Public Debt Lecture-3 by Tarun Das

-

Upload

professor-tarun-das -

Category

Documents

-

view

220 -

download

0

Transcript of Public Debt Lecture-3 by Tarun Das

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

1/52

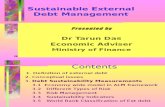

UNITAR Lecture-3 External Debt by Tarun Das 1

Management of

External Debt in India

Presented by

Dr Tarun Das

Economic Adviser

Ministry of Finance

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

2/52

UNITAR Lecture-3 External Debt by Tarun Das 2

Contents

1. Indias position in the world

2. External debt situation

3. Trends for debt sustainabilityratios since 1990

4. Legal system and governance

5. Policies and capacity building6. Lessons from Indian experience

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

3/52

UNITAR Lecture-3 External Debt by Tarun Das 3

1

Indias positionin the world

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

4/52

UNITAR Lecture-3 External Debt by Tarun Das 4

1.1 International Comparisonof top 10 debtor countries in

2003C o u n try a n d R a n k i nT o ta l e x te rn a l S h a re o f D e b t to G N

te rm s o f sto ck o f d e b t co n ce ssio n a l ra tio

e x te rn a l d e b t (U S $ b il l io n )d e b t (p e r c e n t) (p e r c e n t)

1 . B ra z i l 235 1 30

2 . C h in a 194 1 7 15

3 . R u ssia n F e d e ra tio n 1 76 1 50

4 . A rg e n tin a 166 1 104

5 . T u rke y 146 4 77

6 . M e x ic o 140 1 23

7 . In d o n e sia 134 2 7 80

8 . In d ia 114 3 8 22

9 . P o la n d 9 5 7 40

10 .P h i l ip p in e s 6 3 2 3 77

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

5/52

UNITAR Lecture-3 External Debt by Tarun Das 5

1. Internat ona ompar sonof top 10 debtor countries in

2003C o u n try a n d R a n k in R a ti o o f sh o r t te rm D e b t se rv ic

te r m s o f stoc k o f d e b t to (p e r c e nt) ra tio

e x te r n a l d e b t T o ta l d e b t F o re i gn e x ch . (p e r ce n t)

1 . B ra z i l 8 .3 3 9 .8 6 3 .8

2 . C h in a 3 2 .7 1 7 .5 7 .3

3 . R u ssia n F e d e ra tio n 1 7 .6 3 9 .3 1 1 .8

4 . A rg e n tin a 1 3 .8 1 6 2 .4 3 7 .9

5 . T u rk e y 1 5 .8 6 4 .7 3 8 .5

6 . M e x ic o 6 .6 1 5 .5 2 0 .9

7 . In d o n e sia 1 7 .0 6 3 .2 2 6 .0

8 . In d ia 4 .2 4 .6 1 8 .1

9 . P o la n d 2 0 .5 5 7 .4 2 5 .1

1 0 .P h i l ip p in e s 9 .9 3 9 .0 2 2 .1

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

6/52

UNITAR Lecture-3 External Debt by Tarun Das 6

.

Group ClassificationSeverely Indebted:Either PV/XGS > 220%

Or PV/GNP > 80%

Low Income:PC-GNP less than $765

Middle Income : PC-GNP between$766 and $9385

Moderately Indebted:

Either 132%

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

7/52

UNITAR Lecture-3 External Debt by Tarun Das 7

.of top 10 debtor countries in2003

C o u n t r y a n d P V o f P V / G N PP V t o I n d e b t e d n e

R a n k i n E D T r a t i o e x p o r t s a n d i n c o mt e r m s o f E D T $ B l n ( % ) ( % ) C l a s s i f i c a t i

1 . B r a z i l 2 5 4 . 1 5 4 3 2 3 S e v e r e / M i d

2 . C h i n a 1 8 8 . 5 1 5 4 8 L e s s / M i d d

3 . R u s s i a n F e d e r a t i o n1 8 6 . 5 1 1 7 5 3 1 S e v e r e / M i d4 . A r g e n t i n a 1 8 4 . 2 5 2 1 3 5 M o d e r a t e / M

5 . T u r k e y 1 5 7 . 1 2 5 8 3 L e s s / M i d d

6 . M e x i c o 1 5 3 . 0 8 1 2 4 3 S e v e r e / M i d

7 . I n d o n e s i a 1 3 6 . 9 8 2 2 0 0 S e v e r e / M i d

8 . I n d i a 1 0 0 . 3 1 9 1 0 6 L e s s / L o w

9 . P o l a n d 9 3 . 5 4 8 1 4 7 M o d e r a t e / M

1 0 . P h i l i p p i n e s 6 5 . 4 8 0 1 4 7 M o d e r a t e / M

1 5 I t ti l C i

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

8/52

UNITAR Lecture-3 External Debt by Tarun Das 8

1.5 International Comparisonof South Asian countries in2003

Country PV PV to PV to I ndebtednes

and Rank in of Debt GNP XGS and income

terms of EDT $ Bln ratio ratio Classificatio

1. I ndia 100.3 19 106 Less/ Low

2. Pakistan 29.7 41 189 Moderate/ Lo3. Bangladesh 12.8 25 128 Less/ Low

4. Srl Lanka 8.4 51 110 oderate/ Mi

5. Nepal 2.1 38 131 Less / Low

6. Bhutan 0.4 74 252 Severe/ Low

7. Maldives 0.2 35 41 Severe/ Midd

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

9/52

UNITAR Lecture-3 External Debt by Tarun Das 9

2

External Debt Situationof India

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

10/52

UNITAR Lecture-3 External Debt by Tarun Das 10

2.1 External Debt of IndiaExternal Debt of India

Year Total Official Official Conce-End (US$ Bln) Creditors Debtors ssiona l

(percent (percent (percent

1990-91 83.8 64 60 46

1995-96 93.7 64 57 452000-01 101.3 51 43 35

2001-02 98.4 52 44 36

2002-03 105.0 48 42 37

2003-04 111.7 45 40 36

2004-05 123.3 43 39 34

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

11/52

UNITAR Lecture-3 External Debt by Tarun Das 11

2.2 Creditor Composition ofExternal Debt (in per cent)

Creditors March 1991 March 2005

Multilateral 28 26

Bilateral 32 14

Non-residentIndians

17 26

Others 23 34

Total 100 100

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

12/52

UNITAR Lecture-3 External Debt by Tarun Das 12

2.3 Debtor composition ofExternal debt (in per cent)

Debtors March 1998 March 2005Government 50 39

Non-government 50 61

-- Financial Sec 22 34

-- Public sector 10 17

-- Private sector 13 4

-- Short-term 5 6

Total 100 100

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

13/52

UNITAR Lecture-3 External Debt by Tarun Das 13

2.4 Currency Compositionof External Debt

Currency March 1996 March 2005

US dollar 41 45

SDR 15 16Indian Rupees 15 19

Japanese Yen 14 11

Euro 9* 5

Pound sterling 3 3Others 3 1

Total 100 100

* DM, French Franc, Netherlands Guild

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

14/52

UNITAR Lecture-3 External Debt by Tarun Das 14

2.5 Contingent ExternalLiability of the Central

GovtYear As per cent As per cent to

to GDP total external debt

1994 4.3 13.1

1995 3.7 12.5

2000 1.3 7.3

2002 1.5 7.1

2003 1.3 6.2

2004 1.0 5.82005 1.0 5.5

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

15/52

UNITAR Lecture-3 External Debt by Tarun Das 15

3

Trends of Debt Sustainability

Indicators

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

16/52

UNITAR Lecture-3 External Debt by Tarun Das 16

3.1 Significant reduction in ExternalDebt Service Ratio (at end March)

(% of gross current receipts)3 5 . 3

3 0 . 2

2 7 . 52 5 . 4 2 5 . 9 2 6 . 2

2 3 . 0

1 9 . 5 1 8 . 81 7 . 1 1 6 . 2

1 3 . 71 6 1 6 . 2

6 .1

0510152 02 53 03 54 0

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

2002 2003 2004 2005

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

17/52

UNITAR Lecture-3 External Debt by Tarun Das 17

3.2 Significant reduction in ExternalDebt to GDP ratio (at the end March)

2 8 . 7

3 8 . 73 7 . 5

3 3 . 8

3 0 . 8

2 7 . 02 4 . 62 4 . 32 3 . 6

2 2 . 12 2 . 62 1 . 12 0 . 2

1 7 . 81 7 . 4

0510152 02 53 03 54 04 5

1991 1993 1995 1997 1999 2001 2003 2005

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

18/52

UNITAR Lecture-3 External Debt by Tarun Das 18

3.3 Significant reduction in ExternalDebt to current receipts ratio (March)

3 2 93 1 2

3 2 3

2 7 6

2 3 6

1 8 91 7 0

1 6 0 1 6 2

1 4 61 2 8 1 2 2

1 1 09 9 9 5

05 010 015 02 0 02 5 03 0 03 5 0

1991 1993 1995 1997 1999 2001 2003 2005

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

19/52

UNITAR Lecture-3 External Debt by Tarun Das 19

3.4 Reduction in Concessional to TotalExternal Debt Ratio (end March)

4 5 . 94 4 . 84 4 . 54 4 . 44 5 . 3 4 54 2 . 3

3 9 . 53 8 . 53 8 . 9

3 5 . 53 6 . 03 6 . 83 6 . 1

3 3 . 5

0510152 02 53 03 54 04 55 0

1991 1993 1995 1997 1999 2001 2003 2005

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

20/52

UNITAR Lecture-3 External Debt by Tarun Das 20

1 0 . 2

8 .3

7 .0

3 .94 .3

5 .4

7 .2

5 .4

4 .44 .0

3 .6

2 .8

4 .44

6 .1

024681012

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

2002 2003 2004 2005

3.5 Reduction in Short Term Debt toTotal External Debt Ratio (end March)

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

21/52

UNITAR Lecture-3 External Debt by Tarun Das 21

3 8 2

1 2 6

9 8

2 4 2 1 3 0 3 0 1 9 1 5 1 1 9 5 .4 6 .5 4 .1 6 .105 010 015 02 0 02 5 03 0 03 5 04 0 04 5 0

1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001

2002 2003 2004 2005

3.6 Reduction in Short Term Debt toTotal Foreign Exch. Ratio (end March)

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

22/52

UNITAR Lecture-3 External Debt by Tarun Das 22

3.7 Substantial increase inForeign Investment Inflows (US$ billion)

0 .1 0 .10 .6

4 .2

5 .1 4 .9

6 .05 .4

2 .3

5 .15 .9

6 .7

4 .6

1 1

1 2 . 5

02468101 21 4

1990-911991

-921992

-931993

-941994

-951995

-961996

-971997

-981998

-991999

-002000

-012001

-022002

-032003

-042004

-05

in

US$

billion

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

23/52

UNITAR Lecture-3 External Debt by Tarun Das 23

4

Legal System

and Governanceof Public Debt in India

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

24/52

UNITAR Lecture-3 External Debt by Tarun Das 24

4.1.4.1.Fiscal FederalismFiscal Federalism& Public& Public DebtDebt

India has a fiscal federalism with distinctpowers of Union and state governments.

As per Indian budgetary practice, PublicDebt comprises of :

Internal Debt

External Debt

Other Liabilities.

Other Liabilities include provident funds,

post office and small savings deposits,reserve funds etc.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

25/52

UNITAR Lecture-3 External Debt by Tarun Das 25

4.2. Fiscal Federalism4.2. Fiscal Federalism

& Public& Public DebtDebt State Governments power to

borrow is limited to Internal Debt. Indian Constitution provides power

to Central and State Governments

to place limits on internal andexternal debt.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

26/52

UNITAR Lecture-3 External Debt by Tarun Das 26

4.3 Laws and Acts for Public Debt Management of Public Debt and External Debt in

India are governed by various Acts. Under the provisions of the Reserve Bank of India

(RBI) Act of 1935, RBI acts as the debt managerfor the domestic debt of both the Uniongovernment and state governments.

The procedures and rules for internal debtmanagement are indicated in the Public Debt Actof 1944, amended from time to time.

Limits on Public debt are specified under the FiscalResponsibility and Budget Management (FRBM)

Act of 2003 and FRBM Rules of 2003.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

27/52

UNITAR Lecture-3 External Debt by Tarun Das 27

Arrangement inArrangement in

Management of DomesticManagement of Domestic

DebtDebt Reserve Bank of India acts as the principaldebt manager for domestic debt of theCentral Govt with active advice from theMinistry of Finance.

Institutional Arrangement :

Front Office : RBI

Middle Office : Budget Division, MoF

Back Office : Comptroller & AuditorGeneral.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

28/52

UNITAR Lecture-3 External Debt by Tarun Das 28

4.5 Institutional arrangementfor management of external

debt Ministry of Finance plays the key role in

close association with the RBI.

- Head Office: Finance Minister

Front Office : Fund-Bank, ECB, ADB, EEC,

FI/FT, Japan Divisions of MOF; and RBI Middle Office : External Debt Management

Unit (EDMU) in MoF:

Back Office : Office of the Controller of AidAccounts and Audit (CAA&A).

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

29/52

UNITAR Lecture-3 External Debt by Tarun Das 29

4.6 Accountability and Audit

All expenditures and receiptsare subject to audit andaccounting principles, under

Controller General of Accounts Controller of Aid Accounts and

Audit Office for external debt.

4 7 Fiscal Responsibility and

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

30/52

UNITAR Lecture-3 External Debt by Tarun Das 30

4.7 Fiscal Responsibility andBudget Management (FRBM) Act

2003

FRBM Act 2003 and FRBM Rules 2004 cameinto force w.e.f. 5 July 2004.

The Act mandates the Central govt toeliminate revenue deficit by March 2009 andto reduce fiscal deficit to 3% of GDP by March

2008. Under section 7 of the Act, the central govt is

required to lay before both houses ofParliament Medium Term Fiscal PolicyStatement, Fiscal Policy Strategy Statement

and Macro Economic Framework Statementalong with the Annual Financial Statement andDemand for Grants.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

31/52

UNITAR Lecture-3 External Debt by Tarun Das 31

4.8 FRBM Rules 2004

Reduction of revenue deficit by 0.5% of GDPor more every year.

Reduction of gross fiscal deficit by 0.3% ofGDP or more every year.

No assumption of additional debt exceeding9% of GDP for 2004-05 and progressivereduction of this limit by at least onepercentage point of GDP in each subsequent

year.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

32/52

UNITAR Lecture-3 External Debt by Tarun Das 32

4.9 FRBM Rules 2004

No guarantee in excess of 0.5% of

GDP in any financial year. Four fiscal indicators to be projectedfor the medium term. These includerevenue deficit, fiscal deficit, tax

revenue and total debt as % of GDP. Greater transparency in the budgetary

process, rules, accounting standardsand policies having bearing on fiscal

indicators. Quarterly review of the fiscal situation.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

33/52

UNITAR Lecture-3 External Debt by Tarun Das 33

4.10 FRBM Rules 2004

The rules mandate the Central Governmentto take appropriate collective action in thecase of revenue and fiscal deficitsexceeding 45% of the budget estimates, ortotal non-debt receipts falling short of 40%of the budget estimates at the end of half

year of the financial year.

The rules also prescribe the formats for themandatory statements.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

34/52

UNITAR Lecture-3 External Debt by Tarun Das 34

4.10 Medium Term Fiscal Indicators

Items 2004-05RE

2005-06 BE

2006-07 Tar

2007-08Tar

1.Revenue Deficit as

% of GDP

2.7 2.7 2.0 1.1

2.Fiscal Deficit

as % of GDP

4.5 4.3 3.8 3.1

3.Gross tax rev.

as % of GDP

9.8 10.6 11.1 12.6

4.Year-end debt

stock (% of GDP)

68.8 68.6 68.2 67.3

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

35/52

UNITAR Lecture-3 External Debt by Tarun Das 35

4

Policies for ExternalDebt Management

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

36/52

UNITAR Lecture-3 External Debt by Tarun Das 36

4.1 Management of ExternalDebt

Cautious and step by step and gradualapproach towards capital accountconvertibility.

Liberalization of non-debt creating

financial flows (such as FDI andportfolio equity) followed byliberalization of long-term and mediumterm debt inflows.

Partial liberalization of externalcommercial borrowing.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

37/52

UNITAR Lecture-3 External Debt by Tarun Das 37

4.2 Management of ExternalDebt

Tight control on short term external debtand close watch on the size of the currentaccount deficit.

Subnational entities (such as States, localgovernments) are not allowed to borrow

directly from Fund-Bank, ADB. Capital account restrictions for residents

and modest short-term liabilities helpedIndia to insulate from the East Asian

economic crisis during 1997-2000.

4 3 M t f

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

38/52

UNITAR Lecture-3 External Debt by Tarun Das 38

4.3 Management ofSovereign External Debt

High share of concessional debt (80% at the end of March 2005).

No government borrowing fromexternal commercial sources.

No short-term external debt bygovernment.

Maturity of government debt

concentrated towards long-end forthe debt portfolio.

4 4 M t f

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

39/52

UNITAR Lecture-3 External Debt by Tarun Das 39

4.4 Management ofSovereign External Debt

No tied loans since 2003.No external assistance from bilateral

countries except from Japan, USA, EC andRussian Federation since 2003.

Prepayment of more expensive debt.India prepaid $5.9 billion debt to World

bank and ADB in 2002-2004.

Bilateral loans amounting to $1.3 billion

from Sweden, Netherlands, Austria,Australia, Canada, Spain, Denmark, Kuwaitand Saudi Arabia were completelyliquidated in 2002-04

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

40/52

UNITAR Lecture-3 External Debt by Tarun Das 40

4.5 Indias Views on World Bank

Debt Relief Program of HIPCs India fully supports the HIPC

program.

India is the first developing countryto join the program.

However, Indias view is that extra

resources should be generated forthe the program and it should notbe at the cost of resource flows to

other developing countries.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

41/52

UNITAR Lecture-3 External Debt by Tarun Das 41

4.6 Indias Views on World Bank Debt

Relief Program of HIPCs Debt write-off programs should be

supplemented by credible

structural reforms and macrostabilization policies for:

>Sustainable high growth

>Reduction of fiscal deficit

>Employment generation programs

>Poverty alleviation programs

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

42/52

UNITAR Lecture-3 External Debt by Tarun Das 42

5

Monitoring,Dissemination and

Capacity Building

5 1 Monitoring of External

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

43/52

UNITAR Lecture-3 External Debt by Tarun Das 43

5.1 Monitoring of ExternalDebt 100% government debt data and 78% of total

external debt data are computerized on thebasis of Commonwealth Secretariat DRMS.

Projects underway to computerise fully NRIdeposits and short term debt which account forthe residual 22% of total external debt.

Historical trends and future projections of debtstock and debt services are available foranalysis, scenario building and as MIS inputs.

Debt Data updated quarterly for March, June,

September, December. June 2005 debt data arenow under compilation .

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

44/52

UNITAR Lecture-3 External Debt by Tarun Das 44

5.2 Debt DataDissemination Data by both Creditors and Debtors

classification are available. Data by Currency, maturity and interest mix

are also available.

Data cross-classified by institutions and

instruments are also available.Time lag for data update : 8 weeks - well

below the SDDS benchmark of the IMF.

Status Report on External Debt is presentedto the Parliament every year. Also posted onthe MOF homepage(www.nic.in/finmin/miscellaneous).

5 3 Capacity Building for

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

45/52

UNITAR Lecture-3 External Debt by Tarun Das 45

5.3 Capacity Building forExternal Debt Management

World Bank provided an IDF Grant for strengtheningexternal debt management of India.

Achievement under IDF Grant :

Computerization and common database platform onthe basis of CS:DRMS.

Debt-Data connectivity established between RBI,Office of CCAA&A and the EDMU in the MOF.

Organized 3 international seminars & one workshopwith active participation by the World Bank, RBI,Financial Institutes, Commercial banks, corporate

bodies, investment banks.

Published three Books on papers & proceedings.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

46/52

UNITAR Lecture-3 External Debt by Tarun Das 46

5.4 World Bank IDF Grant Projects completed with partial help of IDF Grant:

Report on Monitoring of Non-Resident Indian Deposits. Report on Monitoring of Short-term External Debt.

Report on Monitoring of non-debt financial flows.

Report on Measurement of External Sector Related Contingent liabilities.

Building Models on Sovereign External Debt Management and External DebtSustainability.

Report on Middle Office for Public Debt

Establishment of the Centre of Excellence for training at the CAB, RBI, Pune.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

47/52

UNITAR Lecture-3 External Debt by Tarun Das 47

6

Lessons from IndianExperience

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

48/52

UNITAR Lecture-3 External Debt by Tarun Das 48

6.1 Lessons from Indian Experience Management of external debt is closely related to

the management of domestic debt, which in turndepends on the management of overall fiscal

deficit.

Debt management strategy is an integral part of the

wider macro economic policies, which act as thefirst line of defense against any external financial

shocks.

For an emerging economy, it is better to adopt a

policy of cautious and gradual movement towards

capital account convertibility.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

49/52

UNITAR Lecture-3 External Debt by Tarun Das 49

6.2 Lessons from Indian Experience

At the initial stage, it is better to encourage non-debtcreating financial flows followed by liberalization of

long-term debt.

It is necessary to adopt suitable policies for enhancing

exports and other current account receipts which

provide the means for financing imports and debt

services.

Detailed data recording and dissemination are pre-

requisites for an effective management and monitoring

of external debt and formulation of appropriate debt

management policies.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

50/52

UNITAR Lecture-3 External Debt by Tarun Das 50

6.3 Lessons from Indian Experience

Need for Setting up an integrated Public DebtOffice

- To deal with both domestic & external debt

- To set bench marks on interest rate, maturitymix, currency mix, sources of debt

- Identification and measurement of contingentliabilities

-- Policy formulation for debt management

-- Monitoring risk exposures

- Building Models in ALM framework

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

51/52

UNITAR Lecture-3 External Debt by Tarun Das 51

6.4 Lessons from Indian Experience

It is vital that external forward liabilities and

short-term debt are kept within prudential limits.

It is important to strengthen public and

corporate governance and enhance

transparency and accountability. It is also necessary to strengthen the legal,

regulatory and institutional set up for

management of both internal and external debt.

A sound financial system with well developed

debt and capital market is an integral part of a

countrys debt management strategy.

-

8/14/2019 Public Debt Lecture-3 by Tarun Das

52/52

UNITAR Lecture-3 External Debt by Tarun Das 52

Thank you

Have a Good Day