Picower Foundation -- 2003 Tax Return

-

Upload

main-justice -

Category

Documents

-

view

217 -

download

0

Transcript of Picower Foundation -- 2003 Tax Return

-

8/14/2019 Picower Foundation -- 2003 Tax Return

1/42

i A

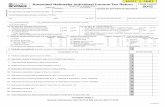

F o r m 990 'PF R e turn of Pr iv ate Found a tio nor Section 4947(a)(1) Nonexempt Charitable TrustTrea ted a s a Pr ivate F ound at io nDepar tment of the T reasuryInternal Revenue S e r v i c e Note : Th e organizat ion may be able to use a copy of this return to sat isfy state repo rt in g

~a^

r-i

C-)G

0WZZU6 !?

U se th e IRS Name of o rganizationlabel. The Picower Foundation

Otherwise , Number and street (or P 0 box number if mail is not delivered to street address) Room/suiteprnt 1410 South Ocean Bvdor type .See Specific City or town, state, and ZIP codeInstructions. PalmBeach, FL33480H Check type of organization : [5~ Section 501(c)(3) exempt private foundatio nuSection 4947(a)(1) nonexempt charitable trust u Other taxable private foundationI Fair market value of all assets at end J Accounting method: Q Cash uAccrual

of year (from Part fl, col. (c), uOther5 2 3 427,191 (specify) ----------------------------line 16) $ (P art 1, column (d) must be on cash basis .)Analysis of Revenue and Expenses (The total o f (a) R e v e n u e a n damounts in columns (b), ( c ) , and (d) may not necessar ily equal expenses per (b ) Net ~rnth e amounts in co lumn ( a ) ( s e e page 10 o f the instructions)) books inc

F or calendar year 2003 , or tax year beginn i ng , 2003 , and end in gG Check all that apply : u Initial return uFinal return uAmended return uAddress change

1 Contributions, gifts, grants, etc , received (attach schedule)Check u if the foundation is not required to attach Sch B

2 Distributions from split-interest trusts .3 Interest on savings and temporary cash investments4 Dividends and interest from securities .5a Gross rents .

b (Net rental income or (loss)6a Net gain or ( loss) from sale of assets not on line 10

b Gross sales price for all assets on line 6 a7 Capital gain net income (from Part IV, line 2) .8 Net short-term capital gai n9 Income modif icat ion s

1 0 a G r o s s s a l e s l e s s r e tu r n s a n d a l lo w a n c e sb Less : Cost of goods so l dc Gross prof it or ( loss ) (attach schedule) .11 Other income (attach schedule) .12 Total . Add lines 1 th r13 Comp nsatio r , tr stees, etc

y 14 Oher s andw15 Pensi ns, g~p~~e fit~

I 16a Legal a s e urebAccouinfees "c Other ofess~e w r ~ l ~c Mtta~lchedNle) .

~ 17 Interest ~~ . . . ~L 18 Taxes (attach schedule) (see page 13 of the instructions)19 Depreciation (attach schedule) and depletio n

V 20 Occupancy .a 21 Travel , conferences, and meet ings .22 Print ing and p ubl icat ion s23 Other expenses (a t tach schedule )

S 24 Total operating and adm i n istrative expe nses .Add lines 13 through 23

& 25 Contributions, gifts, grants paid .O 26 Tota l expenses and d isbursements. Add l ines 24 and 25

27 Subtract line 26 from line 12:a E xcess of r e ve n ue over expe ns e s a n d d isbursem en tsb Net investment income (if negative, enter -0-) .c Adjusted net income (if negative, enter -0-) .

For Paperwork Reduct ion Act Notice , see the instruct ions .

OMB No 1545 - 0052

200 320

uN ame changA Employer identification number

13 ;69?7043o i e iepnone iwrnoer see pag e iu oi in e inst ruct io

(561 ) 835-1332C If exemption application is pending, check here uD 1 . Foreign organizat ions, check h e re u

2 . Foreign organizat ions meet ing t he 85% test ,check here and attac h computa tion . uE If private foundation status was t ermina tedunder sect ion 507(b)( 1 )( A), ch eck h ere uF I f the foundat i o n is in a 6 0-mo n t h te r m inat o nunder sect ion 507(b)( 1 )( B ) , chec k here . u

( d ) D is b ur se m e nt s;tmen t (c) A d justed net for ch ar i tab leincome purposes(cas h bas i s on ly )

17,260 .E 17,260 .6,043,666 . 6,043,666 .

26,060,92 8

25,000424,384

48,181651,174996 .53 7

2,807,90322,262,540

6 , 060 , 926 .

6,060,926 .

Cat No 11 289X

0

424 3848,612

1 3 9 6 , 6

38,18

996 531,74

1 53 - 342,121,72

22 262 540 124 .384 .26

0

F o r m 990-PF ( 2 0 0

-

8/14/2019 Picower Foundation -- 2003 Tax Return

2/42

F or m 990 - P F (2003)Attached schedules and amounts in the descript ion column Beginning of yearBalance Sheets should be for end-of-year amounts only (See instructions ) (a) Book Valu e

1 Cash-non-inerest-bearing69292 Savings and temPorarYcashinvestments 716188 .

H

d

eaJ

NdVis

c

0d

dZ

3 Accounts rece ivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Less : allowance for doubtful accounts _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4 Pledges receivable _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _L e s s : allowance for doubtful accounts . . . . . . . . . . . . . . . . . . . . .

5 Grants receivable6 Receivables due from off icers , directors , trustees , and othe rdisqualif ied person s (att ach schedu l e) ( see page 15 of theinstructions )7 O ther notes and loans re c e iv a ble (attac h sc h e d ule) Io - - - - - - - - - - - - - - - - -

L e s s - a l l o w an c e fo r d oubt f u l a cc o u n ts _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _8 Inventor ies for sa le or us e .9 Prepaid expenses and deferred charges .

10a Inves tments-U S . and sta t e gov ernmen t o bligation s (a ttach sch edule)b Investments-corporate stock (attach schedule)c Investments-crporate bonds (attach sc h edu l e ) .

11 Inv estments - land , bu i ld ings , an d e quipment basi s _ _ _ _ _ _ _ _ _ _ _ _ _ _ _L e s s : a c cumulated depre ci ation ( a tt a c h s c hedule ) lo -------------------

12 Investments-mo rtgage loan s13 Investments-ther (attach schedule) .14 Land , buildings, a n d equipment . b a si s ._ _ . 042_ , 0 1 2

L es s : ac c umulat e d d e pre ci ation (atta c h sche d u le ) __ 1_~467 _ ~ 740 .15 Other assets (describe Trans it__Chek- - -----------------------16 Total assets (to be completed by all f il er s-ee page 16 of

the instructions . Also , see page 1 , item I )17 Accounts payable and accrued expenses18 Grants payable19 Deferred revenue .20 Loans from off ic e r s , d irect o r s, t r u s tees, and other di squa li f i e d p e rso n s21 Mort gages and other notes payable (att ach schedu le)22 Other liabilities (descr ibe _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _23 Total liabiliti es (add lines 17 through 22) .

Organ i zations that follow SFAS 11 7, check here uand complete l i nes 24 through 26 and lin es 30 and 31 .24 Unrestricted25 Temporarily restricted26 Permanently restricted .

O rg a n i zat ion s th at do n ot f o ll o w SFAS 11 7, ch eck here and complete lines 2 7 th rough 31 .27 Capital stock, trust principal, or current funds .28 Paid-in or capital surplus, or land, bldg ., and equipment fund29 Reta i ned earn i ngs , accum u l a ted i ncom e, endowm ent , o r o ther fund s30 Total net a ssets or fund ba la n ces (see page 17 of th einstructions )31 Total lia b ilit ie s and net asset s/fund bala n ces (see page 17 of

11,126. 11,12676,455 .476 . 357,234,733 . 358 , 287,289 .77,174,373 .1 77 .137,920. 157,953,192 .

6,213,770 . 5,574,272 .2,016. 1,810 5,574,272 .1,810 .

460,568,752 . 1 441,559,363 . 1 523,427,191 .583. 709

583.1 709

460, 568,169.441,558,654.

460 .568,169 .1441,558,654 .

460,568,752 .441,559,363 .

F7MAnalysis of Changes in Net Assets or Fund Balance s1 Total net assets or fund ba lances at beginn ing of year-art I I , column (a), line 30 ( must agree with

end-of-year figure repo rted on prior years return) .2 Enter amount from Part I , line 27a .3 Other increases no t included i n l ine 2 ( itemize) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4 Add lines 1 , 2 , and 35 Decreases not inc l uded in line 2 (itemize ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6 Total net assets or fund balances at end of year (line 4 minus l i ne 5~-Part II , column ( b ) , line 30 .

Pa g e 2E nd of year

( b ) Boo k V a l u e ( c ) F a i r M a r k e t V a l ue5 , 028. 5,028

1,594,474 . 1,594,474 .

460,568,169 .(19,009,515 . )

441,558,654 .

441,558,654 .F o r m 990 - PF ( 2 0 0 3 )

-

8/14/2019 Picower Foundation -- 2003 Tax Return

3/42

Fo rm 990- P F ( 2003) Page 3MIM C a p ital Gain s a nd Losses for Tax on Inve stment In com e

(a) Li st and d es crib e th e k in d (s) of p roperty so ld (e g , r e a l estate , (b) H ow acquired (c ) Date acquired (d) Date s o ld2- s tor y b ri ck ware h ouse, o r co m mon stoc k, 200 s h s M LC Co) D P--Donat ioc hase (mo , da y, yr) (o, day, yr)aNONbcde

(e ) Gross sa les price (f Depreciation allowed(gost or o th e r bas i s ( h ) G a in or ( l o s s )(or a l lo wabl e) p lu s expense of sa le (e ) p lus (f l m i nu s g )bcde

C om p l ete only for asse t s showing gain in column (h) a nd owne d(i) F . M .V . as o f 12/3 1 /69 G ) Adju sted basi sI aso2/31/69

the foundation on 12/31/69 (n Ga in s (Co l . (h) gain minus(k) Excess of col. () co(k), but not less than -0-) orover col. 0), if any Losses (fromco (h)

de2 Capital gain net income or (net capital loss) . If gain, also enter in Part I, line 7If (loss), enter -0- in Part I, line 7 } 2 -0-3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6) :

If gain, also enter in Part I, line 8, column (c) (see pages 13 and 17 of the instructions) .If ( loss), ent r -0- in Pa rt I, l ine 8 3 -0-Qualificatio n Under Section 4940(e) for R educed Tax on Net Investment Incom e

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income .)If section 4940(d)(2) applies, leave this part blank .Was the organization liable for the section 4942 tax on the distributable amount of any year in the base period? uYes El NoIf "Yes," the organization does not qualify under section 4940(e) . Do not complete this part .

I Enter the appropriate amount in each column for each year ; see page 17 of the instructions before making any entries .B as e pe io d yearsC a len dar ye ar (o r tax yea r b e

2002

( b )i n ) A d j u s t e d q u a l i f y i n g d i s t r i b u t i o n s

29 , 845 , 287 .32,571,002 .19 .847.006 .

(c )Ne t va lu e of nonc ha n table - u se as set s506,059,967 .528,930,867 .700,885,994 .446.115.204 .

D i s t r i b u t i o n r a t i o( c o l (b ) d i v ided by c o l ( i0.0589760 . 0615790 .0283170 .0298210 .035083

2 0 .213776

3 0 .042755

4 494,652,888 .

5 21,148,884 .

6 60,6097 21,209,493 .

2 Total of l ine 1, column (d )3 Average distribution ratio for the 5-year base period-divide the total on line 2 by 5, or bythe number of years the foundation has been in existence if less than 5 years .4 Enter the net va lue of nonchar i tab le-use assets for 2003 f rom Pa rt X, l ine 5 .5 Multiply line 4 by line 36 Enter 1 % of net investment income (1 % of Part I , line 27b)7 Add lines 5 and 68 Enter quaifyng dstribuions fromPat XI, line 4 I 8 I 24 384 269

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1 b, and complete that part using a 1 % tax rate . Seethe Part VI instructions on page 17 .Form 990-PF (2003

-

8/14/2019 Picower Foundation -- 2003 Tax Return

4/42

Form 990 -P F (2003)Tax Based on Inves tment o r 4948-se e a a a e 1 7

1a Exem pt opera t ing founda t ions descr ibed in se ct ion 4940(d )(2) , check here [j and enter "N/A" on line 1Date of ruling letter. . . . . . . . . . . . . . . . . . (a ttach copy of rul i ng letter if nece s sa ry-see instr u ctions)

b Domestic organizations that meet the section 4940(e) requirements in Part V, chec khere [N and enter 1 % of Part I, line 27b

c All other domest ic organizat ions enter 2% of l ine 27b Exempt foreign organizat ions enter 4% of Part I , l ine 12, col (b )2 Tax u nder sec t ion 5 1 1 (dome s t ic sec t ion 4 94 7(a ) (1 ) t rus ts and taxab le f ounda t ions on ly . O the rs en te r - 0 - )3 Add lines 1 and 24 Subt i tl e A ( incom e) tax (dom es t ic sec t ion 4 9 47(a ) (1 ) t rus ts and taxab le f ounda t ions on ly Othe rs en te r - 0 - )5 Tax based on investment incom e. Subtract line 4 from line 3 If zero or less, enter -0 -6 Credits/Payments:

a 2003 estimated tax payments and 2002 overpayment credited to 2003 sa 125,18900b Exempt foreign organizations-tax withheld at source 6 bc Tax paid with application for extension of time to file (Form 8868) 6cd Backup withholding erroneously withheld 6d

7 Total credits and payments. Add lines 6a through 6 d8 Enter any penalty for underpayment of estimated tax . Check here D if Form 2220 is attached9 Tax due. If the total of lines 5 and 8 is more than line 7, enter a m ount owe d . . 10 Overpayment. If line 7 is more than the total of lines 5 and 8, enter the amount overpaid

11 Enter the amount of line 10 to be : Cre d ited to 20 04 est i m a ted t ax 64, 580 . I Refunded Statements Re Activities

Page 4

125,189 00

64 580 00

NoIs During the tax year, did the organization attempt to influence any national, state, or local legislation or di dit participate or intervene in any political campaign? . El a

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see pag e18 of the instructions for definition)? .

If the answer is "Yes" to 1a or 1b, attach a detailed description of the activities andcopies of any materialspublished or distributed by the organization in connection with the activities .

c Did the organization file Form 1120-POL for this year? .d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year :

(1 ) On the organization . $() On organization managers . $e Enter the reimbursement (if any) paid by the organization during the year for political expenditure tax imposed

on organization managers . $2 Has the organization engaged in any activities that have not previously been reported to the IRS? .

If "Yes," attach a detailed description of the activ ities3 Has the organization made any changes, not previously reported to the IRS, in its governing instrument, articles

of incorporation, or bylaws, or other similar instruments? If "Yes," attach a conformed copy of the changes .4a Did the organization have unrelated business gross income of $1,000 or more during the year? ,b If "Yes," has it filed a tax return on Form 990-T for this year? N/A

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year ?If "Yes," attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either :By language in the governing instrument o r By state legislation that effectively amends the governing instrument so that no mandatory directionsthat conflict with the state law remain in the governing instrument? .

7 Did the organization have at least $5,000 in assets at any time during the year? If "Yes," complete Part fl, col. (c), and Part X V .8a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

instruction s) _Floridaand New Yorkb9

1011

12

X

2 X

34a X4b5 X

If the answer is "Yes" to line 7, has the organization furnished a copy of Form 990-PF to the Attorne yGeneral (or designate) of each state as required by General Instruction G? If "No," attach explanation gb XIs the organization claiming status as a private operating foundation within the meaning of section 49426)(3 )or 49420)(5) for calendar year 2003 or the taxable year beginning in 2003 (see instructions for Part XIV o npage 25)? If "Y es," complete Part XIV 9 XDid any persons become substantial contributors during the tax year? I f "Y es," attach a schedulelisting their names and addresses 10 XDid the organization comply with the public inspection requirements for its annual returns and exemption application? 11 XWeb site address ------ N/A------------------------------ ------ - ------------- - - ---------------- - ---------------------The books are in care of . Jeffry_ M.__Picower_____________________________________ Telephone no . 561-835-1332___Located at _1410 South Ocean Bvd PalmBeach, Florida ,__ ZIP+4 p 33480----------------------------------------------------------------------- -------

13 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of F orm 1041 -Check here . t uand enter the amount of tax-exempt interest received or accrued during the year . . 1 1 3 1Form 990- P F ( 2 0 0 3 )

-

8/14/2019 Picower Foundation -- 2003 Tax Return

5/42

-

8/14/2019 Picower Foundation -- 2003 Tax Return

6/42

F orm 990- PInformation About Offi ce rs, Dire ctors, Tru ste e s, Foundation Manager s, High ly Paid Emp l oyees ,and Contra cto rs

I List all off i cers, di rectors , trustee s, foundat i on managers and their compensation (see page 20 of the instru ctions) :(b ) Title, and average (c ) Compensation (d) Contributions to (e) Expense account,(a) Name and addresshous per w eek (If not paid, enter emplo yee beneft plans oth e r a ll owan cesd e vote d to postion--) an d defer red co mpen sat ion

SEE SCHEDULE ATTACHED------------------------------------------------------ 22,169. 2831.NON2 Compensation of five highest-paid employees (other than those included on line 1-see page 20 of the instructions) .If none , enter "NONE ."

(b) Tit le and averagedontributions t o(a) Name and address of ea ch e m poyee pai d mo r e th an $50,000 hoursper w eek(c)Com pensatio n em p loy e e benefit (e) Expens e account ,d e voted to positi onpas and defe r red other a lowa ncescom pen satonAlice A. Tan rL Vyiuui viii ci

. . . .. . . . . . . 4 0 Hrs/Wk 66,113w r o nd ti nEllen Flax Programirector

Pi w da t i - - - - - - - - - - - - - - 4 0 Hrs/Wk 61,972Martha A Livingston Program Dire t

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

1,164. NONE

C O The Picower Foundation 30 Hrs/Wk 014 7 6 ..___Stanley . Baumb la tS PogamOicer 949. NONE11,024. NON

1 , 481. NON

Total number of other employees paid over $50,000 . BONE3 Five highest-paid independent contra ctors fo r professional services--(see page 20 of the instru ctions). If none , enter"NONE ."

(a) Name and address of each pe rson paid more than $50 , 00 0S _ C L^_ _ .Li G S faT~P

OnP M F , T P1 a 7a ' Su ite 2000 , Buffalo . NY 14203-239. Mo zgam- , _ _ LeFZis_ . & _ . B ockiu. s _ _ LLP - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -P 0 Box 8500 5-6050, Philadelphia , PA 19 1 78-6050. Hogan . & _ . Hartson LLPri q 5 1 'nthTTWA alli nntnnil(' ')nnna_ i i n4

(b) Type of servic eLegalLegal

Legal

(c) Compensation162,081 .

147,703 .

76,229 .

---------------------------------------------------------------------------------------------Total number of others rece iving over $50,000 for professional services

. M- Summary of Direct Charitable ActivitiesList the foundat ion 's fou r larges t d i rec t ch aritable ac ti vit ies durin g the tax year I nclude re l evan t statistica l in fo rma t ion such as the num ber I Exp e n se sof organizations an d other beneficiaries served, confe rence s con ven e d , research pape rs produced, etc1 . _ I3QNE- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

3 ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

4 - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - -

F o r m 990-PF ( 2 0 0 3 )

-

8/14/2019 Picower Foundation -- 2003 Tax Return

7/42

Form 990-PF (2003 )- Summ ary of Program - Re l ated Inves tments (see page 21 of the insi

Descr ib e the two large s t p ro g r a m -re lat ed investme nts m a de by the found a tio n during t h e tax year on li n es 1 and 2

Page

Amount1 NONE

2

A l othe r p rogram-related inves t ments See page 21 of the ins truct io ns3 NONE

Total . Add lines 1 th rough 3 NONEMinimum investment Return (All domestic foundations must complete this part . Foreign foundations,see page 21 of the instructions . )

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc .,purposes :a Average monthly fair market value of securities is 501 029 806b Aerageo mnhycashbaancesc Fair market value of all other assets (see page 22 of the instructions) . ICNONd Total (add lines 1a, b, and c) id 502,185,673e Reduction claimed for blockage or other factors reported on lines 1 a an d

1c (attach detailed explanation) le2 Acquisitionindebtedness applicable toline 1assets 2NON3 Subrac ne2fromne1d302,185,6734 Cash deemed held for charitable activities . Enter 1/z% of line 3 (for greater amount, see page 23 4 7,532,785of the instructions) .5 Net value of noncharitable-use assets. Subtract line 4 from line 3 . Enter here and on Part V, line 4 5 494,652,8886 Minimum investment return. Enter 5% of line 5 6 24,732,644

Distributable Amount (see page 23 of the instructions) (Section 49420)(3) and (j)(5) private operatingfoundations and certain foreign organization s check here u and do not comp ete t h is part.)

1 Mnimum i n vestme nt return f rom P ar t X , l i n e 62a Tax on inv estm e nt in come for 200 3 from Part VI , line52a0F609 .b Income ta x for 2003. (This does n ot include t he tax from Pa rt VI.) 2c Add lines 2a and 2b

3 Distributable amount before adjustments. Subtract line 2c from line 1 .4a Recove r ies of amounts treated as quali fying distributions . 4aNONEb Income d istributions from section 4947(a)(2) trusts 4bc Add lines 4a and 4b

5 Add lines 3 and 4c6 Deduct ion from dist r ibutable amount (see page 23 of the instruct ions )7 Distributable amount as adjusted. Subtract line 6 from line 5 En t er here and on Part X I I I,linel .

Qualifying Distributions (see page 23 o f the instruct io ns)

NONE

NONE

24,672,035

I Amounts paid (including administrative expenses) to accomplish charitable, etc . , purpos es: ~~a Expenses, contributions, gifts, etc .-total from Part I, column (d), line 26 is 24, 384, 269b Program-related investments-Total from Part IX-B b

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc ,2NONEpurposes .3 Amounts set aside for specific charitable projects that satisfy thea Suitabil i ty test (prior IRS appro val required) 3 ab Cash dist r ibut ion test (attach the req uired schedule) 3 b N O N E

4 Qualifying d istribut ions. Add lines 1a through 3b. Enter here and on Part V, line 8, and Part All, line 4 . 4 24, 384, 2695 Organizations that qualify under section 4940(e) for the reduced rate of tax on net investment 60,609

income . Enter 1 % of Part I, line 27b (see page 24 of the instructions) . 56 Adjusted qual ify i ng di stributions. Subract line5fromline46 24 .323,660Note : T h e amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundatiqualifies for the section 4940(e) reduction of tax in those years .

F o r m 990- PF ( 2 0

-

8/14/2019 Picower Foundation -- 2003 Tax Return

8/42

I

For m 990 -P F (2003 )Undistributed Income (see page 24 of the instructions )

1 Distributable amount for 2003 from Part Xi,line 7

2 Undistributed income, if any, as of the end of 2002a Enter amount for 2002 only .b Total for prior years. 20,20,1

3 Excess distributions carryover, if any, to 2003-aFom1998NONb From1999NONEc From2000NONEd From 200 1e From2002NONf Total of lines 3a through e .

4 Qualifying distributions for 2003 from PartXII, line 4 : $ 24 .384.269 .

a Applied to 2002, but not more than line 2a .b Applied to undistributed income of prior years

(Election required-see page 24 of the instructions )c Treated as distributions out of corpus (Election

required-see page 24 of the instructions)d Applied to 2003 distributable amoun te Remaining amount distributed out of corpus

5 Excess distributions carryover applied to 2003(If an amount appears in column (d), thesame amount must be shown In column (a) . )

6 Ent r the net tota l of each column asind icate d be l ow :

a Corpus . Add l ines 3f , 4c, and 4e . Subt ract l ine 5b Prior years' undistributed income. Subtract

line 4b from line 2bc Enter the amount of prior years' undistributed

income for which a notice of deficiency hasbeen issued, or on which the section 4942(a)tax has been previously assessed

d Subtract line 6c from line 6b. Taxableamount-see page 24 of the instruction s

e Undistributed income for 2002 . Subtract line4a from line 2a . Taxable amount-see page24 of the instructions .

f Undistributed income for 2003 Subtractlines 4d and 5 from line 1 . This amount mustbe distributed in 2004 .

7 Amounts treated as distributions out ofcorpus to satisfy requirements imposed bysection 170(b)(1)(E) or 4942(g)(3) (see page25 of the instructions) .

8 Excess distributions carryover from 1998not applied on line 5 or line 7 (see page 25of the instructions) .

9 Exess d i stributions carryover t o 2004 .Subtract lines 7 and 8 from line 6a

10 Analysis of l ine 9 :a Excess from 1999 .b Excess from 2000 . NONEc Excess from2001 NONEd Excess from 2002 . NONEe Excess from 2003 . NONE

(a)Corpus

NONE

NONE

NONE

NONE

NONE

NONE

( b )Yea r s pr i o r to 2002

NONE

NONE

NONE

( c )200 2

16,385,409 .

16,385,409 .

Page 8

( d )2003

24,672,035 .

16,673,175 .

F o r m 990-PF ( 2 0 0 3 )

-

8/14/2019 Picower Foundation -- 2003 Tax Return

9/42

Fo rm 99 0-PF (2003 )Private Operating Foundations (see pace 25 of the instructions and Part V I

1a

b2a

bc

d

If the foundation has received a ruling or determination letter that it is a private operatingfoundation, and the ruling is effective for 2003, enter the date of the ruling *Check box to indicate whether the organization is a private operating foundation described in section u 4' .Enter the lesser of the adjusted net Tax year Prior 3 yearsincome from Part I or the minimum (a ) 2003 (b ) 2002 (c ) 20 01(d00 0investment return from Part X for eac hyear listed85% of line 2 aQualifying distr ibutions from Pa rt XII,l ine 4 for each year l iste dAmounts included in line 2c not used directlyfor active conduct of exempt activitie s

e Qualifying distr ibutions made directlyfor act ive conduct of exemp t act iv it iesSubtract l ine 2d from line 2c

Page9) N/A

or u 49420(5(e) Tota l

3 Complete 3a b, or c for thealternative test relied upo na "Assets" alternative test-enter

(1) Value of all asset s(2) Value of assets qualifying

under section 49420)(3)(B)(i) .b "Endowment" alternative test- Enter 2/of minimum investment return shown inPart X, line 6 for each year listedc "Su pport" alternative test-ener

(1) Total support other than grossinvestment income (interest,dividends, rents, paymentson securities loans (section512(a)(5)), or royalties)(2) Support from general publicand 5 or more exemptorganizations as provided insect ion 49420)(3)(B)(ni )(3 ) Largest amount of support

from an exempt organization(4 ) Gross investment incomeSupplementary Inform a tion (Complete this pa rt only if the organization had $5 ,000 or more inassets at any time during the year-ee page 25 of the instructions . )

1 Information Regarding Foundation Managers :a List any managers of the foundation who have contributed more than 2% of the total contributions received by t he foundatibefore the close of any tax year (but only if they have contributed more than $5,000) (See section 507(d)(2) . )

Jeffry M . Picowerb List any managers of the foundation who own 10% or more of the stock of a cor poration (or an eq ually la r ge portion of townership of a partnership or other entity) of which the foundation has a 10% or greater interest .

N/A2 Information Regarding Contribution , Grant , Gift, Loan, Scholarship, etc., Programs:

Check here [YS if the organization only makes contributions to preselected charitable organizations and does not acceunsolicited requests for funds If the organization makes gifts, grants, etc . (see page 25 of t he instructions) t o ind iv idualsorganizations under other conditions, complete items 2a, b, c, and d .a The name, address, and telephone number of the person to whom applications should be addressed :

N/Ab The form in which applications should be submitted and information and materials they should include :

N/Ac Any submission deadlines :

N/Ad Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or othfactors N/A

Form 99O-PF (20

-

8/14/2019 Picower Foundation -- 2003 Tax Return

10/42

F o r m 990- PF ( 2 0 0 3 )

Form 990 -PF 0Supplementa ry Information (continued)

-

8/14/2019 Picower Foundation -- 2003 Tax Return

11/42

F o r m 990- P F (2003)Analysis of Income-Producing Activities

Enter gross am ounts unless otherwise indicated . Unrelated business income(a (bB usin e ss code Amount

PageE x c l u d e d b y section 5 1 2 , 5 1 3 , or 514(e)R e l a t ed or exem

(C ) (d) function incomE xclusion c ode A m o u n t ( See page 26 o

1 Pogamsevcerevenue hensruconabcdefg Fees and contracts from government agencie s

2 Memb ership dues and assessments .3 Interest onsavings andtemporarycashinvestments 14 17,260 .4 Dvdends andinerest fromsecurities 1460436665 Net rental income or (loss) from real estate :

a Debt-financed propertyb Not debt-financed property .

6 Net rental income or (loss) from personal property7 Other investment income .8 Gain or (loss) from sales of assets other than inventory9 Net income or (loss) from special events .

10 Gross profit or (loss) from sales of inventory11 Other revenue : a

bcde

12 Subtotal. Addcoumns(b, (d, and(e 6060921 3 Total. Addne12 coumns(b, (d, and(e 136,060,926*(See worksheet in line 13 instructions on page 26 to verify calculations . )

= Relationship of Act iv ities to the Accomplishment of Exempt Purpose sdine No. Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly tV the accomplishment of the organization's exempt purposes (other than by providing funds for such purposes) . (Spage 26 of the instructions.) N/A

Four, 990-PF ( 2

-

8/14/2019 Picower Foundation -- 2003 Tax Return

12/42

Fom990PF2003 Page2' Information Regarding Transfers To and Transactions and Relationships With N oncharitable1 Did the organization directly or indirectly engage in any of the following with any other organization described in section Yes No501 (c) of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political organization sa Transfers from the reporting organization to a nonchantable exempt organization of VNE11

(1(2) Other assets.isX

b Other transactions . X) M1) Sales of assets toa noncharitable exempt organization1( 1(2) Purchases of asse ts from a noncharitable exempt organization . lb(2) X(3) Rental of facilities, equipment, or other assets lb(3) X(4) Reimbursement arrangements.i(4) X(5 Loanso oanguaanees5 g(6) Performance of services or membership or fundraising solicitations 1 b (6c Sharing of facilities, equipment, mailing lists, other assets, or paid employees. isX

d If the answer to any of the above is "Yes," complete the following schedule . Column (b) should always show the fair marketvalue of the goods, other assets, or services given by the reporting organization If the organization received less than fairmarket value in any transaction or sharing arrangement, show in column ( d) the value of the goods, other assets, or servicesreceived .

(a) N ame o f organization (b ) Type of organizatio n

Under penalties of perjury, I declare that I have examined this return, including accbelief, it is true, correct, and complete Declaration of preparer (other than taxpayer

2CN

46nAA2nsSigna tu re of officer or truste eN a,

:2 t ctoa ny

Preparers'signatureFinn's name (or yours i fsel f-employed), address,an d ZI P code

sched u les and

(c) D escr ipt ion o f relationship

the best of my know ledge an d

2a Is the organization directly or indirectly affiliated with, or related to, one or more tax-exempt organization sdescribed in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? uYes KI Nob If "Yes," complete the following schedule .

-

8/14/2019 Picower Foundation -- 2003 Tax Return

13/42

-

8/14/2019 Picower Foundation -- 2003 Tax Return

14/42

THE PICOWER FOUNDATION12-31-0 3

FORM 990-PF, PART I - ACCOUNTING FEES

DESCRIPTION

KPMG, LLP345 Park AvenueNew York, NY 1015 4

TOTALS

REVENUEAND

EXPENSESPER BOOKS

21,500 . 0 0

21,500 .00

NETINVESTMENTINCOME

NONE

#13-692704 3

ADJUSTEDNETINCOME

NONE

CHARITABLEPURPOSES

21,500 .00

21,500.00

-

8/14/2019 Picower Foundation -- 2003 Tax Return

15/42

THE PICOWER FOUNDATION12-31-03

FORM 990-PF, PART I - OTHER PROFESSIONAL FEE S

DESCRIPTION

CONSULTING FEESMichael S . Levine133 Michaels CourtJupiter, FL 33458

REVENUEAND

EXPENSESPER BOOKS

40,251 .2 5

OUTSIDE SERVICES

Christopher K . Gould298 Bleecker Street, Apt . 2New York, NY 10014 480.00

#13-692704 3

NET ADJUSTEDINVESTMENT NETINCOME INCOM

TOTALS 40,731.25 NONE NONE

CHARITABLEPURPOSES

40,251 .2 5

480 . 0 0

40,731 .25

-

8/14/2019 Picower Foundation -- 2003 Tax Return

16/42

THE PICOWER FOUNDATION12-31-0 3

FORM 990-PF, PART I - TAXE S

DESCRIPTION

EXCISE TAXESFICASUI

TOTALS

REVENUEAND

EXPENSESPER BOOKS

10,000 .0033,182 .2 94,998 .6 7

48,180 . 9 6

NETINVESTMENTINCOME

NONE

#13-692704 3

ADJUSTEDNETINCOME

NONE

CHARITABLEPURPOSES

NONE33,182 .294,998 .6 7

38,180 . 9 6

-

8/14/2019 Picower Foundation -- 2003 Tax Return

17/42

THE PICOWER FOUNDATION12-31-03

FORM 990-PF, PART I - OTHER EXPENSE S

DESCRIPTION

COMPUTER EXPENSE

PAYROLL SERVICES

DUES & SUBSCRIPTIONS

ENTERTAINMENT EXPENSE

INSURANCE

LC FEES/SOLOW BLDG

MAINTENANCE & REPAIR

MESSENGER EXPENSE

MISCELLANEOUS EXPENSE

DELIVERY EXPENSE

OFFICE EXPENSE

OFFICE SUPPLIES

PROCESSING FEE

POSTAGE

REGISTRATION & FEES

TELEPHONE

REVENUEAND

EXPENSESPER BOOKS

52,831 .9 5

1,749 .80

1,999 .93

3,268 .2 2

34,866 .07

9,241 .66

15,628 .4 4

3,293 .74

84 .69

36 .0 0

16,356 .24

3,155 .13

276 .04

111 .8 2

2,619 .00

7,827 .4 2

NETINVESTMENTINCOME

TOTALS 153,346.15 NONE

#13-6927043

ADJUSTEDNETINCOME

NONE

CHARITABLEPURPOSES

52,831 .9 5

1,749 .80

1,999 .93

3,268 .2 2

34,866 .07

9,241 .66

15,628 .4 4

3,293 .74

84 .69

36 .0 0

16,356 .2 4

3,155 .13

276 .04

111 .8 2

2,619 .00

7,827 .4 2

153,346 .15

-

8/14/2019 Picower Foundation -- 2003 Tax Return

18/42

Date Quantity SecurityTOC K

-9412500 ALCATEL ALSTHOMA DS04-9135600 AMGEN INC04-9488000 BELLSOUTH CORP16 -944956 5 BIOGEN IDEC INC28-01170436 CARMAX INC03 -90 79 , 20 0 CATERPILLAR INC28 -011450 0 CAVCO INDUSTRIE SINC28 -0 1 2 90 , 000 CENTEX CORP28 -015430 00 CIRCUIT CITY

STORES INC08 -94 57,500 CONOCOPHILLIPS09-9115600 FANNIE MAE31 -03546 1 FIDELITY SPARTA NUS TREASURYMONEY MARKET13 - 91 1 2 , 00 0 GENERAL ELECTRI C

CO.04-9131200 JOHNSON &JOHNSO N

- 0 1 28 2 , 000 KB HOME- 0 1 305 , 00 0 KRISPY KREME

DOUGHNUTS IN C05 -9510, 00 0 NATIONALSEMICONDUCTORCO R P28 -01 32 ,000 NE TWOR KAPPLIANCE INC .9-9 1 68, 400 PF IZER I N C .03-01420000 SIEBEL SYSTEMS INC

-94222750 STAPLES INC12 -9544800 0 TEXA SINSTRUMENTS INC .29 - 0 1 3 80,00 0 TOLL BROTHERS IN C

BILLS18 - 0 3 18 7 ,9 90 ,0 0 0 US TREASURY BILLDUE 02/ 19 /200 4

1 . 000% Due 02 - 19 -0 425-03 169 ,690 , 00 0 US TREASURY BILL

DUE 02/26/20041 . 000% Due 02-26 -0 4

-0312500 0 US TREASURY BILLD UE 04/01/200 40 930% Du e 04-01 -04

28- 03 1 00 ,000 US TREASURY BILLDUE 04/22/ 20040 . 980% D u e 0 4-2 2-0 4

PORTFOLIO APPRAISALTHE PICOWER FOUNDATION

December 31, 2003Unt Toa Mrkt Pct UnrealizedAnnual CuCos t Cost Pe V a lue Asets Gan /Loss Income Y

33 . 1 3 41 4 , 1 1 0 . 436 .542328 62 .5 0

13 69 1 , 20 4 , 500 0071 6 354 , 84 0 . 62

1 7 .97 3062 , 34 5 . 371936 1 , 53 3 , 52 5 . 0 01 0 43151174 8 040 8 5 11 , 846 , 825 201136 6,169,939 4125 77 1 , 48 1 , 93 7 5013 .78214987 50

1 .005461 005 . 1 9 62,25000

11 .59 361,725.0 032 22 9,084,9 40 .0 036.16 1 1 ,029,950 .0 01 7 37 2,606,250 00

12 85 160, 62 5 .006179 2 , 19 9 , 724 . 0028 . 30 2 , 490 ,4 00 .0 036 70 181 9 , 035 . 5030 .935271 ,5 85 . 4883 . 02 6,57 5 ,1 84 . 0024 .0 0 348 , 0 00 . 00

10 7 . 65 31 , 21 8 , 5 00 001 0 . 1 3 5 , 50 0 ,590 . 0065 57 3,77 0 , 27 5 .0075 06 1 , 170 , 936 . 0 0100 5 , 46 1 . 0 0

30 .98 371,760.0 051 .66 1,6 1,792 .0 072 52 20,450,6 40 .0 036 60 1 1 ,163,000 .0 039 . 4 1 5,91 1 ,500 00

00 -253,4 85 430 .41966 ,86 1 .5 00 .5 1 ,285,900 .0 004 1,464 , 1 9 4 88

1 .0 2,209,240.1113 5,041,659 000 .1 1 96 ,825 .2061 1 9,37 1 ,674 801 1 -669,349 4 10 .7 2,288,337 .5 002 955,948 500.0000

4 , 250 000 0 066, 880 . 000 000 .0 0

1 07 , 712 0 00 0046 , 40 0 . 003 8 ,010 002 0,70 0 . 00

1 8 , 72 0 . 000 . 00

14 . 82 5, 51 4 ,7 4 0 005 .5337815 0 . 0021 .539044 , 3 00 . 004 09 9 10 , 25 0 . 005 .442436 , 0 00 . 00

1 6 82 6 , 39 1 , 780 0074,492,844 .3 3

99 58 187,202,321 .9 0

99 58 1 68 ,978 ,998 90

01 30 9 ,51 0 0003 1 ,250,06 7 0 04 .0 1 1 , 3 65 , 70 0 .0 022 13 ,0 5 0 001 2 3 ,3 05 , 25 0 0 0

9,600 0039 ,936 0084,600 0 0

0 .0 00 .0 0

2044 7,603,680 .0 0 1 .5 2 ,088,940 0 0 0 .003 5 33241 6, 572 . 0 0 0 .52038 , 42 2 0 0 46 , 51 2 . 0013 .92584 6, 4 00 .0 0 1 2 -3 , 19 7,90 0 .0 0 0 0027 . 30 6 ,0 81 , 075 .0 0 1 .25170 , 825 . 0 0 0 . 002 9 38 13 , 1 62,240.00 26 1 0,726 , 24 0 003880 .0 03 9 76 15 , 1 08,800 00 3 .0 8 ,7 1 7 ,0 20 0 0 0 . 00

150,257,774 .98 29.6 75,764,930 65 521,400.0 0

99 87 1 87,755,012 .50 370 552,690 60 1 , 879 ,900.00 1

99 . 87 16 9 , 47 7 , 887 . 5 0 3 3 .4 48 , 888 60 1 , 696 , 9 00 . 0099 77 1247 08 75 99 . 7 7 12 4 , 70875 0.0000 1 ,1 62 .50 099 619961 1 00 99 72 99,71 8 75 0.01075 980.00 1

356,405,640.55 357,457,32750 70.4 1,051,686 .95 3,578,942.50 1SH ANDEQ U I VALENTS

U S D OLLA R 0 . 43 0 43 0004304300

1

0 000. 00

-

8/14/2019 Picower Foundation -- 2003 Tax Return

19/42

t y

PORTFOLIO APPRAISALTHE PICOWER FOUNDATION

December 31, 2003Unt Totl M rket Pt. Unreali zedAnnul C

SecurityCst Cost Pe ValueAses G a in/Loss Incom Y4 3 0 ,898 ,48 5 .3150,7 1 5 , 102 .91 100 . 0 76 , 81 6 ,61 7 . 60 4, 1 0 0 ,3 42 .50 0

2

-

8/14/2019 Picower Foundation -- 2003 Tax Return

20/42

PORTFOLIO APPRAISALTHE PICOWER FOUNDATION

December 31, 2003Unt Tota Mrket Pct Unrealized Annual Cue QuanitySecurityCot Ct PriceVaueAset s Gain/Lo ss Income Yiel

K6- 00 60 , 003 AMERICAN INTL 2 41 144849 35 6 28 3,97 6 ,998 84 8.5 3,83 2 , 14 9 49 18000 90

GROUPING144,849.35 3,97699884 82.5 3,832,149.49 18,000.90 0

S-03 831000 US TREASURY BILL 9977 8 29,092 86997 8 29,961 .25 172 8 68 39 8 , 3 10 . 00

DUE 02/1 9/200 41 . 000% Du e 02 -1 9 - 04

829,092.8682996125 17.2868398310001S

U S DO LLAR 1 3, 1 38 041, 13 8 0403 0 0013,138.0413138040.3 0 000

L98

,080.25 4 ,820,098 . 1 3 100.0 3,8 33,01 7 .8826310.900

-

8/14/2019 Picower Foundation -- 2003 Tax Return

21/42

THE PICOWER FOUNDATION12-31-0 3

COMMON STOCK

Shares Security Name Cost

437,461 Cytokine PharmaSciences, Inc $2,500,226 .0 0

$2,500,226 .00

Market Value

$3,718,418 . 5 0

$3,718,418 .50

-

8/14/2019 Picower Foundation -- 2003 Tax Return

22/42

THE PICOWER FOUNDATION12-31-03

FORM 990-PF, PART VIII - LIST OF OFFICERS, DIRECTORS AND TRUSTEES

Title and TimeName & Address Devoted to Position (C) (D)

Jeffry M. Picower Trustee NONE NONEc/o The Picower Foundation 25 Hrs/Wk

#13-6927043

(E )

NONE

Barbara Picower Trustee/ 22,169. 2,831. -0-c/o The Picower Foundation Executive

Director

Norman B . Leventhalc/o The Picower Foundation

William D . Zabe lc/o The Picower Foundation

Gerald C . McNamarac/o The Picower Foundation

Martin R . Postc/o The Picower Foundation

Trustee NONE NONE.75 Hrs/Wk

Trustee NONE NONE.75 Hrs/Wk

Trustee NONE NONE.75 Hrs/Wk

Trustee NONE NONE.75 Hrs/Wk

NONE

NONE

NONE

NONE

GRAND TOTALS 22,169. 2,831. NONE

-

8/14/2019 Picower Foundation -- 2003 Tax Return

23/42

TH E PICOW ER FOU NDAT I O NEIN 13 -69 2 7043

NAM E AND A D D RESSNDVDUAL501C)(3) P URPOSE A M OU N TE lizabeth Ke h le rE xecutive Directo rAm e ri can Ba l let Th e a terN01(C)(3) To s up por t th e AB T S c h ool Series 30,000 1890 B roadwa yNew York , NY 1 000 3M arta PizarroExecutive DirectorBa r ry U n ive r s it y N 501 (C)(3) T o f un d it s Ju s t Checking' 200 , 0 00 2113 0 0 Nor t h Ea s t Se cond Avenue Progra mMiami Shores , FL 33 1 6 1 - 6 6 9 5Earl Mart in P halenCE OB . E L . L . Found a t io n N 501(C)(3) Ex pansion o f t h e B ASICS P rogram50,00 360 Clayton StreetDo r c hester, M A 02 1 2 2Jenn y M org e nt h auTs upport i t s S u m m e r Program sExecutive Dire ctor at Ca mp H idde n Valley andFre shAFundN0 1(C)(3) Ca m p Mariah 60,000 4633 Th i rd Aven u e, 14 th F l oo rNY , N Y 1 001 7Am y Jaffe Barzac hEx ecu ti v e Directoe ow er F o unda ti o nBoundles s P laygrou nd s N 501(C)(3) P laygrou nd i n J o h n P r i nce P ark 180,000 5One Reg e n cy D ri veBloomf e l d, CT 06 00 3Em il y Raffe rtySen io r V i ce Presi dent fo r E xterna l Aff ai r sM et ro p o l i tan M useum of Ar t N 501(C)(3) Genera l Operat ing Supp o rt100000 610 00 Fifth Ave nu eNY , N Y 1 0028Rodne y K irschVice Presi dent of D ev e l op me ntPenn State N 50 1 (C)(3) The Picower Em bark P rogram 250,000 711 6 O ld Ma i nUn i versit y Park , PA 1 6802- 15 0 1R onay Mensc h el T o s u ppor t th e fo l lowi ng Sum m e rPresident/CEO Da y C amp Extended H o urs an dPh ip ps Co mm u ni ty D ev e l op men t N 50 1 (C)(3) Da l y Ave nue Ea r ly C h ildh oo d 114 ,00 0 843 West 23rd St ree t Cen te r/Head S tart Cen te rNY , NY 1 0 01 0Ru th Lande Shum anP residen tPubl ic o lor N 501( C )(3) School to work p rog ra m 60,000 9114 E as t 32nd S t ., S uite 900NY , NY 10 0 1 6J oyce Roch eExecutive DirectorG i r ls IncN501C3co n o m ic L it e racy Program117000 1120 Wal l St ree tNY, N Y 10005

1 ,lb l,UVU

-

8/14/2019 Picower Foundation -- 2003 Tax Return

24/42

TH E PICOW ER F OUNDATIONEI N 1 3 -6 9 2 70 4 3NAMEANDADDRESSNDV IDUAL 50 1 (C)(3) PURPOSEAMUNT

M y l es G o rdonVi ce Pre si dent o f E d uc at io nAmerican M useum of Natural History N 501(C)(3) I nside View H igh School Interns h p12500Central P a rk West 79th St reet Progra mNew Yor k , NY 1 00 2 4-5 1 9 2Rober M o rr iso nPresiden tVH-1 Sa ve the Musi c N51 (C )(3 ) M us ic Ed u cat ion i n o n e Pa lm B e a ch250 0 01515BoadwyCunt y S c h o o l 2N ew Yo rk , NY 1 00 36E lizab eth S t oc kEx e c u t ive Direct o rCompuerso YouhN51( C )(3 ) Gen era l O p e rat i n g S u pport 50,000 32112 Bro a d w a y, Suite 5 1 3New York , NY 1002 3Ch u ck Ves tP residentMIT-Leventhal N 501 (C )(3) Le v e nth al Gradu a te F el low s h i ps 2 00,00 0 477 Massa chusetts A ve n u eCamb ridg e , M A 0 21 3 9Aileen H effere n Lilac B a ll , Co ord in at o r o f te s t i n g ,Execut iv e Director En dow m ent , S um m er S t i p end s ,PepoPepN51 ( C )(3 ) Coll ege Visit Fund ,Suden 25,000 5328Ws 71s Sree Emrgn cy Fund , Fa culty , Pr eparat ory C o m p on en tNew York ,NY10023Unt , a n d G e n e ral O per at ing S u p p o rtM a ry Kathl e e n Fos te rP re siden tJunior Achievement N51 (C )( 3) Ex c h a nge Ci ty 5 0, 000 65601 Corporate Way, Su ite 40 0West Palm Beach , FL 3340 7Diane Ba d largeo nSen ior V i ce Pres iden t of Pr og ra m sSeedcoN5

1 (0(3) EarnFair Alliance 15 0,000 7915 Broadway , Suite 17 03New York , NY 1001 0Alan Kirsc hnerWt P a l m B e ach S ch o l ars h ips, Chall en ge G r an t ,Director of Developmn PamBa c h C o ll e g e Works h ops an d F in an c ia lUn it e d Neg r o College Fu n d N 50 1 (C )(3) Ai d and for Admin i st raveexpenses 9500 88260 Willow Oaks Corp o ra t e dr iv eFai rf ax, VA 22 03 1 -45 1 1S co t t Badesc hEx ec ut ive D irec to rU n i ted Way P a l m Beach County N501(C(3) Pcower Quaity Chldcarentiaive49091 92600 Quantum Bl vdBo on Beach , Fl 3342 6An ne t t e BerkowitzSen ior V ice Pres iden t fo r E d uc a tionWildlife Conse rvat io n S o c iet y N 501( C )( 3 ) Im p le m e ntati on a nd nat iona l ex p a n s io n of Elly J e ll y 11 5 ,0 0 0 1 02 30 0 S outhern B oulevard Looks at M arine Animal sBr onx, N Y 1 0 4 60

1,550,91 4 2

-

8/14/2019 Picower Foundation -- 2003 Tax Return

25/42

THE P ICOWER FOUNDA T IONEIN 13-692704 3NAMEANDADDRESSINDVDUAL 501(C)(3) PURPOSEAMOUNM s . Am y Jaffe B zachO reach & Educat io nExecutive Director Program a n d Maintenanc eBoundessPaygroundsN51 (C)(3) C s ts of the new website 50 ,000One Regency Driv eBloomfield , CT 0600 3Ms Ma ryOConno Mdde&HghSchooExecutive Director Outreach Program , Tee nBoysandGrlsCubsof PamBeachN50( C )(3 ) Club After Sc h o ol Program , 213 , 000 2800 No rthpoint Parkway ,Sute204BeoeShool Progra mWest Palm Beach , FL334071946andtheCompter Technolo g y Pr o gr amMs Sarita Gupt aExecu ti ve DirectorCAREN501C(3 EmrgencyResponseFund150000 3650 First AvenueNew York , NY 10016Ms. Lil liam Barno s-Paol iSenior Vice President & CE OChild Care and Early Education Fun dUnited Way of NewYokCyN501C3Child Care and Early Education Fund 50,000 42 Park AvenueNew York , NY 1001 6Mr Philip CotloffExecutive DirectorChldrensAdSoceyN 5 01 (C )( 3 ) Parent R es o urce Cent ers at F i ve S it es 100 ,000 5105 East 22nd StreetNew York , NY 1001 0Ms Tana EbboleExecutive Directo rChildren's Behavioral Health In i tiati v e N50(C)(3) Primary Project/Early Intervent ion152144 6Oakwood Center of the Palm Beaches ,1041 45th Stree tWest Palm Beach , FL 33407Ms Julia E ri cksonExecutive DirectorCity Harvest N501C)(3) Sponsorship of One Truck Route 165,000 7575 8th Avenue , 4th Fl oo rNew York , NY 1001 8Mr Thomas Doughe rtyExecutiv e DirectorDoctorso theWordN501C(3 Genera Operan g Suppo rt 75,000 8375 West Broadway , 4th Flo o rNew York , NY 1001 2Mr Wil liam BakerPresidentWNET/Channel Thirteen, Cyberchase N 501(C)(3) Cyberc h as e 750 , 000 9450 West 33rd Stree tNew York , NY 1000 1M r William Bake rPresiden tWNET/C hannel Th ir teen ,NTT N01 (C)(3) Nation al T e acher T ra inin g I ns ti tue500001450 West 33rd Stree tNew York , NY 10001

1 ,755 .1443

-

8/14/2019 Picower Foundation -- 2003 Tax Return

26/42

T H E P I C O W E R F O UNDAT IO NEIN 13-692704 3NAMEANDADDRESSINDVDUAL 501C)(3) PURPOSEAMOU

Mr. Will Weis sVice President of Developmen tCty Cener N501(C(3) Genera OperangSupport 5000 1130 W est 56th Stree tNew York, NY 1001 9Mr Wil l iam Aki nPresiden tConcerned Ctizens of Montauk N501(C)(3) Genera Operating Support 5000 2P .O . Box 91 5Montauk, NY 1195 4Ms Jaqueline PineCo-Executive Directo rEarly Stages Program of New York N 501(C)(3) General Operating Support 20,000 3330 W est 42nd St ree tNew York, NY 1003 6Dr. Diane Meie rDirector, Pal l iative C are In st i tuteMount Sna Schoo of Medcne N 501 (C)(3) General Operating Support 5,000 4One Gustave Levy Place, Box 107 0New York, NY 1002 9Mr Ned Barne sPresiden tPamBeach Cvc Assocation N501(C)(3) Genera Operating Support 100 5The Paramount Bui lding, 139 Nort hCounty Road, Suite 3 3Palm Beach, FL 3348 0Ms . Paige Robinso nAnnual Fund Directo rPaywights Horizon N501(C)(3) Genera Operating Support 10000 6630 N inth Avenue, Suite 70 8New York, NY 1003 6Ms . Ruth MadoffQueens Col lege Foundatio n65-30 Kssena Bvd N501(C)(3) Genera Operating Support 5000 7Flushing, NY 1136 7Ms Judith Jamiso nArtistic Directo rAvn Aley Dance Foundaton N501(C)(3) Genera Operatng Support 15000 8211 W est 61st Street, 3rd f loo rNew York, NY 1002 3Ms . Evelyn Laude rPresiden tBreast Cancer Research Foundation N 501(C)(3) General Operating Support 2,500 9654 Madison Avenue, Suite 120 9New York, NY 1002 1Ms . Nancy Mahon, Es qExecutive Directo rGods Love We Deiver N501(C)(3) Genera Operating Support 10000 1166 Avenue of the America sNew York, NY 10013 77,600 4

-

8/14/2019 Picower Foundation -- 2003 Tax Return

27/42

T HE P ICOW ER F OUNDATIO NE IN13-692704 3NAMEANDADDRESSINDVDUAL 501C)(3) PURPOSE AMOUNTMr. Alan Friedma n

Directo rNewYork Hal of ScenceN501(C(3) ScenceCareer Ladder 100,000 147-01111hSree andAter Schoo ScenceCubFlus hing Meadows Corona Park, NY 11368Ms Lucy Friedma nPresiden tTheAter Schoo CorporaionN501(C(3) Physica EducaionFtness 175,000 2925NnhAvenueTanngandSportsIntavNew York, NY 1001 9Ms. Lilliam Barrios-Paol iSenior Vice President & CEOUntedWay of NewYork Cty -Quaity NYN501(C(3) Quaity NY250,000 32 Park Avenu eNew York, NY 1001 6Ms Debbi Preh nKdsnNewDrectonsCHAMP . Afterschool Program499Eas PametoParkRoadN501(C(3) 250,000 4Boca Raton, FL 3343 2Ms . Gretchen Buchenhol zExecutive DirectorAssocaiontoBeneit ChldrenN501(C(3) Youth Services Program50,000 5419 East 86th StreetNew York, NY 1002 8David Rosen nExecutive DirectorAVODAHN501(C(3) Genera OperangSupport 75000 6443 Park Avenue SouthNew York, NY 1001 6Roxanne SpillettPresiden tBoys and Girls Clubs of America N 501(C)(3) Promotion of "Toward a Brighter 200,000 71230 West Peachtree Sree NWTomorrowAtlanta, GA 30309-3447Dr Michael Carerr aDirecto r

Chldrens AdSocey PBN501(C(3) TheTeenPregnancy Prevenion50,000 8105Eas 22ndSree PogamRepcaona IS9New York, NY 1001 0Brother Brian CartyPrincipa lDe La Sale Academy N501(C)(3) Schoarship Support 50,000 9202 West 97th Stree tNew York, NY 1002 5George McDonal dPresiden tThe Doe Fund, Inc N501(C)(3) Ready, Wlling and Abe 60,000 10232 East 84th StreetNew York, NY 10028

1,260,000 5

-

8/14/2019 Picower Foundation -- 2003 Tax Return

28/42

T HE P ICOW ER FO U N D A T IO NEIN . 13-692704 3INDVDUAL 501C)(3) PURPOS E

Ms Erynn de Casanov aDevelopment Associat eCom mittee for Hispanic C hildre nandFames N501(C(3) Genera OperangSupport 250140 W est 22nd Street, Suite 301Ne w York, NY 1001 1Ms Caralynn SandorfDirector of Developmen tJewish Comm unity Center i nManhatanN501(C(3) Genera OperangSupport 25000 2334 Am sterdam Avenu eN ew York, NY 10023Ms . Maryanne Bohatyrit zDirectorH .O .P.EPoect N501(C(3) Genera OperaingSupport 10,000 35 Harvard CircleWest Palm Beach, FL 3340 9The Rev . D r . Walter J Smit hPresident and CE OHeathcareChapancy N501(C(3) Genera OperangSupport 2,500 4307 East 60th Stree tNew York, NY 10022-150 5Leukemia & Lymphoma Societ yof AmericaGoRuh Madof N501(C(3) Genera OperangSupport 1,000 51311 Mamaroneck Avenu eW h it e Plains, NY 1060 5Jerome RadwinCE OAmerican Fdtn for Aids Research N 501(0(3) General Operating Support 1,000 6120 W all Stree tNew York, NY 1000 5Gary DunningExecutive D irecto rBgAppeCrcusN501(C(3) Genera OperaingSupport 25,000 7505 Eighth Avenu eNew York, NY 1001 8Karen Brooks Hopkin sPresiden tBookynAcademy o MuscN501(C(3) Genera OperangSupport 10,000 830 Lafayette Avenu eBrooklyn, NY 11 21 7Arnold Lehma nExecutive D irecto rBrookynMuseumo Art N501(C(3) Genera OperangSupport 15,000 9200 E astern Parkwa yBrooklyn, NY 112 3 8Lucia DeRespini sExecutive D irecto rLenox Hl NeghborhoodHousesN501(C(3) Genera OperangSupport 5,000 1331 East 70th Stree tNew York, NY 10021 97,000 6

-

8/14/2019 Picower Foundation -- 2003 Tax Return

29/42

THE PI CO W E R FO U NDA TIONEIN , 13 -69 2 70 43

NAME AND ADDRESS.NDVDUAL501C)(3) PURPOSE AMOUNTMs Joi GordonExecutive Directo rDess for Success N501(C(3) Saary Support for a Corporate 50,000 132East 31st Sreet, 7hFoor Conributions CoordnatoNew York, NY 100 1 6Ms . Digna SSnchezExecutive Directo rLearnngLeaders N501(C(3) CorePogrammng85000 2352 Park Avenue SouthN ew York, NY 10010 -170 9Mr . Bob Hughe sPresiden tNew Visions for Public Schools N 501 (C)(3) Pnrncipal Mentoring Program 205,324 396 Morton Stree tNew York, NY 100 1 4Ms Dar lene Kostru bExecutive Directo rPamBeachLteracy CoaitionN501(C(3) Gades Famly Lteracy 50000 4551SE8thSreet, Sute101PogramDelray Beach, FL 33483-518 3Mr Hollis Headric kExecutive Directo rCener for Ats EducationN 501 (C)(3) School Partnership Program 70,000 5225 W est 34th Street, Suite 111 2New York, NY 1012 2Dr Irwin Redlene rPresiden tChildren's Health Fund-Asthma N 501(C)(3) Childhood Asthma Initiative 1,000,000 6317 East 64th St ree tNew York , NY 100 2 1Dr . Irwin Redlene rPresiden tChdrens HeathFund-Readng N501(C(3) Readng Proect 100,000 7317 East 64th Stree tNew York , NY 100 2 1Ms . Marcia SteinExecutive Directo rCtymeas onWhees N501(C(3) WeekendMeas, Passover 125,000 8355 LexngtonAvenue -3rdF Packages andSecondMeasNew York, NY 100 1 7M GeoffreyCanadaSupport BabyCoegePesdent &CEOHaremGemsAter SchooHaremChdrens ZoneN501(C(3) ProgrammngandBeacons, 1000000 91916Park Avenue, Sute 212TRUCE andFnanca LteracNewYok NY10037EducaoMs . Brigit Beye aExecutive Directo rJumpstart N501(C(3) QuatyEnrchment for 400001505 EghhAvenue, Sute 2207Educators PrograNew York , NY 100 18 2,725,324 7

-

8/14/2019 Picower Foundation -- 2003 Tax Return

30/42

THE PICOWER FOUNDATIONEIN 13-692704 3NAMEANDADDRESSNDVDUAL501C)(3) PURPOSEAMOUN

Ms Hattie Jutagi rDirector of Developmen tLnconCener Theaer N 501 (C)(3) The Open Sages Pogram50000 1150 West 65th Stree tNew York, NY 1002 3Mr. Barry Grov eExecutive DirectorManhatanTheareCubN501(C(3) CoreEducaonPogram60000 2311 West 43rd Stree tNew York, NY 1003 2Dr Christina Orr-Cahal lExecutveDrector Tofund threePamBeacNorton Museum of At N501(0(3) County Pogressive Aterschool 71000 31451Souh Oive Avenue At Community Education (PACE SteWest Palm Beach, FL 3340 1Mr. Ph pWhtacreGenera Operang Funds Apert JewsExecutveDrector Famlyand ChdrenServcesPalmBeach CommunityChest N 501 (C)(3) Council of PB County, Legal Aid Society 50,000 444Cocoanu Row Sute M201of PBC Seagul Industries for thePamBeach FL33480 Dsabed and TheLordsPacMr Thomas Cahil lExecutive Directo rSudonaSchoo N501(0(3) EaryChdhood Program75000 5410 West 59th StreetNew York, NY 1001 9Mr . Arthur Johnso nSuperintendantThe School District of Palm Beac hCounyN501(C(3) SngeSchoo Cuturefor Academcs294000 63330 Forest Hl Bvd , B147PrograWest Palm Beach, FL 3340 6Governor Gaston CapertonPesden Pepang nsprngandConnecnCollege BoardN501(C(3) all Sudents to College andOpportunity 349044 745 Columbus Avenu eNew York, NY 10023Judith Mitchel lCEOKavs Center for Performng Ats N501(C(3) Capital Campaign 100000 8701 Okeechobee Blvd .West Palm Beach, FL 3340 1JudthMtchel Tosupport ts "S*T"AR seres tCEOpogamopovdesudenswhthKavs Center for Performng Ats N501(C(3) opportunityto see performances at 400000 9701 OkeechobeeBvd thecener and oher venueWest Palm Beach, FL 3340 1Michael PosnerExecutive Directo rLawyers Committee for Huma nRghsN501C3 TheAsyumPogam2100001333 Seventh Avenu eNew York, NY 10001

1,659,044 8

-

8/14/2019 Picower Foundation -- 2003 Tax Return

31/42

THE PICOWER FOUNDATIO NEIN 13-6927043NAME&ADDRESSINDVDUAL 501(c)(3) PURPOSEAMOUN

Janine Nina TrevensArtistic DirectorTADA N501C(3 Genea OpeangSuppot 2500115 West 28th, 3rd Floo rNew York, NY 1000 1Joan Wexle rDean & Professo rBrookynLawShoo N501C(3 Genea OpeangSuppot 50002250 Joralemon StreetBrooklyn, NY 1120 1Bunny WilliamsCo-Founde rTas nNeedN501C(3 Genea OpeangSuppo2500360 East 66th Street, Suite 2 BNew York, NY 1002 1Priscilla BurtonCaPCueN501C(3 Genea OpeangSuppot 1000041250 Fourth Street, Suite 360Santa Monica, CA 9040 1Herbert Podel lAttorney at LawFamily and Children's Associatio nPodel HavenN501C(3 Genea OpeangSuppot 50005100 East Old Country RoadMineola, NY 1150 1Jim Martindal eCysticFbrossFoundaionN501(C(3) Genera OperaingSupport 5000 62200 North Florida Mango Road ,Suite 304West Palm Beach, FL 3340 9Michael JacobsonExecutive DirectorCenter for Science in the Publi cIneest N501C(3 Genea OpeangSuppot 100071875 Connecticut Avenue, Suite 300Washington, D C 20009Alan MenilloPresiden tFarfiedFreFghtersLoca 1426 N501(C(3) Genera OperaingSupport 2,500 8P O Box 26 1Fai r field, CT 06430Christopher Lydd yFarfiedPoiceExporer Post 279 N501(C(3) Genera OperaingSupport 2,500 9100 Reef Roa dFa i rfi eld, CT 0643 0Ana OliveiraExecutive DirectorGay Mens Heath Css N501C(3General Operating Support 5,000 10119 West 24th StreetN ew York, NY 10011 41,000 9

-

8/14/2019 Picower Foundation -- 2003 Tax Return

32/42

THE PICOWER FOUNDATIO NEIN : 13-692704 3

NAME AND ADDRESSINDVDUAL 501(C(3) P U RPOSEAOUN TMichael StottsM anaging D irect o rGeorge Street P ayhouseN50(C)(3) General Operating Support 7,500 19 Livingston Avenu eNew B runswick, NJ 0890 1D avid A ltchekInstitute for Sports Medcne Research N50(C)(3) General Operating Support 5,000 2660 M adison AvenueNew York, N Y 1 002 1Joanne Donova nM elmark HomN50(C)(3) General Operating Support 1 0,000 32600 Wayland RoadBerwyn, P A 1 93 1 2M onika D illonDirector of D evelopmen tM useum of Modern At N501 (C(3) General OperatingSupport 5,000 411 West 53rd Stree tN ew York, N Y 1 00 1 9Katherine Foste rD irector of SponsorshipNew York Ci t y B al le N501(C(3) Genera OperangSupport 25000 5CenterN ew York, NY 1 0023E rnesto LoperenaE xecutive Directo rN ew York Council on Adoptable Children N 501(C)(3) General Operating Support 20,000 6589 E ighth Avenue, 15th FloorN ew York, N Y 1 00 1 8John RandolphC hairmanPalm B each Fellowship of Christians an dJewsN501(C(3) Genera Operang Support 5000 71 39 N orth County Road, Suite 18AP alm Beach, F L 33480Kent KoelzFire Rescue Chie fTown of P alm B each F ire Rescue N501(C(3) General OperatngSupport 5,000 8360 South County Road P .O Box 2029P alm B each, F L 33480G loria Ka oD irector of OperationsNew York Hospital/Cornell Univ Medica lCr N501(C(3) Genera Operang Support 1000 9525 E ast 68th Street, Box 123New York, N Y 1002 1Lewis Fomo nVP & Membership ChairmanPreservation Fdtn. o PBN501(C(3) Genera Operang Support 500 1356 South County Roa dPalm B each, FL 33480

84,000 1 0

-

8/14/2019 Picower Foundation -- 2003 Tax Return

33/42

THE PICOWER FOUNDATIONEIN . 13-692704 3NAMEANDADDRESSINDVDUAL 501C)(3) PURPOSE AMOUNT

Arlene LaneP.S169MN501(C(3) Genera OperangSupport 1999 1110 East 88th StreetNew York, NY 10128Michael SeltzerPresidentNYRAGN501(C(3) Genera OperangSupport 5000 2505 Eighth Avenue, Suite 180 5New York, NY 1001 8Melinda Utal-MartinezDirector of Corporation and Fdt nRelationsSurvvors of theShoahN501(C(3) Genera OperatingSupport 5,000 3P .O Box 3168Los Angeles, CA 9007 8Jim SirchDirectorConnecticut AudubonN501(C(3) Genera OperatingSupport 1,000 42325 Burr Stree tFa i rfield, CT 06430Miles Lerma nChairmanUnited States Holocaust Memoria lMuseumN501(C(3) Genera OperangSupport 10000 5P.O Box 9098 8Washington, D C . 20006Thomas WeisskopfDirecto rUniversity of Michigan Residentia lCoegeN501(C(3) Genera OperangSupport 100 6East Quandrangl eAnn Arbor, MI 4810 9Jean WickenExecutive Directo rSouth Florida Chapter Susan JKomenBreast Cancer FdnN501(C(3) Genera OperangSuppot 2,500 7P.O Box 88 0West Palm Beach, FL 3340 2John SanchezExecutive Directo rEast SdeHouseSetlemen N501(C(3) Genera OperaingSupport 1,000 8337 Alexander Avenu eBronx, NY 10454Eris Ben-Israe lDirector of Development & Impac tFriends of the Israel Defens eForces N501(C(3) Genera OperangSupport 5000 9298 Fifth Avenue, 5th FloorNew York, NY 1000 1George PolskyFounder & Executive Directo rStreetSquashN501(C)(3) Genera OperatingSupport 20,000 10245 Seventh Avenue, Suite 11 BNew York, NY 10001

51 .599 11

-

8/14/2019 Picower Foundation -- 2003 Tax Return

34/42

THE PICOWER FOUNDATIONEIN : 13-692704 3NAMEANDADDRESSINDVDUAL501C)(3) PURPOSEAMOUN

Ralph Nea sPresiden tPeople for the American Way N 501(C)(3) General Operating Support 25 , 000 12000 M Street , NW , Suite 40 0Washington , D . C . 20036Jer ry KatzkePresidentBonneYouthGroupN501(C(3) General OperatingSuppot 5 , 000 21221 Church Avenu eBrooklyn , NY 11218

3

4

5

6

7

8

9

1 0

30,000 12

-

8/14/2019 Picower Foundation -- 2003 Tax Return

35/42

THE PICOWER FOUNDATIONEIN 13-692704 3NAME AND ADDRESS NDVDUAL501C)(3) PURPOSEAMOUNChuckVest Toprovdefundngfor theconstructioPesden o thePcower Cener for LearnngMassachuse tt s Institute o fTechnoogyN 501 (C)(3) and Memory, research and 10,000,0077 Massachuse ttsAvenuedeveopmen andfour endowdcharCambridge, MA 02139Paul Le Cler cPresident To support "Click On @ the Libra ry"New York Public Libra ry N501(C(3) NYPLs dgtadivide program1,086600 2Fifth Avenue and 42nd Stree tNew York, NY 1001 8Lillian T amay oExecutive Directo rPanned Parenthood of PBN501(C)(3) Tosuppot Educational, Breast Health 75,000 32300 North Forida MangoRoad and Teen Tme ProgramWest Palm Beach, FL 3340 7Al+sa Rubin KurshanVice- President of StrategicPlanning and Organizationa lResourcesTofunditsCampngprogramUJA Federation of NYC (Variou sPograms) N501C(3 Campustoommunity, and Self-Help 287,900 4130 East 59th StreetNew York, NY 1002 2Alisa Rubin KurshanVice- President of Strategi cPlanning and OrganizationalResource sUJAFederation o NYC(Lmmud) N501(C(3) Tosuppot Lmmud220415 5130 East 59th Stree tNew York, NY 1002 2Shelly HorrowitzIsrae TraumaCoaitionTosuppot the Israel Trauma Coalitio nUJAFederaono NYCN501C(3 andVctmso Terror 100000 6130 East 59th Stree tNew York, NY 10022

7

8

9

1 0

1 1 , 769 .915 1

GRAND TOTAL $22,262,540 .

-

8/14/2019 Picower Foundation -- 2003 Tax Return

36/42

THE PICOWER FOUNDATION12-31-03

#13-692704 3

FORM 990-PF, PART II, LINE 14 - LAND, BUILDING AND EQUIPMENT

Furniture & FixturesOffice & Computer EquipmentComputer SoftwareLeasehold Improvements

Accumulated Depreciation

1,691,527169,19113, 805

5,167,4897, 042 , 01 2(1,467,740)5,574,27 2

FORM 990-PF, PART I, LINE 19 - DEPRECIATION

Furniture & Fixture sOffice & Computer EquipmentComputer SoftwareLeasehold Improvements

240,99033, 69 24,602

371,89 0

651,174

-

8/14/2019 Picower Foundation -- 2003 Tax Return

37/42

Th e Pi cower FoundationDepreciation Schedule

160d DaeCos Year 2001200220032004200520062007200820092010 Total

09/05/01 1,62 1 ,6 919577,896 22 231,670 28 231,67028 231,67028 231,67028 231,67028 231,67028 156,77405 1 , 621 , 691 . 9 5act 0111021584667 11319223 8 22638 22638 22638 22638 22638 11319158466

01/23/02 44370 00 7316929633857633857633857633857633857633857316929 44370 . 00In 0124021029007 73 50 1470014700 147001470014700 147 00 7350 1 , 029 . 00act 0131 /02 1659007 718 50 23700237002370023700237002370018 5 0 1,65900act 0211 /0241776 7 2984568596859685968596859682984 417 .76

02/1302111 00 779371587115871158711587115871158717937111100al Inter 0319/02 5019917 358 5677 13 71 7 13 7 17 1 3 71 7 1 3 71 7 1377 1 335858 5 , 019 .91act 050802 1,68404 71345726915291529 15269529 15 269 1513457188404

1 10 /02 1280007 97 42 1886 18286 1 82 86 18 2 86 182 86 1 82 869142128000act 07250216688071192 238 4 0 23 8 4 0 2384028 40 2380 2340 11 9 20 1 , 668 .80/30/02 62000744298857 88 57 8857 88 57 88 57 88 57 4429 620 .00

64417act 0 2 /1 4 /0391 9 0 4 676567 1,31292 1,31292 1,31292 1,31292 1,31292 1,31292 65647 9 ,190 461 , 691 , 526 .5874896 .22 236,002. 01 240990 .20 241 ,646. 65 241 646.65 241646. 65 241 646 .65 166,750.425644.6665647 1 , 6 91 , 526 .58

1 , 691 , 5 26 .5816 5puter Eqpt DaeCos Year 20012002200320042005200620072008Toa

09/05!01 145,80574 5927 4529,1611529,6115 29,16115 29,161 16 19,73369 145 ,605 .7401/07/02 10,43170510431720863 2,086 3 4 2,086 34 2,08634 1,04317 10 ,431 .7 001/15/02 3,706 64 53706674133713371 33741 33370 66 3 ,7 06 .64S0125022002005200204004040040400404004020020 2 ,002 .00

Cons 05J3002416829 5 416 82 83366 83366 83366 83366 416 84 4 ,168 .29 0530026196356195123931239312393123936197 619.63061110299800 59980 19960 19960 19960 19960 9990 998 .00

926 . 2 61212031468945145892917929179291792917914589145894169 , 190.949427.4531353.7533692 .3033838.1933838 .1924410.732484 .4314589 169190 .94

169 ,190.941 67

areDate Cost Year 20120022003204 2005 Total09/05J01 1 0,782 50 31,16195 35917359417243221 10 , 782.5 0

1 02227260 33787575750 75750 37875 2,272. 5002010275000 312500 25000 25000 12500 75000ases 2 002322.5 0

13,805.00 1 , 161 .95409 7924601 . 67 3 , 439.715037 5 13,805.0013,805 . 00

-

8/14/2019 Picower Foundation -- 2003 Tax Return

38/42

1 70

10906101 4 654, 317 23 14 107477 49 332451 23 332451 23 332451 23 332451 23 332451 23 332451 23 3324 5 1 2332 , 45 1 2 3 33 2 ,451 23332,51 23 332,451 23332,5 23

/1502 23380 13 9021798179817981981798179817981981798 17981798/15 /02 56922 132184379437943794379 4379437943794379 43794379 43 7 9

, Inc . 01 /15 /02 42000 131614323132313231 32 3 1 3231331321 32 3132 3 32 3132 3. 0 /15 102254913099196196 196 196196196196196196196196

0 1 /15026801320475475 4 75 4 75 4 75 475475 475475475475M0/15/02 11478134418838838838838838838838838838838830 1 150237500131402885288528852885288528852885288528852885288501 117102 30 0,0 000013 1 1,598 48 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 92 23,076 920 1 /23/02795808 133,05836611678611678611678611678611678611678611678611678611678611678611678207/02 50021 131922384838483848384838483848384838483848384834 8207 /02 87264 13 3354 6 7 13 67 1 3 6773 613 67 13673 67 1 3 67 136736736713207 /02700130260540405404 0 54 0 54 054 0 54 0 54 0 5 4 0 5 4207 /02180000013692281384 6213 84 621384621384 62 1 ,38462 1 ,38462138462 13846213862 1 ,38 4 62138462207 /024,60000 13173103415 3 46 1 5 346 1 5 346 1 5 346 1536 1536 1 5 346153615361536 1 5207/ 02 4,50000 1 3 173 1 0 346 1536 1 5 346 153465 346 1536 1536 1536 153461536 1536 1 5/07 /02 85961333661661 6 6 1 6 6 1 661661 66166166166166

/07 /02250000013 96151923081923081923081923081923081923081923081923081923081923081923080 4 /04/0231577 13 131392627526276262752627526275262752627526275262752627526276

Inc . 05/29/02 3,68400 131417228338 283 38 2833828338 283 3828338283382338283382833828338rtz, Inc . 05/2902229621388017661766176617661766176617661766776617661766

/05/0270033 00 13 2693605387155387155387155387155387155387155387165387155387155387155387 5ses 2002 512146 . 27

illman 072903 51700122154308 4 3 0 8 43084308 4308430843084308 43 0843 08illman 09/ 11 /03 508 50 12 21 1642384238 42 3 8 4238 423842384238423842384238

025. 505,167, 489.00107477 .49 352,149.14 371,889. 82 371 932 .56 371,932. 56 371932 .56 371,93256 371932 56 371 932.56 371932 .56 371932 .56 371932 .56 371932 56

19 2,963 . 11 62 3,6 02.8265, 1 73.9 9

-

8/14/2019 Picower Foundation -- 2003 Tax Return

39/42

00 '606 ,L91 `S00'68C 'L9 l ,S LE '4lL` 46Z

09909 9 1 lZ8EOOLS9LZ8000 0 'O L 09 69'ZZS6ZZOS89900489EZL48LL 9 l4 'E8LS00 000 '9ZZS969658ZE00GOOOELlS00 009'4 O lCLL900000,91 BZZ69Z9OO L 9Z09S49ZL84SE l acosezs ev80 8L 9' 6L9s8509L900 000 '009 84 869 ' l l Z600 SL044 SBSLl 144808l904 Z64 S Z 960900OZ44l 9ZZ 699 LS4Z6L08 Z 00 6Z L l' 4S94 SL EL6 '4ZZ Z

WWI SLOZ4LO

-

8/14/2019 Picower Foundation -- 2003 Tax Return

40/42

* " a t'

INFORMATION STATEMENT TO INTERNAL REVENUE SERVICE FROM CENTEXCORPORATION STOCKHOLDERS

STATEMENT OF CENTEX CORPO RATION STOCKHOLDERS RE CEIVING A DISTRIBUTIONOF COMMO N STOCK IN CAVCO INDUSTRIES , INC . ("CAVCO " ) (A CONTROLLE DCORPORATION ), PURSUANT TO RECS . X1 . 355- 5(b)

1 . The undersigned, a stockholder owning shares of CentexCorporation as of the close of regular trading on the New YorkStock Exchange on June 12, 2003, rece i ved distribution ofstock in a controlled corporation pursuant to 355 .

2 . The names and addresses of the corporations involved ar eParent : Centex Corporation2728 North Harwoo dDallas, Texas 7520 1Controlled Corporation : Cavco Industries, Inc .1001 North Central, 8t' Floo rPhoenix, Arizona 8500 4

3 . No stock or securities in Centex Corporation were surrenderedby the undersigned .

4 14 , 504 common shares of Cavco were received .

5 . By letter dated April 17, 2003, the Inter n al Revenue Serviceruled that the distribution of shares of Cavco was anontaxable 355 corporate separation .

Aa~..iA...~Stockholder

-

8/14/2019 Picower Foundation -- 2003 Tax Return

41/42

F o r m 8 8 6 8 ( 1 2 -2 0 0 0 ) Page 2 IF you are filing for an Additional (not automatic) 3 -Month Extension , complete only Part 11 and check this box ErNote : Only complete Part 1 1 1f you have already been granted an automatic 3-month extension on a previously sled Form 8868. If you are filingor an A u to m a t i c 3 - Mo nth Ex tens ion , complete only P a r t I (on page 1 ) . Additional (not automatic) 3 - Mo nth Exten sion of Time-Must F i le Original and One Copy .Type or N m e of Exempt Organization Em ployer identif icat ion num berpn ThePcowe Foundaon13692704 3File by the Number, street, and room or suite no If a P 0 box, see instructions For IRS use onlye x t e n ded 1410 South Ocean Boulevarddue dat e f o rfiling the City, town or post office, state, and ZIP code For a foreign address, see instructions .return Seei n s t r u c t i o n s . P a lm B e a ch , F l o r i d a 3 3 4 8 0Ch e c k type of return to b e file d (File a separate application for each return)-E] Form 990 u Form 990-EZ u Form 990-T (sec 4 01(a) or 408(a) trust) u Form 1041-A u Form 5227 u Form 8870u F orm 990-BL 0Form 990-PF u Form 990-T (trust other than above) u Form 4 72 0 u F orm 6069STOP : Do not comple t e P art I I i f you we r e n o t al re a dy grante d an auto matic 3 -month exte n s ion on a prev i o u sly f led Form 8868 . If the organization does not have an office or place of business in the U nited States, check this box uIf this is for a G roup Re turn, enter the organization's four digit Group Exemption Number (GEN) If this i sfor the w h ole group, check this box u . If it is for pa rt of the group, check this box u and attach a list with thenames and EINs of al l memb ers the extension is fo r

4 I request an ad d i t ional 3-mon th extension of time unt i l N o ve m b e r 1 5 20 0 45 For calendar year 0 0 3 , or other tax year beginning . . . . . . . . . . . . . . . . . . . . . . 20 - -- and end ing . . . . . . . . . . . . . . . . . . . . . . 20 .- .- .- ----------------------------------- --6 If this tax year is for less than 12 months, check reason : u Initial return u Final return u Change in accounting period7 State in detail why you need the extension Additional time is needed to insure that complete and accurate returns arefiled .

8a If this application is for F orm 990-BL, 990-PF, 990-T, 4 720, or 6069, en ter t he tentative t ax , l ess any 6 0 , 6 0 9 . Tnonrefundable credits . See instructions $b I f this appl icat ion is for Form 990-PF, 990-T, 472 0, or 6069, enter any refund able cred i ts and est imate dtax payments made . Include any prior year overpayment allowed as a credit and any amount paid .reviously with Form 8868 s124 , 289c B alance Due . Subtract line 8b from l ine 8a . Include your payment with this form, or , i f required, d eposi twith FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment System) See _ 0 _instructions $

Signature and Verificatio nUnder penalt ies of perjury, I declare that I have examined this form, Includ ing accompanying schedules and statements, and to the best of my knowledge and bel ief ,it is true, correct, and complete, and that I am authorized to prepare this for mSignature 4p,M/ T it le TuseeDae 111,64

Notice to Applicant-To Be Completed by the IRS10T11"We have approved this application Please attach this form to the organization's retur nu We have not approved this application However, we have granted a 10-day grace period from the later of the date shown below or the duedate of the organization's return (including any prior extensions) . This grace period is considered to be a valid extension of time for elections

otherwise required to be made on a t imely return Please attach this form to the organization's return .u We have not approved this application . After consid ering the reasons stated in item 7, we c annot grant your request for an extension of t imeto file We are not granting a 10-day grace period .u We cannot consider this application because it was filed after the due date of the return for which an extension was requeste du O t h e r - - - - - - - - - - - - - - - - - . . . . . . - . . . . . . . . . . - . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . - - - - - - - - - - - - - - - . . . . . . . . . . . . . . . . . . . . - . . . . . .

8 yDecoI AmongAlt e rn ate Mai l in g Address - Enter the address if you want the copy of this application for an addtt ona~returned to an address different than the one entered above .N a m eTy pe or Numbr and s treet ( inc lud e s uite , r o o m , o r a p t . no . ) Or a P.O . b o x n u m b e rprint B U B M I 3 8 1 0 N P F tO f PE S ~ B YC i ty o r to w n , province or state , a n d c o u n t ry ( including postal or ZIP co de)

F o r m 8 8 6 8 ( 1 2 - 2000 )

-

8/14/2019 Picower Foundation -- 2003 Tax Return

42/42

F or m 886 8(D e cember 2000)Depa r tm e n t of the T reasuryInternal Revenue Se rv ic e

Application for Extension of Time To File anExempt Organization Return Fi le a separate a pp l icat ion for each return

O M B N o 1 5 4 5- 1 7 0 9

If you are filing for an Automatic 3 -Month Extension , complete only Pa rt I and check this box t If you are filing for an Additional (not automatic) 3 -Month Extension , complete only Pa rt II (on page 2 of t h i s for m ) .Note : Do not complete Pa rt 11 unless you have already been granted an automatic 3 - month extension on a previously fledForm 8868 . Autom a t i c 3 - M onth Exten s ion of Time-Only su bmit or iginal (no copies needed )Note : Form 990-T corporations requesting an automatic 6-month extension-check this box and complete Part / only uA ll other corporations (including Form 990-C filers) must use Form 7004 to request an extension of time to file income taxreturns Partnerships, REMICs and trusts must use Form 8736 to request an extension of time to file Form 1065, 106 6 , or 1041Ty pe or Name o f Ex e m p t Orga niz at ionEmpoyer denfcatonnumberprint The Picower Foundation 13 : 6927043Fi le by the Nu m be r , s treet , and roo m or sui t e no If a P .O box, see inst ructionsdue date fo rf i li n g y o u r 1 410 South Ocean Boulevardr e t u r n Se eInstructions City, t ow n or post o f f ice, state, an d Z I P code F o r a fore ign address, see i ns t ru c ti on sPalm Beach , FL 33480Check type of re turn to be filed (file a separate application for each return )u Form 990 u Form 990-T (corporation) u Form 4720u Form 990-BL u Form 990-T (sec 401(a) or 408(a) trust) u Form 5227u Form 990-EZ u Form 990-T (trust other than above) u Form 60690Form 990-PF u Form 1041-A u Form 8870 If the organization does not have an office or place of business in the United States, check this box u If t his is for a Group Return , enter the organization's four digit Group Exemption Number (GEN) I f this i sfor the whole group, check this box u . If it is for part of the group, check this box u and attach a list with thena m es and EINs of all members the extension will cove r1 I request an automatic 3-month (6-month, for 990- T corporation ) extension of time until August 15 2004,

to fide the exempt organization return for the organization named above The extension is for the organization's return for---------------1 0 - 0calendar year 20 03 o rD o - u tax year beginning --------------------------------- , 20 . . and ending . . . . . . . . . . . . . . . ------------------- 2

Initial return u Final return u Change in accounting period3a If t his app l ication is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax, less any 60,609nonrefundable credits . See instructions

f this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax paymentsmade . I nclude any prior year overpayment allowed as a credit $ 124,289