PG Calc | Invested in your mission ©2009 PG Calc Working with Life Income Options Working with Life...

-

Upload

ella-singleton -

Category

Documents

-

view

214 -

download

1

Transcript of PG Calc | Invested in your mission ©2009 PG Calc Working with Life Income Options Working with Life...

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Working with Life Income Options:

Moving to the Next Level

Jeff LydenbergPG Calc

http://www.pgcalc.com

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Raising money in a bad economy

• Focus on how giving helps

• Don’t assume everyone equal

• Acknowledge reluctance

• Modify gifts to meet donor need

• Life income gifts can help

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

What donor’s are thinking

• I’m not as rich as I once was.

• When is the market going to come back?

• I have multiple priorities.

• How can I make a gift and meet other needs?

• Can I position myself for recovery?

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

What charity is thinking

• We still need money.

• How are we going to fill the shortfall in fundraising?

• How can we meet commitments but respect our donor’s needs?

• How can I capture dollars that count?

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Market Risk/Volatility

• Swings in giving are not as severe as broader economic conditions!

• 100 point change in S & P 500 = $1.5 billion change in philanthropy

• 37% drop in the S & P in last year

• $1.161 trillion of philanthropy lost as of 3/18/2009

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Effect of Economy on Charity

• Decrease in value of endowments

• Fewer and smaller private foundation grants

• Reduced corporate giving due to smaller profits

• Smaller bequests with shrinkage of estate assets

• Probable reduction in major outright gifts and life-income gifts

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Qualified Retirement Plans

• Limits on contributions

• $22,000 for most

• Concerns about market risk in IRAs, 401(k)s

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Capital Gain Taxes

• 15% for most

• Dramatic declines in market values

• Long term investors still concerned

• Recovery will come

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

How to respond to planned gift donors

• Gift annuities– Safe, guaranteed payments for life– Backed by all of Partners assets– Not subject to market risk– Payments not tied to asset performance– Gift annuities counter-cyclical

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Essentials

• Charity pays fixed amount to one or two individuals for life

• Deduction = contribution minus present value of annuity

• Immediate annuity: payments begin immediately after gift

• Deferred annuity: payments begin at designated future time

• Annuity rates based on age of beneficiary

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Essentials

• Prototype CGA prospect– Ages: mid-70s and older– Fiscally conservative– Not wealthy (or do not think they are)– Loyal annual fund donors, usually very

low amounts

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Cash

• For duration of life expectancy:– Payments partially ordinary income– Payments partially tax-free return of

capital

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Cash

Present Value of an Annuity Gift Value

A$58,917

B$41,083

$100,000 gift, $6,100 annual payment

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Cash

Tax free return of capital:

$58,917 ÷13.1 = $4,497Ordinary income $1,603

$6,100

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Appreciated Property

• For duration of life expectancy:– Payments partially ordinary income– Payments partially capital gain– Payments partially tax-free return of

capital– No tax-free if zero basis

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Appreciated Property

Present Value of Annuity Gift Value

ACost

$23,567

BGain

$35,350

CCost

$16,433

DGain

$24,650

$58,917 $41,083

$100,000 property, $40,000 cost basis$6,100 payment

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Taxation: Appreciated Property

Tax free return of capital:

$23,567÷13.1 = $1,799.01

Capital gain:

$35,350 ÷13.1 = $2,698.47

Ordinary income $1,602.52 $6,900.00

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Charitable Remainder Trust Essentials

• Deduction for present value of remainder

• At least annual payments

• Life or no more than 20 years

• No more than 5% or 50% payout

• Deduction at least 10% of principal

• Payable as an annuity or unitrust amount

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Charitable Remainder Trust Essentials

• Prototype CRT prospect– Ages: mid-50s to 70– Fiscally savvy and often aggressive

investors– Wealthy or very affluent– Less likely to be loyal donors, but

average gifts are high

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Charitable Remainder Annuity Trusts

• Annuity amount negotiated

• Only 20,000 in existence

• More expensive and complicated than gift annuities

• Subject to market risk

• Can run out of money!!

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Charitable Remainder Unitrusts

• Standard Charitable Remainder Unitrust Pays the fixed percentage

• Net-income Charitable Remainder Unitrust Pays lesser of fixed percentage or actual net income.

• Net-Income with Make-up Charitable Remainder Unitrust Pays lesser of the fixed percentage or actual net income, but can pay make-up distributions to beneficiaries to the extent of accrued past deficiencies in payments.

• Flip Trust Converts from net income trust to straight payout upon the occurrence of a triggering event.

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Charitable Remainder Trust Taxation

• WIFO (worst-in, first-out)

• First: Ordinary income to the extent payments consist of interest, dividends, and rents earned by the trust.

• Second: Capital gain to the extent payments consist of capital gain realized by the trust.

• Third: Tax-exempt income from tax-exempt securities.

• Fourth: Tax-free return of principal.

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Pooled Income Fund

• PIF is a trust operated by charity, not tax-exempt

• Distributes income proportionate to beneficiaries interest in the fund

• Poor man’s CRT

• Highly disfavored due to low interest and dividends

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Gift Annuity Funded with Cash

• Ms Sylvester, age 75– $50,000 invested in CDs– $1,080 after-tax income

• $50,000 gift annuity– $3,150 before-tax– $2,926 after-tax

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Remainder Unitrust Funded with Stock

• Mr. and Mrs. Coronado, ages 72 and 70– $250,000 stock, $20,000 cost basis– $3,188 after-tax income

• 5% Charitable Remainder Unitrust– $12,500 before-tax– $9,275 after-tax– Year 5 $14,069 before-tax– Year 10 $16,310 before-tax

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Flip CRUT to Supplement Retirement

• Dr. Bernard, age 50– Contributing maximum to qualified plans– Heavily invested in market

• 5% Flip Unitrust– Adds to trust each year till retirement– Pays net income during working years– Pays unitrust amount beginning at age 65– $1,000,000 principal at retirement– $50,000 income in first year of retirement

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Remainder Annuity Trust for Income Security

• Ms Carmelo, age 84– $500,000 of appreciated stock– $15,000 dividend income

• 8% Charitable Remainder Annuity Trust– $40,000 annual payments– No capital gain– Income tax deduction

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Build-up Deferred Gift Annuity

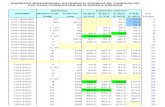

• Mr. and Dinofrio, ages 58 and 57– Contribute $20,000 each year to fund DGA– Each annuity start date staggered

Year Annuity payment Annuity Rate

2020 $1,340 6.72021 2,680 6.7 2022 4,040 6.8 2023 5,400 6.8 2024 6,800 7.0 2025 8,200 7.0 2026 9,620 7.1

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Flexible Deferred Annuity

• Mr. Jasper, Age 54– Stock worth $100,000, $60,000 cost basis– Start dates between 9/30/2020 and 9/30/2029– Lowest deduction of all possible start dates

Elective Age at Annuity TotalStart DateStart DateRate Annuity9/30/2020 66 8.6% $8,6009/30/2021 67 9.0% $9,0009/30/2022 68 9.6% $9,6009/30/2023 69 10.1% $10,1009/30/2024 70 10.8% $10,800

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Promoting Gift Annuities Despite the Economy

Gift Date 10-Year Treasury After-Tax Income

Gift Annuity After-Tax Income

Differential

6/12/08 $2,827 $6,353 $3,526

10/31/08 2,626 5,995 3,369

2/1/09 1,675 5,772 4,097

•Gift annuity rates at historic lows

•Still competitive with fixed income vehicles

©2009 PG Calc Working with Life Income Options

PG Calc | Invested in your mission

Leveraging Depressed Asset values

• Contribution $2,000,000

• Taxable gift to daughters $1,271,860

• Taxable gift to daughters $1,907,790(if gift delayed until stock appreciates to previous $3,000,000 value)

• Reduction of taxable gift $635,930 if trust funded now