Personal Instalment Loan - Debt Consolidation Loan and DBS ... · Personal Instalment Loan - Debt...

Transcript of Personal Instalment Loan - Debt Consolidation Loan and DBS ... · Personal Instalment Loan - Debt...

Fax : 2235 5947Page 1 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Note: 1. Please use the signature of the direct debit account and ensure that you sign the alternation as well. 2. All direct marketing calls from the Bank originate from numbers with prefix 3668 or 2290. The Bank does not engage or authorize outside companies as representatives. In addition, only staff of the Bank is authorized to follow up this loan application.

Signature of Applicant (Please sign on each page)

X svDate

DBS

/AF/

5436

/04/

2015

/MD

To: DBS Bank (Hong Kong) Limited (the”Bank”)Please complete by using English BLOCK letters. Please tick the appropriate box where applicable.All fields are mandatory unless specified.Applicant must be a Hong Kong permanent resident aged 21 or above with a minimum annual income of HK$100,000.

Loan Particulars

Applicant Information

Loan Amount Requested HK$

Minimum HK$20,000, maximum HK$1,200,000 or 18 times of monthly salary (whichever is lower), and must be in multiples of HK$1,000.

The Bank may adjust the credit limits of any of your credit cards issued by the Bank or its predecessors in connection with your application and its approval, as deemed necessary.

If your loan application is not approved, you agree that we could consider to change this application to other Personal Loans product’s application.

Loan Period 12 18 24 30 36 42 48 54 60 66 72 Months

Which DBS Finance would you like to go for handling the loan application? Kwun Tong Causeway Bay Shatin Tsim Sha Tsui Tsuen Wan Kwai Chung

I would also like to apply for the DBS Platinum APDEC-DX / MasterCard along with this application* (291) TODC TODCFTWelcome offer: HK$500 Cash Rebate# (v)

* This application is not applicable to existing DBS Credit Card Cardholders.# DBS Credit Card Welcome Offer Terms and Conditions apply.

This application will be processed after you have drawn down the Debt Consolidation Loan or cancelled the application of Debt Consolidation Loan. In processing this application, the Bank may obtain your credit data from the credit reference agency again for reference.

Applicant Information

(If applicable)

Name in English

Surname

Given Name

Name in Chinese

Date of Birth D M Y

HKID Card No.

Marital Status Single (1) Married (2) Divorced (1) Others (1)

Nationality

No. of Dependents (including parents and children)

( )

Post Secondary or below (1) University or Above (2)

Others

Education Level

(English name as on HKID Card)□ Mr □ Miss □ Mrs □ Ms

Year(s) of Residence Y M Home Tel. No.

Mobile Phone*/Pager No.

Email Address

Mortgaged (2)Rented (3)

Quarters (4)Public Housing (3)Owned (Non-Mortgaged) (1)Live with Parents (5)

Others (6)

Home Address (in BLOCK LETTERS, overseas address and P.O. Box are not accepted)(If the below home address is not your permanent home address, please also provide the permanent home address proof) Flat/Room Floor Block Building

Street/Road

District /Area HK (01) KLN (02)

NT (03) Outlying Islands (03)

Flat/Room Floor Block Building

Street/Road

Distric t /Area HK (01) KLN (02)

NT (03) Outlying Islands (03)

Residential Status

(if any)

* Please note that the Bank will send the MasterCard SecureCode one-time password to you via the above mobile phone number for you to conduct online credit card transactions which require identity authentication.

Self-employed Yes (1) No (2)

Name of Employer

Office AddressFlat/Room Floor Block Building

Street/Road

District/Area

Office Tel. No.

Year(s) of Service Y M

Nature of Business Position

Monthly Income HK$ x M

Other Income (Please specify) HK$

If current employment is less than 1 year, please fill in the following information concerning the employment prior to it:

Self-employed? Yes No

Name of Previous Employer

Nature of Business Position

Year(s) of Service Y M (Minimum 1 year)

Monthly Income HK$ x M

Other Income (Please specify) HK$

Occupation

(If applicable)

HK (01) KLN (02)NT (03) Outlying Island (03)

( )

( )

For Bank Use Only

Br A/C Off code

CA

PR

ME INT

RE

(Mobile Phone & Pager No. are not accepted)

Monthly Rental & Mortgage Repayment HK$Secured Overdraft Minimum Payment HK$

Mortgaged property address (no need to state if it is the same as the residential address)

Fax : 2235 5947Page 2 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

Balance Transfer Information

I hereby authorise DBS Bank (Hong Kong) Limited (”DBS”) to transfer the outstanding balance(s) of the following credit card account / loan / personal overdraft to my DBS Debt Consolidation Loan account:

* Application for transferring balance of any account with DBS will not be accepted.

# If your application for transfer includes balances of more than 6 accounts, please photocopy this form and return all the forms to us together with this application form upon completion.

1. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

3. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

5. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

2. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

4. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

6. Bank name

Account number

Latest outstanding amount

Credit limit (if applicable)

Credit facility

Credit card Instalment Loan Revolving Loan Overdraft

Fax : 2235 5947Page 3 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Your Preference of DBS Credit Card

1. Please indicate your choice of Reward Scheme: Cash Rebate Scheme (1) Redemption Scheme (2)

If no choice is indicated, Cash Rebate Scheme will be applied.

2. Please send statement to^ Home (H) Office (W) (P.O. BOX is not acceptable)

If the credit card application is approved, the address chosen will be used as official correspondence address for ALL your credit card accounts with us.

^ eStatement Service is available for subscription via DBS iBanking free of charge, allowing you to view your Statement online anytime, anywhere. If you have subscribed to eStatement Service for other DBS credit card(s) / Compass VISA card held with the Bank, you will automatically receive eStatement for the credit card you are now applying for.

3. Display language on ATM screen Language on screen Chinese (1) English (2)

4. Credit Limit Arrangement The Bank may choose to approve certain transactions that would

result in your credit limit to be exceeded. An overlimit charge (as set out in the Fee Schedule) is payable for each statement cycle where your credit limit has been exceeded. If you do not wish the Bank to approve any transaction that would result in your credit limit (being the combined credit limit and the individual credit limit of each of your card account) to be exceeded, please tick the box below.

□ I do not wish the Bank to approve any transaction that would result in my credit limit to be exceeded. I understand that despite this request, my credit limit may still exceed as a result of circumstances described in Clause 2.2 of the relevant credit card terms and conditions. (OL=Y)

Note: If you have previously informed the Bank of such choice and you have left the box above blank, you will be deemed not to have changed to your existing choice.

5. The Bank will set up a DBS iBanking account for the card applicant automatically upon approval of the credit card. If you already have a DBS iBanking account, the Bank will not arrange the account set up for you again. The use of internet banking services is subject to the Terms and Conditions for DBS iBanking Service.

Please put a tick in the box below if you do not wish to use this service:

□ I do not wish to use the service (PC:2)

Relationship with Staff Member(s) or Director(s) of the Bank

Are you (or any proposed guarantor) a relative / spouse of any of the directors or employees of the Bank or its parent, DBS Bank Ltd, or any of its other subsidiaries?

Yes, name of the relevant director or employee in English

No, I confirm that, at present, there is no such relationship. I agree to notify the Bank promptly in writing if I become so related.

If you leave this section blank, we will assume you have no such relationship, but you will be held responsible for any failure to declare any relevant relationship.

Relationship

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

Direct Debit Authorization

Bank and Branch Name

My Account No.

(Direct credit account should be the same as direct debit account)

Bank No.

Branch No.

I hereby authorize the below named Bank ("my Bank") to effect transfers from my account with my Bank ("my account") to DBS in accordance with such instructions as my Bank may receive from DBS from time to time, including but not limited to the Monthly Repayment, outstanding payment amount and / or all fees, charges and expenses whichever is / are applicable. I agree that my Bank shall not be obliged to ascertain whether or not notice of any such transfer has been given to me. I accept full liability for any overdraft (or increase in existing overdraft) on my account which may arise as a result of any such transfer(s). I agree that should there be insufficient funds in my account to meet any transfer hereby authorized, my Bank shall be entitled, in its discretion, not to effect such transfer in which event my Bank may make the usual charge and that it may cancel this authorization at any time on one week's written notice. This authorization shall have effect until further notice. I agree that any notice of cancellation or variation of this authorization which I may give to my Bank must be given so as to be received by my Bank at least seven working days' notice prior to the date on which such cancellation/ variation is to take effect. I confirm that my signature on this authorization form is same as that for the operation of my account. All cost, charges, interest, fees and expenses that may be levied by my Bank in connection with this arrangement shall be for my account. I will on request provide DBS with such further information as DBS may require in connection with this arrangement. All information provided to DBS is correct and I will forthwith notify DBS of any change to such information. I hereby authorize DBS to provide to my Bank any or all of my information to enable this arrangement to be set up or maintained. I confirm that I am the sole beneficial owner of the funds in my account maintained with my Bank and I am free and entitled to deal with the funds in my account. I will on demand indemnify DBS against all losses, costs, expenses, claims, demands, proceedings and liabilities that it may suffer or incur arising out of or acting on this arrangement. I authorize my Bank to provide to DBS all such information relating to my account.

Loan Disbursement and Repayment Method

Direct Credit Authorization

I hereby authorize DBS Bank (Hong Kong) Limited (”DBS”) to transfer the outstanding balance(s) of my personal overdraft / loan / credit card account to my DBS Debt Consolidation Loan account and credit the remaining approved loan after balance transfer (if applicable) to my sole name bank account as stated below (“my account”).

Correspondence Address

Home Address Office Address (P. O. Box is not acceptable)

If the loan application is approved, the address chosen will be used as official correspondence address for ALL your loan accounts with us.

Fax : 2235 5947Page 4 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

Opt-out from Use of My Personal Data in Direct Marketing

Declaration and Signature

DBS Credit Card Welcome Offer Terms and Consitions

The Bank intends to use my personal data in direct marketing and cannot do so without my consent. If I do not wish the Bank to use my personal data in direct marketing or do not wish to receive direct marketing materials by certain channels, I should tick (" ") any of the following opt-out channel(s):

Email (email address provided above)

SMS (mobile phone number provided above)

All channels (including email, mail, SMS, phone)

Opt-out from Provision of My Personal Data to Other Persons for Direct Marketing

The Bank may provide my personal data to other persons for their use in direct marketing and, whether or not such persons are members of the Bank's group. I should tick (" ") this box if I do not wish the Bank to provide my personal data to any other persons for their use in direct marketing. If I have applied for or will apply for any product or service that is provided by the Bank jointly with a co-branding partner, this opt-out will not apply to such co-branding partner to whom I consent to provide my personal data.

The above options represent my present choice of whether or not to receive direct marketing contact or information. This replaces any choice previously communicated by me to the Bank.

Note: The above choice applies to the direct marketing of the classes of products, services and/or subjects, the kinds of data which may be used in direct marketing and the classes of persons to which data may be provided for them to use in direct marketing as set out in the Bank’s Data Policy Notice.

I have read, understood and agreed to be bound by all the following terms and conditions: including (a) DBS Credit Card Welcome Offer Terms and Conditions (b) Personal Instalment Loan – Debt Consolidation Loan and DBS Platinum MasterCard Application Terms and Conditions (c) DBS Credit Card Terms and Conditions (d) Personal Instalment Loan Terms and Conditions (e) DBS$ Award Scheme Terms and Conditions (f) DBS$ Redemption Offer Terms and Conditions (g) Key Facts Statement (h) Tax Requirements Notice and (f) Data Policy Notice.

I understand that copies of these documents are available on request or can be viewed from the Bank’s website (www.dbs.com/hk).

I agree that the Data Policy Notice shall apply to all information related to me that I have provided to the Bank in this application form or that the Bank has obtained from any other sources or that arises from my relationship with the Bank or any other DBS Group company (“Data”). I agree that the Data Policy Notice shall form part of the Personal Instalment Loan Terms and Conditions and DBS Credit Card Terms and Conditions (If I apply DBS Platinum MasterCard at the same time). I agree that my Data may be used for such purposes and disclosed to such persons (whether in or outside Hong Kong) in accordance with the Data Policy.

I declare and warrant that I have (a) no overdue credit card or other loan payments outstanding for over 30 days; (b) not had any credit cards in my name cancelled due to payment default; and (c) not had a bankruptcy petition made against me and I am not petitioning or intending to petition for my bankruptcy.

I understand and agree that this application is subject to the Bank’s final approval. If the loan is approved by the Bank, I agree and authorize the Bank to debit from my account the monthly repayment on the date and of the amount as specified in the notification letter of Personal Instalment Loan- Debt Consolidation Loan. I understand and agree that if I apply to use any services related to my credit card (such as Internet Account, "Call-a-loan" Service and Balance Transfer etc.), in addition to the DBS Credit Card Terms and Conditions, the terms and conditions governing the use of such related services, which will be provided to me on application of the related services, shall also apply. Copies of such terms and conditions are available on request from the 24-hour Customer Services Hotline at 2290 8888 or from the Bank’s website at www.dbs.com/hk or at any branches of the Bank.

By signing on this page, it signifies my declaration and consent to the matters set out above.

1. The welcome offer is only available to applicants who submit the Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum Master-Card Application Form (“Application Form”) to DBS Bank (Hong Kong) Limited (”the Bank”) on or before 31 December 2015 (“Offer Ending Date”) and submit all supporting documents required by the Bank and have successfully applied to be the principal cardholder of DBS Credit Card (“New Card”) to be issued by the Bank within one month from the date of application.

2. If you have successfully applied for more than one New Card by submitting multiple Application Forms to the Bank, you will only be entitled to redeem ONE welcome offer in respect of all applications submitted before the Offer Ending Date.

3. Redemption of the welcome offer is only applicable to new customer, which is defined as applicants who, during the New Card approval do not hold, and in the 12 months prior to the date of application for the New Card have not held and/or cancelled any principal credit card (including Co-branded Cards and COMPASS Credit Card) issued by the Bank.

4. “Eligible Transactions” are the posted retail transactions and cash advance transactions (for Eligible Transactions being settled with a Credit Card Interest-free Instalment Loan, only posted monthly instalments shall be counted). For the avoidance of doubt, the following types of transactions shall not be considered as Eligible Transaction: Cash advance handling/administration fees, casino chips, foreign exchange, finance charges, reversed transactions, late charges, credit card annual fee, Call-a-loan, Balance Transfer, Funds Transfer, Fee Based Instalment, tax payment, any

bill payment transactions made via DBS iBanking/JET Payment Service of JETCO/24-hour Customer Services Hotline or other available means as specified by the Bank from time to time, transactions that have been subject to cancellation, charge-back, return of goods and/or refund or any other categories of transactions specified by the Bank from time to time.

5. Fulfillment of the Spending Requirement shall be calculated based on Eligible Spending transactions conducted with each New Card successfully applied before the Offer Ending Date. If you have successfully applied for more than one New Card, Eligible Spending transactions conducted with different New Cards cannot be combined for the purpose of calculating fulfillment of the Spending Requirement.

6. Welcome offer cannot be transferred, nor exchanged for cash/credit limit/other prizes.7. Welcome offer is only applicable to cardholders whose credit card accounts are in good standing, remain valid and not in default during the

spending period and when the welcome offer is issued.8. Any fraud and/or abuse of the welcome offer (as determined by the Bank at its sole discretion) will result in forfeiture of your entitlement to the

welcome offer and/or cancellation of all or part of your account(s) with the Bank. The Bank reserves the right to deduct an amount equivalent to the value of the welcome offer awarded to you inappropriately pursuant to any fraud and/or abuse directly from your account(s) held with the Bank without prior notice and/or to take legal action in such instances to recover any such amounts.

9. You must accumulate Eligible Spending in the amount of HK$1,000 or above (“Spending Requirement”) within 2 months of the New Card issuance date (“Spending Period”) to be eligible to HK$500 Cash Rebate. Cash Rebate will be credited to your New Card’s account within 3 months after the end of Spending Period, and shown on the monthly statement.

10. The Bank reserves the right to vary the terms and conditions and/or to change or terminate the welcome offer. In the event of any dispute, decision of the Bank shall be final and binding.

11. Should there be any discrepancy or inconsistency between the English version of these terms and conditions and the Chinese version, the English version shall prevail.

Fax : 2235 5947Page 5 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

Highlights of DBS Credit Card Terms and Conditions

You must read the entire DBS Credit Card Terms and Conditions carefully. Your attention is drawn to the following key terms and conditions.

1. Immediately after you receive a Card, please review the DBS Credit Card Terms and Conditions and if you accept it, please (i) complete the Card acknowledgment/activation procedure; and (ii) sign the back of the Card without delay.

2. You must keep your Card securely and ensure that your PIN is not disclosed to any other person. You must take all reasonable steps to keep your Card safe and your PIN secret and to help prevent fraud.

3. Should you discover that your Card or PIN is lost, stolen or used in an unauthorised way, you must notify us as soon as reasonably practicable upon discovery of the loss, theft or unauthorised use.

4. Provided that you have not acted fraudulently or with gross negligence and you have not failed to inform us of the loss, theft or unauthorised use of your Card and/or the PIN, you shall not be liable for any unauthorised transactions (except cash advances). If you have acted fraudulently or with gross negligence, then you shall be liable for all unauthorised transactions.

5. You shall be liable for all transactions effected or authorised through the use of the Card. If there is a Supplementary Card, you are jointly and severally liable with the Supplementary Cardholder for such part of the outstanding balance in connection with the Supplementary Card. The Supplementary Cardholder is liable, jointly and severally with you, only for such part of the outstanding balance as relates to the use of his/her Supplementary Card.

6. On or before the payment due date in each month, you must pay us the statement balance in full or at least pay the minimum payment as specified in any monthly statement in accordance with the Fee Schedule or any other notice. If you fail to pay the minimum payment on the payment due date as specified in any monthly statement, then your Card Account will be regarded as in a delinquent status and a late fee and a finance charge will be charged.

7. You agree to examine each Card Account statement received from us and to notify us of any alleged error or omission within 60 days after such statement was provided. After such 60-day period, such statement shall be deemed accepted and conclusively settled and no claim to the contrary by you shall be admissible.

8. We may (where the circumstances are considered reasonable) at any time suspend, withdraw, cancel or terminate your right to use the Card, Card Account and/or any related services offered. You may terminate your Card and Card Account at any time by giving us notice. Upon the termination of your Card and Card Account, all outstanding debit balances shall become immediately due and payable.

9. We shall be entitled at any time and without notice to you, to combine or consolidate any credit balance on any of your accounts maintained with us (whether matured or not) with the settlement of any debit balance on your Card Account and to set off any such credit balance against any such debit balance.

10. If you report an unauthorised transaction to us before the payment due date, you may withhold payment of the disputed amount during the investigation period.

11. We may, at our discretion, appoint debt collection agents and/or lawyers for collection of any moneys owing by you to us or for enforcement of any of our rights against you hereunder. You shall indemnify us on demand in respect of all collection costs and expenses that we reasonably incur. The total collection costs to be recovered shall in normal circumstances not exceed 30% of the amount owing by you to us.

1. The welcome offer is only available to applicants who submit the Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum Master-Card Application Form (“Application Form”) to DBS Bank (Hong Kong) Limited (”the Bank”) on or before 31 December 2015 (“Offer Ending Date”) and submit all supporting documents required by the Bank and have successfully applied to be the principal cardholder of DBS Credit Card (“New Card”) to be issued by the Bank within one month from the date of application.

2. If you have successfully applied for more than one New Card by submitting multiple Application Forms to the Bank, you will only be entitled to redeem ONE welcome offer in respect of all applications submitted before the Offer Ending Date.

3. Redemption of the welcome offer is only applicable to new customer, which is defined as applicants who, during the New Card approval do not hold, and in the 12 months prior to the date of application for the New Card have not held and/or cancelled any principal credit card (including Co-branded Cards and COMPASS Credit Card) issued by the Bank.

4. “Eligible Transactions” are the posted retail transactions and cash advance transactions (for Eligible Transactions being settled with a Credit Card Interest-free Instalment Loan, only posted monthly instalments shall be counted). For the avoidance of doubt, the following types of transactions shall not be considered as Eligible Transaction: Cash advance handling/administration fees, casino chips, foreign exchange, finance charges, reversed transactions, late charges, credit card annual fee, Call-a-loan, Balance Transfer, Funds Transfer, Fee Based Instalment, tax payment, any

DBS Credit Card Welcome Offer Terms and Consitions

bill payment transactions made via DBS iBanking/JET Payment Service of JETCO/24-hour Customer Services Hotline or other available means as specified by the Bank from time to time, transactions that have been subject to cancellation, charge-back, return of goods and/or refund or any other categories of transactions specified by the Bank from time to time.

5. Fulfillment of the Spending Requirement shall be calculated based on Eligible Spending transactions conducted with each New Card successfully applied before the Offer Ending Date. If you have successfully applied for more than one New Card, Eligible Spending transactions conducted with different New Cards cannot be combined for the purpose of calculating fulfillment of the Spending Requirement.

6. Welcome offer cannot be transferred, nor exchanged for cash/credit limit/other prizes.7. Welcome offer is only applicable to cardholders whose credit card accounts are in good standing, remain valid and not in default during the

spending period and when the welcome offer is issued.8. Any fraud and/or abuse of the welcome offer (as determined by the Bank at its sole discretion) will result in forfeiture of your entitlement to the

welcome offer and/or cancellation of all or part of your account(s) with the Bank. The Bank reserves the right to deduct an amount equivalent to the value of the welcome offer awarded to you inappropriately pursuant to any fraud and/or abuse directly from your account(s) held with the Bank without prior notice and/or to take legal action in such instances to recover any such amounts.

9. You must accumulate Eligible Spending in the amount of HK$1,000 or above (“Spending Requirement”) within 2 months of the New Card issuance date (“Spending Period”) to be eligible to HK$500 Cash Rebate. Cash Rebate will be credited to your New Card’s account within 3 months after the end of Spending Period, and shown on the monthly statement.

10. The Bank reserves the right to vary the terms and conditions and/or to change or terminate the welcome offer. In the event of any dispute, decision of the Bank shall be final and binding.

11. Should there be any discrepancy or inconsistency between the English version of these terms and conditions and the Chinese version, the English version shall prevail.

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

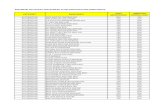

Key Facts Statement

Fax : 2235 5947Page 6 of 9

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

Annualised Percentage Rate (APR) for Retail Purchase

APR for Cash Advance

Delinquent APR

Interest Free Period

Minimum payment

Annual Membership Fee

Cash Advance

Fees relating to Foreign Currency Transaction

Fees relating to Settling Foreign Currency Transaction in Hong Kong Dollars

Late Payment Fee

Over-the-limit Fee

Returned Payment Fee

36.07% when you open your account and it will be reviewed from time to time. We will not charge you interest if the statement balance is paid in full by the payment due date each month. Otherwise, interest will be charged on (i) the outstanding statement balance from the day after the date of that statement on a daily basis until payment in full and (ii) the amount of each new transaction (entered after the date of that statement) from the date such transaction is posted on a daily basis until payment in full.

38.41% when you open your account and it will be reviewed from time to time. Interest will be charged from the date a cash advance is made until the date of actual repayment.

If you fail to pay the minimum payment shown on any monthly statement, the rate for finance charge will be adjusted by adding Delinquency Adjustment Rate of 4.5% (the "Adjusted Interest Rate").APR of the Adjusted Interest Rate is 42.16% for Retail Purchase 44.84% for Cash AdvanceThe Adjusted Interest Rate will apply from the day following the date of the monthly statement issued after the occurrence of the delinquency until the full amount or at least the minimum payment is paid on or before the payment due date for 6 consecutive monthly statements

• Up to 60 days• No interest-free period on cash advance, Balance Transfer, Funds Transfer and bill payment

transaction to merchant categories Banking and Credit Card Services / Credit Card Payment / Credit Services

If the total outstanding balance is HK$200 or above, the minimum payment will be the sum of the followings:(i) all charges, fees, costs, expenses, interests and/or finance charges posted to the current statement

of Card Account;(ii) any amount in excess of the credit limit incurred after last statement date; and(iii) 1% of the statement balance excluding all charges, fees, costs, expenses, interests and/or finance

charges posted to the Card Account;or HK$200, whichever is higher plus any outstanding minimum payment.If the total outstanding balance is less than HK$200, the minimum payment will be the total outstanding balance.

DBS Platinum Credit Card• Principal Card HK$1,500 per card• Supplementary Card HK$750 per card

Cash Advance Handling Fee4% on cash advance amount, minimum HK$100; andCash Advance Administration FeeHK$20 per transaction

1.95% of every transaction effected in a currency otherthan Hong Kong dollar

Customers may sometimes be offered the option to settle foreign currency transactions in Hong Kong dollars at the point of sale overseas. Such option is a direct arrangement offered by the overseas merchants and not the card issuer. In such cases, customers are reminded to ask the merchants for the foreign currency transactions are entered into as settling foreign currency transactions in Hong Kong dollars may involve a cost higher than the foreign currency transaction handling fee. For this transaction in Hong Kong dollars made outside Hong Kong, we will not charge any further markup

A blanket fee of HK$300 or the minimum payment, whichever is lower

Overlimit Charge HK$180 per statement cycle

Handling Charge on Dishonoured Cheque / Autopay Rejection HK$120 per transaction of returned payment

INTEREST RATES AND INTEREST CHARGES

FEES

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Personal Instalment Loan – Debt Consolidation Loan and DBS Platinum MasterCard Application Terms and Conditions

Fax : 2235 5947Page 7 of 9

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

1. By making an application to DBS Bank (Hong Kong) Limited (the “Bank”, which expression shall include its successors and assigns) for the Personal Instalment Loan – Debt Consolidation Loan (the “Loan”) and DBS Platinum MasterCard (the “Card”), you are deemed to have read and accepted these terms and conditions and shall be bound by them.

2. The Loan is subject to the Personal Instalment Loan Terms and Conditions. Use of the Card shall be subject to the DBS Credit Card Terms and Conditions and any terms and conditions applicable to the use of any related services (such as Internet Account, “Call-a-loan” Service and Balance Transfer) which you have applied or may apply to use. Copies of such terms and conditions are available on request from the 24-hour Customer Services Hotline at 2290 8888 or from the Bank’s website at www.dbs.com/hk or at any branches of the Bank.

3. There is a minimum annual income requirement for application of the DBS Platinum Credit Card of HK$150,000.

4. You declare and warrant to the Bank that the information provided in the application for the Loan and the Card and all the supporting documents are true, correct and complete. You hereby authorise the Bank to verify your information contained in the application and any supporting documents from any source that the Bank may deem appropriate. The information you have provided to the Bank in the application is required and will be used by the Bank to assess your application for the Loan and the Card and provide ongoing services to you. Failure by you to provide any such required information to the Bank may result in your application for the Loan and the Card to be rejected.

5. You declare to the Bank that you have read and understood the Bank’s Data Policy Notice and you agree that the Data Policy Notice shall form part of the Personal Instalment Loan Terms and Conditions and part of the DBS Credit Card Terms and Conditions. You agree that the Bank’s Data Policy Notice in force from time to time together with any other notices and communications concerning your data issued by the Bank from time to time (“Data Policy”) shall apply to all information related to you that you have provided to the Bank in the application for the Loan and the Card or that the Bank has obtained from any other sources or that arises from your relationship with the Bank or any other DBS Group company (“Data”). Your Data may be used for such purposes and disclosed to such persons (whether in or outside Hong Kong) in accordance with the Data Policy. You hereby agree, in particular, that the Bank may: (a) verify, provide and collect information about you from other organisations, institutions or other persons; (b) transfer the Data outside Hong Kong SAR including to Singapore; (c) compare your Data with any data the Bank has obtained and use the results for taking of any action including actions that may be adverse to your interests (including declining the application for the Loan and the Card); and (d) provide your Data to credit reference agencies, or, in the event of default, to debt collection agencies.

6. You understand that you have the right to: (a) request to be informed which items of Data are routinely disclosed to credit reference agencies or debt collection agencies; (b) request to be provided with further information to enable an access and/or correction request to be made to the relevant credit reference agency or debt collection agency; and (c) ask the Bank to request the relevant credit reference agencies to delete your consumer credit data upon termination of the loan account if there is no payment default for a period in excess of 60 days on the account within 5 years immediately before the termination of the account. If there is any payment default, unless the amount in default is fully repaid or written off (other than due to a bankruptcy order) before the expiry of 60 days from the date such default occurred, you are liable to have your consumer credit data retained by the relevant credit reference agencies for a period of up to 5 years from the final settlement date of the default amount. In the event any amount in the loan account is written off due to a bankruptcy order being made against you, you are liable to have your consumer credit data retained by the relevant credit reference agencies, regardless of whether there is payment default for a period in excess of 60 days on the account, for a period of up to 5 years from the final settlement date of the default amount or 5 years from the date of discharge of your bankruptcy as notified to the credit reference agency whichever is earlier.

7. The annual fee chargeable for a classic DBS Platinum Credit Card is HK$1,500, while that for each supplementary card issued thereunder is HK$750. Sucessful application can enjoy first 2-year annual fee waiver.

8. The current annualized percentage rate (“APR”) applicable for calculating any finance charge is as follows:

The Bank reserves the right to revise the APRs from time to time with prior notice

Cash AdvanceRetail Transaction

38.41%

36.07%

Personal Instalment Loan Terms and Conditions

Fax : 2235 5947Page 8 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD

1. Acceptance of these Terms and Conditions By requesting the Personal Instalment Loan, Express Loan, Salaries Tax

Loan or Debt Consolidation Loan (the "Loan"), I shall be deemed to have read, understood and accepted these Terms and Conditions.

2. Approval of the Loan and Conditions Approval of the Loan and the terms applicable to the Loan (including

amount, tenor of and interest rate applicable to the Loan) shall be at the sole discretion of DBS Bank (Hong Kong) Limited (the "Bank", which shall includes its successors and assigns) and is conditional upon fulfillment of the following conditions to the Bank’s satisfaction:

(a) provide all documentary proof required by the Bank which the Bank may independently verify;

(b) a satisfactory review of my credit profile available at the credit reference agency;

(c) in respect of a Debt Consolidation Loan application, (i) reduce the credit limit in respect of any credit card and/or loan account or (ii) cancel any credit card and/or loan account I maintain with another financial institution as required by the Bank.

3. Cancellation of Application I may not cancel an application for the Loan once processing

has commenced unless permitted by the Bank. If the Bank at its discretion permits cancellation of my Loan application, I shall pay the Bank all reasonable costs and expenses in connection with the cancellation.

4. Undertakings in respect of Debt Consolidation Loan If the Loan is a Debt Consolidation Loan, I undertake to the

Bank that: (a) I shall not: (i) increase the credit limit in respect of a credit card and/or

loan account which I have agreed to reduce; (ii) re-apply for a credit card and/or re-open a loan account

which I have agreed to cancel; (iii) increase the credit limit of any existing credit card

and/or loan account within 12 months from the drawdown of the Loan; or

(iv) apply for any new unsecured facility with another financial institution within 12 months from the drawdown of the Loan.

(b) If the Loan amount granted by the Bank is smaller than the total outstanding debt(s) owned by me to other financial institutions listed in the Loan application form, I shall be solely responsible for any shortfall and make my own arrangement(s) to repay the same to the said financial institutions.

5. Immediate Repayment I agree to pay to the Bank on demand all principal, interest and

other charges of and relating to the Loan. The Bank shall have the right to review, modify, reduce and/or cancel the Loan and demand immediate repayment of all outstanding principal of the Loan and interest thereon without prior notice.

6. Monthly Repayment On or before each Monthly Repayment Date, I agree to pay the

Monthly Repayment Amount. The Bank may at its discretion: (a) apportion the monthly repayments between principal,

interest and handling fee as the Bank shall determine; and/or (b) debit my account with such Monthly Repayment Amount on

each Monthly Repayment Date (which expressions as used herein shall have the same meanings as respectively referred to in the Bank's notification letter to me in relation to the Loan). If the Monthly Repayment Date for a particular month falls on a Saturday, a Sunday or a public holiday, my account will be debited on the preceding clearing day. If the Monthly Repayment Date falls on any of 29th, 30th or 31st of each

month and a particular month does not have such date, my account will be debited on the last clearing day of that month.

I may not alter the Monthly Repayment Date unless permitted by the Bank. If the Bank at its discretion permits alteration of the Monthly Repayment Date, I shall pay the Bank all reasonable costs and expenses in connection with the alteration.

7. Late Repayment Surcharge For each month I fail to pay any Monthly Repayment Amount

in full when due, the Bank will charge: (a) a default interest of 3% of the total Monthly Repayment

Amount overdue; and (b) a late charge of HK$300. 8. Early Repayment Early full repayment of the Loan is permissible upon seven

days’ prior written notice to the Bank provided that I shall on the date of such repayment pay the outstanding loan principal (including any arrears), outstanding handling fee, interest up to the next repayment date and an early settlement administrative fee (the “Early Repayment Amount”). The early settlement administrative fee shall be calculated by reference to the number of years in the remaining Loan period (any part of a year shall be rounded up to a year) and chargeable for each year at a rate of 1.5% per annum on the principal amount of the Loan. The outstanding loan principal and interest shall be calculated by the Bank in such manner as the Bank may at its sole discretion determine. Upon my request, the Bank may issue a certificate in relation to the Loan confirming the outstanding principal of the Loan, interest payable thereon, any charges due and the early settlement administrative fee. In the absence of manifest error, such certificate of the Bank shall be binding and conclusive on me. If I pay a lump sum amount (“Lump Sum”) to the Bank which is not enough to pay the Early Repayment Amount, I agree that the Bank may hold the Lump Sum as a prepayment and deduct the Monthly Repayment Amount from the Lump Sum on each Monthly Repayment Date until the Lump Sum is fully deducted. The Bank shall then debit my account with such Monthly Repayment Amount or part of it (as appropriate) on each Monthly Repayment Date thereafter until the Loan is fully repaid. I may not withdraw the Lump Sum or any remaining portion unless permitted by the Bank upon my written notice to the Bank. In case the Bank exercises its discretion to return any amount to me, I shall pay the Bank all reasonable costs and expenses in connection with the refund.

9. Set-off In addition to any general lien or similar right to which the

Bank may be entitled at law, the Bank may, at any time without prior notice, combine or consolidate any or all of my accounts (whether singly or jointly with others) with my liabilities to the Bank and set off or transfer any sum or sums standing to the credit of any of my accounts in or towards satisfaction of my liabilities to the Bank, whether such liabilities be primary, collateral, several, joint or in other currencies. Further, in so far as my liabilities to the Bank are contingent or future, the liability of the Bank to me to make payment of any sum standing to the credit of any of my accounts shall to the extent necessary to cover such liabilities be suspended until the happening of the contingency or future event.

10. Bank Charges I shall pay the Bank a handling charge as set out in the Bank

Charges Schedule in force from time to time, for each repayment returned for lack of available funds. I authorise the Bank to debit my Loan account any such amounts so payable.

11. Amendment The Bank will give me at least 30 days' notice in any manner it

thinks fit before amending the fees and charges or these Terms and Conditions. Any such amendment will be binding on me if I continue to utilise the Loan or allow the Loan to be outstanding after the effective date of the amendment.

12. Collection Costs The Bank may take such steps and actions as it reasonably

thinks fit to enforce repayment of the Loan and interest thereon and these Terms and Conditions including without limitation, employing lawyers and third party debt collection agents to collect any sums I owe the Bank. I shall indemnify the Bank on demand for all reasonably incurred costs and expenses incurred by the Bank in respect of any such enforcement steps and actions provided that the total amount of such costs of debt collection agents to be recoverable shall in normal circumstances not exceed 30% of the amount of the debt. I also agree and authorise the Bank to disclose relevant information to such persons for these purposes.

13. Contact Arrangements Communications delivered personally or sent by post will be deemed

to have been delivered to me (where delivered personally) at the time of personal delivery or on leaving it at such address, or (where sent by post) 48 hours after posting. If any of my personal details (including my address, employment, permanent residence or telephone number) has been changed, I will promptly inform the Bank in writing. I shall also notify the Bank promptly in writing of any difficulty in repaying any indebtedness or in meeting any payment to the Bank arising from the Loan.

14. No Waiver No failure, act, omission or delay by the Bank to exercise or enforce

any right shall operate as a waiver of such right, nor will any single, partial or defective exercise of any right prevent any other or further exercise of it or the exercise of any other right.

15. Miscellaneous These Terms and Conditions: (a) are personal to me and my rights or obligations may not be assigned

by me, but the Bank may assign or otherwise dispose of all or any of its rights and obligations hereunder;

(b) shall be binding upon my executors, administrators and personal representatives; and

(c) shall be governed by and construed in accordance with the laws of the Hong Kong Special Administrative Region and shall not operate so as to exclude or restrict any liability, the exclusion or restriction of which is prohibited by the laws of the Hong Kong Special Administrative Region, and if they contain any provision which is invalid for any reason, shall be ineffective only to the extent of such invalidity, which shall not affect the validity of the remaining Terms and Conditions.

16. Tax I agree to be bound by the terms relating to tax reporting, withholding

and associated requirements specified in the Tax Requirements Notice from time to time issued by the Bank, which are incorporated by reference into and shall form part of these Terms and Conditions. A copy of the Tax Requirements Notice is available on request at the Bank’s branches or from the website (www.dbs.com/hk).

If there is any inconsistency between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

Required Documents

1. Acceptance of these Terms and Conditions By requesting the Personal Instalment Loan, Express Loan, Salaries Tax

Loan or Debt Consolidation Loan (the "Loan"), I shall be deemed to have read, understood and accepted these Terms and Conditions.

2. Approval of the Loan and Conditions Approval of the Loan and the terms applicable to the Loan (including

amount, tenor of and interest rate applicable to the Loan) shall be at the sole discretion of DBS Bank (Hong Kong) Limited (the "Bank", which shall includes its successors and assigns) and is conditional upon fulfillment of the following conditions to the Bank’s satisfaction:

(a) provide all documentary proof required by the Bank which the Bank may independently verify;

(b) a satisfactory review of my credit profile available at the credit reference agency;

(c) in respect of a Debt Consolidation Loan application, (i) reduce the credit limit in respect of any credit card and/or loan account or (ii) cancel any credit card and/or loan account I maintain with another financial institution as required by the Bank.

3. Cancellation of Application I may not cancel an application for the Loan once processing

has commenced unless permitted by the Bank. If the Bank at its discretion permits cancellation of my Loan application, I shall pay the Bank all reasonable costs and expenses in connection with the cancellation.

4. Undertakings in respect of Debt Consolidation Loan If the Loan is a Debt Consolidation Loan, I undertake to the

Bank that: (a) I shall not: (i) increase the credit limit in respect of a credit card and/or

loan account which I have agreed to reduce; (ii) re-apply for a credit card and/or re-open a loan account

which I have agreed to cancel; (iii) increase the credit limit of any existing credit card

and/or loan account within 12 months from the drawdown of the Loan; or

(iv) apply for any new unsecured facility with another financial institution within 12 months from the drawdown of the Loan.

(b) If the Loan amount granted by the Bank is smaller than the total outstanding debt(s) owned by me to other financial institutions listed in the Loan application form, I shall be solely responsible for any shortfall and make my own arrangement(s) to repay the same to the said financial institutions.

5. Immediate Repayment I agree to pay to the Bank on demand all principal, interest and

other charges of and relating to the Loan. The Bank shall have the right to review, modify, reduce and/or cancel the Loan and demand immediate repayment of all outstanding principal of the Loan and interest thereon without prior notice.

6. Monthly Repayment On or before each Monthly Repayment Date, I agree to pay the

Monthly Repayment Amount. The Bank may at its discretion: (a) apportion the monthly repayments between principal,

interest and handling fee as the Bank shall determine; and/or (b) debit my account with such Monthly Repayment Amount on

each Monthly Repayment Date (which expressions as used herein shall have the same meanings as respectively referred to in the Bank's notification letter to me in relation to the Loan). If the Monthly Repayment Date for a particular month falls on a Saturday, a Sunday or a public holiday, my account will be debited on the preceding clearing day. If the Monthly Repayment Date falls on any of 29th, 30th or 31st of each

month and a particular month does not have such date, my account will be debited on the last clearing day of that month.

I may not alter the Monthly Repayment Date unless permitted by the Bank. If the Bank at its discretion permits alteration of the Monthly Repayment Date, I shall pay the Bank all reasonable costs and expenses in connection with the alteration.

7. Late Repayment Surcharge For each month I fail to pay any Monthly Repayment Amount

in full when due, the Bank will charge: (a) a default interest of 3% of the total Monthly Repayment

Amount overdue; and (b) a late charge of HK$300. 8. Early Repayment Early full repayment of the Loan is permissible upon seven

days’ prior written notice to the Bank provided that I shall on the date of such repayment pay the outstanding loan principal (including any arrears), outstanding handling fee, interest up to the next repayment date and an early settlement administrative fee (the “Early Repayment Amount”). The early settlement administrative fee shall be calculated by reference to the number of years in the remaining Loan period (any part of a year shall be rounded up to a year) and chargeable for each year at a rate of 1.5% per annum on the principal amount of the Loan. The outstanding loan principal and interest shall be calculated by the Bank in such manner as the Bank may at its sole discretion determine. Upon my request, the Bank may issue a certificate in relation to the Loan confirming the outstanding principal of the Loan, interest payable thereon, any charges due and the early settlement administrative fee. In the absence of manifest error, such certificate of the Bank shall be binding and conclusive on me. If I pay a lump sum amount (“Lump Sum”) to the Bank which is not enough to pay the Early Repayment Amount, I agree that the Bank may hold the Lump Sum as a prepayment and deduct the Monthly Repayment Amount from the Lump Sum on each Monthly Repayment Date until the Lump Sum is fully deducted. The Bank shall then debit my account with such Monthly Repayment Amount or part of it (as appropriate) on each Monthly Repayment Date thereafter until the Loan is fully repaid. I may not withdraw the Lump Sum or any remaining portion unless permitted by the Bank upon my written notice to the Bank. In case the Bank exercises its discretion to return any amount to me, I shall pay the Bank all reasonable costs and expenses in connection with the refund.

9. Set-off In addition to any general lien or similar right to which the

Bank may be entitled at law, the Bank may, at any time without prior notice, combine or consolidate any or all of my accounts (whether singly or jointly with others) with my liabilities to the Bank and set off or transfer any sum or sums standing to the credit of any of my accounts in or towards satisfaction of my liabilities to the Bank, whether such liabilities be primary, collateral, several, joint or in other currencies. Further, in so far as my liabilities to the Bank are contingent or future, the liability of the Bank to me to make payment of any sum standing to the credit of any of my accounts shall to the extent necessary to cover such liabilities be suspended until the happening of the contingency or future event.

10. Bank Charges I shall pay the Bank a handling charge as set out in the Bank

Charges Schedule in force from time to time, for each repayment returned for lack of available funds. I authorise the Bank to debit my Loan account any such amounts so payable.

11. Amendment The Bank will give me at least 30 days' notice in any manner it

thinks fit before amending the fees and charges or these Terms and Conditions. Any such amendment will be binding on me if I continue to utilise the Loan or allow the Loan to be outstanding after the effective date of the amendment.

12. Collection Costs The Bank may take such steps and actions as it reasonably

thinks fit to enforce repayment of the Loan and interest thereon and these Terms and Conditions including without limitation, employing lawyers and third party debt collection agents to collect any sums I owe the Bank. I shall indemnify the Bank on demand for all reasonably incurred costs and expenses incurred by the Bank in respect of any such enforcement steps and actions provided that the total amount of such costs of debt collection agents to be recoverable shall in normal circumstances not exceed 30% of the amount of the debt. I also agree and authorise the Bank to disclose relevant information to such persons for these purposes.

13. Contact Arrangements Communications delivered personally or sent by post will be deemed

to have been delivered to me (where delivered personally) at the time of personal delivery or on leaving it at such address, or (where sent by post) 48 hours after posting. If any of my personal details (including my address, employment, permanent residence or telephone number) has been changed, I will promptly inform the Bank in writing. I shall also notify the Bank promptly in writing of any difficulty in repaying any indebtedness or in meeting any payment to the Bank arising from the Loan.

14. No Waiver No failure, act, omission or delay by the Bank to exercise or enforce

any right shall operate as a waiver of such right, nor will any single, partial or defective exercise of any right prevent any other or further exercise of it or the exercise of any other right.

15. Miscellaneous These Terms and Conditions: (a) are personal to me and my rights or obligations may not be assigned

by me, but the Bank may assign or otherwise dispose of all or any of its rights and obligations hereunder;

(b) shall be binding upon my executors, administrators and personal representatives; and

(c) shall be governed by and construed in accordance with the laws of the Hong Kong Special Administrative Region and shall not operate so as to exclude or restrict any liability, the exclusion or restriction of which is prohibited by the laws of the Hong Kong Special Administrative Region, and if they contain any provision which is invalid for any reason, shall be ineffective only to the extent of such invalidity, which shall not affect the validity of the remaining Terms and Conditions.

16. Tax I agree to be bound by the terms relating to tax reporting, withholding

and associated requirements specified in the Tax Requirements Notice from time to time issued by the Bank, which are incorporated by reference into and shall form part of these Terms and Conditions. A copy of the Tax Requirements Notice is available on request at the Bank’s branches or from the website (www.dbs.com/hk).

If there is any inconsistency between the English and Chinese versions of these Terms and Conditions, the English version shall prevail.

Please submit photocopies of the following documents in order to facilitate your application. Documents supplied, including this application, will not be returned. 1. HK Permanent Identity Card(Document copies should be enlarged and

copied in clear quality with A4 paper); and2. Latest home address proof issued within the last 2 months (e.g.

electricity bill, rate bill, bank statements ), if you have a permanent home address, please also attach the permanent home address proof; and

3. Bank statement or passbook for which disbursement and repayment will be made (for passbook record, please provide the first page of the passbook that showing your name and account number are printed); and

4. Bank statement or confirmation letter showing your name and account number for which balance transfer will be made; and

5. Photocopy of the below documents applicable to you (please tick) For Employed Group (Fixed Income Earner) Full set of latest Salaries Tax Demand Note; or Latest 1 month’s computer generated Payroil Advices; or Latest 3 months' bank statement / passbook showing your name, account number and salary entries;

For Employed Group (Non Fixed Income Earner) Full set of latest Salaries Tax Demand Note and (A) Latest 1 month's computer generated Payroll Advices or (B) Latest 1 month's bank statement / passbook showing your name, account number and salary entries; or Latest 3 months' computer generated Payroll Advices; or Latest 3 months' bank statement / passbook showing your name, account number and salary entries; For Self-employed Group Full set of latest 2 years’ Profits Tax Demand Note and Latest 3

months' bank statement / passbook showing your name, account number and transaction entries;

Except for online statement

The Bank reserves the right to request additional documents for application processing.

Personal Instalment Loan Terms and Conditions

Fax : 2235 5947Page 9 of 9

Personal Instalment Loan - Debt Consolidation Loan and DBS Platinum MasterCard Application Form

Signature of Applicant (Please sign on each page)

X svDate

Note: Please use the signature of the direct debit account and ensure that you sign the alternation as well. DBS

/AF/

5436

/04/

2015

/MD