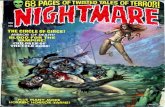

Non Performing Assets: Bankers' Nightmare

-

Upload

rajesh-mudholkar -

Category

Economy & Finance

-

view

288 -

download

3

description

Transcript of Non Performing Assets: Bankers' Nightmare

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Reserve Bank of India - Financial Stability Report

Dec 2013http://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=725

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Gross Non Performing Assets – ` 2.29 lakh crore vs.

` 1.67 lakh crore, year ago

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Recast loans at all-time high `4

lakh crore (10.2% of advances) as of

Sep 2013

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Discussion Paper on Early Recognition of Financial

Distress, Prompt Steps for Resolution and Fair Recovery for Lenders: Framework for

Revitalising Distressed Assets in the Economy

http://rbi.org.in/Scripts/PublicationReportDetails.aspx?ID=715

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

• Increase in NPAs and restructured accounts during recent years due to slowdown of the economy.

• Financially distressed assets also deteriorate quickly in value.

• Need to recognize financial distress early, take prompt steps to resolve it, and ensure fair recovery for lenders and investors, or sale of unviable accounts.

• Equal need for proper credit discipline among lenders. That is, however, not the focus of this Paper.

.....says

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Do Lenders Have the Right Tools to Assess Risk Before Lending ?

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Do Borrowers Have the Right Tools to

Manage Risk?

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Rational Rational InvestorInvestor

Corporate Corporate FinanceFinanceVs.

Chronic conflictChronic conflict = = Financial CrisisFinancial Crisis

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Financial Planning Standards Board Ltd

Certified Financial Planner Board of

StandardsFinancial planning professionals help

investors make rational investment decisions,

promote long term investment planning

aligned with defined goals.

Highest Global

Standard

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Rational investors follow & expect long term equity

returns linked to business performance, not

speculative short term price

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

“ The riskiness of an investment is not is not measured by betameasured by beta but rather by the reasoned

probability of that investment causing its owner a loss of purchasing power over his

contemplated holding periodcontemplated holding period.”

Warren E. Buffett, Chairman, in a letter to Shareholders of Berkshire Hathaway, February 25, 2012

Long term planning Long term planning makes short term makes short term volatility irrelevantvolatility irrelevant

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Berkshire Hathaway

Dow Jones Index

Jan,1990 to Feb,2014

The Result

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

“the opportunity cost of capital depends depends on the project’s betaon the project’s beta.. ...SiemensSiemens, a German industrial giant, uses 16 uses 16

different discount ratesdifferent discount rates, depending on the riskiness of each line of its

business.”Fundamentals of Corporate Finance, 3rd edition, ISBN 0-07-

553109-7, Richard A. Brealey, Stewart C. Myers, Alan J. Marcus, Stephen A. Ross, Randolph W. Westerfield, Bradford

D. Jordan, pages 421-423.

What Corporate What Corporate Finance PrescribesFinance Prescribes

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Feb,2004 to Feb,2014

The Result

Siemens

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Neither the ‘short-term’ nor ‘beta’ are relevant for ‘opportunity cost’‘opportunity cost’ of

equity

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Corporate financial practice conflicts with

rational investor expectations, breeds

‘Financial Crisis’‘Financial Crisis’such as 2008such as 2008

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

“....we do not yet havedo not yet have complete and generally

accepted explanations for how financial marketsfinancial markets

function......Mispricing of assets may contribute to financial financial

crisescrises”- 2013 Nobel Economic Sciences

Prize Committee

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

Raises questions, ‘Financial Economics’

never asked

Answers those, ‘Financial

Economics’ never could

To prevent ‘FINANCIAL CRISIS’, and transform To prevent ‘FINANCIAL CRISIS’, and transform ‘Financial Management’ from a ‘Cultivated Art’ ‘Financial Management’ from a ‘Cultivated Art’

into a truly ‘Objective Science’ into a truly ‘Objective Science’

Copyright 2014- Rajesh D. Mudholkar, Author 'The Timeless Essence of Financial Science', http://valueerodingfallacies.blogspot.in

http://valueerodingfallacies.blogspot.in