OVG Annual Report Summary DEF

-

Upload

wessel-simons -

Category

Documents

-

view

662 -

download

1

Transcript of OVG Annual Report Summary DEF

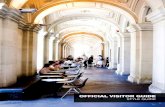

Ahead of the Curve

SummaryAnnual Report 2011

OVG Real Estate B.V.

re/developers

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

2 3

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

6.0 –– Board Reportpage 32

7.0 –– Financial Statements 2011page 36

7.1 Consolidated Balance Sheet (after appropriation of result)

7.2 Consolidated Income Statement7.3 Consolidated Cash

Flow Statement7.4 Notes to the Consolidated

Financial Statements

–– Project Highlightspage 51

Colophonpage 118

1.0 –– Ahead of the Curvepage 04

2.0 –– OVG at a Glance in 2011page 12

3.0 –– Key Statisticspage 14

4.0 –– Management Boardpage 16

4.1 Board4.2 Advisory Board

5.0 –– Business Profile page 20

5.1 Activities5.2 Mission5.3 Strategy5.4 CSR & Sustainability

Contents ––

5

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

EntREpREnEuRS REAd thE SiGnS Of ECOnOmiC ChAnGE

BEfORE thEy impACt On BuSinESS And inVEStmEntS

1.0 –– Ahead of the Curve

Ahead of the Curve Generally speaking, being ahead of the curve means you have anticipated the market or are ahead of everyone else. It refers to your position on the statistical bell curve, where the top of the curve represents the median, average result. By being ahead of the curve you represent the top percentile of results that either has the advanced skills or understanding that sets you apart. The company is beating the odds and trying to stay ahead of the game. It also means you take action to prevent a problem rather than waiting until it occurs. You know how to read the signs of economic change before they impact your business and investments.

Forward Thinking OVG Real Estate is that kind of company, that continuously looks for ways to stay ahead of the game and provide added value for her customers. Today’s economic, social and climate changes demand forward thinking. The essential elements that enable OVG to meet these demands are: bright, talented staff, entrepreneurship, a mindful approach, new product/market combinations and placing our clients’ needs at the core.

4

6 7

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

has also made the Netherlands the second wealthiest country in the European Union in terms of per capita income and the unemployment figures in the Netherlands are among the lowest in Europe. The country’s geographical position in the EU is very strong; the workforce is well educated, multi-lingual and flexible and the country has an excellent physical infrastructure. The Netherlands has a number of key logistics hubs such as the largest Port in Europe (Rotterdam) and Schiphol Airport, as well as a high penetration of broadband Internet. This provides the country with a sound physical infrastructure and consequently enables it to be a top performer in terms of logistics.

Looking at the Dutch real estate investment market, we see continued demand for high-quality offices with strong credit tenants at prime locations. One of OVG’s specialist sectors. Successful sales of projects such as the Danone Innovation Centre in Utrecht in 2011 and attractive long term return figures for Dutch office investments both confirm this. According to IPD, 10-year total return for Dutch offices up to January 2011 amounted to 6.4%, outperforming office investments in the UK and Germany and outperforming the Dutch AEX equities index. On the other hand we note that the Dutch office market has become a two-tier market. Prime offices in good locations continue to find healthy demand from occupiers and investors, but a large segment of older offices in less central locations faces structural oversupply. OVG is playing an active role in working with industry and government partners towards reducing the structural oversupply. Starting with issues within our own control we have adapted our own change strategy with the aim that from 2012 50% of our Dutch pipeline will comprise redevelopments of older offices.

OVG and Triodos Bank set up the joint venture JOIN Ontwikkeling over a year ago; aimed at sustainable social real estate for the Dutch care, health and education sectors. JOIN wants to strategically improve real estate performance for this market that is currently undergoing severe budget challenges. We foresee this market demonstrating a continuing strong added value in 2012 when partnering with clients in long-term real estate management, financing and investments.

Internationally, OVG is aiming for growth throughout Europe. Our high reputation for sustainability, risk management and execution means we actively follow our corporate clients cross-border. With our entrepreneurial spirit combined with the strong relationship with our clients at the core of our business, we are looking to attract new capital

2011 was again a good year for OVG; we retained our position as the Netherlands’ largest commercial real estate developer and one of the top 3 office developers in Europe. Our financial performance was strong; we gained market share; our completed development portfolio grew to 550,000 sqm GFA; we delivered Europe’s first LEED Platinum office and took important steps towards growth in new markets such as social real estate, redevelopment and international commercial real estate.

OVG has maintained its position as No.1 Dutch real estate developer for corporate accounts. We have enjoyed working with new and returning clients such as: Deloitte/AKD, Danone, TNT, Triodos, Van Oord, Schneider Electric, Eneco, UPC, KPMG, Cofely, Sonion, Oranjewoud, Asics, Nederlandse Hartstichting, Timberland, RET, Avery Dennison, PGGM/IVG and Q8, delivering the highest international sustainability standards ranging from LEED Platinum to BREEAM Excellent. We are also proud to announce that in June this year we launched a special technology innovation partnership with one of our clients, Schneider Electric, for the further implementation of the most up-to-date energy management technologies in new and existing buildings.

We are proud to have the Netherlands as our home market. According to the World Economic Forum, the Netherlands has the seventh-best business climate in the world. The high productivity of Dutch workers

–– 2011 Was a good year for OVG. Our financial performance was strong; we gained market share; we successfully completed all our projects and took important steps for growth in new markets such as social real estate, redevelopments and international commercial real estate.

–– internationally, OVG is aiming for growth throughout Europe. Our high reputation for sustainability, risk management and execution means we actively follow our corporate clients cross-border.

Coen van Oostrom –Founder and CEO, OVG Real Estate.

8 9

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

2011

2003

2005

2006

2007

2008

2009

2010

2012

700,000

175,000

0

350,000

525,000

Cumulative Completed Real Estate in Gross Floor Area2012 showing the expected sqm to be completed

year

2011

2012

2004

2005

2006

2007

2008

2009

2010

800,000

200,000

0

400,000

600,000

Cumulative Signed Rental Agreements in Gross Floor Area2012 showing the expected sqm to be signed

year

to finance our international growth so that we can start building our dream of becoming the European provider of real estate for our clients.

Cities consume over two-thirds of the world’s energy and account for more than 70 percent of global carbon dioxide emissions. Since 90 percent of the carbon emissions from buildings derive from existing, old building stock retrofits are increasingly important. We anticipate an interesting market in retrofitting European cities where every investment in energy efficiency delivers a direct payback.

In this light OVG has launched a new, second, 1 billion dollar commitment with the Clinton Global Initiative, in which we aim to work closely together with the C40 cities network. The C40 Cities Climate Leadership Group is a network of large and engaged cities from around the world committed to implementing meaningful and sustainable climate-related actions locally that will help address climate change globally. Personally, I would like to thank President Bill Clinton for his efforts in 2011 in the start-up of this new initiative.

It is a challenge, these days, to predict the future. We do know it requires an agile organization able to respond quickly to the changes and opportunities we see. Our team shares a strong belief in entrepreneurship; real entrepreneurs adapt; they anticipate their market; they read the signs of economic change. They keep ahead of the curve.

My colleagues on the Management Board and I take great joy in leading this company. We would like to express our sincere gratitude to all the people inside and outside the company who contributed to the successful realization of our developments. The unconditional commitment of great talent is worth more than figures can show.

Coen van Oostrom Founder and CEO

OVG Real Estate B.V. Rotterdam, The Netherlands –– March 16, 2012

Sustainability Project Ratings 2011registered for assessment

Sustainability Benchmark 2011certified BREEAM assessment ratings

LEED Platinum (1)

DGNB Gold (2)

BREEAM Good (1)

BREEAM Very Good (4)

BREEAM Certifications for OVG (8)

BREEAM Excellent (5)

BREEAM Outstanding (1)

Greencalc+ C (2)

Greencalc+ B (2)

Greencalc+ A (2)

Other BREEAM certifications in Dutch Market (19)

10 11

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Aug03th Handover of Eneco office Rotterdam

Sep05th Building commences for Danone Utrecht Science Park

13th Start of Cofely buildings redevelopment Rotterdam Harbour

16st Handover of Asics office Hoofddorp

21th OVG announces new 1 billion USDollar commitment at Clinton Global Initiative

29th Opening TNT Head Quarters: most sustainable office in Europe

30th Vancouver Rotterdam handed over to tenant

Oct10th Building commences for Sonion office Hoofddorp

20th Handover of UPC office Leeuwarden

Nov21st Rental agreement signed with

Sthree Holdings BV for Maastoren

30th Deloitte project Zuidas Amsterdam receives first BREEAM Excellent certificate on Zuidas Amsterdam

Dec 01st Rental agreement signed with Q8

(Kuwait Petroleum Europe B.V.) for the Haagsche Zwaan

Jan 20th Project Pollux Frankfurt receives first BREEAM-in-Use Excellent certificate outside UK

31th Handover of KPMG The Hague

Feb 03rd Cofely Rotterdam purchase agreement signed 09th Handover of TNT Hoofddorp

17th Rental agreement signed with Timberland

Mar 14th Coen van Oostrom awarded K.P. van der Mandele Medal for conscious entrepreneurship

Apr 13th OVG International announces winner architectural competition HumboldthafenEins Berlin

27th Building commences for Timberland

May04th OVG Launches its ‘five rules for development’

Jun 07th UPC Leeuwarden project receives BREEAM Excellent certification

08th Danone Utrecht project receives BREEAM Excellent certification

10th OVG announces strategic technology partnership with client Schneider Electric

22nd Avery Dennison LOI signed

30th Danone Utrecht Science Park purchase agreement signed

Jul 06th Building commences for Schneider Electric office Hoofddorp

12th Heads of Agreement signed for Unit4 Sliedrecht

16th Contract for Schneider Electric office in Hoofddorp signed

28th Rental agreement signed with Sonion Hoofdorp

2011 In Brief –– Calendar

OVG re/developers

1110

Ahead of the Curve Annual Report 2011 OVG Real Estate B.V.

12 13

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

year

year

year

2.0 –– OVG at a glance in 2011

2.1 Major Developments in 2011In the 2011 our revenue totaled € 188,066.Earnings before tax increased from € 5,310 in 2010 to € 9,861 in 2011. Net earnings improved from € 3,899 to € 7,471. During 2011, staff numbers increased from 48 FTE in January 2011 to 49 FTE as of December 31, 2011. The average number of FTE in 2011 was 51. All figures stated in this report are in thousands of €’s unless stated otherwise.

year

Revenue (Euro x 1,000)

year

2004

2005

2006

2007

2008

2009

2010

2011

200,000

100,000

0

300,000

400,000

Total Assets (Euro x 1,000)

2004

2005

2006

2007

2008

2009

2010

2011

200,000

100,000

0

300,000

400,000

Operating Result (Euro x 1,000)

2004

2005

2006

2007

2008

2009

2010

2011

10,000

0

20,000

30,000

Net Earnings(Euro x 1,000)

10,000

0

20,000

30,000

year

2004

2005

2006

2007

2008

2009

2010

2011

Earnings before tax(Euro x 1,000)

2004

2005

2006

2007

2008

2009

2010

2011

10,000

0

20,000

30,000

OuR mAJOR dEVELOpmEntSin 2011

hEALthy COmpAny,tRACK RECORd,QuALity fiRSt

Shareholders’ Equity(Euro x 1,000)

2004

2005

2006

2007

2008

2009

2010

2011

40,000

20,000

0

60,000

14 15

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Consolidated income Statement (x 1,000 euros) 2011 2010 2009 2008 2007

Revenue 188,066 160,737 282,592 269,248 326,554

Operating result 9,832 5,478 232 2,091 24,324

financial expenses 1,831 564 833 293 -

Earnings before tax 9,861 5,310 1,754 1,207 29,847

net earnings 7,471 3,899 1,469 198 22,185

Consolidated Balance Sheet (x 1,000 euros) 31-12-2011 31-12-2010 31-12-2009 31-12-2008 31-12-2007

total fixed assets 56,402 24,980 22,841 22,985 13,709

Work in progress 101,984 187,364 148,386 232,280 298,245

Shareholders' equity 57,599 50,128 46,229 44,760 48,062

Long term liabilities 26,702 5,625 11,036 7,000 12,375

Balance sheet total 200,398 244,454 211,847 311,419 326,586

Ratios 31-12-2011 31-12-2010 31-12-2009 31-12-2008 31-12-2007

Average # staff 51 41 42 57 48

Operating result / revenues 5.2% 3.4% 0.1% 0.8% 7.4%

net earnings / revenues 4.0% 2.4% 0.5% 0.1% 6.8%

Revenues / average # staff 3,688 3,920 6,728 4,724 6,803

Solvency* 28.7% 20.5% 21.8% 14.4% 14.7%

Working capital** 39,679 45,763 48,143 36,895 61,009

net earnings / average shareholders' equity 13.9% 8.1% 3.2% 0.4% 55.5%

* Represents shareholders’ equity divided by total assets.** Represents current assets minus current liabilities.

3.0 –– Key Statistics

Net earnings show a sharp improvement over 2011 aided by increased revenue and the fact that the company made very little use of its available bank facilities. Main reason for the reduction in the balance sheet is found in the decrease of work in progress. Although the portfolio is currently at a level in line with our market expectations many projects are in a start-up phase and therefore show relatively limited positions in our work in progress balance as per end of 2011. For 2012 we expect a higher position at year-end compared to 2011. Our strategy for development without purchasing the land in advance has not been modified and will continue for 2012. Our fixed assets increased due to an expansion of our finished products. All projects on hand are currently leased and supporting our bottom line. For 2012 we expect to invest in office equipment and ICT although the effect on the fixed asset position will be marginal. The equity position of the company improved 15% compared to 2010. Our solvency improved significantly (28.7% in 2011 compared to 20.5% in 2010) as work in progress lessened in combination with an improved equity position. We expect further improvements with respect to our ratios for 2012 although an increased work in progress could cause a slight decrease in solvency. Although average staff numbers increased compared to 2010 we are monitoring our staff and related expenses based on our future outlook and are in a position to act accordingly. We expect that the staff numbers will not increase, but that more assets will be focused towards international expansion.

16 17

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

4.1 BoardThe Board is responsible for OVG policy. Under the chairmanship of founder and Chief Executive Officer Coen van Oostrom, in 2011 the Board comprised two Board Members (Coen van Oostrom and Bas van Holten) who have joint responsibility for running the company, implementing its strategy and achieving its objectives and results.

As of February 2012 Mr. Jeppe de Boer joined the Board as Chief Investment Officer. Jeppe de Boer is an experienced international real estate banker who previously worked as Managing Director at Renaissance Capital in Moscow and Executive Director at Goldman Sachs in London. We expect his expertise to be very valuable for the strategic and international development of the company.

OVG Nederland

OVG International

JOINOntwikkeling by OVG & Triodos

Executive Board

Sustainability Center

Branding

Finance, Tax & Accounting

HRM & Office Management

Organizational Structure ––

4.0 –– Management Board

the Rotterdam under Construction –View from the Erasmus Bridge, Rotterdam.

the Rotterdam ––high-rise solution for sustainable cities.

“Rotterdam is the only city in the netherlands that dares to put up a building like this.” Rem Koolhaas –––

OuR REAL EStAtE COmpAny hAS thREE BuSinESS unitS

OVG nEdERLAnd, OVG intERnAtiOnAL, JOin OntWiKKELinG

18 19

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Coen van Oostrom –– Chief Executive Officer Responsibilities and core tasks include: – Chairman of the Executive Board – Chairman of OVG International – Managing Director of JOIN Ontwikkeling

(OVG/Triodos joint venture) – Company Strategy – Finance, Tax and Accounting

Bas van Holten –– Managing Director of OVG Nederland Responsibilities and core tasks include: – Chairman of OVG Nederland

Jeppe de Boer ––Chief Investment Officer Responsibilities and core tasks include:– Corporate Finance – Corporate Development– Fund Management 4.2 Advisory Board

Mr. Joost H. van Heijningen Nanninga –– Current functions: Partner of Egon Zehnder International, Member of the Advisory Board CVC Benelux, Member of the Supervisory Board of USG People, Member of the Supervisory Board of Breevast, ZBG Group, Member of INSEAD Dutch Council, Member of Advisory Board of Rotterdam School of Management, Member of the Advisory Board Jones Lang LaSalle Holland.

Mr. Frank H.G. de Grave ––Current functions: Member Upper House (Senate) of the Dutch Parliament; National Chair of the Order of Medical Specialists, Chair of PGGM, Chair of the Supervisory Board ARTIS zoo, Governor of SADC (Schiphol Area Development Corporation), Member of Advisory Council for Otto Uitzendorganisatie, Member of Board of Governors Pantar Arbeidsbemiddeling, Member of the Supervisory Board Omroeporganisatie NTR, Chair of the Supervisory Board Verweij-Jonker Instituut, Chair of the Supervisory Board of Sectorinstituut Bibliotheken, Chair of the Supervisory Board De Key Building Society, Member of Advisory Council Conclusion BV, Member of Advisory Council Astra Zeneca, Member of Advisory Council Apotheekzorg BV.

–– in 2012 an additional seat on the board was created for mr. Jeppe de Boer, who joined OVG Real Estate in february in the position of Chief investment Officer. in this position he will be responsible for Corporate finance, Corporate development and fund management.

Mr. Dick P.M. Verbeek –– Current functions: Vice Chairman Emeritus of Aon Group, Chairman of the Supervisory Board of Robeco Group N.V., Member of the Supervisory Boards of Aegon N.V. and Aon Groep Nederland B.V. Chairman Benelux Advisory Committee Leonardo & Co., Member of the Advisory Board CVC Benelux, Chairman of the INSEAD Dutch Council, Chair of the Board of Stichting Arboretum Trompenburg, Chair of the Board of Diergaarde Blijdorp, Board Member of the Stichting Administratiefonds Rotterdam.

tnt Center hoofddorp –Most sustainable office in Europe.

–– the Advisory Board of OVG has three members: mr. Joost van heijningen nanninga, mr. frank de Grave and mr. dick Verbeek. their prime responsibility is to advise on the direction the organization should take in order to keep on track for the future.

tnt Center Segment –– OfficesLessee –– tnt ExpressLocation –– Beukenhorst-Zuid, hoofddorpArchitect –– paul de Ruiter architects Size –– 17,250 sqmdelivery –– Q1 2011Sustainability –– LEEd platinum, Greencalc+ A

1005 pts

20 21

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

the Rotterdam Co-developer –– mAB developmentSegment –– multifunctional buildingLessee –– Amvest, nh hoteles, municipality

of RotterdamLocation –– Wilhelminapier, RotterdamArchitect –– Rem Koolhaas, Offices for metropolitan Architecture (OmA)Size –– 160,000 sqm delivery –– Q4 2013Sustainability –– Greencalc+ A

5.1 Activities Development OVG is an independent property developer, active throughout Europe. We develop highly sustainable buildings, always from the perspective of the end-user. Our core purpose is to combine our entrepreneurial spirit, integrity and solid financial position with a strong relationship with our clients.

With active involvement in top-level networks such as World Economic Forum, Clinton Global Initiative and CoreNet Global, we aim to be a mindful and entrepreneurial company that proactively reads the signs of change and always stays ahead of the curve.

mAximiZE REAL EStAtE VALuES By BEinG thE LEAdinG EuROpEAn dEVELOpER in ZERO-CARBOn SuStAinABLE BuiLdinGS

the Rotterdam under Construction –More than 4,500 people are involved in the realization process of The Rotterdam.

5.0 –– Business Profile

“We treasure the value of entrepreneurship at all times.” Coen van Oostrom –––

22 23

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

OVG Nederland Additional strategic focus for OVG Nederland: – Focus on sustainable inner-city public transport locations in the big

4 cities. We believe in the value of inner-city public transport locations for the development of sustainable buildings. We will adopt an active position on these, wherever necessary.

– Focus on corporate office clients by further strengthening their corporate account management system and approach.

– Focus on investors for active partnering to realize innovative building and area developments.

– Support a healthy office market by focusing acquisition on a balanced 50% new and 50% redevelopments of our Dutch portfolio. Internally this strategy is supported by the implementation of our ‘5 Rules for Development’.

Five internal Rules for Development:1 new tracks: new build and re/development. 2 multiple Solutions: always offer an alternative to new build.3 Centrepoint Locations: always offer a Public Transport location.4 Sustainable by nature: BREEAM Very Good is our minimum.5 Beyond the project: offer a solution for owner’s old premises.

These five rules are an elaboration of the principles that OVG Nederland BV holds and observes.

OVG International Additional strategic focus for OVG International: – Further growth of our developments in European cities, following our

corporate clients cross border and providing them with one pan-European real restate partner.

– Further develop Germany as second home market and secure and structure permanent first class local team.

– Build a global real estate brand recognized for excellence, entrepreneurship and sustainability by tenants, cities, capital markets and the real estate community.

– Build ‘one’ OVG, based on the core values of the company. The group of OVG country teams supports each other and collectively speaks the same language to our stakeholders.

5.2 MissionOVG wants to maximize real estate values by being the leading European developer in zero-carbon sustainable buildings.

To fulfill our mission we embrace five lines of corporate behavior: – Everyone an Entrepreneur: to stimulate a company culture in which

everyone is an entrepreneur. – Sustainability: sustainable development is a second nature to us. – honesty: operating according to the highest ethical standards of

business honesty. – Company Excellence: aspiring to company excellence, always

building from good to great. – delighted Customers: going the extra mile to amaze our clients.

In order to achieve its mission OVG has chosen to focus on sustainable development in three areas, linked to a new business unit structure: – Offices and multi-functional buildings in the Netherlands

by OVG Nederland. – Offices and multi-functional buildings in Europe

by OVG International. – Real estate for care, health and education in the Netherlands

by JOIN Ontwikkeling, the joint venture between OVG and Triodos.

5.3 Strategy

Corporate Strategy To fulfill our ambition of becoming the leading European property developer in sustainable real estate, we have defined four engines of growth for all business units:1 Corporate Account Management: further strengthening of our core

expertise and purpose.2 Sustainable Innovation: balanced focus on both new and re-

developments, constantly pushing for positive change and improvement for our clients.

3 Product Development: designing new real restate concepts based on flexibility in space, time and contracts.

4 Fund Strategy: explore ambitions in setting up and managing real estate funds and increase access to capital markets for international growth.

24 25

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

–– in 2010 OVG and triodos Bank set up the joint venture JOin Ontwikkeling. JOin Ontwikkeling is aimed at sustainable social real estate for the care, health and education sectors.

–– JOin wants to strategically improve real estate performance for this market that is currently undergoing strong budget challenges. due to both partners’ many years of expertise, we foresee JOin creating significant direct added value in coming years.

JOIN OntwikkelingAdditional strategic focus for JOIN Ontwikkeling: – Focus on clients for care, health and education market. – Partner with clients in long-term real estate

management, financing and investments. – Provide financial space for clients through strategically

redesigning their real estate portfolio. – Further strengthen the capacities of OVG and Triodos

as JOIN’s shareholders. – Build the new company’s brand.

Financial ManagementOur objective for 2012 is to find new ways to improve our financial performance. We aim to achieve this by: – Strong focus on available cash at hand. – Further improvement of financial competences within

our company. – Attract alternative sources of funding. – Increased co-operation with our main contractors.

These key financial strategy components will provide: – A stable financial environment to support the group’s

ambitions. – Support for prompt decisions regarding opportunities

and threats.

tnt Center hoofddorp –Connectivity formed the guiding principle of the design.

Opening tnt Center –Peter Blom (CEO Triodos Bank), Frans Weekers (Dutch State Secretary of Finance), Marie - Christine Lombard (CEO TNT Express), Coen van Oostrom (CEO OVG Real Estate).

tnt Center Segment –– OfficesLessee –– tnt ExpressLocation –– Beukenhorst-Zuid, hoofddorpArchitect –– paul de Ruiter architects Size –– 17,250 sqmdelivery –– Q1 2011Sustainability –– LEEd platinum, Greencalc+ A

1005 pts

26 27

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

–– When developing real estate we work closely with each of the city’s com-munities. therefore we think it is important to invest in a wide range of cultural programs and organizations that would not survive without the support of business community.

–– in 2012, we are celebrating a unique collaboration with the City of Rotterdam with the Veerhavenconcert, a free, outdoor classical music concert that OVG is organizing in Rotterdam for the tenth time.

–– the rapidly chan-ging economic environment continues to place risk management at the top of our priorities list.

–– in addition to other measures, OVG is currently strategically working together with a number of large, financially strong builders in order to reduce the risk of bankruptcies and their potential consequences.

Risk Management Additional process monitoring further strengthened OVG’s risk management in 2011. OVG always develops on the basis of a signed lease agreement. When making new offers to its tenants OVG specifically takes account of changing market conditions and returns in the market. OVG has the best advisors in the market who undertake an extensive spatial planning analysis prior to every binding lease agreement in order to limit spatial planning risks to a minimum. OVG is currently strategically working together with a number of large, financially strong builders in order to limit construction risks with regard to schedule, price and supply reliability to a minimum. By working together with these sound parties, OVG reduces the risk of main contractor bankruptcies and the consequent risks that can be involved. Knowledge exchange and innovative contracting with these preferred suppliers also enables OVG to increase the supply reliability and innovation of its buildings for its clients.

Talent ManagementWe continue to believe that attracting, developing and retaining talent is just as important as developing buildings. In 2011 we introduced our new ‘OVG House of Development’; the company-wide personal development standard for ensuring the development of future leaders in real estate.

Today’s extremely changeable business environment requires an agile organization, able to adapt rapidly and respond to changes and opportunities with efficient costing. This means keeping our team as lean and yet as entrepreneurial as possible. OVG treasures the value of entrepreneurship, as the core competence of the company.

5.4 CSR & Sustainability Corporate Social Responsibility OVG believes in cooperation and is convinced that by sharing insights and resources, industry leaders, governments, academics and citizens can work together more effectively to overcome pressing issues, including climate change, poverty and social imbalance. In order to create a harmonious society, OVG invests in a wide range of cultural programs and organizations that focus on bridging the gaps between cultures and generations.

In 2011 OVG supported the following networks and charities:AmCham, Clinton Global Initiative, Concertgebouw Amsterdam, CoreNet Global, De Groene Zaak, FRESH, Millennium Promise, OBR Student City, Rotterdam Philharmonic, SHARE, Stichting DON, Stichting Hoogbouw, Stichting Hoogvliegers, Stichting Vruchtenburg, SVR, TEDx Rotterdam, World Economic Forum and Veerhavenconcert. The two largest programs, Millennium Promise and Veerhavenconcert, are described in this annual report.

For some years now, OVG has been affiliated with the Millennium Promise, led by Jeffrey Sachs, which aims to eradicate extreme poverty by 2015. In order to achieve this commendable goal, Millennium Promise focuses on uniting individuals, governments, corporations and NGOs to jointly address the causes and the symptoms of poverty.

Each year OVG organizes the OVG Veerhavenconcert, a free, outdoor classical music concert in Rotterdam and also an outdoor concert for children.

timberlandSegment –– Warehouse Lessee –– timberland EuropeLocation –– xL Businesspark, AlmeloArchitect –– Johan de Vries architectsSize –– 40,000 sqmdelivery –– Q1 2012Sustainability –– BREEAm Good

28 29

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

–– the Clinton Global initiative (CGi) is a network in which organizations promise to put in place extreme objectives in order to combat climate change.

–– in 2011, OVG launched a new 1 billion uS dollar commitment to the Clinton Global initiative, for setting up an international fund and knowledge network aimed at sustainable new and re-development in cities. for this commitment we aim to work together with the C40 cities network.

Clinton Global initaitive, new york 2011 –OVG receives special announcement from President Clinton for reaching its 2007 environmental targets two years ahead of schedule.

SustainabilityOVG actively invests in innovation with its own Sustainability Center for research and development to support its goal of being the leading European Developer in zero carbon real estate.

In 2011 OVG appointed a special team for innovation in the field of redevelopment and transformation of old buildings. This decision is in line with our strategy to focus on both new and re-development in the future.

BREEAm, LEEd, Greencalc+ and dGnBIn the Netherlands, OVG works according to BREEAM, Greencalc+ and LEED sustainability rating systems for both new and re-developments. In Germany OVG follows the DGNB standard, locally approved by tenants, investors and authorities. We encourage harmonization of these certification systems, but have built up expertise and past performance in all areas.

We always aim for the highest sustainability ratings within the client’s assignment and guide tenants and investors through this process. We prefer to contractually agree a binding commitment on the sustainability performance for early commitment by all parties involved. When bidding to clients our minimum sustainability rating for new projects is BREEAM Very Good.

OVG projects 2011 Sustainability Rating * ** *** **** *****

Asics • Greencalc+ C

Avery dennison BREEAm Very Good

Cofely Greencalc+ C

danone BREEAm Excellent

deloitte/AKd Zuidas BREEAm Excellent

Eneco • Greencalc+ B

humboldthafenEins dGnB Gold

nederlandse hartstichting • BREEAm Excellent

Oranjewoud BREEAm Very Good

pollux • dGnB GoldBREEAm-in-use Excellent

Schneider Electric BREEAm Very Good

Sonion BREEAm Very Good

the Rotterdam Office Greencalc+ A

timberland BREEAm Good

tnt Center • LEEd platinum, Greencalc+ A 1005 pts

triodos Bank BREEAm Outstanding

upC • BREEAm Excellent

Van Oord Greencalc+ B

design• final

Sustainability Rating * ** *** **** *****LEEd Certified Silver Gold platinum -BREEAm pass Good Very Good Excellent OutstandingdGnB - Bronze Silver GoldGreencalc+ - C B A

Benchmark international Sustainability Rating

30 31

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Sustainability Highlights – To date, the Dutch Green Building Council, has issued 27 BREEAM-NL

certifications for buildings in the Netherlands, 8 of them were awarded to OVG projects.

– Of the 7 BREEAM Excellent certificates in the Netherlands, 4 were awarded to OVG projects.

– OVG delivered Europe’s most sustainable building in Europe with the TNT Center, which is also the first CO2 emission free and energy productive office in the Netherlands.

– OVG jointly owns the TNT Center and TNT has the first official green lease contract for an office tenant in the Netherlands.

– OVG delivered the first ever BREEAM-NL Excellent Office in the Netherlands (Nederlandse Hartstichting Project).

– The Eneco Project has the largest solar façade installed in the Netherlands.

– The Pollux Building in Frankfurt received the first BREEAM-In-Use Excellent certification outside the United Kingdom.

The properties OVG delivered in 2011 will save 2.7 million kWh per year in comparison to the current Building Code requirements. This will power 790 households per year.

Clinton Global InitiativeIn October 2007, OVG made a commitment to the Clinton Global Initiative (CGI), in which companies promise to put extreme objectives in place in order to combat climate change, among other things. At that time OVG promised to invest a billion dollars over five years in the development of sustainable buildings, with an intended saving over the entire life cycle of one megaton of CO2.

On 21 September 2011, during the annual CGI meeting in New York, CEO Coen van Oostrom received a citation from President Clinton for his role as catalyst for sustainable real estate development. During this meeting OVG launched a new 1 billion US dollar commitment, for setting up an international fund and knowledge network aimed at sustainable new and re-development in cities. For this commitment we aim to work together closely with the C40 cities network. The C40 Cities Climate Leadership Group is a network of large and engaged cities from around the world committed to implementing meaningful and sustainable climate-related actions locally that will help address climate change globally.

EnecoSegment –– Offices, area

redevelopmentLessee –– EnecoLocation –– prins Alexander, RotterdamArchitect –– dam en partners architectsSize –– 30,300 sqmdelivery –– Q3 2011Sustainability –– Greencalc+ B

32 33

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

6.0 –– Board Report A significant part of this building will also be used for R&D. We foresee to sell all the buildings for which construction started in 2011 to institutional investors. We expect that there is a growing demand in the investment market for highly sustainable buildings at prime locations with reliable tenants, one of OVG’s specializations. This applies to both new build and renovations.

We believe our product represents exceptional value. Our outlook is confident and in 2012 we will therefore further concentrate on retaining real estate, either ourselves or with partners. This will enable us to take advantage of low interest rates, which in combination with the longer lease contracts we conclude with our tenants, will offer a good return over many years.

There is an imbalance in the Dutch offices market with a growing vacancy rate of low quality real estate, requiring a demolition fund or strategy. We see increasing potential for redevelopment of old stock at A-locations into highly sustainable modern real estate and OVG has committed to a redirection of strategy in this market and to focus on 50% of our Dutch portfolio to be redevelopments. Green field projects in out of town locations will be started only under exceptional circumstances. We do not, however, advocate a total stop for new buildings. There is still a demand for high-quality and low-risk profile offices on prime locations.

OVG and Triodos Bank set up the joint venture JOIN Ontwikkeling over a year ago; aimed at sustainable social real estate for the Dutch care, health and education sectors. A great deal of work has been done in advising clients on how to strategically improve their real estate performance with partnerships in long-term real estate management, financing and investments. In the coming year we expect this to result in a number of significant developments. One project arising from the joint venture with Triodos, the building for UPC in Leeuwarden, was completed in 2011. This building achieved a BREEAM Excellent rating making it one of the most sustainable buildings in the Netherlands.

OVG’s international team made significant progress in 2011 to bring about a successful continuation to its project in Berlin. Early in the year an architects’ competition was organized together with the City of Berlin that resulted in KSP Jürgen Engel architects being selected as project architect. In the final weeks of the year a tenant was found with whom a (not yet binding) Letter of Intent has been entered into. We are optimistic that we shall be able to finalize the marketing for this project in 2012.

OVG can look back on a good performance in 2011; our financial performance was strong. We retained our position as the Netherlands’ largest commercial real estate developer and one of the top 3 office developers in Europe; our completed development portfolio grew to 550,000 sqm GFA; we continued to focus on high-quality sustainable real estate at prime locations. Far-reaching steps have been taken to serve new, international markets and progress has been achieved in the growth in social real estate in our home market the Netherlands.

OVG has maintained its position as No.1 Dutch real estate developer for corporate accounts. In 2011 OVG Nederland completed offices for Eneco, TNT, KPMG and Asics. We are proud that all these offices achieved a very high sustainability rating. The TNT building in particular surpasses every other office building. It is the first LEED Platinum and the first energy positive office building in Europe. Building work also commenced on a number of new projects over the past year: Timberland, Cofely, Danone, Schneider, Deloitte/AKD Zuidas and Sonion. The new Innovation Center for Danone, in particular, is a trendsetting development. We increasingly see companies investing in Research and Development and needing specific buildings for this. This also applies to the tenant Avery Dennison, with whom we entered into a Letter of Intent in September.

–– in 2011 OVG maintained its position as no.1 dutch real estate developer for corporate accounts.

–– We have enjoyed working with new and returning clients such as: deloitte/AKd, danone, tnt, triodos, Van Oord, Schneider Electric, Eneco, upC, KpmG, Cofely, Sonion, Oranjewoud, Asics, nederlandse hartstichting, timberland, REt, Avery dennison, pGGm/iVG and Q8, delivering the highest international sustainability standards ranging from LEEd platinum to BREEAm Excellent.

34 35

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

2011

2012

2004

2005

2006

2007

2008

2009

2010

800,000

200,000

0

400,000

600,000

Cumulative Signed Rental Agreements in Gross Floor Area2012 showing the expected sqm to be signed

year

Sustainability Project Ratings 2011registered for assessment

Sustainability Benchmark 2011certified BREEAM assessment ratings

–– it is a challenge, these days, to predict the future. We do know it requires an agile organization able to respond flexibly to the changes and opportunities we see.

–– OVG shares a strong belief in entrepreneurship; real entrepreneurs adapt; they anticipate their market; they read the signs of economic change. they keep ahead of the curve.

In addition various new projects have started in Vienna, Frankfurt and Brussels for example. It gives us confidence that our business model, which is based on working in a client-oriented and sustainable manner, will also lead to international success.

2011 was a year in which excellent contributions were made by the staff combining both lean development and high quality green development. This hard work has achieved highly satisfactory results. We would like to take this opportunity to also thank all stakeholders for their dedication in 2011.

Coen van Oostrom

OVG Real Estate B.V. Rotterdam, The Netherlands –– March 16, 2012

Bas van holten

2011

2003

2005

2006

2007

2008

2009

2010

2012

700,000

175,000

0

350,000

525,000

Cumulative Completed Real Estate in Gross Floor Area2012 showing the expected sqm to be completed

year

LEED Platinum (1)

DGNB Gold (2)

BREEAM Good (1)

BREEAM Very Good (4)

BREEAM Certifications for OVG (8)

BREEAM Excellent (5)

BREEAM Outstanding (1)

Greencalc+ C (2)

Greencalc+ B (2)

Greencalc+ A (2)

Other BREEAM certifications in Dutch Market (19)

37

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

7.1 Consolidated Balance Sheet (after appropriation of result)*

note 31-12-2011 31-12-2010

tangible fixed assets 1 917 1,017

investment property 2 22,542 16,551

financial fixed assets 3 32,943 7,412

total fixed assets 56,402 24,980

Work in progress 4 61,214 43,856

Construction contracts 5 40,770 143,508

Accounts receivables 6 4,973 1,195

Affiliated company 7 1,080 1,505

Other receivables and prepayments 8 4,080 3,332

total receivables 10,133 6,032

Cash and cash equivalents 9 31,879 26,078

total current assets 143,996 219,474

total assets 200,398 244,454

note 31-12-2011 31-12-2010

Shareholders' equity 57,599 50,128

minority interest 1,766 1,443

Group equity 10 59,365 51,571

provisions 11 10,014 13,547

Loans and borrowings 12 26,702 5,625

Long term liabilities 26,702 5,625

project financing 13 55,428 113,719

Accounts payables 21,542 32,207

Affiliated company - -

tax payables and social charges 14 9,546 8,970

Accruals and other payables 15 17,801 18,815

Current liabilities 104,317 173,711

total equity & liabilities 200,398 244,454

* All amounts are in 1,000 euro’s

OVG re/developers

7.0 –– Financial Statements 2011

36

Steve Jobs –-Entrepreneur, technologist and visionary

“innovation has nothing to do with how many R&d dollars you have. it’s about the people you have, how you’re led, and how much you get it.”late Steve Jobs, Fortune 1998 –––

38 39

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

7.3 Consolidated Cash Flow Statement*

fy 2011 fy 2010

Operating result 9,832 5,478

Adjustments for:

depreciation tangible fixed assets 235 249

(increase)/decrease provisions -3,812 -270

Changes in working capital:

(increase)/decrease in inventory 85,380 -42,676

decrease in other current assets (excl. cash) -4,101 9,797

(increase)/decrease in current liabilities (excl. financing credit institutions) -11,103 4,193

70,176 -28,686

Cash flow from business activities 76,431 -23,229

interest 167 -

taxation -2,067 -1,400

Cash flow from operating activities 74,531 -24,629

investments tangible fixed assets -168 -14

disposals tangible fixed assets 33 -

investment in investment property -5,991 404

disposals/(investments) in participations (incl. loans to participations, nett)

-24,858 1,811

Additions in loans to shareholders - -947

Repayment loans to shareholders 947 -

Additions in deferred taxation -1,479 -

investments in minority interest - 1,418

Cash flow from investment activities -31,516 2,672

Additions/(repayment) long term liabilities 21,077 -5,411

movement projectfinancing -58,291 28,655

Cash flow from financing activities -37,214 23,244

increase / (decrease) cashflow 5,801 1,287

Opening cash 26,078 24,791

movement cash 5,801 1,287

Closing Cash 31,879 26,078

* All amounts are in 1,000 euro’s.

7.2 Consolidated Income Statement*

note fy 2011 fy 2010

Revenue from projects A 185,044 157,526

Other revenue B 3,022 3,211

total revenue 188,066 160,737

direct project costs 166,976 145,583

Salaries & pensions C 5,673 4,438

depreciation & amortisation 235 249

Other operating expenses d 5,350 4,989

total operating expenses 178,234 155,259

Operating Result 9,832 5,478

financial income 1,998 564

financial expenses -1,831 -564

Result from participations E -138 -168

29 -168

Earnings Before tax 9,861 5,310

Company tax f -2,067 -1,400

Result third party interest -323 -11

net Result 7,471 3,899

* All amounts are in 1,000 euro’s.

40 41

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Entities Established in % Shareholders Shareholder(s)

OVG Real Estate B.V. Rotterdam 86.5% C.p.G. van Oostrom Beheer B.V.

8.5% Stichting ESA

5.0% hnOG Beheer B.V.

OVG projectontwikkeling B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten ii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten V B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten Vi B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten Vii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xi B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xii B.V. Rotterdam 100% OVG Real Estate B.V.

Laan op Zuid B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xViii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xix B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xx B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxi B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxiii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG Landbank B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxV B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxVi B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxix B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxxiV B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxxV B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxxVi B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxxVii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten xxxViii B.V. Rotterdam 100% OVG Real Estate B.V.

OVG nederland B.V. Rotterdam 100% OVG Real Estate B.V.

OVG property investments B.V. Rotterdam 100% OVG Real Estate B.V.

OVG infrastructure development B.V. Rotterdam 100% OVG Real Estate B.V.

OVG deutschland B.V. Rotterdam 100% OVG Real Estate B.V.

OVG international B.V. Rotterdam 100% OVG Real Estate B.V.

OVG deutschland B.V. Rotterdam 100% OVG Real Estate B.V.

OVG maatschappelijke projecten B.V. Rotterdam 100% OVG Real Estate B.V.

OVG projecten iii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten iV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Viii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten ix B.V. Rotterdam 100% OVG nederland B.V.

7.4 Notes to the Consolidated Financial Statements

All amounts are stated in thousands of Euros unless indicated otherwise.

ActivitiesOVG Real Estate B.V. having its legal seat at Wilhelminakade 300 in Rotterdam, is engaged in development of real estate, mainly in the commercial market. In this respect OVG Projectontwikkeling B.V. represents the service organization for the projects of OVG Real Estate B.V.

Group StructureFinancial information relating to subsidiaries within the group is included in the consolidated financial statements. The consolidated financial statements have been prepared in accordance with the accounting principles regarding valuation and profit recognition of OVG Real Estate B.V.

Minority interests in equity and results of group companies are separately disclosed in the consolidated financial statements.

The results of subsidiaries acquired during the year are consolidated from the date of acquisition. At acquisition the assets, provisions and liabilities are valued at fair values. Goodwill paid is capitalized. The results of subsidiaries sold during the year are consolidated until the movement of leaving the group.

Consolidation PrinciplesThe consolidated financial statements include the accounts of OVG Real Estate B.V. and all entities in which a direct controlling interest exists. All intercompany balances and transactions have been eliminated in the consolidated financial statements.

The consolidated companies in the report are:

42 43

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Entities Established in % Shareholders Shareholder(s)

OVG projecten LxViii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lxix B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lxx B.V. Rotterdam 100% OVG nederland B.V.

OVG investment management B.V. Rotterdam 100% OVG international B.V.

OVG deutschland B.V. Rotterdam 100% OVG international B.V.

OVG projecten LiV B.V. Rotterdam 100% OVG deutschland B.V.

OVG humboldthafen Verwaltungs Gmbh Berlin 100% OVG projecten LiV B.V.

OVG humboldthafen Gmbh & Co KG Berlin 100% OVG projecten LiV B.V.

OVG A2 maastricht B.V. Rotterdam 100%OVG infrastructure development B.V.

OVG maasboulevard B.V. Rotterdam 100%OVG infrastructure development B.V.

BAm-huis den haag Beheer B.V. Rotterdam 70% OVG projecten xxi B.V.

BAm-huis den haag C.V. Rotterdam 69.3% OVG projecten xxi B.V.

Rotterdam 1% BAm-huis den haag Beheer B.V.

Exploitatiemaatschappij marconistraat 2 B.V. nieuwegein 100% OVG property investments B.V.

Stichting OVG i Rotterdam 100% OVG projecten xxxViii B.V.

Sirius C.V. Rotterdam 100% OVG projecten xxxViii B.V.

Join Ontwikkeling B.V. Rotterdam 70% OVG Real Estate B.V.

Join projecten 1 B.V. Rotterdam 100% Join Ontwikkeling B.V.

Join projecten 2 B.V. Rotterdam 100% Join Ontwikkeling B.V.

Join projecten 3 B.V. Rotterdam 100% Join Ontwikkeling B.V.

Join projecten 4 B.V. Rotterdam 100% Join Ontwikkeling B.V.

Join projecten 5 B.V. Rotterdam 100% Join Ontwikkeling B.V.

Entities Established in % Shareholders Shareholder(s)

OVG projecten x B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xiii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xiV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xVii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxVii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxViii B.V. Rotterdam 100% OVG nederland B.V.

OVG Lansingerpoort B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxxi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxxii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxxiii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xxxix B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xL B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLiii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLiV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLVi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLVii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLViii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten xLix B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten L B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Li B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Liii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LVi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LVii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LViii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lix B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lx B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lxi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lxii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten Lxiii B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LxiV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LxV B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LxVi B.V. Rotterdam 100% OVG nederland B.V.

OVG projecten LxVii B.V. Rotterdam 100% OVG nederland B.V.

triodos/OVG Green Offices B.V. Rotterdam 50% OVG projects B.V.

de Rotterdam Beheer B.V. Rotterdam 25% OVG projects B.V.

de Rotterdam C.V. Rotterdam 24.75% OVG projecten xxxiii B.V.

1% de Rotterdam Beheer B.V.

Businesspark Gouda B.V. Rotterdam 50% OVG property investments B.V.

Schiepoort V.O.f. Rotterdam 50% OVG projecten ii B.V.

Stadsherstel historisch Rotterdam n.V. Rotterdam 1% OVG Real Estate B.V.

Companies mentioned below are not consolidated in the report, because OVG Real Estate B.V. does not hold, directly or indirectly, more than half of the voting capital and does not have a decisive influence on these companies.

44 45

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Interest rate riskThe company hedges this risk by entering into an interest rate swap contract to cover expected significant increases in market interest rates.

Credit riskThe company trades only with creditworthy parties and has implemented procedures to check the creditworthiness of parties. The company applies strict credit control and reminder procedures. The company’s credit risk is minimal due to the above measures. In addition, there are no significant concentrations of credit risk within the company.

PRINCIPLES OF VALUATION OF ASSETS AND LIABILITIES Tangible Fixed AssetsTangible fixed assets are presented at cost less accumulated depreciation and, if applicable, less impairments in value. Depreciation is charged to the income statement based on the estimated useful life and calculated as a fixed percentage of cost, taking into account any residual value. Depreciation is provided from the date an asset comes into use. Tangible fixed assets relate to properties not held for development or investment purposes.

Investment PropertyInvestment properties are those that are held either to earn rental income or for capital appreciation or for both and those properties are stated at fair value without depreciation. External, independent valuation companies, having an appropriate recognized professional qualification and recent experience in the location and category of property being valued, value the investment portfolio once a year. Any gain or loss arising from a change in fair value is recognized in the income statement as result from revaluation.

Financial Fixed AssetsThe (non-consolidated) participations are – on the basis of the share in the equity of the company – valued at net asset value and if applicable less impairments in value. The net asset value is based on the latest available financial statements of the company. With the valuation of participations any impairment in value is taken into account. The results are accounted for in profit and loss according to the interest held. The loans to participations are valued at face value after deduction of any provisions.

GENERAL ACCOUNTING PRINCIPLES FOR THE PREPARATION OF THE CONSOLIDATED FINANCIAL STATEMENTS

The financial statements are prepared in accordance with generally accepted accounting principles in the Netherlands and Title 9, Book 2 of the Netherlands Civil Code.

Valuation of assets and liabilities and determination of the result takes place under the historical cost convention. Unless presented otherwise at the relevant principle for the specific balance sheet item, assets and liabilities are presented at face value.Income and expenses are accounted for on accrual basis. Profit is only included when realized on the balance sheet date. Losses originating before the end of the financial year are taken into account if they have become known before preparation of the financial statements.

The financial information relating to OVG Real Estate B.V. is included in the consolidated financial statements. Accordingly, in accordance with Article 402, Book 2 of the Netherlands Civil Code, a company profit and loss account has been presented in condensed form.

Change in accounting policiesIn 2011 a change of accounting policy regarding the presentation of work in progress and construction contracts is applied to comply with RJ 220 ‘inventory’ and RJ 221 ‘construction contracts’. As from 2011 OVG distinguishes construction contracts and work on progress. Construction contracts are contracts carried out on behalf of a third party while work in progress is the unsold construction of an asset of combination of assets. This change in accounting policy is applied retrospectively and has no effect on results and/or equity of the company, but leads to reclassifications within the financial position.

Financial InstrumentsThe information included in the notes for financial instruments is useful in estimating the extent of risks relating to both on-balance-sheet and off-balance-sheet financial instruments.

The company’s primary financial instruments, not being derivates serve to finance the company’s operating activities or directly arise from these activities. The company’s policy is not to trade in financial instruments.

The principal risks arising from the company’s financial instruments are interest rate risks and credit risks.

46 47

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

ProvisionsFor amounts of taxation payable in the future, due to differences between the valuation principles in the annual report and the valuation for taxation purposes of the appropriate balance sheet items, a provision has been formed for the aggregate of these differences multiplied by the future tax rate.

The provision for rental guarantees for completed projects is recorded on behalf of the estimated costs expected to arise from the current rental guarantees.

Other provisions are provisions for incentives to be paid according to signed rental agreements and for other amounts to be paid. A provision is recognized when an obligation exists.

Long term provisions are valued at net present value.

Principles for the determination of the resultsAll initial start-up costs for potential projects are expensed. Rental guarantees are expensed as part of the estimated profit upon completion.

Revenue from projects is recognized as actual costs plus mark-up. The mark-up is quarterly recognized by the formula: calculated profit end of work multiplied by the percentage of the stage of completion minus profit already accounted for. The stage of completion is determined by the number of days under construction divided by the total number of construction days. Profit mark-up commences in the case that the project is sold at the start of the construction period. Losses are recognized in the year in which they become foreseeable.

Corporate income taxCorporate income tax is calculated at the applicable rate on the profits for the financial year, taking into account deductible costs and permanent differences between profit calculated according to the profit and loss account and profit calculated for taxation purposes.

Financial derivatesFinancial derivates are recognized at cost, the fair value is disclosed in the notes to the consolidated balance sheet.

Participations with a negative equity are valued at nihil and to the amount of the negative equity a provision is made. In case of loans to or receivables on the participation, the provision will be charged to the receivables. In case a balance remains, a provision for participations is made.

Work in progressWork in progress is the unsold construction of an asset or combination of assets whose performance generally extends over several reporting periods.

Project costs are the direct project costs, interest on loan capital, the mark-up for costs attributable to project activities in general and can be allocated to the project based on the normal level of project activity, and other costs that can be attributed to the principal under the project. A provision for expected losses on a project is charged to the item work in progress. Construction contractsA construction contract carried out at the instruction of a third party is a contract entered into with a third party for the construction of an asset or combination of assets whose performance generally extends over several reporting periods. Contract revenue and contract costs from the construction contract are taken to the profit and loss account pro rata to the extent of the work performed at the balance sheet date, if the outcome of a construction contract can be reliably estimated (percentage of completion method).

Contract costs are the direct contract costs, interest on loan capital, the mark-up for costs attributable to contract activities in general and can be allocated to the contract based on the normal level of contract activity, and other costs that can be attributed to the principal under the contract.A provision for expected losses on a contract is charged to the item construction contracts. In addition, instalments already invoiced are set off against the item construction contracts . The net amount for each construction contract is recognised as an asset or a liability where the balance of the construction contract is positive or negative, respectively.

ReceivablesReceivables are included at face value, less any provision for doubtful accounts. These provisions are determined by individual assessment of the receivables.

48 49

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

Other income and expensesAll costs which can not directly be allocated to a project are expensed.

Tax liabilitiesOVG Real Estate B.V. is the head of a fiscal unity for the value added tax and the corporate income tax and for that reason it is, jointly and severally liable for the tax liabilities of the whole fiscal unity. Tax liabilities of the subsidiary companies are presented under the tax payables in the balance sheet.

Principles for preparation of the consolidated cash flow statement

The cash flow statement is prepared according to the indirect method. The funds in the cash flow statement consist of cash, cash equivalents and bank facilities.

Corporate income taxes, issuances of share capital, interest received and dividends received are presented under the cash flow from operating activities. Interest paid and dividends paid are presented under the cash flow from financing activities.

To: the Management Board of OVG Real Estate B.V.

The accompanying summary annual report, which comprise the consolidated balance sheet as at 31 December 2011, the consolidated income statement and the consolidated cash flow statement for the year then ended, and related notes, is derived from the audited consolidated financial statements of OVG Real Estate B.V. for the year ended 31 December 2011. We expressed an unqualified audit opinion on these consolidated financial statements in our report dated 16 March 2012.

These consolidated financial statements and this summary annual report, do not reflect any subsequent events as from the date of our report being 16 March 2012.The summary annual report does not contain all disclosures required by the accounting principles generally accepted in the Netherlands. Reading the summary annual report therefore is not a substitute for reading the audited consolidated financial statements of OVG Real Estate B.V. as a whole.

Management’s responsibilityManagement is responsible for the preparation of this summary annual report on the bases described in the notes.

Auditor’s responsibilityOur responsibility is to express an opinion on the summary annual report based on our procedures, which were conducted in accordance with Dutch law, including the Dutch Standards on Auditing 810 ‘Engagements to report on summary financial statements’.

OpinionIn our opinion, the accompanying summary annual report derived from the audited consolidated financial statements of OVG Real Estate B.V. for the year ended 31 December 2011 are consistent, in all material respects, with those financial statements and prepared in accordance with the notes.

Rotterdam, 30 March 2012

Ernst & Young Accountants LLPsigned by W.P. de Pater

Independent auditor’s report ––

51

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.

51pROJECt OVERViEWAnd StORiES

A ViSuAL tOuR thROuGh OuR pROJECt pORtfOLiO

52

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

founding OVG –– At the age of 27 Coen van Oostrom starts OVG. A real estate company based on a new business model: client ahead of location. OVG’s new development approach reduces cost price by 20-30%. OVG Development = Lean Development.

inspired by Al Gore ––

CEO Coen van Oostrom is inspired during lunch with Al Gore: An Inconvenient Truth requires a Convenient Answer: sustainable buildings. Van Oostrom decides to change his business model from ‘lean development’ to ‘green development’.

first Corporate Client ––

OVG signs first contract with a Corporate Client: Eastman Chemical in Rotterdam. We can now truly call ourselves authentic real estate developers.

Growing up ––

OVG wins prestigious contract for the development of the Maastoren for Deloitte/AKD. The tallest tower in the Netherlands turns out to be a historical breakthrough project for the company.

Building our dream ––

Developing the first building gave us the confidence to build our dream: to become the largest commercial developer in the Netherlands within 10 years.

1997 1999 2003 2005 2006

OVG’s 15th Anniversary –– History at a GlanceOVG REAChES A SiGnifiCAnt miLEStOnE thiS yEAR - itS 15th AnniVERSARy. JOin uS in tAKinG A LOOK BACK.

1 Billion uSd for Green Buildings ––

Coen van Oostrom makes ambitious climate commitment to the Clinton Global Initiative and promises to invest 1 billion USD in sustainable real estate in 5 years. OVG believes in the power of initiative and sets the standard for green buildings in the Netherlands.

Blueprint forSustainability ––

OVG wins pioneering TNT Green Office tender in the Netherlands. This becomes a genuine blueprint for sustainable development. It is a best-in-class first CO2 emissions-free office building; the first green lease; the first LEED Platinum design.

Crossing Borders ––

During the economic crisis, OVG demonstrates ‘The Art of Possibility’ and launches the largest project in the Netherlands, The Rotterdam, in collaboration with MAB Development. Meanwhile OVG arrives in Germany, crossing the border with projects such as the HumboldtHafenEins in Berlin and Triton in Frankfurt.

Joint-venture with triodos ––

OVG steps into new social real estate market with Triodos and founds joint venture called JOIN. A promising real estate company is born that combines the best of both worlds.

transition to re/developers ––

OVG decides to break real estate tradition and enters the redevelopment market. The future challenge is for both new and re-development. Quality for end users remains our first priority.

2007 2008 2009 2010 2011

54 55

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

54iCOniC OffiCE dEVELOpmEnt in BERLin, fACinG thE REiChStAG

OVG ChOOSES GERmAny tO BECOmE SECOnd hOmE mARKEt

1.0 –– HumboldtHafenEins

humboldthafenEins –– At the heart of Europe’s political center

“We aim to realize the most sustainable office in Germany.” Coen van Oostrom –––

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

humboldhafenEins –Situated in the midst of Berlin’s political power.

56

58

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

–– photo #2the location is unique. humboldthafenEins is situated in the midst of Berlin’s political power, the home of Germany’s government. the building is positioned perfectly in the central district of Berlin mitte, right next to Berlin’s hauptbahnhof: Europe’s largest and most modern central railway station. the German government quarter, the federal ministries, the federal intelligence Service, the total tower and the Charité, are all a short walk away.

–– photo #3to the north lies the invalidenstrasse, one of Berlin’s important east-west axes. here stands the landmark hamburger Bahnhof, home to the museum for Contemporary Art, behind which is to be built the Europa-Viertel, a compact, sustainable, climate-compatibly conceived, new mixed-use urban quarter. northeast of humboldthafenEins, lies the world famous Charité, with its university campus, the renowned research hospital and the Berlin medical historical museum.

–– photo #4-5 Berlin is where all the main government bodies and ministries, as well as the trade and industry associations and media enterprises have their offices. high-end shops, cafés, restaurants, first class hotels and residences, museums and concert halls provide further amenities for these offices.

the prominent location of humboldthafenEins ensures a unique vista across the Spreebogen and the extensive park to the south toward the chancellor’s office, the government quarter and the Reichstag. the views from the upper floors extend all the way over the tiergarten to the potsdamer and Leipziger platz.

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.

60

OVG re/developers

Waterfront area –Design by KSP Jürgen Engel architects.

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.

62

OVG re/developers

–– photo #7 the concept for humboldthafenEins is as a high-quality, sustainable, multi-tenant building, that can serve as a prestigious headquarters for a single tenant, as well as a first class address for major German and international corporations. the design amplifies the basic concept of the north-south alignment through the Spreebogen and humboldthafen, set out in the 19th century by the architect peter Joseph Lenné.

humboldthafenEins comprises approximately 30,000 sqm ofoffice and ancillary functions on seven floors and an underground car park. the building is optimized to accommodate a variety of highly efficient workspace configurations: from open bay layout to cellular offices to combinations thereof.

–– photo #8-9 the meandering architecture and open structure of the three courtyards ensure that all offices have ample daylight. the multiple entrances ensure that tenants and their guests can access the building either via an impressive main lobby or directly to the various building sections.

the office floors benefit from a clear height of 2.90 meters, while the top floor has a spectacular free height in excess of 4.5 meters. Both the upper floors and the mezzanine areas offer generous areas for receptions and conferences with wide vistas across the water and over the tiergarten, all the way to potsdamer and Leipziger platz.

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.

64

OVG re/developers

–– photo #10-11 An architects’ competition was held by OVG and the City of Berlin that attracted an extremely high standard of entries. the ultimate winner was KSp Jürgen Engel architects. the process was elaborate, with much attention paid to the soundness of the procedure, the accuracy of the briefing and the group process for evaluation by all the experts.

the building is designed to meet the German Green Building Council’s dGnB Gold status; the highest sustainability rating achievable in Germany. the design complies with the high requirements set for ecological quality, energy efficiency and future durability.

–– photo #12 the central courtyard on the Alexanderufer leads to the waterfront promenade with its attractive restaurant and cafe areas, making it an asset for humboldthafenEins as well as a popular Berlin city destination. it ensures that social cohesion is added to the office building location and makes the humboldthafenEins more than just a building.

the waterfront promenade, has a unique historical legacy. in the future, it will be a lively place for office workers, to mix with pedestrians walking by or visiting the restaurants near the water. in the past, the Berlin Wall used to run exactly on this location, alongside the river Spree.

67

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.

66

OVG re/developersOVG re/developers

OVG held an architects’ competition, together with the City of Berlin, which was won by KSp Jürgen Engel architects. KSp is one of Germany’s internationally successful architecture firms and maintains five offices nationwide as well as an office in China. One of its most prominent projects was the annex to the Chinese national Library in Beijing.

–– photo #13 OVG Real Estate’s partner in this project is Bischoff & Compagnons property networks Gmbh, Berlin, an owner-operated project development firm, founded in 1996 with a focus on high-quality commercial buildings with sophisticated architecture at outstanding locations in Berlin mitte.

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

68

2.0 –– The Rotterdam

AGAinSt ALL OddS, dEVELOpERS OVG REAL EStAtE And mAB dEVELOpmEnt ARE BuiLdinG A nEW VERtiCAL City in ROttERdAm

thE BuiLdinG iS CALLEd ‘thE ROttERdAm’ And WiLL pROVidE 160,000 SQuARE mEtERS Of OffiCES, hOtEL, ApARtmEntS, REStAuRAntS & ShOpS

the Rotterdam –– high-rise solution for sustainable cities.

“Rotterdam is the only city in the netherlands that dares to put up a building like this.” Rem Koolhaas –––

Ahead of the Curve Summary Annual Report 2011 OVG Real Estate B.V.OVG re/developers

70

the Rotterdam under Construction –View from the Erasmus Bridge Rotterdam.