Pilot Project on Market Coupling PEG Nord / PEG Sud

description

Transcript of Pilot Project on Market Coupling PEG Nord / PEG Sud

Pilot Project on Market CouplingPEG Nord / PEG Sud

3rd Workshop on Gas Target ModelLondon

11 APRIL 2011

Preliminary note

• GRTgaz and Powernext are actively working on the Target Model as well as on the market coupling pilot project in France. GRTgaz and Powernext believe that Market Coupling is only one of the many topics to be covered by discussions related to the Target Model, such as the optimal size of market areas, consistency of long term and short term mechanisms, price signals for the development of new interconnection capacities…

• GRTgaz and Powernext hope that this presentation will in any case contribute to the design of the future organization of the European gas market

A need for a large French hub

• French hubs under fast development

• Market participants almost unanimous:– Need for a single French hub – In the short term:

• Need for solutions to better connect market zones by optimizing capacity utilization

• Need to increase market liquidity and access to zone Sud

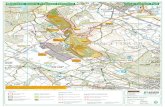

CONTEXT

Current situation

• PEG Sud less liquid than PEG Nord

76%

19%

5%

Spot Volumes - Geographical Distribution (% ) Year 2010

Spot PEG Nord Spot PEG Sud

Spot PEG TIGF

0

200

400

600

800

1 000

1 200

1 400

9/2009

10/2009

11/2009

12/2009

1/2010

2/2010

3/2010

4/2010

5/2010

6/2010

7/2010

8/2010

9/2010

10/2010

11/2010

12/2010

1/2011

2/2011

GW

h/m

onth

Day-Ahead traded volume on Powernext PEG Nord - PEG Sud

PEG NORD Total Traded Volume (DA) (MWh/day)

PEG SUD Total Traded Volume (DA) (MWh/day)

Spread difference vs. regulated tariff

• Regulated tariff is higher than the spread value

-1,20

-1,00

-0,80

-0,60

-0,40

-0,20

0,00

0,20

0,40

0,60

0,80

2009

-09-

24

2009

-10-

22

2009

-11-

19

2009

-12-

17

2010

-01-

19

2010

-02-

16

2010

-03-

16

2010

-04-

15

2010

-05-

14

2010

-06-

14

2010

-07-

12

2010

-08-

09

2010

-09-

07

2010

-10-

05

2010

-11-

02

2010

-11-

30

2010

-12-

30

2011

-01-

28

2011

-02-

25

Spread EOD (PEG Sud - PEG Nord) EUR/MWh North to South Regulated tariff

Different options to create a single Hub

• Full zone merging– Either via significant investments– Or via a combination of investments (including reinforcement of the

core network on North and South market areas) and contractual arrangements (such as flow commitments) A mid to long term option (2016) due to the necessary investments

• Enhanced connection of existing zones– Via market coupling between PEG Nord and PEG Sud, thanks to a pilot

project initiated by Powernext and GRTgaz

MARKET COUPLING EXPERIMENTATIONPEG NORD / PEG SUD

A market coupling project suitable for gas business

• Continuous trading of gas : main differences between gas and electricity– Gas supply is far more flexible than in electricity as it is

storable• No need for production plant call in advance as in electricity;

access to storage, LNG terminals, etc.• Daily balancing regime in France

no need for auctions: continuous trading of gas is the standard organization of the market and better adapted to its needs

Main design issues

• One single French hub as a long term objectiveIn the short term, better connection of markets and optimization of capacity utilization

Easy and flexible mechanism that can be implemented rapidly …

… that makes available to the market unsold capacities at market price …

…and keep gas flexibilities

Pilot project Market coupling PEG Nord/ PEG Sud

Need

Context and

constraints

Questions

Solution

Design a market coupling mechanism adapted to gas :- Capacity dedicated to the pilot project ?- Mechanism for allocating capacity ?- Products to be marketed ?

Capacity dedicated to the pilot project

• For this experimentation, it was decided to dedicate 10 GWh/d of day-ahead firm capacity in both directions (5% of total firm capacity)

– This capacity was unsold after the Open Subscription Period for annual capacity, it will not be made available through any other short term product (monthly, daily) other than market coupling

– The mechanism does not rely on sold unused capacity (no restriction of re-nomination rights)

Mechanism for capacity allocation

• 3 mechanisms were studied and discussed in order to allocate the available capacity:1. Through an explicit auction of capacities on an ad-hoc platform2. Through an auction of gas molecule, combined with implicit

allocation of capacities3. Through a defined time window where all market participants

can disclose their needs (continuous trading) which will be matched with available capacities at a random time

• The third mechanism has been chosen because it can be integrated within continuous trading, which is the standard organization for the gas market

Products to be marketed• Capacity rights or spread products?

– Trading capacity rights needs property transfer while trading spread products does not

• Spread products are:– Easier to trade and manage for participants (Trayport technology –

standard in the gas sector)– Easier to implement for GRTgaz and Powernext– More flexible (participants can valuate all their flexibility means in

spreads: storage, transport, etc.)– Identical to capacity rights on Day-Ahead products as there are no

maintenance risks

Capacities will be made available by GRTgaz through spread products on the Powernext screen

Products to be marketed

• What is a spread product?

PEG Nord Spread product : PEG Sud / PEG Nord PEG Sud

Buyer Seller Buyer Nord → Sud Seller Nord → Sud Buyer Sellerquantity price price quantity quantity price price quantity quantity price price quantity

1 000 24,050 24,200 1 500 1 500 0,050 1 500 24,250 24,600 1 000 2 000 24,000 24,250 250 500 24,200 24,700 2 000

Implicit need to buya 1 500 MWh gas flow from North to South

at 0,050€/MWh

Products to be marketed

• What is a spread product?

PEG Nord Spread product : PEG Sud / PEG Nord PEG Sud

Buyer Seller Buyer Nord → Sud Seller Nord → Sud Buyer Sellerquantity price price quantity quantity price price quantity quantity price price quantity

1 000 24,050 24,200 1 500 1 500 0,050 0,550 1 000 1 500 24,250 24,600 1 000 2 000 24,000 24,250 250 500 24,200 24,700 2 000

Implicit need to sell a 1 000 MWh gas flow from North to South

at 0,550€/MWhallowing a corresponding reverse flow from South to

North

Products to be marketed

• What is a spread product?– Each participant can valuate its capacity or flexibility mean to flow gas

between North and South zones

PEG Nord Spread product : PEG Sud / PEG Nord PEG Sud

Buyer Seller Buyer Nord → Sud Seller Nord → Sud Buyer Sellerquantity price price quantity quantity price price quantity quantity price price quantity

1 000 24,050 24,200 1 500 1 500 0,050 0,300 500 1 500 24,250 24,600 1 000 2 000 24,000 24,250 250 0,550 1 000 500 24,200 24,700 2 000

Proposal to sella 500 MWh gas flow from North to South

at 0,300€/MWh

Products to be marketed

• What is a spread product?– Spread products can increase liquidity on underlying markets

PEG Nord Spread product : PEG Sud / PEG Nord PEG Sud

Buyer Seller Buyer Nord → Sud Seller Nord → Sud Buyer Sellerquantity price price quantity quantity price price quantity quantity price price quantity

1 000 24,050 24,200 1 500 1 500 0,050 0,300 500 1 500 24,250 24,500 500 2 000 24,000 24,250 250 0,550 1 000 500 24,200 24,600 1 000

24,700 2 000

Proposal to sella 500 MWh gas flow from North to South

at 0,300€/MWh

Market coupling mechanism• One window during the core period of Powernext of 15 minutes when matching of

GRTgaz unsold capacities and best orders happens– This mechanism is equivalent to an implicit auction embedded into the continuous trading

platform without implying any change in the market participants habits (except for spread orders which are directly posted – which is an additional possibility)

PEG Nord Spread product : PEG Sud / PEG Nord PEG Sud

Buyer Seller Buyer Nord → Sud Seller Nord → Sud Buyer Sellerquantity price price quantity quantity price price quantity quantity price price quantity

1 000 24,050 24,200 1 500 750 0,200 0,300 500 750 24,250 24,500 500 2 000 24,000 24,250 250 1 500 0,050 0,550 1 000 1 500 24,250 24,600 1 000

500 23,950 24,400 750 500 24,200 24,700 2 000

Proposal to buya 1 500 MWh gas flow from North to South

at 0,050€/MWh:GRTgaz agrees to sell the corresponding

quantity

Market coupling mechanism

• Automatic matching of GRTgaz available capacities– Corresponds to selling North to South (or South to North) gas flows at

a decreasing market price according to the order book– Allows to match offer and demand between both virtual trading points– Should facilitate price convergence (to be confirmed by the

experimentation)– Should improve the global liquidity of both market zones (to be

confirmed by the experimentation)

Project planning

January February March April May June July August September2011

GRTgaz starts its interventions on Powernext spread contracts

CRE’s deliberation on market coupling project

Launch of PegSud/PegNord spread contracts on Powernext

Assessment of the coupling

mechanism and improvements

Conclusions

• It is possible to design a market coupling mechanism, which is suitable to the specific organization of the gas market and of gas exchanges (continuous booking).

• A pilot project will be implemented in the coming weeks between PEG Nord and PEG Sud : this pilot project should help enhancing liquidity, fostering price convergence and optimizing capacity utilization

• Market coupling is viewed as an interim step before merging existing market zones