Russ Weninger legal counsel for Family and Spousal Sponsorship

OSB Family Law Conference SPOUSAL SUPPORT · OSB Family Law Conference SPOUSAL SUPPORT ... the...

Transcript of OSB Family Law Conference SPOUSAL SUPPORT · OSB Family Law Conference SPOUSAL SUPPORT ... the...

OSB Family Law Conference SPOUSAL SUPPORT

How much and for how long?Recent case law and a tasty variety of

alternative approaches

TAB 16 - 1

REMINDERS

• Any spousal support award must be identified as transitional, maintenance or compensatory, whether the judgment is stipulated or not.

• Any spousal support must have a description of the factors utilized in setting the amount, even in a stipulated judgment.

• The factors need to be explicit: eg H’s gross, W’s gross, why is there earning disparity, etc.

TAB 16 - 2

Things I Snuck In Because I Could

• A stipulated order must be signed by all sides to the litigation. If the case is put on the record by stipulation, and is ratified by the Court, it is no longer a stipulated order/ judgment unless the parties agreed to different terms.

• A cc in a letter is not a certificate of service. Letters are routinely discarded.

TAB 16 - 3

Other Rants

• There is only 1 general judgment in any DR case, unless one has been vacated.

• Orders to reinstate after Rule 7 dismissals should be orders to vacate the dismissal judgment.

• Limited judgments are only for prejudgment matters which bear a money award for support, attorney fees or litigation expenses.

TAB 16 - 4

Last Gasp at Improving Practices

• Affidavits/declarations must be signed by a person with first hand knowledge, not the attorney [unless the attorney actually knows].

• TPOR/status quo orders are the most frequently denied requests for relief, because the affidavit does not set forth the actual address where the child has lived for the past 3 months.

TAB 16 - 5

MORE REMINDERS

• In Oregon, transitional support is not for a party who is in transition. It is solely for the purpose of allowing the recipient to enhance earning capacity. The statute says “as needed for a party to attain education and training necessary to allow the party to prepare for reentry into the job market or for advancement therein”.

TAB 16 - 6

Recent Cases - Income

• An obligor lawyer billing 2 hours per day in his specialty field cannot be stimulated to change his area of practice to pay a liveable amount of maintenance. No indication that he was shirking. CoA used his actual income to set spousal rather than prospective income.

• However, CoA used historic amount as pros-pective income to set compensatory spousal.

• Andersen, 358 Or App 568 (2013).TAB 16 - 7

Recent Cases - Income

• H owned a business and stopped receiving any salary 3 mo after divorce was filed. In 8 months before trial, H hired someone else to run his business “to look for work” & applied to 2 places. $120k went in & out of a bank account without explanation. H received $1800 unemployment comp; CoA affirmed finding H’s Y @ $8000 because H failed to explain why he couldn’t earn his former Y. Finding was not speculative. The CoA cited Andersen.

• Cortese, 260 Or App 291 (2013)

TAB 16 - 8

Recent Cases – IncomeThe Takeaway

• For maintenance and transitional support, the income figures for current support can’t be too far afield from the actual or probable numbers.

• But the Court can set a lower current number with a step up based on anticipated increase in obligor’s Y.

• Court may be able to leave modification window open for obligee by finding that the spousal doesn’t meet her needs and spousal is based on obligor’s Y. Obligor’s increased Y may be a basis for modification.

• Compensatory is based on earning potential.TAB 16 - 9

Recent Cases – Transitional• Transitional support is only for educational or

retraining purposes, not to transition a spouse to a new lifestyle. If it’s not education or retraining, it is maintenance.

• Stuart & Ely, 259 Or App 175 (2013) citing Cassezza, 243 Or App 400 (2011). In Cassezza, the trial court found that W’s earning capacity was diminished by her pain. The transitional award was for her to attend a pain clinic to learn how to deal with her pain and get a job. CoA said that’s maintenance.

TAB 16 - 10

Recent Cases - TransitionalThe Takeaway

• A spouse seeking transitional needs to prove what the plan is, including timeline, cost, availability of other resources [loans/scholar-ships] and how spousal aids self-support.

• Court can order direct payment of tuition & fees to satisfy the order if obligee is flakey.

• Can court order reimbursement to obligor if obligee fails to reasonably complete plan? Refund of tuition? Would this settle a case?

TAB 16 - 11

Recent cases - Amount

• 24 yr marriage, both parties mid 40s, W with BA degree, unemployed for 10 years but taking master’s online in accounting, with health problems related to diabetes, car accidents. H earned $11,560/mo, ordered to pay $4,200 unallocated maintenance and compensatory. Appeal focused on amount; CoA found compensatory not designed to punish H’s poor money management, but that poor credit and bankos would affect W’s employability. CoA cited putting parties on “as equal footing as possible”. Steele, 254 Or App 79 (2012).

TAB 16 - 12

Recent Cases – AmountTakeaway on Steele

• Husband didn’t appeal the Court’s failure to separate out maintenance and compensatory even though there are different bases for the awards and limitations on modifying compensatory. Better practice may be to define each form of support.

• Poor financial management and debt-ridden marital estate may be factors in compensatory.

TAB 16 - 13

Recent Cases - Amount

• 42 yr marriage, H 69 & W 64. H on SS, W working; H slightly more Y from small ranch fund. H proposed splitting the Y; W sought spousal, which was awarded by trial court. Ct almost but didn’t quite equalize Ys. CoA noted 10% disparity in Ys, affirmed and ruled that when W retires, her Y will be substantially less and she can move to modify.

• Waid 257 OrApp 495 (2013).TAB 16 - 14

Recent Cases – AmountTakeaway on Waid

• The CoA cites the proposition that, in a long term marriage, the parties should leave on as equal footing as possible.

• W appealed because H has 10% more income than she [$300 difference to low income folks seems a lot.].

• In a 42 yr marriage, CoA said close enough.

TAB 16 - 15

Recent Cases - Duration

• 10 yr marriage, W diagnosed w/rheumatoid arthritis during marriage. Court awarded 5 yrs transitional with no educational plan in mind, declined to award maintenance; W is disabled. CoA remanded to award indefinite maintenance.

• Rodrigues & Gerhards, 258 OrApp 199 (2013).

TAB 16 - 16

Recent Cases – DurationThe Takeaway

• The Court has to ignore the pleading eyes of the obligor to relieve the obligation when a spouse is disabled during the marriage, needs support and there is some ability to pay, even in a short term marriage. For better or worse.

• Court can order that a party apply for SSD/SSI but SSI award is usually reduced $ for $ for payment of spousal and SSD must be applied for within 1 yr of being employed.

TAB 16 - 17

Recent Cases - Settlement

• Court must first determine if there is an ORS 107.104 agreement, or any other kind of agreement, then decide if enforcement is proper. Parties disagreed if there were a meeting of the minds; trial judge skirted issue and made spousal award as if there were no agreement.

• Haggerty, 261 Or App 159 (2014).

TAB 16 - 18

Recent Cases - Settlement

• Parties entered into written settlement agreement. W repudiated the agreement before it was incorporated into a judgment. Trial Court enforced the agreement because its terms did not violate public policy and the Court failed to review terms to see if they were just and equitable. CoA reversed.

• Brown, 259 OrApp 618 (2013).

TAB 16 - 19

Recent Cases – SettlementThe Takeaway

• First, make a finding if there was ORS 107.104 agreement or any other agreement. If so,

• Second, make finding if the agreement violated public policy in the inception [eg fraud, duress, non-disclosure]or the application [eg unforeseen issues]. If not,

• If 107.104 applies, enforce the agreement.• If not, review the agreement and make just

and equitable findings.TAB 16 - 20

Recent Cases – ModificationChange of Circumstances

• Trial court found W’s income doubled since judgment; CoA did de novo review and found no substantial change in income. Indefinite support was continued as originally ordered.

• McKinnon, 256 OrApp 184 (2013).

TAB 16 - 21

Recent Cases – ModificationChange of Circumstances

• Originally a stipulated judgment. Wife filed a modification, claiming change of circumstances of reduced income from lost employment. Court found she proved change of circumstances, but then, found it just and equitable to reduce her support. CoA satisfied that he did not need to plead his relief because W knew about it.

• W failed to reveal her income and expenses in original proceeding and filled up an IRA. But trial court did not punish her by reducing spousal.

• Dow, 256 Or 454 (2013)

TAB 16 - 22

Recent Cases – ModificationChange of Circumstances

• Judgment awarded W transitional and maintenance, & H could modify if W earned >$3500/mo. W remarried 5 mo later. Court terminated transitional but retained maintenance. CoA affirmed finding that remarriage was unanticipated, some portion of new H’s income inured to her benefit even though they kept finances separately. W conceded that she didn’t need the transitional. Maintenance was still just & equitable because her income was still <$3500/mo.

• Tilson, 260 Or App 427 (2013).

TAB 16 - 23

Recent CasesDiscovery Violation

• It is not an abuse of discretion to strike a party’s pleadings in the face of repeated discovery violations. Proceeding was modification in county with LR requiring filing of response before hearing is set.

• CoA affirmed award of ORCP 68 atty fees even though “defaulted” party was not served.

• Uhde, 260 Or App 284 (2013).

TAB 16 - 24

Interest Compounding on Arrears

• The old rule: If an obligee obtained an order which consolidated support and arrears, the combined judgment bears legal rate interest.

• The new rule: Only the arrearage portion of the consolidated judgment bears interest. But an obligor can’t get postjudgment relief if a compounded interest judgment was entered.

• Chase, 354 Or 776 (2014)

TAB 16 - 25

10 Year Review

• ORS 107.407 allows a review of spousal support to see if the obligee has made reasonable efforts to become self sufficient. No change of circumstance showing is required. ORS 107.412 sets for the procedure and factors for the Court to review. The obligee does not need to prioritize short term financial success over alternative approaches to achieve self sufficiency. Here, W didn’t use transitional to attend school, but continued former minor employment while developing a real estate career. Hall 263 OrApp 429 (2014).

TAB 16 - 26

Massachusetts Spousal Guidelines

• Massachusetts historically had a toggle switch for spousal support: lifetime or none.

• A 10 year political process resulted in the following guidelines which are designed to be the maximum amount the Court should award.

• A poll of family law judges in MA last year, with over 50% response rate showed that:

TAB 16 - 27

MA Spousal Guidelines, page 2

• 50% of the judges thought the number were fair; 25% thought they favored the obligor and 25% thought they favored the obligee.

• The rules have been in effect since 2012 and there is not substantial appellate interpretation of some of the terms. Because this was a politically negotiated resolution, arguably there are some vagaries.

TAB 16 - 28

MA Spousal Guidelines, page 3

• General term alimony is for economic dependence.

• Rehabilitative is for economic self-sufficiency within a predicted time, including training and reemployment.

• Reimbursement is for <5 yr marriage to compensate for payor completing education.

• Transitional is for <5 yr marriage to transition payee to an adjusted lifestyle or location.

TAB 16 - 29

MA Spousal Guidelines, page 4General Term Alimony Length

• General terminates upon obligee remarriage or may end if cohabitation > 3 months.

• Time limits for general term alimony are:• <5 years, ½ of marriage length• 5-10 years, not more than 60% of length• 10-15 years, not more than 70% of length• 15-20 years, not more than 80% of length• 20+ year, indefinite length is OK.

TAB 16 - 30

MA Spousal Guidelines, page 5Rehabilitative Alimony Timelines

• Rehabilitative Alimony terminates upon remarriage.

• It is not to be > 5 years but can be modified if obligee shows compelling circumstances of inability to self-support despite reasonable efforts and it is not unduly burdensome to obligor. Court must still consider the length of the marriage.

TAB 16 - 31

MA Spousal Guidelines, page 6Reimbursement Alimony

• Reimbursement alimony is non-modifiable but terminates on obligee’s death.

• Reimbursement is not subject to the income guidelines of other support.

TAB 16 - 32

MA Spousal Support, page 7Amount Limitations

• Except for reimbursement alimony or circumstances warranting deviation for other forms of alimony,

• The amount should generally not exceed the recipient’s need or 30 to 35% of the difference between the parties’ gross income.

• Gross income excludes capital gains, dividends and interest on assets awarded to a party.

TAB 16 - 33

MA Spousal Guidelines, page 8Reasons to deviate from limits

• Grounds to deviate from the limitations include:• Advanced age, chronic illness, unusual health issues.• Tax considerations• Health and life insurance provided by the payor• Sources and amounts of unearned income• Significant premarital economic contributions • Significant separations of parties during marriage• Inability to self support because of payor’s abuse• “Deficiency of property, maintenance, or employment

opportunity”.

TAB 16 - 34

MA Spousal Guidelines, page 9Modification Rules

• MA has some standard unanticipated change of circumstances modifications.

• Agreements to not modify are enforced.• The income and assets of payor’s new spouse

are not to be considered.• Income from OT or a second job which

commenced after the initial order is immaterial if the party has a FT job.

TAB 16 - 35

British Columbia Guidelines

• The Canadian government commissioned a study which developed these advisoryguidelines which are utilized nationwide.

• If there is no child support: multiply the number of years of marriage and/or cohabitation by 1.5 to 2% up to 50% times the difference in the parties’ incomes. Support is paid for 50-100% of the length of the marriage. Over 20 years, it is indefinite.

TAB 16 - 36

BC Guidelines, page 2

• If there is child support, things become much more complex. Calculate the individual net disposable income (INDI) of each party. Obligor’s INDI is gross – taxes/necessary deductions (net) – child support – spousal. Obligee’s INDI is net + child + spousal support. The lower income spouse is to end up with 40-46% of the combined INDI of the parties.

TAB 16 - 37

BC Guidelines, page 3

• The underlying statutory authority is much like Oregon. Spousal support is no fault.

• The Court is to be mindful of the need for the receiving spouse to become self supporting as can be reasonably done.

• The Court is to consider in making its award:• the financial means and needs of both

spouses;• the length of the marriage;

TAB 16 - 38

BC Guidelines, page 4

• the roles of each spouse during their marriage;• the effect of those roles and the breakdown of

the marriage on both spouses' current financial positions;

• the care of the children;• the goal of encouraging a spouse who receives

support to be self-sufficient in a reasonable period of time; and

• any orders, agreements or arrangements already made about spousal support.

TAB 16 - 39

BC Guidelines, page 5

• Judges must also consider whether spousal support would meet the following purposes:

• to compensate the spouse with the lower income for sacrificing some power to earn income during the marriage;

• to compensate the spouse with the lower income for ongoing care of children; or

• to help a spouse who is in financial need if the other spouse has the ability to pay.

TAB 16 - 40

American Academy of Matrimonial Lawyers

• The AAML created a commission to create guidelines. In 2007, AAML accepted the recommendations that, with the opportunity to adjust for unique circumstances:

• Amount: Take 30% of the payor’s gross income minus 20% of the payee’s gross, so long as, when added to the payee’s gross, the payee’s income does not exceed 40% of the combined gross of the parties.

TAB 16 - 41

AAML page 2

• Length. The duration of the award is arrived by multiplication as follows:

• 0-3 years – 0.3 x marriage length• 3-10 yrs - 0.5 x marriage length• 10-20 yrs - 0.75 x marriage length• Over 20 yrs – indefinite (AAML “permanent”)• Gross income is state’s defined income for

child support purposes, not counting child support.

TAB 16 - 42

AAML, page 3

• This method does not apply to spouses whose combined gross > $1,000,000.

• Deviation factors: Adjustment may apply if:1. Spouse is the primary caretaker of child/disabled adult.2. Spouse has a pre-existing court support order.3. Spouse paying court ordered debts, including uninsured/unreimbursed medicals.

TAB 16 - 43

AAML, page 4

• More deviation factors:4. A spouse’s unusual needs.5. A spouse’s age or health.6. A spouse sacrifice of a career/opportunity or support of the career of the other spouse.7. A disproportionate award of marital estate8. Unusual tax consequences.9. Other factors including parties’ agreement.

TAB 16 - 44

MAINE Spousal SupportTimeline Guideline

• Maine has a standard set of factors for setting the amount of spousal support.

• “General support” provides financial assistance to a spouse with substantially less income potential.

• “Transitional support” provides for transitional needs including short-term needs resulting from financial dislocation because of the divorce, and re-entry/retraining for work.

TAB 16 - 45

Maine, page 2

• “Reimbursement support” is for exceptional circumstances including a party’s economic misconduct or substantial contributions to the other party’s career advancement.

• Nominal support is awardable to preserve a party’s ability to seek a modification.

• Rebuttable presumptions re: general support:1. No spousal if < 10 yr marriage

TAB 16 - 46

Maine, page 3

2. Term of spousal may not > ½ the length of marriage of parties married between 10-20 years.3. Court finding that these presumptions would be inequitable or unjust is sufficient as a rebuttal.

TAB 16 - 47

Maricopa County AZSpousal Support Guidelines

• Maricopa County AZ defined guidelines in 2000 and reconfirmed them in 2002.

• The guideline support amount is:1. Obligor’s income minus obligee’s income multiplied by the Duration Factor.2. The Duration Factor is the duration of the marriage (whole number) multiplied by 0.015 (rounded to hundredths), not > 0.50.

TAB 16 - 48

Maricopa County, page 2

3. Duration of support. The duration is a range equaling the duration of the marriage (whole number) x 0.3 to 0.5. If the obligee is 50+ yrs old and the marriage is 20+, support is indefinite.

An indefinite award may specify that it ends at obligor’s retirement.

Prerequisite to support is finding of entitlement based on one of 4 statutory factors.

TAB 16 - 49

Maricopa County, page 3

• Arizona’s 4 statutory bases for spousal:1. Obligee lacks sufficient property (including court’s award) to provide for own needs,2. Obligee unable to be self-sufficient through employment or has child or age or condition that outside employment should not be required, or lacks earning ability in market to be self-sufficient.

TAB 16 - 50

Maricopa County, page 3

• Arizona spousal requirements continued:3. Obligee contributed to educational opportunities of the other spouse.4. Marriage was of long duration and obligee is of an age that may preclude gaining employment providing self-sufficiency.

TAB 16 - 51

New York StateTemporary Maintenance 2010

• Effective 2010, New York has temporary maintenance guidelines. These are not used to set alimony, which is based on typical statutory factors.

• The Court uses the lesser amount of the following formulas:1. Subtract 20% of obligee’s income from 30% of obligor’s income, OR

TAB 16 - 52

NY Temp Maintenance, page 2

2. Multiple the total income of the parties by 40% and subtract the obligee’s net income.Income is determined in the same fashion as child support, generally a gross income figure.

TAB 16 - 53

Pennsylvania GuidelinesTemporary Support Only

• Pennsylvania’s unique approach as of 1989, is:• There are 3 categories of support:

1. “Spousal support” is awardable to an estranged spouse w/o filing divorce action.2. “Alimony pendente lite” or APL is standard pendente lite spousal support.3. “Alimony” is post judgment spousal support.

TAB 16 - 54

Compare for Yourself

• Plug the number of years married and parties’ income into alimonyformula.com or rosen.com/alimony formula to get:AAML, Old 1/3-1/3-1/3, Ginsburg Formula, Massachusetts max, AZ Maricopa County, CA Santa Clara County, KS Johnson County, Pennsylvania, Texas max and VA Fairfax County. Beware of similar websites full of malware including parkermediation.net.

TAB 16 - 55

PA Temp Supp Guidelines, page 2

• Spousal support and APL are by guidelines:1. 40% of the net monthly income differential if there are no children.2. 30% of the net monthly income differential after subtracting child support if there are children.

* Alimony is based on a standard set of factors, except there are defenses based on fault.

TAB 16 - 56

State Family Law Advisory CouncilReport Re: Spousal Support Considerations

• SFLAC respectfully requests that any future legislation regarding spousal support be in accord with the following considerations.

1. Spousal support may be awarded in three different categories, each with their own factors, some of which overlap. The Court must exercise careful discretion to craft an award, where appropriate, in light of the totality of the parties’ circumstances.

TAB 16 - 57

SFLAC Considerations, page 2

2. Transitional support may be awarded to allow a party to attain education and training necessary to enter into employment or for advancement. The Court should consider the duration of the marriage, a party’s training and employment skills, a party’s work experience, the financial needs and resources of each party, tax consequences to each party, a party’s custodial and support responsibilities, and any other appropriate factors.

TAB 16 - 58

SFLAC Considerations, page 3

3. Maintenance support may be awarded to a party to assure that a party does not suffer a disproportionate reduction in lifestyle on account of the separation. The Court should consider the duration of the marriage, the parties’ ages, their physical and mental health, their standard of living during the marriage, the parties’ relative income and earning capacities, a party’s training and employment skills, a party’s work experience, tax consequences to the parties, custodial and child support obligations, and any other appropriate factors.

TAB 16 - 59

SFLAC Considerations, page 4

4. Compensatory support my be awarded when one spouse has contributed significantly economically or otherwise to the education, training, vocational skills, career or earning capacity of the other, as is fair under all of the circumstances. The Court should consider the amount, duration and nature of the contribution, as well as the duration of the marriage, the parties’ relative earning capacities, the extent to which the marital estate has already benefited from the contribution, tax consequences, and any other appropriate factors.

TAB 16 - 60

SFLAC Considerations, page 5

5. Spousal support in a long term marriage should maintain the parties in a relatively equivalent lifestyle.

6. Self-support and economic independence should be reasonably promoted.

7. Spousal support is neither a reward nor a punishment and is not fault based.

8. Neither spouse should be a public charge or impoverished if the other spouse is able to provide support.

TAB 16 - 61

SFLAC Considerations, page 6

9. If spousal support is stepped up or down, the step should be reasonably related to an anticipated change in a party’s economic circumstances.

10. The economic impact of remarriage should be considered as any other economic change of circumstances in a modification action.

TAB 16 - 62

SFLAC Considerations, page 7

11. A primary consideration in any modification of spousal support is the purpose of the initial award.

12. The obligor’s retirement is often a substantial and unanticipated change of circumstances whether the retirement is planned or not.

TAB 16 - 63

SFLAC Considerations, page 8

13. An award of spousal support must take into consideration the property each party is awarded, whether marital or non-marital.

14. The Court must take into consideration the tax consequences to the spouse paying and the spouse receiving spousal support.

TAB 16 - 64

SFLAC Practical Considerations

A. Many people entering or leaving into marriage have disparate earning capacities.

B. The marriage partner with less earning capacity often functions in a role of family care rather than career development.

C. A marriage partner who has the primary charge to care for children, including taking time off from work to deal with illness and appointments, will likely suffer some loss in career.

TAB 16 - 65

SFLAC Practical Considerations, page 2

D. A party who enjoys greater career opportunities during the marriage is likely to continue to enjoy a higher trajectory of earnings, lifestyle, and retirement in the future.

E. Conversely, a party who has had reduced career opportunities during the marriage is not likely to achieve a similar level of earnings, lifestyle and retirement as the other party.

TAB 16 - 66

SFLAC Question for Legislature

• SFLAC suggests the following policy questions for the legislature to address:

Q1. In a spousal support modification, is it appropriate to require the either party to account for or spend down assets which were awarded to that party as part of the dissolution judgment?

TAB 16 - 67

SFLAC Questions for Legislature

Q2. Should modification be based on a change of circumstances or is the sheer passage of time a reasonable reason for a review? In that review, is it appropriate that the focus be the obligee’s attempts or success at becoming more self-sufficient?

Q3. Should the length of time that the parties have been physically and financially separated be an enumerated factor in determining support?

TAB 16 - 68

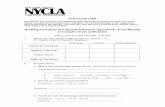

SUMMARY OF SPOUSAL SUPPORT GUIDELINES IN MASSACHUSETTS POLLS complied 6/7/13

Numbers responding 45 attorneys 28 judges

Experience in role < 5yrs 11% <5yrs 39% as lawyer/judge 5-10 18 5-10 11 >10 71 >10 50 Experience in dom rel <5yrs 11% <5yrs 0 5-10 23 5-10 0 >10 66 >10 100 Perception of fairness

Basically fair 64% 78% Favor oblige 8 7 Favor obligor 19 7 Unsure 9 8

Judge’s perception of attorney response to fairness of guidelines Basically fair 50% Favor oblige 7 Favor obligor 4 Not sure/other 39 Parties’ perception of guidelines Basically fair 34% 22% Favor obligee 19 15 Favor obligor 28 4 Don’t know 19 59 Application of guidelines Easy 9% 17 Moderately easy 34 50 Neither easy or hard 37 28 Moderately hard 17 5 Hard 3 0 Use of guidelines Rarely used 3% 0% Sometimes used 21 12 Often used 50 56 Almost always used 26 32 How are guidelines used Rigid application 0% 0% Absolute maximum 6 0 As the norm 43 48 Just another tool 27 44 Start of discussion 24 28

TAB 16A - 1

MASSACHUSETTS SPOUSAL SUPPORT GUIDELINE POLLS Summary compiled 06/07/13 PAGE 2 Attorneys Judges Impact on litigation No significant change 24% 62% More cases filed 43 19 Less cases filed 6 0 Unsure 27 19 Changes in number of contested spousal support cases if at least one party is represented No substantial change 21% 46% More hearings 24 31 Fewer hearings 15 12 Don’t know 40 11 Changes in number of contested spousal support cases if all parties self- represented No substantial change 13% 60% More hearings 7 12 Fewer hearings 3 8 Don’t know 77 20 Changes in length of hearings in contested spousal support cases when one party is represented No substantial change 23% 58% Longer hearings 13 4 Shorter hearings 29 19 Don’t know 35 19 Changes in length of hearing in contested spousal support cases When both parties are represented When neither party is represented No substantial change 16% 68 Longer hearings 19 4 Shorter hearings 28 4 Don’t know 37 24 Use of expert testimony after guidelines in effect No substantial change 22% 52% Used more 12 8 Used Less 0 16 Don’t know 65 24

TAB 16A - 2

MASSACHUSETTS SPOUSAL SUPPORT GUIDELINE POLLS Summary compiled 06/07/13 PAGE 3 Attorneys Judges Changes in level of agreements No substantial change 48% 25% More settlements 42 71 Fewer settlements 10 4 Conclusions Good idea 65% 88% Bad idea 7 4 Well implemented 7% 44% Poorly implemented 20 0 Unintended 32 8 Consequences Goals of guidelines Met 39% 75% Not met 32 4 Other 29 21 PRIMARY COMMENTS

1. This was a 10 year process rife with political accommodations. 2. Many of the terms contained in the guidelines are open to interpretation which the appellate

courts will need to address. 3. It is too soon to tell how effective or fair the guidelines are.

TAB 16A - 3

SPOUSAL SUPPORT

1. STATUTORY BASIS. ORS provides the statutory basis and considerations for spousal support. Spousal support is awardable in lump sum, period payments or both. ORS 107.105((1)(d).

2. FINDINGS. Findings for the basis of support is not just statutorily required; it is the only effective tool to assess the circumstances when a later modification is filed. Making a finding about the purpose of the spousal support award will assist a reviewing court.

3. TRANSITIONAL SPOUSAL SUPPORT. This is awarded only for a spouse to obtain education and training to obtain or enhance employment opportunities. Factors the Court should review: A. Duration of the marriage B. Party’s training and employment skills C. Party’s work skills D. Financial needs and resources of each party E. Tax consequences to each party F. Custodial and child support responsibilities G. Any other factor the Court deems equitable and just.

The Court should expect the obligee to demonstrate the cost and duration of the educational program as well as how the training will make the obligee more self-sufficient economically. If the Court is concerned that the obligee may not follow through with the educational plan, the Court can allow the obligor to make timely payment directly to the institution for obligee’s tuition, books and fees to satisfy all or a portion of the spousal support obligation.

4. COMPENSATORY SPOUSAL SUPPORT. This is to compensate a spouse for a substantial financial or other contribution to the education, training, vocational skills, career or earning capacity of the other party. It replaces the old “enhanced earning capacity” property award. The Court’s consideration is to include: A. The amount, nature and duration of the contribution B. The duration of the marriage C. The relative earning capacity of the parties D. The extent to which the marital estate has already benefitted from the contribution E. The tax consequences to each party F. Any other factor that the deems equitable and just.

The substantial contribution can be putting a spouse through school, or even providing the exclusive homemaking services which frees the other spouse to focus on a career.

TAB 16B - 1

Having a substantial marital estate to divide does not preclude compensatory support, but must be taken into account in making an award, as in all categories of support. The obligor can seek modification only upon involuntary, extraordinary and unanticipated change of circumstances which reduce the obligor’s earning capacity.

5. MAINTENANCE. This is the catch-all for all other spousal support, designed to assure that a spouse has a reasonable standard of living. Factors the Court are to consider are: A. Duration of the marriage B. Age of the parties C. Health of the parties D. Standard of living during the marriage E. Relative income and earning capacity of the parties F. Work experience G. Financial needs and resources of each party H. Tax consequences to each party I. Custodial and child support responsibilities J. Any other factors the Court deems just and equitable.

6. TAXES. Generally, spousal support is tax deductible to the obligor [even without itemizing] and

taxable t o the obligee. See 26 US Code Section 71 A. Joint filing of taxes eliminates the deductibility/taxability of spousal support. B. Pendent elite support is deductible/taxable only if identified as spousal support, not

unallocated family support. A general judgment can re-denominate a portion of family support as spousal, so long as a portion is identified as child support.

C. Direct payment of benefits for the obligee spouse, such as for life insurance or tuition are deductible if ordered by the Court.

D. Spousal support that looks like property division or child support will not be deductible. E. If spousal support is stepped down related to a child no longer receiving support [eg age,

military service, marriage], IRS will recalculate the deductibility and treat the portion which has been stepped down as non-deductible child support.

F. If spousal support is “front-loaded”, the “excess payments” are neither taxable nor deductible. This applies to extra-judicial proceedings. (1) Excess payments are the sum of the excess payments for the 1st post separation year

plus the excess payments for the 2nd post separation year. (2) Excess payments for the first post separation year is the excess, if any, of:

(A) The amount of the alimony paid during the 1st post sear over (B) The sum of: the average of alimony payments paid by obligor during the 2nd

post separation year, reduced by the excess payments for the 2nd post separation

TAB 16B - 2

year and the alimony paid by obligor during the 3rd post separation year, plus $15,000.

(3) Excess payments for the 2nd post separation year, the excess, if any, is: (A) The amount of alimony paid during the 2nd post separation year over (B) The sum of the amount of the alimony paid during the 3rd post-separation year

plus $15,000. (4) This segment doesn’t apply if either spouse dies before the close of the 3rd post

separation year or the obligee remarries before the close of the 3rd post separation year and that death ends the spousal support obligation.

(5) This segment doesn’t apply if the payment is made pursuant to a judgment. (6) The term “alimony” doesn’t apply to fluctuating payments not within the obligor’s

control to pay a fixed portion of obligor’s income (whether business or personal) over at least a three year period of time.

(7) The first separation year means the 1st calendar year in which obligor paid spousal support under this section. The 2nd and 3rd post separation years are the 1st and 2nd succeeding calendar years, respectively.

7. SUBJECT MATTER JURISDICTION. A. The Court must have subject matter jurisdiction over spousal support in order to ender a

judgment. B. If the parties were previously divorced in a proceeding by a Court that had subject matter

jurisdiction over the marriage and personal jurisdiction over the parties, the court lacks subject matter jurisdiction over spousal support in a subsequent proceeding.

C. If the divorce judgment in a prior proceeding was granted without personal jurisdiction over one of the parties, the Court may have subject matter jurisdiction over spousal support.

D. The Court may be able to reserve the issue of spousal support for a later proceeding if it lacks jurisdiction over the respondent.

E. A reservation should be explicitly included in the judgment with a finding for the reason for the reservation.

F. Once Oregon has established a spousal support award, it has continuous exclusive jurisdiction over that award throughout its existence. ORS 110.327(6).

G. A registered domestic partnership under ORS 106.300 is treated like a marriage for all purposes including the award of spousal support.

8. PERSONAL JURISDICTION. A. The Court must have personal jurisdiction over the respondent to issue a spousal support

judgment. B. The Court may have subject matter jurisdiction over the marriage, custody & parenting

time, and in rem/quasi in rem jurisdiction over marital property located within the state, but lack personal jurisdiction to award support, divide debt and award non-Oregon property.

9. LENGTH OF THE MARRIAGE

TAB 16B - 3

A. Caselaw suggests that a short term marriage for spousal support analysis is 10 years, medium is 10-20 years, long term is 20 years +, with an unnamed special category for 30+.

B. If the obligee becomes disabled during the marriage, the length of term of the marriage may be irrelevant. Indefinite support is likely if needed and there is an ability to pay.

C. Caselaw further suggests that an award of one-half of the length of the marriage in short term and medium term marriage is well within “the range of discretion” and that an award of indefinite support is likely with a long term marriage. But there is no formula and each case must be determined on its own circumstances.

D. Although not enumerated as a factor in determining spousal support, the Court may consider pre-marital cohabitation if the parties were clearly financially interdependent. Similarly the Court may consider periods if separation, particularly if the parties operated financially independent of each other.

10. EARNING CAPACITY. A. The Court must evaluate a parties’ earning capacity in setting support. B. If a party has voluntarily terminated employment or reduced the parties’ earnings, the

Court is not bound by that party’s current income, but can look to prior income to determine earning capacity.

C. In setting transitional or maintenance support, the Court must look at current earning capacity, which may be reduced by virtue of economic circumstances beyond the party’s control.

D. In setting compensatory support, the Court may look at historic and projected earnings which may be substantially different that current income.

E. If the obligor has substantial bonus income, the Court may consider ordering monthly payment of spousal support based on regular income and an annual lump sum to be paid upon receipt of the bonus. If the bonus is significantly variable, the Court may consider ordering that the obligor pay over a percentage rather than a fixed amount.

11. AMOUNT OF SPOUSAL SUPPORT A. Oregon does not have guidelines for the amount of support. Except in very long term

marriage (that unnamed category), the purpose of spousal support is not to equalize the parties’ income. Even with the very long term marriage, the Court has recently approved an award dividing income 45/55 over the objections of the obligee.

B. Theoretically, the number should flow from the enumerated factors. It should not discourage a spouse from becoming self-supporting, but recognize a lifestyle that is commensurate with the paying spouse, to the extent that It is possible.

C. The Court can’t order nominal support if an effort to provide modification protection to an obligee unless the parties agree to it.

D. If the Court believes that spousal support should be awarded because of the obligee’s need, but the obligor has a limited ability to pay, the Court may create some protection for the obligee by making a finding that the spousal support ordered is insufficient to meet the spouse’s needs and is reduced because of the obligor’s current circumstances.

TAB 16B - 4

12. STEPPED UP AND STEPPED DOWN SUPPORT

A. The Court has the ability to step up or step down support in response to expected changes in the parties’ financial circumstances.

B. A step up might be appropriate if the obligor has undertaken to pay substantial debt which will predictably end or in a downward economic transition which the Court predicts will upswing.

C. A step down might be appropriate if the obligor can reasonably be anticipated to become more self-supporting after a period of time. In a limited time award, it may be used as a method to wean the obligee from support; in an indefinite award, a stepdown should not be used to pacify the obligor.

13. MODIFICATION A. The Court has the power to modify a transitional and maintenance support award based on

an unanticipated and substantial change of circumstances of either party. The Court can modify both the term and the amount.

B. The Court has a limited ability to modify compensatory support. The obligee’s circumstances do not play into the change of circumstances, only the obligor’s involuntary, extraordinary and unanticipated loss of income.

C. The Court cannot modify support payments which have accrued before the service of a downward support modification motion.

D. The Court cannot modify a support order which has ended by its own terms or has been paid in full before a modification motion is filed

E. The obligee’s remarriage does not terminate spousal support, unless there is a judgment which so provides. Remarriage usually can be a change of circumstance giving rise to a review of the reasonableness of support. A co-habitation with financial interdependence can be treated as a marriage. If the obligee and new partner are sharing expenses or resources, it is typical to add up their income and divide by two to determine what resources are available to the obligee; if the new partner is paying court ordered support, it is best to subtract that from the equation before summing up.

F. A party’s agreement to not modify support may be enforceable if it was appropriate in its creation (no fraud/undue influence/failure to disclose material facts) and appropriate in its application (spouse not a ward of the state). The Court does not lose jurisdiction over the issue of modification even if a judgment improperly states so.

G. If the Court modifies a spousal support award (usually reducing or ending it) because of a circumstance which ends, the Court can re-instate all or a portion of the support award so long as the time period for the support has not terminated.

H. If an obligor is unable to pay the full support awarded in a limited time award, in a modification action, the Court can sum up the full amount payable, reduce the monthly obligation and extend out the payment schedule, if appropriate.

I. If a judgment provides for spousal support without a categorization, the modification court should treat the support as maintenance.

TAB 16B - 5

14. 10 YEAR REVIEW A. ORS 107.407 allows an obligor to request a hearing to review the obligee’s efforts at becoming economically self sufficient. The Court can reduce or terminate support if the efforts have not been reasonable. B. ORS 107.412 describe the procedure and the factors that the Court should utilize. C. If the spousal support was negotiated as part of property settlement, it can’t be modified. D. If the obligee’s health has interfered with self-sufficiency efforts, that is excusable. E. Efforts don’t mean success. Porter, 100 Or App 401 (1990). F. Obligee’s long term plan for economic self-sufficiency may be reasonable even though Short term success is lacking. Hall, 263 Or App 429 (2014)

15. PLEADINGS A. ORCP applies to family law proceedings. B. Case law suggests that, even if a spousal claim is not specifically contained within the

pleadings, so long as the parties are clearly informed of the claims informally, the Court can order support.

16. LIFE INSURANCE. The Court may order the obligor to provide life insurance to secure payment of the spousal support award. Term insurance is less expensive and there is no temptation for the obligor to borrow against equity developed in the policy. If the obligee wants to fund a life insurance policy, the Court can order the obligor to cooperate with the application process, including providing history and participating in a physical examination. If the obligor pays the premium, it qualifies as tax deductible spousal support.

TAB 16B - 6

KEITH R. RAINES Bar Memberships: Oregon State Bar 1976; District of Oregon 1977, 9th Circuit Court of

Appeals 1981; Washington & Multnomah County Bar Associations Personal: Remarried with 3 children, ages 30, 27, 26 Employment: 06/01 to present Washington County Circuit Court Judge,. Chief Family Court Judge

Founding judge of juvenile drug court 08/00 to 06/01 Pro Tem Judge for small claims and juvenile 09/95 to 06/01 Founder of & lawyer at St. Matthew Legal Clinic,

now joined with St. Andrew Legal Clinic 09/79 to 09/95 Co-founder of & lawyer at St. Andrew Legal Clinic 1977 OLCC hearings officer part time 1976 to 1979 Private practice

Judicial Activities Present State Family Law Assistance Committee; Circuit Court Judges’s Assoc Family Law Section Chair; WashCo Conciliation Services Advisory Committee Chair; WashCo Bench Bar Committee; WashCo Family Law Bench Bar Committee, statewide author, lecturer & mentor for Circuit Court Judges

Past Circuit Court Judges Family & Juvenile Law Committee, Vice Chair (committee disbanded) Co-author, Dom Rel Bench Book on Paternity Author, Dom Rel Bench Book on Spousal Support

Education: 1976 JD Lewis & Clark Law School, night program 1972 BA Econ Lewis & Clark College

OSB Activities: 1995 to 2004 State Lawyers Assistance Committee 1992 to present Fee Dispute Arbitration Panel 1994 to 1999 Disciplinary Board Trial Panels 1992 to 1994 Judicial Administration Committee, Chair 1994

Past Local Bar Activities: Washington County Bar: Supplemental Local Rules Committee Multnomah County Bar: Local Professional Responsibility Committee

Court Liaison Comm, Mediation Commission Alternative Dispute Committee, past chair

Awards: 2012 Citation of Honor, Martin Luther King Jr, Awards 1991 Alumnus of the Year, Jesuit High School

1989 Public Service Award, Oregon State Bar 1989 Jefferson Award, American Inst for Public Service 1987 Knight of the Realm, Junior Court of Rosaria 1986 Paul Harris Fellow, Rotary International 1986 St. Thomas More Award, Catholic Lawyers

Community Activities: Current Birthright of Hillsboro, Secretary; Hillsboro Rotary;

Past Albina Rotary Club, past president; Albina Ministerial Alliance board; NAMI Wash County, past president , Youth Progress Assn 05/28/14

TAB 16C