PROSPECTUS...PROSPECTUS POLARCUS LIMITED (a public quoted company organized under the laws of Cayman...

Transcript of PROSPECTUS...PROSPECTUS POLARCUS LIMITED (a public quoted company organized under the laws of Cayman...

PROSPECTUS

POLARCUS LIMITED

(a public quoted company organized under the laws of Cayman Islands)

The information contained in this prospectus (the "Prospectus") relates to the listing on Oslo Børs of the 1,000,000,000 new shares (the "New Shares") issued by Polarcus Ltd ("Polarcus" or the "Company", and when taken together with its consolidated subsidiaries, the "Group" or the "Polarcus Group"), each with a par value of USD 0.01, in a private placement to certain investors successfully placed on 10 February 2017 (the "Private Placement"). The contemplated listing of the New Shares is expected to take place on or about 22 March 2017.

In addition, the Prospectus relates to the repair offering (the "Offering") by the Company of up to 122,000,000 new shares with a par value of USD 0.01 each (the "Offer Shares") at a subscription price of NOK 0.33 per Offer Share. In connection with the Offering, non-transferable subscription rights (the "Subscription Rights") will be granted to shareholders of the Company as of 9 February 2017, as registered in the Norwegian Central Securities Depositary (the "VPS") on 13 February 2017 (the "Record Date"), who did not participate in the Private Placement (the "Eligible Shareholders"). Each Eligible Shareholder will be granted 0.33 non-transferable Subscription Rights for each existing share registered as held by such Eligible Shareholder as of the Record Date. The number of Subscription Rights granted to each Eligible Shareholder will be rounded down to the nearest whole Subscription Right. Each Subscription Right gives the right to subscribe for, and be allocated, one Offer Share in the Offering. Over-subscription and subscription without Subscription Rights will be permitted; however there can be no assurance that Offer Shares will be allocated for such subscriptions. The subscription period for the Offering will commence at 22 March 2017 and end at 5 April 2017 (the "Subscription Period"). The Company's shares (the "Shares") are listed on Oslo Børs under the ticker code "PLCS".

Subscription Rights that are not used to subscribe for Offer Shares before the expiry of the Subscription Period will have no value and will lapse without compensation to the holder.

The Subscription Rights and the Offer Shares have not been and will not be registered under the Securities Act or the securities laws of any state of the United States and may not be offered or sold within the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. The Offering is not being extended into the United States. Outside the United States, the Subscription Rights and Offer Shares are being offered to non-US persons in offshore transactions (each as defined in Regulation S) in reliance on Regulation S under the Securities Act. The Offer Shares are subject to restrictions on transferability and resale and may not be transferred or resold except as permitted under applicable securities laws and regulations. See Section 16 "Selling and Transfer Restrictions". Investors should be aware that they may be required to bear the financial risks of this investment for an indefinite period of time.

Assuming due payment of the Offer Shares subscribed for and allocated in the Offering, delivery of the Offer Shares in the VPS is expected to take place on or about 10 April 2017.

Prospective investors should read this Prospectus in its entirety. Investing in the Shares involves a high degree of risk. See Section 2 "Risk factors".

Manager:

ABG Sundal Collier ASA

The date of this Prospectus is 21 March 2017

2

IMPORTANT INFORMATION

This Prospectus has been prepared solely for use in connection with the contemplated listing of the New Shares and the Offering. Please see Section 17 "Definitions and glossary" for definitions of terms used in this Prospectus.

The Prospectus has been prepared to comply with the Norwegian Securities Trading Act of 29 June 2007 No. 75 (the "Norwegian Securities Trading Act") and related secondary legislation, including the Commission Regulation (EC) No. 809/2004 implementing Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003 regarding information contained in Prospectuses, as amended, and as implemented in Norway (the "Prospectus Directive"). This Prospectus has been prepared solely in the English language. The Financial Supervisory Authority of Norway (the "Norwegian FSA") has reviewed and approved this Prospectus in accordance with Sections 7-7 and 7-8 of the Norwegian Securities Trading Act on 21 March 2017. The Prospectus is valid for a twelve-month period following its approval. The Norwegian FSA has not controlled or approved the accuracy or completeness of the information given in this Prospectus. The approval given by the Norwegian FSA only relates to the information included in accordance with pre-defined disclosure requirements. The Norwegian FSA has not made any form of control or approval relating to corporate matters described or referred to in this Prospectus.

The information contained herein is current as of the date hereof and subject to change, completion and amendment without notice. In accordance with Section 7-15 of the Norwegian Securities Trading Act, significant new factors, material mistakes or inaccuracies relating to the information included in this Prospectus, which are capable of affecting the assessment of the Shares between the time when this Prospectus is approved and the date of listing of the Offer Shares on Oslo Børs, will be included in a supplement to this Prospectus. Neither the publication nor distribution of this Prospectus shall under any circumstances create any implication that there has been no change in the Group's affairs or that the information herein is correct as of any date subsequent to the date of this Prospectus.

No person is authorised to give information or to make any representation concerning the Group or in connection with the the Offering or the listing of the New Shares and the Offer Shares other than as contained in this Prospectus. If any such information is given or made, it must not be relied upon as having been authorised by the Company, the Manager or by any of their affiliates, advisers or selling agents.

The distribution of this Prospectus and the offering or sale of the Offer Shares and the issue of the Subscription Rights are in certain jurisdictions restricted by law. Persons into whose possession this Prospectus may come are required by the Company and the Manager to inform themselves about and to observe such restrictions. No action has been taken by the Company or the Manager that would permit, otherwise than under the Offering, an offer of the Offer Shares, the issue of the Subscription Rights, or possession or distribution of this Prospectus or any other offering material or subscription form relating to the Offer Shares or the Subscription Rights in any jurisdiction where action for that purpose is required. This Prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any New Shares or Offer Shares offered by or on behalf of the Company or any other person in any jurisdiction in which such offer or solicitation is not authorized, or it is unlawful for such person to make such an offer or solicitation.

Prospective investors should rely only on the information contained in this Prospectus. Prospective investors also acknowledge that: (i) they have not relied on any advisor of the Company or any person affiliated with such advisor in connection with any investigation of the accuracy of any information contained in this Prospectus or their investment decision; and (ii) they have relied only on the information contained in this Prospectus, and that no person has been authorized to give any information or to make any representation concerning the Company or its subsidiaries or the Offer Shares (other than as contained in this Prospectus) and, if given or made, any such other information or representation should not be relied upon as having been authorized by the Company or its advisors. The Company has not authorized any other person to provide prospective investors with different information. No reliance

3

should be placed on any different or inconsistent information provided by any person. Prospective investors should assume that the information appearing in the Prospectus is accurate only as at the date on the front cover of the Prospectus, regardless of the time of delivery of the Prospectus or of any offer or sale of the Offer Shares. The business, financial condition, results of operations and prospects of the Company could have changed materially since that date. The Company expressly disclaims any duty to update this Prospectus except as required by applicable law. Neither the delivery of this Prospectus nor any sale made hereunder shall under any circumstances imply that there has been no change in the Company's affairs or that the information set forth in this Prospectus is correct as at any date subsequent to the date hereof. This Prospectus should be read in its entirety before making any subscription for the Offer Shares.

In the ordinary course of their respective businesses, the Manager and certain of its affiliates may have engaged, and may in the future engage, in investment and commercial banking transactions with the Company and its subsidiaries.

This Prospectus and the terms and conditions of the Offering as set out herein shall be governed by and construed in accordance with Norwegian law. The courts of Norway, with Oslo as legal venue, shall have exclusive jurisdiction to settle any dispute which may arise out of or in connection with the Offering or this Prospectus.

____

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN RECOMMENDED BY ANY UNITED STATES FEDERAL OR STATE SECURITIES COMMISSION OR REGULATORY AUTHORITY. FURTHERMORE, THE FOREGOING AUTHORITIES HAVE NOT CONFIRMED THE ACCURACY OR DETERMINED THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

____

The distribution of this Prospectus, the offer and sale of the Offer Shares and the issue of Subscription Rights are in certain jurisdictions restricted by law. No action has been or will be taken to permit a public offering of the Offer Shares or the possession or distribution of this Prospectus (or any other offering or publicity materials or subscription form(s) relating to the Offer Shares) (i) in the United Kingdom, other than to (a) persons who have professional experience in matters relating to investments who fall within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the "Order"), (b) high net worth entities and other persons to whom it may otherwise lawfully be communicated falling within Article 49(2)(a) to (d) of the Order or (c) other persons to whom it may otherwise lawfully be communicated or (ii) in any other jurisdiction, where action for that purpose may be required.

Accordingly, neither this Prospectus nor any advertisement or any other offering material may be distributed or published in any jurisdiction except under circumstances that will result in compliance with any applicable laws and regulations. Persons into whose possession this Prospectus comes are required by the Company and the Manager to inform themselves about and to observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. For a further description of certain restrictions on the offering and sale of the Offer Shares, see Section 16 "Selling and Transfer Restrictions". Neither the Company, the Manager nor its advisors accept any legal responsibility for any violation by any person, whether or not a prospective investor, of any such restrictions.

4

Contents

1. SUMMARY ......................................................................................................... 7

2. RISK FACTORS ................................................................................................. 22 2.1 Risk factors related to the industry in which Polarcus operates ............................................ 22 2.2 Risk factors related to the Company and the Group ............................................................ 23 2.3 Risks factors related to finance ........................................................................................ 27 2.4 Risk factors related to the Shares .................................................................................... 28

3. RESPONSIBILITY FOR THE PROSPECTUS ............................................................. 31

4. GENERAL INFORMATION .................................................................................... 32 4.1 Presentation of financial and other information .................................................................. 32 4.2 Rounding ...................................................................................................................... 32 4.3 Industry and market data ............................................................................................... 32 4.4 Forward-looking statements ............................................................................................ 33 4.5 Manager ....................................................................................................................... 34 4.6 No advice ..................................................................................................................... 34 4.7 Third party information ................................................................................................... 34 4.8 Enforcement of civil liability ............................................................................................ 34

5. PRIVATE PLACEMENT ........................................................................................ 36 5.1 The Private Placement and the New Shares ....................................................................... 36 5.2 Proceeds of the Private Placement and use thereof ............................................................ 36 5.3 Resolution to issue New Shares ....................................................................................... 36 5.4 Share capital following completion of the Private Placement ................................................ 36 5.5 Dilution ........................................................................................................................ 37 5.6 The New Shares ............................................................................................................ 37 5.7 VPS registration and delivery of the New Shares ................................................................ 37 5.8 Selling and transfer restrictions ....................................................................................... 37 5.9 Advisors ....................................................................................................................... 37 5.10 Expenses ...................................................................................................................... 37 5.11 Lock-up ........................................................................................................................ 37 5.12 Interest of natural and legal persons involved in the Private Placement ................................ 37 5.13 Jurisdiction ................................................................................................................... 38

6. THE OFFERING ................................................................................................. 39 6.1 The Offering .................................................................................................................. 39 6.2 Participation of major existing shareholders and members of the Company's

management, supervisory or administrative bodies in the Offering ....................................... 44 6.3 Delivery and listing of the Offer Shares ............................................................................. 44 6.4 Mandatory anti-money laundering procedures ................................................................... 44 6.5 Financial intermediaries .................................................................................................. 45 6.6 Selling Restrictions and restrictions on distribution of Subscription Rights ............................. 45 6.7 The Offer Shares ........................................................................................................... 46 6.8 Shares following the Offering .......................................................................................... 46 6.9 Dilution ........................................................................................................................ 46 6.10 Advisors ....................................................................................................................... 47 6.11 Net proceeds and expenses related to the Offering ............................................................ 47 6.12 Interests of natural and legal persons involved in the Offering ............................................. 47 6.13 Publication of information relating to the Offering .............................................................. 47 6.14 Jurisdiction and governing law ......................................................................................... 47

5

6.15 Lock-up ........................................................................................................................ 47 6.16 Supplementary Prospectus .............................................................................................. 47

7. INDUSTRY AND MARKET .................................................................................... 49 7.1 Market overview ............................................................................................................ 49 7.2 Seismic fleet overview .................................................................................................... 51 7.3 Positioning of Polarcus in the market ................................................................................ 52

8. BUSINESS ....................................................................................................... 57 8.1 Incorporation, registered office and registration number ..................................................... 57 8.2 Group history ................................................................................................................ 57 8.3 Overview of business activities ........................................................................................ 59 8.4 Data acquisition methods ................................................................................................ 63 8.5 Vision and strategy ........................................................................................................ 66 8.6 Organization and business lines ....................................................................................... 67 8.7 The Polarcus fleet .......................................................................................................... 69 8.8 Material contracts .......................................................................................................... 74 8.9 Organizational structure ................................................................................................. 85 8.10 Legal and arbitration proceedings .................................................................................... 90

9. OPERATING AND FINANCIAL INFORMATION ......................................................... 91 9.1 Summary of significant accounting policies ....................................................................... 91 9.2 Consolidated historical financial information ...................................................................... 92 9.3 Summary of key financials .............................................................................................. 96 9.4 Segment information ...................................................................................................... 97 9.5 Operating and financial review ........................................................................................ 99 9.6 Significant changes in financial and trading position after 31 December 2016

and trend information .................................................................................................. 113 9.7 Investments ................................................................................................................ 113 9.8 Summary of financing .................................................................................................. 114 9.9 Capital resources and indebtedness ............................................................................... 123 9.10 Auditors...................................................................................................................... 125

10. BOARD OF DIRECTORS, MANAGEMENT AND EMPLOYEES ..................................... 127 10.1 Introduction ................................................................................................................ 127 10.2 Board of directors ........................................................................................................ 127 10.3 Management ............................................................................................................... 132 10.4 Employees .................................................................................................................. 135 10.5 Benefits upon termination ............................................................................................. 137 10.6 Pension Scheme .......................................................................................................... 137 10.7 Corporate governance .................................................................................................. 138 10.8 Conflicts of interests .................................................................................................... 139

11. RELATED PARTY TRANSACTIONS ...................................................................... 140 11.1 Related party transactions during the financial year 2013 ................................................. 140 11.2 Related party transactions during the financial year 2014 ................................................. 140 11.3 Related party transactions during the financial year 2015 ................................................. 140 11.4 Related party transaction during the financial year 2016 ................................................... 140

12. CORPORATE INFORMATION AND DESCRIPTION OF THE SHARE CAPITAL ............... 141 12.1 General corporate information ....................................................................................... 141 12.2 Shares and share capital............................................................................................... 141

6

13. SECURITIES TRADING IN NORWAY ................................................................... 157 13.1 Introduction ................................................................................................................ 157 13.2 Trading and settlement ................................................................................................ 157 13.3 Information, control and surveillance ............................................................................. 157 13.4 The VPS and transfer of shares ...................................................................................... 158 13.5 Shareholder register – Norwegian law ............................................................................ 158 13.6 Foreign investment in Norwegian shares ......................................................................... 158 13.7 Disclosure obligations ................................................................................................... 158 13.8 Insider trading ............................................................................................................ 159 13.9 Mandatory offer requirements ....................................................................................... 159 13.10 Foreign exchange controls ............................................................................................ 160

14. TAXATION ..................................................................................................... 161 14.1 Introduction ................................................................................................................ 161 14.2 Responsibility for withholding taxes at source .................................................................. 163

15. ADDITIONAL INFORMATION ............................................................................. 164 15.1 Documents on display .................................................................................................. 164 15.2 Incorporation by reference ............................................................................................ 164

16. SELLING AND TRANSFER RESTRICTIONS ........................................................... 166 16.1 General ...................................................................................................................... 166 16.2 Transfer restrictions ..................................................................................................... 168

17. DEFINITIONS AND GLOSSARY .......................................................................... 171

7

1. SUMMARY

Summaries are made up of disclosure requirements known as "Elements". These Elements are numbered in sections A– E (A.1 – E.7) below.

This summary contains all the Elements required to be included in a summary for these types of securities and issuer. Because some Elements are not required to be addressed, there may be gaps in the numbering sequence of the Elements. Even though an Element may be required to be inserted in the summary because of the types of securities and issuer, it is possible that no relevant information can be given regarding the Element. In this case a short description of the Element is included in the summary with the label of "not applicable".

Section A – Introduction and Warnings

A.1 Warning This summary should be read as an introduction to the Prospectus.

Any decision to invest in the New Shares or the Offer Shares should be based on consideration of the Prospectus as a whole by the investor.

Where a claim relating to the information contained in the Prospectus is brought before a court, the plaintiff investor might, under the national legislation in its Member State, have to bear the costs of translating the Prospectus before the legal proceedings are initiated.

Civil liability attaches only to those persons who have tabled the summary including any translation thereof, but only if the summary is misleading, inaccurate or inconsistent when read together with the other parts of the Prospectus or if it does not provide, when read together with the other parts of the Prospectus, key information in order to aid investors when considering whether to invest in such securities.

A.2 Resale or final placement of securities by financial intermediaries

Not applicable. This Prospectus will not be used in subsequent resales by financial intermediaries.

Section B - Issuer

B.1 Legal and commercial name

The legal name of the Company is Polarcus Limited and the Company's commercial name is Polarcus.

B.2 Domicile/Legal form/Legislation/Country of incorporation

The Company is an exempted company validly incorporated with limited liability in the Cayman Islands, is registered with the Cayman Islands Registrar of Companies with registration number 201867 and regulated by the Companies Law.

B.3 Current operations, principal activities and markets

Polarcus is one of the five global marine three dimensional (3D) towed streamer geophysical service providers. The other providers are WesternGeco (Schlumberger), CGG, PGS and Shearwater. The seismic data acquired by the Company's vessels is used by oil and gas companies to evaluate hydrocarbon structures and to increase chances of commercial success ahead of

8

the exponentially more expensive drilling phase. The data is also used to determine size and structure of known reservoirs in order to maximize field recovery and ongoing production rates. Polarcus has two principal business activities currently: contract seismic services and multi-client projects.

B.4a Significant recent trends affecting the issuer and the industry in which it operates

Not applicable. There are no significant recent trends affecting the issuer and the industry in which it operates.

B.5 The Group The Company is the parent company of the Group.

B.6 Persons having an interest in the issuer's capital or voting rights

Shareholders owning 5% or more of the Shares have an interest in the Company's share capital, which is notifiable pursuant to the Norwegian Securities Trading Act.

The Company is not aware of any persons or entities, except for those set out below, who, directly or indirectly, have an interest of 5% or more of the Shares as of the date of this Prospectus. The following persons or entities have given notice of an interest of 5% or more of the Shares in the Company:

Carl-Gustav Zickerman (through his wholly owned company Zickerman Holding Ltd), has holdings corresponding to a total of 89,201,797 Shares, corresponding to 5.83% of the issued share capital.

Board member Carl-Peter Zickerman (through his wholly owned company Zickerman Group Ltd), gave notice on 10 February 2017 that he held holdings corresponding to a total of 89,201,798 Shares, corresponding to 5.8% of the issued share capital.

Bybrook Capital LLP gave notice on 8 March 2017 that they, through Bybrook Capital Master Fund LP and Bybrook Capital Hazelton Master Fund LP, in aggregate, held holdings corresponding to a total of 220,416,926 Shares, corresponding to 14.4% of the issued share capital. Each of Bybrook Capital Master Fund LP and Bybrook Capital Hazelton Master Fund LP individually holds shares correspondning to 7.2% of the issued share capital after the Private Placement but before the Offering.

Pareto Asset Management AS gave notice on 13 March 2017 that funds managed by them, in aggregate, held holdings corresponding to a total of 84,344,300 Shares, corresponding to 5.51% of the issued share capital.

In addition the following nominee accounts hold more than 5% of the shares outstanding. These accounts may represent one or more individual investors which may or may not include the above

9

mentioned entities and persons.

Skandinaviska Enskilda Banken nominee account has holdings corresponding to a total of 109,877,030 Shares, corresponding to 7.2% of the issued share capital.

J.P. Morgan Securities nominee account has holdings corresponding to a total of 227,502,572 Shares, corresponding to 14.8% of the issued share capital.

A separate J.P. Morgan Securities nominee account has holdings corresponding to a total of 100,000,000 Shares, corresponding to 6.5% of the issued share capital.

The Company is not aware that the Company is controlled or owned, directly or indirectly, by any Shareholder or related Shareholders.

B.7 Selected historical key financial information

10

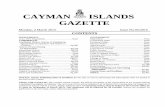

Consolidated Statement of income

Unaudited Unaudited Unaudited Audited Audited Audited

(In thousands of USD) Q4 2016

Q4 2015

31-Dec-16

31-Dec-15

31-Dec-14

31-Dec-13

Revenues Contract revenue 36,024 53,903 185,095 270,757 419,185 496,422 Multi-client revenue 11,224 12,070 56,569 92,819 44,535 33,748 Other income - 6,477 1,752 13,895 2,989 2,075 Total Revenues 47,248 72,450 243,416 377,471 466,709 532,245 Operating expenses Cost of sales (45,625) (58,119) (176,850) (204,287) (296,817) (302,962) General and administrative costs (4,246) (5,958) (19,358) (21,536) (19,765) (17,396) Provision for onerous contracts (26,356) (8,803) (46,356) (8,803) - Depreciation and amortization (11,255) (19,054) (48,672) (72,414) (79,089) (73,776) Multi-client amortization (21,000) (10,481) (56,807) (69,274) (37,228) (16,524) Impairments (24,774) (247,373) (26,658) (315,430) (35,111) (3,495)

Total Operating expenses (133,256) (349,788) (374,701) (691,744) (468,010) (414,153) Operating profit (86,008) (277,338) (131,285) (314,273) (1,301) 118,092 Share of profit/(loss) from joint ventures - (45) (1,220) (983) (280) (265) Finance costs (8,548) (13,770) (37,041) (61,136) (85,293) (80,100) Finance income 780 2,855 1,961 12,395 21,793 6,348 Changes in fair value of financial instruments (1,569) (1,401) (9,013) (13,310) - Gain on financial restructuring - - 177,787 - - -- Gain on acquisition of joint venture - - - - - - Profit before tax (95,346) (12,362) 154,802 (373,011) (78,392) 44,075

Income tax expense (1,650) 527 (3,243) (1,093) (243) (609) Net profit and total comprehensive income (96,996) (289,173) 20,274 (374,105) (78,635) 43,466

Earnings per share attributable to the equity holders during the period (In USD)

- Basic (0.183) (4.317) 0.046 (5.585) (0.145) 0.086

- Diluted (0.183) (4.317) 0.046 (5.585) (0.145) 0.086

Consolidated balance sheet:

Unaudited Audited Audited Audited

(In thousands of USD) 31-Dec-16 31-Dec-15 31-Dec-14 31-Dec-13

ASSETS

Non-current Assets

Property, plant and equipment 443,377 634,419 927,815 972,802

Multi-client project library 45,107 50,828 88,731 88,704

Investment in joint ventures - 1,220 2,203 2,483

Intangible assets - 255 31,969 36,739

Total Non-current Assets 488,484 686,721 1,050,718 1,100,728

Current Assets

Receivables from customers 47,595 58,755 73,056 103,425

Other current assets 21,337 34,185 41,658 29,996

Restricted cash 731 14,519 8,236 20,471

Cash and bank 13,731 53,976 65,488 60,045

11

Total Current Assets 83,394 161,434 188,437 213,937

TOTAL ASSETS 571,878 848,156 1,239,156 1,314,665

EQUITY and LIABILITIES

Equity

Issued share capital 5,305 13,396 13,396 10,144

Share premium 586,401 532,222 532,222 501,843

Other reserves 29,865 32,556 33,149 38,533

Retained earnings/(loss) (442,764) (466,309) (93,302) (22,942)

Total Equity 178,807 111,865 485,465 527,578

Non-current Liabilities

Bond loans 34,582 - 226,743 202,801

Long-term finance lease - - 165,278 154,333

Other interest bearing debt 858 644 236,345 277,262

Long-term provisions 37,320 - - -

Other financial liabilities 10,511 22,324 13,310 -

Total Non-current Liabilities 83,271 22,968 641,676 634,397

Current Liabilities

Bond loans - 220,625 - 37,110

Finance lease - 166,018 8,394 5,897

Other interest bearing debt 249,649 256,911 44,358 41,656

Provisions 6,820 8,803 - -

Other accruals and payables 34,402 30,858 40,206 29,518

Accounts payable 18,929 30,109 19,056 38,509

Total Current Liabilities 309,880 713,323 112,015 152,690

TOTAL EQUITY and LIABILITIES 571,878 848,156 1,239,156 1,314,665

12

Consolidated cash flow statement:

Unaudited Unaudited Unaudited Audited Audited Audited

(In thousands of USD) Q4 2016

Q4 2015

31-Dec-16

31-Dec-15

31-Dec-14

31-Dec-13

Cash flows from operating activities

Profit/(loss) for the period (96,996) (289,173) 20,274 (374,105) (78,635) 43,466

Adjustment for:

Depreciation and amortization 11,255 19,054 48,672 72,414 85,374 77,271

Multi-Client amortization 21,000 10,481 56,807 69,274 37,228 16,524

Impairments 24,774 247,373 26,658 315,430 35,110 -

Changes in fair value of financial instruments

1,569 1,401 (13,315) 9,013 13,310 -

Employee share option expenses 141 150 581 505 2,890 2,689

Interest expense 8,825 13,172 32,659 55,055 62,229 76,080

Interest income (17) (41) (93) (799) (779) (204)

Gain on financial restructuring - - (177,787)

Effect of currency (gain)/loss (3,136) (1,099) (620) (4,785) (6,662) (5,306)

Gain on buyback of convertible bonds

- (1,204) - (1,204) (4,096) -

Net movement in provisions 26,356 8,803 30,553

Share of (profit)/loss from joint ventures

- 45 1,220 983 280 265

Working capital adjustments:

Decrease/(Increase) in current assets

21,794 18,211 19,727 22,284 25,597 6,575

Increase/(Decrease) in trade payables and accruals

1,468 1,432 2,745 3,428 (7,736) (26,092)

Net cash flows from operating activities

(2,582) 28,605 48,082 167,494 157,826 191,268

Cash flows from investing activities

Payments for property, plant and equipment

(965) (1,049) (16,387) (15,125) (52,727) (50,368)

Proceeds from sale of assets held for sale

- - - - - 128,003

Proceeds from the disposal of multi-client projects

- 6,714 - 25,197 - -

Payments for multi-client project library

(12,580) (11,616) (44,649) (96,969) (46,895) (47,927)

Payments to acquire intangible assets

- (12,326) (7) (12,439) (13,631) (14,130)

Net cash flows used in investing activities

(13,545) (18,276) (61,042) (99,336) (113,252) 15,578

Cash flows from financing activities

Net receipt from bank loans - - 7,900

Proceeds from the issue of ordinary shares

- - - - 33,631 16

Net proceeds from the issue of senior bonds

- - - - 56,102 93,083

Repayment of bond loans - (777) - (777) (58,734) (115,653)

Receipt from sale lease-back fund - - - - 20,000 -

Repayment of lease liabilities - (1,450) - (7,653) (6,559) (17,009)

Repayment of other long-term debt

(2,303) (1,437) (14,386) (15,144) (30,287) (75,329)

Interest paid (4,250) (7,550) (24,413) (41,632) (51,411) (58,777)

Financial restructuring fees paid - - (6,231) - - -

Other finance costs paid (397) (162) (959) (6,372) (1,023) (7,348)

Decrease/(Increase) in restricted cash

30 12,117 13,788 (6,282) 12,235 (12,365)

Security deposit related to currency swaps

(1,630) (3,480) 4,280 (510) (6,890) -

Interest received 17 41 93 799 779 204

Net cash flows from financing activities

(8,534) (2,697) (28,156) (77,571) (32,156) (193,178)

Effect of foreign currency revaluation on cash

1,168 (59) 872 (2,098) (6,975) 2,550

Net increase in cash and cash equivalents

(23,493) 7,573 (40,245) (11,512) 5,443 16,217

Cash and cash equivalents at the beginning of the period

37,224 46,403 53,976 65,488 60,045 43,828

Cash and cash equivalents at the end of the period

13,731 53,976 13,731 53,976 65,488 60,045

13

Consolidated statement of changes in equity:

For the year ended 31 December 2016

Number of

Shares

Issued Share capital

Share Premium

Other Reserves

Retained Earnings/

(Loss) Total Equity

(In thousands of USD except for number of shares)

Balance as of 1 January 2016 66,981,368 13,396 532,222 32,556 (466,309) 111,865

Total comprehensive income/(loss) for the period

- - - 20,274 20,274

Employee stock options

- - 581 - 581

Other movements*

- - (3,272) 3,272 -

Issue of share capital

Class B shares issued to $95m bondholders

February 2016 at USD 0.0013 per share 265,384,592 345 26,044 - - 26,389

Class B shares issued to 350m NOK bondholders

February 2016 at USD 0.0013 per share 118,260,837 154 11,606 - - 11,760

Class B shares issued to $125m bondholders

February 2016 at USD 0.0013 per share 79,846,150 104 7,836 - - 7,940

Merger of share classes (on 13-April-2016)

Repurchase of Class B shares at USD 0.0013 per share (463,491,579) (603) - - - (603)

New ordinary shares issued at USD 0.20 per share 463,491,579 92,698 (92,096) - - 603

Reduction in nominal value

15 August 2016, from USD 0.20 to USD 0.01 per share

(100,790) 100,790 - - -

Balance as at 31 December 2016 530,472,947 5,305 586,401 29,865 (442,764) 178,807

*Other movements represent the fair value of employee stock options unexercised and expired during the period.

For the year ended 31 December 2015 - Audited

Number of

Shares Issued Share

capital Share

Premium Other

Reserves

Retained Earnings/(

Loss) Total Equity

(In thousands of USD except for number of shares)

Balance as of 1 January 2015 669,813,679 13,396 532,222 33,149 (93,302) 485,465

Total comprehensive income/(loss) for the period - - - (374,105) (374,105)

Employee stock options - - 505 - 505

Other movements (1,098) 1,098 -

Consolidation of share capital

On 22 November 2015 (at 10:1 from USD 0.02 to USD 0.20 per share) (602,832,311) - - - - -

Balance as at 31 December 2015 66,981,368 13,396 532,222 32,556 (466,309) 111,865

*Other movements represent the fair value of employee stock options unexercised and expired and the equity component of convertible bonds repurchased and cancelled.

14

For the year ended 31 December 2014 - Audited

Number of

Shares

Issued Share capital

Share Premium

Other Reserves

Retained Earnings/(

Loss) Total Equity

(In thousands of USD except for number of shares)

Balance as of 1 January 2014 507,221,179 10,144 501,843 38,533 (22,942) 527,579

Total comprehensive income/(loss) for the period - - - (78,635) (78,635)

Employee share options - - 2,890 - 2,890

Other movements* - - (8,275) 8,275 -

Issue of share capital

October 2014 at NOK 1.40 (USD 0.21) per share 162,592,500 3,252 31,639 - - 34,891

Transaction costs on issue of shares - (1,260) - - (1,260)

Balance as at 31 December 2014 669,813,679 13,396 532,222 33,149 (93,302) 485,465

*Other movements represent the fair value of employee stock options unexercised and expired and the equity component of convertible bonds repurchased and cancelled.

For the year ended 31 December 2013 - Audited

Number of

Shares Issued Share

capital Share

Premium Other

Reserves

Retained Earnings/(

Loss) Total Equity

(In thousands of USD except for number of shares)

Balance as of 1 January 2013 507,196,179 10,144 501,827 40,868 (71,432) 481,407

Total comprehensive income for the year - - - 43,466 43,466

Employee share options - - 2,689 - 2,689

Other movements* - - (5,024) 5,024 -

Issue of share capital

20 March 2013 at NOK 3.58 (USD 0.62) per share 25,000 1 16 - - 17

Balance as of 31 December 2013 507,221,179 10,144 501,843 38,533 (22,942) 527,578

*Other movements represent the equity component of USD 35 million convertible bonds repaid upon maturity on 30 July 2013 (refer to Note 16 and Note 18.1).

Significant subsequent changes

Other than the Private Placement, the Offering, the contemplated bareboat charter of POLACUS AMANI and the 2017 Amendments, there has been no significant change in the Group's financial or trading position since 31 December 2016.

B.8 Selected key pro forma financial information

Not applicable. The Prospectus does not contain pro forma financial information.

B.9 Profit forecast or estimate

Not applicable. The Company has not made any profit forecasts or estimates.

B.10 Qualifications in the audit report on the historical financial information

In the Company's Annual Report from 2014, the Company's auditor, Ernst & Young AS, highlighted the Company's evaluation of its going concern assumption at that time, which was disclosed by the Company in the notes to the financial statements. The reason for the Company assessing its going concern assumption at that

15

time as having a material uncertainty was due to a tie-up of working capital, a decline in oil prices creating significant market uncertainty, and the Company needing to secure sufficient backlog in the future. The auditor emphasized the going concern assumption, liquidity risks and loan covenants, as well as the impairment assessment for the Company's vessels and seismic equipment. Based on these factors, as well as the market and financing situation, it was the auditor's opinion that there was an indication of uncertainty regarding the Company's ability to continue as a going concern. In the Company's most recent Annual Report from 2015 there are no qualifications in the audit report.

B.11 Working capital The Company has sufficient working capital for its present requirements for the next 12 months.

B.17 Credit ratings Not applicable.

Section C - Securities

C.1 Type and class of securities admitted to trading and identification number

The New Shares are registered in the VPS under ISIN KYG7153K1572. The New Shares have been listed and tradeable on Merkur Markets, with ticker code "PLCS-ME" for the period between issuance of the New Shares and the approval of this Prospectus

With effect from the listing thereof, the New Shares will be registered in the VPS under ISIN KYG7153K1085, which is the same ISIN under which the Company's listed shares are registered.

The Company's register of shareholders with the VPS is administrated by DNB Bank ASA, Verdipapirservice, Dronning Eufemias gate 30, 0191 Oslo.

C.2 Currency The New Shares and the Offer Shares are issued in NOK.

C.3 Number of shares and par value

The Company's authorized share capital is USD 19,567,097.7956 divided into 1,878,341,579 Ordinary Shares of a nominal or par value of USD 0.01 each and 602,832,312 Class B shares of a nominal or par value of USD 0.0013 each.

The Company's issued share capital is USD 15,304,729.47 divided into 1,530,472,947 Shares each with a nominal or par value of USD 0.01, all fully paid and issued in accordance with Cayman Island law. There are no issued Class B shares.

C.4 Rights attached to the securities

The New Shares are Ordinary Shares of the Company with no special rights attached to them.

C.5 Restrictions on free transferability

The New Shares are freely transferable, subject to any local regulatory transfer restrictions.

16

C.6 Admission to trading The New Shares have been listed and are tradeable on Merkur Markets, with ticker code "PLCS-ME" under a separate ISIN number being KYG7153K1572 for the period between issuance of the New Shares and the approval of this Prospectus.

The New Shares are expected to be listed on Oslo Børs. The listing thereof is expected to take place on or about 22 March 2017.

The Offer Shares are expected to be listed on Oslo Børs. The listing thereof is expected to take place on or about 10 April 2017.

C.7 Dividend policy Polarcus is committed to maximizing the shareholder value, by inter alia declaring dividends to the Shareholders from its profit. However, the Company is restricted from declaring dividends under its loan facility and bonds.

Polarcus has not issued any dividends in the Company's history.

Section D - Risks

D.1 Key information on the key risks that are specific to the issuer or its industry

Economic development and trends The demand for the Company's services will depend substantially on the level of activity and capital spending by oil and gas companies and specifically in relation to development and exploration expenditure.

Government regulation and political risk Changes in the legislative and fiscal framework governing the activities of oil and gas business could have a material impact on exploration and development activities or affect Polarcus' operations or financial results directly or indirectly.

Competition Polarcus operates in a highly competitive global market.

Fluctuating revenues from period to period The Company's future revenues may fluctuate significantly from quarter to quarter and from year to year as a result of various factors driven by both supply and demand influences.

Insurance coverage Although the Company has taken out insurance coverage that the Company considers customary in the industry, such insurance arrangements will not carry full coverage of all its operating risks.

Contractual and counter-party exposure The revenues of the Company will be dependent on contract awards at competitive terms. Furthermore, the revenues of the Company will depend on the financial position of its customers and the willingness and ability of these customers to honour their obligations towards

17

Polarcus in a timely manner.

Multi-client investments The Company has made considerable investments in acquiring and processing seismic data that the Company owns ("multi-client data"). The multi-client data is being licensed to third parties for non-exclusive use in oil and gas exploration, development and production activities. However, the Company does not know with certainty how much of the multi-client data it will be able to license or at what price.

Operating risks The Company's assets are concentrated in a single industry and the Group may be more vulnerable to particular economic, political, regulatory, environmental or other developments than a company with a more diversified portfolio of activities.

The seismic data acquisition operations are exposed to extreme weather and other potentially hazardous conditions. There is an inherent exposure to technical risks, which may lead to operational problems, and increased operational costs and/or loss of earnings, additional investments, penalty payments, and other such costs which may have a material effect on the earnings and financial position of the Company.

Technology may become obsolete The Company's technology could be rendered obsolete as new and enhanced products and services are introduced to the seismic market.

Tax Operating internationally, Polarcus will be subject to taxation in several jurisdictions around the world. With increasingly complex and ever changing tax regulations and interpretation of these, the taxation of the Company could increase in certain jurisdictions. The Company may also in the future be subject to review of past years tax returns and be subjected to additional taxes and penalties. These conditions may have a material effect on the Company's financial results.

If Polarcus is controlled by Norwegian taxpayers, the Norwegian CFC-regulation ("NOKUS"- rules) may, in certain conditions, result in the Company being taxed under Norwegian law as if it had been a Norwegian company. Pursuant to the Company's Articles of Association, the Company may refuse to accept shareholder positions leading to the CFC-regulations becoming applicable. Also, other amendments to applicable tax provisions may have negative impact on the return on the investment of Norwegian taxpayers.

Access to funding The Company may require additional capital in the future due to unforeseen liabilities or in order for it to take advantage of opportunities for acquisitions, joint ventures

18

or other business opportunities that may be identified by the Company.

Should the current working capital and cash flow from operations not be sufficient to meet the Company's financing needs, the Company may be forced to reduce or delay capital expenditures or research and development expenditures, and/or sell assets or businesses at unanticipated times and/or at unfavourable prices or other terms, and/or to seek additional equity capital or to restructure or refinance its debt.

Financial leverage and breach of covenants The financial leverage of the Company or any breach of covenants (or other circumstances which entail that loans fall due prior to the final maturity date) may have several adverse consequences, including the need to refinance, restructure or dispose of certain parts of the Company's businesses in order to fulfil the Company's financial obligations.

Defaults and insolvency of subsidiaries In the event of insolvency, liquidation or a similar event relating to one of the Company's subsidiaries, all creditors of such subsidiary would be entitled to payment in full out of the assets of such subsidiary before the Company, as a shareholder, would be entitled to any distributions. Such an event would likely cause a cross-default under all the Group's current financing instruments entitling the Group's secured creditors to enforce their security rights in priority to the Company, a shareholder.

Exchange rate fluctuations Currency exchange rate fluctuations and currency devaluations could have a material impact on the Company's results from time to time.

Uncertainty with respect to exercise of call option It is not certain that the Company will have sufficient liquidity to exercise the call options under CB Tranche B1, CB Tranche B2 and the Unsecured Bonds at the reduced call option prices.

Debt service and increased charter rates from 1 January 2019 As part of the 2016 Restructuring and consequent to the 2017 Amendments, the Company will not have to service the repayment instalments under certain financing arrangements until 2019, and not pay interest on certain bonds until 2019. The ability to make principal and interest payments when due, and to fund ongoing operations, including payment of increased charter rates, will depend on the Group's future performance and ability to generate cash and profit, which is subject to market conditions and general economic, financial and competitive factors beyond the Group's control.

19

D.3 Key information on the key risks that are specific to the securities

Volatility of share price There can be no assurance that an active market for the Company's Shares can be sustained. The Company's share price may experience substantial volatility. The market price of the Shares could fluctuate significantly.

Risks related to issuance of Shares or other securities It is possible that the Company may decide to offer additional Shares in the future in order to strengthen its capital base or for other reasons. Any additional offering of Shares may be made at a significant discount to the prevailing market price and could have a material adverse effect on the market price of the outstanding Shares.

Risks associated with dilution Due to regulatory requirements under foreign securities laws or other factors, foreign investors may not be able to participate in a new issuance of Shares or other securities and may face dilution as a result.

Any investor that is unable or unwilling to participate in the Company's future share issuances will have their percentage shareholding diluted.

Section E - Offer

E.1 The total net proceeds and an estimate of the total expenses

The gross proceeds to the Company from the Private Placement amounted to NOK 330 million. The costs and expenses of, and incidental to, the listing of the New Shares amounted to approximately USD 2.5 million. Based on this, the net proceeds to the Company amounted to approximately NOK 309 million.

The gross proceeds to the Company from the Offering will be approximately NOK 40.3 million assuming it is fully subscribed. The Company's total costs and expenses of, and incidental to, the Offering are estimated to amount to approximately NOK 1.2 million. Based on these assumptions the net proceeds to the Company will be NOK 38.1 million.

E.2a Reasons for the offering and use of proceeds

The cash received as proceeds from the Private Placement and the Offering will be used to pay the fees and expenses of the Private Placement and the Offering respectively and to strengthen the Company's liquidity position as well as for general corporate purposes.

E.3 Terms and conditions of the offering

The Offering comprises of an offering of up to 122,000,000 Offer Shares each with a nominal value of USD 0.01, at a Subscription price of NOK 0.33 per Offer Share, corresponding to gross proceeds of up to approximately NOK 40 million.

Eligible Shareholders of the Company as of the end of 9 February 2017, as registered in the VPS on the Record Date, who did not participate in the Private Placement, and who are not resident in a jurisdiction where such offering

20

would be unlawful, or for jurisdictions other than Norway, would require any filing, registration or similar action, will be granted non-transferable Subscription Rights giving a right to subscribe for, and be allocated, Offer Shares in the Offering. Each Eligible Shareholder will, subject to applicable securities laws, be granted 0.33 non-transferable Subscription Rights for each existing Share registered as held by such Eligible Shareholder as of the Record Date. The number of Subscription Rights granted to each Eligible Shareholder will be rounded down to the nearest whole Subscription Right.

The Subscription Rights will be registered in the VPS on ISIN KYG7153K1655 and will be distributed to each Eligible Shareholder's VPS account on or about 6 April 2017.

The Subscription Period for the Offering will commence at 22 March 2017 and end at 5 April 2017.

Allocation of the Offer Shares is expected to take place on or about 6 April 2017.

The allocation of Offer Shares to subscribers in the Offering shall be made pursuant to the following criteria:

a. Allocation will be made to subscribers on the basis of granted Subscription Rights which have been validly exercised during the Subscription Period.

b. If not all Subscription Rights are exercised, subscribers having exercised their Subscription Rights and who have over-subscribed will be allocated additional new Offer Shares on a pro rata basis based on the number of Subscription Rights exercised by each such subscriber. To the extent pro rata allocation is not possible, the allocation shall be determined by drawing of lots.

c. Any remaning Offer Shares not allocated pursuant to the criteria in items a. and b. will be allocated to subscribers not holding Subscription Rights. Allocation will be made pro rata based on the respective subscription amounts, provided, however, that such allocations may be rounded down.

The Board reserves the right to round off, reject or reduce any subscription for Offer Shares not covered by Subscription Rights on the on basis of criteria such as (but not limited to) current ownership in the Company relative to orders size, sector knowledge, perceived investor quality and investment horizon.

No fractional Offer Shares will be allocated. Allocation of fewer Offer Shares than subscribed for will not impact the subscribers' obligation to pay for the number of Offer Shares allocated.

Notifications of allocated Offer Shares in the Offering and the corresponding amount to be paid by each subscriber will be set out in a letter from the Manager, which will be mailed on or about 6 April 2017. The Company expects to

21

issue a stock exchange notification announcing the results of the Offering on or about the same date.

The Payment Date for the Offer Shares in the Offering is 7 April 2017.

Registration of the share capital increase pertaining to the Offer Shares issued in the Offering is expected on or about 10 April 2017. Delivery of the Offer Shares issued in the Offering is expected to take place by registration of the Offer Shares in the VPS on or about 10 April 2017.

The Offer Shares issued in the Offering will be listed on Oslo Børs as soon as the Offer Shares issued in the Offering have been registered in the VPS.

E.4 Material interests in the offering

The Manager or its affiliates have provided from time to time, and may provide in the future, investment and commercial banking services to the Company and its affiliates in the ordinary course of business, for which they may have received and may continue to receive customary fees and commissions. The Manager does not intend to disclose the extent of any such investments or transactions otherwise than in accordance with any legal or regulatory obligation to do so. The Manager will receive a management fee in connection with the Private Placement and the Offering and, as such, have an interest in the Private Placement and the Offering.

Beyond the above-mentioned, the Company is not aware of any interest, including conflicting ones, of any natural or legal persons involved in the Private Placement or the Offering.

E.5 Selling shareholders and lock-up agreements

Not applicable. There are no selling shareholders in the Private Placement, nor are there any lock-up restrictions on the New Shares issued in the Private Placement or the Offering.

E.6 Dilution resulting from the Offering

Following completion of the Private Placement and the Offering, the aggregate dilution for the existing shareholders is approximately 67.9% (assuming full participation in the Offering).

E.7 Estimated expenses charged to investor

Not applicable. The Company will not charge any expenses to the investors.

22

2. RISK FACTORS

Investments in the Company's New Shares involves inherent risks. Before making an investment decision with respect to the New Shares, investors should carefully consider the risk factors set forth below and all information contained in this Prospectus, including the Annual Financial Statements and related notes. The risks and uncertainties described in this Section 2 are the material known risks and uncertainties faced by the Group as of the date hereof that the Company believes are relevant to investments in the New Shares.

Investments in the New Shares are suitable only for investors who understand the risks associated with this type of investment and who can afford to lose all or part of their investment. The absence of negative past experience associated with a given risk factor does not mean that the risks and uncertainties described in that risk factor are not a genuine potential threat to investments in the New Shares. If any of the following risks were to materialise, individually or together with other circumstances, they could have a material and adverse effect on the Group and/or its business, financial condition, results of operations, cash flows and/or prospects, which could cause a decline in the value and trading price of the New Shares, resulting in the loss of all or part of investments in the New Shares.

The order in which the risks are presented does not reflect the likelihood of their occurrence or the magnitude of their potential impact on the Group's business, financial condition, results of operations, cash flows and/or prospects. The risks mentioned herein could materialise individually or cumulatively. The information in this Section 2 is as of the date of this Prospectus.

2.1 Risk factors related to the industry in which Polarcus operates

2.1.1 Economic development trends

The demand for the Company's services will depend substantially on the level of activity and capital spending by oil and gas companies and specifically in relation to development and exploration expenditure. The activities of the oil and gas companies tend to follow the prices of oil and gas which have fluctuated widely over recent years. A decrease in oil and gas prices may have a negative impact on the expenditure on exploration activities which may affect demand for the services of the Company. Financial projections for and valuation of Polarcus' assets are largely based on certain assumptions including those related to future conditions for the markets in which Polarcus will sell its services. Actual changes in market conditions may affect the accuracy of the assumptions and future prospects of Polarcus. Historically, the markets for oil and gas have been volatile.

2.1.2 Multi-jurisdictional operations

Operations in international markets are subject to risks inherent in international business activities which might significantly affect the Company's financial performance and competitiveness, including, but not limited to;

general economic conditions in each relevant country,

changes in taxation and other fiscal regulations,

unexpected changes in regulatory requirements,

environmental protest activity,

compliance with a variety of foreign laws and regulations,

war, terrorist activities, piracy, political, civil or labour disturbances, economic sanctions, trade policies, embargos, border disputes, military activity,

renegotiation or cancellation of contracts by client,

23

restrictions in currency repatriation,

challenges in enforcing contractual rights including the right to payment, and

changes in laws that restrict operations or increase the cost.

2.1.3 Government regulation and political risk

Changes in the legislative and fiscal framework governing the activities of oil and gas business could have a material impact on exploration and development activities or affect the Company's operations or financial results directly. Changes in political regimes might constitute a material risk factor for Polarcus' operations in foreign countries, including contract and bareboat chartering arrangements for the Polarcus vessels. In a worst case scenario, political authorities will in certain circumstances be in a position to seize the vessels when these are operating within or flagged under a particular jurisdiction.

In certain countries there is an inherent risk of bribery, corruption and unethical work practices. The Company has developed clear policies and operating procedures to avoid these risks, and to the extent where reasonably possible, the Company will ensure that all external bodies that it is required to interact with, operate to the same high standards. Nevertheless, the Company's operations could be impacted through the actions of these external bodies. The Company's operations are subject to numerous international conventions as well as national, state and local law, and regulations in force in the jurisdictions in which the Company conducts, or will conduct, its business. These laws and regulations relate to, inter alia, the protection of the environment, natural resources, human health and safety, taxes, certification and visa regulations, licensing and permits for offshore blocks and other requirements. In particular, compliance with environmental regulations may require significant expenditures and breaches may result in fines and penalties, which could be material. Whereas the Company pays and has paid particular attention to safety, conduct and the environment in its execution of business, stricter regulation or changes in the application of existing regulations may impose increased costs for operating the business of the Company, or otherwise impact the Company's financial condition, operating results or future prospects. The Company also operates to strict international standards prohibiting unlawful commercial practices.

The Company cannot predict the extent to which its future cash flow and earnings might be affected by mandatory compliance with any such new legislation or regulations.

2.1.4 Competition

Polarcus operates in a highly competitive global market. The Company may face competition from other marine seismic companies as well as other ship owners that introduce capacity into the market place. This, as well as overcapacity in the seismic market, could adversely affect the operating results of the Company.

Polarcus' revenue and operating results can vary significantly from quarter-to-quarter and year-to-year driven by competitor fleet size and global fleet distribution relative to market demand. Polarcus' operating income is challenging to forecast due to changes in market demand driven directly by changes in oil and gas company expenditures.

2.1.5 Commodity prices

Any large fluctuations in oil price could materially impact the demand for seismic services.

2.2 Risk factors related to the Company and the Group

2.2.1 Service life and technical performance

The service life of a modern seismic vessel is generally considered to be approximately thirty years, but could depend on its efficiency, periodic vessel maintenance and demand for such

24

vessels. There can be no guarantee that the vessels or equipment deployed by Polarcus will have a long service life. The vessels may have particular unforeseen technical problems or deficiencies, new environmental requirements might be enforced or new technical solutions or vessels might be introduced to the industry.

The complex operations of the Company may lead to technical and operational difficulties that result in downtime for the vessel or inability of the vessel to complete a contract. Such risks may materially affect the operating results and reputation of the Company.

2.2.2 Fluctuating revenues from period to period

The Company's future revenues may fluctuate significantly from quarter to quarter and from year to year as a result of various factors including the following:

increases and decreases in industry-wide capacity to acquire seismic data;

fluctuating oil and gas prices, which may impact customer demand for the Company's services;

different levels of activity planned by the customers;

the timing of offshore lease sales and licensing rounds and the effect of such timing on the demand for seismic data and geophysical services;

the timing of award and commencement of significant contracts for geophysical data acquisition services;

weather and other seasonal factors;

seasonality and other variations in the licensing of geophysical data from the Company's multi-client data library; and

reduced vessel utilization due to longer than scheduled yard stays, transits and/or delays in obtaining necessary permits.

2.2.3 Access to personnel

The Company's development and business success are significantly dependent upon senior management and other key personnel. Attracting and retaining qualified field and office based personnel is of significant importance for the operation of the Company's business. The maritime and seismic industries are highly competitive for skilled personnel. There is no guarantee that the Company will be able to attract and retain the personnel required to continue its business and successfully execute the business strategy which might have negative effects on the Company's operating results and financial performance.

2.2.4 Insurance coverage

Although the Company has taken out insurance coverage that the Company considers customary in the industry, such insurance arrangements will not fully cover all its operating risks. Operation of the vessels represents a potential risk of loss of or damage to the vessels and equipment. In addition, the Group may not be able to maintain adequate insurance cover for its vessels and equipment in the future or do so at premiums that are considered reasonable. An accident involving any of the Group's assets could result in loss of earnings, fines or penalties, higher insurance costs and damage to the reputation of the Company. The Group may not have sufficient insurance cover for the entire range of risks resulting in particular losses not being covered. Any significant loss or liability not insured could have a material adverse effect on its business, financial condition and results of operations. In addition, the loss of or continuing unavailability of one or several of its vessels could have an adverse effect on the Group even if effective insurance cover should be available.

25

2.2.5 Contractual and counter-party exposure

The revenues of the Company are dependent on contract awards at competitive terms. Furthermore, the revenues of the Company will depend on the financial position of the customers and the willingness of these customers to honour their obligations towards Polarcus in a timely manner. There can be no guarantees that the financial position of the contract parties will be sufficient to adhere to the obligations under the contracts with the Company. The inability of one or more of the contractual parties to make payment under the contracts might have a significant adverse effect on the financial position of the Company.

Polarcus is and will in the future be party to various contracts related to its business, most importantly seismic survey contracts and bareboat chartering arrangements. Consequently, the Company is and will be exposed to counter party risks. Any potential default by such counterparties or their inability or lack of willingness to fulfil their commitments may have a material adverse impact on the Company's operating results and financial position. In a worst case scenario the counter party will under certain circumstances be in a position to seize the vessels for a period of time when these are operating within or flagged under a particular jurisdiction.

The Company has currently no new building projects or concrete plans for new projects, but may in the future enter into contracts related to construction of vessels. Any material delays related to the construction of vessels or other contracts of importance for the construction and equipment of a vessel may have a material adverse effect on the Company and its financial position. A potential default or delay by any counterparty, including the shipyard, could have an adverse effect on the Company and its financial position.

2.2.6 Multi-client investments

The Company has made considerable investments in acquiring and processing seismic data that the Company owns ("multi-client data"). The multi-client data is being licensed to third parties for non-exclusive use in oil and gas exploration, development and production activities. However, the Company does not know with certainty how much of the multi-client data it will be able to license or at what price. There can be no assurance that the Company will be able to recover all costs and investments associated with acquiring and processing multi-client data. If there is a material adverse change in the general prospects for oil and gas exploration, development and production activities in areas where the Company acquires multi-client data, the value of such multi-client data could be impaired and the Company could be required to take a charge against its earnings. The value of multi-client data could also be impaired by technological or regulatory changes and by other industry or general economic developments. In general, the Company's future sales of multi-client data licenses are uncertain and depend on a variety of factors, many of which will be beyond the Company's control.

2.2.7 Operating risks

The Company's assets are concentrated in a single industry and the Group may be more vulnerable to particular economic, political, regulatory, environmental or other developments than a company with a more diversified portfolio of revenue generating activities. It is not possible to give any guarantees that the vessels will be employed for the duration of their service life. There is an inherent exposure to technical risks, which may lead to operational problems, increased operational costs and/or loss of earnings, additional investments, penalty payments, and other such costs which may have a material effect on the earnings and financial position of the Company.

The seismic data acquisition operations are exposed to extreme weather and other hazardous conditions. In particular, a substantial portion of the Group's operations are subject to risks that are customary for marine operations, including capsizing, grounding, collision, interruption and damage or loss from severe weather conditions, fire, explosions and environmental contamination from spillage. Any of these risks, whether in the marine or

26

onshore operations, could result in damage to or destruction of vessels or equipment, injury to personnel or property damage, and/or suspension of operations or environmental damage. In addition, the operations involve risks of a technical and operational nature due to the complex systems that are utilized. If any of these risks materialize, the Group's business could be interrupted and the Group could incur significant liabilities. In addition, many similar risks may result in curtailment or cancellation of, or delays in exploration and production activities of the Group's customers, which could in turn adversely impact the Group's operations and/or reputation.

2.2.8 Technology may become obsolete

The Company's technology could be rendered obsolete as new and enhanced products and services are introduced to the seismic market. The Group's success depends to a significant extent on its ability to source, develop and produce new and enhanced products and services on a cost effective and timely basis in accordance with industry demands. While the Group commits resources to research and development, it may encounter resource constraints or technical or other difficulties that could delay introduction of new and enhanced products and services in the future. In addition, continuing development of new products and services inherently carries the risk of obsolescence of older products and services. New and enhanced products and services, if introduced, may not gain market acceptance or may be adversely affected by technological changes.

2.2.9 Commodity Prices

Polarcus is exposed to the impact of market fluctuations in the price of certain key commodities and specifically, oil prices, fuel and transportation costs. Any large fluctuations in these prices driven by the global economy, exacerbated further by exchange rate fluctuations, could materially impact future operating results.

2.2.10 Tax

Operating internationally, Polarcus will be subject to taxation in several jurisdictions around the world. With increasingly complex and changing tax regulations and interpretation of these regulations, the taxation on the Company could increase in certain jurisdictions. The Company may also in the future be subject to review of past years tax returns and be subjected to additional taxes and penalties. These conditions may have a material effect on the Company's financial results.