Attribution: Asia Pacific Satellite communications …/media/Files/Insights/APSCC...Meanwhile, for...

Transcript of Attribution: Asia Pacific Satellite communications …/media/Files/Insights/APSCC...Meanwhile, for...

Attribution: Asia Pacific Satellite communications council (APSCC), APSCC 2013 Q1 newsletter, ISSN 1226-8844; URL: http://www.apscc.or.kr/upload/pdf/Q1%202013.pdf

Getting Enterprise Networks Ready for Greater Speed and Performance Dave Bettinger, Chief Technology Officer & Senior Vice President of Engineering, iDirect

One of the most significant trends in enterprise connectivity is the need for faster bandwidth. It’s a development that’s evident across virtually every market – corporate, maritime, oil and gas, cellular backhaul, utilities and many others. It’s driven by end users who want to run a broader range of business applications over a satellite network and who need to expand their network to new sites and new users.

This development will further intensify once High Throughput Satellites (HTS) come online. NSR projects that we’ll see at least 1.6 Tbps of HTS capacity by 2020. While much of this capacity was originally targeted toward the consumer market, close to 50% of all revenues will come from will be from enterprise-class and military applications. These applications offer a much higher value per bit and are very important to service providers in a mixed-service offering.

These trends are encouraging for everyone in the satellite industry. However, they will place a strain on service providers to deliver higher data rates and support larger scale networks. As a result, service providers need to plan wisely to meet both immediate and future changes in how they serve their customers.

Let’s look at how several key markets are growing, how they will be impacted by HTS, and how service providers must prepare for the increased customer expectations and technical demands that HTS will bring.

Vertical market developments ���The maritime industry has been one of the most recent and dramatic VSAT success stories. In a relatively short period of time, VSAT replaced L-band connectivity as the communications technology of choice to link ship and shore. COMSYS projects the number of vessels with VSAT will double by 2016 to more than 26,000 vessels, and annual revenues will exceed $1.2 billion. While crew welfare remains the primary onboard application, vessel operators are expanding their priorities to business and operational functions, as well as corporate network access.

Maritime will be one of the first enterprise markets to benefit from HTS. Lower capacity, hardware and installation costs will change the economics of VSAT service. This will open up an untapped segment of the maritime market that includes small to mid-sized shipping companies, ferries, fishing vessels, yachts, and other specialized vessels.

Meanwhile, for current users, HTS capacity offers the ability to increase the flexibility of their existing investment in satellite or expand their network to more of their fleet at a lower cost.

Cellular backhaul is another fast growing enterprise market. Satellite is already being used on 2G net- works to extend carrier-grade voice service into remote areas. But a whole new level of growth is coming as mobile data is expected to explode. Cisco projects that data traffic will increase 18-fold worldwide by 2016, and the number of mobile devices will surpass 10 billion.

Mobile operators are discovering that they can dramatically lower the cost or rural network expansion by deploying small cell infrastructure in place of macro cells. And HTS will significantly lower the cost of satellite bandwidth, making cellular backhaul much more affordable.

So, what are some of the key technology capabilities that will enable service providers to capitalize on enterprise market opportunities?

Making TDMA faster ���

Across the enterprise market, shared-bandwidth TDMA (Time Division Multiple Access) systems are taking market share from dedicated SCPC (Single Channel Per Carrier) systems. According to COMSYS, maritime SCPC systems have slipped from 80% of installations in 2003 to less than 33% today. They have been replaced by TDMA. NSR reports that in the cellular backhaul market, mobile operators are transitioning from SCPC to TDMA at a rate of 15%.

Traditionally, SCPC held an advantage over TDMA in data throughput rates. However, with new pro- cessing innovations, TDMA technology has advanced significantly, reaching SCPC rates. This gives service providers the throughput capabilities they need today, while retaining the efficiencies of multi-site bandwidth sharing.

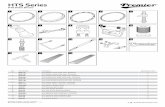

The Evolution X7: iDirect’s New High Performance TDMA Remote

Preparing for HTS

���HTS, of course, will impact the enterprise market significantly, delivering faster throughput rates at lower costs per MB. However, while HTS brings considerable opportunity, it comes with its own set of challenges.

New satellite architectures. Satellite operators are choosing different architectures to get the most out of the markets and geographic areas they want to serve. HTS satellites encompass a wide range of different bands, beam sizes and earth orbits – each with its distinct strengths and unique physics.

Diverse business models. HTS satellite architectures will impact the value chain – who owns and manages infrastructure and who owns and manages customer relationships. That means new business models will emerge for bringing HTS capacity to market. These can range from managed services developed by satellite operators and delivered through service providers to new arrangement for infrastructure sharing and collaboration. Success will require flexibility to adapt to any business model present or future.

All this gives new importance to the capabilities of ground infrastructure, which must enable the entire value chain – satellite operator, service provider and end user – to capitalize on these opportunities in the most profitable ways with maximum choices, flexibility and value. As networks become more complex, ground infrastructure must be able to deal with it.

HTS ground infrastructure requirements

���So what does an HTS platform look like? There are five foundational requirements:

• A universal IP hub that can support all frequencies and all satellite architectures. With HTS, satellite operators and service providers will need to manage an increasingly diverse and integrated network portfolio that spans HTS and traditional MEO and GEO satellites; integrates bandwidth across multiple bands and beams around the world; supports legacy deployments and new growth; and meets the needs of any network size, application and bandwidth requirement.

• Infrastructure that can scale with demand. Service providers need to leverage their current infrastructure to transition to HTS. A total hardware replacement solution would be too costly.

Yet, service providers must also be able to deploy high-bandwidth networks exceeding hundreds of megabits per remote site and large-scale networks including hundreds of thousands of terminals. The key to achieving this is to engineer current platforms to handle exponentially more bandwidth and symbols, reaching data rates in the tens of GBs. Further, a platform with a hub chassis and line card system enables service providers to launch and scale HTS networks in a pay-as-you-grow manner, while building on current infrastructure investments.

• Carrier-class service reliability. As operators and service providers position HTS satellite as a mainstream technology, it is critical that they deliver carrier-class service reliability. That means ground infrastructure must ensure maximum availability. A network must automatically optimize inbound and outbound traffic for high performance under any condition – adjusting to weather, beam location and terminal size. And it requires hub diversity to overcome rain fade and hub redundancy to ensure network failover.

• Easy to use, easy to deploy terminals engineered to meet distinct end user needs. End users will demand lower cost, more compact and ever faster remotes that are integrated into a complete, smaller-sized terminal. These enhancements will significantly reduce the capex required to deploy a VSAT network, and that will help increase the number of first-time VSAT users.

• A single network management system (NMS) to make large-scale deployments manageable and that automates, optimizes and integrates NOC and business applications. To run their businesses efficiently, service providers will need to manage their HTS and non-HTS deployments through a single NMS that can handle large-scale deployments. The NMS must also be able to sync with billing systems and consumer grade provisioning systems. Further, it should provide extensive network monitoring and analysis and enable operators to extend core functionality and customized features to end users.

The path forward ���

The overall market for enterprise connectivity is surging. To capitalize on this immediate opportunity, service providers need to implement higher speed networks that can handle growing volumes of voice and data traffic. And to prepare for future demand, service providers need to implement a plan for HTS. These investments must be done in tandem. They are tied to the same underlying trend – the rapid development of satellite as a mainstream connectivity solution.

Dave Bettinger is iDirect’s chief technology officer and senior vice president of engineering. Bettinger is responsible for the oversight of all technology decisions within iDirect and serves to drive strategic direction for product development, technology alliances, along with mergers and acquisitions. Bettinger currently services on the board of directors for the Global VSAT Forum and is an active member of the Telecommunications Industry Association, IEEE and IPv6 Forum. Bettinger is a graduate of Virginia Tech with a Masters of Science degree in Electrical Engineering and has been awarded six patents in the area of satellite communications.