Oshkosh Aviation Business Park UW Oshkosh Business Accelerator

Oshkosh Corporation (NYSE:OSK) · 16 Source: Rouse Asset Services, April 2014 Note: Rouse rebased...

Transcript of Oshkosh Corporation (NYSE:OSK) · 16 Source: Rouse Asset Services, April 2014 Note: Rouse rebased...

MOVING THE WORLD AT WORK

Oshkosh Corporation (NYSE:OSK)KeyBanc Capital Markets Industrial, Automotive &

Transportation ConferenceMay 29, 2014

MOVING THE WORLD AT WORK

Forward-Looking Statements

2Oshkosh Corporation Investor Handout May 29, 2014

This presentation contains statements that the Company believes to be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including, without limitation, statements regarding the Company’s future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations, are forward-looking statements. When used in this presentation, words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or the negative thereof or variations thereon or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties, assumptions and other factors, some of which are beyond the Company’s control, which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. These factors include the cyclical nature of the Company’s access equipment, commercial and fire & emergency markets, which are particularly impacted by the pace of U.S. and European economic recoveries; the strength of emerging market growth and projected adoption rate of work at height machinery; the expected level and timing of DoD and international defense customer procurement of products and services and funding thereof;risks related to reductions in government expenditures in light of U.S. defense budget pressures, sequestration and an uncertainDoD tactical wheeled vehicle strategy, including the Company’s ability to successfully manage the cost reductions required as a result of lower customer orders in the defense segment; the Company’s ability to win a U.S. JLTV production contract award; the Company’s ability to increase prices to raise margins or offset higher input costs; increasing commodity and other raw material costs, particularly in a sustained economic recovery; risks related to facilities consolidation and alignment, including the amounts of related costs and charges and that anticipated cost savings may not be achieved; the duration of the ongoing global economic uncertainty, which could lead to additional impairment charges related to many of the Company’s intangible assets and/or a slower recovery inthe Company’s cyclical businesses than Company or equity market expectations; risks related to the collectability of receivables, particularly for those businesses with exposure to construction markets; the cost of any warranty campaigns related to the Company’s products; risks related to production or shipment delays arising from quality or production issues; risks associated with international operations and sales, including foreign currency fluctuations and compliance with the Foreign Corrupt Practices Act; the Company’s ability to comply with complex laws and regulations applicable to U.S. government contractors; the impact of severeweather or natural disasters that may affect either the Company, the Company’s suppliers or its customers; the impact of cyber security risk and costs of defending against, mitigating and responding to a data security breach; and risks related to the Company’s ability to successfully execute on its strategic road map and meet its long-term financial goals. Additional information concerning these and other factors is contained in the Company’s filings with the Securities and Exchange Commission, including the Form 8-K filed April 29, 2014. All forward-looking statements speak only as of the date of this presentation. The Company assumes no obligation, and disclaims any obligation, to update information contained in this presentation. Investors should be aware that the Company may not update such information until the Company’s next quarterly earnings conference call, if at all.

MOVING THE WORLD AT WORK

Oshkosh Corporation

Leading global provider of specialty vehicles

- Moving the World at Work

Nearly 100 years in business; incorporated in 1917

Four business segments

TTM Revenue: $7.1 billion (1)

Market Capitalization (2): $4.4 billion

Responsible capital allocation

(1) As of March 31, 2014(2) As of May 20, 2014

Defense

Commercial

3Oshkosh Corporation Investor Handout May 29, 2014

Access Equipment

Fire & Emergency

Defense

Commercial

MOVING THE WORLD AT WORK

Oshkosh Corporation Sales Mix

Source: Oshkosh Corporation 10-Q Filing dated April 30, 2014

4Oshkosh Corporation Investor Handout May 29, 2014

48%

30%

10%

12%

Revenue by SegmentFirst Six Months FY14

Access Equipment Defense Fire & Emergency Commercial

76%

5%10%

9%

Revenue by GeographyFirst Six Months FY14

United States Other NA EAME Rest of World

MOVING THE WORLD AT WORK

Strong Free Cash Flow(1)

5Oshkosh Corporation Investor Handout May 29, 2014

Targeting free cash flow to approximate net income or higher over time

Relatively low annual capital spending requirements:$50 - $100 million

Significant cash flow available to execute capital allocation strategy

(1) Free cash flow is cash from operations less net capital expenditures

Fiscal Year

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

2006 2007 2008 2009 2010 2011 2012 2013

Cum

ulat

ive

Free

Cas

h Fl

ow (m

illio

ns)

MOVING THE WORLD AT WORK

Responsible Capital Allocation Strategy

Reinstated $0.15 quarterly cash dividend Repurchased 9.8M OSK shares for $368M; July 2012 – March 31, 2014 Refinanced $250M in Sr. Notes, now due March 2022

─ Interest rate reduced from 8.25% to 5.375%

6

Return capital to shareholders

Re-invest in core business

Invest in external growth

opportunities

Hold cash

Reduce debt

Long-term targeted capital

structure

Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

Strong Performance in FY13…

(1) Non-GAAP results. See Appendix: Non-GAAP to GAAP Reconciliation(2) Variance calculated from high end of range.

Analyst Day FY13 Measure FY13 Estimates Actual %Variance(2)

Revenue $7.5 - $7.8B $7.7B (1.7%) Solid non-defense growth largely offset anticipated defense decline

Adjusted Operating Income(1) $380 - $420M $535M 27.4% MOVE initiatives provide strong foundationfor growth to FY15 objectives

Adjusted EPS(1) $2.35 - $2.60 $3.74 43.8% Strong growth despite lower defense revenue

Free Cash Flow(1) $75 - $100M $386M 286.0%Consistent generator of strong FCF

7Oshkosh Corporation Investor Handout May 29, 2014

…Driving Toward FY15 Targets

MOVING THE WORLD AT WORK

Transforming Oshkosh with MOVE

MOVING THE WORLD AT WORK

Transforming – More Diverse, Global Industrial Company

FY15E Sales (1)

FY11 Sales

Defense Non-Defense

Non-Defense Sales Become Majority of Revenue by FY15

FY13 Sales

(1) Based on Company estimates as of September 2012 Analyst Day

9Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

MOVE – The Right Strategy

Focuses on drivers that create highest shareholder value Expected to drive higher incremental margins across non-Defense

businesses over cycle

FY15 EPS Target$4.00 to $4.50

10Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

Powering Our Transformation –The Oshkosh Operating System Customer-centric application

of lean principles─ Develops talent to deliver value

for customers

Improves processes needed todeliver key elements of MOVE

Supports drive to improve cash flow

Implementation gaining momentum

Company-wide foundation for building shareholder value

11Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

Customer Supporting Systems

12

Leaders Cascade Training

Driving Our Customer-Centric Culture -OOS Foundational Training

Customer Satisfaction

Launched September 2013

Launched December 2013

Customer First

Launched November 2012

Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

Transforming Operations –Continuous Improvement Events

13Oshkosh Corporation Investor Handout May 29, 2014

Using Problem Solving Tools to Improve Paint Quality

Developing Customer-Centric Key Performance Indicators

Using Process Mapping to Reduce Lead Time

Improving Station Layout to Reduce Non-Value Added Motion

MOVING THE WORLD AT WORK

Oshkosh Segment Overview

MOVING THE WORLD AT WORK

Access Equipment

May 29, 2014Oshkosh Corporation Investor Handout 15

Market leader with innovative product offerings- Aerial work platforms- Telehandlers

Innovation focus evident at ConExpo trade show, March 2014 185’ Ultra Boom AWP Refreshed North America’s top telehandler

brand, SkyTrak®

Industry’s first hybrid diesel-electric boom lift Introduced global telehandler - RS series

Strong execution driven by MOVE strategy

Positive global trends

MOVING THE WORLD AT WORK

North American Metrics Remain SolidRefreshing Fleets, Increasing Penetration

Residential and Non-Residential Spending(Y-O-Y % Change)

N.A. Rental Equipment Access - Fleet Age(AWP & TMH)

N.A. Rental Equipment Company Fleet Utilization

Recent Used Equipment Value Trends(OLV)

Source: Global Insight Estimates, March 2014

Based on International Rental News/Dan Kaplan sample of medium to large NA rental equipment companies (United Rentals, RSC, H&E, HERC).

(% C

hang

e)(%

Tim

e U

tiliz

atio

n)

OLV

(% o

f Cos

t)

Source: Rouse Rental Report. Calendar year-end data for 2008-13, 2014YTD through March

(Age

in M

onth

s)

16

Source: Rouse Asset Services, April 2014Note: Rouse rebased the Rouse Value IndexTM in January 2014

May 29, 2014Oshkosh Corporation Investor Handout

50

55

60

65

70

75

1Q'10

2Q'10

3Q'10

4Q'10

1Q'11

2Q'11

3Q'11

4Q'11

1Q'12

2Q'12

3Q'12

4Q'12

1Q'13

2Q'13

3Q'13

4Q'13

Ind. Avg.

40

45

50

55

60

2008 2009 2010 2011 2012 2013 2014YTD

‐40%

‐30%

‐20%

‐10%

0%

10%

20%

30%

2008 2009 2010 2011 2012 2013 2014E 2015EResidential Non‐Residential

25.0

30.0

35.0

40.0

45.0

Jul 12

Aug 12

Sep 12

Oct 12

Nov

12

Dec 12

Jan 13

Feb 13

Mar 13

Apr 1

3

May 13

Jun 13

Jul 13

Aug 13

Sep 13

Oct 13

Nov

13

Dec 13

Jan 14

Feb 14

Mar 14

AWP ‐ Articulating Boom AWP ‐ Scissor Lifts

AWP ‐ Telescopic Boom Forklifts Hi‐Reach

MOVING THE WORLD AT WORK

May 29, 2014Oshkosh Corporation Investor Handout 17

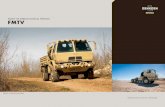

Leading supplier to U.S. DoD for medium and heavy payload TWVs Managing programs with lower expected funding Working on multiple international opportunities- Middle East: M-ATV, Medium & Heavy

TWV platforms- Canada: MSVS SMP

Defense Team Driving Hard Through Downturn

(1) FY15 estimates as of September 2012 Analyst Day(*) Non-GAAP results. See Appendix: Non-GAAP to GAAP Reconciliation

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

FY12 FY13 FY14E FY15E

Sale

s in

Bill

ions

$4.0

$3.0

$1.725-$1.75 $1.5 Target (1)

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

FY12 FY13 FY14E FY15E

6.0%

7.4%

4.5% -4.75%*

Baseline~2.0% (1)

Ope

ratin

g In

com

e M

argi

n

DoD Funding Drives Lower Defense Outlook Through FY15

$0.8 Baseline (1)

MOVING THE WORLD AT WORK

Competing in Light TWV MarketJoint Light Tactical Vehicle Program

JLTV represents opportunity to recreate the business- One of three EMD phase suppliers - Strong congressional and pentagon

program support- Large unit potentialo Initial contract ~17,000o Total U.S. requirements of ~55,000o Attractive global customer prospects

- Leverages Oshkosh strengths- Contract award scheduled for

summer/fall 2015

May 29, 2014Oshkosh Corporation Investor Handout 18

MOVING THE WORLD AT WORK

Fire & Emergency

May 29, 2014Oshkosh Corporation Investor Handout 19

Industry-leading brands- Pierce firetrucks- Oshkosh ARFF and snow removal

vehicles- Frontline broadcast vehicles

Extensive new product launches at FDIC show in April 2014

Slowly recovering U.S. municipal demand

Lower funding limiting federal demand

Investing in operations to achieve MOVE targets Expect greater benefit in 2H 2014

and throughout 2015

MOVING THE WORLD AT WORK

Domestic Fire Market Drivers Recovering • Municipal fire truck orders improving with tax receipts

HOUSING PRICES & LOCAL PROPERTY TAXES

20May 29, 2014Oshkosh Corporation Investor Handout

‐8%

‐6%

‐4%

‐2%

0%

2%

4%

6%

8%

10%

12%

14%

Year‐Over‐Year Percent Change In Housing Prices vs. Local Property Taxes (4‐quarter moving average)

RecessionHousing Price IndexLocal Property Taxes

Source: Rockefeller Institute analysis of U.S. Census Bureau Quarterly Summary of State and Local Government Tax Revenue and Federal Housing Finance Agency, House Price Indexes data (All Transactions).

MOVING THE WORLD AT WORK

Commercial

May 29, 2014Oshkosh Corporation Investor Handout 21

Leading brands for concrete mixers and RCVs Positive outlook for U.S.

concrete mixer market Housing trend generally

positive Strong ConExpo trade show Expect flat U.S. RCV

market in 2014 Remain focused on driving

improved segment results Expect greater benefit in

2H 2014 and into 2015

MOVING THE WORLD AT WORK

Construction: Substantial MixerOpportunities with Modest Recovery

Housing Starts and Mixer Shipments (1959-2013)

22

Sources: Housing Starts - U.S. Census Bureau. Mixer Shipments - Truck Mixer Manufacturers Bureau; U.S. and Canada.

May 29, 2014Oshkosh Corporation Investor Handout

0

2,000

4,000

6,000

8,000

10,000

12,000

0.0

0.5

1.0

1.5

2.0

2.5

Mixer units

Hou

sing

Sta

rts

(Uni

ts in

Mill

ions

)

Housing Starts Mixer Units Shipped

Moody’s – Mar. ’14Global Insight – Mar. ’14PCA – Nov. ’13

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

2012 2013 2014E 2015E

Hou

sing

Starts (un

its in

millions)

U.S. Housing Starts Forecast

Moodys Portland Cement AssociationGlobal Insight Average Analyst Estimate

MOVING THE WORLD AT WORK

Moving Forward in 2H FY14

MOVING THE WORLD AT WORK

MOVE Investments Providing Returns Recovering demand for

non-defense businesses in North America- Europe looking stronger Additional cost take-out- Focus on product, process

and overhead costs- Dedicated teams leveraging

the Oshkosh Operating System

Innovations improving customers’ performance at work Driving to grow

international sales

24May 29, 2014Oshkosh Corporation Investor Handout

MOVING THE WORLD AT WORK

Q2 Performance Highlights

Solid performance despite significant defense sales decline- Market conditions improved for most

non-defense businesses

Strong international order trend in access equipment continued

Important new product launches at trade shows

Refinanced debt

Reiterated FY14 adjusted EPS* expectations of $3.40 to $3.65

Net

Sal

es(b

illio

ns)

Adjusted EPS*

OSK Fiscal Q2 Performance

* Non-GAAP results. See Appendix for reconciliation to GAAP results.

May 29, 2014Oshkosh Corporation Investor Handout 25

$1.68

$1.98

$0.80

$0.96

$0.00

$0.25

$0.50

$0.75

$1.00

$1.25

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

FY14 FY13Net Sales Adjusted EPS*

MOVING THE WORLD AT WORK

Expectations for FY14**

Additional expectations Corporate expenses ~$10 million higher than

adjusted FY13* Tax rate* of ~32% CapEx of ~$80 million Free cash flow* ~$200 million Share count of ~86.0 million

Segment information

Measure Access Equipment Defense Fire &

Emergency Commercial

Sales(billions) $3.40 - $3.45 $1.725 - $1.75 ~$0.80 $0.85 - $0.875

Operating Income Margin 14.5% - 14.75% 4.5% - 4.75%* 3.5% - 3.75% 6.0% - 6.25%

Revenues of $6.7 billion to $6.8 billion Adjusted operating income* of $490 million to $520 million Adjusted EPS* of $3.40 to $3.65

Comments on FY14 Second Half Expect Q3 to be strongest earnings quarter

of the year Expect reduction in defense segment sales

and operating income from Q3 to Q4

* Non-GAAP results. See Appendix for reconciliation to GAAP results.** Information current as of April 29, 2014.

May 29, 2014Oshkosh Corporation Investor Handout 26

MOVING THE WORLD AT WORK

Our Commitment to Shareholders Continue executing MOVE to drive shareholder value- Strong start to FY14 - Benefiting from housing starts; expect follow on growth in non-

residential construction and municipal recovery- MOVE initiatives driving margin expansion- Targeting FY15 EPS of $4.00 to $4.50

Oshkosh Operating System developing processes and talent

27

Transforming to Sustain Long-Term Value Creation for Shareholders

Oshkosh Corporation Investor Handout May 29, 2014

MOVING THE WORLD AT WORK

For informationcontact:

Patrick N. DavidsonVice President, Investor Relations(920) [email protected]

Jeffrey D. WattDirector, Investor Relations(920) [email protected]

MOVING THE WORLD AT WORK

Appendix: Commonly Used Acronyms

29

ARFF Aircraft Rescue and Firefighting M-ATV MRAP All-Terrain VehicleAWP Aerial Work Platform MECV Modernized Expanded Capability VehicleCapEx Capital Expenditures MRAP Mine Resistant Ambush ProtectedCNG Compressed Natural Gas MSVS Medium Support Vehicle System (Canada)DGE Diesel Gallon Equivalent NOL Net Operating LossDoD Department of Defense NPD New Product DevelopmentEAME Europe, Africa & Middle East NRC National Rental CompanyEMD Engineering & Manufacturing Development OI Operating IncomeEPS Diluted Earnings Per Share OOS Oshkosh Operating SystemFHTV Family of Heavy Tactical Vehicles PLS Palletized Load SystemFMS Foreign Military Sales PUC Pierce Ultimate ConfigurationFMTV Family of Medium Tactical Vehicles R&D Research & DevelopmentHEMTT Heavy Expanded Mobility Tactical Truck RCV Refuse Collection VehicleHET Heavy Equipment Transporter RFP Request for ProposalHMMWV High Mobility Multi-Purpose Wheeled Vehicle ROW Rest of WorldIRC Independent Rental Company SMP Standard Military Pattern (Canadian MSVS)IT Information Technology TACOM Tank-automotive and Armaments CommandJLTV Joint Light Tactical Vehicle TDP Technical Data PackageJPO Joint Program Office TPV Tactical Protector VehicleJROC Joint Requirements Oversight Council TWV Tactical Wheeled VehicleJUONS Joint Urgent Operational Needs Statement UCA Undefinitized Contract ActionL-ATV Light Combat Tactical All-Terrain Vehicle UIK Underbody Improvement Kit (for M-ATV)LVSR Logistic Vehicle System Replacement

May 29, 2014Oshkosh Corporation Investor Handout

MOVING THE WORLD AT WORK

30

The table below presents a reconciliation of the Company’s presented non-GAAP measures to the most directly comparable GAAP measures (in millions, except per share amounts):

Fiscal Year EndedSeptember 30,

2013

Operating income (non-GAAP) 534.8$ Tender offer and proxy contest costs (16.3) Impairment charge (9.0) Union contract ratification costs (3.8) Operating income (GAAP) 505.7$

Earnings per share from continuing operations-diluted (non-GAAP) 3.74$ Tender offer and proxy contest costs, net of tax (0.12) Impairment charge, net of tax (0.06) Union contract ratification costs, net of tax (0.03) Earnings per share from continuing operations-diluted (GAAP) 3.53$

Net cash flows provided by operating activities 438.0$ Additions to property, plant and equipment (46.0) Additions to equipment held for rental (13.9) Proceeds from sale of property, plant and equipment 0.1 Proceeds from sale of equipment held for rental 7.5 Free cash flow 385.7$

Operating expenses-Corporate (non-GAAP) (147.6)$ Tender offer and proxy contest costs (16.3) Operating expenses-Corporate (GAAP) (163.9)$

May 29, 2014Oshkosh Corporation Investor Handout

Appendix: Non-GAAP to GAAP Reconciliation

MOVING THE WORLD AT WORK

Appendix: Non-GAAP to GAAP Reconciliation

• The tables below present a reconciliation of the Company’s presented non-GAAP measures to the most directly comparable GAAP measures:

May 29, 2014Oshkosh Corporation Investor Handout 31

2014 2013

Adjusted earnings per share from continuingoperations-diluted (non-GAAP) 0.80$ 0.96$

Reduction of valuation allowance on net operatingloss carryforward 0.14 -

Pension curtailment, net of tax (0.03) - Debt extinguishment costs, net of tax (0.08) -

Earnings per share from continuingoperations-diluted (GAAP) 0.83$ 0.96$

Three Months EndedMarch 31,

MOVING THE WORLD AT WORK

Appendix: Non-GAAP to GAAP Reconciliation

• The tables below present a reconciliation of the Company’s presented non-GAAP measures to the most directly comparable GAAP measures (in millions, except per share amounts):

May 29, 2014Oshkosh Corporation Investor Handout 32

Low High

Adjusted operating income (non-GAAP) 490.0$ 520.0$ Pension curtailment (4.1) (4.1) Operating income (GAAP) 485.9$ 515.9$

Adjusted earnings per share from continuing operations-diluted (non-GAAP) 3.40$ 3.65$ Reduction of valuation allowance on net operating loss carryforward 0.14 0.14 Pension curtailment, net of tax (0.03) (0.03) Debt extinguishment costs, net of tax (0.08) (0.08) Earnings per share from continuing operations-diluted (GAAP) 3.43$ 3.68$

Defense adjusted operating income margin (non-GAAP) 4.50% 4.75%Pension curtailment (0.25)% (0.25)%Defense operating income margin (GAAP) 4.25% 4.50%

Fiscal 2014 Expectations

MOVING THE WORLD AT WORK

Appendix: Non-GAAP to GAAP Reconciliation

• The tables below present a reconciliation of the Company’s presented non-GAAP measures to the most directly comparable GAAP measures (in millions, except per share amounts):

May 29, 2014Oshkosh Corporation Investor Handout 33

Fiscal 2014Expectations

Net cash flows provided by operating activities 290.0$ Additions to property, plant and equipment (80.0) Additions to equipment held for rental (13.0) Proceeds from sale of equipment held for rental 3.0

Free cash flow 200.0$

Effective tax rate (non-GAAP) 32.0%Reduction of valuation allowance on net operating loss carryforward (3.0)%Effective tax rate (GAAP) 29.0%