that are still influencing the Markets:

(3rd July 2019)-According to the trade sources in U.P. the prices are steady as the potato release

percent from storages is less as compared to last year and loading in cold stores is also higher

compared to last year. Prices are likely to remain steady for coming week.

(3rd July 2019)-According to the State government, total production in U.P is estimated to be 14.77

million tons from a total area of 6.10 lakh hectares.

(1st July 2019)-Potato prices in Agra are trading on lower side as compared to last year due to higher loading in cold storages.

(25th June 2019)-In west Bengal 17% potato has been released from cold storage from a total capacity of 70.62 lakh tons.

(25th June 2019)-According to the trade sources in U.P. the prices are steady as the percent released from storages is less as compared to last year. Prices are likely to remain steady for coming week.

(16th June 2019)-In West Bengal, loading in cold storage is completed and traders are expecting 85% capacity utilization this year from a total storage of 70.62 lakh tons. So far approximately 15% potato has been released.

(14th June 2019)-In potato most of the markets prices are trading on lower side compared to previous year’s prices because of higher storage in U.P compare to last year. Last year in U.P storage was approximately 111 lakh tons compared to 123 lakh tons this year.

(13th June 2019)- In most of the markets of UP potato prices are trading below three year average

price and are likely to trade on lower side for couple of weeks.

Price and Arrivals at Major Markets

Potato

State Markets Modal Wholesale Prices (Rs/Qtl) Arrivals in Tons

Source 11-Jul-19 10-Jul-19 Change 11-Jul-19 10-Jul-19 Change

Andhra Pradesh Palamaner NA NA - NA NA - NAM

Karnataka Bangalore 1425 1425 Unch 1260 832 429 Agmarknet

Belgaum 1200 1200 Unch 256 256 Unch Agmarknet

Gujarat Surat 1000 975 25 655 650 5 Agmarknet

Madhya Pradesh Indore 900 900 Unch 207 268 -61 Agmarknet

Maharashtra Pune 1300 1300 Unch 965 853 112 Agmarknet

Delhi Delhi 1094 1090 4 1137 1305 -168 Agmarknet

Uttar Pradesh Agra 825 820 5 1115 1230 -115 Agmarknet

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Tomato

Today’s Developments: (No significant development today) Developments that are still influencing the Market:

(2nd July 2019) In Delhi, tomato from Himachal Pradesh is fetching high prices in between Rs 1400 to Rs 2000/ quintal. “Goli” variety of tomato is fetching lowest prices of Rs 200 to Rs 800/quintal.

(1st July 2019) In Delhi, tomato crop is coming in market mainly from Himachal Pradesh and smaller quantity from Uttar Pradesh and local region of Haryana.

(1st July 2019) All India tomato arrivals are comparatively lower than last year during same time because of which prices are firm in market.

(25th June 2019) In Madanapalle prices are trading near Rs.2310 compared to last week’s Rs.2414, as the arrivals have decreased in the last week.

(11th June 2019) Tomato current price are trading on higher side compared to three year’s seasonal average price in most of the markets because of lower crop size this year due to lesser water availability in producing regions.

(11th June 2019) In Andhra Pradesh, prices are trading on higher side because of lower arrivals from producing regions amid lower crop size. Prices are expected to come down slightly in coming week because of arrival of summer crop from Chitoor and Anantpur district.

( 6th June 2019) - In Madanapalle, prices have dropped down by Rs. 500 to Rs. 800/ quintal because of increase in arrivals from producing regions.

(3rd June 2019) - On Tuesday, prices have dropped down in few markets because of increase in arrivals from producing regions.

(1st June 2019) - Higher arrivals reported in most of the markets but prices are firm and likely to remain firm in most of the markets for coming weeks.

(30th May 2019) - In Andhra Pradesh, prices are trading on higher side because of lower arrivals

from producing regions amid lower crop size. Prices are expected to trade in similar range for

coming weeks because of lower crop size of summer crop due lower water availability in dams.

Price and Arrivals in Major Markets

Tomato

State Markets Modal Wholesale Prices (Rs/Qtl.) Arrivals in Tons

Source 11-Jul-19 10-Jul-19 Change 11-Jul-19 10-Jul-19 Change

Andhra Pradesh

Mulakalacheruvu 1600 1600 Unch 29 23 6 Agmarknet

Madanapalle NA 1000 - NA 193 - NAM

Kalikiri NA 2330 - NA 5 - NAM

Pattikonda NA NA - NA NA - NAM

Gurramkonda NA 1680 - NA 3 - NAM

Karnataka Chintamani 2333 2333 Unch 780 780 Unch Agmarknet

Kolar 1533 1733 -200 1417 1494 -77 Agmarknet

Maharashtra Pune 1500 1400 100 118 229 -111 Agmarknet

Delhi Delhi 1339 1339 Unch 448.7 478.9 -30 Agmarknet

Telangana Bowenpally 3000 3200 -200 316 296.8 19 Agmarknet

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Turmeric

Today’s Developments:

In Andhra Pradesh, Telangana, Tamil Nadu, Turmeric sowing current year reported delay by 10 – 15 days due to delayed monsoon, in Andhra Pradesh sources revealed that area may go down current year, farmer may shift to Maize crop. Till now, turmeric sowing almost completed in AP and Telangana.

Recent Developments that are still Influencing Markets:

In Maharashtra Nanded and Basmat regions, Turmeric seed quality which are stored for sowing purpose reported damaged by 10 - 15% due to dry weather. Turmeric sowing continued slowly, next 10 – 15 days crucial for area point of view. If prevailing weather (very less rainfall) continues area likely to go down by 20 -25%.

In Maharashtra, rainfall during 01-03-2019 to 03-07-2019, in Marathwada region lower by 30% and in Madhya Maharashtra region rainfall departure lower by 12%.

In Andhra Pradesh, Duggirala market new turmeric crop continued in the market, currently on an average 16,000 – 17,000 quintal reported on daily basis.

In Sangli district of Maharashtra and adjoining area of Karnataka till now 35 -40% turmeric sowing completed, farmers were waiting for rainfall. Next 15 – 20 days is crucial for sowing, if rainfall not happen turmeric sowing area drastically come down.

Prices & Arrivals

NCDEX:

Turmeric at NCDEX

Contract Change Open High Low Close Volume O.Int

July-19 -48.00 5892.00 5976.00 5870.00 5870 3955 2075

Aug-19 -14.00 6726.00 6770.00 6660.00 6692 3785 11735

Sep-19 -12.00 6788.00 6824.00 6730.00 6750 1415 5650

As on 11 July, 2019 at 5:00 pm Prices in Rs/quintal, Volumes and Open interest in MT

Turmeric

State Market Variety Modal Price (Rs/Qtl)

Change Arrivals (Qtl)

Change Source 11-July-19 10-July-19 11-July-19 10-July-19

Andhra Pradesh

Duggirala Finger NA 5330 -

NA 87 - NAM Bulb NA 5330 -

Kadapa Finger 5312 5352 -40

776 402 374 NAM Bulb 5425 5390 35

Telangana

Nizamabad Finger NA 5850 -

NA NA - NAM Bulb NA 5425 -

Warangal Finger 5850 5850 Unch

2600 2600 Unch Agriwatch Round 5650 5650 Unch

Tamil Nadu

Erode Finger 6534 NA -

295.5 NA - Agmarknet Bulb 5984 NA -

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Chilli

Today’s Developments:

As per trade information, chilli cold storage stocks as on date (including old and new crops) in Guntur stood at 166,500 to 175,500 MT and in Andhra Pradesh around 220,500 to 229,500 MT according to various trade estimates. Current year cold storage stocks reported lower as carry forward stocks reported less.

Recent Developments that are still Influencing Markets:

Good domestic and export demand from Bangladesh, China, Malaysia, Sri Lanka reported at Guntur mandi.

Current year chilli sowing area may increase due to prevailing higher prices and expecting higher further due to lower cold storage stocks, however monsoon rainfall is crucial factor for chilli sowing area.

As per Agriwatch’s final production estimate, Red Chilli production for 2019-20 is estimated at 12.22 lakh MT. Previous year’s production was 10.50 lakh MT.

Prices & Arrivals

Red Chilli

State Market Variety Modal Price (Rs/Qtl)

Change Arrivals (Qtl)

Change Source 11-July-19 10-July-19 11-July-19 10-July-19

Andhra Pradesh

Guntur Teja 10800 11000 -200 1054 1258 -204 NAM

334 9800 9900 -100 NA NA - NAM

Telangana Khammam Red 6000 6000 Unch 165 207 -42 Agmarknet

Warangal Talu 3000 NA - 710 NA - Agmarknet

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Maize

Today’s Developments:

USDA increased its world corn ending stock estimates by 8.40 MMT to 298.92 MMT for 2019/20

compared to previous month due to increase in production estimates for 2019/20. Corn ending

stock estimates for U.S also increased due to increase in production estimates while for Ukraine,

it increased its corn ending stock estimates only 0.015 MMT to 1.232 MMT compared to

previous month but lower by 0.38 MMT compared to last year estimates.

As per USDA, U.S corn exports reached 44.03 MMT in the 2018-19 marketing year. At 1.14 MMT

(for the period 28th June- 04th July, 2019) US corn exports were up 287 percent from the

previous week and 80 percent from the previous 4-week average; mainly for the destination like

Japan (737,400 MT, including 379,200 MT late reporting), Mexico (224,400 MT), Colombia

(122,400 MT), Canada (21,000 MT), and Taiwan (15,700 MT).

Recent Developments that are still Influencing Markets:

As per trade source, in Nizamabad, stock of maize could be around 5000 MT which was 8000 MT

during corresponding period last year. Maize is moving towards Hyderabad at Rs. 2450 per

quintal; soured from Nizamabad.

As per media report, Government has allowed another 4 lakh tonnes of feed grade Maize(dent

corn) to be imported under TRQ @ 15 % custom duty for actual users. Earlier, Government

allowed 1 lakh tonnes of feed grade Maize (corn) under TRQ wherein MMTC and NAFED each

were allowed to import 50,000 tonnes of corn for poultry firms during the financial year 2019-

20; starting from April 1.

As per trade sources, India imported around 74,378 MT of maize for the month of May’19. Out

of which, around 72,225 MT was imported from Ukraine for the Kandla port at an average value

of $203.28/ MT.

In U.S, corn has been emerged 98% as of 07th July, 2019 which is lower by 2% compared to

previous year and last 5 year average period. Corn has been silked 8% as of 7th July, 2019 which

is lower by 26% compared to last year. 57% crop of Corn is in good to excellent condition which

is up by 1% compared to previous week.

In India, maize has been sown in around 21.06 lakh hectares as on 05th July’19 which is lower

than 30.96 lakh hectare covered during corresponding period last year. In Telangana, it has been

sown in 0.89 lakh hectare which is lower than 0.96 lakh hectare covered during corresponding

period last year. In Karnataka, it has been sown in 2.19 lakh hectare which is lower than 7.17

lakh hectare covered during corresponding period last year. However, in Rajasthan, maize has

been sown in around 6.79 lakh hectares which is higher than 2.69 lakh hectares covered during

corresponding period last year.

In A.P, maize has been sown in around 0.06 lakh hectares as on 5th July’19 which is lower than

0.27 lakh hectare covered during corresponding period last year. Maize crops are at sowing to

vegetative stage.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

As per trade sources, India exported around 35,016 MT of maize for the month of May’19 at an

average FoB of $288.95/ MT. Indian maize is exported mainly to Nepal mainly through Raxaul

followed by Jogbani ICD and Sonauli ICD port.

The Government has given its approval to increase the MSP of Maize by Rs. 60 per quintal to Rs.

1760 per quintal for kharif season of 2019-20.

As per trade source, In Karnataka, farmers are likely to shift from cotton, groundnut, tur and

sugarcane to maize. As maize traded higher than MSP and it is Photo-insensitive crop; farmers

are likely to sown more maize during kharif season. While, in Maharashtra, M.P, Rajasthan and

A.P; some crop area of soybean could shift towards maize.

Prices & Arrivals:

Maize

State/ District

Market Grade Modal Price (Rs./Qtl)

Change Arrivals (Qtl)

Change Source 11-July-19 10-July-19 11-July-19 10-July-19

Telangana Nizamabad Bilty 2300 2300 Unch 3000 2000 1000 AGRIWATCH

Bihar Gulabbagh Bilty 2200 2200 Unch NA NA - AGRIWATCH

Karnataka Davangere Bilty 2350 2350 Unch 1000 1000 Unch AGRIWATCH

Delhi Delhi Loose 2100 2050 50 NA NA - AGRIWATCH

Andhra Pradesh

Kurnool Loose NA NA - NA NA - ENAM

*Difference between current and previous day’s prices.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Sugar

Today’s Developments:

Indian sugar prices showed steady trend in almost all over markets on Thursday. The prices are expected to remain steady to low for coming few days due to less demand and higher sales quota as per the consumption.

Kolhapur sugar market price stood at Rs.3100 and khatauli market prices stood slightly higher at Rs. 3250.

Severe drought circumstances has reduced the total sugar production estimates to 13 million tonnes in Thailand around 7% reduction is expected compared to this year (2018-19). Sugarcane output is expected to decline about 8% to 120 million tonnes in 2019-20 season which will start from Nov’19 due to scanty rainfalls and decreased acreage compared to 130.9 million tonnes of cane in 2018-19. But it is highly dependent on rainfall whether the output would increase or decrease.

Today’s Developments that are still Influencing Markets:

(12th July 2019) The Brazilian real rallied to a 3-1/2 month high against the dollar on Wednesday, which discourages export selling by Brazil’s sugar producers. Sugar prices also have support from reduced sugar output in Brazil, the world's biggest sugar producer, after Unica reported Wednesday that Brazil's 2019/20 Center-South sugar production through June fell -8.9% y/y to 8.905 MMT.

(10th July 2019) According to All India Sugar Trade Association, the Central Government should introduce dual MSP where Central Northern states MSP to be higher than that of Central Southern states or Maharashtra State Government gives transport subsidy for the difference of transportation cost which can enable Maharashtra to sell the allotted quota allotted every month.

(10th July 2019) Since Oct’18 to May’19, the Central Government has allocated 60.50 LMT to sugar mills in Maharashtra and mills are able to sale only approximately 46 LMT failing to sell 14 LMT and hence falling short of cash liquidity worth Rs. 4350 crores. There is excess transportation cost difference of Rs.1800 to Rs.2000 per MT which Maharashtra seeks help from the Government.

(8th July 2019) Kharif sowing of sugarcane crop was delayed in key growing states like Maharashtra, Karnataka. The total Kharif planting reached 49.98 lakh hectare as on 4th July’19, 1.66 lakh ha higher than last week and down by 1.43 lakh ha compared to previous year (51.41 lakh ha) in 2018-19 season.

(5th July 2019) Kisan Cooperative Sugar Mill from Uttar Pradesh has got permission from Central government to export 59,000 quintals sugar to Sri Lanka. The government is planning over framing new sugar export policy to reduce surplus and address the concerns of the glut in sugar industry.

(4th July 2019) Kharif sowing of sugarcane crop was delayed in key growing states like Maharashtra, Karnataka. The total Kharif planting reached 49.81 lakh hectare as on 28th June’19 down by 1.46 lakh ha compared to previous year (50.68 lakh ha) in 2018-19 season. It is expected to pick up the pace due to onset of monsoon in major growing states and the revival of standing sugarcane crop is now on positive side.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

(3rd July 2019) Export demand for sugar has been decreasing since last month, exporting around 31LT till May’19. Exports are expected to reach upto 33-35LT till the end of this season (2018-19 SS). Domestic sugar prices are dwindling at or below MSP due to lack of demand against the huge stacks of sugar piles.

(3rd July 2019) The food ministry has allocated July month’s sales quota at 20.5 LT to each 534 mills in India lower than 21.5 LT in previous month. Due to unsold stocks in the previous month and due to the possibility of less demand in July because of arrival of monsoon, less sales quota has been decided for this month.

(2nd July 2019) ISMA estimates production of about 282 lakh tons of sugar in the season 2019-20, which is about 47 lakh tonnes lower than the current 2018-19 SS production of around 329.5 lakh tonnes, down 14.26%. Uttar Pradesh is estimated to have sugarcane area at 23.60 lakh ha, as against 24.11 lakh ha in 2018-19. Maharashtra’s cane area has estimated down by about 30% for 2019-20 SS, due to poor rainfall from September’2018 onwards and lack of pre-monsoon rainfall, followed by low reservoir levels, which adversely affected sowing of 15 month and 12 month crops. Sugarcane area in Karnataka has also decreased for 2019-20 sugar season to be about 4.20 lakh ha as against 5.02lakh ha in 2018-19, which is lower by about 16%. Sugarcane area in Tamil Nadu for 2019-20 has also decreased to about 2.30 lakh hectare as against 2.60 lakh hectare in 2018-19 SS.

(29th June 2019) As Indian government is encouraging mills to divert to ethanol from sugar production, as on 17th June’19, ethanol blending has increased around 10 times to 6.2% as compared to 0.67% in 2012-13 and 4.22% in 2017-18. The government plans to achieve 10% blending of ethanol in petrol by 2022 to boost agriculture sector, creating independency on energy imports and promoting the use of environment friendly fuel.

(27th June 2019) Sugarcane production and yield is likely to decrease in the coming season 2019-20 in major states Maharashtra and Karnataka due to low moisture availability and absence of pre-monsoon rains. Maharashtra is prevailing from drought with around 40% of the state drought –prone.

Prices

Sugar (M grade)

State/ District Market

Modal Price (Rs /Qtl)

Change Source 11 July-19 10 July-19

Maharashtra Kolhapur 3100 3100 Unch AW

Uttar Pradesh Khatauli 3250 3250 Unch AW

Andhra Pradesh Vijayawada 3560 3560 Unch AW

Delhi Delhi 3160 3150 10 AW

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Cotton Today’s Developments:

Cotton prices expected to be bearish as there is less demand and imports are also in sluggish mode. Moreover, in almost most of the markets arrivals have been ended.

India receives 28% above average rainfall this week especially in cotton growing area of central India which was very important for the vegetative growth of cotton in its initial growth. The cotton crop in India needs average or above average rainfall in the coming weeks so as for the good health of the crop. But according to the latest report released by IMD, reveals that in the coming next two weeks the rainfall is expected to be below normal in India which seems to be very crucial for kharif growing crops for its initial vegetative phases. As in many cotton growing regions, the seedling are in need of water for proper germination.

Recent Developments that are still Influencing Market:

(11th July 2019) According to the latest US crop progress report week ending 7th July’19, 47% of the crop is squaring although less than last years’ progress which was 57% in the same time. The condition of the crop seems good with warming temperatures suitable for the development of the crop. Possibility for the positive impact on the yield of the crop in 2019-20 season.

(10th July 2019) As on 8th July’19, Telangana covered the cotton total area of 8.80 ha and slightly ahead from last year area which stood at 8.79 ha. This year the cotton area in Telangana is going to increase by 2-3% from last year due to less water availability which is encouraging farmers to switch from growing rice this season.

(8th July 2019) As on 4th July’19, the total cotton area of 45.85 lakh ha has been reported sowing in India, 18.77 lakh ha higher than previous week (27.08 lakh ha) and 16.02% less against the previous year of 54.59 lakh ha in 2018. Higher area is reported from Haryana (6.76 lakh ha), Punjab (4.02 lakh ha) and Gujarat (14.35 lakh ha), whereas, less area is reported from Maharashtra (4.56 lakh ha), Telangana (7.89 lakh ha), AP (0.43 lakh ha), Tamil Nadu, Karnataka.

(5th July 2019) US nearby demand has come to a standstill as the exports has been in sluggish mode and continuous cancellation of shipments from China and Argetina. China is likely to procure US cotton or reserve US cotton into state warehouses. In short run, price spread between domestic and foreign cotton is still likely to narrow.

(4th July 2019) The cabinet committee on Economic Affairs (CCEA) has announced MSP for 2019-20 kharif crops. Medium staple cotton is raised by Rs.105 to Rs.5255/quintal and long staple cotton increased by Rs.100 to Rs.5550/quintal. This move of the government would encourage farmers to plant more cotton compared to its competing crops for the coming cotton season.

(4th July 2019) From May 5 to July 3, the cumulative turnover of reserve cotton was 389,000 tons, and the turnover rate was 86.54%. On July 2nd, China Sold 100% Of Total Put Auction at 11933.2157 tons for sales. Average Transaction price was 13,101 Yuan/ton (Down by 179 Yuan/ton from the previous day). The discounted 3128 price was 14,340 yuan/ton (Down by 128 yuan/ton from the previous day).

(3rd July 2019) USDA expects that Indian cotton exports for 2019-20 season is likely to increase by 11 lakh bales and estimated to reach upto 64 lakh bales, whereas, imports are estimated at 18 lakh bales for 2019-20 cotton marketing season by USDA. USDA expects the cotton production at 37.5 million bales with a planted area of 125 lakh ha in 2019-20. Due to the rapid pace of extending rainfall to all over India, the cotton yield may increase compared to previous year.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

(2nd July 2019) Daily arrivals stood at 4,850 bales as on 1st July, with central India having highest arrivals of 4000 bales followed by South zone and North zone stood at 600 bales and 250 bales respectively.

(2nd July 2019) As on 27th June’19, the total cotton area of 27.08 lakh ha has been reported

sown in India 15% less against the previous year of 32.2 lakh ha in 2018. Higher area is

reported from Haryana (0.74 lakh ha), Punjab (0.28 lakh ha), Rajasthan (0.35 lakh ha) and

Madhya Pradesh (0.23 lakh ha), whereas, less area is reported from Maharashtra, Telangana

(3.92 lakh ha), Karnataka, AP (0.58 lakh ha), Tamil Nadu, Odisha and Gujarat.

(29th June 2019) Around 15-20% more area is likely to be under herbicide resistant BT cotton

in Maharashtra. Nearly 20-25 lakh hectare is expected to come under HT Bt variety of cotton

this kharif. Nationally, around 40-45 lakh packets of HT Bt cotton seeds are reported to be in

circulation, according to industry sources.

(28th June 2019) Around 15-20% more area is likely to be under herbicide resistant BT cotton

in Maharashtra. Nearly 20-25 lakh hectare is expected to come under HT Bt variety of cotton

this kharif. Nationally, around 40-45 lakh packets of HT Bt cotton seeds are reported to be in

circulation, according to industry sources.

(27th June 2019) The agriculture department in Bhatinda is targeting to increase the yield in

the coming season for cotton from 888 kg/ha in 2018-19 to 920kg/ha in 2019-20 and would

also bring the area to 1,40,000 ha in the year 2019-20. This year, the area was 91,000 ha. This

would increase the yield of Punjab in the coming season as Bhatinda is one of the largest cotton

growing districts of Punjab.

Prices:

Cotton

State/ District Market

Modal Price (Rs /Qtl)

Change

Arrivals (Qtl)

Change Source 11-July-19 10-July-19 11-July-19 10-July-19

Gujarat Rajkot 6140 6155 -15 210 180 30 Agriwatch

Andhra Pradesh Adoni

6011 6050 -39

553 440 113 Agriwatch

Andhra Pradesh Guntur NA NA - NA NA - NAM

Andhra Pradesh YEMMIGANUR NA NA - NA NA - NAM

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Palm Oil

Today’s Developments:

No significant development today

Recent Developments that are still Influencing Markets:

(11 July 2019)- According to cargo surveyor Societe Generale de Surveillance (SGS), Malaysia’s

July 1-10 palm oil exports fell 2.9 percent to 366,242 tons compared from 377,235 tons in

corresponding period last month. Top buyers were India at 115,645 tons (100,354 tons),

European Union 84,880 tons (44,600 tons), China at 41,200 tons (55,800 tons), Pakistan at

39,000 tons (0 tons) and United States at 1,000 tons (55,680 tons). Values in brackets are figures

of corresponding period last month.

(11 July 2019)- Palm oil prices are expected to be underpinned by lower than expected fall in

end stocks of palm oil in Malaysia in June, fall in exports of palm oil in Malaysia, expectation of

rise of palm oil production in Malaysia and Indonesia from July and appreciation of ringgit. Palm

oil end stocks in Malaysia to fell lower than expected on lower exports and higher imports

despite sharp fall in production of palm oil in June. Production of palm oil is expected fell in

Malaysia in June on seasonal downtrend of production and due to labor shortage as workers

were off field due to holy month of Ramadan. However, as the Ramadan is over and labor has

returned production of palm oil will rebound from July. Exports of palm oil from Malaysia fell in

July on weak demand from other destinations except India, EU and China. Demand from India is

expected to weaken due to rise in stocks of palm oil at Indian ports, lack of fresh demand

triggers and weak monsoon. If monsoon remains weak then import demand from India will pick

up. Demand from China rose in July due to lower supply of soy oil in the country due to lower

import of soybean on outbreak of swine flu in the country and US-China trade dispute. Further,

demand rose due to demand at lower levels. Appreciation of Ringgit has led to fall in palm oil

prices as it makes palm uncompetitive to competing oils.

(9 July 2019)- According to Malaysia Palm Oil Board (MPOB), Malaysia’s June palm oil stocks fell

0.97 percent to 24.24 lakh tons compared to 24.47 lakh tons in May 2019. Production of palm oil

in June fell 9.17 percent to 15.18 lakh tons compared to 16.72 lakh tons in May 2019. Exports of

palm oil in June fell 19.35 percent to 13.83 lakh tons compared to 17.15 lakh tons in May 2019.

Imports of palm oil in June rose 63.86 percent to 1.01 lakh tons compared to 0.62 lakh tons in

May 2019. End stocks of palm oil fell less than trade expectation on lower exports and higher

imports of palm oil.

(9 July 2019)-Import duty on palm stearin will be taxed at 7.5 percent, according to Finance

Minister Nirmala Sitaraman in her first budget. Palm product with Free Fatty Acid (FFA) at or

above 20 percent is subject to import duty. Palm stearin is used in various industrial applications

including soaps. India imported palm stearin from Malaysia and Indonesia. Indian industry was

asking for long to increase import duty on palm stearin which decreased refining margins of

palm oil. This step will help Indian palm oil refiners.

(1 July 2019)-According to Indonesia trade ministry, Indonesia kept July crude palm oil export

duty unchanged at zero. The reference price is set at USD 542.45 per ton, much lower than

lower threshold for export duty and below threshold of USD 570 to calculate export levy.

Indonesia has kept crude palm oil export duty at zero since May 2017.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

(24 June 2019)-According to Malaysia Palm Oil Board (MPOB), Malaysia kept July crude palm oil

export tax unchanged at 0.0 percent. Export duty of palm oil is calculated at reference price of

1970.44 ringgit ($474.69) per ton. Tax is calculated above 2,250 ringgit starting from 4.5 percent

to a maximum of 8.5 percent.

(14 June 2019)-Crude Palm oil import scenario- According to Solvent Extractors Association

(SEA), CPO Imports rose 32.53 percent y-o-y in May to 4.40 lakh tons from 3.32 lakh tons in May

2019. Imports in oil year 2018-19 (November 2018-May 2019) were reported lower by 3.10

percent y-o-y at 37.45 lakh tons compared to 38.67 lakh tons in corresponding period last oil

year.

(14 June 2019)-RBD palmolein import scenario- RBD palmolein imports rose y-o-y in Apr 13.4.8

percent to 3.71 lakh tons from 1.58 lakh tons in May 2018. Imports in oil year 2018-19

(November 2019-May 2019) were reported higher by 37.96 percent y-o-y at 15.70 lakh tons

compared to 11.38 lakh tons in corresponding period last oil year.

(9 June 2019)-According to China's General Administration of Customs (CNGOIC), China’s May

edible vegetable oils imports rose 36.4 percent m-o-m to 7.08 LT from 5.19 LT in April 2019.

Imports rose 17.2 percent y-o-y from 6.04 LT in May 2018. Year to date imports of edible

vegetable oil rose 42.2 percent to 31.89 lakh tons.

Prices:

Palm Oil Prices (In Rs./ 10 Kg)

State/District Market 11 July 2019 10 July 19 Change Source

Crude Palm Oil (FFA 5%)

Gujarat Kandla 493 494 -1 Agriwatch

Andhra Pradesh Krishnapatnam 482 485 -3 Agriwatch

RBD Palmolein

Gujarat Kandla 555 558 -3 Agriwatch

Andhra Pradesh Kakinada 555 558 -3 Agriwatch

Andhra Pradesh Krishnapatnam 547 550 -3 Agriwatch

*Difference between current and previous day’s prices.

Futures prices of CPO at MCX:

Palm Oil at MCX

Contract Open High Low Close Change Volume(Lots) O.Int

31-Jul-19 493.10 497.80 491.40 497.40 4.20 932 4213

31-Aug-19 494.80 499.80 493.30 499.30 4.30 676 2958

30-Sep-19 498.00 501.50 495.00 498.40 0.70 59 160

As on 11-July-2019 at 9 pm Rs/10 Kg

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Sunflower oil Today’s Developments:

No significant development today

Recent Developments that are still Influencing Markets:

(9 July 2019)-Sunflower oil premium over soy oil in CNF markets have decreased to $122 per ton

from $98 per ton last week and premium in domestic markets have reached to 60 per 10 kg, up

Rs 33 per 10 kg from last week. Also, premium of sunflower oil over RBD palmolein has

increased to Rs 245 per 10 kg Rs 210 per 10 kg last week. Prices of sunflower oil are estimated to

trade higher on firm demand and parity in imports. High premium over palm oil will cap gains in

prices.

(28 June 2019)-Sunflower oil premium over soy oil in CNF markets have decreased to $98 per

ton from $77 per ton last week and premium in domestic markets have reached to 33 per 10 kg,

up Rs 20 per 10 kg from last week. Also, premium of sunflower oil over RBD palmolein has

increased to Rs 210 per 10 kg Rs 200 per 10 kg last week. Prices of sunflower oil are estimated to

trade higher on firm demand and parity in imports. High premium over palm oil will cap gains in

prices.

(21 June 2019)-Sunflower oil premium over soy oil in CNF markets have decreased to $77 per

ton from $43 per ton last week and premium in domestic markets have reached to 20 per 10 kg,

up Rs 12 per 10 kg from last week. Also, premium of sunflower oil over RBD palmolein has

increased to Rs 200 per 10 kg Rs 185 per 10 kg last week. Prices of sunflower oil are estimated to

trade higher on firm demand and parity in imports. High premium over palm oil will cap gains in

prices.

(14 June 2019)-Sunflower oil imports scenario- According to Solvent Extractors Association

(SEA), Sunflower oil imports fell 60.4 percent y-o-y in May to 1.31 lakh tons from 3.31 lakh tons

in May 2018. Imports in oil year 2018-19 (November 2018-May 2019) were reported lower by

10.73 percent y-o-y at 14.73 lakh tons compared to 16.50 lakh tons in corresponding period last

oil year.

(14 June 2019)-Sunflower oil premium over soy oil in CNF markets have decreased to $43 per

ton from $53 per ton last week and premium in domestic markets have reached to 12 per 10 kg,

up Rs 25 per 10 kg from last week. Also, premium of sunflower oil over RBD palmolein has

increased to Rs 185 per 10 kg Rs 202 per 10 kg last week. Prices of sunflower oil are estimated to

trade higher on firm demand and parity in imports. High premium over palm oil will cap gains in

prices.

Prices:

Sunflower Oil Prices (In Rs./ 10 Kg)

State/District Market 11 July 2019 10 July 19 Change Source

Tamil Nadu Chennai 805 805 Unch Agriwatch

Andhra Pradesh Krishnapatnam 805 810 -5 Agriwatch

Andhra Pradesh Kakinada 805 810 -5 Agriwatch

*Difference between current and previous day’s prices.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Groundnut oil

Today’s Developments

No significant development today

Recent Developments that are still Influencing Markets:

(28 Jun 2019) Groundnut oil prices are expected to be supported by weak supply prospects and

firm demand. Supply of groundnut oil has decreased due to lower auction of groundnut by

NAFED as it is quoting higher prices at auction. This has led to lower supply of groundnut oil

supporting prices. Further, demand has firmed in expectation of low supply prospects.

In Andhra Pradesh prices are supported due to peak demand season. Demand will remain firm

until July as demand from pickle manufacturers, chatni and other value added products pick up

during this period.

(21 Jun 2019) Groundnut oil prices are expected to be underpinned by fall in demand due to rise

in prices of groundnut oil and high volatility in prices. Groundnut oil prices surged in very short

interval denting demand. Retail demand waned due to high volatility in prices. Higher volatility

in prices leads to weakening of demand.

In Andhra Pradesh groundnut price are expected to be supported by peak season demand.

Demand in Andhra Pradesh generally firms between May-July on account of higher demand

from pickle manufacturers, chatni and other value added products.

(7 Jun 2019) Groundnut oil prices are supported by firm demand. Retail demand has firmed due

to expectation of rise in prices of prices which has led to preponing of demand. NAFED is

aggressively disposing groundnut stocks. Total progressive purchase in 2018 was 7.03 lakh tons

while carryover stocks of 2017 was 3.6 lakh tons. So total stock was 10.73 lakh tons. At present

total stock with NAFED is 5.98 lakh tons. With aggressive sale of NAFED, end stocks with NAFED

at the end of the season will be less than 2 lakh tons.

In Andhra Pradesh groundnut price are supported by peak season demand. Demand in Andhra

Pradesh generally firms between May-July on account of higher demand from pickle

manufacturers, chatni and other value added products

Prices:

Groundnut Oil Prices (In Rs./ 10Kg)

State/District Market 11 July 2019 10 July 19 Change Source

Gujarat Rajkot 1150 1150 Unch Agriwatch

Telangana Hyderabad 1070 1075 -5 Agriwatch

Tamil Nadu Chennai 1050 1050 Unch Agriwatch

*Difference between current and previous day’s prices.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

Rice

Today’s Developments:

No significant developments today.

Recent Developments that are still influencing the Markets:

(10th Jul 2019) The total procurement by FCI for Rice KMS 2018-19 stood at 437.51 lakh tonnes much higher than 381.84lakh tonnes in previous year due to higher production estimate, procurement is higher this year as compare to last year. As on 8th July’19, highest procurement of 113.34 lakh tonnes was in Punjab followed by Telangana & AP procuring 51.86 lakh tonnes and 45.65 lakh tonnes respectively.

(8th Jul 2019) Government has offered 237290 tonnes of rice in OMSS until fourth tender in June’19 out of which 218690 tonnes was sold. State government bought 218690 tonnes of rice whereas no sales happened among bulk consumers. In the month of June’19, government has sold 111000 tonnes of wheat against offered quantity of 190100 tonnes.

(4th Jul 2019) The Government has announced to increase the MSP of normal grade paddy by

65 rupees to 1815 and 'A' grade Paddy MSP of 1835 rupees per quintal. MSP increased in

paddy, not according to expectation. The government does not want to encourage paddy

sowing to see the water crisis. Increasing the MSP will not affect the prices of paddy.

(4th Jul 2019) The beneficial policies and schemes of the Telangana government are coming out

with great meaning. There is a tremendous increase in paddy production and government

procurement. During the marketing season of 2018-19, the total government procurement of

paddy in Telangana rose to new record level of 77.41 lakh tonnes, which was 23.43 lakh tonnes

more than the total procurement of 2017-18 season from 53.98 lakh tonnes.

(26th Jun 2019) Iran Govt Approves Rice Cultivation Restrictions Due to Water Shortage Iran

Gov't Approves Rice Cultivation Restrictions Due to Water Shortage: Restrictions will be

imposed on rice cultivation in Iranian provinces other than the two northern provinces of Gilan

and Mazandaran. According to deputy agriculture minister for water and soil affairs, the

decision has been made by the Cabinet and conveyed to provinces across the country for

implementation.

(25th Jun 2019) To save Basmati export to Europe, USA and Arab countries, Punjab, which is

highest user of fertilisers and insecticides per hectare in the country, much above the national

average, has launched a ‘pesticide-free’ Basmati campaign in the state. Basmati exporters and

Basmati growers in the state are now working together to use fewer pesticides in order meets

the new guidelines of the European Union (EU) and other countries regarding the Basmati

import from India. This effort is to achieve total compliance with EU Maximum Residue Level

(MRLs). The Department of Agriculture, through its network of field officers, would recruit fresh

agriculture graduates to fan out to all the Basmati clusters in the state and directly remain in

touch with the farmers.

(24th Jun 2019) NCDEX will start the futures trading of Mung and basmati from July 1, NCDEX has

sought approval from SEBI to launch futures trading in Tur and Urad.

(19th Jun 2019) In order to reduce the growing stock of food-grains in the country, the Finance

Ministry has proposed to the Food Ministry to give additional 2 kg of rice 2 kg wheat per month

under National Food Security.

Daily Price Monitoring Report 12th July, 2019

27/09/2017

(17th Jun 2019) With the delay in the monsoon, paddy sowing is being affected in the country.

Paddy sowing has been done in 4.3 lakh hectare in the country till June 14, which was 5.47 lakh

hectares during the same period last year. If monsoon is weak, then it may have an impact on

paddy production.

Prices & Arrivals

Rice

State/ District

Market Variety Modal Price (Rs /Qtl)

Change Arrivals (Qtl)

Change Source

11-Jul-19 10-Jul-19 11-Jul-19 10-Jul-19

CHHATTISGAR

H

BALOD PADDY-SWARN

A MASOO

RI

1470 1470 Unch 492 534 -42 E-nam

CHHATTISGAR

H

BHATAPARA

PADDY-HMT

2100 2150 -50 1000 2000 -1000 E-nam

CHHATTISGAR

H

BALOD PADDY 1001

1440 1600 - 492 534 -42 E-nam

TELANGANA

BADEPALLY

Paddy RNR

NA NA - NA NA - E-nam

TELANGANA

MAHBUBNAGA

R

RNR 1800 1819 -19 214 102 112 E-nam

Disclaimer

The information and opinions contained in the document have been compiled from sources believed to be reliable. The company

does not warrant its accuracy, completeness and correctness. Use of data and information contained in this report is at your own

risk. This document is not, and should not be construed as, an offer to sell or solicitation to buy any commodities. This document

may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior

permission from the Company. IASL and its affiliates and/or their officers, directors and employees may have positions in any

commodities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such

commodities (or investment). Please see the detailed disclaimer at © 2019 Indian Agribusiness Systems Ltd.