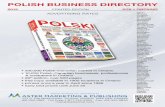

Polish Market No. 7-8 (180) 2011

-

Upload

polishmarket-online -

Category

Documents

-

view

245 -

download

0

description

Transcript of Polish Market No. 7-8 (180) 2011

RyszardFlorek

Polish M

arket :: 7–8/2

011

President of FAKRO

PUBLISHED SIncE 1996

15 yearsNo. 7-8 (180) 2011 :: www.polishmarket.com.pl

Innovation and modernityEnergyMiningSteel industryEastern markets

KATOWICE COAL HOLDING SA (KHW SA Katowice)

Coal

- S

afet

y - En

vironment

We have energy for the fu�re

JOIN US

We are a Polish energy holding with 16-percent market share in national energy sales.Our company is re�onsible for production, distribution and delivery of electrici�.Our main focus is continuous development. We already deliver electrici� to over2.5 million households and 300 thousand companies. Moreover, our company uses162 thousand km of power lines in an area covering a quarter of Poland.We are looking to the fu�re with energy. 45 hydropower plants and a number ofwindmills connected to our network give us 30 percent of the market share inelectrici� production from renewable sources. We are a national leader in greenenergy production.

www.energa.pl

Energa - Mamy Energie EN - PolishMarket 230x295+5mm.qxd 1/7/10 10:38 AM Page 1

Leader in oil and fuel logistics

Sosnowiec, Poland

Riga, Latvia

Severstallat Silesia

Severstallat Silesia Sp. z o.o.Nowopogońska 1; 41-200 Sosnowiec, PolandT: +48 32 364 24 01; F: +48 32 364 23 03e-mail: [email protected]; www.severstallat-silesia.pl

Achieve more together

Steel distributor and processor

4 :: polish market :: 7-8/2011

ContentsContents

From The President’s Press Office # 8

From The Government Information Centre # 9

OUR GUESTS

Prof. Michał Kleiber, President of the Polish Academy of Sciences (PAN): We have to promote innovation # 10

Prof. Krzysztof Rybiński, Rector of Vistula University: Let us favour ambition and innovation # 11

Prof. Leszek Rafalski, Director of the Road and Bridge Research Institute (IBDiM): Research achievements and road practice # 12

Marcin Korolec, Undersecretary of State of the Ministry of Economy: Poland offers its advice and experience, bets on partnership # 14

PRESIDENT’S awaRD

The Economic Award of the President of the Republic of Poland # 18

Polish Economic Nobel Prize # 20

Fakro – we are successful on the global market # 22

INNOVaTION

Progress 2011 Innovation Gala # 24

Andrzej Najgebauer, Professor at the Jarosław Dąbrowski Military University of Technology in Warsaw and school’s Prorector for Research: Detecting threats # 37

Ecological energy for economy and industry # 39

7-8/2011 ENERGy & MINING & STEEl INDUSTRy

Biling system – how do you do it? # 40

Bogdan Sadecki: The positive energy market in Poland # 42

Ranking of companies in the energy, mining and metallurgical sector # 45

Be Smart Eco with Energa Group # 50

Grzegorz Onichimowski, President of the Management Board of Towarowa Giełda Energii S.A. (POLPX): A marketplace with energy # 52

Robert Soszyński, Chairman of the Board in PERN “Przyjaźń” S.A.: A new strategy # 54

Oil & Gas: hydrocarbons prevail # 56

The tricky mining boom # 57

Bogdan Sadecki: Coal has been and will be important to Poland # 58

Sandra Wierzbicka: Polish-US cooperation in shale gas exploration # 60

Henryk Jezierski, Undersecretary of State, National Chief Geologist: Shale gas – an inimitable opportunity # 64

Prof. Józef Dubiński, Corresponding member, Polish Academy of Sciences: Mining through an experts eye # 66

Bogdan Sadecki: Successes and challenges of steel industry in Poland # 69

The Polish steel market # 71

TRaNSfORMaTION aND PRIVaTIzaTION

Artur Woźniak, President of the Polish Pharmaceutical Holding (PHF): Haste is only good for catching fleas # 74

EaSTERN COOPERaTION

Łukasz Adamski, an analyst at the Polish Institute of International Affairs: So close, yet so far # 77

Beata Wojna, the head of the Research and Analyses Department at the Polish Institute of International Affairs (PISM): The Southern and Eastern dimentions of the European Neighbourhood Policy are balanced # 80

6 :: polish market :: 7-8/2011

Contents

Markiyan Malskiy, Ambassador Extraoridinary and Plenipotentiary of Ukraine to the Republic of Poland: 2o years of good Neighbourhood on the way to EU # 81

Sandra Wierzbicka: Poland-Ukraine # 82

India: a welcome warm as the weather # 84

Poland and Thailand: friendship and cooperation # 86

MałOPOlSka REGION

Małopolska a region brimming with temptations # 87

Ranking of companies in Małopolskie province # 90

OPINION

Małgorzata Zaleska: The case of Polbank # 73

Katarzyna Niezgoda, President of Deni Cler Group S.A.: A recipe for leaders # 92

Publisher: Oficyna Wydawnicza RYNEK POLSKI Sp. z o.o. (RYNEK POLSKI Publishers Co. Ltd.)

President: Krystyna Woźniak-Trzosek

Vice-Presidents: Błażej Grabowski, Grażyna Jaskuła

address: ul. Elektoralna 13, 00-137 Warsaw, Poland Phone (+48 22) 620 31 42, 652 95 77 Fax (+48 22) 620 31 37 E-mail: [email protected]

Editor-in-Chief: Rita Schultz [email protected]

Editorial board: Jerzy Bojanowicz, Ewelina Janczylik, Janusz Korzeń, Maciej Proliński, Jan Sosna, Magdalena Szwed, Janusz Turakiewicz, Sandra Wierzbicka, Elżbieta Wojnicka.

English Editor: Sylwia Wesołowska-Betkier

Translators: Maciej Bańkowski, Grażyna Śleszyńska, Sylwia Wesołowska-Betkier, Sandra Wierzbicka

Photographers: Jan Balana, Łukasz Giersz

Polish Market Online Editor-in-Chief: Wiktoria Grabowska

Sales: Phone (+48 22) 620 38 34, 654 95 77

Katarzyna Malinowska – Sales Director [email protected] Suhoveeva [email protected] Surma [email protected]

PR: Joanna Fijałkowska [email protected]

Design and DTP: Foxrabbit Designers

Printing: Zakłady Graficzne TAURUS – Stanisław Roszkowski, www.drukarniataurus.pl

Basic circulation: 8,000

Oficyna Wydawnicza RYNEK POLSKI Sp. z o.o. Nr KRS 0000080385, Sąd Rejonowy dla m.st. Warszawy XII Wydział Gospodarczy Kapitał zakładowy 80.000,- zł. REGON 011915685, NIP 526-11-62-572

Published articles represent the authors’ personal views only. The Editor and Publisher disclaim any responsibility or liability for their contents. Unso-licited material will not be returned. The editors re-serve the right to edit the material for length and content. The editors accept no responsibility what-soever for the content of advertising material. Re-production of any material from this magazine re-quires prior written permission from the Publisher.

Marek Zuber, a financial markets analyst: Will the euro zone survive? # 93

law & TaxES

Leszek Kot, “Barylski, Olszewski, Brzozowski” Attorneys at law: Scrambling with procurement law # 94

Maja Sujkowska, Chairperson General Partner’s Board at European Center for Legal Consultations: Pursuing a career in a regulated profession in Poland # 96

CUlTURal MONITOR

In the European league of opera masters # 98

Culture is everywhere # 100

Cultural Monitor # 102

Jerzy Owsiak: Something to be proud of # 104

EVENTS

Meeting of the Friends of the Polish Success Academy # 107

Cross-border opportunities of SMEs # 108

Luxury and Beauty # 110

Deni Cler Milan Show Autumn – Winter 2011/2012 # 112

CorreCtionThe statement by LOT spokesman Leszek Chorzewski printed in the 5/2011 edition of “Polish Market” contains an error. The first paragraph of the answer to the question: “What are the advantages of LOT and what are the main ideas that will be shaping the futures of one of the strongest and high-profile brands on the Polish market?”

correctly reads as follows:

„A state-of-the-art fleet based on Embraer planes is definitely what we can call our good side. The decision that we had taken a couple dozen years ago to purchase Embraer planes from the Brazilian producer allowed us to make our fleet up-to-date. LOT was the first European airline to introduce EMB 170 airplanes. The de-liveries of EMB 195, which can board 112 passengers, has commenced this year. The first plane joined our fleet in April and is to serve our European connections. Currently LOT is using 25 planes from the Brazilian producer and we are planning to introduce three more Embraer 195’s during this year and next.”

The Editorial board apologizes for the mistake.

Editorial

7-8 /2011 :: polish market :: 7

After the catastrophe in Japan, once again we began to fear nuclear power plants and the debate whether it is worth investing in this type of energy production resumed. Polish nuclear programme is being ques-tioned, especially after Germany decided to close part of its nuclear power plants. And then, an alternative for Poland ap-peared – shale gas.

The first drilling results are promising, but we have to wait sev-eral more years for reliable and complete data on our resourc-es. Under the currently granted licenses, and there are over 90 of them, at least 120 bore holes are to be drilled.

“Many people look forward to a joint report of the US Geologi-cal Services and the National Geological Institute – the Nation-al Research Centre, which is due to be released in autumn of 2011. However, we need to bear in mind that it will also serve as a more reliable projection presenting an estimate of the Pol-ish shale gas resources,” says Henryk Jezierski, Undersecre-tary of State, National Chief Geologist, in an interview pub-lished in this issue.

Shale gas exploration and exploitation may well become the first field in Polish-US cooperation in which Poland will be a full partner and not just a sales market. “Secretary Hilary Clin-ton, as well as President Obama are interested in the possibil-ities of working together, both because it is good for Poland’s and our economic prosperity, but also it’s the kind of cooper-ation that has real strategic significance for both of our coun-tries. It is important for both of us to work to improve our own energy security on a national basis as well as promoting national security through the trans-Atlantic space,” said Lee Feinstein, US Ambassador to Poland.

But of course there are also the nuclear energy sceptics. The voices of opposition are beginning to emerge, saying that shale gas production is associated with a threat to the environment, environmentalists are beginning to vigilantly watch the pro-tests in the United States, where such production is under-way. However, one thing is certain: no risk, no growth, no in-novation, no modernity, and no inventions. Fear of progress is a universal human trait – after all we have been warned about steam engines, which were called monsters, dragons and more.

Fear of the new has always distinguished a regular mortal from a scientist.

Krystyna Woźniak-TrzosekPresidentRynek Polski Publishers Co. Ltd.

July 1 has become an important date for Po-land. Here we are, having taken over the Pres-idency from Hungary, and now leading in the EU Council is our job. Among others, the pri-ority of the Polish Presidency is that the pro-cess of signing association agreements and creating free trade zones progressed within the Eastern Partnership, particularly com-pletion or significant progress in negotiations with Ukraine and Moldova. Polish Presidency will also strive for progress in negotiations concerning visa liber-alization. Probably the key political decisions in this regard will be made during the September Eastern Partnership Summit with the participation of the heads of state and government of all member and partner states. In the case of Belarus, the aim of the Europe-an Union is to encourage this country to cooperate with the West, however, provided that the country respects basic rules of democ-racy and human rights. “It is not just about economic moderniza-tion, or modernization of legal institutions and the political system. What is needed is the modernization of the observance of human rights, and in this respect we have been observing a regress in the countries of Eastern Partnership. Even Ukraine, which used to be the ‘top student’, fell in the Freedom House ranking to the catego-ry of half-free countries,” you will read in one of the articles in the Eastern Cooperation section.

Marcin Korolec, in an interview for “Polish Market” underlines that 25 years ago Poland and Ukraine were at the same level of econom-ic development. Currently, Poland is several times more developed than Ukraine, but it should be remembered that the main cause behind the development of Poland is the integration with the Eu-ropean Union. And this – in the opinion of the Deputy Minister of the Economy – is a good argument for our Ukrainian partners that it is worth making the difficult, pro-integration decisions and that it is worth to decide to take up the challenges connected with the process of integration.

Beata Wojna, PhD, states that Polish plans concerning Eastern Partnership may have to be altered. The international situation has caused the European Neighbourhood Policy to become the priority. “The fact, that the Polish Presidency programme includes signifi-cant references to the Southern dimension of this policy, should be considered a good sign and an attempt to move away from think-ing about European Neighbourhood Policy in terms of rivalry be-tween its Southern and Eastern dimensions.”

Let us remain optimistic and hope that our priorities and coop-eration with our partners from the East will bring business part-ners and will earn Poland the opinion of the promoter of Eastern Partnership.

Rita SchultzEditor-in-Chief

8 :: polish market :: 7-8/2011

President visits SlovakiaBilateral economic, trade, and polit-ical cooperation, and the priorities of the Polish Presidency of the EU, con-stituted the subjects of talks in Bratis-lava between the Presidents of Poland – Bronisław Komorowski, and of Slo-vakia – Ivan Gašparovič.

The issues of energy security and the new 2014-2020 EU budget were also discussed.

Both leaders, who before noon presided over the plenary talks of the Polish and Slovakian delegations, expressed their satisfaction with the very satisfactory mutual relations. As Bronisław Komorowski stressed at a joint press conference after the meeting with Ivan Gašparovič, Po-land and Slovakia are linked by rela-tions at “an absolutely above stand-ard level.”

“We also talked about 2011 being our year. The Slovakian Republic held the Presidency of the Visegrád Group, which it has now handed over to the Czech Republic. Hungary presided over the EU, and now the Presidency has been taken over by Poland,” ob-served Gašparovič at the conference. The Slovakian President added that it was the time for his country “to em-phasise its role, while Poland can pro-mote our interests.”

After the meeting with his Slova-kian counterpart, the Polish Presi-dent attended a breakfast organised by Prime Minister Iveta Radičová. Then he met the Mayor of Bratislava, Milan Ftacnik, a representative of the Polish community, and the Speaker of Na-tional Council of the Slovak Repub-lic, Richard Sulik. ::

German Chancellor angela Merkel in PolandAngela Merkel and her husband, Professor of Quantum Chemistry Joachim Sauer, paid a private visit to Pomer-ania at the invitation of the Polish President. During the walk, which started in the courtyard of Gdańsk’s Torture Chamber, the Presidential couple and their guests strolled through Gdańsk’s Main Town, seeing Artus Court, and St. Mary’s Church, whose steeple has been recently renovated. Merkel felt particularly connected with Gdańsk – in 1928 her mother was born there.

President Komorowski, when asked about the subject of the talks with the German Chancellor, emphasised that this was a private visit, so it had no “political agenda.”

“Of course, there are subjects that always come to mind, besides the strictly private talks, such as European issues, or the problems of Polish-German relations,” said the Pol-ish President.

In Bronisław Komorowski’s opinion, this kind of meeting is always an opportunity to tighten personal contacts and cooperation. “This is always worth doing, also in interna-tional relations. I am looking forward to this visit, hoping that it will be mostly a private one, providing rest and lei-sure to the Chancellor,” said the President before the meet-ing. ::

President’s participation in the inauguration of the Polish Presidency

“It is truly a very important and beautiful day, the 1st of July 2011,” said President Bronisław Komorowski a few minutes after midnight, when an illumination with the logo of the Pol-ish Presidency had been lit on the facade of the Presidential Palace.

“It is worth remembering that it has been exactly 20 years since the dissolution of the Warsaw Pact in 1991. So we have 20 important years for Poland behind us, good years, open-ing good prospects for the future. There is a lot to be glad about, and to be proud of. The Pol-ish Presidency of the Council of the European Union has started. It is a great success for us, a source of great joy,” said the President.

Polish President talks to the President of the European Council about Eastern policy

Eastern policy, particularly towards Moldo-va and Ukraine, was one of the issues dis-cussed during the meeting of Bronisław Ko-morowski and the President of the European Council Herman Van Rompuy.

“I would like to observe with enormous satisfaction that there is far-reaching agree-ment on the subject of the prospects of Euro-pean integration for Moldova and Ukraine,” stressed the Polish President. He added that the President of the European Council will be presiding over the Eastern Partnership Sum-mit in Warsaw, which is due to take place in September.

Both politicians met at the Belvedere Pal-ace on the occasion of the inauguration of the Polish Presidency. President Komorowski

emphasised that the meeting with President Van Rompuy was pleasant and insightful. “It is a momentous event,” Van Rompuy described the launch of the Polish Presidency. He added that the European project is still attractive to our neighbours – it is a symbol of peace and prosperity on our continent. He underlined that during the time of its membership in the EU, Poland has gathered enough experience to cooperate with EU’s partners and to know how to reach agreement. ::

7-8/2011 :: polish market :: 9

Prime Minister on the Polish PresidencyPrime Minister Donald Tusk has present-ed the priorities of the Polish Presidency in the Polish Parliament. He emphasised that dur-ing Poland’s Presidency the Polish govern-ment will not only make efforts to maintain, but also improve, Poland’s status as a respon-sible and highly-respected country.

“It is expected that the Presidency will allow us to create political leadership which does not consist of taking routine decisions but which may help the EU as a whole,” he said. “It is of paramount importance that during the Presidency we can maintain and increase Poland’s status as a country which is highly valued in internal EU debates and which demonstrates a high level of respon-sibility with regard to the EU’s foreign rela-tions,” he stressed, adding that Poland will focus on maintaining and improving its sta-tus as a responsible state which is able to deal with its economic and financial issues.

The Prime Minister underlined that Po-land has developed its image as a country which is becoming the new driving mo-tor of the European Union. “Today Poland is treated as one of the leaders - of which un-fortunately there are few in the EU - which strive to force through issues of EU-wide

significance,” said the Prime Minister. As he observed, since the beginning of the crisis Poland has consistently acted against state control and nationalism, which is visible in the actions and declarations of some politi-cians and EU Member States.

Donald Tusk remarked that it is impor-tant for good political initiatives to appear during the Presidency. “We have a signifi-cant interest in Poland’s Presidency being remembered by Europeans through issues including the finalising of long-term pro-cesses,” he said. “It is possible that during the Polish Presidency we will see the com-pletion of negotiations with Croatia, which

would mean that its accession treaty will be signed during the Presidency,” explained the Prime Minister. He also added that it is still possible to complete negotiations with Ukraine, concerning the association agree-ment and the agreement on free trade. “This would be the first successful step in the pro-cess of bringing Ukraine closer to Europe,” the Prime Minister stated.

“I think that those who are strongly op-posed to my government should for these few months attempt to act respectfully and re-frain from thoughtless and aggressive state-ments directed against the promotion of Po-land’s national interest,” he added. ::

Joint session of the Council of Ministers and European Commission“Today’s meeting has reaffirmed our mutual intentions of strong cooperation aimed at ensuring that a majority of our de-cisions are EU-oriented,” declared Prime Minister Donald Tusk after the meeting on 8 July with European Commission President Jose Manuel Barroso, and the joint session of the Council of Ministers and the EU College of Commissioners at the Prime Minister’s Office.

Joint sessions of the government and EU Commissioners is a traditional start to any Presidency of the EU. Such meetings allow a detailed discussion of the plan of the ro-tating Presidency of the Council of the Eu-ropean Union.

The first point on the agenda of the Euro-pean Commission’s visit to Warsaw was the plenary session, during which the most im-portant elements of the Polish Presidency programme were discussed. Prime Minister

Donald Tusk and European Commission Pres-ident Jose Manuel Barroso, as well as Minis-ters and Commissioners, discussed the is-sues of the new long-term EU budget, energy policy, universal EU patents, the Single Mar-ket Act, the establishment of a European En-dowment For Democracy, the new regulation concerning cohesion policy, and the legis-lative package of the Common Agricultural Policy. The subjects discussed also included the issue of Polish vegetable exports to the Russian market.

After the plenary session, a bilateral meeting of President Jose Manuel Barroso and Donald Tusk took place, while respec-tive Ministers worked with Commissioners in thematic groups. During these individ-ual meetings Ministers and Commissioners reached agreement on issues such as how the Council of the European Union (presided

over by Poland) will be working on legal Acts submitted by the European Commission in the coming months. During a joint press conference both Prime Minister Tusk and President Barroso stressed the importance of good cooperation between the Presiden-cy and the Commission. “If Europe is inca-pable of taking collective decisions based on cooperation, then all European coun-tries will have to suffer the consequences. When we speak about the EU, what is im-portant is a community approach and full solidarity,” President Barroso said. “At the moment Europe is full of pessimism. There are extreme forces questioning the essence of the EU and thereby doing their own states a great disservice. I hope that Polish opti-mism and enthusiasm will become conta-gious,” Barroso added. ::

10 :: polish market :: 7-8 /2011

ConstructionOur Guest

we have to promote innovation

There are many firms in Poland that are truly innovative, though completely unknown. For this rea-son I highly value such initiatives as the Polish Market Award Progress 2011 because they help us to find such firms and promote them as modern en-terprise models. Publicising genuine successes of innovative firms, suc-cesses that are so rarely noticed by the media, is an important part of our joint activity aimed at develop-ing our country. We all too often dis-cuss matters which are of little or no importance from the point of view of the real interests of the Polish econ-omy. I think that such a competition should be continued. We should do everything we can to make sure that innovative firms can feel everyday our respect for them and our pride in their achievements.

Risk assessmentIn Poland, there are still too many constraints hampering the devel-opment of innovation. There are ad-ministrative barriers in the form of regulations that are not conducive to risk-taking in innovative activi-ty. Among these regulations are such important laws as the law on pub-lic procurement, law on public-pri-vate partnership and the law on off-set projects, or investment in Poland by foreign suppliers of military equip-ment. In line with the letter and spirit of our law, the best thing is to carry out safe projects, which do not re-quire taking any risk. But this is no road to big success – businesses ready to take well-calculated risks, some-thing possible only in the proper reg-ulatory environment, have the great-est achievements. Another barrier

are constraints on access to high-risk capital. Paradoxically, the problem is not a shortage of money. Banks have financial means but are reluctant to take the risk of investing in an un-certain success of innovative activ-ity because it is necessary to know how to assess the risk. Our history provides a partial excuse for the sit-uation – we still have relatively few innovation successes on which such calculations can be based. But it is not true that it is absolutely impossible to assess this risk. However, confi-dence is needed that this kind of ac-tivity may be truly profitable, as is the case across the world.

wise PolandThe “Wise Poland” manifesto I have recently published is the result of my determination in fighting the wide-spread disbelief that success based on human creativity can be achieved. I know the problems that Polish in-novators are facing. But every day I meet many people who prove that creativity in thinking about a firm’s activity may bring about real suc-cesses. Unfortunately, this potential is not sufficiently exploited in Po-land. At school, there is no emphasis placed on developing students’ cre-ativity and ability to work together in a team. Apart from creativity, the eagerness and ability to work togeth-er is the key condition of success. You may be creative and at the same time cooperate with others, reach compro-mises in discussion and know how to reach agreement on the most difficult issues. Polish people do not trust in-stitutions or each other. Meanwhile, it is impossible these days to do great things all on one’s own. ::

Prof. Michał kleiberPresident of the Polish Academy of Sciences (PAN)

7-8 /2011 :: polish market :: 11

ConstructionOur Guest

let us favour ambition and innovation

What is innovation? It means put-ting into practice an idea which cre-ates a new value for a firm or country. It is worth emphasising that one of our strengths is that Polish people are en-terprising. We can do something out of nothing. We have proven that if we only want to we are able to get involved in a social activity. The best example is our activity in the net and the web portals created.

There are several excellent exam-ples which show that we can think in terms of innovation. Luckily, it is not so that the whole Polish economy has difficulty embracing innovation. In a recently published Report on In-novation in the Polish Economy, we present the first examples of institu-tional cooperation between universi-ties and business. It is at the interface of business and science that the most valuable innovations emerge. We have many “clever guys” and young people achieving international success. It is worth investing in young people who win prestigious scientific and com-puting competitions, both at home and abroad.

A big advantage is the expansion of large metropolitan centres because this is conducive to the development of innovation. We should take advan-tage of that. Millions of people across the world have a respect for Poland and sentimental attachment to it. This is important news, one which we should also use to develop an innovation-based economy.

Unfortunately, the report also pre-sents the weaknesses of the Polish state. First of all, there is red tape, which especially hampers innovation. The fear to take a risk is still wide-spread, especially in the public sec-tor. We are still not greedy enough – I mean not only greed for money but also greed for international suc-cess or eagerness to leave behind a good business. Polish people should be more ambitious, more greedy. We think that comfort kills innovation. Real innovators work in garages, and do not enjoy luxuries or benefit from huge subsidies for developing a pro-ject or product. A trait that does not reflect well on us Poles is that we do not want to work together. The best example of this unwillingness is that more than 10 graphic marks are used to promote Poland abroad.

Polish people have become workahol-ics – instead of developing innovation, we work almost the longest hours in the world. The Polish education sys-tem and the system of financing scien-tific research are assessed very poorly. It even seems that it eliminates inno-vators. We should send our children to work so that they can learn how to be enterprising and how to earn their own money.

But the most important thing is that the drive for innovation is wak-ing up in people, something which of-fers hope for the development of our country. ::

Prof. krzysztof RybińskiRector of Vistula University

12 :: polish market :: 7-8 /2011

Research achievements and road practice

What do you think are the key transportation issues connect-ed with Poland being the co-host of EURO 2012 European Football Championship?Transportation in the context of

the co-organization of EURO 2012 is a huge challenge. According to the esti-mates, Poland may be visited by even one million football fans. Regarding land transportation, the key issue is the broad range of the planned for 2012 development of the motorways and expressways network in accordance with the Government National Road Construction Programme 2008-2012. This programme envisages the con-struction of 906 kilometres of mo-torways and 2,101 kilometres of ex-pressways by June 2012. The coming months will show what percentage of this programme will be implemented. I believe that other important issues are those connected with the mod-ernization of railways, coordination

of traffic and internal transport in host-cities.

What is the role of the Institute in the broader understood research process?The Road and Bridge Research In-

stitute (IBDiM) is a leading Polish sci-entific institution dealing with prob-lems of infrastructure. Our research and implementations, expertise and consultations support investments, modernizations and renovations of roads and bridges. We also help to in-troduce rational road network man-agement systems. We recognize the state of roads and bridges using mod-ern diagnostics methods, we create and implement innovative solutions for materials, as well as technologies for road and bridge construction. We have accredited research laboratories and we certify products used in com-munication construction. The results of our research and our experience is

used by both road administration – on the national and local level, and com-panies executing road works.

Does research conducted by the In-stitute result in a high level of inno-vation of this sector of the economy?In the recent years IBDiM partici-

pated in the development of many in-novative solutions working with other research institutions and enterpris-es. Examples of this are innovative projects like: LED Road Signs (DZD) – electronically controlled new gen-eration signs with variable content; Active, Intelligent Road and Bridge Safety Barriers (AIBDiM) using arti-ficial intelligence in monitoring and controlling of road barriers, as well as the Intelligent System of Complex Ve-hicles Identification (ISKIP) enabling automatic identification of the vehicle based on simultaneous recognition of such characteristics as colour, brand, type and the registration number.

Mobile laboratory measuring road infrastructure

Prof. Leszek Rafalski, director of the Road and Bridge Research Institute (IBDiM)

7-8 /2011 :: polish market :: 13

How do you use European experi-ence to stimulate investments and support investors?IBDiM actively cooperates with for-

eign centres and participates in nu-merous international organizations. It is associated e.g. in FEHRL – the Fo-rum of European National Highway Research Laboratories bringing to-gether the leading European institu-tions dealing with the issues of roads and bridges. This organization cre-ates strategic research programmes (SEERP) which are the basis of later research projects financed by the Eu-ropean Commission. A representative of IBDiM is an employee of FEHRL sec-retariat. This has direct bearing on the transfer of modern solutions for Polish road practice. IBDiM is also a partner of many European programmes. An ex-ample of the high level of our research is, one of the three in Europe, Mobile

laboratory of pavement parameters quantification based on non-destruc-tive testing research – SPID.

Do technologies and materials used in the construction of Polish roads meet European standards?Materials used for the construction

and maintenance of roads in Poland do not differ from European standards. Most of the materials meet the PN-EN norms. Numerous modern materi-als such as polymer pavements, poly-mer modified emulsions, thin hot and cold layers were introduced to Pol-ish road construction practice. Re-cently, work on the implementation of mineral compounds connected with foamed asphalt has been carried out. It is investors who decide about the construction of roads and the thick-ness of individual layers. One way of cost-effective building is staging the

Implementation of the intelligent system of comprehensive vehicle identification project

Researching road barriers: Crash test in a training site

Traffic speed deflectometer seen inside the mobile lab

thickness of the structure. However, this technology often makes it difficult for users to travel smoothly on the mo-torway, because performing the work requires exclusion of the reinforced lane. Another problem are the too low offers of the contractors which impede the implementation of materials and products of high quality.

What is the scale of needs and com-pletions in the field of bridge con-struction in Poland? What are the good examples of such invest-ments?It is difficult to precisely deter-

mine the overall needs in the field of new bridge construction. The analy-ses carried out few years ago show that 20 new bridges are needed only on the Vistula River in order to ensure ade-quate traffic conditions in Poland. At present, the construction of the long-awaited North Bridge in Warsaw is un-derway. Speaking about bridge invest-ments in Poland, I see the need to build small and medium-sized bridges. The fast implementation of this type of bridges, especially on motorways and expressways, is enabled by an innova-tive programme “Bridges in 3 months” developed by our Institute. Its essence is to return to pre-fabricated systems which would allow faster completion of bridges. ::

Road and Bridge Research Institutewww.ibdim.edu.pl

14 :: polish market :: 7-8 /2011

ConstructionOur Guest

Poland offers its advice and experience, bets on partnership

“European Dilemmas - Partner-ship or Rivalry?” is the slogan of the forthcoming 21st Economic Fo-rum in the Polish mountain resort of Krynica Zdrój. The forum is the most important meeting in Po-land of politicians, business peo-ple, researchers and media people from European countries, espe-cially Central and Eastern Europe. What do you expect of the debates?I think that partnership is a fun-

damental European value, both in the internal and external dimension. The rules of the single market mean that all the countries apply very similar or identical economic regulations. There are no differences in this respect be-tween new and old European Union members or rich and poor members. One should remember that the part-nership also applies to dialogue with external countries, which is a very important item of our common dis-cussion. We need to create a new ap-proach to the neighbourhood poli-cy without dividing it into eastern or southern policy. The neighbourhood policy should be expanded by the ex-port of our economic achievements, legal regime, food safety and stand-ardisation rules, and other elements necessary in building a single mar-ket. In the difficult time of economic crisis in the world and in Europe, we will not be talking about any large-scale EU enlargement. But Poland’s and other countries’ experience shows that economic integration has a very favourable impact on the development

Undersecretary of State at the Ministry of Economy Marcin Korolec talks to Ewelina Janczylik on the eve of Poland’s presidency of the Council of the European Union.

of both a new member state and the remaining EU members. Our propos-al for discussion within the Europe-an Union Council of Ministers and with the Eastern Partnership mem-bers will be how to expand the area where the EU internal market regu-lations are in force, especially regula-tions on the free movement of goods, services and capital.

Do you expect the Eastern Part-nership programme to be a suc-cess? Will we be able to share our experience with our neighbours and win them over for some ideas?Poland has greatly benefited from

economic integration. As a result, our Polish experience is very valuable. It is an excellent argument for our partners, not only Eastern Partner-ship members but also North Afri-can countries. Twenty five years ago Poland and Ukraine were at the same level of economic development. Now, Poland is several times more devel-oped than Ukraine. And one should remember that our integration with the EU contributed the most to this development. It is a very good ar-gument for our Ukrainian partners, showing them that difficult pro-in-tegration decisions are worth taking and that challenges associated with the integration process are worth ac-cepting.

What impact can the difficult eco-nomic situation of Greece have on the EU economy? Could this crisis discourage our eastern partners? Does the European Union have any emergency plan?I think that the European Un-

ion has to cooperate with its neigh-bours, whether they are in the east or in the south. These countries should be helped – but of course only if they want to be helped. We have to propose them the integration process as an in-strument supporting their economic growth. Otherwise, the neighbouring countries will not use the opportunity offered by economic and political in-tegration. The European Union has to become again the centre of economic gravitation. It is a very bold approach but without it we will not succeed in building a positive economic vision.

21st Economic ForumKrynica, Poland, September 7-9, 2011

„European Dilemmas- Partnership or Rivalry?”

The base for the 2011 Economic Forumprogramme will be groups of topicsdiscussed during the 2011 edition:Macroeconomics, Business and Management International Politics, Forum of Regions, Energy Forum, Innovations and SustainableDevelopment, New Economy, State andReforms

» More than 120 plenary sessions and panel discussions, lectures of the personalities of the publicsphere, workshops and round table discussions;

» 2 000 invitees from Europe, Asia,USA and Middle East countries

Cultural programme: literatureevenings, presentation of movies,concerts, evening cocktails organisedby the Economic Forum partners;

Wide variety of recreational eventsscheduled for September 8 and 9 after4pm more various than in 2010

The Economic Forum in Krynicahas became an important spot onthe political map of the world andprobably the only one, where Eastmeets West on such a large scale

www.economic-forum.pl contact: [email protected]

210x290 FE_230x295 10-06-2011 16:27 Strona 1

16 :: polish market :: 7-8 /2011

ConstructionOur Guest

On June 20 you accepted your nomination as a member of the EU-Russia Gas Advisory Council from EU Commissioner for Ener-gy Günther Oettinger. What is your most important task in this insti-tution?Just days before Poland assumes

the presidency of the Council of the European Union, this decision is very good news. The future of the EU en-ergy policy will be the main political topic we want to propose for discus-sion to the ministers responsible for energy. The European Union is and will remain a net importer of energy resources. We have to work out basic rules for our relations in this respect with external partners. Of course, each EU member state taking part in the discussion has various kinds of experience in its relations with other countries. The important thing will be conclusions from this debate adopted by member states and then commu-nicated to their external partners. I hope one conclusion will be that the EU’s external energy policy should be based on the paradigm of the inter-nal energy market, third party access rights (TPA) and the transparency of commercial contracts. I think that by appointing me to this post the Euro-pean Commission wanted to point to the process which Poland had started in relations with the Russian Feder-ation in 2010. In the near future nat-ural gas will have its “golden age” in the EU, irrespective of whether it will be imported or come from indigenous sources. Gas will probably be one of the most important resources, if not the most important one. The Russian Federation is a very important trade partner for the European Union. We have to promote our internal energy market rules towards external part-ners. This is how I see my role in the Gas Advisory Council. Interestingly, I am the only central government of-ficial in the Council.

The prospect of using shale gas has been discussed in Poland for a few years now. And you said that nat-ural gas may experience its “golden age” soon. If so, does Poland have a chance to become a shale gas super-power? Or is it too early to say so?I would very much like gas com-

panies’ estimates concerning Polish

shale gas resources to come true. As far as I know, the geological structure of the Polish shale gas deposits is al-most identical with that of the depos-its in the United States. Consequent-ly, the probability that shale gas could be used on a large scale in Poland is very high. The drilling process has only started in Poland and we know about one horizontal well that has been completed so far. Press reports are very optimistic but we cannot be certain about shale gas resources in Poland until several hundred wells have been drilled. One optimistic re-port is not enough. But if it is proved right by successive wells then I think the Polish gas sector will indeed have very good prospects, which will also be associated with decisions by our important partners in the European Union. Today, we have to wait patient-ly for more news about gas deposits.

On April 11 Poland became a mem-ber of the Council of the Interna-tional Renewable Energy Agency (IRENA). You represent our coun-try. The Council promotes renew-able energy and its use. How is Po-land going to pursue the Council’s tasks?The idea to set up an internation-

al agency for renewable energy orig-inated in Germany. And this is how the idea to promote renewable en-ergy emerged. Initially, discussion on establishing the agency was held locally. But in 2008 more countries started to declare their intention of

joining the organisation. Today, the agency is a global organisation with over 100 members. The Agency’s As-sembly, which is its highest authori-ty, held its first meeting in early April. The Assembly formally approved Abu Dhabi as the IRENA headquarters and formally elected its statutory bod-ies. One of them is the Council. It is to meet twice a year and offer advice to the Director-General about the direction in which the organisation should develop. First of all, the agency should be a platform for the exchange of information about available tech-nologies. For the European Union the problem of renewable energy means discussion about sustainable devel-opment and a reduced use of fossil fuels. But one should remember that renewable energy is the only chance for many African and Asian countries to progress to a higher development level. There are still scores of people who have no access to electricity and will not gain this access without the use of dispersed sources of renewable energy. We need an institution offer-ing reliable information about which technologies are worth promoting and adopting. An objective and ana-lytical approach to this issue is need-ed. And these are the tasks adopted by the IRENA Council. In the time of crisis the agency is not likely to have much money for loans. But we are at the start of our road and the organi-sation has every chance to play a very important role in the future.

Interview: Ewelina Janczylik

© C

arlo

Tac

cari

- Fo

tolia

.com

18 :: polish market :: 7-8 /2011

President’s award

Bronisław Komorowski, the President of the Republic of Poland, has grant-ed the Presidential Economic Awards in Poznań. They went to the best four Polish enterprises selected from among 13 companies that had been nomi-nated by the Chapter of the Presidential Economic Award. The laureates were:

In the “Innovation” category: Solaris Bus & Coach S.a.

In the “Corporate Governance and Corporate Social Responsibility” category: Novol Sp. z o.o.

In the “Presence on the Global Market” category: Grupa fakRO

In the “Green Economy” category: waTT Produkcja Systemów Solarnych

The ceremony took place in Poznań during the Gala of the 90th Anniversary of the Poznań International Fair. ::

The Economic awardof the President of the Republic of Poland

© p

hoto

s: p

rezy

dent

.pl

The President of Poland presents the award to Solange and Krzysztof Olszewski of SolarisBus&Coach

The President of Poland presents the award to Ryszard Florek, president of Fakro

The President of Poland presents the award to the representatives of Novol:

Piotr Nowakowski and Piotr Olewiński

The President of Poland presents the award to Marek Szymański, the executive director at WATT

20 :: polish market :: 7-8 /2011

President’s award

Polish Economic Nobel Prize

What does Corporate Social Re-sponsibility mean for you? Is it just meeting formal and legal require-ments or also social activity and eco-friendliness?P. Olewiński: Novol’s activities are

guided by the principal of sustaina-ble development because of the belief that the implementation of projects aimed at environmental protection, although it does not bring immedi-ate financial benefits, is necessary in

The President’s Economic Award is one of the most prestigious awards, which over the years were granted to Novol. It bears enormous emotional weight – after all, it is a prize awarded by the most important person in Poland on the basis of an evaluation carried out by a broad chapter consisting of recognized business and economic authorities, says Piotr Nowakowski, President of Novol Sp. z o.o. The fact of receiving it from the President’s hands is a huge ennoblement for us. This gives us the greater satisfaction that we did not enter the competition ourselves, but we were proposed by an independent organization, adds Piotr Olewiński, the Vice-President.

order to ensure ecological safety and the conservation of natural values of our surroundings.

Novol, owing to sustainable and in-tegrated policy, seeks to reconcile the need to achieve satisfactory economic performance with deep concern for the natural and social environment. Un-doubtedly, the implementation of the international programme “Responsi-ble Care” (www.rc.com.pl) is an im-portant element in achieving these

goals. It is an expression of commit-ment to voluntarily undertake effec-tive measures ensuring the implemen-tation of principles of eco-ethics, the improvement of working conditions, increase of process safety and stay-ing in touch with the environment. In order to improve the results of envi-ronmental performance, NOVOL has implemented and certified for com-pliance with the international stand-ard ISO 14001: 2004, an environmen-tal management system.

You have received the award in the Corporate Governance and Corpo-rate Social Responsibility catego-ry. It concerned companies which show particular attention to man-agement standards. How did you achieve the highest level of good organization and governance?P. Nowakowski: According to us

the key factor is the establishment of a team of responsible co-workers and perfecting partner relations in inter-nal and external contacts. Creating a proper working atmosphere and re-specting another people is an essen-tial component of our everyday work.

P. Olewiński: A steady team of peo-ple, whom we can trust is a power-ful asset of our company. Over the years, there are better and worse pe-riods in business and it is precisely in these vulnerable times that our ap-proach to this way of working pays. A good team makes it easier to nav-igate through difficult moments and solve problems faster. A confirmation of this aspect is the very low turnover of employees in our company. ::

From left: Piotr Nowakowski, President of Novol, Piotr Olewiński, Vice President of Novol

22 :: polish market :: 7-8 /2011

President’s award

fakRO – we are successful on the global market

What does the Economic Prize of the President of Poland mean to FAKRO?This prestigious award, which

FAKRO has received for the second time, is first and foremost proof that a Polish company can succeed on the competitive global market, although this still represents a great challenge for Polish companies. This means not only grappling with a capital giant, but it also is a technological race. Glob-al competition forces companies to continuously increase quality, be in-novative, motivates them to act and develop. It has the features of sports-manship, where the prize at stake is winning in the worldwide economic competition. FAKRO has successful-ly won over foreign markets. Today it is the world’s second largest producer of roof windows. The FAKRO Group,

Interview with Ryszard Florek, president of FAKRO

employing 3,300 people, consists of 12 production companies and 14 dis-tribution companies located in Eu-rope, Asia and America. FAKRO roof windows are distributed in 47 coun-tries worldwide. The company is also the world’s leading manufacturer of attic stairs.

The work of my associates and em-ployees in Poland and abroad has also contributed to winning such a prestig-ious prize. It is also thanks to our dis-tributors, roofers assembling our roof windows and customers who choose our products. It is them who give us the opportunity to develop an inter-national business. Our success is also the result of excellent cooperation with foreign partners, who are very com-mitted to building and strengthening the position of FAKRO on the global market. All this makes the company

grow and create more jobs, not only on the production lines but also in the research and development and export departments. We were also given the opportunity to be one of the compa-nies which drive the economic de-velopment of our country and create Poland’s prestige on the internation-al arena. After all, it is Poland that has become the global leader in roof win-dow manufacturing.

What, in your opinion, is the most important in managing a company?To manage a business you need to

have specific knowledge and persever-ance in pursuing goals. You also need courage. I mean the willingness to take risks. But with all this you must be able to count, predict, analyze, listen and take concrete decisions. All un-dertakings should be carried out with persistence, unconventional thinking and responsiveness to market chang-es. Flexibility in relation to market and customer requirements, as well as continuous investment in prod-uct quality and the implementation of new solutions in production are also necessary.

An extremely important element is the ability to recruit employees. The realization of an idea is only possible when the project is carried out by peo-ple, who believe that even the most fantastic visions can come true. The condition of belonging to such a group is knowledge, diligence and determi-nation in pursuing a goal. The success of a company is always built by peo-ple. In a changing economy an in-creasing role is played by the knowl-edge and attitude of employees. This is the “competitiveness factor” that allows companies to find their niche on the market.

What makes your products desir-able also outside of Poland?FAKRO always approaches individ-

ually customer needs. Due to climat-ic and architectural differences these

Ryszard Florek receives the President’s Economic Award from Bronisław Komorowski, the President of the Republic of Poland

7-8 /2011 :: polish market :: 23

President’s award

needs are very diversified. But there are many features that all our cus-tomers have in common. These are: the need to feel safe, focus on energy saving, the user’s comfort and to have as much natural light in the room as possible. All FAKRO roof windows meet these needs.

A unique feature of our roof win-dows is their safety. FAKRO roof win-dows are equipped with a special top-Safe reinforcement system, which significantly increases the window’s resistance to break-ins, and addition-ally protects against accidental open-ing, when stepping on the sash when someone is on the roof. FAKRO also offers a specialized Secure window, which apart from the topSafe system is also equipped with a package with anti-burglary P2A-class glass, a sys-tem protecting against removing the glass and a handle with lock. This way the window is in different ways pro-tected from intrusion, such as hitting from above, lifting the handle, easy disassembly or breaking the glass.

An important feature of FAKRO products is their energy efficiency, which is a result of many factors. An important element is the automat-ic air inlet V40P, which is typical-ly mounted in roof windows. By au-tomatically adjusting the size of the flow channel, the inlet provides the optimum amount of air, providing a healthy micro-climate in the attic and energy savings. It is worth add-ing that FAKRO has the warmest win-dow on the market – FTT U8 Thermo – in its product line. It is tailored to the needs of passive buildings. When assembled with the Thermo flash-ings, it has the heat transfer coeffi-cient of 0.58 W/m2K, which makes it the most energy efficient roof win-dow in the world.

The preSelect and proSky roof win-dows series are a symbol of comfort. PreSelect is a new-generation roof window with two separate functions of opening the sash: tilting and rotat-ing. The separated opening functions provide stability and increase the us-er’s safety. The tilting function allows easy approach to the edge of an open window, which increases the utility space of the room and provides un-obstructed view outside. The rotation function is used to wash the outside of the window and to install the awning.

ProSky windows have large di-mensions it terms of height and width, but are suited to standard spacing of rafters. They are ideal for lighting the room, and the handle on the bottom frame is always at hand. In turn, the increased axis of rotation allows even a tall person to comfortably stand at an open window.

FAKRO is still one of the few inno-vative companies in Poland. Where does this modern approach come from? What are the activities tak-en in this regard?Since the beginning, FAKRO has

focused on innovation, which, next to the highest quality of products, is the key to success on global markets. In the pioneering years, I personally worked on developing new solutions and constructing roof windows. Now the company has a modern R&D cen-tre which employs over 70 engineers. FAKRO has filed almost 80 patent ap-plications. We export not only roof windows, but also solutions and the creative technological thought de-veloped by Polish engineers. This way FAKRO sets new trends for the roof window industry in the world and Poland has become the world leader in their production.

Innovation opens the way for suc-cessful expansion into foreign markets. Therefore, FAKRO yearly enriches its product line by implementing new

technologies, and the engineers from the R&D department are the authors of many breakthrough solutions in the roof window industry.

What are your further develop-ment plans?For years, we have been consist-

ently executing our company strat-egy of building a global business and strengthening our number two position in the world. We are aiming at reduc-ing the gap to the global market leader in roof window production. A higher share in the global market means low-er costs, mainly of distribution, while it limits the possibility of price dif-ferentiation for our main competitor, which today is the main constraint for FAKRO’s development. ::

FPP - V preSelect roof window

FTT U8 Thermo roof window

24 :: polish market :: 7-8 /2011

Innovation

The purpose for organizing this ceremony was the announcement of the most innovative firms on the Pol-ish market. The guests were greeted by Rita Schultz, the Editor-in-Chief of the “Polish Market” economic magazine. Then, Professor Krzysztof Rybiński, the Rector of the Vistula Universi-ty and the co-organizer of the event, highlighted in his speech the strengths of the Polish economy, owing to which companies who think truly innova-tively are present and successful on the market. However, Prof. Rybiński did not forget about the weaknesses of the innovative economy, which in turn cause the lack of economic de-velopment and create insurmount-able barriers. Yes, we have brilliant youth, but the system of education it-self is on a very poor level. We can also boast some examples of innovation,

however, bureaucracy known to all and risk aversion discourage inves-tors. Such examples could be mul-tiplied. The night of 28 June showed that we must think positive and sup-port companies, which are not afraid to take chances and create an inno-vative project.

Prof. Michał Kleiber, President of the Polish Academy of Sciences (PAN), also present at the ceremony, said that he appreciated initiatives of this kind because they help in discovering in-novative businesses. Such events are very important, as in Poland atten-tion is often directed towards things of little importance from the point of view of Poland’s interest. Prof. Kleib-er believes that everything should be done to encourage Polish entrepre-neurs to show their achievements, to boast them.

In attendance was also Prof. Hen-ryk Skarżyński, one of the most famous Polish researchers, who bets on inno-vation. His achievements are known and appreciated throughout the world.

The 2011 Progress Awards were granted in 7 categories. In the first one, for projects created indepen-dently, the award went to Integer.pl. In the best innovative project in the utility and versatility category two companies were awarded: Hydrome-ga and Unikkon Integral. In the ecolo-gy category the endeavours to protect the environment of three companies were distinguished: - Ecotech Polska Sp. z o.o., Ferro Sp. z o.o., and TFP Sp. z o.o. In the category project for small and mid-sized enterprises mis24.pl was awarded. For the best innovative project created with a research insti-tution Grupa TP was acknowledged. In the best innovative project in the telecommunications category Exatel S.A. was awarded and in the best in-novative project in the banking cate-gory the winner was Alior Bank. ::

Photos: Łukasz Giersz

The Innovation Gala organized by the “Polish Market” magazine and Vistula University took place in the Le Regina Hotel in Warsaw on 28 June 2011.

Progress 2011 Innovation Gala

private banking

HIGHER CULTURE OF BANKING.Alior Bank raises standards in every fi eld of banking, also in Private Banking.You can experience it in our Private Banking Branches:

Warsaw, Al. Jerozolimskie 94, Marzena Pietrzak, PB Offi ce Manager, +48 782 892 129; Gdańsk, al. Grunwaldzka 163, Jan Stranz, PB Branch Manager, +48 726 235 713; Katowice, ul. Rynek 12, Ewa Stelmaszek, PB Branch Manager, +48 782 893 391; Kraków, ul. Pilotów 2, Janusz Patla, PB Branch Manager, +48 723 685 006; Poznań, ul. Szyperska 14, Agnieszka Ostoia–Nowak,

PB Branch Manager, +48 723 685 343; Wrocław, ul. Marii Skłodowskiej-Curie 34, (Grunwaldzki Center Building, 5th fl oor),

Edyta Wantuch, PB Branch Manager, +48 726 087 692.

www.aliorbank.pl

ALI 069 11 A AliorPrivateBankingPolishMarket230x295.indd 1 7/20/11 1:12:48 PM

26 :: polish market :: 7-8 /2011

Innovation

krzysztof Chełpiński President, mis24.pl sp. z o.o.

what are the benefits of using the iPartner24 service?Imagine a world in which your TV automatically switch-es on your favourite channel, the refrigerator orders your

favourite meal and the car takes you to the chosen destination. This is the world from which our application, the iPartner24 internet ser-vice, comes from. It is designed to help companies operate efficiently and effectively, and free the company managers from everyday care for the business, directing their attention to the outer world, where they will be able to look for new innovative ideas, find contracts, build the company’s product line in areas hitherto unknown. I believe that this is very important for the economy. iPartner24 internet service is available immediately. It does not require any initial costs or invest-ment. You pay only for the use of it. Customers have an impact on the shape of the service by reporting their needs, which we gradual-ly realize. Our service can be used by businesspeople as well as reg-ular internet users. I will admit that I use it to store my documents in order to be able to find the desired information in the shortest time possible. Our company is developing the iPartner24 service, while be-ing its user, hence the new functionalities stem from practical needs, and the service itself is very well thought out and tailored for the user.

Is the iPartner24 project the only service provided by your company?The iPartner24 is the fundamental service of mis24.pl. Its usefulness in managing a small company is proved by the fact that it was chosen to cooperate with the SZOK service in a project carried out by the Cham-ber of Commerce for Electronics and Telecommunications. It serves as an application engine there. The SZOK service, delivered also via the In-ternet, promotes process management, providing exemplary models of organization for small and mid-sized enterprises. It allows these com-panies to use process management without the need to spend money on consultants, who would help describe the processes in the organ-ization. The models provided by SZOK are proved and they were de-signed with the use of the best world practices.

In addition to the iPartner24 service, mis24.pl is also the adminis-trator of a networking portal for wine lovers – nasze-wina.pl. The por-tal was created as a private initiative of my wife and me. Our intention is to create a community of wine lovers, with emphasis on the word lovers, for whom wine is a passion. Developing this networking por-tal, we also learn how such a community is formed, something we try to use in promoting our main product.

Tomasz Sańpruch (Capital24.tv), Maja Lidke (EFL), Anna Rosińska (Enel-Med), Agnieszka Nogajczyk-Simeonow (PTE Allianz), Aleksandra and Paweł Trochimiuk (Partner of Promotion)

Krzysztof Chełpiński (mis24.pl), Mirosław Kasprzak (PTE PZU), Bożena Lublińska-Kasprzak (PARP), Paweł Trochimiuk (Partner of Promotion)

Artur Niewrzędowski (Talking Heads) and attorney Michał Wochnik

Bożena lublińska-kasprzakPresident, Polish Agency for Enterprise Development (PARP)Although there are many awards granted for innovation at conferences and by various institutions, I think that

there are never too much of them. It is definitely worth to show, re-ward and award such companies. It is worth that they and their heads become a kind of celebrities, that they are in the media. Our experi-ence and research show that these examples are important. They en-courage and stimulate creativity, which Polish entrepreneurs are not missing. And this is necessary, because Polish companies, although they say they have problems with financing innovations, are really in-terested in introducing cutting-edge innovative solutions. Innovation does not always require a lot of money. Often it can be an organiza-tional or marketing change, one that can be introduced even by em-ployees themselves. PARP has recently completed a competition “Cre-ating Tomorrow” promoting employees who, by themselves, prepare innovative projects within their companies.

STRONG POINT OF ANY KITCHENFerro kitchen battery from scratch-resistant high quality steel

www.ferro.pl

28 :: polish market :: 7-8 /2011

Innovation

Piotr Radliński President of Unikkon Integral Sp. z o.o.Daniela Grabowska Vice-President of Unikkon Integral Sp. z o.o.

a company which is to meet the needs of customers in creating new computer solutions using the best and latest technologies. How do you do it?

We implement very different projects both simple and highly complex, and innovative. Our latest system MagicScribe identifies and converts speech into text. This system is widely used by doctors, lawyers, judg-es, journalists and “common” users. In practice, spoken text is changed by our programme into written text.

who will benefit from this project? Only large enterprises and in-stitutions or any user? Is the project popular?

This is a programme anyone could benefit from, high school students, journalists, judges, doctors, lawyers. This system can also facilitate contact with the world for people with impairments. Our system has been used in medicine for a year now. The first period of promoting the programme was the hardest and we emphasize with pride that we need clients who understand modernity and want to actively par-ticipate in its implementation. The system is used not only by indi-vidual users, but also institutions, and media helping us in promoting and developing new technologies. To date we have sold over 1,000 li-cences. We create technologies which initially are very innovative, but soon it turns out that the technology is no longer perceived as a technological innovation, but an indispensable tool in everyday life. Owing to our customers and striving to cater for their needs, we cre-ate ever new, ever more perfect programmes. This is also how Mag-icScribe was developed.

Dominik wojewódka President, EcotechEach award makes me happy. In this case I am partic-ularly happy because of the reputation of “Polish Mar-ket,” as well as the participation of the academic circle

from which I derive.Granting us the award exactly on this day is very symbol-

ic for me, as today is the day when the sale of Ecotech’s shares was launched. This is a private issue addressed to a maximum of 99 shareholders. We plan to raise about PLN5 million from the stock exchange.

First we will dedicate the funds for completing the construc-tion of our plant near Opole. Part of the proceeds will be dedicat-ed to finalizing and closing the already signed foreign contracts. These are mainly government contracts. And another part of the funds will be used for further research. We plan to take up work with waste, with which no one has done anything yet: radioactive waste and explosives. This is hazardous waste, occurring mainly abroad. Because it is outside of Poland that we most often operate.

Currently we have an agreement with the government of Ar-menia considering two very large projects. We have acquired these contracts owing to the GreenEvo project supporting Pol-ish export technologies. We have also signed a letter of intent with Vietnam for the decommissioning of chemical residues re-maining after the war. It is also a major project which will prob-ably include the rehabilitation of a military airfield. We are also carrying out a project in Israel. Very soon we will launch a plant in Lithuania. We are also carrying out talks with China, Canada, USA, Belgium and Holland.

Jarosław Chałas (Chałas & Partners Law Firm), Jerzy Marszalec, PhD (Innovatech Consulting)

Ewelina Janczylik (Polish Market), Piotr and Ewelina Dziubiński (TV Biznes), Jacek Kopyra (Korporacja Radex)

Lyreco : Beata Świerczyńska, Jakub Leonowicz, Arkadiusz Maciejewski, Paweł Szymczuk, Małgorzata Malinowska and Rita Schultz (Polish Market)

7-8 /2011 :: polish market :: 29

Innovation

Krzysztof Chełpiński (mis24.pl), Krystyna Woźniak–Trzosek (Polish Market), Bożena Skibicka (MIS SA), Agnieszka Nogajczyk–Simeonow (PTE Allianz), Dorota and Grzegorz Ciechomski

Anna Rosińska (Enel-Med), Rita Schultz (Polish Market), Aleksandra Trochimiuk (Tailor&Baker)

Marek Zuber (economist) and Rafał Hiszpański (Warta)

Polish Market: Sandra Wierzbicka (editor and translator), Katarzyna Malinowska (marketing director), Maciej Proliński (editor), Błażej Grabowski (vice-president)

Mirosław Kasprzak (PTE Allianz) and Natalia Suhoveeva (Polish Market)

30 :: polish market :: 7-8 /2011

Innovation

waldemar BudzyńskiVice-president for Technical Affairs, Exatel

Exatel is one of the largest telecommunication com-panies in Poland. what entities are your services addressed to?

Exatel caters for businesses, large operators and institutions of state administration in Poland. More than 1,500 entities are our clients. We provide services related to data transmission, line lease, voice service and internet. We rely on the newest and most modern technologies, owing to which we maintain a strong position on the market. Exatel has one of the most in-novative networks in Europe with a length of 20,000 kilome-tres of optic fibres.

you have received the award for the SuperCore IP project. what is it and what are its benefits?

We have been seeing the need to increase the capacity of back-bone networks for a good few years now. Last year, Exatel de-cided to expand its backbone network through equipping it in highly efficient routers integrated with IPoDWDM links and thus increasing its capacity 8 times, from 5 Gbit/s to 40 Gbit/s. This is one of the most advanced technologies currently used in tele-communications, which reduces the necessary investment out-lays as well as the costs of maintaining the network (i.e. through reducing electricity consumption).

zbigniew zienowicz President, Hydromega Sp. z o.o.

Since the beginning of your activity you have been dealing with designing and producing hydraulic sys-tems and industrial automation, but you have also been running research.

The common feature of all our projects are actuator-based hy-draulic systems, which occur practically in all of our innovative products. The idea for the company arose almost 30 years ago in the Gdynia Shipyard, when it turned out that the realization of many interesting and innovative projects was impossible in the shipyard. The company has grown on the basis of many interest-ing ideas and knowledge, which until today is its greatest asset. Consistent policy has led to many innovative products which to-day are produced in series. One of Hydromega’s successes was undertaking export production. There would be no development without investments. Using, among others, EU subsidies we have expanded our production facilities, which was a prerequisite for the realization of the currently signed contracts.

The title which you have won is a confirmation that a well thought-out tactic, creativity and introducing innovative pro-jects are a recipe for success.

It is difficult to talk about the recipe for success when talking about the economy. The awarded project is the result of many years of work of a group of people, including research institutes and the Military Technical Academy (WAT) and the Innovation Centre of the Polish Federation of Engineering Associations (NOT). Today Lewiatan has both civil and military applications. I am happy that our designs are created in cooperation with research and develop-ment institutes. We have a certain ease in establishing contacts with the world of science. I believe than we are helped by our pas-sion with which we create and implement our projects, which, I think, are the recipe for success, about which you asked at the beginning of our conversation.

Maja Sujkowska (ECKP), Beata Sujkowska (Ecoacoustic), Jarosław Chrobociński (Le Regal)

Maja Lidke (EFL), Balbina Wołongiewicz (Natura Drogerie)

Henryk Lewiński (Israel-Poland Chamber of Commerce) and Jarosław Dąbrowski (a Finance)

7-8 /2011 :: polish market :: 31

Innovation

Rafał Brzoska President, InPost Sp. z o.o.In the short span of the last few years we have proved that as the Integer.pl Group we can create new and improve existing solutions in the field of postal and courier services. The best area for innovation is without doubt

the e-commerce market and the social shopping industry. An imitative business is not a challenge for us, therefore we treat those projects which bring original, not routine so-lutions as priority.

The award granted to the Group by “Polish Market” for self-developed independently created innovations materializes our success. We are happy, because the awards we re-ceive are solely our credit, and our original projects gain experts’ recognition and enjoy increasing popularity among their users. It is extremely motivating to continue to fight for the leadership in innovation both in the postal and courier industry, as well as in the e-commerce sector. Therefore, we can ensure that Paczkomaty and InFlavo are only the beginning of our expansion, not only on the Polish, but also on the international, markets.

We can definitely talk about innovation in regard to the InFlavo platform and Pacz-komaty service. Even for this reason that these projects are fully based on an original business concept and self-developed IT solutions developed by Integer.pl Group.

InFlavo is a completely new and first of its kind service in the world. Of course, im-plementing a platform enabling comprehensive sales of products and services through Facebook or introducing Paczkomaty was inspired by the current trends on the e-com-merce market, including the continuously growing popularity of networking websites. However the business idea and software were launched solely by the Integer.pl Group. An important issue – which despite appearances is not obvious – is whether and how quickly innovative services will gain their supporters. New solutions – despite their func-tionality – are accepted by the market with caution. It takes a lot of time to change con-sumer habits and systematically build their confidence in completely new, non-stand-ard and which is the most important – previously unknown services. We can say with satisfaction that both InFlavo and Paczkomaty – despite their yet short presence on the market – day by day increase the number of satisfied customers, who having used these solutions once, cannot imagine functioning without them.

Marek Zuber (economist); Błażej Grabowski (Polish Market); Krystyna Woźniak-Trzosek (Polish Market); Rita Schultz (Polish Market); Edward Trzosek (Bel Investment Group); Henryk Lewiński (Israel-Poland Chamber of Commerce)

Prof. Michał Kleiber

Prof. Henryk Skarżyński

32 :: polish market :: 7-8 /2011

Innovation

Marcin Bosacki Head of International & Social Media, InPostInnovations in Inpost are created in many ways. On the one hand through internal talks within the team,

on the other – we closely and carefully follow what is happening in the world, especially on the markets better developed than the Pol-ish one – the United States, Great Britain, some Western European countries. We peek, talk with our partners, actively participate in industry conferences and we try to adjust these ideas to our local conditions. It is also exceptionally important for us what our Cus-tomers think about our solutions. Also for this reason we are active in networking media and we listen to what over 250,000 people who like our services have to say. Each remark is carefully analysed by us, and later – of course, if possible – implemented... Other ideas are not thrown away. They are always on the list and step by step we try to improve our services so that they meet the expectations of all our customers.

Rafał Czekaj Director of Innovation, Alior BankThis is the first award we have received for the Dig-ital Signage project. We are glad that it is the one to be noticed, because there are many ideas important

for Alior Bank behind it.First of all, it shows that we are all the time looking for innova-

tion and ways to break the current rules of the market. Secondly, it lets us build a completely different than the existing relation with our customers. We have introduced screens, which are placed on the desks of our advisors. They allow presenting the offer in an in-teractive way, but first of all they build a completely different rela-tionship between the bank employee and the customer, than when the banker looks at the screen and the customer looks into the face of the banker, trying to guess what mysterious things he or she sees there. Now both can look at what is discussed and have a conver-sation as partners.

Thirdly, it shows our commitment to reduce the amount of pa-per documents, printed and copied in a branch. On the one hand it minimizes costs, but on the other hand, it is about environment pro-tection. When we think about how many trees less will be cut down owing to the fact that there will be less paperwork, how much less will have to be transported and stored, it begins to be really impor-tant for our natural environment.