Project Conserve - Royal Commission

Transcript of Project Conserve - Royal Commission

Project Conserve

Due Diligence Findings - Credit Stream

September 2009

Confidential I nformation contained in this report is st rictly confident ial and may be subject to legal professional privilege. It is the exclusive property of Australia and New Zealand Banking Group Limited, and is solely for ANZ internal use. No part of it may be circulated, copied, quoted or otherwise referred to without prior written approval of ANZ Group.

ANZ.800.616.1266

Page 1

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Executive summary

• The Conserve book consists of ~ $2.4 billion of lending with WA (29%) and NSW (27%) sharing the bulk of the assets. The customer footprint favours NSW (37%) with Vic (18%) and WA (16%) also contributing the largest concentration of customers by number

• Grain Sheep and Beef Cattle are the two most significant industry concentrations with over 50% of the total exposure. It is noted that the Conserve book has very little exposure to the dairy industry (current watch industry for the ANZ Agri book) and the remaining lending assets are spread across a broad range of alternate Agri industries – no exposure to non farm-gate lending is evident

• Segmentation of the assets is heavily skewed toward the middle market with 65% of the FUM held in the $500k - $5 million band with 71% of the customers by number making up the sub $500k sector

• Non performing accounts being risk grade D1/D2 (ANZ equivalent risk grade 7 - 9) has increased by ~$70 million since March 2009 and at $160 million represents 6.75% of the total loan book (up from 4.05% in March). The ANZ book has increased the total value to $117 million in July 2009 which represent 1.13% of the loan book – an increase of 0.16% ($21 million) since March 2009

• Non accrual accounts being risk grade E (ANZ equivalent risk grade 10) has increased to $71 million in August 2009 and now represents 3% of the total loan book. Comparatively the ANZ Commercial Agri book has non accrual lending of $176 million (or 1.76% of Loan Book) as at month end August 2009.

• Total specific provision on the above loan balance is at $32.45 million (i.e. 46% cover) with comparative performance highlighted from the ANZ Agri Commercial book that currently has specific provisions of $25.1 million (14% coverage) against a book of $10.5 billion (i.e. 0.25% as against the 1.35% of the Conserve assets).

• Should the acquisition take place it is expected that the current level of provision will mean that the overall provision number for the ANZ Commercial Agri book will increase to 0.44% of the loan book

• The heaviest concentration of accounts by industry is 20.28% in the cropping industry with South Australia accounting for 44% of the overall FUM in the non accrual band

ANZ.800.616.1267

Page 2

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Executive summary

• Under ANZ’s capital methodology, the collective provision balance would be required to increase by $5.4 million (+39%) to a total of $19.4 million

• The $2.0 billion RWA equates to a regulatory capital balance of $158 million utilising ANZ’s Advanced Internal Rating Based Basel II accreditation, at an annual cost of $23.8 million

• The non performing loan book identified in the physical file review indicates that further specific provisioning would be required. The upward trend of the D1 and D2 managed accounts (ANZ equivalent risk grade 8) indicates that further specific provision of $17 million would be required to account for the expected trend in non performing loans

• Conserve’s credit assessment and valuation methodology, whilst identified as having a reasonable parity to ANZ’s approach, does have the issue of Conserve’s Rural Finance Managers being allowed to value property assets for security purposes. The risk associated with this is two fold:

• Potential for poor quality assessment leading to further loss from non performing loans

• Potential loss of customers due to a more stringent lending policy applied by ANZ

• There is an immediate repricing opportunity given the variable book (~$1 billion) is currently priced off a Conserve Index rate, implying a reasonably simple conversion to an appropriate ANZ pricing index. Currently there is a 0.63% margin differential between ANZ and Conserve variable rates offering a potential $6 million annual revenue opportunity

• It is evident that the Conserve proposition is limited to a reasonably small number of products (mainly Working Capital and Senior Debt), with the file review showing over 64% of files reviewed as having split banking arrangements. The opportunity for ANZ to access in excess of 4,500 clients with a full product offering is considered a major opportunity of this transaction

ANZ.800.616.1268

Key issues and risks identified

Overview of issue and potential impact

• Increased trend of managed and non accrual loans. It is estimated t hat addit ional specific and collective provisioning of up to $22 million will be required which represents a 63% increase in stated values as at 31 August 2009

• Valuation methodology - due diligence enquiries confirmed that Conserve's policy to allow Rural Finance Managers to conduct valuation assessments is outside of normal ANZ policy

• Assessment process - a lack of robust assessment around future expected cash flow does give concern as the potential for further risk down grades as a result of poorer than expected returns for some clients

• Operational risk

Potential severity

High

Medium

Low

Low

ANZ.800.616.1269

Mitigant I Comment I Recommendation

• The Due Diligence team have been able to sample a meaningful representation of customers t hat are listed in t he high risk groupings. The worst situation is believed to have been presented and t he mitigant now becomes the value at which the book will be purchased, allowing for t he increase in required provisions

• Samples revea led that actual va luation results were considered within expected boundaries. It is noted that further specific provision may be required in some circumstances due to t his lending practice

• Limited future cash flow I sensitivity analysis seen on reviewed files . Partially mitigated by Conserve's strong network and the close working relationships I knowledge that other parts of the Conserve business have with their customers

• Current operational risk policies appear adequate however t he integration of Conserve's employees into ANZ, includ ing compliance with ANZ policy and procedures, will need to be closely managed

Page 3

ANZ.800.616.1270

Key Opportunities Identified

Overview of Opportunities Potential to extract Value

• On the variable book a lone (c.$1 • Ability to extract a great er margin from both the

High billion), repricing to parity with ANZ

variab le rate and fixed rate lending book ( i.e. +0.63%) equates to a potentia l $6 m il lion revenue benefit

• Conserve's existing footp rint is heavi ly concentrated in Western Australia and

• Enhanced market share and abi lity to leverage New South Wales. This footp rint is

opportunities across identified ANZ growth Medium complimentary to the ANZ Agri Asset

corridors Writing Strategy which has identified WA and NSW as potentia l growth markets

• The physical file checks revea led 64%

Split banking Medium of the clients reviewed had alternate

• debt facilities (Asset Finance and Senior Debt) at an average of $370k

• A potential opportunity exists to cross-sell interest rate risk management

• Interest rate risk management Medium products to Conserve's fixed rate loan customers, with the potentia l revenue benefit estimated at $1.2 million

Page 4

Page 5

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Annexure I – Scope

Objective: To gain a comprehensive understanding of the assets of Conserve Financial Services including credit risk, non-performing loans and provisioning, as well as operating risk review. The purpose of the review is to identify key risks, potential value impacts and opportunities for ANZ (to be incorporated into the Business Plan)

Key Areas of Review: Credit Risk • Fully describe and highlight the composition of the portfolio and relate key metrics to

the ANZ Agri book for comparison• Identify key portfolio trends• Undertake a review of a representative sample of credit files to compare and assess

consistency between high level portfolio trends and individual customer findings (including segmentation, risk grade and credit quality)

• Review policies and procedures to confirm application of Basel II and APRA requirements (including documentation and customer management protocols)

• Review pricing, including capability to reprice the existing lending book and parity to ANZ product offering

• Review loan security, ensuring enforceability and ability to register existing securitiesNon Performing Loans / Provisions / Capital adequacy• Based on the portfolio review, determine the appropriate level of provisioning for non-

performing loans (both current and forecast)• Review the current capital balances covering the portfolio and determine the release

available to ANZ as part of Basel II AIRB• Conduct analysis to provide sufficient information to provide a comparative view of

the collective provision, individual provision and risk weighted asset balance and charges relative to the existing ANZ book

Approach and Methodology: • Review documents provided

in the online data room• Request further details and

information via the Q&A process

• Attend management presentations and / or relevant breakout session

• Conduct selected reviews of identified customer files

• Communicate directly with Conserve senior credit managers as agreed with Conserve

Due Diligence Team: Steve Chugg; John Redpath; Gavin Emery; Steve Radeski; John Kerlin; James McKeefry; Ashley Kelly; Ivan Mioc; Warrick Luke; Mark Feilding ; Ian Westaway; Nigel Taylor, Andrew Wilson-Annan, Valerie Colaso, Joanne Kelly

ANZ.800.616.1271

Page 6

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Annexure I – Scope (continued)

Objective: To gain a comprehensive understanding of the assets of Conserve Financial Services including credit risk, non-performing loans and provisioning, as well as operating risk review. The purpose of the review is to identify key risks, potential value impacts and opportunities for ANZ (to be incorporated into the Business Plan)

Key Areas of Review:Operational Risk • Operational risk management: organisation structure, relevant policies, risk registers,

key risk indicators, operational losses, operational risk reports and reporting policy• Internal audit system: relevant policies, internal audit plan, internal audit reports• Internal control system: internal control policy, the discretion and authority policy,

security management policy, physical security policy, information technology security, material security event reports

• AML / Trade Sanctions: relevant policies, KYC, event reporting procedures, AML / Trade Sanctions event registers

• Fraud control: fraud control plan and policy, external and internal fraud events and losses

• Customer protection: policy relating to personal data protection, customer complaint procedures and complaints statistics

• Regulatory compliance: the framework of compliance system, organisation structure, relevant policies, details of regulatory compliance breaches, regulatory examination reports and audit rating, compliance culture and training

• Operational risks associated with the current operating model

Approach and Methodology: • Review documents provided

in the online data room• Request further details and

information via the Q&A process

• Attend relevant management presentations

Due Diligence Team: Steve Chugg; John Redpath; Gavin Emery; Steve Radeski; John Kerlin; James McKeefry; Ashley Kelly; Ivan Mioc; Warrick Luke; Mark Feilding ; Ian Westaway; Nigel Taylor, Andrew Wilson-Annan, Valerie Colaso, Joanne Kelly

ANZ.800.616.1272

ANZ.800.616.1273

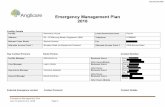

Portfolio Snapshot - 31 August 2009

Loan Size Profile LVR Profile {Conserve's Securitv Indicator Geographic Profile (By FUM) Scale)

$0-$100k $ 65,569,937 2.50% NSW $ 709,012,216 27.09% $1 OOK-$500K $ 425,722,566 16.26% A $ 287,327,150 10.97% VIC $ 282,872,968 10.81% $500k-$2mil $ 978,744,527 37.38% B $ 272,337,235 10.40% QLO $ 457,201 ,309 17.47% $2mil-$5mil $ 734,820,966 28.06% c $ 902,467,634 34.46% WA $ 782,888,515 29.91 % $5mil-$1 Omil $ 312,689,886 11 .94% 0 $ 370,976,075 14.17% Other States $ 385,739,923 14.74% >$10 mil $ 101 ,008,912 3.86% E $ 423,631 ,707 16.18%

F $ 353, 153,011 13.49% G $ 8,663,982 0.33% K $ 0.00%

Sector Profile Loan Profile {b)l customer} LVR Profile (ANZ's Securi!.3£ Indicator Scale - adjusted to Real Estate

Grain/Sheep $ 676,105,121 25.82% securi!.3£ onl)l}} Beef/Cattle $ 619,185,714 23.65% <$100k 154133.59% A $610,262,381 23.31 % Sheep/Beef Cattle $ 306,597,574 11 .71 % B $698,672,853 26.68% Grain/Beef $ 200,110,924 7.64% $100K - <$SOOK 174738.09% c $501 ,393,542 19.15% Cereal Grains $ 190,510,648 7.28% 0 $293,741 ,266 11 .22% Other $ 626,046,813 23.91 % $500k - <$2mil 99521.69% E $184,329,367 7.04%

F $129,425,526 4.94% $2mil - <$5mil 2495.43% G $24,622 0.00%

NIA $200, 707,236 7.66%

Risk Profile Conserve's Scale} GeoR:"aphic Profile {By Security Indicator (ANZ's Scale)

~In! itner) G Risk Category 1.14% 1.82% Conserve ANZ

WA 745 16.25% 3 .35% 6.10% 5.13% 3.75% 2.16% 1.43% 2.15% A3 4- $ 342,357,090 13.07% B1 5 $ 628,893, 107 24.02% SA 602 13.13% 4.87% 6.19% 5.03% 2.75% 1.27% 0 .83% 1.89%

B2 6 $ 595, 107,501 22.73% NT 33 0 .72% 5.19 % 6.23% 3.59% 1.29% 1.84% 0 .74% 1.25%

C1 6- $ 524,139,042 20.02% VIC 839 18.30% 4.98% 4.84% 1.23% 1.19 % 0 .52% 0 .32% 0 .29%

C2 6-17 $ 352,138,151 13.45% NSW 1712 37.34% 1.57% 1.28% 0.26% 0 .09% 0 .01% 0 .17% 0 .07% 0 1 8 $ 90,000,757 3.44% QLO 6 10 13.30%

0.68% 0 .18% 0 .73% 0.16% 0 .03% 0 .03% 0 .01% 02 9 $ 47,396,022 1.81% ACT 8 17.00%

1.00% 0 .06% 0.37% 0 .01% 0 .03% 0 .01% 0 .01% E 10 $ 38,525,124 1.47% TAS 36 0 .79%

26.84% 19.23% 11.26% 7.06% 4 .67%

Page 8

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Lending Book Overview- Key Metrics– The loan book of $2.4 billion is represented across all Australian states and territories with a concentration in WA (29%) and NSW

(27%) as measured by Funds Under Management

– The customer segment of between $500k and $2 million (FUM) represents 37% of total lending while the segment <$2 - $5 million comprises the next greatest concentration of 28%

– The loan book is structured with 48% of it being Variable Term Loans, 35% being in Working Capital Facilities (Overdraft, Seasonal and Line of Credit) with the balance (17%) comprising Fixed Term Loans.

– In terms of actual customer numbers, the highest concentration is in NSW with 37% and VIC (18%) with WA (16%) the next highest representation

– Of the total ~4,500 customer groups, 33% hold less then $100k in lending FUM and a further 38% hold between $100 - $500k

– The file review conducted revealed the following observations:

› Of the 113 files reviewed, 64 were identified as having split banking arrangements. The bulk of the additional debt (27%) is in asset finance facilities with RABO and Westpac being the predominant provider of alternate senior debt facilities

› Of the larger exposures (ie > $5 million) the majority are located in WA (20 / 48) and QLD (16 / 48 files)

Annexure II – Detailed Due Diligence Findings

ANZ.800.616.1274

Annexure 11 - Detailed Due Diligence Findings

Managed Loan Book

Non Accrual Lending

The performance of the Conserve book over the past 6 months has seen the following t rends :

ANZ.800.616.1275

- Non accrua l accounts being risk grade E (ANZ equiva lent risk grade 10) has increased to $71 mill ion in August 2009 and now

represents 3% of the total loan book of the business. Comparatively the ANZ Commercia l Agri book has non accrual lending

$176 million (or 1.76% of loan book) for the month end August 2009

- With in the non accrua l ba lances there is evidence of sign ificant fi les contributing to the overa ll number. Examples of sign ificant

exposures are shown as per below:

E Accts RLCPWT E Accts RWTl

$9,092,525

$2,960,759

3 $16,029,939

1 $5,888,162

- Total provision on the above loan balance is at $32.45 m ill ion ( i.e. 46% cover)

1

1

Dat a as at 3 1 August 2009

> Comparative performance is highlighted from the ANZ Agri Commercial book that currently has specific provisions of $25.1

million (14% coverage) against a book of $10.5 billion ( i.e. 0 .25% as against the 1.35% of the Conserve assets)

> Should the acquisition take place it is expected that the current level of provision w ill mean that the overall provision

number for the ANZ Commercial Agri book will increase to 0.44% of the loan book

- The heaviest concentration of accounts by industry is 20.28% in the cropping industry with South Austral ia accounting for 44%

of the overall FUM in the Non Accrual band

Page 9

ANZ.800.616.1276

Annexure 11 - Detailed Due Diligence Findings

Managed Loan Book

Non Performing Loans

- Non performing accounts being risk grade 0 1 I 0 2 (ANZ equiva lent risk grade 7 or worse) has increased by "'$70 million since

March 2009 and at $160 m illion represents 6.75% of the total loan book (up from 4.05% in March). The ANZ book has

increased t he total value to $117 m ill ion in July 2009 which represent 1.13% of the loan book - an increase of 0.16% ($21

million) since March 2009

- Further, it has been ident ified that of the $2.2 billion funded in the RLCPWT 6. 7% sits in the risk band 01 and 0 2. Considering

60% of this debt is at an LVR of greater then 60% it can be expected that further write down of this book wi ll occur as gearing

levels are considered high by ANZ standards

Aua-09 Jul-09 Jun-09 Mar-09 Aua-09 Jul-09 Jun-09 Mar-09 Risk Grade- Portfolio ~NZ Portfolio

01 90136 105 441 113 725 70 969 RG 8&9 (01 & 02) 117 700 119 600 96100 02 69,856 53,571 50,217 25,701 E 71144 69 036 65 386 54 007 RG 10 IEl 176 700 162 900 128 200

Grand Total 231136 228 048 229 328 150 677 Grand Total 294 400 282 500 224 300 Total Loan Book 2 371 908 2 365 641 2 346 803 2 297 358 Total Loan Book 10 405 000 10 370 000 9 896 000

Grand Total % of Book 9.74% 9.64% 9.77% 6.56% t;rand Total % of Book 2.83% 2.72% 2.27% D1 & 02 as % of Book 6.75% 6.72% 6.99% 4.21 % Retain % Book 1.13% 1.15% 0.97% Soecific Provisionina 32450 20 390 19 800 16 900 Soecific Provision 21 600 19400 16400 Soecific Provision Cover 46% 30% 30% 31 % Soecific Provision Cover 12.22% 11.91 % 12.79% rotal E as % of Book 3.00% 2.92% 2.79% 2.35% Total RG10 % of Book 1.70% 1.57% 1.30% ~ollective Provision 14000 22153 21324 19600 ~ollective Provision 12 300 10 100 7 500 Coll Prov % Prod Loans 0.61 % 0.96% 0.93% 0.87% Coll Prov % Prod Loans 0.12% 0.10% 0.08%

Page 10

Page 11

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Managed Loan Book

Increased Specific Provision

The escalated trend in the managed accounts is seen as a material risk to the value of the book and is confirmed by the physical file review that has taken place. During the review approximately 15% of files in this band were reviewed and they accounted for 47% of the Loan Balance. Using this data to extrapolate the trend it is considered that an additional $17 million in specific provision will be required taking the balance to $50.2 million as at August 2009

Annexure II – Detailed Due Diligence Findings

Provision Methodology

Considering only the D1 and D2 files:(Under Conserve policy no provision is raised for these files until they migrate to risk grade E status, therefore no provision considered for this book)(E accounts to be considered separately)

ANZ file Reviews: 27 of 174 files reviewed (15.5%)$64 million of loan value against $137 million (47%)Additional specific provision considered necessary $7.6 million (i.e. 11.87% of Reviewed loan value - $64 million)

Based on the review covering 47% of FUM it is considered relevant to apply the 11.87% to the whole $137 million (D1 / D2) book = $16.26 million additional provision

Considering E file Under Provision

ANZ File Reviews: 11 of 40 customers (27.5%)$22 million of loan value against $71 million (30.9%)Additional SP considered necessary $0.7 million (i.e. 3.18% of reviewed loan value - $22 million)

Based on review covering 30% of the total book value it is considered relevant to apply only (2/3rds of the review % i.e. 2.1%) = $1.491 million additional provision

Total additional provision = $17.75 million (total specific provision becomes $50.2 million)

ANZ.800.616.1277

Page 12

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Provisioning / Capital Management

Under ANZ methodology, as at 31 August 2009:– The collective provision balance would be required to increase by $5.4 million (+39%) to $19.4 million– An additional $2.0 billion in risk weighted assets would be required, representing $158.4 million of regulatory capital at an annual

cost of $23.8 million, thereby satisfying an internal ANZ threshold of CP Bal / Cr RWA >1.0%– As at 31 August 2009, Conserve held a collective provision balance of $14 million, based on a subjective approach against the

assets held of $2.4 million in drawn balance, representing a coverage of 59bps, compared to a current coverage held by ANZ Regional Commercial and Agri of 53bps, confirming ANZ’s relatively favourable risk profile

– Having mapped Conserve’s risk grading to ANZs, allowing for differences in security coverage calculations and determining the appropriate collective provision balance utilising ANZ methodology suggests that Conserve’s collective provision balance should be $19.4 million, an increase of $5.4 million to enable a coverage of 82bps to reflect the relative lower quality of the Conserve portfolio

– Conserve currently does not hold any calculate any risk weighted assets for the provision of capital due to the current lack of regulatory coverage. Applying ANZ methodology to this portfolio would suggest that $2.0 billion of additional risk weighted assets would be required. Credit risk weighted assets represent 93.6% of the total, operating risk weighted assets the vast majority of the remainder. This compares to ANZ’s Regional Commercial Banking business (‘RCA’) total of $7.3 billion – comparable credit risk weights of 72% for Conserve and ~41% for ANZ RCA reflecting the improved credit risk profile of the current ANZ portfolio

– The $2.0 billion in risk weighted assets equates to a regulatory capital balance of $158 million utilising ANZ’s Advanced Internal Rating Based Basel II accreditation, at an annual cost of $23.8 million

Annexure II – Detailed Due Diligence Findings

ANZ.800.616.1278

ANZ.800.616.1279

Annexure 11 - Detailed Due Diligence Findings

Pricing Review (Loan Book only) - Since September 2007 the portfolio lending margin has been within a narrow band (3.00% - 3.12% ) despite significant funding

cost reductions in t he commercial market over the same period. Since September 2008 lend ing margins w it hin ANZ Commercial Bank have increased by "'92bps ending July 2009 at 3.07%

- The margin on variable term loans for ANZ agribusiness (3.51 % July 2009) is higher than the margin over the Conserve Base Rate (2.88% November 2008) and maximum margin (3.29% November 2008). No assessment of relative pricing for r isk has been undertaken however t here is no evidence of interest rate r isk management strategies at a customer level being evident

- Given the Conserve variable book tota ls "' $1 billion the ability to reprice the variable book represents a $7 million revenue opportunity

- The margin on fixed term loans for ANZ agribusiness at 1.65% (July 2009) is lower t han margins on Conserve fixed term loans (2.34% November 2008) however it is to be noted that t he opportunity to reprice the fixed book will emerge wit hin 1.92 years (on average)

- Margin on overdrafts for ANZ agribusiness at 3. 74% is comparable to Conserve overdrafts at 3.89%

Product Line of Credit Overdraft Seasonal Total ccounts 74 3,238 1,340 592 2,194 7,438

DR Balance ($'000s) 71,144 806,226 31,793 384,776 1,077,969 2,371,908 Limit 38,525 994,763 65,281 385,407 1,116,749 2,600,726 Utilisation 185% 81% 49% 100% 97% 91% Vo Portfolio Balance 3% 34% 1% 16% 45% 100% ustomer Rat e 12.6 1% 9.25% 10.69% 12.07% 9.06% 9.68% 9.82% onserve Base Rate 6.79% 6.80% 6.80% 6.80% 6.72% 6.80% 6.79%

Margin over Conserve Base Rat e 5.82% 2.45% 3.89% 5.27% 2.340/ot 2.88% 3.03% Maximum margin* 6.22% 2.86% 4.30% 5.68% 3.29% 3.43%

ustomer Rat e Au 09 10.32% 6.95% 8.39% 9.77% 7.38% 7.53% NZ product equ ivalent Overdraft ABL Fixed ABL Variable NZ Agri Customer Rate (July 09) 7 .92% 7.35% NZ Agri Margin (July 09) 3.74% 1.65% 3.51% erm - Loan Maturity (yrs) 6.62 1.05 0.5 9.21 8.14 5.91 erm to Fixed Maturity (yrs) 1.92

12 month ortfolio rowth 114% -4% -10% -13% 10% 2%

Page 13

Page 14

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Risk Management ProcessGeneral Comment

– Conserve have a documented and updated Credit Manual Policy that sets out the procedural requirements for the dedicated Rural Finance Managers (‘RFMs’) to follow when assessing credit applications for new and existing clients

– Discretion to approve lending by the RFM’s is to a maximum of $500k within certain customer characteristics with additional support from the State Finance Managers and Regional Credit Managers (up to $5 million) for existing clients. Note that no discretion is held by front line sales staff to approve new to Conserve clients – this must be approved by the independent credit department

– On a monthly basis the Head of Credit prepares a report (RMC) detailing portfolio trends along various segmentation bands, risk profiles as well as state and industry trends. This report appears to be comprehensive and covers all major information categories

– The physical file review team have reported a high level of acumen within the dedicated Agri credit cell and whilst portfolio trends have been deteriorating the action and intent of the credit team appear to be commensurate with that of a skilled Agri lending team

– It is apparent that Conserve have previously made use of PWC to conduct an external Operational audit of its activities, this reporting was ceased after provision of the September 2008 report as agreed with the companies bankers (ANZ and RABO).

– Perusal of the September 2008 report provides a reasonably clean bill of health in terms of day to day operating policy and has typically included file reviews to confirm application of the policy to the file behaviour

Page 1 of 2

Annexure II – Detailed Due Diligence Findings

ANZ.800.616.1280

Page 15

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Risk Management Process continued….Weaknesses

– The valuation policy adopted by Conserve is well outside of the attributable ANZ policy with a revaluation required every three years (ANZ every 12 months) and importantly the valuation can in most cases be conducted by the RFM based on reasonable comparable sales data

– The file review team was aware of this policy and brought in the internal valuation specialists (AAAVU) to review both the methodology and physical file samples. The findings have confirmed that whilst the practice of allowing RFM’s to complete the valuation is well outside of acceptable practice the actual values were in the main within reasonable levels of acceptability

– The other major weakness that was identified from the file review team was that despite the credit policy calling for sensitised forward cash flow forecasts / stock budgets etc the application in practice was not this robust. In the case of most files reviewed the physical file showed no sign of this type of forward looking analysis which places concern on the ability to accurately forecast the trends around the problem loan accounts as no forward analysis is being completed

Page 2 of 2

Annexure II – Detailed Due Diligence Findings

ANZ.800.616.1281

Page 16

DRAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT – D

RAFT

Operational Risk

Annexure II – Detailed Due Diligence Findings

– Conserve does not have its own dedicated risk policy or processes but uses the AWB group standards. The policy implies that all subsidiary companies and business units within AWB Group have dedicated operational risk and compliance resources. A review of the organisation structure supplied did not clearly show this. Reference was made to credit risk resources but not other risk resulting in the risk that dedicated resources have not been managing operational risk and compliance across Conserve

– A review of the Enterprise Risk Policy and Risk Management Policy provided a robust approach to Risk management highlighting policy structure, procedural requirements, responsibilities for risk, Risk management and oversight. All of these were similar in nature to ANZ and conformed to the Australian Risk Management Standard AS4360

– The policy refers to Operational Risk Principles, Fraud Control Program, Insurance Program, Emergency, Security and Business Continuity Management, as well as strategic and reputation risk

– In relation to compliance, the policy refers to obligations and breeches but supporting documentation in relation to obligations, complaints and breaches remains outstanding

ANZ.800.616.1282