PMS SELECTOR€¦ · PMS strategy is meant to invest in concentrated basket of 15-25 well...

Transcript of PMS SELECTOR€¦ · PMS strategy is meant to invest in concentrated basket of 15-25 well...

PMS SELECTORDON’T JUST INVEST | MAKE AN INFORMED DECISION

How PMSs have an edge over other Equity products

Portfolio Management Services

We shortlist and share the Top PMSs based on our 4P Analysis

Our 4P Analysis

Presenting our bouquet of Top PMSs to choose from

Top PMSs

The PMS providers we are empaneled with

Our PMS Partners

Views from PMS Fund Managers

Indian Equities – The Way Forward

PMSs offer a better substitute to Direct Equity Portfolio for HNIs

PMS v/s Direct Equity

Why and how Portfolio Management Schemes give you an edge?

PMS strategy is meant to invest in concentrated basket of 15-25well researched companies. Such focused approach generatessuperior long-term performance and is meant for sophisticatedand informed investors who really want money to work harder forthem and are focused on long term performance and, notbothered by short to medium term volatility.

Concentrated, and Focussed

PMS strategy gives access to direct shareholding in thebusinesses, making it a more direct method of investing. Whenone invest in companies, it opens the door to not only growswith the rise in corporate earnings and dividends, but also thegrowth of investors own intellectual capital. As here investorclearly gets to know what’s happening in the portfolio. In thelong term, growth in all three matters and adds up.

Own businesses, and not units

PMS strategy works on the concept of personal demat holding withcommon research, and not a pooled stock portfolio acrossinvestors. Pooled stock portfolio concept is prone impulsive andbehavioral flows which rise with rising markets and peak out athigher valuations and fall with falling markets and bottom out atattractive valuations. In PMS, one investor’s behavioral reactions tomarket movements doesn’t impact other investor’s portfolios.

You own your own portfolio

Since PMS works with a concentrated approach, there is nocompulsion to churn a stock that is performing irrespective of itsrising weight in the portfolio over years. What matters is theexpected earnings and growth potential in the businesses held.Unlike this, in mutual funds, beyond a point, at times fundmanager may be forced to let go of a performing stock to cut itsrising weight, given the regulations.

Buy and hold, with low churn

WHY PMS

The difference between successful and really successful people is that really successful people say no to almost everything

~ Warren Buffet

PMS Value Proposition

Low Portfolio

Churn

Focused Strategies

(15-25 Stocks)

Consistent Alpha on

Benchmark

Managed Risk +

Liquidity

Fee Customization

(Fixed or Variable)

High Engagement & Transparency

Consistent to its Investment

Style

Professionally Managed Services

Suitable for HNIs, Corporates and NRIs

⚫ PMSs come with a minimum ticket size of Rs 25 lakhs

⚫ Only Sophisticated Investors can invest in a PMS because of its restriction of ticket size

Long-Term Wealth Creation Products

⚫ PMSs being more concentrated with active management tends to generate more alpha

⚫ One should target to invest in a PMS with a time horizon of 5 years

PMSs v/s Direct Equity Investments

Active Portfolio Management

Robust Risk Management

Tailor made to your objectives

Superior Returns

Active portfolio management is the cornerstone of successful equity investment.

Active Portfolio Management

Investments decisions are based on strong research conducted and vetted by investment teams.

Robust Risk Management

The portfolio manager builds and manages portfolios keeping in mind the strategy selected and the timing of the investment

Tailor made to your objectives

Data suggests 90 per cent of direct equity portfolios have been beaten by PMS investments

Superior Returns

Better option for High Net

Worth Individuals

A managed portfolio will always be better than a Direct Equity Portfolio. PMS allow investors to customize portfolios, depending on risk appetite and returns expectations. PMS is the next step for those who already have dabbled in direct investments. A concentrated portfolio like PMS though add to more risks but increases the potential of higher returns as well.

PMSs offer a better substitute to Direct Equity Portfolio for HNIs

01

02

03

04

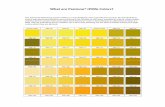

Our 4P Analysis

We first perform following basic filters on 100+ PMS products

• Min 2 Year of performance • Min 100 Cr of AUM

• Existence of Strong Term • Not Taking Un-due Risk

This reduces the Universe to 35 names

PhilosophyWe meet with the team, understand

their credentials and the philosophy. We do a thorough interview with the fund

manager and/or key people in the team. We check whether the team has shown

adherence to its philosophy during good and bad times in the past.

PortfolioWe check the construct, level of

concentration, allocation to sectors, EPS and forward PE .

PerformanceWe analyze period wise performance and compare it objectively. We give much higher weightage to long term performance and also allocate ranks on the basis of consistency.

PriceWe are quite particular about understanding in detail the fee structure, expenses, and exit loads.

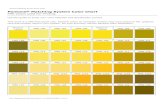

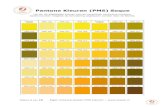

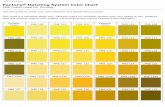

Top PMSs

PMSCOMPARISON

Motilal NTDOP

ASKIndia

Entrepreneur

IIFL Multi cap

Axis Brand EquityMarcellus Consistent

Compounders

Ambit Good and Clean

Multi capOriented

Multi capOriented

Multi capOriented

Multi capOriented

Large capOriented

Mid & Small capOriented

Portfolio Type

Diversified Portfolio Of Best Companies From Sectors That Stand To Contribute Most To Next Trillion GDP

Growth.

Portfolio Of Large And Growing Companies

With Promotors Significant Skin In The

Game

Low Beta PMS

Multi Cap Portfolio of Recognized Brands

Concentrated Portfolio Of Top 1% Of Companies

Concentrated Portfolio Of Mid-Cap Companies With A

Good Record And Clean Accounting

Fund Manager Manish Sonthalia Sumit Jain Aniruddha Sarkar Trideep Bhattacharya Rakshit Ranjan Aishvarya Dadheech

Age of PMS 11 Years and 10 Months 9 Years and 9 Months 4 Years and 9 Months 2 Years and 8 Months 10 Months 4 Years and 6 Months

AUM (cr.) 9,106 9,780 1,200 1,069 456 121

No of Stocks 26 19 28 20-22 12 13-18

Large | Mid | Small Cap Allocation

44.70% | 51.50% |3.60%

74.00% | 25.00% | 0.00%

60.94% | 21.68% | 14.33%

56.20% | 25.00% | 11.30%

68.00% | 25.00% | 6.00%

20.00% | 40.00% | 35.00%

Return Since Inception

15.94% 18.70% 18.435 12.60% 22.30% 12.40%

Fee Structure 2.50% p.a 2.50% p.a 2.50% p.a 2.50% p.a 2.00% p.a 2.50% p.a

Exit Loads 2% for 1st Year3% for 1st Year2% for 2nd Year1% for 3rd Year

3% for 1st Year2% for 2nd Year1% for 3rd Year

3% for 1st Year2% for 2nd Year1% for 3rd Year

Nil Nil

Data Source – PMS-AIF.com | As on 30th Sep 2019

2Point2 Capital ALFAccurate Advisors Alchemy Axis Mutual Fund Edelweiss

Invesco Kotak Prabhudas Liladhar Purnartha SBI

Sundaram TATA UNIFI

Our PMS PartnersWe are empanelled with all the PMS Providers

MOTILAL Next Trillion Dollar Opportunities (NTDOP)

Date of Inception

BenchmarkFund

Manager05-Dec-2007 Nifty 500 Manish Sonthalia

Portfolio Holdings (Top 10 Stocks)Stock Holding % of Market Value

Kotak Mahindra Bank Ltd 13.17%Voltas 10.91%

Page Industries Ltd 7.44%City Union Bank Ltd 5.25%

L&T Technology Services Ltd 4.87%ICICI Bank Ltd 4.44%

Bajaj Finance Ltd 4.25%Max Financial Services Ltd 3.98%

Eicher Motors Ltd 3.89%Tech Mahindra Ltd 3.67%

Sector Holdings (Top 5 Sector)Sector Holding % of Market Value

Banking and Finance 34.13%FMCG 15.32%

Diversified 14.07%Auto & Auto Ancillaries 9.95%

Infotech 8.54%

• Focus on return on net worth – Companies which are likelyto earn 20-25 % on its net worth going forward.

• Margin of safety – To purchase a piece of great business ata fraction of its true value.

• Focus on Next Trillion Dollar GDP growth

• The focus is on buying companies that will benefit outof the Next Trillion Dollar GDP growth.

• Buying stable earnings / cash flows in reasonably pricedassets

• Long-term investment view – Strongly believe that“Money is made by investing for the long term”

• Bottom up approach – To identify potential long-termwealth creators by focusing on individual companies andtheir management bandwidth.

• Focused strategy construct – The portfolio consists of 26stocks

Performance Motilal NTDOP Nifty 50

6 Months -0.39% -3.30%

1 Year 1.86% 2.50%

3 Year 6.86% 8.10%

5 Year 16.54% 7.80%

Since Inception

15.94% 5.28%

Data Source – PMS-AIF.com | As on 30th Sep 2019

ASK India Entrepreneur Portfolio (IEP)

Date of Inception

BenchmarkFund

Manager25-Jan-2010 BSE 500 Sumit Jain

Portfolio Holdings (Top 10 Stocks)Stock Holding % of Market ValueBajaj Finance 7.90%Bajaj Finserv 6.94%P I Industries 6.61%Asian Paints 6.59%Dabur India 6.13%

Pidilite Industries 6.05%Kotak Mahindra Bank 6.01%

Cholamandalam Investments 5.84%Havells India Ltd 5.60%IndusInd Bank 5.49%

Sector Holdings (Top 5 Sectors)Sector Holding % of Market Value

Banks 11.00%Building Products 10.80%

FMCG 10.40%NBFC 9.30%

Insurance 8.00%

• Identify large and growing business opportunities withcompetitive advantage that are significant sized (min Rs.100cr of PBT)

• The quality of the business should be good to be able tofund strong growth through internal cash generation . So,it looks for 20% compounded growth from each businessand targets over 25% growth from the portfolio

• To fund this growth, the business ROCE should be over25% so that growth can be funded and there are surplusesfor dividend

• The management should have the drive and have skin inthe game to deliver compounded growth period afterperiod (uncompromised corporate governance is a must).Hence, invest into businesses with an identifiable businesshouse at helm with minimum 25% stake.

• We seek to identify such businesses at reasonablediscount to value and stay invested for a length of timeand make money as EPS compounds

Performance ASK IEP BSE 500

6 Months 5.50% -3.20%

1 Year 13.80% 2.50%

3 Year 11.10% 8.20%

5 Year 14.30% 7.80%

Since Inception

18.70% 8.57%

Data Source – PMS-AIF.com | As on 30th Sep 2019

IIFL Multi Cap PMS

Date of Inception

BenchmarkFund

Manager31-Dec-2014 Nifty 50 Aniruddha Sarkar

Portfolio Holdings (Top 10 Stocks)Stock Holding % of Market Value

HDFC Bank 7.41%Bajaj Finance 7.23%

ICICI Bank 6.91%Procter & Gamble Health 6.18%

Axis Bank 4.90%Larsen & Toubro 4.76%

Wipro 4.49%State Bank of India 4.25%

Crompton Greaves Consumer 3.6%Credit Access Grameen 3.49%

Sector Holdings (Top 5 Sectors)Sector Holding % of Market Value

Financials 40.81%Information Technology 15.65%

Industrials 11.65%Health Care 10.32%

Materials 7.59%

• The portfolio is comprised of 15-20 high-qualitycompanies which are business leaders, have a strongmanagement, low leverage and which offer a large marginof safety

• Investments pertain to largely in 2 – 4 high convictionsectors

• Identifying companies within the high conviction sectorsthat have attractive business models, strong balancesheets, good corporate governance practices and run byexcellent management teams

• Significant Alpha Generation with Low Risk (Pastportfolios have a beta of 0.7 – 0.8 which is lower thanmost mutual funds)

• Aims to target superior outperforming stocks over thebenchmark through concentrated sector or stockpositions where stocks are mostly held for the long term,typically almost always over 12 months

Performance IIFL Multicap Nifty 50

6 Months 6.87% -1.53%

1 Year 23.54% 13.36%

3 Year 12.93% 10.22%

5 Year - -

Since Inception

18.43% 8.75%

Data Source – PMS-AIF.com | As on 30th Sep 2019

AXIS Brand Equity

Date of Inception

BenchmarkFund

Manager27-Jan-2017 BSE200 Trideep Bhattarcharya

Portfolio Holdings (Top 10 Stocks)Stock Holding % of Market Value

HDFC Bank 9.80%Bajaj Finance 8.20%Asian Paints 7.20%ICICI Bank 6.80%

Astral Poly Technik 6.80%V-Guard Industries 4.70%

Whirlpool India 4.50%M R F 4.40%

HDFC Standard Life 4.10%Kansai Nerolac Paints 4.00%

Sector Holdings (Top 5 Sectors)Sector Holding % of Market Value

Finance 34.10%Consumer 28.20%

Industrial products 7.60%Capital Goods, E&C 6.80%

Autos & Logistics 5.30%

Brands not only help to create a strong recall in the minds ofconsumers but also make for a worthy investment theme.Companies with brands create a distinct bargaining powerdue to economies of scale, high entry barriers, strong pricingpower and/or operating in under-penetrated markets. Thesetranslate into superior margins and growth.• Bottom-up” stock pick up is followed, and higher

allocations are given to “best-ideas after bottom upresearch” within the frame of “strong-brands”.

• Portfolio is constructed as a “balanced-mix” ofestablished brands as well as emerging brands.

• Portfolio follows multi cap investment strategy withexposures across various sectors and market-capitalization.

• Portfolio strives for enhanced risk adjusted returns andfollows screening mechanism to select qualitybusinesses.

• Portfolio follows low churn and companies are selectedwith over 3 years perspective.

Performance Axis Brand Equity BSE200

6 Months 6.80% -2.30%

1 Year 14.60% -

3 Year 10.00% -

5 Year - -

Since Inception

12.60% 9.74%

Data Source – PMS-AIF.com | As on 30th Sep 2019

MARCELLUS Consistent Compounders

Date of Inception

BenchmarkFund

Manager01-Dec-2018 Nifty 50 Rakshit Ranjan

Portfolio Holdings (Top 5 Stocks)Stock Holding % of Market Value

HDFC Bank 11.80%Pidilite Industries 10.80%Page Industries 10.80%

Asian Paints 10.80%Relaxo Footwear 9.80%

Sector Holdings (Top 5 Sectors)Sector Holding % of Market Value

Home Building Materials 30.00%Consumer Discretionary 26.00%

Financials 26.00%Consumer Staples 16.00%

Cash 2.00%

It identifies firms with high pricing power that helps sustaina wide gap between returns on capital employed and cost ofequity. The portfolio aims to hold such firms for 8-10 yearson average where healthy returns are generated withvolatility like that of a government bond. PortfolioConstruction involves a two-stage process:

• Filter based approach to create an investibleuniverse of 30-35 stocks

• In-depth bottom-up research of such companiesin the universe to assess sustainable competitivemoats to build a portfolio of 10-20 stocks thatdeliver healthy compounded earnings growthover long periods of time.

Corporate Governance:- The foremost step to building aninvestment portfolio is to identify and staying awayfrom companies which are not clean in terms of accounting. This is the universe of companies that is studied forinvesting.

Performance Marcellus CC Nifty 50

6 Months 16.40% -0.50%

1 Year - -

3 Year - -

5 Year - -

Since Inception

22.30% 6.70%

Data Source – PMS-AIF.com | As on 30th Sep 2019

AMBIT Good and Clean

Date of Inception

BenchmarkFund

Manager12-Mar-2015 BSE Midcap Aishvarya Dadheech

Portfolio Holdings (Top 5 Stocks)Stock Holding % of Market ValueP I Industries 7.28%

Cholamandalam Investments 7.15%City Union Bank 7.07%

La Opala RG 6.32%Torrent Pharma 6.20%

Sector Holdings (Top 5 Sectors)Sector Holding % of Market Value

Financials 29.00%Consumer Discretionary 24.00%

Speciality Chemicals 14.00%Pharmaceuticals 12.00%

Homebuilding 12.00%

(A) Good – Selection of companies based on capitalallocation track record and quality of improvement infinancial metrics over the past six years

(B) Clean – Selection of companies based on the quality oftheir accounts and corporate governance.

The ‘Good’ strategy helps generate upside while notcompromising on the ‘Clean’ strategy, which reducesdownside risk. Essentially, while the objective is to generatereturns, the even bigger goal is to better manage drawdowns because the company believes doing the lattersuccessfully is critically vital in achieving the former.

Ambit’s proprietary forensic accounting framework helpsweed out firms with poor quality accounts and helps identifyefficient capital allocators with a holistic approach toconsistent growth. It results in a concentrated portfolio of15-16 stocks that draws down lesser than the market incorrections and has low churn (not more than 15-20% in anyyear amounting to 2-3 holdings being replaced).

Performance Ambit G & C Nifty 50

6 Months 4.60% -12.20%

1 Year 21.20% -6.60%

3 Year 12.70% 1.30%

5 Year - -

Since Inception

12.40% 4.10%

Data Source – PMS-AIF.com | As on 30th Sep 2019

Indian Equities - The Way AheadQuality Investments + Informed Decisions = Wealth Creation

Quality investments show resilience and Informed decisions are held on in good as we as bad times. This combination leads to creation of wealth in long term

The Benefits of the tax cut would extend to a lot of sectors and would attract more stablecapital flows in terms of FDI than volatile FII. India remains a bright spot in emergingmarkets. Recent move is specifically highly positive for Private banks, FMCG and CapitalGoods.

Many stocks are available at cheap price, but, do not focus on price, focus on earnings,and stick to companies/businesses/stocks with reasonable ROEs, good corporategovernance and low debt to equity as these businesses will have better compoundingbenefit of corporate tax cuts in long term. Also, markets could to be volatile in near term,and Q2 numbers would be challenging, so, there would opportunities to invest on dips. But,if one has been waiting to invest till now, one must invest over next 45 to 90 days and notdelay further. A view of 2-3 years can generate above average returns for investors. For lessvolatile returns, stick to sector leaders. They may look optically expensive but havesignificant quality on offer too. Indian markets have a lot of sectors that have only 4-5players and the leaders have significant market share which are sustainable.

The Nifty index has returned just 3-4% CAGR in earnings over last 10 years, while more than250 companies from BSE 500 have given CAGR of around 18% in the same period. Thishighlights that there is a lot of value and opportunity in Indian stock market that a fundmanager can tap. Invest through well-regulated professionals like portfolio managementservices.

Mr. Rajesh KothariFounder, Managing Director, and Portfolio Manager with AlfAccurate Advisors

This is a phase in the economywhere we have fiscal as well asmonetary measures being takento uplift it. RBI has reduced thebenchmark policy rates by almost100 bps already, and the latest taxcut is targeted to inject the much-needed fiscal boost. Corporatetax rate cut is a surprise, bold andlong term move that has a directpositive impact on the Earningper share(EPS), and hence hasbeen cheered by markets. But it isa big structural economic reformwhich opens many areas ofpossibilities for corporate India inlong term and would lead tomany years of growth forcorporates and capital markets.Compounding impact over next 5to 10 years brings the realopportunity to create wealth for

investors.

It must be noticed that instead ofrelaxing consumer taxes to beginwith, government chose to relaxcorporate tax which goes to showgovernment wants investmentsto happen. Just think of thequantum of surplus that isintended. Tax cuts bring 1.5L croreworth of stimulus this year, and injust 2 years this accumulates toUSD 40 billion worth of additionalinvestable surplus for corporates.Present government can beexpected to announce moresurprises like reduction inpersonal tax rate, strategicdivestments in governmentcompanies, land and labourreforms (which will lead to ease ofdoing business). Government isfocused, wants “growth” ofeconomy and is aiming the $5Trillion mark of GDP in 5 years.

Thank youDisclaimer:PMS AIF World is an Alternative Investments Focussed Full Services Brand owned byHeWePro Consultants Private Limited. We provide analytics backed quality and informedinvesting with an endeavour for long term wealth creation and prosperity. The performancedata that we publish, is taken from the latest factsheets procured from respective productproviders. The data presented is as of 31st Aug 2019. Performance up to 1 Year is absoluteand above 1 Year is annualized. We’ve taken due care in collating the data from respectiveproviders and its published on the best effort basis. The accuracy of the data cannot beguaranteed. PMS AIF World would not be held responsible for any investment decisionsarising from use of this data whatsoever. Investments are subject to market related risks. Pastperformance may or may not be sustained in future and should not be solely referred as abasis for any investment decisions. Please read the disclosure documents carefully beforeinvesting.Portfolio Management Services are market linked and do not offer any guaranteed/assuredreturns.

ContactFor any queries or partnering with us, youcan reach out to us.

Lovish [email protected] | +91 8882321898

Click on the logo to access the World of Superior Investments