Property and Casualty (P&C) Insurance BPO – Service ... · Genpact’s capabilities in P&C...

Transcript of Property and Casualty (P&C) Insurance BPO – Service ... · Genpact’s capabilities in P&C...

EGR-2018-28-R-2587

R

Copyright © 2018 Ev erest Global, Inc.

We encourage you to share these materials internally within your company and its affi liates. In accordance with the license granted, however, sharing these materials outside of your organization

in any form—electronic, written, or verbal—is prohibited unless you obtain the express, prior, and written consent of Everest Gl obal, Inc. It is your organization’s responsibil ity to maintain the

confidentiality of these materials in accordance with your l icense of them.

R

Property and Casualty (P&C) Insurance BPO – Service Provider

Landscape with Services PEAK Matrix™ Assessment 2018

SELECT SLIDES

Insurance - Business Process Outsourcing (BPO)

Market Report – March 2018

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 2

R

R

Everest Group PEAK Matrix™ is a proprietary

framework for assessment of market impact and

vision & capability

Everest Group PEAK Matrix

Vision & capability

Measures ability to deliver services successfully

High

Low

Low High

Leaders

Aspirants

Ma

rke

t im

pa

ct

Measure

s im

pact

cre

ated in

the

mark

et

Major Contenders

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 3

R

R

Services PEAK Matrix™ evaluation dimensions

Measures impact created in the market –

captured through three subdimensions

Market adoption

No. of clients, revenue base, and YOY growth, deal value/volume

Portfolio mix

Diversity of client/revenue base across geos and type of engagements

Value delivered

Value delivered to the client based on customer feedback and transformational impact

Vision and strategy

Vision for the client and itself; future roadmap and strategy

Scope of services offered

Depth and breadth of services portfolio across service sub-segments / processes

Innovation and investments

Innovation and investment in the enabling areas, e.g., technology IP, industry/domain knowledge, innovative commercial constructs, alliances, M&A, etc.

Delivery footprint

Delivery footprint and global sourcing mix

Measures ability to deliver services successfully.

This is captured through four subdimensions

Ma

rke

t im

pact Major Contenders

Leaders

Aspirants

Vision & capability

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 4

R

R

Everest Group confers the Star Performers title on

providers that demonstrate the most improvement

over time on the PEAK Matrix™

Star Performers are identified by top quartile performance improvement on the X and Y axes for each segment

Methodology Everest Group selects Star Performers based on the relative YOY improvement on the PEAK Matrix

Year 1

Year 0

Ma

rke

t Im

pa

ct

Vision & capability

We identify the service providers whose improvement ranks in the top quartile and award the Star Performer rating to those service providers with: The maximum number of top-quartile performance

improvements across all of the above parameters AND At least one area of top-quartile improvement

performance in both market success and capability advancement

The Star Performers title relates to YOY performance for a given service provider and does not reflect the overall market leadership position, which is identified as Leader, Major Contender, or Aspirant.

In order to assess advances on market impact, we evaluate each service provider’s performance across a number of parameters including: Yearly ACV/YOY revenue growth # of new contract signings and extensions Value of new contract signings Improvement in portfolio mix Improvement in value delivered

In order to assess advances on vision and capability, we evaluate each service provider’s performance across a number of parameters including: Innovation Increase in scope of services offered Expansion of delivery footprint Technology/domain specific investments

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 5

R

R

Everest Group PEAK Matrix™

P&C Insurance BPO Service Provider Landscape with

PEAK Matrix™ Assessment

Everest Group P&C Insurance BPO Service Provider Landscape with Services PEAK Matrix™ Assessment1 2018

1 Assessment for Accenture, Capgemini, Capita, HCL, Intelenet, and Shearwater Health excludes service provider inputs and is based on Everest Group’s proprietary Transaction

Intell igence (TI) database, service provider public disclosures, and Everest Group’s interactions with insurance buyers

Leaders

Major Contenders

Aspirants

Star Performers

Vision & capability (Measures ability to deliver services successfully)

Ma

rke

t im

pact

(Measure

s im

pact c

reate

d in

the m

arket)

High

Low

Low High

Leaders Major Contenders

HCL

Accenture

Capita

Cognizant EXL

Genpact

Syntel Capgemini

Infosys

Shearwater Health

Intelenet

Sutherland Global Services

NIIT Technologies

TCS

Tech Mahindra

Conduent

WNS

DXC Technology

Aspirants

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 6

R

Service provider

Market impact Vision & capability

Market

adoption

Portfolio

mix

Value

delivered Overall

Scope of

services offered

Innovation

and investments

Delivery

footprint

Vision and

strategy Overall

Cognizant

DXC

Technology

EXL

Genpact

WNS

Summary dashboard | Market impact and vision & capability

assessment of providers for P&C Insurance BPO 2018

Leaders

Measure of capability: Best-in-class Very high High Medium high Medium Medium low Low Not mature

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 7

R

P&C insurance BPO Star Performers 2018

Distinguishing features

Star Performers 2018

P&C insurance BPO

Star Performers 2018

Distinguishing features in market impact in

2018

Distinguishing features in vision and capability

in 2018

Aggressive expansion of its revenue and client

base through multiple acquisitions such as BrightClaim and National Vendor

Scaled up its operations in markets of North America and Continental Europe

Augmented onshore capabilities to deliver business

process services, especially claims processing Major investments in digital platforms, such as CORA,

that enable analytics and AI for its clients and augmentation solutions such as for automation and

workflow management

Significant top-line increment through scope

expansion, thus contributing to overall market growth

Expanded its scope of operations in the UK and Latin American markets

Invested in various proprietary insurance-specific digital

solutions such as Digital Insurance Hub and Connected Home

Made significant inroads into automation space with its Updater and Extractor solutions

Signed several new contracts; one of the

leading service providers in terms of new contract signings

Registered double-digit revenue growth on a substantial base and contributed significantly

to market expansion

Launched multiple augmentation solutions catering to

various next-generation technology developments such as automation, analytics, and omnichannel experience

Significantly expanded delivery capabilities, especially from onshore and nearshore delivery centers

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 8

R

The top three service providers account for nearly 60% of the

of the P&C insurance BPO market

5%

2%

10%

15%

Service provider market share in P&C insurance BPO June 2017 (TTM1); By revenue (in US$ billion)

1.3-1.5 100% =

1 Trail ing twelve months

Source: Everest Group (2018)

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 9

R

Cognizant, Genpact, and TCS accounted for the bulk of

market expansion in P&C insurance BPO

10%

15%

20%

Growth of P&C insurance BPO revenue June 2017 (TTM); Percentage growth in revenue

Source: Everest Group (2018)

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 10

R

45-50%

10-15%

10-15%

25-30% 25-30%

20-25% 15-20%

10-15%

20-25%

P&C insurance BPO service provider landscape is quite

consolidated in every geography with top two service

providers accounting for more than 50% of the markets

P&C insurance BPO market share by signing regions Revenue in US$ million

North America Europe

100% = 800-900 100% = 30-60

Others

EXL Cognizant

Genpact

DXC Technology

Others

Infosys

Genpact

Cognizant

UK Asia Pacific

100% = 100-150 100% = 350-450

Others

WNS

Genpact

Conduent

DXC Technology Others

DXC Technology

WNS

EXL

25-30%

20-25% 20-25%

10-15%

10-15%

50-55%

10-15%

10-15%

25-30%

Source: Everest Group (2018)

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 11

R

While DXC Technology has the largest market share in

mid- and large-sized buyers, Genpact leads in small-sized

buyer segment

20-25%

15-20%

10-15%

10-15%

5-10%

25-30%

35-40%

15-20%

10-15%

5-10%

5-10%

15-20%

30-35%

15-20%

15-20%

5-10%

5-10%

20-25%

20-25%

15-20%

10-15% 10-15%

30-35%

Market share by P&C insurance BPO

Number of FTEs in ‘000s

200-250

Others

550-650

Accenture

EXL

Others

100% =

WNS

Others

Cognizant

Genpact

Cognizant Conduent

EXL

TCS

500-600 35-40

Cognizant

WNS

EXL

Genpact

Others

Genpact

WNS

Market share by P&C insurance BPO buyer segments

Revenue in US$ million

Large-sized buyers

(Revenue >US$10 billion)

Mid-sized buyers

(Revenue US$5-10 billion)

Small-sized buyers

(Revenue <US$5 billion)

DXC

Technology

EXL

DXC

Technology

DXC

Technology

Source: Everest Group (2018)

Copyright © 2018, Everest Global, Inc.

EGR-2018-28-R-2587 12

R

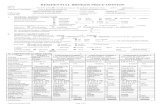

Market impact Vision & capability

Market adoption

Portfolio mix

Value delivered Overall

Scope of services offered

Innovation and investments

Delivery footprint

Vision and strategy Overall

Genpact

Everest Group assessment – Leader

Strengths Areas of improvement

Genpact’s capabilities in P&C insurance BPO comprise a substantial FTE resource base, a comprehensive coverage of P&C insurance value chain, significant growth in client accounts (powered by their recent acquisitions), a comprehensive delivery model covering large number of centers across onshore, nearshore, and offshore locations, and digital platforms embedded with analytics, lean six sigma, and built on industry expertise

Genpact has had an experience of servicing buyers of all sizes, be it small-, mid-, or large-sized insurers

Its substantial growth has been driven largely by its strategic acquisitions to gain onshore operational capabilities, especially for extensive digital solutions that smoothen claims processing and augment the end-customer experience

Genpact has been able to create significant adoption of its RPA and analytics solutions with its clients. Along with the technology leverage, Genpact also has capabilities for servicing non-core operations such as regulatory reporting and risk management

Although Genpact has a global presence in P&C insurance BPO services, a large part of its revenue is driven by North American buyers. Genpact should target building more traction in the other markets as well, for which it could leverage its existing global capabilities and experience

After the acquisitions, its customer portfolio mostly comprises small-sized buyers. It should continue to target larger client accounts, which will help drive its revenue further

While an inorganic growth strategy would serve Genpact well in quickly acquiring and leveraging capabilities, it still would need to stress the efficient integration of acquired capabilities in its incumbent business models to continue to expand in the future

Genpact would also be required to continue to ramp up their onshore delivery capabilities, which they are already doing through acquisitions, in order to service some of the judgment-intensive processes such as underwriting and claims adjustment for their clients

Measure of capability: Best-in-class Very high High Medium high Medium Medium low Low Not mature