Pattaya city condominium market report h1 2013

-

Upload

mark-bowling -

Category

Documents

-

view

215 -

download

3

description

Transcript of Pattaya city condominium market report h1 2013

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

THAILAND

www.colliers.co.th

A similar number of newly launched units were introduced in the first half of this year, as were in the second half of 2012.

Just 800 units were completed and transferred during H1 2013. This is higher than the total number of units completed in 2012.

A large number of Pattaya and Bangkok-based developers continue to give a strong vote of confidence for the Pattaya market.

The average take-up rate and average price for the first six months of 2013 are similar to the previous year.

The new Jomtien Second Road is the most densely developed area throughout the municipality during 2012. Jomtien, in particular, runs the risk of oversupply, and many government agencies and property gurus are concerned about the Jomtien situation.

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

EXECUTIVE SUMMARY

PATTAYA CITY CONDOMINIUM MARKET REPORT

Pattaya City Condominium Market Report

NEWLY LAUNCHED UNITS IN H1 2013

HISTORICAL SUPPLY, H1 2013

COLLIERS INTERNATIONAL | P.2

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

Newly launched units in the first half of 2013 were similar in number to those launched during the second half of last year. Approximately 7,400 units were launched in the first half of 2013, and most (around 52%) of the newly launched condominium units in H1 2013 were located in the Jomtien area.

Three listed developers, Sansiri, Supalai and SC Asset Corporation, launched their first projects in Pattaya City in the first half of 2013 and received good feedback from buyers, especially the Thai market .

At the end of H1 2013, the total supply of condominium units amounted to approximately 47,490. During H1 2013, a rather low figure of just 800 units were completed and transferred. More than 13,000 units are under construction and expected to be completed in the second half of 2013, the highest on record for Pattaya City.

The labour shortage is still the major obstacle in the construction industry, which is causing delays to complete some condominium projects on time in Thailand, including some in Pattaya.

Source: Colliers International Thailand Research

Source: Department of Land and Colliers International Thailand

Pattaya proved to be the most popular area for the condominium market in the years prior to 2000; however, from 2001 onwards, the Jomtien area has displayed continual growth due to the abundance of remaining beachfront and secondary development sites. Pattaya, on the contrary now faces a scarcity of development sites and those that are available are becoming prohibitively expensive. During 2005, the Pattaya City Administration initiated improvements to be made along Thappraya Road and introduced a new Jomtien Second Road extension. The road was designed to alleviate traffic congestion from the beach road and now has many sois linking the roads together.

With the introduction of this new road, which is still an on-going project, we have witnessed the entire area opening up and becoming available for large-scale resort-style mass development, mostly appealing to the lower end of the market.

The condominium supply expected to be completed between H2 2013 and 2015 in the Jomtien area is more than 15,000 units.

Source : Colliers International Thailand Research

SUPPLY BY ZONE, H1 2013

COLLIERS INTERNATIONAL | P.3

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.4

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

Source: Colliers International Thailand Research

Source: Colliers International Thailand Research

Note: Based on developers estimates of completion dates.

CONDOMINIUM SUPPLY BY LOCATION, H1 2013

CUMULATIVE FUTURE SUPPLY BY YEAR AND LOCATION, H1 2013

The largest condominium supply is in Jomtien, representing about 42% of the total, followed by Pattaya with approximately 30%.

The Pattaya area was home to the majority share of the Pattaya City condominium market from 1990 to 2000, but due to the limited plots of land, developers are moving south. Jomtien is the new location for property development, especially around the Jomtien Second Road, which officially opened in 2005. Thus, the total share of the Jomtien

area has increased to become the largest share of the Pattaya City condominium market.

The pattern of overall real estate development is different for Jomtien and Pattaya, as Pattaya contains the vast majority of both hotels and commercial developments, which leaves very limited land supply for large-scale condominiums.

FUTURE SUPPLY

According to claims by developers, more than 13,200 units are scheduled to be completed and transferred during the second half of 2013. From 2013 to 2015, Jomtien will continue to be the main player in the Pattaya condominium market, particularly in the mid-range to

low-end sectors. Most large-scale condominium projects were launched in Jomtien area during the past few years, some with more than 1,000 units.

COLLIERS INTERNATIONAL | P.5

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

Source: Colliers International Thailand Research

NEWLY LAUNCHED UNITS BY LOCATION AND HALF YEAR H1 2013

New launches for H1 2013 were very similar to the second half of last year and Jomtien is still the most fashionable for condominium developers, followed by the Pattaya area. Three new projects were launched in Jomtien consisting of 1,000 units or more in each project

The majority of condominium projects launched in the last 12 months have focused on mid-range to low-end buyers, though there are some

exceptions concentrating at the upper end of the market also reporting strong sales figures. Mainstream buyers, both foreign and Thai, are mostly looking for an affordable holiday home, not far from the beach, with good facilities and trusted management from a recognised developer with a good track record.

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.6

Source: Colliers International Thailand Research

TAKE-UP RATE OF LAUNCHED PROJECTS FROM 2010 TO H1 2013

The average take-up rate for Pratumnak increased by an average of 1 - 2% from the second half of 2012. Wongamat is highest in average take-up rate, due to no new condominium projects being launched in the area and some projects were already completed and ready to transfer.

The take-up rate of Pratumnak and Na Jomtien increased by an average of approximately 7% from the second half of 2012, and the

remaining locations, Pattaya and Jomtien, recorded a slight decrease. Many new condominium projects were launched in Jomtien and Pattaya in the first six months of 2013, which affected all average take-up rates in the area. In addition, some projects in those two areas have more than 1,000 units.

In contrast to the last few years when foreign buyers were the mainstay of the Pattaya and Jomtien property scene, we’re seeing a remarkable entry into all segments of the market from Thai buyers. For many years, the majority of the foreign-owned local development companies struggled to sell their 51% Thai requirement. There is now a massive shift as we witness many Thai developers coming to Pattaya, who successfully sell well to the Thai market but do not come close to filling their foreign ownership quota.

Many Thai developers appear to be finding international sales difficult to attract in Pattaya, having rested on their reputation in Bangkok without a clear perception of how Pattaya and the foreign market works. To many foreign buyers the big name Bangkok developers are unheard of and often their marketing isn’t even foreigner friendly. This is changing somewhat and many of the Thai developers are realising that to be a success in Pattaya they cannot rely solely on the local market and are attempting to address the situation, gradually.

The Thai market is particularly brand-conscious and tends to follow well-known names such as LPN, Q House, Major Developments and other listed developers such as Sansiri and Supalai. Other lesser known Pattaya based foreign developers have discovered the attraction of adding a brand name hotel component to their project which adds prestige, desirability, and sales to both Thais and foreigners have been encouraging.

The Russian market continued its resilience during the first half of the year and it appears that they are less affected by global economic problems than other nations. European, British and American buyers have not shown the demand of previous years. Emerging markets such as India and China have now started to dip their toes into the water, with interest in the Pattaya market from these economic powerhouses continuing to grow rapidly. We believe that these countries could quite possibly become the superpowers of the future when it comes to buying property in Pattaya, just as the Russian market has increased year on year for the last decade

During the early part of the year, we witnessed a wide range of condominiums enter the market and were astonished by the massive success of many and the incredible take-up rates in most areas. Certain projects have been almost sold out as soon as they were launched, others took several months to reach 50 to 70% sold, however, the overall results are very encouraging for the market in general and there seems to be no stopping the immense popularity that Pattaya holds for both investors and end users.

There are warning signs that investors should consider if entering the market for the first time. However with the guidance of a reputable local agent who can provide unbiased advice, there are still many potentially sound investments to be made.

DEMAND

FOREIGN OWNERSHIP/DOMESTIC DEMAND

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.7

Source: Colliers International Thailand Research

AVERAGE SELLING PRICE PSM BY LOCATION, H1 2013

BEACH FRONTAGE AND HEIGHT OF CONDOMINIUMS EFFECT ON PRICE H1 2013

The average selling price in Wongamat remains the highest, compared to all other locations in Pattaya City. Most condominium projects in the area are luxury projects and are almost complete or ready to move in. Most condominium projects in the Jomtien area are mid-range to low-end projects, targeting the budget buyers group. The average price in

Jomtien in H1 2013, increased by around 3 - 5% from the previous year, but it is still lower than in other locations. In addition, some projects in the Jomtien area are offering more than 1,000 units per project.

Beach frontage is the key driver in attracting higher prices for luxury condominiums. Prices can rise by over 100% when a project is located by the beach, especially in the Wongamat and Na Jomtien areas.

The average selling price of a high-rise project is higher than that of a low-rise, due to the increased construction costs, and the privilege of

having a sea view from all units also commands a premium. However, certain low-rise projects with an emphasis on facilities such as a large themed lagoon swimming pool or amenities one would expect to find in a resort will often command higher pricing.

PRICE

Source: Colliers International Thailand Research

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.8

OUTLOOKMost listed developers have launched their condominium projects in Pattaya City already and have created a hugely competitive market, which should benefit buyers. All of them also achieved high take-up rates, especially the mid-range projects. Local developers are also still strong in the market, particularly those with a good reputation and excellent track record; others have looked to diversify into other sectors after discovering greater competition and narrower margins.

Many condominium projects were launched in all locations of Pattaya City, especially in the Jomtien area. Therefore, some government agencies and property experts were concerned about oversupply in the condominium market, especially in the Jomtien area.

Most new condominium projects launched in 2012 and in the first half of 2013 are mid-range to low-end, so the average selling price in all locations still remains similar or slightly lower than in the previous year. Many cost factors directly related to construction such as materials and logistics fees increased, so the average price in the

second half will probably increase by more than 5%. Land prices across Pattaya and Jomtien are now becoming prohibitively expensive as zoning and EIA regulations play a major part in what can actually be built.

Some new community malls and tourist attractions were completed and opened their doors in 2012 and in H1 2013, and have attracted many foreign and Thai tourists. In addition, some water park projects are under construction and expected to be completed in 2013 - 2014. When all of the projects are completed, many Thai and foreign tourists will be attracted and the property market in Pattaya city should grow further in popularity.

The second half of 2013 is the high season of Pattaya, and we expect the take-up rate to increase significantly from the first half.

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.9

APPENDIX

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.10

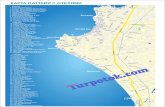

ZONING

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL | P.11

DESCRIPTION

Pattaya is a city located on the east coast of the Gulf of Thailand about 165 km southeast of Bangkok. It is within, but not under the jurisdiction of Amphoe Bang Lamung in the province of Chonburi. The city of Pattaya is a self-governing municipality that covers the whole tambon of Nong Prue, Na Klua, parts of Huai Yai and Nong Pla Lai. It is located within the heavily industrialised Eastern Seaboard zone, along with Sri Racha, Laem Chabang and Chon Buri. It has a population of 556,916 and covers an area of 49.37 sq km.

Pattaya City occupies most of the coastline of Banglamung (one of the 11 districts that comprise Chonburi Province). It is divided into a larger northern section that spans the areas to the east of Naklua Beach (the northernmost beach) and Pattaya Beach (the main beach), plus the Buddha Hill headland (immediately south of Pattaya Beach), and a smaller southern section covering the area to the east of Jomtien Beach, which lies directly south of Buddha Hill.

The report covers the Pattaya City area, as well as Na Jomtien, and a distinction is made between Pattaya City and Pattaya Bay, which constitutes part of the overall area under consideration.

Pattaya City can be divided into five zones for the purposes of this report. Below is a summary of each zone.

Wong AmatThis is the area to the north of Pattaya Nua and is considered a more peaceful, up-market location and a relatively new setting for condominium development. Wong Amat Beach is considered the finest in Pattaya and boasts several of the higher-end luxury hotels and condominiums. Limited beachfront land should ensure that prices increase in tandem with the popularity of this area from both Thais and foreigners.

Pattaya This area is considered as the city centre. The section of beach from Central Road south to the harbour runs adjacent to the core of Pattaya’s abundant nightlife area. Pattaya Nua and Klang are the areas favoured by Asian visitors, especially Chinese and Koreans. A large number of expat employees also prefer this location due to easy access of the main highways. The area of South Pattaya is popular among Middle Eastern, South Asian and Russian visitors. The area along Soi 15 Second Road is enjoying a resurgence in popularity among buyers.

PratumnakLocated to the south of Pattaya and bordering Jomtien, Pratumnak is considered a quiet residential area with a mix of luxury villas, high- and low-rise condominiums. The Pratumnak area features two beaches, Cosy Beach and Haad U Thong, which are popular with Russian and Scandinavian visitors. Restrictions on condo development, limited availability of land and desirability of the area should ensure that property prices in Pratumnak will steadily rise.

JomtienJomtien Beach is about 1 km south of Pratumnak Hill. The locale is home to many high-rise condominiums, beachfront hotels, shops and restaurants. The area at the beginning of Jomtien is considered busier, while the area located at the end of this beach, known as Na Jomtien, is considered to be much more peaceful and less congested.

Na JomtienNa Jomtien Beach is south of Jomtien and partially does not have a beachfront road and is less developed as a result. The main road connection is Sukhumvit Road, which is located 500 - 1,000 m from the beach; this area extends to Ban Amphoe Beach in Sattahip District.

Note: The report covers residential areas located on or west of Sukhumvit Road.

PATTAYA CITY CONDOMINIUM MARKET REPORT | H1 2013

COLLIERS INTERNATIONAL THAILAND MANAGEMENT TEAM

RESEARCHSurachet Kongcheep | Associate Director

ADVISORY SERVICES | HOSPITALITY Jean Marc Garret | DirectorWanida Suksuwan | Associate Director RETAIL SERVICESAsharawan Wachananont | Associate Director

OFFICE SERVICESNattawan Radomyos | Senior Manager

PROJECT SALES & MARKETINGWanna Sutitosatham | Associate Director RESIDENTIAL SALES & LEASINGNapaswan Chotephard | Senior Manager

INDUSTRIAL SERVICESNarumon Rodsiravoraphat | Associate Director ADVISORY SERVICESNapatr Tienchutima | Associate Director

REAL ESTATE MANAGEMENT SERVICESThanasit Tonsatcha | Associate Director

INVESTMENT SERVICESNukarn Suwatikul | Associate Director Ravinthorn Toungtrikoon | Senior Manager

VALUATION & ADVISORY SERVICESPhachsanun Phormthananunta | DirectorRatchaphum Jongpakdee | Associate Director Wanida Suksuwan | Associate Director PATTAYA OFFICEMark Bowling | Associate Director Supannee Starojitski | Senior Business Development Manager / Office Manager

HUA HIN OFFICESunchai Kooakachai | Associate Director

www.colliers.co.thwww.colliers.co.th

RESEARCHER:

ThailandSurachet KongcheepSenior Manager | ResearchEMAIL [email protected]

482 offices in 62 countries on 6 continents

• A leader in real estate consultancy worldwide• 2nd most recognized commercial real estate brand globally

• 2nd largest property manager• 1.1 billion square feet under management• Over 13,500 professionals

COLLIERS INTERNATIONAL THAILAND:

Bangkok Office 17/F Ploenchit Center, 2 Sukhumvit Road, Klongtoey,Bangkok 10110 ThailandTEL +662 656 7000FAX +662 656 7111 EMAIL [email protected] Pattaya Office 519/4-5, Pattaya Second Road (Opposite Central Festival Pattaya Beach), Nongprue, Banglamung, Chonburi 20150TEL +6638 427 771FAX +6638 427 772 EMAIL [email protected] Hua Hin Office 27/7, Petchakasem Road, Hua Hin, Prachuap Khiri Khan 77110 ThailandTEL +6632 530 177FAX +6632 530 677 EMAIL [email protected]

This report and other research materials may be found on our website at www.colliers.co.th. Questions related to information herein should be directed to the Research Department at the number indicated above. This document has been prepared by Colliers International for advertising and general information only. Colliers International makes no guarantees, representations or warranties of any kind, expressed or implied, regarding the information including, but not limited to, warranties of content, accuracy and reli-ability. Any interested party should undertake their own inquiries as to the accuracy of the information. Colliers International excludes unequivocally all inferred or implied terms, conditions and warranties aris-ing out of this document and excludes all liability for loss and damages arising there from. Colliers Inter-national is a worldwide affiliation of independently owned and operated companies.

Accelerating success.