Presentation1 121023042438 Phpapp02 [Autosaved]

-

Upload

tafakharhasnain -

Category

Documents

-

view

224 -

download

0

Transcript of Presentation1 121023042438 Phpapp02 [Autosaved]

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

1/26

STOCKEXCHANGE

EASY WAY TO EARN MONEY,

EASY WAY TO LOOSE MONEY

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

2/26

WHAT IS STOCK EXCHANGE?

Definition of Stock Exchange : The securities regulation act of 1956

defined stock exchange as an association , organization , or a

individual which is established for for the purpose of assisting ,

regulating , and controlling business in buying ,selling and dealingin securities.

Meaning : This comes under treasury sector ,which provides

service to stock brokers & traders to trade stocks ,bonds and

securities. Stock exchanges helps the companies to raise their fund.Therefore the companies needs to list themselves in the Stock

Exchange and the shares will be issued which is known as equity or

a ordinary share and these shareholders are the real owners of the

company the Board Of Directors of the Company are elected out of

these Equity Shareholders only.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

3/26

FEATURES OF STOCK EXCHANGE

It is an organized market

It is a securities market

It is an important constituent of capital market i.e., market for long-

term finance

It is a voluntary association of persons desirous of dealing in securities

Stock exchange is a voluntary association, its membership is not open to

everybody

In a stock exchange, only the members can deal in i.e., buy & sell

securities The members of a stock exchange can buy and sell securities either as

brokers for & on behalf of their clients

The dealings in a stock exchange are under certain accepted code of

conduct i.e., rules and regulations

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

4/26

IMPORTANT FUNCTION OF STOCK EXCHANGE

Provide central and convenient meeting places for sellers and buyer of

securities

Increase the marketability and liquidity of securities

Contribute to stability of prices of securities

Equalization of price of securities

Smoothen price movement

Help the investors to know the worth of their holdings

Promote the habit of saving and investment

Help capital formation

Help companies and government to raise funds from the investors

Provide forecasting service

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

5/26

HISTORY OF STOCK EXCHANGE

The stock exchange was established by East Indiacompanyin 18thcentury . In India it was establishedin 1850 with 22 stock brokers opposite to town hallBombay .This stock exchange is known as oldest stockexchange of Asia.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

6/26

Initial members who are

still running their businessin stock exchange are

D.S.Prabhudas &company

Jamnadas Morarjee

Champak lal Devidas

Brymohan Laxminarayan

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

7/26

BROKER AND JOBBER

BROKER:He is one acts as a intermidiary onbehalf of others. A broker in a stock exchange ,isa commission agent who transacts business in

securities on behalf of non members.JOBBER:He is not allowed to deal with the

public directly .He deals with brokers who areengaged with the investors . Thus, the securities

is bought by the jobber from members and sellsto members who are operating on the stockexchange as broker.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

8/26

DIFFERENCES BETWEEN A JOBBER AND A BROKER

JOBBER

A jobber is an independent

dealer in securities, purchasing

or selling securities on his own

account

A jobber deals only with the

brokers ,does not deal with the

general public

A jobber earns profit from his

operations i.e., buying andselling activities

Each jobber specializes in certain

group of securities

BROKER

A broker deals with the jobber

on behalf of his clients. in other

words, a broker is a middleman

between a jobber and clients

A broker is merely an agent,

buying or selling securities on

behalf of his clients

A broker gets only

commission for his dealings

The broker deals in all

types of securities

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

9/26

SPECULATION AND SPECULATOR

SPECULATION :It is the transaction of members tobuy or sell securities on stock exchange with a view tomake profits to anticipated raise or fall in price ofsecurities.

SPECULATOR: The dealer in stock exchange whoindulge in speculation are called speculator . They do nottake delivery of securities purchased or sold by them , butonly pay or rescue the difference between the purchaseprice and sale price . The different types of speculators are

BULL

BEARSTAG

LAME DUCK

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

10/26

BULL {TEJIWALA}

He is speculator who expects the future raise in price of

securities he buys the securities to sell them at future dateat the higher price.

He is called as bull because his activities resembles as a bull ,as the bull tends to throw its victims up in the air through itshorns. In simple the bull speculator tries to raise the price of

securities by placing a big purchase orders.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

11/26

BEAR {MANDIWALA}

He is speculator whoexpects future fall in prices, he does an agreement tosell securities at future

date at the present marketrate .

He is called as bear becausehis altitude resembles withbear , as the bear tends tostamp its victims down to

earth through its paws . Insimple the bear speculatorforces of prices ofsecurities to fall throughhis activities.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

12/26

STAG {DEER}

He operates in new issueof market . He is just like abull speculator . He applieslarge number of shares inthe issue market only by

paying , application money, allotment money. He isnot a genuine investorbecause , he sells thealloted securities at thepremium and makes profit.In simple he is cautious in

his dealings . He creates anartificial rise in prices ofnew shares and makesprofits.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

13/26

LAME DUCK

He is speculator when thebear operator finds itdifficult to deliver thesecurities to the consumer

on a particular day asagreed upon , he strugglesas a lame duck in fullfillinghis commitment . Thishappens when the prices

do not fall as expected bythe bear and the otherparty is not willing topostpone the settlement tothe next period.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

14/26

Largest stock exchanges

IN THE WORLD

LONDON STOCK EXCHANGE

NEW YORK STOCK EXCHANGE

SHANHAI STOCK EXCHANGE

AUSTRALIA STOCK EXCHANGE

TOKYO STOCK EXCHANGE

HONG KONG STOCKEXCHANGE

TORONTO STOCK EXCHANGE

DEUTSCHE BORSE

BM&F BOVESPA

NASDAQ OMX STOCKEXCHANGE

IN INDI

NATIONAL STOCK EXCHANGE

BOMBAY STOCK EXCHANGE

CALCUTTA STOCK EXCHANGE

COCHIN STOCK EXCHANGE

MULTI COMMODITYEXCHANGE

DERIVATIVES EXCHANGE

OTC EXCHANGE PUNE STOCK EXCHANGE

INTERCONNECTS EXCHANGE

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

15/26

LONDON STOCK EXCHANGE

It was the first stock exchange established by

east India company in 18thcentury in London.

The top gainer of LONDON STOCK EXCHANGE

is Blue chip shares.

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

16/26

BOMBAY STOCK EXCHANGE

It is oldest and first stockexchange of Indiaestablished in the year1875. First it was startedunder baniyan treeopposite to town hall ofBombay over 22 stock

brokers. The top gainer inBSE is 100 companies inthat GMR infra is first

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

17/26

NATIONAL STOCK

EXCHANGE OF INDIA NSE

OR NSEI

)The NSE of India is the leading stockexchange of India, covering 370 cities and

towns in the

country. It was established in1994 as a TAX

company. It was established by 21 leading

financial institutions and banks like theIDBI,ICICI,IFCI,LIC,SBI,etc.

Features of NSEINation wide coverage i.e., investors from all over country

Ringless i.e., it has no ring or trading floor

Screen-based trading i.e., trading in this stock exchange is done electronically.

Transparency,i.e.,the use of computer screen for trading makes the dealings insecurities transparent.

Professionalization in trading, i.e., it brings professionalism in its functions

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

18/26

OVER-THE-COUNTER EXCHANGE

OF INDIA OTCEI

)The OTCEI is a national,ringless and computerized stock

exchange. It was established in october,1990.it started its

operation in september,1992.

Features of OTCEI1. It is a nation-wide stock exchange. Its operational areas cover entire India.

2. It is a ringless stock exchange. The trading ring(i.e., trading place)commonly found in atraditional stock exchange is not found in the OTCEI.

3. It is a computerized stock exchange

Advantages of OTCEI

1. It helps the investors to have easy and direct access to the stock exchange2. It helps investors to get fair prices for their securities

3. It provide safety to the investors

4. To provide computerized trading system

5. To provide investors a convenient,effcient and transparent mode ofinvestment

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

19/26

SECURITIES AND EXCHANGE

BOARD OF INDIA(SEBI)The SEBI was constituted on 12thApril,1988 under a

resolution of the Government of India. On 31stjanuary,1992,it was made a statutory bodyby the

Securities and Exchange board of India Act,1992.

The Companies (Amendment) Act,2000 has given certain

powers to SEBI as regards the issues and transfer of

securities and non-payment of dividend

Function Of SEBIRegulating the business in stock exchange and any other securitiesmarkets.

Promoting and regulating self-regulatory organization.

Registering and regulating the work of collective investmentscheme,incluing mutual funds.

Prohibiting fraudulent and unfair trade practices relating tosecurities market.

Promoting education, and training of intermediaries of securitiesmarket

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

20/26

Power of SEBIPower to approve the bye-laws of stock exchange

Power to inspect the books of accountsPower to grant license to any person for the purpose of dealing in certain areas.

Power to delegate powers exercisable by it.

Power to try directly the foliation of certain provision of the company Act

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

21/26

How to see the value of

shares in stock exchangeSENSEX is an indicator to checkout in

BSE

NIFTY is an indicator to checkout in NSE

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

22/26

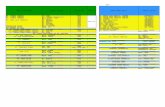

Latest news of BSE and NSE

Most profitable company in BSE is GMR Infra

Most profitable company in NSE will be

RELIANCE and ICICI

During last three months nearly only 26% of

profit is earned by our stock exchanges the

working hours will be

From 9:30 to 3:30 from Monday to Friday

The Dail graph of the

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

23/26

The Dail graph of thecompanies will be showed in

following manner

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

24/26

How stock exchanges get

moneyThey get their money by listing fees

paid by the corporation to have theircompany traded

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

25/26

HOW TO DEAL AND INVEST IN

STOCK EXCHANGEIn order to deal with a securities one as to have anaccount called Demat a/c or Trading a/c. It is just like abank account. Same procedure of opening the bankaccount is followed to open the a/c. But all the banks

does not give this facility of opening the account , onlyfew banks provide this facility. After demat a/c orTrading a/s is opened then the securities is bought andsold. The banks which gives facility of demat a/c inIndia is

ICICI Bank Citi Bank

Bank of Baroda

-

8/11/2019 Presentation1 121023042438 Phpapp02 [Autosaved]

26/26

HAPPY INVESTMENT WITH

LOTS OF PROFITSEND

************

![download Presentation1 121023042438 Phpapp02 [Autosaved]](https://fdocuments.net/public/t1/desktop/images/details/download-thumbnail.png)

![Presentation1 [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/589b986b1a28abd63e8b4a2d/presentation1-autosaved-autosaved.jpg)

![whatsinstorefortheasiapacificoilgasmarketsin2012-111220015151-phpapp02 [Autosaved]](https://static.fdocuments.net/doc/165x107/577d20351a28ab4e1e92407e/whatsinstorefortheasiapacificoilgasmarketsin2012-111220015151-phpapp02-autosaved.jpg)

![ATC ppt [autosaved] [autosaved] [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/558ca444d8b42a27548b465c/atc-ppt-autosaved-autosaved-autosaved-autosaved.jpg)

![presentation1-121023042438-phpapp02 (1)(1)[1]](https://static.fdocuments.net/doc/165x107/577cd9071a28ab9e78a28345/presentation1-121023042438-phpapp02-111.jpg)

![Presentation1 e commerce [autosaved]](https://static.fdocuments.net/doc/165x107/55aabe7b1a28ab4f138b4897/presentation1-e-commerce-autosaved.jpg)

![Presentation1[1] [Autosaved]Nou (2)](https://static.fdocuments.net/doc/165x107/577cd8301a28ab9e78a09fd1/presentation11-autosavednou-2.jpg)

![li-filightfidelity-130813102733-phpapp02 [Autosaved].pptx](https://static.fdocuments.net/doc/165x107/577cd6f31a28ab9e789da726/li-filightfidelity-130813102733-phpapp02-autosavedpptx.jpg)

![Presentation 2-100712214811-phpapp02 [autosaved]](https://static.fdocuments.net/doc/165x107/555c205cd8b42a0b418b48d3/presentation-2-100712214811-phpapp02-autosaved.jpg)

![Presentation3 [Autosaved] [Autosaved]](https://static.fdocuments.net/doc/165x107/577d2e691a28ab4e1eaef4b4/presentation3-autosaved-autosaved.jpg)