Oakville MIC

-

Upload

jay-gabrani -

Category

Real Estate

-

view

126 -

download

0

Transcript of Oakville MIC

In this presentation, you will

learn:

1. 3 threats to your search for yield

2. 3 vital questions you must ask your financial

planner to see if your portfolio is prepped for 2017-

2020

3. How to use private mortgage lending to create

income...and secure your capital

You Have A Tremendous

Responsibility

Your family relies on you to make good

decisions with your investable capital.

“You want to earn Yield.”

However…

You Have A Tremendous

Responsibility

Economic uncertainty is all around us.

Yields are our all- time lows

What are you supposed to do with your idle

and non- performing equity?

My Promise...

I promise to show you how Private Mortgage

Lending can help you protect your wealth and

create a passive income stream.

It's a bold promise... stay with me and I'll show

you how

Why this Presentation?

• There are overwhelming amounts of information to consume, lots of Yield-focused investment choices to consider but you are busier than ever

• I want to simplify it all for you

A bit about me…

About Me …

• Born on December 28, 1971 in Toronto,

Ontario• First 16 yrs of life were uneventful and normal

• Liked sports

• Got along with everybody

• Did well in school

About Me …

The Trip That Changed My Life

• Visited my father’s family in India in 1987• Exposed to family business

• Grandfather told him “if you ever want to be free, do

your own business”

I came back from that trip and I told my parents:

“I’ll never work for anyone after I’m 25”

About Me …Price Waterhouse Pen Set - My going away gift

Eager to get started on my entrepreneurial

ventures, the last day of my accounting career was

Dec. 27, 1996, the day before my 25th birthday

About Me …From Accounting to Franchise Cafe

Jay’s first business (1998-2011). $1M+ annual sales, 30+ employees who regularly served 5000 people per week… It’s where Jay “cut his teeth”

About Me …Jay’s $50,000 Aqua Lounge watch

Aqua Lounge had a tremendous financial beginning and bad ending… Jay lost money, learned lots of lessons, AND…

About Me …My Children (Silver Linings 2, 3 & 4)

Jaiden Sereena Angellica

Aug. 2005 Feb. 2007 Sept. 2009

About Me …

How Do I Take Care of These Kids?

• Read over 150 business / real estate books

• Started investing in Real Estate in 2007 in

Edmonton Alberta… I bought right at the top

of the market and then the credit crisis hit.

• Focused switched to Oakville Real Estate in

2009-2010 (Acres of Diamonds)

Oakville Real Estate Venture

What That Lead To?

• Purchased multiple properties in targeted

area worth almost $1.9 million

• These properties have more than doubled

in price

• Best financial decision I ever made

What I Want For YOU…

• Clarity

• Certainty during uncertain economic times

• A Simple, Time Efficient Choice

…So you can protect your wealth and create

a passive income.

Three Threats for your Search

of Yield

1. Central bank manipulation around the

world

2. Super expensive asset prices which lead

to low yields

3. Negative interest rate policy where banks

and government bonds are going to charge

you to hold your money

Biggest Threats To Your

Investable Capital

• In Canada• Oil prices

• Government Deficits

• Weak Dollar

• Worldwide• Debt issues… Debt Cycle was not allowed to clear

during credit crisis.

• Other Brexit-type event.

• Money Printing

• Political Instability (TRUMP anyone?)

• Terrorism

The Most Devastating

Day Of My LifeWhy Am I Telling You This?

I value genuineness… all people go through tough times in life… it is what shapes our futures…I appreciate being real with people and when they are real with me

If someone you love is suffering from depression and or addictions, PLEASE HELP THEM

I was unable to help Ella… it is the biggest regret of my life

The Bottom line for YOU

It’s difficult to make

intelligent investment decisions

which will protect

your wealth and create a passive

income stream.

The Bottom line for YOU

The Unspoken Threat:

• Lack of Time: Everyone has become so

much “busier”

• Lack of Knowledge: Overwhelming amounts

of information

Possible Solution: Let someone else handle

it… a Financial Planner?

The Bottom line for YOU

The Financial Planner Option (ASK…)

1. How much exposure do I have to high-yield junk bonds

noninvestment grade?

2. What has performance been of my portfolio for the last five

years before fees and after fees

3. Do I have any bond or-year-old products which will be hurt

by negative interest-rate policy?

Here is an Alternative

Would You Like An Alternative Which:

• Earns passive income

•Protects your principal via Canadian real

estate

•Performs independent of stock

market/mutual funds

But first, how did I find it?

A Real-Life Example: 408 Seabourne Drive

Purchased in 2011 for $410,000 (25% DP = 100 - 500 and 75% LTV 1st mortgage for $307,500)Valued in 2015 for $630,000 (only debt was 1st mortgage fro approximately $280,000)

Refinance Options:

• The Bank• Denied loan

• Partner/Owner’s income did not increase in proportion

to property value

• The Mortgage Broker• 2nd Mortgage

• Additional Fees

• Higher Interest Rate

•Opened Jay’s eyes to mortgage lending

instead of borrowing to own real estate

Private Mortgage Lending:

Why Now?

• Economic uncertainty across the world

threatens ability to earn Yield from your

assets

• Private mortgage lending operates outside of

financial advisors and the stock market

• Security for mortgage increases with rising

real estate prices

Mortgage Lending: Risks

1. Counter party risk• 1 lender and 1 borrower

• if you were investing $100K in mortgages, would you

want it invested evenly in 10 mortgages or just 1?

Risk Mitigation:

• spread risk amount out among many different

mortgages

Mortgage Lending: Risks

2. Borrower's financial capacity • If something happens to the borrower then lender's

risk is magnified

• Life happens (job loss, family issue, health issue)

• Very tough to control

Risk Mitigation:

• Get security (ties into point 3)

Private Mortgage Lending:

Risks

3. Value of real estate• if the value of the house you have lent on goes down

the value of your mortgage principal is at risk

Risk Mitigation:

• get certified appraisal report

• invest in an area with solid real estate

economic fundamentals so house values stay

strong

Private Mortgage Lending:

Benefits• Healthy returns (borrowers willing to pay more

can’t access traditional financing , 8%-12%)

• Principal is secured with hard asset and recourse rights

• No cost to lend money – the borrower pays any mortgage related legal and setup cost

• Versatile (cash/ idle equity / registered funds OK)

• Easy to understand

Private Mortgage Lending: How

can I?

JAY, I like the idea of private mortgage

lending to preserve and grow my investable

capital, but:

• I don’t have time / knowledge to do this

• I wouldn’t know where to begin

• What can I do?

What Is a MIC?

• A pool of private money invested in a pool of mortgages (eliminates counter party risk)

• Generates stable and predictable cash flows for its investors… mic pays no taxes... All net income must be returned to investors

• Zero repairs, tenants issues and no ongoing management hassles

• Fully secured by real estate

• Legal and understandable structure

What Is a MIC?

MIC Types:

• Big MIC • Public, open to anyone

• Small MIC • can have 49 investors maximum

• Not open to public

I will be introducing you to the small MIC

What Is a MIC? • Want to preserve and grow wealth

• Investors receive preferred shares of

the mic

• $1 invested = 1 share

• Earn quarterly income (called

dividends)

• Want to borrow money and use their

real estate as collateral

• MIC lends them money... Collects

interest / fees

• They are willing to pay higher rates of

interest

• This is Jay

• Coordinates and manages

relationships with 49 investors,

Mortgage brokers, real estate

professionals and borrowers

• Oversees mortgage

administration and legal paper

work

• Earns fees

• Not applicable in early stages of MIC

• Bank only wants to provide more

money for MIC to lend after 1-2 yrs. of

positive performance

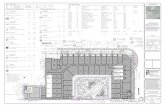

MIC

Structure

Great

Lending Area

Investment

Success

Great Lending Area Criteria:

• Area has experienced significant equity growth (lots of security)

• Average income of the area is high

• Highly desirable, in demand area which will maintain asset values regardless of economic uncertainty

• Extensive knowledge of area, people and properties

Why Oakville?

Gentrification

50 – 70 yr. old homes being torn down and replaced with brand new custom homes

Why Oakville?

Big lot sizes

• Oakville lots come with 50’, 60’, 70’ ft.

frontages

• Area maintains asset values

• Prices are sticky downwards

Why Oakville?

Risk of a Correction?Oakville is highly desirable

• 85% residential and 15% commercial

• People move here because they want to live here

• Not dependent on any single employer / industry

• The number of properties is finite

• Gentrification only going to continue (10 – 15 years)

Lots of money has been printed and distributed… it

needs a home

• Smart money will always be ready to buy

Tough to have a major correction in this geographical

area

The MIC Strategy

• “Open for business” Early June 2016

• Secure Funding from 49 investors max

• Securely lend this money out as 1st and 2nd mortgages to Oakville borrowers and experienced builders

• Oversee the mortgage underwriting and administration process

• Regulatory Compliance requirements to ensure rules to maintain tax exempt MIC status are being met• OSC Regulations • CRA Regulations

The MIC Strategy

Why Invest?

Who else do you know that combines:• Extensive business experience

• Financial /accounting background

• Real life real estate investor (arranged many mortgages)

• Strong Communication skills

• Extensive network of Oakville contacts

• Along with being the MIC manager, my family and I are investing alongside you.• Total invested amount: Min $200k

Investor FAQs

1. Can investors use RRSP, TFSA, RESP’s

to invest in a mic?

➢ Yes to all

2. What will investors returns be?

➢ single high digits/yr ….with collateral

3. Limit to number of investors?

➢ Min 20 max 49

Investor FAQs4. Who can invest? ➢2 degrees of separation: ➢Friends, family and colleagues of Jay Gabrani ➢Plus their friends, family and colleagues

➢or Accredited Investors

5. Is there a min investment? ➢Yes, $150k (due to maximum of 49 investors)

6. Is there a minimum investment timeline?➢I would ask for at least 2 years….no redemption

fees then… secondary mortgages are placed 1-3 years

Investor FAQs

7. How does the mic access registered funds?

➢Mic uses a trustee called Olympia Trust

➢Investors will open an account with Olympia and move their registered funds there (usually 2-6 weeks for processing and transfer)

➢Olympia will send funds to the mic

8. Do i need an Olympia account if I am investing cash / idle equity?

➢no Olympia trust necessary… investment funds sent directly to mic

Investor FAQs

9. Can I combine my different registered

funds to meet $150k minimum investment?

➢yes, just requires an extra Olympia Trust form

10. Can spouses combine registered funds to

meet $150k minimum investment?

➢Yes

Other Questions

• How does the MIC Manager make money?

• Management / admin / Mrktg fees (3% of assets)

• High because of 49 investors max

• Includes staff and overhead costs

• Marketing fees included (to get borrowers)

• Performance fees (only if returns >6%)

• Finder fee (up to 2%... In certain cases only)

All net income must be returned to investors annually

What Jay Takes Care of

• What if a borrower can’t pay?

• Golden lending rule: loan it/own it

• Mortgage secured by real estate

• Six month legal exercise to get money back

• All missed payments and fees are added on

• Jay oversees the lawyer who does this

Other Questions

• How is the MIC tracked?

• Regulated by the Ontario Securities Commission

(OSC knows MIC investors at all times)

• Investors receive independently audited financial

statements on an annual basis

Other Questions

• What if a borrower can’t pay?

• Golden lending rule: loan it/own it

• Mortgage secured by real estate

• Six month legal exercise to get money back

• All missed payments and fees are added on

• Jay oversees the lawyer who does this

I’m Interested …!

• What should I do?

•Please click on green button

•A new tab will open where you can request your

Investor Interest Letter

•Enter your Name and Email … and Submit!!

•Shortly, you will receive an email with your Investor

Interest Letter

Investor Interest Letter

• 2 page document which gives Jay an idea of your investment objectives, risk tolerance and timelines

• This is ONLY an expression of interest and NOT an obligation for you or the Oakville MIC

• Fill out form and send back to Jay

•Documents can be filled out online using Docusign (eliminate printing and scanning)

You Will Sign

•Oakville MIC Investor Interest Letter

• Oakville MIC Subscription Agreement

• Oakville MIC Offering Memorandum

•Relevant Olympia Trust Forms (for registered funds only)

Please Act Quickly

LIMITED AVAILABILITY

• 49 Investors Maximum

•Or Friday December 31st, 2016

•Whatever comes first

Still Have Questions?

Feel free to contact Jay with any questions,

comments or concerns

Phone / Text (preferred) : 416-989-5387

Email: [email protected]

Look forward to helping you “Protect your

wealth and create passive income”

Lending Criteria: Overview

• A gap exists between what Oakville property owners

need and what conventional lenders will provide

……..The Oakville MIC looks to fill that gap

Loan Programs

•Term Mortgages

•1st and 2nd

•Residential Construction (based on progress draws)

Eligible Properties

•We specialize in providing residential mortgages in

Oakville

•No commercial or industrial properties will be

considered

Loan Guidelines

•Min / max loan amount

•25k - 500k

•Min / max term

•1 month to 3 years

•Amortization

• flexible

• interest only

• Rate

•varies depending on circumstances

•Payment frequency

•monthly