Own Your Power - Admirals Bank · Own Your Power Residential Solar Product Guide ... Is your...

Transcript of Own Your Power - Admirals Bank · Own Your Power Residential Solar Product Guide ... Is your...

Own YourPower

Residential Solar Product Guide

Own YourPower

Residential Solar Product Guide

This product guide is confidential and for internal or informational use only.Do not reproduce or redistribute.

800-715-8472Learn more: https://www.admiralsbank.com/renewable-energy-lending

Advantages

••

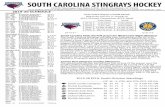

We’re Admirals Alternatives

Product Guide

Residential Solar Lending

Section 1: Closing the Deal

Is your customer a good Admirals loan candidate? Ask these questions to qualify them and leverage these simple talking points to help you close more deals using Admirals.

Question 1: “Do you want to own your solar system, but don’t want to come out of pocket?”

Admirals is a no money down ownership solutionDesigned to maximize returns on solar ownership

Question 2: “Do you have tax appetite?”

•

•

Question 3: “Do you like your �nancing products to have �exibility and choice?”

•

•

Question 4: “Do you have a sense for your credit?”

••

Minimum FICO score of 650 to borrow up to $25,000 and 700 to borrow up to $40,000No bankruptcies in past two yearsMaximum debt-to-income ratio of 45%•

•

Question 5: “How many mortgages do you have on your home?”

• If you already have two, let’s refer to the Pre-Screening Document to �nd out if you can still qualify

Admirals Alternatives, a division of Admirals Bank, assists homeowners across all 50 states seeking ownership of home solar systems. We have o�ered home improvement loans since 1987, and our solar lending programs have been customized through market feedback to best support our customers. Our products are designed to maximize homeowner savings on solar invest-ments. Admirals Bank is federally-chartered, and has Admirals Alternatives centers in New England and California.

Talk to your local tax advisor and/or local electricity provider or government representative about:o Taking advantage of 30% Federal Tax Credit (plus any state and local credits, rebates and incentives)o Leveraging tax credits and incentives to keep payments low

Tax deductible interest on secured loans for additional savings

Fully secured and combo secured/unsecured loan options availableo No equity or appraisal requirementso Lien will be placed against the property in the �rst or second position

Fixed rates and �exible termsPay o� early with no penalties

o Peace of mind if you move or sell your home

Product Guide

Residential Solar Lending

Here are the options on how to get started:

Loan Advisor will help explain the program to your customer and get them pre-quali�ed within minutesCustomer may choose to continue to stay on the line with the Loan Advisor to complete application, which may take up to 15-20 minutes

•

•

Pre-qualify your customer online at https://www.admiralsbank.com/renewable-energy-lending/for-con-tractors/prequali�cation-form

Sales rep must log into the Contractor Dashboard for accessSales rep sends pre-quali�cation link to the customer's email from the Contractor DashboardCustomer completes the form and is pre-quali�ed based upon credit within secondsLoan Advisor is alerted via e-mail and follows up with the customer the next day to take the full application

•

••

Refer your customer online at https://www.admiralsbank.com/renewable-energy-lending/for-con-tractors/contractor-upload

Allows customer to talk to the bank on their own timeSales rep uploads customer name and contact information onto the Contractor DashboardLoan advisor is alerted via e-mail and follows up with customer at the customer’s requested time

•

••

Call a Loan Advisor at (800) 615-8472:

1All loans are subject to credit approval. A prequali�cation is not an approval. Approvals require the submission of a complete loan application.

Have your customer fully apply online at https://www.admiralsbank.com/renewable-energy-lending/-for-homeowners/how-to-apply

Full, secure, digital loan applicationTakes about 20-30 minutesLoan Advisor is alerted via e-mail and calls customer with a credit decision in 24-72 hoursWhen utilized, SolarPlus is billed on the same statement as Solar StepDownFirst payment is due one month after the loan is funded

•

••

••

Get an Application StartedAdmirals o�ers a few di�erent ways to get your customer’s application started. Once your customer applies, you have visibility into the approval and funding process in the Pipeline Report on the Contractor Dashboard. Remember, pre-quali�cation can be instantaneous, and full approval can take as little as 24 hours.1 Unlike a home mortgage or HELOC, which can take 30-120 days, the customer will receive the funds via check or wire transfer in 11-12 days (includ-ing Saturdays, but not Sundays or Bank holidays) after the application date. Please note, installers may not in any way assist the borrower with or participate in the application process or transfer or accept loan/credit documents between Admirals Bank and borrower.

•

Billing Information

Product Guide

Residential Solar Lending

SolarPlus:

Combined maximum loan amount: $40,0004 Unsecured, same-as-cash loan is matched to 30% of system value—no interest, no payments on this portion for 18 months5

Secured FHA Title I loan covers remainder of system �nancing—�exible loan terms available for multiple monthly payment optionsAdditional qualifying requirements: minimum FICO score of 700

•

•

•

Admirals makes billing simple and easy for homeowners.

Besides a $100 fee due to the Notary at closing, upfront payment is not requiredHomeowner pays the bank monthly according to the payments in the signed loan documentsHomeowner may pay via ACH or checkWhen utilized, SolarPlus is billed on the same statement as Solar StepDownFirst payment is due one month after the loan is funded

•

••

Loan Product Details

Section 2: The Details

We never charge any fees to installers for using our products. Additionally, our loan products do not restrict installers on system size or equipment used. The loan program is broken down into two components: (1) Solar StepDown and (2) SolarPlus.

Solar StepDown: Question: What is StepDown? Answer: StepDown is the ability to lower monthly loan payments by applying money from solar incentives and other sources to the loan balance.2

Secured loan with $25,000 maximum amount3 FHA Title I home improvement loan (1% annual HUD insurance fee built into loan payments)Flexible terms Rates ranging from 4.95% to 9.95%, depending on credit scoreQualifying requirements: minimum FICO score of 650, debt-to-income ratio of 45% or less, and no bankruptcies in past two years

•••••

••

Question: What is SolarPlus?Answer: SolarPlus, the Bank’s �agship renewable energy loan, allows homeowners to combine an unsecured, same-as-cash loan for 30% of their system’s value, with a term loan for the remaining amount of the system value, keeping payments very low from day 1.

•

2Customer may apply moneys to loan balance several times, however, is only allotted one re-amortization in �rst 24 months. 3Includes 5% origination fee and other pass-through expenses (usually around $650) to the homeowner4Includes 5% origination fee5If the customer elects not to pay o� the full principal amount of the loan within 18 months of funding date, then: (1) the interest accrued from the funding date will not be waived by the Bank and (2) all accrued interest due from the funding date will be capitalized and added to the outstanding principal balance due. Interest will then be charged on the new principal balance and continue until the full principal balance has been paid.