70427872 Westinghouse Ltv 27w7hd Ltv 32w6hd Ltv 37w2hd Lcd Tv Sm ET

ONESource - cofcu.org · Loan Loyalty Rewards equals 1.49% (your final APR). Equity loans require...

Transcript of ONESource - cofcu.org · Loan Loyalty Rewards equals 1.49% (your final APR). Equity loans require...

With spring just around the corner, it’s time to tackle that home improvement project you’ve been planning for months. Use the equity in your home with a low-rate Home Equity Loan or Line of Credit to pay for your home improvement project.

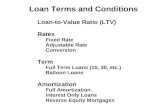

Borrow More, Do MoreOther lenders may offer the option to borrow up to only 70% or 80% of your home’s loan to value(LTV). At CommonWealth One, you can borrow up to 90% of your home’s LTV, so you have more cash on hand to accomplish your goals. You can also use the equity in your home to pay for college expenses, consolidate debt and more.

• Home Equity Loan Rates as low as 3.74% APR*

• Loan amounts up to $250,000• Fixed- and variable-rate options• Affordable monthly payments• Possible tax-deductible interest*

Zero Equity Home Equity LoanIf you have little to no equity available in your home, you can complete home improvement projects, pay for education expenses or consolidate debt with our Zero Equity Home Equity Loan.

• Loans up to $25,000• Terms up to 10 years• No title insurance or appraisal required• Fewer fees and less paperwork than conventional Home

Equity Loans

And, you can still enjoy the low interest rates and possible tax-deductible options of a Home Equity Loan.

Apply TodayVisit cofcu.org, call us at (703) 823-5211, or stop by a branch.

How Much Can You Borrow?You can borrow up to 90% of your home’s loan to value (LTV) with our Home Equity Loans.*

If your home’s market value is $300,000 and you owe $200,000 on your mortgage, 90% of your home’s value is $270,000. After deducting the amount you owe on your mortgage ($270,000 - 200,000), you can borrow up to $70,000.*APR=Annual Percentage Rate. Home Equity Loans are available on primary

residences located in Virginia, Maryland, and Washington, D.C. The 90% LTV does not apply to the Zero Equity Home Equity Loan. Please check with your tax advisor regarding loan interest deductibility. LTV=Loan to Value.

Fuel Your Savings with our 1.99% APR* Visa® Balance TransferWish you could blast your debt to another planet? Do the next best thing – take advantage of our special balance transfer offer and watch your savings take off!

• 1.99% APR* on a CommonWealth One Visa credit card for 12 months

• No balance transfer fees• Offer good until February 29!

Get the Best Offer in Town and SaveAs your credit union, we are looking out for your long-term financial well-being and advise you to read the fine print when it comes to other balance transfer offers that seem too good to be true.

When you transfer balances to a CommonWealth One Visa credit card, you get 1.99% APR* for 12 months from that transfer date with no balance transfer fee. After 12

months, you still save money when those balances are charged your normal low interest rate.

We will not charge you a 3-5% fee on your balances, nor will we skyrocket your interest rate to a higher interest rate if you make a late payment. To calculate how much you could save over the life of your balances, visit cofcu.org/loansaver.

Transfer Balances or Apply for a Commonwealth One Visa Credit Card Today Visit cofcu.org/transfer, call us at (703) 823-5211, or stop by a branch.

Four Ways to BorrowEquityFive 3.74% APR* (variable)

EquityLine 3.50% APR* (variable)

EquityPlus 3.74% APR* (fixed)

Zero Equity 7.15% APR* (variable)

We’ve Teamed Up with TurboTax® to Maximize Your Refund!

Savings of up to $15 on TurboTax federal products and a chance to win $25,000 in the TurboTax

Payday Sweepstakes!*

Learn more at cofcu.org/turbotax today.

*No purchase necessary to enter and win.

ONESource February 2016

SPRING FORWARDon home improvement projects

Home Equity Loan Rates as low as 3.74% APR*

Our Best Rate Promise... Puts the Brakes on High Auto Loan Rates!We offer the best auto loan rates in town – we promise! If you are pre-approved for an auto loan or have an auto loan from another lender, we promise to meet or beat that rate.* Here are our other advantages that make us the best place for borrowing:

• Financing up to 125% of value• GAP insurance for just $299• Loan terms up to 84 months• Rate Match Program• Loan Loyalty Rewards Program• Option to choose your own loan

payment due date• Skip a payment twice a year• Available protection options, including Paintless Dent Protection

and Tire & Wheel Protection

Save money on your next new or used auto purchase or refinance! We’ll make you happy you chose CommonWealth One – we promise.

Apply TodayVisit cofcu.org, call us at (703) 823-5211, or stop by a branch.

*Proof of written pre-approval documentation required.

Member Appreciation Day Our next Member Appreciation Day is right before Valentine’s Day – the perfect time to offer you our heartfelt thanks for your membership! Please join us for light refreshments at a branch on Thursday, February 11.

We Support America Saves WeekAmerica Saves Week is February 22-27, and we will be celebrating in branches to increase awareness of the importance of a savings plan. According to americasavesweek.org, people are twice as likely to spend less than their income and save the difference if they have a savings plan. We encourage you to take the America Saves Pledge, through which you identify:

• A savings goal (such as an emergency fund or retirement)• An amount to save per month• The number of months you will save that amount

Our team is here to help with a variety of high-yield savings options to meet your goals. Just give us a call at (703) 823-5211 or visit cofcu.org.

Cherry Blossom Run ReminderAs a sponsor and active volunteer for the annual Cherry Blossom 10 Mile Run, we invite you to join us on Sunday, April 3. We ask that participants donate $50 to the Children’s Miracle Network®. For an application and instructions, contact Susanne Waltemyer at (703) 236-7635 or [email protected]. Thank you for your support.

Featured R ates

For mortgage and other rates, visit cofcu.org.

*APR=Annual Percentage Rate.**Rates effective 2/1/16 and subject to change. Rates shown are fixed unless otherwise noted. Some rates quoted reflect a 0.50% reduction for Loan Loyalty Rewards. Example: 1.99% (current rate) less 0.50% Loan Loyalty Rewards equals 1.49% (your final APR). Equity loans require 90% LTV. LTV=Loan to Value. Refinanced funds cannot be used to pay off existing CommonWealth One loan balances. Variable credit card rate information: This APR will vary with the market based on the Prime Rate. Equal Opportunity Lender. For more information, please contact us.

Loan Rates APR* RangeNew Cars

Up to 36 months 1.49 - 10.99%

37 - 60 months 1.74 - 11.24%

61 - 72 months 2.24 - 11.74%

73 - 84 months 2.99 - 12.49%

Used Cars: 2011 models and newer

Up to 36 months 1.49 - 10.99%

37 - 60 months 1.74 - 11.24%

61 - 72 months 2.24 - 11.74%

73 - 84 months 2.99 - 12.49%

Used Cars: 2010 models and older

Up to 60 months 3.74 - 13.24%

61 - 72 months 4.24 - 13.74%

Home Equity Loans

Zero Equity Loan 7.15 - 18.00%

EquityPlus (up to 60 months) 3.74 - 8.74%

EquityFive (variable) 3.74 - 8.74%

EquityLine (variable) 3.50 - 8.50%

OneLine of Credit (variable) 8.00 - 12.50%

Personal Loans (up to 60 months) 7.90 - 16.40%

Visa Signature Rewards 9.99 - 18.00%

Visa Platinum Rewards 8.99 - 16.99%

Visa Platinum 7.99 - 15.99%

Federally Insured by NCUA

P.O. Box 9997 • Alexandria, VA 22304-0797cofcu.org • facebook.com/cofcuRouting number: 256078365

(703) 823-5211 • (800) 424-3334Text Banking Short Code: 59289

PhoneOne 24/7 Account Information:(703) 823-3510 • (800) 424-2328

Visa® 24-Hour Info, Lost or Stolen Card:Credit Card: (800) 449-7728Debit Card: (800) 472-3272

Nationwide Shared Branches:(888) SITE-CO-OP • co-opsharedbranch.org

Nationwide Allpoint™ No-Fee ATMs:allpointnetwork.com

Scholarship Applications Due March 31!

Visit cofcu.org/scholarships

PLANT THE SEED FOR A SPRING MOVE!

Apply for a mortgage at CommonWealth One today.Visit cofcu.org/mortgage.

Thank You for Teaming Up and Winning with Us!Our Team Up and Win football season was a hit! We’re glad to have all of you on our CommonWealth One team. Stay tuned for new promotions – there are more membership rewards to come!