Optimal Compensation and Pay-Performance Sensitivity in a...

Transcript of Optimal Compensation and Pay-Performance Sensitivity in a...

MANAGEMENT SCIENCEArticles in Advance, pp. 1–17issn 0025-1909 �eissn 1526-5501 http://dx.doi.org/10.1287/mnsc.1110.1417

© 2011 INFORMS

Optimal Compensation and Pay-PerformanceSensitivity in a Continuous-Time

Principal-Agent Model

Nengjiu JuDepartment of Finance, School of Business and Management, Hong Kong University of Science and Technology,

Clear Water Bay, Kowloon, Hong Kong; and Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University,200030 Shanghai, China, [email protected]

Xuhu WanDepartment of Information Systems, Business Statistics and Operations Management, School of Business and Management,

Hong Kong University of Science and Technology, Clear Water Bay, Kowloon, Hong Kong, [email protected]

This paper studies the optimal contract between risk-neutral shareholders and a constant relative risk-aversionmanager in a continuous-time model. Several interesting results are obtained. First, the optimal compensa-

tion is increasing but concave in output value if the manager is more risk averse than a log-utility manager.Second, when the manager has a log utility, a linear contract is optimal when there is no explicit lower boundon the compensation, and an option contract is optimal when there is an explicit lower bound. Third, opti-mal effort is stochastic (state dependent). Fourth, consistent with empirical findings and contrary to standardagency theory predictions, the relationship between pay-performance sensitivity and firm performance and thatbetween pay-performance sensitivity and firm risk can be nonmonotonic.

Key words : continuous-time principal-agent models; optimal concave contract; stochastic optimal effort;pay-performance sensitivity

History : Received August 11, 2010; accepted June 12, 2011, by Wei Xiong, finance. Published online in Articlesin Advance.

1. IntroductionWe study the optimal contract between well-diversified risk-neutral shareholders and a con-stant relative risk-aversion (CRRA) manager in acontinuous-time agency model. In our model, themanager controls the instantaneous growth rate ofan output process. Cost of effort is assumed as astandard quadratic function. A number of interestingresults are obtained.

First, the optimal contract is strictly increasing butconcave in the output value if the manager is morerisk averse than a log-utility manager. Because of thewealth effect, relative to a log-utility manager, it ismore cost effective to compensate a more risk-aversemanager with a contract that has a relatively higherportion in equity-linked compensation at the lowerend of the output value than at the higher end. Theconcavity of the optimal compensation is in sharpcontrast with the convexity of compensations suchas stock options whose optimality is normally notestablished.

If, on the other hand, the managerial compen-sation has a positive lower bound (which can beinterpreted as a base payment or limited liability), the

optimal compensation consists of a cash payment plusan equity-linked component when the output valueis above a certain level. Although the equity-linkedcomponent has the appearance of a stock option(kinked payoff due to the lower-bound constraint), itis generally not.

The result that the constrained optimal compensa-tion with a lower bound is option-like appears to begeneral and has also been obtained in, among others,Kadan and Swinkels (2008) and Jewitt et al. (2008).Even though these papers have all considered boundson compensations, they differ in focuses. For exam-ple, whereas studying the effects of compensationbounds in static agency models is the focus of Jewittet al. (2008), our paper is on the dynamics of optimalefforts and compensation in a dynamic model. On theother hand, whereas the focus of Kadan and Swinkels(2008) is on the effort incentives when compensationis in stock or stock option, our paper determines theoptimal contract from an unrestricted contract space,except perhaps a lower-bound constraint.

Second, when the manager has a log utility, a lin-ear contract is optimal when there is no explicit lowerbound on the compensation, and an option contract

1

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Published online ahead of print September 20, 2011

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity2 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

is optimal when there is an explicit lower bound. Thereason is that, besides the wealth effect, our modelexhibits a scale effect. In our model, effort affectsthe output scale rather than level.1 Same effort levelhas a larger impact on output value when the assetvalue is higher. This scale effect calls for a higherportion of equity-linked compensation that induceshigher effort. For a manager more risk averse than alog-utility manager, the wealth effect dominates anda concave compensation becomes optimal. For a log-utility manager, the wealth effect and scale effect bal-ance out and a linear contract becomes optimal whenthere is no lower bound on the compensation andan option contract becomes optimal when there is alower-bound constraint.2

Third, the optimal effort is stochastic and in starkcontrast with the constant effort result in the stan-dard exponential-normal settings of Holmstrom andMilgrom (1987) and the deterministic counterpart inOu-Yang (2003, 2005). In models where effort affectslevel, its impact on final output value is independentof current asset value (state variable). Therefore, opti-mal effort does not depend on the state variable. Bycontrast, effort in our model affects scale. As a result,the optimal effort becomes state dependent. However,the exact behavior depends on risk aversion and isour focus in §4.

Fourth, the relationship between pay-performancesensitivity (PPS) and firm performance and thatbetween PPS and firm risk may be nonmonotonic andhence consistent with the extant empirical evidence.One of the central features of standard agency modelsis that firm performance should be positively corre-lated with PPS. Whereas a positive relation is reportedin McConnell and Servaes (1990) and Lazear (2000),no significant relation is found in Himmelberg et al.(1999) and Palia (2001). Another central prediction ofthese models is that PPS should be negatively cor-related with firm risk. Whereas a negative relationis supported by the studies of Lambert and Larker(1987), Aggarwal and Samwick (1999), Jin (2002), andGarvey and Milbourn (2003), a positive relation isfound in Demsetz and Lehn (1985). Furthermore, alarge body of empirical work (Garen 1994, Yermack1995, Bushman et al. 1996, and Ittner et al. 1997) findsthat there is no significant relationship between PPSand firm risk. Prendergast (2002) provides empiricalevidence, argues, and develops a theoretical model toshow that the relation between PPS and risk can bepositive.

1 See Remark 1 for more detail.2 Studies that take stock or stock options as the compensation formwithout addressing their optimality include, among others, Cade-nillas et al. (2004), Carpenter (1998, 2000), Carpenter and Remmers(2001), Carpenter et al. (2009), and Guo and Ou-Yang (2006).

The rest of this paper is organized as follows.Section 2 specifies the model assumptions and themaximization problems of the shareholders and theCRRA manager. Section 3 develops the major solu-tion steps and techniques and solves the maximiza-tion problems. Section 4 discusses properties of theoptimal effort. Section 5 focuses on the relationsbetween PPS and firm performance and risk. Sec-tion 6 offers a few empirical predictions. Section 7concludes. Appendix A provides a complete charac-terization of the optimal compensation. Appendix Bproves some properties of the optimal effort.

2. A Continuous-TimePrincipal-Agent Model

2.1. Asset Value Dynamics Under DifferentProbability Measures

Assumption 1. Under no managerial effort, the firm’sasset value follows a geometric Brownian motion:

dVt = Vt4�dt +�dB0t 51 (1)

where � and � are constants and B0t is a standard Wiener

process under reference probability measure P 0 on space4ì1F5. Let Ft denote the information set generated by B0

t .

Assumption 2. Through costly managerial effort et ,the probability measure P 0 is changed into a new equiva-lent measure P e defined by

dP e

dP 0=M e

T 1

where M eT is an FT -adapted martingale under measure P 0

and has the following representation:

M eT = exp

(

−12

∫ T

0

(

et�

)2

dt +

∫ T

0

(

et�

)

dB0t

)

0 (2)

Note that by the Girsanov theorem, Bet , defined by

Bet = B0

t −

∫ t

0

(

et�

)

dt1 (3)

is another standard Wiener process under the newmeasure P e. Consequently, under P e the value of thefirm’s assets is governed by

dVt = Vt44�+ et5dt +�dBet 50 (4)

In the following, expectations under P 0 and P e are,respectively, denoted as Ɛ06· �Ft7 and Ɛe6· �Ft7.

Remark 1. The effect of the costly effort in (4) isto increase the (instantaneous) expected growth rateby et and the output level Vt grows at the rate ofVtet , proportional to its current level Vt , a scale effect.This is different from the setting of Holmstrom andMilgrom (1987), in which the level Vt grows at therate of et .

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 3

One standard assumption of the extant literatureis that the output process is an arithmetic Brownianmotion. In a recent important advance, He (2009)develops a tractable continuous-time agency modelwith a geometric Brownian motion output process.We too model the output process without effort in (1)as a geometric Brownian motion. However, our paperdiffers from He (2009) in other modeling aspects: theagent is risk averse in our model whereas she is riskneutral in He (2009); effort is restricted to two dis-crete values (zero or a positive constant) in He (2009)whereas in our model it is optimally determined with-out restrictions and is stochastic; and managerial pay-ment and consumption occur at the terminal datein our model whereas they occur intertemporally inHe (2009).

2.2. The Contract SpaceAssumption 3. At time 0, the shareholders offer a com-

pensation, ST , which is payable at contract horizon T tothe manager, and ST is continuous and positive (ST > 0).Otherwise, the contract space of ST is unrestricted exceptthat there may be a lower bound KL > 0 such that ST ≥KL.

2.3. The ManagerBesides the arithmetic Brownian motion output pro-cess assumption, another standard one is to presumea constant absolute risk-aversion (CARA) utility.Although a CARA utility affords tractability in manyapplications, it exhibits no wealth effect. Instead, weuse a CRRA utility.

Assumption 4. The manager has a CRRA utility ofconsuming ST . Disutility of exerting costly effort is sepa-rable from utility of consumption and given by

C6et7=�

2e2t 1 (5)

where � is a constant.It follows then that the objective of the manager

is (for unconditional expectations, we omit the initialinformation set F0 from the expectation operators),

max8et9

VM 6ST 1 8et9Tt=07= Ɛe

[

S1−�T

1 −�−

∫ T

0

�

2e2s ds

]

1 (6)

where � ≥ 1 is the constant relative risk-aversionparameter.3

Remark 2. Different from the monetary effort costin Holmstrom and Milgrom (1987), which is insepa-rable from the compensation, effort cost in our modelis in disutility and separable from the utility fromcompensation (like in Sannikov 2008). This modelingfeature, coupled with the quadratic form of the costfunction C6et7, is the key reason that our model istractable. See §3.1 and Remark 4 for details.

3 For an integrability condition, we require that � ≥ 1. See Foot-note 5 for details.

2.4. The PrincipalAssumption 5. The shareholders are risk neutral.

Let W0 denote the manager’s initial wealth, �0 herreservation wage, and ST the sum of W0 and compen-sation. Accordingly, the shareholders solve the follow-ing problem:

maxST

V S6ST 7 = maxST

Ɛe∗

6VT − 4ST −W057

= W0 + maxST

Ɛe∗

6VT − ST 7 (7)

such that

8e∗

t 9Tt=0 ∈ arg maximizes VM 6ST 1 8et9

Tt=071 (IC)

VM 6ST 1 8e∗

t 9Tt=07≥U4W0 + �050 (IR)

3. Optimal Strategies3.1. The Manager’s Problem: Optimal EffortWe follow Sannikov (2008) to derive the optimaleffort. His approach relies on taking the manager’scontinuation value Yt as a state variable, which is themanager’s expected utility at time t, given that sheexerts the principal’s desirable effort from t onward.That is, Yt is given by

Yt = Ɛe

[

S1−�T

1 −�−

∫ T

t

�

2e2s ds

∣

∣

∣

∣

Ft

]

1 YT =S1−�T

1 −�0 (8)

Obviously, Yt −∫ t

0 �/2e2s ds is a P e-martingale. By

the martingale representation theorem, there exists a�t process such that

dYt =�

2e2t dt +�tdB

et 0 (9)

By Equation (4) in Sannikov (2008), the optimal effortis determined by

e∗

t = arg min(

12�e2

t −�t

�et

)

=�t

��0 (10)

Therefore, in equilibrium

dYt =�

24e∗

t 52dt +��e∗

t dBet

=�

24e∗

t 52dt +��e∗

t

(

dB0t −

e∗t

�dt

)

= −�

24e∗

t 52dt +��e∗

t dB0t 0 (11)

Remark 3. To demystify the optimal effort condi-tion (10), we offer the following heuristic derivation.4

Because dBet = dB0

t − 4et/�5dt, we can write (9) as

dYt =

(

�

2e2t −

�t

�et

)

dt +�tdB0t 0 (12)

4 For a more rigorous treatment, see Sannikov (2008).

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity4 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

Therefore,

Yt = YT −

∫ T

t

(

�

2e2s −

�s

�es

)

ds −

∫ T

t�s dB

0s 1 (13)

where the terminal utility YT is given in (8). The rea-son that we have transformed to B0

s is that the mea-sure P 0 is not affected by effort et . Thus, for a given �s ,t ≤ s ≤ T , we can maximize Yt in (13) by choosing etto maximize the second term (i.e., minimize the inte-grand �e2

s /2 −�ses/� at each s).

It is clear from (11) that �t (equivalently e∗t ) is deter-

mined by the diffusion function of Yt . The form in(11) suggests an exponential transformation. Let

Y e∗

t = exp(

Yt

��2

)

0

By Ito’s lemma we have

dY e∗

t = Y e∗

t

(

e∗t

�

)

dB0t 1 Y e∗

T = exp(

S1−�T

41 −�5��2

)

0 (14)

It is clear from (14) that the diffusion of Y e∗

t deter-mines e∗

t . Furthermore, Y e∗

t is a P 0-martingale and hasthe following conditional expectation representation:5

Y e∗

t = Ɛ06Y e∗

T �Ft7= Ɛ0

[

exp(

S1−�T

41 −�5��2

)

∣

∣

∣

∣

Ft

]

0 (15)

It follows then that the manager’s initial optimalexpected utility is given by

VM 6ST 1 8e∗

t 9Tt=07

= Y0 = ��2 log4Y e∗

0 5

= ��2 log(

Ɛ0

[

exp(

S1−�T

41 −�5��2

)])

0 (16)

Equation (15) makes it clear that under optimalmanagerial effort e∗

t , the manager’s utility dependsonly on the compensation ST and measure P 0, whichis independent of e∗

t . So we have eliminated the effortchoice from the decision-making process. It followsthat the key is to determine the optimal contract ST .We turn our attention to that in §3.3.

Remark 4. Two modeling features allow us toobtain the striking result (15). The first is that thecost function is separable in utility. This allows us toobtain (10). The second is that the cost function isquadratic. This allows us to obtain (11). If the cost

5 Integrability in (15) requires � ≥ 1. To see this, consider the casewhere the manager is offered a constant fraction, �, of the outputvalue VT (nonoptimal compensation) and she exerts a constant efforte (nonoptimal effort). It is easy to check that both the manager’snet utility and the equity value approach infinity as e approachesinfinity if 0 ≤ � < 1.

function is not quadratic but still separable in utility,we can still derive e∗

t as in (10). For example, if C6et7=�e4

t /4, e∗t = 4�t/4��55

1/3. However, we no longer havethe exponential martingale form (11). Both featuresare required to deliver (15).

3.2. Separation of Optimal Effort andChange of Measure

Proposition 1. Under optimal effort, the change ofmeasure has the following representation:

M e∗

T = Y e∗

T /Y e∗

0

= exp(

S1−�T

41−�5��2

)

/

Ɛ0

[

exp(

S1−�T

41−�5��2

)]

0 (17)

Proof. Note that under optimal effort e∗t , the

change of measure in (2) becomes

dM e∗

t =e∗t

�M e∗

t dB0t 1 M e∗

0 = 10 (18)

On the other hand, we have just seen from (14) and(15) that the manager’s utility satisfies

dY e∗

t =e∗t

�Y e∗

t dB0t 1

Y e∗

0 = Ɛ0

[

exp(

S1−�T

41 −�5��2

)

∣

∣

∣

∣

F0

]

0

(19)

Comparing (18) and (19) we see that M e∗

t = Y e∗

t /Y e∗

0 .Q.E.D.

Remark 5. In equilibrium, the change of measure,M e∗

T , depends on compensation ST , but does notdepend on e∗

t explicitly. This property helps make theprincipal’s problem much easier as we see next. Fora similar representation of the change of measure, seeCvitanic et al. (2009). Again, this is a result from thetwo modeling features discussed in Remark 4.

3.3. The Principal’s Problem:Optimal Compensation

Given the change of measure in (17), the principal’sproblem becomes

maxST

Ɛe∗

6VT − ST 7

≡ maxST

Ɛ06M e∗T 4VT − ST 57

= maxST

Ɛ06exp4S1−�T /41 −�54��2554VT − ST 57

Ɛ06exp4S1−�T /41 −�54��2557

1 (20)

subject to

Ɛ0

[

exp(

S1−�T

41 −�5��2

)]

≥ exp(

4W0 + �051−�

41 −�5��2

)

0 (21)

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 5

Proposition 2. For a given constant �, let S�T be the

solution of the following equation

ST +��2S�T = VT +�1 (22)

when VT +�> 0 and for a positive KL define V ∗ by

V ∗=KL +��2K�

L −�0 (23)

Then, the optimal compensation with a lower bound KL isgiven by

S∗

T 4�5=KL14VT ≤ V ∗5+ S�T 14VT >V ∗51 (24)

where 14 5 is the indicator function. In particular, (i) ifreservation �0 < �L0 where �L0 is defined in (A9), the reser-vation constraint (21) is not binding and � is determinedby (A6) and negative; (ii) if, on the other hand, �0 ≥ �L0 ,the reservation constraint is binding and � is determinedby (A11) and can be negative or positive. Moreover, if �0 >�M0 where �M0 > �L0 and is defined in (A14), � > 0. In thiscase, an explicit lower bound is not necessary if � is largeenough so that V ∗ < 0.6

Remark 6. We have reduced the difficult problemof determining the optimal contract to the simplealgebraic equation (22). Clearly, the optimizing STdepends only on VT .

We will focus on our discussions when � > 0. Weconsider two cases separately: (1) there is no explicitlower bound on the compensation; and (2) there is anexplicit positive lower bound.

3.4. Optimal Contract Without anExplicit Lower-Bound Constraint

In this case, S∗T = S�

T . Generally, an explicit solutionfor S∗

T is not available and the simple algebraic equa-tion (22) is solved numerically. However, there arespecial cases where explicit solutions are available.Case 1. � = 1. The optimal contract is linear and

given by

S∗

T =VT +�

1 +��20 (25)

Case 2. � = 2. In this case the optimal contract isnonlinear and given by

S∗

T =

√

VT +�

��2+

(

12��2

)2

−1

2��20 (26)

Remark 7. We have obtained an optimal linear con-tract in a log-utility–geometric Browian motion output

6 See Appendix A for proof.

setting.7 In contrast, the classical result of optimal lin-ear contracts is obtained in the standard CARA utility–Brownian motion output settings of Holmstrom andMilgrom (1987), Schättler and Sung (1993).

Proposition 3. Generally, we have the following prop-erties: (1) the optimal contract is strictly increasing; and(2) it is concave.

Proof. For notational purpose, let f 6VT 7 = S∗T .

Because the optimal compensation f 6VT 7 satisfies (22),we have the following first and second order deriva-tives:

f ′6VT 7 = ¡f 6VT 7/¡VT

=1

1 +���24f 6VT 75−41−�5

> 01 (27)

f ′′6VT 7 = ¡2f 6VT 7/¡V2T

= �41 −�5��24f 6VT 75�−24f ′6VT 75

30 (28)

The optimal contract f 6VT 7 is strictly increasing be-cause f ′6VT 7 > 0. It is concave because f ′′6VT 7 ≤ 0 for� ≥ 1. Q.E.D.

3.4.1. Optimal Contract with an Explicit PositiveLower-Bound Constraint. In this case, V ∗ in (23) ispositive. We can now rewrite (24) as

S∗

T = KL14VT ≤ V ∗5+ S�T 14VT >V ∗5

= KL + 4S�T −KL514VT >V ∗5

= KL + 4S�T −KL5

+0 (29)

The equity-linked compensation (29) has the appear-ance of stock options except that generally it dependson the asset value in complicated ways. However,when the manager has a log utility, the equity-linkedpart becomes stock options. We formalize this impor-tant result in the following corollary.

Corollary 1. For the log-utility (� = 1) manager withan explicit positive lower bound, the optimal compensationbecomes cash plus stock options and is given by8

S∗

T =KL +1

1 +��24VT − 441 +��25KL −�55+1 (30)

where � is determined by

Ɛ064S∗

T 51/4��257= 4W0 + �05

1/4��250 (31)

7 The output process in our model is a geometric Brownian motiononly under the probability space P 0. It is not under the probabil-ity space P e with managerial effort in (4) because et is stochastic(dependent on Vt). In the CARA–Brownian motion models theasset value follows a Brownian motion under both probabilitymeasures because the optimal efforts are constants.8 Recall that with � = 1, S�

T = 4VT +�5/41 +�� 25.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity6 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

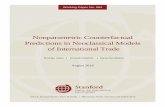

Figure 1 Optimal Effort vs. Intermediate Asset Value

0 200 400 600 800 1,0000

0.05

0.10

0.15

0.20

0.25

Intermediate asset value Vt

*O

ptim

alef

fort

leve

l et *

Opt

imal

effo

rt le

vel e

t*

Opt

imal

effo

rt le

vel e

t*O

ptim

alef

fort

leve

l et

Panel A: � = 1 and no lower bound

0 200 400 600 800 1,0000

0.05

0.10

0.15

0.20

0.25

0.30

Intermediate asset value Vt

Panel B: � = 1 and lower bound KL = 48

0 200 400 600 800 1,0000

0.1

0.2

0.3

Panel C: � = 2 and no lower bound

0 200 400 600 800 1,0000

0.1

0.2

0.3

0.4

Intermediate asset value VtIntermediate asset value Vt

Panel D: � = 2 and lower bound KL = 48

t = 0.5t = 2.5t = 4.5

Notes. Panels A and B plot the optimal effort levels under utility U4W5= log4W 5 at t = 00512051405 as a function of the prevailing asset value without and witha lower bound on the compensation, respectively. The parameter values are T = 5, V0 = 100, �= 0, � = 008, �= 2/� 2,W0 = 0, �0 = 60, and KL = 48. Panels Cand D do the same under U4W5 = W 1−�/41− �5 with � = 2. The parameter values are T = 5, V0 = 100, � = 0, � = 008, � = 10−2/� 2, W0 = 0, �0 = 60, andKL = 48.

Remark 8. For a manger who is less efficient (i.e.,higher �) or a firm with higher risk (�) or both,the shareholders should provide the manager withfewer number of stock options. It is also tempting tothink that the strike price, 41 + ��25KL − �, shouldalso be higher. However, this is not so and in factthe strike price should be lower in order to sat-isfy the manager’s reservation. The reason is that �increases more than 41 + ��25KL does if �2 increases.The shareholders can reward and retain the moreefficient (smaller �) managers by providing them agreater number of stock options but with a higherstrike price.

4. Optimal EffortWith the optimal compensation determined by (22),from (14) the optimal effort itself can in turn be recov-ered by matching the diffusion of dY e∗

t with Y e∗

t 4e∗t /�5.

Let J 6t1Vt7= Y e∗

t . Then, we have

J 6t1Vt7

(

e∗t

�

)

= diffusion of dJ 6t1Vt7= �Vt

¡J 6t1Vt7

¡Vt

0

Therefore, e∗t is determined by

e∗

t =�2Vt

J 6t1Vt7

¡J 6t1Vt7

¡Vt

= �2 ¡ log4J 6t1Vt75

¡ log4Vt50 (32)

Recall that J 6t1Vt7 is obtained through (15).

4.1. Explicit Solutions of the Optimal EffortIn our CRRA uitlity-separable disutility cost and geo-metric Brownian motion setting, the optimal effort isboth time dependent and state dependent (stochas-tic),9 and in general cannot be solved explicitly. How-ever, when � = 1 (log utility) and ��2 = 1/n, where nis a positive integer, we can calculate it explicitly.

To this end, note that in this case (15) becomes

J 6t1Vt7 = Ɛ06SnT �Ft7= Ɛ0

[(

VT +�

1 + 1/n

)n ∣∣

∣

∣

Ft

]

=

(

n

1 +n

)n n∑

m=0

Cmn Ɛ

06V mT �Ft7�

n−m

9 We note that even in the CARA uitlity-inseparable monetary costsetting but with geometric Brownian motion output process, theoptimal effort is also stochastic as in He (2011).

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 7

Figure 2 Effects of Reservation Wage �0 on Optimal Effort Under Utility U4W5=W 1−�/41− �5 with � = 2

0 500 1,0000

0.1

0.2

0.3

0.4

0.5

0.6

Intermediate asset value Vt

0 500 1,000

Intermediate asset value Vt

0 500 1,000

Intermediate asset value Vt

0 500 1,000

Intermediate asset value Vt

*O

ptim

al e

ffor

t lev

el e

t *O

ptim

al e

ffor

t lev

el e

t*

Opt

imal

eff

ort l

evel

et*

Opt

imal

eff

ort l

evel

et

Panel A: �0 = 50.0

0

0.05

0.10

0.15

0.20

0.25

0.30

0.35

Panel B: �0 = 60.0

0

0.05

0.10

0.15

0.20

0.25

Panel C: �0 = 70.0

0

0.05

0.10

0.15

0.20

0.25Panel D: �0 = 80.0

t = 0.5t = 2.5t = 4.5

Notes. Panels A, B, C, and D plot the optimal effort levels at t = 00512051405 as a function of the prevailing asset value, respectively. The parameter values areT = 5, V0 = 100, �= 0, � = 008, and �= 10−2/� 2.

=

(

n

1 +n

)n n∑

m=0

Cmn V

mt �n−m

· exp{

4�+ 005�24m− 155m4T − t5}

1 (33)

where Cmn denotes the combinatory coefficient. Now

by (32) straightforward calculations yield

e∗

t =1n�

∑nm=1mCm

n Vmt �n−mexp84�+005�24m−155m4T −t59

∑nm=0C

mn V

mt �n−mexp84�+005�24m−155m4T −t59

1

(34)

which is clearly time dependent and stochastic.In Appendix B, we prove that e∗

t is increasing inVt and approaches zero as Vt approaches zero andapproaches the upper limit 1/� as Vt → �. Whenn= 1, it is particularly simple and given by

e∗

t =1�

Vte�4T−t5

Vte�4T−t5 +�

=1

�41 + 4�/Vt5e−�4T−t55

1 (35)

which is obviously increasing in Vt and approachesthe limit 1/�. For this special case, e∗

t has no explicit

time dependence if � = 0 and is decreasing in t if�> 0 and increasing if �< 0.

4.2. General Properties and Numerical Examplesof the Optimal Effort

Except the previous special case, the optimal effortneeds to be solved numerically. Before we do so, westate some general properties whose proofs are pro-vided in Appendix B.

Proposition 4. The optimal effort (1) approaches zeroas Vt approach zero and increases with Vt initially; and(2) approaches the upper limit 1/� if � = 1 and approacheszero if � > 1 as Vt approaches infinity.

We have done extensive numerical calculations forthe cases with � = 11213. Most results for different �sare similar. To save space we mostly report results for� = 2.

In Figure 1 we plot the optimal effort (as a func-tion of intermediate asset value Vt) for a given setof model parameters for � = 1 and � = 2 without or

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity8 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

Figure 3 Effects of Cost of Effort Coefficient � on Optimal Effort Under Utility U4W5=W 1−�/41− �5 with � = 2

0 500 1,0000

0.1

0.2

0.3

0.4

0.5

Intermediate asset value Vt

0 500 1,000

Intermediate asset value Vt

Intermediate asset value VtIntermediate asset value Vt

*O

ptim

al e

ffor

t lev

el e

t

*O

ptim

al e

ffor

t lev

el e

t *O

ptim

al e

ffor

t lev

el e

t*

Opt

imal

eff

ort l

evel

et

Panel A: � = 0.009

0

0.05

0.10

0.15

0.20

0.25

Panel B: � = 0.015

0 500 1,0000

0.05

0.10

0.15

0.20Panel C: � = 0.022

0 5,000 10,0000

0.02

0.04

0.06

0.08

0.10

0.12

Panel D: � = 0.03

t = 0.5t = 2.5t = 4.5

Notes. Panels A, B, C, and D plot the optimal effort levels at t = 00512051405 as a function of the prevailing asset value, respectively. The parameter values areT = 5, V0 = 100, �= 0, � = 100, and �0 = 60.

with a lower bound on the compensation. The opti-mal effort is low when Vt is very low. There are tworeasons. First, because of the scale effect, the effectof e∗

t on the output value is small when Vt is small.Second, the equity-linked component in the compen-sation will be small. This provides less incentive forexerting costly effort. However, initially, the optimaleffort increases quickly as Vt increases. This is stilldue to the scale effect of the output process dynamicsin (4). That is, the same effort level increases outputvalue by a larger amount when Vt is higher. There-fore, there is a strong incentive to increase Vt whenit is low by exerting higher effort. However, above acritical level, effort may decline with Vt because nowthe wealth effect dominates. The reason is that whenVt is below the critical value, the marginal benefit(increased utility from consumption) more than off-sets the marginal cost (increased disutility of a highereffort level). However, because of the wealth effect,when the compensation is already likely to be highenough (resulting from a high Vt), the added benefit

of a higher effort level may not offset the increaseddisutility. Therefore, the manager optimally exerts lesseffort.10 This is consistent with the result in Sannikov(2008, p. 964) that “when the agent’s consumption ishigh, it costs too much to compensate him for positiveeffort.”

By contrast, in the Brownian output model of Hom-strom and Milgrom (1987), effort affects the level offuture output but not the scale. Furthermore, effortcost is modeled as an inseparable monetary cost inHomstrom and Milgrom (1987), whereas in our modelit is a separable (dis)utility. The two modeling fea-tures of level effect of effort and inseparable monetarycost of effort jointly determine that optimal effort is aconstant in such a model.

10 The wealth effect argument also applies to the case for � = 1 (log-utility). However, given the quadratic cost function specification,the wealth effect is not enough to offset the scale effect of a highereffort level for a higher Vt . Thus, the optimal effort is an increasingfunction of Vt in this case.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 9

Figure 4 Effects of Output Volatility � on Optimal Effort Under Utility U4W5=W 1−�/41− �5 with � = 2

0 500 1,0000

0.05

0.10

0.15

0.20

0.25

0.30

Intermediate asset value Vt

0 500 1,000

Intermediate asset value Vt

Intermediate asset value Vt Intermediate asset value Vt

*O

ptim

al e

ffor

t lev

el e

t *O

ptim

al e

ffor

t lev

el e

t*

Opt

imal

eff

ort l

evel

et*

Opt

imal

eff

ort l

evel

et

Panel A: � = 0.7

0

0.05

0.10

0.15

0.20

Panel B: � = 0.9

0 500 1,0000

0.05

0.10

0.15

Panel C: � =1.2

0 5,000 10,0000

0.05

0.10

0.15

Panel D: � = 1.5

t = 0.5t = 2.5t = 4.5

Notes. Panels A, B, C, and D plot the optimal effort levels at t = 00512051405 as a function of the prevailing asset value, respectively. The parameter values areT = 5, V0 = 100, �= 0, �= 0002, and �0 = 60.

In Figures 2–4 we plot the optimal efforts withvarious changes of the model parameters. Figure 2indicates that there exists an inverse relation betweenoptimal effort and �0. The reason is that to satisfy ahigher reservation utility (wage), a larger � in (22)is required. A larger � has the effect of reducingthe relative portion of equity-linked component inthe compensation, resulting in a lower optimal effortlevel.

However, we caution that a manager’s reservationis likely positively correlated with her skill/capability,measured by the inverse of the cost of effort �. Indeed,Figure 3 reveals that � has a large impact on theoptimal effort level. Managers with higher reservationbecause of lower � can optimally exert higher effort.

Figure 4 plots the effort for different output volatil-ity � . As expected, higher � leads to lower effort levelbecause any linked-equity compensation is riskier forhigher � . Ideally, output volatility should be underthe control of the manager. In such a model, thereexists a trade-off of lower risk level and the cost

of managing risk. It can also be the case that theexpected growth rate of output process is (possiblypositively) related to the risk level. In either case,the risk level can be endogenously determined. Fortractability and our solution techniques to apply, out-put risk level is exogenously specified in our model.

In Figure 5 we present the optimal effort as a func-tion of the time to terminal date T − t and intermedi-ate asset value (state variable) in a three-dimensionalplot. When Vt is small, e∗

t is an increasing function ofT − t. The reason is that in this case the scale effectdominates (the wealth effect). When T − t is larger, etcan affect the terminal output process value througha longer period. This is unlike the arithmetic Brown-ian motion models where the effort affects the leveland current effort has no impact on later effort. Inour model, current effect affects later effort throughits effect on the output process that in turn affectsfuture effort level because effort depends on outputlevel. In other words, effort in our model has a propa-gating effect. On the other hand, when Vt is large, the

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity10 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

Figure 5 Optimal Effort Plotted Against Time to Terminal DateT − t and Intermediate Asset Value Vt Under UtilityU4W5=W 1−�/41− �5 with � = 2

0200

400600

8001,000

02

46

810

*

0

0.05

0.10

0.15

0.20

0.25

0.30

Intermediate asset value Vt

Time to terminal date T– t

Opt

imal

effo

rt le

vel e

t

Note. The parameter values are T = 5, V0 = 100, � = 0, � = 008, � =

10−2/� 2, and �0 = 60.

wealth effect dominates and et is a decreasing func-tion of T −t. The longer is T −t, the larger is its impacton VT . Because the compensation ST is an increasing

Figure 6 Effects of Reservation Wage �0 Under Utility U4W5=W 1−�/41− �5 with � = 2 for PPS and Performance

50 60 70 80 900.32

0.33

0.34

0.35

0.36

0.37

0.38

0.39

Reservation wage �0

Reservation wage �0

PPS

Panel A: PPS plotted against �0

50 60 70 80 90150

200

250

300

350

400

450

500

Reservation wage �0

Exp

ecte

d to

tal o

utpu

t val

ue E

e* [

VT]

50 60 70 80 9050

100

150

200

250

300

350

Exp

ecte

d re

sidu

al v

alue

Ee*

[VT

–S T

]

Panel C: Ee* [VT – ST] plotted against �0

100 200 3000.32

0.33

0.34

0.35

0.36

0.37

0.38

0.39

Expected residual value Ee* [VT – ST]

PPS

Panel D: PPS plotted against Ee* [VT – ST]

Panel B: Ee* [VT] plotted against �0

Notes. Panels A, B, and C plot the PPS, expected terminal output, and expected terminal residual value as a function of reservation wage, respectively. Panel Dplots the PPS as a function of expected terminal residual value. The parameter values are T = 5, V0 = 100, �= 0, � = 008, �= 10−2/� 2, and W0 = 0.

function of VT , T − t has a positive impact on ST aswell. Because of the wealth effect, the marginal bene-fit of et declines when ST is expected to be high andhigher when T − t is longer. The manager optimallyreduces her effort level. Time to terminal date T − tand intermediate asset value Vt jointly affect optimaleffort e∗

t nonmonotonically. The implication is that ashorter maturity is called for when the equity-linkedcomponent is likely to yield high payoffs, e.g., in-the-money options. When the equity-linked component islikely to yield lower payoffs, e.g., out-of-the-moneyoptions, a longer maturity is more appropriate.

5. Pay-Performance Sensitivity, FirmPerformance, and Firm Risk

One central prediction of standard agency theory isthat firm performance should be positively correlatedwith PPS. The empirical evidence has been mixed.Another central prediction of standard agency theory

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 11

Figure 7 Effects of Output Volatility � Under Utility U4W5=W 1−�/41− �5 with � = 2 for PPS and Performance

0.70 0.75 0.80 0.850.355

0.360

0.365

0.370

0.375

0.380

0.385

0.390

Output volatility �

Output volatility �

Output volatility �

PPS

Panel A: PPS plotted against �

0.70 0.75 0.80 0.85 0.90

250

300

350

400

Exp

ecte

d to

tal o

utpu

t val

ue E

e* [

VT]

Panel B: Ee* [VT] plotted against �

0.70 0.75 0.80 0.85140

160

180

200

220

240

Exp

ecte

d re

sidu

al v

alue

Ee*

[V

T–

S T]

Panel C: Ee* [VT – ST] plotted against �

160 180 200 220 2400.355

0.360

0.365

0.370

0.375

0.380

0.385

0.390

Expected residual value Ee* [VT – ST]

PPS

Panel D: PPS plotted against Ee* [VT – ST]

Notes. Panels A, B, and C plot the PPS, expected terminal output, and expected terminal residual value as a function of volatility, respectively. Panel D plotsthe PPS as a function of expected terminal residual value. The parameter values are T = 5, V0 = 100, �= 0, �= 10−2/0082, W0 = 0, and �0 = 60.

is that PPS should be negatively correlated with firmrisk. Again, the empirical evidence has been mixed.However, these predictions are mostly based on theCARA utility–Brownian motion settings and may nothold in other theoretical settings like ours.

For nonlinear contracts, the literature has generallyused the delta (ã) of compensation as a measure ofPPS. For example, the Black–Scholes delta has beenused as a measure of PPS for option-type compensa-tions. It is easy to check that the Black–Scholes ã isthe expectation of the derivative of the terminal pay-off.11 Similarly, for our nonlinear contracts we useEe∗64¡/¡VT 5f 6VT 77= E06MT f

′6VT 77 as a measure of PPS,where f ′6VT 7 is given in (27).

In Figures 6 and 7 we plot the PPS, expected totaloutput value, equity (expected residual) value as a

11 To see this, note that 4¡/¡VT 54VT − K5+ = 14VT > K5, where K isthe strike price. It can be easily checked that the Black–Scholes ã=

E614VT >K57, where dVt/Vt = 4r +� 25dt+�dBt , r is the riskless rate,� the volatility, and Bt a standard Wiener process.

function of �0, � , and PPS as a function of the equityvalue when � = 2. They indicate that, depending onthe structural parameter values, the relation betweenPPS and equity value and the relation between PPSand firm risk can be increasing or decreasing. Thisis consistent with the empirical evidence. In Figure 8we plot the relation between PPS and firm perfor-mance for different compensation time to maturity.It indicates that performance is higher if the timeto maturity is longer. Therefore, controlling time tomaturity is an important consideration in empiricalwork.

We note that the relation between PPS and �0 (or �)has a direct consequence for the relation between PPSand equity value. Changing �0 corresponds to man-agerial heterogeneity.12 We caution that it is usuallyless difficult to find some heterogeneous variable such

12 We have also calculated these relations by changing W0 or �. Sim-ilar results are obtained and thus not reported.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity12 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

Figure 8 Effects of Intermediate Asset Value Vt Under Utility U4W5=W 1−�/41− �5 with � = 2 on PPS and Performance

200 400 600 800 1,0000.15

0.20

0.25

0.30

0.35

0.40

0.45

Intermediate asset value Vt

Intermediate asset value Vt

Intermediate asset value Vt

PPS

Panel A: PPS plotted against Vt

200 400 600 800 1,0000

500

1,000

1,500

200 400 600 800 1,0000

500

1,000

1,500

0.2 0.3 0.40

500

1,000

1,500

PPS

t = 0.5t = 2.5t = 4.5

Panel B: Et [VT] plotted against Vte*

Panel C: Et [VT – ST] plotted against Vte*

Panel D: Et [VT – ST] plotted against PPSe*

Exp

ecte

d to

tal o

utpu

t val

ue E

t[V

T]

e*E

xpec

ted

tota

l res

idua

l val

ue E

t[V

T–

S T]

e*

Exp

ecte

d to

tal r

esid

ual v

alue

Et

[VT

–S T

]e*

Notes. Panels A, B, and C plot the PPS, expected terminal output, and expected terminal residual value as a function of Vt , respectively. Panel D plots theexpected terminal residual value as a function of PPS. The parameter values are T = 5, � = 008, �= 0, �= 10−2/� 2, W0 = 0, and �0 = 60. The calendar timeis t , i.e., T − t is time to terminal date.

as �0 to explain the relation between two endogenousvariables such as PPS and equity value.13 On the otherhand, explaining the relation between the endogenousPPS and exogenous � is more demanding. To thisend, we offer the following elaboration.

5.1. Decomposition of Pay-PerformanceSensitivity

To understand the behavior of PPS better and how itdiffers from that of a linear contract, we consider thefollowing decomposition:

PPS = Ee∗

6f ′6VT 77= E06MT f′6VT 77

= E06MT 7E06f ′6VT 77+ cov04MT 1 f

′6VT 751 (36)

where cov04 5 denotes the covariance under mea-sure P 0. Because E06MT 7= 1, we have

PPS=Ee∗

6f ′6VT 77=E06f ′6VT 77+cov04MT 1f′6VT 750 (37)

13 We thank the referees for urging us to be cautious on relationbetween two endogenous variables using a heterogeneous variable.

Therefore, the PPS that measures the expected (i.e.,Ee∗

6 7) pay (i.e., F 6VT 7) change versus performance(i.e., VT ) change (i.e., ¡f 6VT 7/¡VT ) under measure P e∗ ,Ee∗

6f ′6VT 7, can be decomposed into that under mea-sure P 0, E06f ′6VT 7, plus the covariance between themarginal compensation f ′6VT 7 and MT . For a linearcontract, f ′6VT 7 is independent of VT and thus covari-ance is zero. Generally, for a nonlinear contract, thecovariance measures the difference between the PPSunder the probability measure with effort (P e∗ ) andthat without effort (P 0). In our model with � = 2,f 6VT 7 is given by (26) and f ′6VT 7 is given

f ′6VT 7=1

√

1 + 2��24VT +�50

To satisfy a given reservation �0, � increases with � .So f ′6VT 7 decreases with � for a given VT . It is

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 13

Figure 9 Effects of Output Volatility � Under Utility U4W5=W 1−�/41− �5 with � = 2 for PPS

0.70 0.75 0.80 0.85

0.40

0.42

0.44

0.46

0.48

0.50

0.52

0.54

0.56

0.58

Output volatility � Output volatility �

E0 [�f

[VT]/�V

T]

Panel A

0.70 0.75 0.80 0.85 0.90

–0.20

–0.18

–0.16

–0.14

–0.12

–0.10

–0.08

–0.06

–0.04

–0.02

cov(�f

[VT]/�V

T, M

T/M

0)

Panel B

Notes. Panel A plots the PPS under the probability measure without effort. Panel B plots the difference between the PPS under the probability measure withand without effort. The parameter values are T = 5, � = 008, �= 0, �= 10−2/� 2, W0 = 0, and �0 = 60.

intuitive then that E06f ′6VT 77 decreases with � .14 Weplot this term in panel A of Figure 9. It is noted that itis indeed decreasing in volatility and conforms withthe usual classical result in models with optimal lin-ear contract such as Holmstrom and Milgrom (1987).This decreasing relation appears to be slightly convex.

On the other hand, we note that

MT = exp(

−1

��2ST

)

/

exp(

−1

��2�0

)

= exp(

−1

√

��24VT +�5+1/4−1/2

)

/

exp(

−1

��2�0

)

0

It is easy to see that f ′6VT 7 is decreasing in VT whereasMT is increasing and thus the covariance is negative.Moreover, as � increases, f ′6VT 7 becomes less depen-dent on VT . For example, as � becomes very large,f ′6VT 7 becomes very small (close to zero) regard-less of the value of VT . Therefore, the covariance is

14 Although this is intuitive, it is not proof because the distributionof VT depends on � .

expected to become smaller in magnitude as � increases.Indeed, panel B of Figure 9 indicates that it is negativebut increasing in volatility (the magnitude becomessmaller). This increasing relation is concave.

The sum of the two panels in Figure 9 yields the PPSrelation in panel A in Figure 7. Because the concavityof panel B is more than the convexity of panel A inFigure 9, their sum results in a nonmonotone relation.Thus, the nonlinearity that yields the covariance termplays an important role of this relation.15

6. Empirical ImplicationsWe propose a few more specific predictions. First,the prediction that the relationship between PPS and

15 Similarly, we can define utility-performance sensitivity (UPS) as

Ee∗

[

¡

¡VT

Y 6VT 7

]

= E06MT f−� 6VT 7f

′6VT 77

and examine its relation with risk accordingly.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity14 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

performance is stronger if time to maturity is longercan be tested by the following exercise:16

firm performance

= a+ bPPS + c4PPS · employment_tenure5+ �1 (38)

where � is a white noise and c is predicted to bepositive.

Second, the prediction that the relationship betweenPPS and firm risk is increasing for lower risk firmsand decreasing for higher risk firms can be testedusing firm samples sorted into risk groups:

PPS = a+ b�d14lowest risk group5

+ c�d24highest risk group5+ �1 (39)

where d14 5 and d24 5 are two dummy variables, andb is predicted to be positive and c negative.

Third, based on the discussion at the end of §4,we propose the following test on the relationshipbetween the moneyness and maturity of executivestock options:

moneyness = a+ b maturity + �1 (40)

where b is predicted to be negative.Although options are typically issued at the money,

a manager’s portfolio may contain existing optionswith different moneyness and maturities. The over-all moneyness and maturity can be constructed, forexample, using value-weighted average. The averagevalues of moneyness and maturity can be endoge-nously affected by choosing the amount and maturityof newly issued options even if they are issued atthe money. The prediction in (40) can be tested cross-sectionally using weighted values.

7. ConclusionIn this paper we have studied the optimal contract-ing problem between risk-neutral shareholders and aCRRA manager. In our model the manager controlsthe expected growth rate of an asset value processby exerting costly effort. In our characterization theoptimal compensation function is the solution to analgebraic equation and an increasing function of theterminal output value. Generally, neither restrictedshares (linear contracts) nor stock options are optimal.The optimal compensation function is linear in theterminal output value if the manager has a log utilityand concave if he is more risk averse.

The optimal effort in our model is stochastic and isin contrast with the results of constant or determin-istic efforts in the standard CARA utility–Brownian

16 We thank the referee for suggesting the test.

motion output settings. We find that in our model theoptimal effort is increasing in the intermediate assetvalue if the manager has a log utility and is increas-ing and then decreasing if the manager is more riskaverse.

Numerical calculations show that the relation-ship between PPS and firm performance and thatbetween PPS and firm risk can be nonmonotonic.These predictions are consistent with empirical find-ings. We have also proposed a few more testablepredictions.

AcknowledgmentsThe authors appreciate comments from Gurdip Bakshi, TaoLi, Peter MacKay, Jianjun Miao, Rong Wang, and seminarparticipants at the Chinese University of Hong Kong, theUniversity of Hong Kong, and the 2007 China InternationalConference in Finance. The authors are most grateful toan anonymous referee and an associate editor for extensiveand thoughtful comments and suggestions. Financial sup-port from Hong Kong government general research fundgrant GRF 620909 is acknowledged.

Appendix A. Characterizing the Principal’sMaximization ProblemForm the Lagrangian,

L =

Ɛ0

[

exp(

S1−�T

41−�5��2

)

4VT − ST 5

]

Ɛ0

[

exp(

S1−�T

41−�5��2

)]

+�

(

Ɛ0[

exp(

S1−�T

41 −�5��2

)]

− exp(

4W0 + �051−�

41 −�5��2

))

0

(A1)

Let

N = Ɛ0[

exp(

S1−�T

41 −�5��2

)

4VT − ST 5

]

1

D = Ɛ0[

exp(

S1−�T

41 −�5��2

)]

0

The derivative of L with respect to ST is

¡L

¡ST=

Ɛ0

[

exp(

S1−�T

41−�5��2

)(

S−�T��2 4VT − ST 5− 1

)]

D

− Ɛ0

[

exp(

S1−�T

41−�5��2

)

S−�T��2

]

N

D2

+�Ɛ0[

exp(

S1−�T

41 −�5��2

)

S−�T

��2

]

0 (A2)

The Kuhn–Tucker first-order conditions (state-by-state, i.e.,for each VT ) are

ST +��2S�T = VT +�D−N/D1 � ≥ 01 and (A3)

�

(

Ɛ0[

exp(

S1−�T

41 −�5��2

)]

− exp(

4W0 + �051−�

41 −�5��2

))

= 00 (A4)

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 15

A.1. IR Constraint (21) Is Not BindingIn this case (A4) implies � = 0 and we can rewrite (A3) as

ST +��2S�T = VT +�1 (A5)

where � is determined by

�= −N

D= −

Ɛ0

[

exp(

S1−�T

41−�5��2

)

4VT − ST 5

]

Ɛ0

[

exp(

S1−�T

41−�5��2

)] 0 (A6)

We only consider the interesting cases where the equityvalue is positive. Thus, �< 0 in (A6).

Let S�T denote the solution of (A5) when VT + � > 0. It is

tempting to set ST = 0 when VT +�≤ 0. However, for � ≥ 1,CRRA utility is not well defined if ST = 0 for a positive prob-ability set Pr4VT ≤ −�5 > 0. Therefore, to have a solution, apositive lower bound KL > 0 on ST needs to be specified.The optimal compensation with a lower positive bound cannow be specified as

S∗

T =KL14S�T ≤KL5+ S�

T 14S�T >KL50 (A7)

More conveniently, we can define

V ∗=KL +��2K�

L −�

and rewrite (A7) as

S∗

T =KL14VT ≤ V ∗5+ S�T 14VT >V ∗50 (A8)

The compensation (A8) defines a minimum binding reser-vation level �L0 :

Ɛ0[

exp(

4S∗T 5

1−�

41 −�5��2

)]

= exp(

4W0 + �L0 51−�

41 −�5��2

)

0 (A9)

When �0 < �L0 , IR constraint is not binding and the optimalcompensation is given by (A8). When �0 ≥ �L0 , IR constraintis binding and we characterize the principal’s maximizationin this case next.

A.2. IR Constraint (21) Is BindingIn this case � ≥ 0 and we still have

ST +��2S�T = VT +�1 (A10)

where

� = �D−N

D= �Ɛ0

[

exp(

S1−�T

41 −�5��2

)]

−

Ɛ0

[

exp(

S1−�T

41−�5��2

)

4VT − ST 5

]

Ɛ0

[

exp(

S1−�T

41−�5��2

)] 0 (A11)

The optimal compensation with no explicit lower bound isgiven by S∗

T = S�T , where

S∗

T =KL14VT ≤ V ∗5+ S�T 14VT >V ∗5 (A12)

when an explicit lower bound KL exists. In either case � isdetermined by

Ɛ0[

exp(

4S∗T 5

1−�

41 −�5��2

)]

= exp(

4W0 + �051−�

41 −�5��2

)

0 (A13)

From (A11), � is recovered.By setting �= 0 in (A10), (A13) defines reservation �M0 :

Ɛ0[

exp(

4S∗T 5

1−�

41 −�5��2

)]

= exp(

4W0 + �M0 51−�

41 −�5��2

)

0 (A14)

When �L0 < �0 ≤ �M0 , IR constraint is binding and �≤ 0. When�0 > �M0 , IR constraint is binding and �> 0.

A.3. Checking the Second-Order ConditionFirst, for a given VT , note that the first-order condition (A5)or (A10) has a unique solution when VT +�> 0 because theleft-hand side is an increasing function of ST . Rearrangingterms we can rewrite (A2) as

¡L

¡ST=

Ɛ0

[

exp(

S1−�T

41−�5��2

)

S−�T��2 4VT +�−ST −��2S�

T 5

]

D1 (A15)

where �= �D−N/D is determined by (A6) for the nonbind-ing case (� = 0) and by (A13) for the binding case (� ≥ 0).The second-order derivative is given by

¡2L

¡S2T

= −

Ɛ0

[

exp(

S1−�T

41−�5��2

)

S−�T��2 4VT +�− ST −��2S�

T 5

]

¡D¡ST

D2

+

Ɛ0

[

exp(

S1−�T

41−�5��2

)(

S−�T��2

)2

4VT +�− ST −��2S�T 5

]

D

+

Ɛ0

[

exp(

S1−�T

41−�5��2

)

4−�5S−�−1T��2 4VT +�− ST −��2S�

T 5

]

D

+

Ɛ0

[

exp(

S1−�T

41−�5��2

)

S−�T��2 4−1 −���2S�−1

T 5

]

D0 (A16)

The first three terms are zero at the first-order condition(A5) or (A10), and the last term is clearly negative. It fol-lows that the first-order conditions determine the uniquemaximum for each VT when a solution exists.

Appendix B. Proof of Proposition 4

B.1. For � > 1, e∗t Initially Increases with Vt and Then

Drops to Zero as Vt Approaches InfinityTo prove this result, recall that

J 6t1Vt7= E0[

exp(

S1−�T

41 −�5��2

)

∣

∣

∣

∣

Ft

]

0 (B1)

Therefore, by (32) we have

e∗

t =�2Vt

J 6t1Vt7

¡J 6t1Vt7

¡Vt

=1

�E0

[

exp(

S1−�T

41−�5��2

)

∣

∣

∣

∣

Ft

]

·E0[

exp(

S1−�T

41 −�5��2

)

S−�T

¡ST¡VT

VT

∣

∣

∣

∣

Ft

]

1 (B2)

where Vt4¡VT /¡Vt5= VT has been used because

VT = Vte4�−�2/254T−t5+�4B0

T −B0t 5

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance Sensitivity16 Management Science, Articles in Advance, pp. 1–17, © 2011 INFORMS

under measure P 0. Using (27) we can rewrite (B2) as

e∗

t =1�Ee∗[

VT S−�T

1 +���2S−41−�5T

∣

∣

∣

∣

dFt

]

0 (B3)

Now, as Vt approaches zero, it is clear from (B3) that e∗t

approaches zero. Because e∗t is obviously positive for Vt > 0,

it follows that e∗t is increasing in Vt initially. To see that it

approaches zero (again) as Vt approaches infinity, we notethat from the first-order condition (22) we have (for � > 1as VT → �)

ST ∼

(

VT

��2

)1/�

0

Therefore,

e∗

t → �2Ee∗[

11 +��24�54VT /4��

255−41−�5/�

∣

∣

∣

∣

Ft

]

→ 00 Q.E.D.

B.2. For � = 1, e∗t Initially Increases with Vt and

Approaches 1/� as Vt Approaches InfinityIn this case (� = 1), (B2) becomes

e∗

t =E064VT +�51/4��25−1VT �Ft7

�E064VT +�51/4��25 �Ft7

=1k

(

1 −�E064VT +�51/4��25−1 �Ft7

E064VT +�51/4��25 �Ft7

)

1 (B4)

which approaches zero as Vt → 0 and approaches 1/� asVt → �. Q.E.D.

Our calculations indicate that e∗t is monotonically increas-

ing in Vt when � = 1, but we are unable to prove this result.However, when ��2 = 1/n where n is a positive integer, thisis true as we show next.

B.3. For � = 1, e∗t Is an Increasing Function of Vt If

��2 = 1/n Where n Is a Positive IntegerNote that when ��2 = 1/n, (B4) reduces to (34). Takingderivative of (34) with respect to Vt and letting b6Vt7 denotethe resulting numerator, we have

Vt b6Vt7 =

n∑

m=1

m2Cmn V

mt �n−ma4m5

n∑

k=0

CknV

kt �

n−ka4k5

−

n∑

m=1

mCmn V

mt �n−ma4m5

n∑

k=1

kCknV

kt �

n−ka4k5

= C0n�

na405n∑

m=1

m2Cmn V

mt �n−ma4m5

+

n∑

m=1

n∑

k=1

m4m− k5Cmn C

knV

m+kt �2n−m−ka4m5a4k51

where a4i5 is defined as

a4i5= exp84�+ 005�24i− 155i4T − t590

To prove e∗t is increasing in Vt , we only need to prove

b6Vt7 > 0. The first term is positive. Now consider the sec-ond term, which can be rewritten as

n∑

m>k

m4m− k5Cmn C

knV

m+kt �2n−m−ka4m5a4k5

+

n∑

m<k

m4m− k5Cmn C

knV

m+kt �2n−m−ka4m5a4k5

=

n∑

m>k

m4m− k5Cmn C

knV

m+kt �2n−m−ka4m5a4k5

+

n∑

k<m

k4k−m5Cmn C

knV

m+kt �2n−m−ka4m5a4k51

where we have switched the dummy indices m and k in thesummation in the second term. Thus,

n∑

m=1

n∑

k=1

m4m− k5Cmn C

knV

m+kt �2n−m−ka4m5a4k5

=

n∑

m>k

4m− k52Cmn C

knV

m+kt �2n−m−ka4m5a4k5 > 00

Therefore, b6Vt7 > 0 and e∗t is increasing in Vt . Q.E.D

ReferencesAggarwal, R., A. Samwick. 1999. The other side of the trade-off: The

impact of risk on executive compensation. J. Political Econom.107(1) 65–105.

Bushman, R., R. Indejikian, A. Smith. 1996. CEO compensation:The role of individual performance evaluation. J. AccountingEconom. 21(2) 161–193.

Cadenillas, A., J. Cvitanic, F. Zapatero. 2004. Leverage decisionand manager compensation with choice of effort and volatility.J. Financial Econom. 73(1) 71–92.

Carpenter, J. 1998. The exercise and valuation of executive stockoptions. J. Financial Econom. 48(2) 127–158.

Carpenter, J. 2000. Does option compensation increase managerialrisk appetite? J. Finance 55(5) 2311–2331.

Carpenter, J., B. Remmers. 2001. Executive stock option exercisesand inside information. J. Bus. 74(4) 513–534.

Carpenter, J., R. Stanton, N. Wallace. 2009. Estimation of employeestock option exercise rates and firm cost: Methodology. Work-ing paper, New York University, New York.

Cvitanic, J., X. Wan, J. Zhang. 2009. Continuous-time principal-agent problems with hidden action and lump-sum payment.Appl. Math. Optim. 59(1) 99–146.

Demsetz, H., K. Lehn. 1985. The structure of corporate ownership:Causes and consequences. J. Political Econom. 93(6) 1155–1177.

Garen, J. 1994. Executive compensation and principal-agent theory.J. Political Econom. 102(6) 1175–1199.

Garvey, G., T. Milbourn. 2003. Incentive compensation when exec-utives can hedge the market: Evidence of relative performanceevaluation in the cross section. J. Finance 58(4) 1557–1581.

Guo, M., H. Ou-Yang. 2006. Incentives and performance in the pres-ence of wealth effects and endogenous risk. J. Econom. Theory129(1) 150–191.

He, Z. 2009. Optimal executive compensation when firm size fol-lows geometric Brownian motion. Rev. Financial Stud. 22(2)859–892.

He, Z. 2011. A model of dynamic compensation and capital struc-ture. J. Financial Econom. 100(2) 351–366.

Himmelberg, C., R. Hubbard, D. Palia. 1999. Understanding thedeterminants of managerial ownership and the links betweenownership and firm performance. J. Financial Econom. 53(2)353–384.

Holmstrom, B., P. Milgrom. 1987. Aggregation and linearity inthe provision of intertemporal incentives. Econometrica 55(2)303–328.

Ittner, C., D. Larcker, M. Rajan. 1997. The choice of performancemeasures in annual bonus contracts. Accounting Rev. 72(2)231–255.

Jewitt, I., O. Kadan, J. Swinkels. 2008. Moral hazard with boundedpayments. J. Econom. Theory 143(1) 59–82.

Jin, L. 2002. CEO compensation, diversification, and incentives.J. Financial Econom. 66(1) 29–63.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.

Ju and Wan: Optimal Compensation and Pay-Performance SensitivityManagement Science, Articles in Advance, pp. 1–17, © 2011 INFORMS 17

Kadan, O., J. Swinkels. 2008. Stocks or options? Moral hazard, firmviability, and the design of compensation contracts. Rev. Finan-cial Stud. 21(1) 451–482.

Lambert, R., D. Larker. 1987. An analysis of the use of accountingand market measures of performance in executive compensa-tion contracts. J. Accounting Res. 25(Supplement) 85–125.

Lazear, E. 2000. Performance pay and productivity. Amer. Econom.Rev. 90(5) 1346–1361.

McConnell, J., H. Servaes. 1990. Additional evidence on equity own-ership and corporate value. J. Financial Econom. 27(2) 595–612.

Ou-Yang, H. 2003. Optimal contracts in a continuous-time dele-gated portfolio management problem. Rev. Financial Stud. 16(1)173–208.

Ou-Yang, H. 2005. An equilibrium model of asset pricing and moralhazard. Rev. Financial Stud. 18(4) 1253–1303.

Palia, D. 2001. The endogeneity of managerial compensation in firmvaluation: A solution. Rev. Financial Stud. 14(3) 735–764.

Prendergast, C. 2002. The tenuous trade-off between risk and incen-tives. J. Political Econom. 110(5) 1071–1102.

Sannikov, Y. 2008. A continuous-time version of the principal-agentproblem. Rev. Econom. Stud. 75(3) 957–984.

Schättler, H., J. Sung. 1993. The first-order approach to thecontinuous-time principal-agent problem with exponentialutility. J. Econom. Theory 61(2) 331–371.

Yermack, D. 1995. Do corporations award CEO stock options effec-tively? J. Financial Econom. 39(2) 237–270.

Copyright:

INFORMS

holdsco

pyrig

htto

this

Articlesin

Adv

ance

version,

which

ismad

eav

ailableto

subs

cribers.

The

filemay

notbe

posted

onan

yothe

rweb

site,includ

ing

the

author’s

site.Pleas

ese

ndan

yqu

estio

nsrega

rding

this

policyto

perm

ission

s@inform

s.org.