Project 1111

-

Upload

rajni25naidu -

Category

Documents

-

view

118 -

download

3

Transcript of Project 1111

PROJECT REPORT

ON

“HUMAN RESOURCES MANAGEMENT

IN

PRIVATE SECTOR BANK”

BACHELOR OF COMMERCE

BANKING AND INSURANCE

SEMESTER-V

SUBMITTED

IN PARTIAL FULFILLMENT OF THE

REQUIREMENT FOR AWARD OF

DEGREE OF BACHELOR OF

COMMERCE – BANKING AND INSURANCE

BY

RAJNI NAIDU

ROLL NO.39

SMT.CHANDIBAI HIMATHMAL

MANSUKHANI COLLEGE

ULHASNAGAR-3

CERTIFICATE

THIS IS TO CERTIFY THAT SHRI/MISS RAJNI NAIDU OF B.COM

BANKING AND INSURANCE SEMESTER-V (2009-2010) HAS

SUCCESSFULLY COMPLETEDTHE PROJECT ON HRM IN

PRIVATE SECTOR BANK UNDER THE GUIDANCE OF PROF.

KAJAL BHOJWANI

COURSE CO-ORDINATOR PRINCIPAL

INTERNAL EXAMINAR

EXTERNAL EXAMINAR

DECLARATION

I, MISS RAJNI NAIDU, THE STUDENT OF B.COM

BANKING AND INSURANCE- SEMESTER-V (2009-2010) HEREBY

DECLARE THAT I HAVE COMPLETED THE PROJECT ON

HUMAN RESOURCES MANAGEMENT IN PRIVATE SECTOR

BANK.

THE INFORMATION SUBMITTED IS TRUE AND ORIGINAL TO

THE BEST OF MY KNOWLEDGE.

SIGNATURE OF STUDENT

RAJNI NAIDU

ROLL NO.39

METHODOLOGY

Primary Data Collection:-

The primary data was collected by making a visit to…..

ICICI Bank,andheri branch

ICICI,ambarnath

The view and opinions were collected from the above mentioned bank.

Secondary data collection:-

The secondary data has been collected from the following sources….

HRM books

Websites

Magazine

ACKNOWLEDGEMENT

I, WOULD LIKE TO ACKNOWLEDGE THE FOLLOWING AS

BEING AN IDEALIST CHANNEL AND A FREASH DIMENSION IN

THE COMPLETION OF THIS PROJECT.

FIRST AND FOREMOST I WOULD LIKE TO THANK MY GUIDE,

PROFESSOR KAJOL BHOJWANI WHO’S IN VALUABLE SUPPORT

AND GUIDANCE HELPED ME IN EVERY ASPECT OF THIS

PROJECT. SECONDLYT,

I WOULD LIKE TO EXPRESS MY DEEP SENSE OF GRATITUDE

TOWARDS OUR BANKING AND INSURANCE CO-ORDINATOR

PROFESSOR KISHORE PISHORI FOR THEIR VALUABLE

GUIDANCE AND SUPPORT WITHOUT THIS PROJECT WOULD

HAVE NOT BEEN POSSIBLE.

LAST BUT NOT THE LEAST I WOULD LIKE TO THANK

ALL THE RESPONDENTS FOR THEIR SUPPORT ANDALL THOSE

PEOPLE WHO DIRECTLY AND INDIRECTLY HELPED ME IN

COMPLETING THIS PROJECT SATISFACTORILY.

OBJECTIVE:-

1) To understand the role of HRM in banks

2) To know the functions of HRM

3) To know the need of HRM in banks

4) To know the structure and position of HR department

5) To study the Human Resources Management

6) To know the changing bank environment and role of HRM

EXECUTIVE SUMMARY

Fast global and technological developments have made today's business

environment highly uncertain and even chaotic. Organizations are

seeking newer ways to promote their adaptability to the complexities of

the changed scenario so as to survive and prosper. Globally, organizations

are striving to realize competitive success through strategic management

of human resources.

Thus, people management has never been more important than it is today.

Therefore new themes have emerged in the process, replacing some of the

old ones. The new thinking in this regard is referred to as Human

Resource Management (HRM), which carries a more proactive and

strategic connotation.

In this project it includes the focus on HRM as Human Resource

Management. Indicating the ability of banks to deliver value to customer.

BROAD CONTENTS

Sr.no. Chapters Page no.

01 Human Resources Management 1-44

02 Human Resources Management in Private

Sector Banks

45-56

03 Case Study on ICICI 57-67

04 Conclusion 68-70

HUMAN RESOURCEMANAGEMENT(HRM)

Human Resource Management (HRM)

INDEX

Sr.no Particulars Pg.no.

01 Introduction 1

02 Meaning and definition 2-6

03 Scope of HRM 7

04 Evolution of HRM 8-14

05 Objectives of human resource management 15-16

06 Functions 17-24

07 Positions and structure of HRM 24-27

08 Human Resources planning 28-31

09 Focus on HRM 32-33

10 HRM implementation activities 34-38

11 HRM development and implementation responsibilities

39-41

12 Evaluation of HRM methods 42-44

HRM in private sector banks

INTRODUCTION

“Human Resources Management” (HRM) is a management

functions that helps managers recruit, select. Train and develop members

for an organization.

HRM involves the application of management functions and principles.

The functions and principles are applied to acquisitioning, developing,

maintaining and remunerating employees in organizations.

It is a series of integrated decisions that form the employment

relationship; their quality contributes to the ability of the organizations

and the employees to achieve their objectives.

Thus, HRM refers to a set of programmers, functions and

activities designed and carried out in order to maximize both employees

as well as organizational effectiveness.

~1~

HRM in private sector banks

Human resources

Management is also

management function

concerned with hiring motivating

and maintaing

people in an organization. It focuses

on people in organization

MEANING AND DEFINITION

“Human resource management is planning, organizing, directing and

controlling of procurement, development, compensation, integration,

maintenance and separation of human resources to the end that

individual, organizational and social objectives accomplished.”

Thus, human resource management refers to a set of programmer,

functions and activities designed and carried out to maximize both,

employee as well as organizational effectiveness.

It is concerned with the people dimensions in the management. Since

every organization is made up of people,

acquiring their services developing their skills

motivating them to higher levels of performance and

ensuring that they continue to maintain their

commitment to the organization are essential to

achieving organizational objectives. This is true,

regardless of the type of organization –government,

business, education, health, recreation or social

actions.

Human resource is one of the natural resources of

any country’s economy.

~2~

HRM in private sector banks

It is the wealth of the country. In the context of banking, human resource

is of greater importance. The deployment of human resource through

proper and efficient selection, training and development, is called Human

Resource Management.

The success of any bank or organization largely depends on efficient

human resource management, apart from operations, marketing and sales,

the HR department manages all the efficient people working in operations

and marketing divisions in any organization.

Human resources are a term with which many organizations describe the

combination of traditionally administrative personnel functions with

performance management, employee relations and resources planning.

The field draws upon concepts developed in industrial/organizational

psychology.

Human resources have at least two related interpretations depending on

context. The original usage derives from political economy and

economics, where it was traditionally called labor, one or four factors of

production. The more common usage within corporations and business

refers to the individual within the firm and to the portion of the firm’s

organization that deal with hiring, firing, training, and other personnel

issues.

~3~

HRM in private sector banks

Human resources management (HRM), or human resource development,

entails planning, implementing, and managing recruitment as well as

selection, training, career and organizational development initiative

within an organization.

The goal of HRM is to maximize the productivity of an organization by

optimizing the effectiveness of its employees while simultaneously

improving the work life of employees and training employees as valuable

resources. Consequently, HRM encompasses efforts to promote personal

development, employee’s satisfaction, and compliance with employment-

related laws.

Michael j.jucius defined as” the field of management which has to-do

with planning, organizing, directing and controlling the functions of

procuring, developing, maintaining and utilizing a lobour force, such that

the-

(a) objective for which the company is established are attained

economically and effectively,

(b) objective of all levels of personnel are served to the highest

possible degree, and

(c) objectives of society are duly considered and served”

~4~

HRM in private sector banks

To achieve equilibrium between employer and employee goals and

need, HRM department focus on these three general functions:-

1. planning

2. implementing and

3. evaluation

The planning function refers to the development of human

resources policies and regulations. Human resources manager attempt

to determined future HRM activities and plan for implementing of

HRM procedures to help companies realizes their goals.

Implementing of HRM plans involves four primary

activities:

a) Acquisition,

b) Development,

c) Compensation and

d) Maintenance.

Acquisition entails the hiring of workers most likely to help a

company attain its goals.

The development function encompasses the training of workers to

perform their task in accordance with company strategy.

~5~

HRM in private sector banks

This activity also involves company efforts to control and change

employee behavior, appraisals, incentives and discipline.

Compensation covers the payment of employees for their services.

Maintenance requires structuring labor relations the interaction

between a company’s management and its unionized employees and

ensuring compliance with federal and state employment law.

~6~

HRM in private sector banks

SCOPE OF HRM

The scope of HRM is indeed vast. All major activities

in the working life of a worker-from the time of his or her entry into an

organization until he or she leaves-come under the preview of HRM.

Specially, the activities included are-HR planning, job analysis and

design, recruitment and selection, orientation and placeme3nt, training

and development, performance appraisal and job evaluation.

Human resource management serves these key functions: 1. Recruitment & Selection

2. Training and Development (People or Organization)

3. Performance Evaluation and Management

4. Promotions/Transfer

5. Redundancy

6. Industrial and Employee Relations

7. Record keeping of all personal data

8. Compensation, pensions, bonuses etc in liaison with Payroll

9. Confidential advice to internal ‘customers’ in relation to problems

at work

10.Career development

11.Competency Mapping

12.Time motion study is related to H.R.Function

~7~

HRM in private sector banks

EVOLUTION OF HRM

The momentum for the industrial revolution grew through the 17th

century. Agricultural methods were continually improving, creating

surpluses that were used for trade. In addition, technical advances

were also occurring, for example the Spinning Jenny and the Steam

Engine. These advances created a need for improved work methods,

productivity and quality that led to the beginning of the Industrial

Revolution.

Adam Smith.

In 1776, Adam Smith wrote about the economic advantages of the

division of labour in his work The Wealth of Nations. Smith (1776)

proposed that work could be made more efficient through specialization

and he suggested that work should be broken down into simple tasks.

From this division he saw three advantages:

- the development of skills

- time saving

- the possibility of using specialized tools.

Smith's suggestions led to many changes in manufacturing processes.

~8~

HRM in private sector banks

Every individual necessarily labours to render the annual revenue of

the society as great as he can. He generally, indeed, neither intends

to promote the public interest, nor knows how much he is promoting it.

By preferring the support of domestic to that of foreign industry, he

intends only his own security; and by directing that industry in such a

manner as its produce may be of the greatest value, he intends only

his own gain, and he is in this, as in many other cases, led by an

invisible hand to promote an end which was no part of his intention.

Nor is it always the worse for the society that it was no part of it."

Adam Smith, considered by many to be the father of Capitalism, also

discussed the Invisible Hand or Laissez Faire approach (this term is

not used in the book but argues the case). "According to the hidden

hand approach, the only responsibility of business is to maximize

profits according to the market principle and within the constraints

of the law. If government interference in business is restricted to a

minimum, society will benefit automatically from the activities of the

business sector."

According to Rossouw (1994) the hidden hand approach lost value when

societies did not benefit automatically from business activity. It was

clear that business could not be relied upon to act in the best

interests of is staff, consumers and the society within which it was

operating.

~9~

HRM in private sector banks

In 1832, Charles Babbage examined and expanded upon the division of

labour in his work, On the Economy of Machinery and Manufacturers. In

this book Babbage offered, as an advantage to the division of labour,

that the amount of skill needed to undertake a specialized task was

only the skill the necessary to complete the task. Babbage analysed

and documented the manufacture of a pin and broke the process down

into seven elements to illustrate his point.

This study became important to employers in that they only had to pay

for the amount of skill required to complete a task.

Trade Unions.

During the late 1700's and early 1800's governments began to feel

pressure from the working class masses who started to question and

defy the power of the aristocracy. The working class began to form

workplace combinations and trade organizations provide a collective

voice for their rights. Governments tried to fight this using

legislation such as the Combination Acts of 1799/1800 in the UK, which

Banned everything from meetings to combinations.

~10~

HRM in private sector banks

"There were also attempts to form general unions of all workers

irrespective of trade. William Benbow (a Lancashire shoemaker), Robert

Owen and many others looked upon trade unionism not just as a means

for protecting and improving workers' living standards, but also as a

vehicle for changing the entire political and economic order of

society. Owen experimented with co-operative ventures and 'labour

exchanges'; both attempts to bypass the existing order of wage

slavery." (Trade Unions Congress, 2004)

Trade Unions were and are still an influential force, working for

continued economic and social development of workers and societies in

many countries around the world. Taylor is considered to be the father of

Scientific Management.

In 1911, his seminal work, The Principles of Scientific Management was

published. This book contains four overriding principles of scientific

management:

- Each part of an individuals work is analysed 'scientifically'.

- The most suitable person to undertake the job is 'scientifically

chosen' and is taught the exact way to do the job.

- Managers must co-operate with workers to ensure the job is done in a

Scientific way.

~11~

HRM in private sector banks

- There is a clear division of work and responsibility between

management and workers. (Bloomsbury, 2002)

"Taylor's impact has been so great because he developed a concept of

work design, work measurement, production control and other functions,

that completely changed the nature of industry. Before scientific

management, such departments as work study, personnel, maintenance

and quality control did not exist."

The Hawthorne Studies :-

The Hawthorne Studies were a groundbreaking set of experiments

conducted at the Western Electric plant in Hawthorne, Chicago by Elton

Mayo. The studies were conducted from 1927 to 1932 and measured the

relationship between productivity and working environment.

The studies were based on preliminary experiments conducted in 1924

that measured the effect of lighting on productivity. (Bloomsbury, 2002)

The results of the experiments showed that changes in the environment

did affect productivity, but this was not the sole factor.

The results of the experiments showed that changes in the environment

did affect productivity, but this was not the sole factor. The workers

considered management to be showing an interest in them and this

improved motivation.

~12~

HRM in private sector banks

Mayo's studies and the subsequent results were a significant break

from the theories of F.W. Taylor in that the workers were not solely

motivated by self interest. Mayo's research has led to the

understanding that workplaces are more than machine like environments

in that there are social environments and human emotions that require

consideration. Mayo's studies led to the rise of the Human Relations

Movement

Contemporary Human Resource Management.

In modern business the Human Resources Management function is

complex and as such has resulted in the formation of Human resource

departments/divisions in companies to handle this function. The Human

resource function has become a wholly integrated part of the total

corporate strategy

The function is diverse and covers many facets including Manpower

planning, recruitment and selection, employee motivation, performance

Monitoring and appraisal, industrial relations, provision management

of employee benefits and employee education training and development.

~13~

HRM in private sector banks

1890-1910

Frederick Taylor develops his ideas on scientific management. Taylor advocates scientific selection of workers based on qualifications and also argues for incentive-based compensation systems to motivate employees.

1910- Many companies establish departments devoted to maintaining

1930

the welfare of workers. The discipline of industrial psychology begins to develop. Industrial psychology, along with the advent of World War I, leads to advancements in employment testing and selection.

1930-1945

The interpretation of the Hawthorne Studies' begins to have an impact on management thought and practice. Greater emphasis is placed on the social and informal aspects of the workplace affecting worker productivity. Increasing the job satisfaction of workers is cited as a means to increase their productivity.

1945-1965

In the U.S., a tremendous surge in union membership between 1935 and 1950 leads to a greater emphasis on collective bargaining and labor relations within personnel management. Compensation and benefits administration also increase in importance as unions negotiate paid vacations, paid holidays, and insurance coverage.

1985-present

The first is the increasing diversity of the labor force, in terms of age, gender, race, and ethnicity. A second trend is the globalization of business and the accompanying technological revolution. These factors have led to dramatic changes in transportation, communication, and labor markets. The third trend, which is related to the first two, is the focus on HRM as a "strategic" function. HRM concerns and concepts must be integrated into the overall strategic planning of the firm in order to cope with rapid change, intense competition, and pressure for increased efficiency.

~14~

HRM in private sector banks

OBJECTIVE OF HUMAN RESOURCES MANAGEMENT

Objectives are pre-determined goals to which individual or group activity

in an organization is directed. Objectives of human resources

management are influenced by social objectives, organizational

objectives, functional objectives and individual objectives. Institutional

are instituted to attain certain specific objectives. The objectives of the

economic institute are mostly too earn profits, and that of educational

institutions are mostly impart education and conduct research so on and

so forth. However, the fundamental objectives if any organization is

survival. Organizations are not just satisfied with goal. Further, the goal

of the most of the organization is growth and/or profit.

The objectives of HRM may be as follows:-

i. To create and utilize an able and motivated workforce, to

accomplish the basic organizational goals.

ii. To establish and maintain sound organizational structure and

desirable working relationship among all the members of the

organization.

~15~

HRM in private sector banks

iii. To secure the integration of individual and groups within the

organization by co-ordination of the individual and group goals

with those of the organization.

iv. To create facilities and opportunities for individual or group

development so as to match it with the growth of the organization.

v. To attain an effective utilization of human resources in the

achievement of organizational goals.

vi. To identify and satisfy individually and group needs by providing

adequate and equitable wages, incentives, employee benefits and

social security and measures for challenging work prestige,

recognition, security, status etc.

~16~

HRM in private sector banks

FUNCTION OF HRM

The Human Resources Management (HRM) function

includes a variety of activities, and key among them is deciding what

staffing needs you have and whether to use independent contractors or

hire employees to fill these needs, recruiting and training the best

employees, ensuring they are high

performers, dealing with

performance issues, and ensuring

your personnel and management

practices conform to various

regulations. Activities also include

managing your approach to

employee benefits and

compensation, employee records

and personnel policies. Usually

small businesses (for-profit or

nonprofit) have to carry out these activities themselves because they can't

yet afford part- or full-time help. However, they should always ensure

that employees have -- and are aware of -- personnel policies which

conform to current regulations. These policies are often in the form of

employee manuals, which all employees have.

~17~

HRM in private sector banks

Note that some people distinguish a difference between HRM (a major

management activity) and HRD (Human Resource Development, a

profession). Those people might include HRM in HRD, explaining that

HRD includes the broader range of activities to develop personnel inside

of organizations, including, e.g., career development, training,

organization development, etc.There is a long-standing argument about

where HR-related functions should be organized into large organizations,

e.g., "should HR be in the Organization Development department or the

other way around?"

The HRM function and HRD profession have undergone tremendous

change over the past 20-30 years. Many years ago, large organizations

looked to the "Personnel Department," mostly to manage the paperwork

around hiring and paying people. More recently, organizations consider

the "HR Department" as playing a major role in staffing, training and

helping to manage people so that people and the organization are

performing at maximum capability in a highly fulfilling manner.

Following are the some of the functions in details:-

Recruitment strategy planning:-

An analysis of the job to be done (i.e. an analytical study of the tasks to

be performed to determine their essential factors) written into a job

description so that the selectors know what physical and mental

characteristics applicants must possess, what qualities and attitudes are

desirable and what characteristics are a decided disadvantage;

~18~

HRM in private sector banks

In the case of replacement staff a critical questioning of the need to

recruit at all (replacement should rarely be an automatic process).

Effectively, selection is 'buying' an employee (the price being the

wage or salary multiplied by probable years of service) hence bad

buys can be very expensive. For that reason some firms (and some

firms for particular jobs) use external expert consultants for

recruitment and selection.

Equally some small organizations exist to 'head hunt', i.e. to attract

staff with high reputations from existing employers to the

recruiting employer. However, the 'cost' of poor selection is such

that, even for the mundane day-to-day jobs, those who recruit and

select should be well trained to judge the suitability of applicants.

Employee motivation:-

To retain good staff and to encourage them to give of their best while at

work requires attention to the financial and psychological and even

physiological rewards offered by the organization as a continuous

exercise.

Basic financial rewards and conditions of service (e.g. working hours per

week) are determined externally (by national bargaining or government

minimum wage legislation) in many occupations but as much as 50 per

~19~

HRM in private sector banks

cent of the gross pay of manual workers is often the result of local

negotiations and details(e.g. which particular hours shall be worked) of

conditions of service are often more important than the basics. Hence

there is scope for financial and other motivations to be used at local

levels.

As staffing needs will vary with the productivity of the workforce (and

the industrial peace achieved) so good personnel policies are desirable.

The latter can depend upon other factors (like environment, welfare,

employee benefits, etc.) but unless the wage packet is accepted as 'fair

and just' there will be no motivation.

Employee services

Attention to the mental and physical well-being of employees is normal

in many organizations as a means of keeping good staff and attracting

others.

The forms this welfare can take are many and varied, from loans to the

needy to counseling in respect of personal problems. Among the activities

regarded as normal are:

Schemes for occupational sick pay, extended sick leave and access

to the firm's medical adviser;

Schemes for bereavement or other special leave;

The rehabilitation of injured/unfit/ disabled employees and

temporary or permanent move to lighter work;

~20~

HRM in private sector banks

The maintenance of disablement statistics and registers (there are

complicated legal requirements in respect of quotas of disabled

workers and a need for 'certificates' where quota are not fulfilled

and recruitment must take place);

Provision of financial and other support for sports, social, hobbies,

activities of many kinds which are work related;

Provision of canteens and other catering facilities;

Possibly assistance with financial and other aid to employees in

difficulty (supervision, maybe, of an employee managed

benevolent fund or scheme);

Provision of information handbooks,

Running of pre-retirement courses and similar fringe activities;

Care for the welfare aspects of health and safety legislation and

provision of first-aid training.

The location of the health and safety function within the organization

varies. Commonly a split of responsibilities exists under which

'production' or 'engineering' management cares for the provision of safe

systems of work and safe places and machines etc.,

But HRM is responsible for administration, training and education in

awareness and understanding of the law, and for the alerting of all levels

to new requirements.

~21~

HRM in private sector banks

Employee education, training and development:-

In general, education is 'mind preparation' and is carried out remote from

the actual work area, training is the systematic development of the

attitude, knowledge, skill pattern required by a person to perform a given

task or job adequately and development is 'the growth of the individual in

terms of ability, understanding and awareness'.

Within an organization all three are necessary in order to:

Develop workers to undertake higher-grade tasks;

Provide the conventional training of new and young workers

Raise efficiency and standards of performance;

Meet legislative requirements (e.g. health and safety);

Inform people (induction training, pre-retirement courses, etc.);

From time to time meet special needs arising from technical, legislative,

and knowledge need changes. Meeting these needs is achieved via the

'training loop'. (Schematic available in PDF version.)

The diagnosis of other than conventional needs is complex and often

depends upon the intuition or personal experience of managers and needs

revealed by deficiencies. Sources of inspiration include

Common sense - it is often obvious that new machines, work

systems, task requirements and changes in job content will require

workers to be prepared;

~22~

HRM in private sector banks

Shortcomings revealed by statistics of output per head,

performance indices, unit costs, etc. and behavioral failures

revealed by absentee figures, lateness, sickness etc. records;

Recommendations of government and industry training

organizations;

Inspiration and innovations of individual managers and

supervisors;

Forecasts and predictions about staffing needs;

Inspirations prompted by the technical press, training journals,

reports of the experience of others;

The suggestions made by specialist (e.g. education and training

officers, safety engineers, work-study staff and management

services personnel).

Designing training is far more than devising courses; it can include

activities such as:

Learning from observation of trained workers;

Receiving coaching from seniors;

Discovery as the result of working party, project team membership

or attendance at meetings;

Job swaps within and without the organization;

Undertaking planned reading, or follow from the use of self–

teaching texts and video tapes;

~23~

HRM in private sector banks

Learning via involvement in research, report writing and visiting

other works or organizations.

So far as group training is concerned in addition to formal courses there

are:

Lectures and talks by senior or specialist managers;

Discussion group (conference and meeting) activities;

Briefing by senior staffs;

Role-playing exercises and simulation of actual conditions;

Video and computer teaching activities;

Case studies (and discussion) tests, quizzes, panel 'games', group

forums, observation exercises and inspection and reporting techniques.

POSITION AND STRUCTURE OF HUMAN RESOURCE MANAGEMENT

Human resource management department responsibilities can be broadly

classified by:-

1) Individual,

2) Organizational, and

3) Career areas.

~24~

HRM in private sector banks

Individual management entails helping employees identify their strengths

and weaknesses; correct their shortcomings; and make their best

contribution to the enterprise. These duties are carried out through a

variety of activities such as performance reviews, training, and testing.

Organizational development, meanwhile, focuses on fostering a

successful system that maximizes human (and other) resources as part of

larger business strategies. This important duty also includes the creation

and maintenance of a change program, which allows the organization to

respond to evolving outside and internal influences. The third

responsibility, career development, entails matching individuals with the

most suitable jobs and career paths within the organization.

Human resource management functions are ideally positioned near the

theoretic center of the organization, with access to all areas of the

business.

Since the HRM department or manager is charged with managing the

productivity and development of workers at all levels Human resource

personnel should have access to—and the support of—key decision

makers.

In addition, the HRM department should be situated in such a way that it

is able to effectively communicate with all areas of the company.

~25

HRM in private sector banks

HRM structures vary widely from business to business, shaped by the

type, size, and governing philosophies of the organization that they serve.

But most organizations organize HRM functions around the clusters of

people to be helped—they conduct recruiting, administrative, and other

duties in a central location. Different employee development groups for

each department are necessary to train and develop employees in

specialized areas, such as sales, engineering, marketing, or executive

education.

In contrast, some HRM departments are completely independent and are

organized purely by function. The same training department, for example,

serves all divisions of the organization.

In recent years, however, observers have cited a decided trend toward

fundamental reassessments of human resources structures and positions.

"A cascade of changing business conditions, changing organizational

structures, and changing leadership has been forcing human resource

departments to alter their perspectives on their role and function almost

over-night,"

"Previously, companies structured themselves on a centralized and

compartmentalized basis—head office, marketing, manufacturing,

shipping, etc. They now seek to decentralize and to integrate their

operations, developing cross-functional teams….

~26~

HRM in private sector banks

Today, senior management expects HR to move beyond its traditional,

compartmentalized 'bunker' approach to a more integrated, decentralized

support function." Given this change in expectations,

Johnston noted that:-

"An increasingly common trend in human resources is to decentralize the

HR function and make it accountable to specific line management. This

increases the likelihood that HR is viewed and included as an integral part

of the business process, similar to its marketing, finance, and operations

counterparts. However, HR will retain a centralized functional

relationship in areas where specialized expertise is truly required," such

as compensation and recruitment responsibilities.

~27~

HRM in private sector banks

Human Resources Planning

The objective of human Resources management is to achieve a high level

of return on an organization investment in people. For many organization

people are the only, or the most expensive, asset upon which the success

of the enterprise is dependent.

Although most organization realize the important of this asset, some have

not put into place the infrastructure components required to manage

people in the same manner in which other assets are managed .Financial,

capital, and information resources, for example, are managed with

careful planning, monitoring, replacement, or upgrading. Often the same

cannot be said for how an organization’s Human Resources are managed.

In order to manage and nurture Human Resources, planning is required to

establish a framework in which this valuable asset will be employed. This

includes identification of objectives, values, principles, and practices to

guide the organization in its use of people. Within this framework the

infrastructure components to give managers the skills and guideline to

apply sound management principles and practices are developed.

The infrastructure is made up of a broad framework and includes such

support mechanisms as organization, performance management

processes, rewards and incentives, recruitment standards and human

resources development principles.

~28~

HRM in private sector banks

These in turn are supported by subsystems which include specific policies

and procedures such as recruitment procedure, compensation policies,

performance appraisal, training and development policies, legislative

compliance, communication devices, and the like.

BENEFITS OF HUMAN RESOURCES PLANNING:-

Human Resources Planning (HRP) anticipates not only the required kind

and number of employees but also determine the action plan for all the

functions of personnel management. The major benefits of human

resources planning are:-

It checks the corporate plan of the organization.

It offsets uncertainty and changes. But the HRP offsets

uncertainties and changes to the maximum extent possible and

enables the organization to have right men at the right time and in

the right place.

It provides scope for advancement and development of employees

through training, development etc.

It helps to anticipate the cost of salary enhancement, better benefits

etc.

~29~

HRM in private sector banks

It helps to anticipate the cost of salary, benefits all the cost of

human resources, facilitating the formulation of budgets in an

organization.

To foresee the need for redundancy and plan to check it or to

provide alternative employment in consultation with trade unions,

other organization and the government through remodeling

organizational, industrial and economic plan.

To foresee the changes in value, aptitude and attitude of human

resources and to change the techniques of interpersonal

management etc.

To plan for physical facilities, working conditions and the volume

of fringe benefits like canteen, school, hospitals, conveyance, child

care centre, quarters, company stores etc.

It gives an idea of the type of tests to be used and interview

techniques in selection based on the lev4el of skills, qualifications,

intelligence, values, etc. of future human resources.

It causes he development of various sources of human resources to

meet the organizational needs

~30~

HRM in private sector banks

It helps to take steps to improve human resources contributions in

the forms of increased productivity, sales, turnover etc.

It facilities the control of all the functions, operations, contribution

and cost of human resources.

Factors Affecting HRP:-

HRP is influenced by several considerations. The more important of them are:

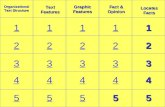

Type and strategy of organization Organizational growth cycles and planning Environmental uncertainties, Time horizons Type quality of forecasting information Nature of jobs being filled and Off-loading the work

~31~

HRM in private sector banks

Type and strategy of organization

Time horizons

Type and quality of

forecasting

Nature

of jobs being filled

Outsourcing

Environmental

uncertainties

Organizational growth cycle

HRP

THE FOCUS OF HRM:-

Businesses and organizations rely on three major resources:

1. Physical resources, such as materials and equipment;

2. Financial resources, including cash, credit, and debt; and

3. Human resources or workers.

In its broadest sense, HRM refers to the management of all decisions

within an organization that are related to people.

In practice, however, HRM is a tool used to try to make

optimum use of human resources, to foster individual development, and

to comply with government mandates.

Larger organizations typically have an HRM department and its primary

objective is making company goals compatible with employee goals

insofar as possible. Hence, for a company to attain its goals, it must have

employees who will help it attain them.

Towards this end, R. Wayne Pace, writing in Human Resource

Development, identifies seven underlying assumptions that provide a

foundation and direction for HRM.

~32~

HRM in private sector banks

First is the acknowledgment of individual worth, suggesting that

companies recognize and value individual contributions.

Second is that employees are resources who can learn new skills and

ideas and can be trained to occupy new positions in the organization.

Third is that quality of work life is a legitimate concern, and that

employees have a right to safe, clean, and pleasant surroundings.

A fourth assumption is the need for continuous learning; talents and

skills must be continually refined in the long-term interests of the

organization.

A fifth assumption supporting the existence of an organized HRM within

a company or institution is that opportunities are constantly changing and

companies need methods to facilitate continual worker adaptation.

Sixth is employee satisfaction, which implies that humans have a right to

be satisfied by their work and that employers have a responsibility and

profit motivation to try to match a worker's skills with his or her job.

The seventh and final assumption is that HRM encompasses a much

broader scope than technical training—employees need to know more

than the requirements of a specific task in order to make their maximum

contribution.

~33~

HRM in private sector banks

HRM IMPLEMENTATION ACTIVITIES:-

To fulfill their basic role and achieve their goals, HRM

professionals and departments engage in a variety of activities in order to

execute their human resource plans. HRM implementation activities fall

into four functional groups, each of which includes related legal

responsibilities: acquisition, development, compensation, and

maintenance.

ACQUISITION:-

Acquisition duties consist of human resource planning for

employees, which includes activities related to analyzing employment

needs, determining the necessary skills for positions, identifying job and

industry trends, and forecasting future employment levels and skill

requirements. These tasks may be accomplished using such tools and

techniques as questionnaires, interviews, statistical analysis, building skill

inventories, and designing career path charts. Four specific goals of

effective human resource planning are:

1. Sustaining stable workforce levels during ups and downs in output,

which can reduce unnecessary employment costs and liabilities and

increase employee morale that would otherwise suffer in the event

of lay-offs.

2. Preventing a high turnover rate among younger recruits.

~34

HRM in private sector banks

3. Reducing problems associated with replacing key decision makers

in the event of an unexpected absence.

4. Making it possible for financial resource managers to efficiently

plan departmental budgets.

The acquisition function also encompasses activities

related to recruiting workers, such as designing evaluation tests and

interview methods. Ideally, the chief goal is to hire the most-qualified

candidates without encroaching on federal regulations or allowing

decision makers to be influenced by unrelated stereotypes. HRM

departments at some companies may choose to administer honesty or

personality tests, or to test potential candidates for drug use. Recruitment

responsibilities also include ensuring that the people in the organization

are honest and adhere to strict government regulations pertaining to

discrimination and privacy. To that end, human resource managers

establish and document detailed recruiting and hiring procedures that

protect applicants and diminish the risk of lawsuits.

DEVELOPMENT:-

The second major HRM function, human resource

development, refers to performance appraisal and training activities. The

basic goal of appraisal is to provide feedback to employees concerning

their performance.

~35~

HRM in private sector banks

This feedback allows them to evaluate the appropriateness of their

behavior in the eyes of their coworkers and managers, correct

weaknesses, and improve their contribution. HRM professionals must

devise uniform appraisal standards, develop review techniques, train

managers to administer the appraisals, and then evaluate and follow up on

the effectiveness of performance reviews.

HRM professionals must devise uniform appraisal standards, develop

review techniques, train managers to administer the appraisals, and then

evaluate and follow up on the effectiveness of performance reviews. They

must also tie the appraisal process into compensation and incentive

strategies, and work to ensure that federal regulations are observed.

Training and development activities include the determination, design,

execution, and analysis of educational programs. Orientation programs,

for example, are usually necessary to acclimate new hires to the

company. The HRM training and education role may encompass a wide

variety of tasks, depending on the type and extent of different programs.

In any case, the HRM professional ideally is aware of the fundamentals

of learning and motivation, and must carefully design effective training

and development programs that benefit the overall organization as well as

the individual. Training initiatives may include apprenticeship,

internship, job rotation, mentoring, and new skills programs.

~36~

HRM in private sector banks

COMPENSATION:-

Compensation, the third major HRM function, refers to

HRM duties related to paying employees and providing incentives for

them. HRM professionals are typically charged with developing wage

and salary systems that accomplish specific organizational objectives,

such as employee retention, quality, satisfaction, and motivation.

Ultimately, their aim is to establish wage and salary levels that maximize

the company's investment in relation to its goals. In particular, HRM

managers must learn how to create compensation equity within the

organization that doesn't hamper morale and that provides sufficient

financial motivation.

Besides financial compensation and fringe benefits, effective HRM

managers also design programs that reward employees by meeting their

emotional needs, such as recognition for good work

MAINTENANCE:-

The fourth principal HRM function, maintenance of human resources,

encompasses HRM activities related to employee benefits, safety and

health, and worker-management relations. Employee benefits are non-

incentive-oriented compensation, such as health insurance and free

parking, and are often used to transfer no taxed compensation to

employees.

~37~

HRM in private sector banks

The three major categories of benefits managed by HRM managers are:

employee services, such as purchasing plans, recreational activities, and

legal services; vacations, holidays, and other allowed absences; and

insurance, retirement, and health benefits.

Human resource maintenance activities related to safety

and health usually entail compliance with federal laws that protect

employees from hazards in the workplace. Regulations emanate from the

federal Occupational Safety and Health Administration, for instance, and

from state workers' compensation and federal Environmental

Protection Agency laws. HRM managers must work to minimize the

company's exposure to risk by implementing preventive safety and training

programs. They are also typically charged with designing detailed

procedures to document and handle injuries.

Maintenance tasks related to worker-management relations primarily

entail: working with labor unions, handling grievances related to

misconduct such as theft or sexual harassment, and devising systems to

foster cooperation.

Activities in this arena include contract negotiation, developing policies

to accept and handle worker grievances, and administering programs to

enhance communication and cooperation.

~38~

HRM in private sector banks

HRM DEVELOPMENT AND IMPLEMENTATION RESPONSIBILITIES

While most firms have a human resources or personnel department that

develops and implements HRM practices, responsibility lies with both

HR professionals and line managers. The interplay between managers and

HR professionals leads to effective HRM practices. For example,

consider performance appraisals. The success of a firm's performance

appraisal system depends on the ability of both parties to do their jobs

correctly. HR professionals develop the system, while managers provide

the actual performance evaluations.

The nature of these roles varies from company to company, depending

primarily on the size of the organization. This discussion assumes a large

company with a sizable HRM department. However, in smaller

companies without large HRM departments, line managers must assume

an even larger role in effective HRM practices.

HR professionals typically assume the following four areas of

responsibility: establishing HRM policies and procedures,

developing/choosing HRM methods, monitoring/evaluating HRM

practices and advising/assisting managers on HRM-related matters. HR

professionals typically decide (subject to upper-management approval)

what procedures to follow when implementing an HRM practice.

~39~

HRM in private sector banks

For example, HR professionals may decide that the selection process

should include having all candidates:-

(1) Complete an application,

(2) Take an employment test, and then

(3) Be interviewed by an HR professional and line manager.

Usually the HR professionals develop or choose

specific methods to implement a firm's HRM practices. For instance, in

selection the HR professional may construct the application blank,

develop a structured interview guide, or choose an employment test. HR

professionals also must ensure that the firm's HRM practices are properly

implemented. This responsibility involves both evaluating and

monitoring.

For example, HR professionals may evaluate the usefulness of

employment tests, the success of training programs, and the cost

effectiveness of HRM outcomes such as selection, turnover, and

recruiting. They also may monitor records to ensure that performance

appraisals have been properly completed.

HR professionals also consult with management on an array of HRM-

related topics. They may assist by providing managers with formal

training programs on topics like selection and the law, how to conduct an

employment interview, how to appraise employee job performance, or

how to effectively discipline employees.

~40~

HRM in private sector banks

HR professionals also provide assistance by giving line managers advice

about specific HRM-related concerns, such as how to deal with problem

employee Line managers direct employees' day-to-day tasks. From an

HRM perspective, line managers are mainly responsible for

implementing HRM practices and providing HR professionals with

necessary input for developing effective practices.

Managers carry out many procedures and methods devised by HR

professionals. For instance, line managers:

Interview job applicants

Provide orientation, coaching, and on-the-job training

Provide and communicate job performance ratings

Recommend salary increases

Carry out disciplinary procedures

Investigate accidents

Settle grievance issues

The development of HRM procedures and methods often requires input

from line managers.

For example, when conducting a job analysis, HR professionals often

seek job information from managers and ask managers to review the final

written product.

Additionally, when HR professionals determine an organization's training

needs, managers often suggest what types of training are needed and who,

in particular, needs the training.

~41~

HRM in private sector banks

EVALUATION OF HRM METHODS

One of the most critical aspects of HRM is evaluating

HRM methods and measuring their results. Even the most carefully

planned and executed HRM programs are meaningless without some way

to judge their effectiveness and confirm their credibility. The evaluation

of HRM methods and programs should include both internal and external

assessments. Internal evaluations focus on the costs versus the benefits of

HRM methods, whereas external evaluations focus on the overall benefits

of HRM methods in achieving company goals. Larger human resource

departments often use detailed, advanced data gathering and statistical

analysis techniques to test the success of their initiatives. The results can

then be used to adjust HRM programs or even to make organizational

changes.

The authors of Human Resources Management posit

four factors, the "four Cs," that should be used to determine whether or

not an HRM department or individual program is succeeding:

commitment, competence, cost-effectiveness, and congruence. In testing

commitment, the HRM manager asks to what extent do policies enhance

the commitment of people to the organization? Commitment is necessary

to cultivate loyalty, improve performance, and optimize cooperation

among individuals and groups.

~42~

HRM in private sector banks

Competence refers to the extent to which HRM policies attract, keep, and

develop employees: Do HRM policies result in the right skills needed by

the organization being available at the proper time and in the necessary

quantity? Likewise, cost-effectiveness, the third factor, measures the

Fiscal proficiency of given policies in terms of wages, benefits,

absenteeism, turnover, and labor/management disputes. Finally, analysis

of congruence helps to determine how HRM policies create and maintain

cooperation between different groups within and outside the organization,

including different departments, employees and their families, and

managers and subordinates.

In addition to advanced data gathering and analysis techniques, several

simple observations can be made that provide insight into the general

effectiveness of a company's human resources. For example, the ratio of

managerial costs to worker costs indicates the efficiency of an

organization's labor force. In general, lower managerial costs indicate a

more empowered and effective workforce. Revenues and costs per

employee, when compared to related industry norms, can provide insight

into HRM effectiveness.

Furthermore, the average speed at which job vacancies are filled is an

indicator of whether or not the organization has acquired the necessary

talents and competencies. Other measures of HRM success include

employee complaint and customer satisfaction statistics, health insurance

and workers' compensation claims, and independent quality ratings.

~43~

HRM in private sector banks

In addition, the number of significant innovations made each year, such

as manufacturing or product breakthroughs, suggest HRM's success at

fostering an environment that rewards new ideas and is amenable to

change.

Besides evaluating these internal aspects of HRM programs, companies

also must assess the effectiveness of HRM programs by their impact on

overall business success. In other words, companies must link their

Evaluation of HRM methods with company performance to determine

whether these methods are helping their business by increasing quality,

reducing costs, expanding market share, and so forth. Ultimately,

companies must make sure that they have the right amount of properly

skilled employees performing tasks necessary for the attainment of

company goals and that greater revenue and profits result from HRM

efforts to increase the workforce and improve worker training and

motivation.

~44~

HRM INPRIVATE SECTOR BANK

Human Resource Management (HRM) in private sector banks

INDEX

Sr.no. Particular Page no.

1 Introduction 45-46

2 Meaning of HRM in Banks 46

3 Need For HRM and Its

Management in banks

47

4 Building up efficiency in Banks with

the help of HRM48-50

5

The Changing Banking Environment

and Role of HRM 50-52

6 Employee Turnover and

Implementation of "Exit Policy"

53-55

7 Human Resource Risk 56

HRM in private sector banks

Introduction

“Human resource management is planning, organizing, directing and

controlling of procurement, development, compensation, integration,

maintenance and separation of human resources to the end that

individual, organizational and social objectives accomplished.”

Thus, human resource management refers to a set of programmes,

functions and activities designed and carried out to maximize both,

employee as well as Organizational effectiveness.

It is concerned with the people dimensions in the management. Since

every organization is made up of people, acquiring their services

developing their skills motivating them to higher levels of performance

and ensuring that they continue to maintain their commitment to the

organization are essential to achieving organizational objectives. This is

true, regardless of the type of organization -government, business,

education, health, recreation or social actions.

Human resource is one of the natural resources of any country's economy.

It is the wealth of the country. In the context of banking, human resource

is of greater importance. The deployment of human resource through

proper and efficient selection, training and development, is called

~45~

HRM in private sector banks

Human Resource Management. The success of any bank or organization

largely depends on efficient human resource management, apart from

operations, marketing and sales, the HR department manages all the

efficient people working in operations and marketing divisions in any

organization.

Thus, HRM refers to a set of programmes, functions and activities

designed and carried out in order to maximize both employees as well as

organizational effectiveness.

Meaning of “Human Resources Management” in Banks

Human resource is one of the natural resources of any country's economy.

It is the wealth of the country. In the context of banking, human resource

is of greater importance. The deployment of human resource through

proper and efficient selection, training and development, is called Human

Resource Management. The success of

any bank largely depends on efficient

human resource management, apart

from operations, marketing and sales,

the HR department manages all the

efficient people working in operations

and marketing divisions in any

organization.

~46~

HRM in private sector banks

Need For HRD and Its Management in banks

There is a qualitative change in the banking paradigm on account

of changes in the industry due to the entry of new private sector

Banks. Therefore, it has become a necessity to recruit, train and

deploy people at all level efficiently, for better performance and

success. This is the basic function of HRD, which includes the

concept of HRM.

A view of the changes in the political scene in the recent past,

seeping changes is expected to take place in the banking industry.

It is expected that only a few banks will remain after a series of

amalgamations and mergers, not only in the Indian banking

industry, but also at the international level.

Emergence of new private sector banks, disintermediation and

competition and self-regulation in monitoring banking has

necessitated efficient Human Resources Management in banks.

HRM is a continuous process, involving selection, recruitment and

training on an "on going basis" for the staff and their deployment in

the right place. The activity is called HR development.

~47~

HRM in private sector banks

Building up efficiency in Banks with the help of HRM

The crucial factors behind successful banking will be continuous

and sustained build up of skills, knowledge, education and attitudes

among people working in the banks, particularly the frontline staff,

working in the branches.

It is possible through professionalization, which is an internal part

of HRM. Bank staff should be motivated and encouraged to

practice professionalism for their personal growth and thus

contribute to the organization's growth.

Building efficiency in banking is, therefore largely dependent on

the best selection process adopted by the HR department. There is

imperative need to build up skills within an organization for the

successful managing of available HR.

Banks have vast human resource specialized in multiple disciplines

like technology, law, operations, foreign exchange, administration

etc. the basic function of HR is to manage them efficiently for

continuous success.

For building up better efficiency in banks HRM in banks have to

follow the bellow two functions:-

~48~

HRM in private sector banks

1) Emphasis on job description and job Assignment.

2) Response to challenges in future.

1. EMPHASIS ON JOB DESCRIPTION AND JOB ASSIGNMENT

One of the important functions of HR department is to ensure proper

definition for workers in the bank. The staff should know about the

vacant positions and the skills required for those particular jobs.

Accordingly, people should be recruited to that particular job. The

allotment of a job to a right person, who has the required skills is called

job assignment. If this function is not properly performed by the HR

department, people in all departments will be in a chaotic situation. This

will impair their performance and subsequently

customer service.

Improvement in performance and skills of existing employees can be

achieved through recruiting the right person for the right place. Thus, job

description and job assignment are parallel concept requiring attention.

2. RESPONSE TO THE CHALLENGES IN FUTURE.

Bankers should chalk out a wide range of strategic responses to the future

challenges. They have to look into the structure, procedures and processes

of the systems and make policies accordingly, to ensure necessary

changes. It is the foremost function of HRM.

~49~

HRM in private sector banks

Banks have to convince their employees that that a challenge is an

opportunity to prove oneself. Bankers in India have to utilize this

opportunity before the competition overtakes them and people in banks

have to respond immediately to the challenges.

This requires the HR department to work efficiently. Banks are in the

service industry, where the raw material is HR. HRM, therefore, emerges

as a very basic and important element for strategic response to the

changes that are taking place in the banking sector. HR departments

should take it seriously to formulate policies to meet this challenge. HRD

is a critical management function. Each manager should have initiative,

awareness, co-ordination and facilitation to perform his role. This is

critical function of HRM.

The Changing Banking Environment and Role of HRM

Owing to the changing banking environment HR department should call

for appropriate response in equipping people who have to perform in the

new environment. People should be prepared to 'accept changes. The

upgraded technology in banks might create fear among the staff regarding

their adaptability to the new environment. It is the responsibility of the

HR department to properly counsel people and prepare them to face the

challenges before them. Their mind should be fine - tuned to work in the

new technological environment.

~50~

HRM in private sector banks

The main function of HRM is to build up capabilities in people

working in banks and intensify their sense of belonging to the

organization. To improve their performance and increase the bank's

productivity HR must incorporate challenges in routine work. Team

spirit has to be inculcated in the branches and greater focus should be

on customer care. This would be possible only through the

unprecedented efforts to be put forth by the HR department.

Rewards, Remuneration, Incentives and Punishments

HR department should make efforts to provide appropriate incentives,

rewards and increase remuneration to employees. Otherwise,

dissatisfaction may creep into all levels of the bank, resulting in"

inefficiency, perfunctory attitude, and poor service standards. These will

ultimately affect the functioning of the organization. Therefore, the HR

department has to formulate policies with utmost care taking into account

all these facets of personnel banking. Radical changes are required in the

performance appraisal system to avoid nepotism. HR policies with regard

to manpower and career planning, and placement policies have to he

revamped. A level of professionalism with the help of technology and

scientific management has to be brought in by the HR departments of

banks. Clear policies regarding performance rewards, incentives and

increase in remuneration have to be outlined and implemented.

~51~

HRM in private sector banks

With regard to the accountability for non-performance and for the

mistakes, the HR department's intervention is a must for establishing the

facts of each case. Proper judgment "with impartial attitude helps develop

satisfaction among the staff members.Before punishing for mistakes and

non-performance, a certain kind of enquiry is required by the HR

department.

In the present scenario, particularly in the new private sector banks,

dismissals are taking place arbitrarily without proper enquiry for

accountability. This will impart the efficiency of the existing staff and

lower dynamism in their performance, ultimately leading to reduced

productivity due to fear and insecurity of losing the job. It is the first and

foremost duty of the HR department to formulate appropriate policies

with regards to punishments.

A set of guidelines and procedures has to be formulated and followed for

punishments to staff in case of any indiscipline.

There are certain inevitable situations in working where the staff needs to

experiment in order to take decisions. In the process mistakes are bound

to occur. Committing mistake is a way of learning. These are not to be

treated as sin by the management. Otherwise, the decision making

process will be vitiated. HRM will play a significant role in handling

situations while awarding punishments to employees without impairing

others’ efficiency.

~52~

HRM in private sector banks

Employee Turnover and Implementation of "Exit Policy"

I n the present scenario, the employee turnover has increased in the

banking industry, specifically in the new private sector banks.

The main reason behind the trend is the recruitment of young

people without experience.

They will be moving to other jobs after gaining experience, for

higher salaries.

This usually has a bad effect on the work atmosphere of the

organization.

The new private sector banks have become a training ground for

the new and fresh recruits.

It is the responsibility of the HR department to arrest this trend of

employee turnover.

The HR department should formulate suitable policies to retain the

staff by providing 'incentives, rewards, and better increments every

year. These policies will ensure organizational efficiency.

~53~

HRM in private sector banks

The employee turnover may increase on account of

o Lacunae in the appraisal systems,

o Non-recognition of talent,

o Discouragement for the staff,

o Lack of motivation,

o Lack of promotions to higher cadre in the organization etc.

HR and personnel departments of banks should realize the

importance of all these aspects and help the organization in

formulating correct policies.

In this process, the HR departments of all banks should realize

the importance of recruiting experienced people in higher positions to

ensure utmost efficiency. It will increase the productivity and

profitability of the organization.

~54~

HRM in private sector banks

Performance Appraisal Systems

It is one of the important functions of the HR department is to

formulate proper policies with regard to performance appraisal

in banks to avoid discrimination in ranking the personnel for

further promotions.

To manage people, it is very important to fudge the abilities

correctly to recognize them.

Self-appraisal system is prevalent for officer cadre personnel

in public sector banks.

In die new private sector banks, if is available to the entire staff

including award staff but it is compulsory, tiring system by

which a section of the employees will he ranked under the

lowest category that is, it requires improvement on a specific

percentage basis.

This is a discouraging exercise and at times even a performer

will be ranked the lowest.

This will have an adverse impact on die organization.

HRM should give a serious thought to this aspect.

~55~

HRM in private sector banks

Human Resource Risk

The banking HR risk is another important aspect to be managed by the

HR and Planning department.

In certain situations the departure of an employee with specialized skills

and knowledge due to resignation, retirement or removal may bring

certain systems to a halt and may even create chaos. This is called HR

risk.

In this process, the-bank may have to pay multiple individuals with

similar knowledge and experience to ensure protection against this risk.

Similarly, the bank may have to face the risk of loss of key personnel,

which is called the risk of inadequate motivation among staff who

manage the situation. If the management offers inadequate incentives or

doesn't, give any incentive at all, or wrong incentives, it may lead to

disastrous financial results, provided the incentives are linked to

individual performance.

In such a case, the personnel will not co-operate in combating the risky

situation. In case a group incentive is given, individual motivation will be

affected.

~56~

CASE STUDY ON CASE STUDY ON ICICI BANKICICI BANK

Case study on ICICI Bank

INDEX

Sr.no. Particular Page no.

01 Introduction of ICICI bank 57-58

02 History of ICICI bank 59-61

03 Awards & recognitions 62-63

04 Questionnaire 64-67

HRM in private sector banks

Introduction of ICICI bank

ICICI Bank (BSE: ICICI) (formerly Industrial Credit and Investment

Corporation of India) is India's largest private sector bank by market

capitalization and second largest overall in terms of assets. Bank has total

assets of about USD 77 billion (at the end of December 2008). The Bank

also has a network of 1,449 branches and about 4,721 ATMs in India and

presence in 18 countries, as well as some 24 million customers (at the end

of July 2007). ICICI Bank offers a wide range of banking products and

financial services to corporate and retail customers through a variety of

delivery channels and specialized subsidiaries and affiliates in the areas

of investment banking, life and non-life insurance, venture capital and

asset management. (These data are dynamic.)

~57~

I HRM in private sector banks

CICI Bank is also the largest issuer of credit cards in India. [1]. ICICI

Bank has got its equity shares listed on the stock exchanges at Kolkata

and Vadodara, Mumbai and the National Stock Exchange of India

Limited, and its ADRs on the New York Stock Exchange (NYSE).

The Bank is expanding in overseas markets and has the largest

international balance sheet among Indian banks. ICICI Bank now has

wholly-owned subsidiaries, branches and representatives offices in 18

countries, including an offshore unit in Mumbai. This includes wholly

owned subsidiaries in Canada, Russia and the UK (the subsidiary through

which the HiSAVE savings brand is operated), offshore banking units in

Bahrain and Singapore, an advisory branch in Dubai, branches in

Belgium, Hong Kong and Sri Lanka, and representative offices in

Bangladesh, China, Malaysia, Indonesia, South Africa, Thailand, the

United Arab Emirates and USA. Overseas, the Bank is targeting the NRI

(Non-Resident Indian) population in particular.

ICICI reported a 1.15% rise in net profit to Rs. 1,014.21 crore on a 1.29%

increase in total income to Rs. 9,712.31 crore in Q2 September 2008 over

Q2 September 2007. The bank's current and savings account (CASA)

ratio increased to 30% in 2008 from 25% in 2007.

~58~

HRM in private sector banks

History of ICICI

1955 The Industrial Credit and Investment Corporation of India

Limited (ICICI) was incorporated at the initiative of World Bank,

the Government of India and representatives of Indian industry,

with the objective of creating a development financial institution

for providing medium-term and long-term project financing to

Indian businesses.

1994 ICICI established Banking Corporation as a banking

subsidiary. Formerly Industrial Credit and Investment Corporation

of India. Later, ICICI Banking Corporation was renamed as 'ICICI

Bank Limited'. ICICI founded a separate legal entity, ICICI Bank,

to undertake normal banking operations - taking deposits, credit

cards, car loans etc.

2001 ICICI acquired Bank of Madura (est. 1943). Bank of Madura

was a Chettiar bank, and had acquired Chettinad Mercantile Bank

(est. 1933) and Illanji Bank (established 1904) in the 1960s.

2002 The Boards of Directors of ICICI and ICICI Bank approved

the reverse merger of ICICI, ICICI Personal Financial Services

Limited and ICICI Capital Services Limited, into ICICI Bank.

~59~

HRM in private sector banks

After receiving all necessary regulatory approvals,

CICI integrated the group's financing and banking operations, both

wholesale and retail, into a single entity.

Also in 2002, ICICI Bank bought the Shimla and Darjeeling

branches that Standard Chartered Bank had inherited when it

acquired Grindlays Bank.

ICICI started its international expansion by opening representative

offices in New York and London.