NEWS BRIEF 24 - Asteco Property Management · 2017-06-11 · experiences for both JLL and Effat...

Transcript of NEWS BRIEF 24 - Asteco Property Management · 2017-06-11 · experiences for both JLL and Effat...

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library IN THE MIDDLE EAST FOR OVER 30 YEARS

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

RESEARCH DEPARTMENT

NEWS BRIEF 24 SUNDAY, 11 JUNE 2017

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR 30 YEARS

Page 2

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

REAL ESTATE NEWS UAE/ GCC

NEW DEAL AIMS TO GET MORE SAUDI WOMEN INTO REAL ESTATE

REAL ESTATE DATA: THE BEDROCK OF PROGRESS

NEW POLICY TO BOOST NRI ACTIVITY IN INDIAN REALTY

EX-DAMAC PROPERTIES CHIEF JOINS SAUDI DEVELOPER

CLOSURE OF PORTS AND ROAD LINKS COULD HAVE AN IMPACT ON QATAR’S

CONTRACTING MARKET

REGIONAL SOVEREIGN WEALTH FUNDS LOOK TO INVEST IN REAL ESTATE FOR

LIQUIDITY

EMAAR PROPERTIES PLANS IPO FOR UAE REAL ESTATE DEVELOPMENT BUSINESS

EGYPT INVESTMENT MINISTER TO SUBMIT DRAFT INVESTMENT REGULATIONS TO

GOVERNMENT WITHIN A MONTH

DUBAI

MUNICIPALITY MEETS WITH REAL ESTATE DEVELOPERS IN DUBAI

DUBAI LAND DEPARTMENT STREAMLINES BROKERAGE ACTIVITY

DUBAI MUNICIPALITY KICKS OFF DH30M AL KHAIL ROAD BEAUTIFICATION

PROJECT

A CHANGING LANDSCAPE: RESIDENTIAL DEVELOPMENT IN DUBAI

DUBAI REAL ESTATE’S INDIA CONNECTION

CONTRACTOR CONFIRMED FOR ALANDALUS TOWN HOUSES

DUBAI WASL LAUNCHES BUILDING CLUSTER FOR HOTEL STAFF

REAL ESTATE LITIGATION AND ARBITRATION

SOFITEL TO OPEN ITS LARGEST HOTEL IN MIDDLE EAST

SOBHA GROUP LAUNCHES MORE APARTMENTS IN HARTLAND

VINCITORE LAUNCHES NEW DUBAI RESIDENTIAL, RETAIL PROJECT

BIG IS BEAUTIFUL WITH THIS DH22.5 MILLION DUBAI MARINA PENTHOUSE

DEVELOPER WASL UNVEILS PLAN TO REVAMP OLDER PART OF DUBAI

UAE'S AZIZI HIRES BUILDER FOR NEW DUBAI RESIDENTIAL PROJECT

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 3

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

REAL ESTATE NEWS

ABU DHABI

MAJESTIC PRINCESS CAPS ABU DHABI’S LONGEST CRUISE SEASON

MARYAH PLAZA ON TRACK FOR COMPLETION BY THE END OF 2018

ABU DHABI EYES MORE TOURISTS FROM RUSSIA, CHINA

NORTHERN EMIRATES

UAE HUB OF GLOBAL INNOVATIVE ECONOMY

INTERNATIONAL

LONDON’S SIGNATURE OFFICE TOWERS HOLD THEIR VALUE

DIVORCES ADD TO HONG KONG’S PROPERTY WOES

UK REALTY COULD TAKE A TIMEOUT COME THE ELECTION

AUSTRALIA ECONOMY SLOWS BUT MARKS RECORD 26 YEARS RECESSION-FREE

HOW TO PROFIT BY INVESTING IN RESIDENTIAL PROPERTY

LONDON PROPERTY MARKET FACES MORE HEADWINDS AFTER ELECTION

9 MILLION HOMEOWNERS IN REGAIN POSITIVE EQUITY SINCE HOUSING CRISIS IN

U.S.

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 4

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

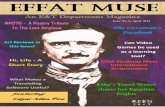

NEW DEAL AIMS TO GET MORE SAUDI

WOMEN INTO REAL ESTATE Saturday, June 10, 2017

JLL, the golbal real estate investment and advisory firm, and Effat University, a private non-profit institution of

higher education for women in Saudi Arabia, have signed an agreement that encourages students into the

property sector.

The memorandum of understanding is a collaboration that aims to increase the participation of female students

in real estate through internships at JLL’s offices in Saudi Arabia.

As part of the agreement, JLL will also deliver presentations at the University to educate and provide knowledge

on the sector in Saudi Arabia.

The MoU was signed in Jeddah between Jamil Ghaznawi, country head of JLL KSA, and Dr Haifa Jamal AlLail,

president of Effat University.

“Real estate offers a diverse and dynamic career path, and this new partnership provides unique opportunities for

us to engage and hopefully attract new talent into our fast-moving industry,” said Ghaznawi.

“We are excited by the partnership and are looking forward to collaborating with Effat University to not only

introduce our industry to the students but also share real-life insights into real estate.”

The MoU includes seminars, lectures, forums, meetings, training and conferences to ensure the benefit of

experiences for both JLL and Effat University.

The University, founded in 1999, operates under the umbrella of King Faisal Charitable Foundation and has four

colleges, 13 undergraduate programs and three graduate programs.

Allail said: “This collaboration will open doors for our students and give them the practical training to be exposed

to real work experiences which is a key factor for their future careers."

Source: Arabian Business

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 5

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

REAL ESTATE DATA: THE BEDROCK OF

PROGRESS Wednesday, June 07, 2017

While great strides have been made in the development and implementation of a legal and regulatory framework

in Dubai’s real estate industry, there remains one area where the industry seems to be lagging the rest of the

world. That area is data availability and transparency.

There are several reasons why data availability and transparency are important to the efficient and effective

operation of any industry and why they can foster development and growth. Here are some of them.

Build trust within the industry: Making more information publicly available will empower all the different

stakeholders and participants in the industry to the extent where a bedrock of trust is developed simply because

the data underlying assumptions, assertions, opinions and points of view is available, accessible, analysable and

can be utilised to build trust between parties.

Generate ideas: The availability and subsequent analysis and modelling of data underpins the generation of new

ideas. An online forum encourages residents to participate by providing alternative ideas. It also helps find new

ways in which communities interact with their governments online.

Risk assessment: We operate within an industry whereby decisions can involve huge capital outlays and where

there may be multiyear lags in returns on billions of dirhams of capital employed. In addition, every day, there are

hundreds of decisions made, which are not of the same value. Average people typically make the biggest decision

of their life when buying property and without data from reliable third-party sources, the perceived risk and

resulting nervousness around a transaction can be debilitating.

Increase community engagement: Once data is available and properly communicated, the number of people

becoming engaged or interested in the industry will multiply significantly. News, data and analysis will drive

dialogue among a broader spectrum of the community so that the discussions are not only limited to those who

are operating within the industry, but with the broader community as well

Develop a better understanding of industry participants’ needs: Effective gathering, organising, analysing and

dissemination of data will give the developer a far greater and deeper understanding of what the various

participants and stakeholder’s needs. Once these needs are identified, ideas and initiatives can be generated to

ensure that the industry is providing its constituents the benefits that they desire, on an equitable basis.

Empower citizens: When local governments are transparent, levels of trust increase. When the trust level is high,

citizens begin to feel empowered to take responsibility.

Measure performance: There is no doubt that proper performance measurement is dependent upon the

availability of good data. The market today is far too cluttered with articles, opinions and predictions that are not

based on a sound bedrock of relevant, up-to-date and analysable data. To be able to accurately measure industry

performance and to be able to drill down to a granular level of detail to analyse why the industry is performing as

it is, what the industry is being affected by, where the industry is strongest or weakest and who is most positively

or negatively affected is critical in assessing the industry’s overall health.

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 6

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

Attract people to the industry: There is no doubt that, as data availability improves, more people will be attracted

to the industry as the need for better and more frequent analysis is required. As this intellectual base develops,

the industry will build a repository of knowledge that will only serve to enable the industry to operate more

effectively and efficiently over time.

Boost the overall economy: There is no doubt that a robust, efficient and developing real estate and construction

industry is a boon to any economy. Better data facilitates better planning for government expenditures in

infrastructure and technology, better resource management, more effective innovation and, ultimately, greater

contribution of the industry to overall economic development and growth.

Foster greater cooperation between the public and private sectors: The more effective the communication,

cooperation, priority setting and shared planning between the public and private sectors, the better the solutions

will be for the community and economy overall. Excellence can be attained through synchronisation of objectives,

and objectives can only be formulated after proper data analysis and goal setting. The key to success is a shared

understanding of the vision and the role each industry participant has in ensuring its achievement.

Educate the world: We all preach about global best practice but how can it be properly applied without the

understanding that blooms from proper data analysis. And why not have the vision where similar industries in

other countries around the world are looking towards Dubai as the centre of the world’s best practice? It’s

possible, but it all starts with having up-to-date, relevant, accessible and analysable data. It’s difficult to excel

without it.

Source: Emirates 24/7

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 7

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

NEW POLICY TO BOOST NRI ACTIVITY IN

INDIAN REALTY Wednesday, June 07, 2017

Several key policy changes in India’s property regulatory system have helped increase the confidence of non-

resident Indians (NRIs) in the country’s real estate market. As of result of these changes, the market now offers

buyers improved security on their investments with tighter regulations and greater transparency. NRIs have

always preferred to invest in Indian realty. In fact, NRI investments are expected to almost double by the end of

the year compared to 2013, when it stood at $6 billion (Dh22.03 billion), according to Ashwinder Raj Singh, CEO of

JLL Residential (JLLR). Last year, the total NRI investments in primary sales residential real estate reached

approximately $9.6 billion, Singh says. This year, the figure is expected to touch around $11.5 billion, which would

be 20 per cent of the total market estimated at $60 billion. Out of this, 20 per cent of NRI investment come from

the UAE.

“The new residential launches in the eight major Indian cities have dipped by 19 per cent in the first quarter of

2017, post demonetization,” says Singh. “Builders are more focused on clearing existing inventory, which has

resulted in unsold inventory reducing slightly by 3.12 per cent in the first quarter this year compared with the

fourth quarter of last year. This is definitely a positive development. With some liquidity coming into the system,

new investments will be made in the affordable housing sector, where the maximum demand lies, and can result

in positive growth.”

Singh says buyers are active in the primary market, supported by financing. “A lot of enquiries are taking place,”

he says. “Home loan rates have reduced and buyers are offered exciting schemes, including discounts, parking,

club facilities, etc., as well as financing deals by the builders.”

Singh says this indicates that the residential market will start growing faster by the end of the year. “Market

activity is picking up and even the secondary market will show signs of recovery in the foreseeable future.”

RERA

Among the key initiatives, the Real Estate Regulation Act (Rera), which was implemented last month, brings clarity

and fair practices in the property segment, protecting the interest of all it stakeholders. “Rera is a shot in the arm

for NRIs as it will bring in transparency in all residential property deals and ensure timely delivery of projects,”

says Singh. “NRIs will now have regulatory support in case of disputes and a working mechanism to ensure they’re

not exploited by fly-by-night operators.”

However, Singh says NRIs need to be aware of the rules implemented by the local governments. “There might be

some changes while executing Rera at state level,” says Singh. “Also, they need to study the background of the

builder and the project’s progress report and verify it with the updated information on the Rera website.”

R. Srividya, general manager of corporate sales and brand engagement of the Indian Property Show, Sumansa

Exhibitions, believes that Rera will ease the apprehension of investors. “The legislation’s objective is to protect the

right of the consumers and bring forth transparency in the real estate sector by making the developers

accountable for every penny invested by the consumer,” explains Srividya. “The central government has given

stern deadlines for the implementation of the Act.”

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 8

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

Under the Act, if a developer commits an infraction, the aggrieved party is entitled to relief. “It is even directed

that the parties have the right to cancel their booking in case of any legitimate deficiency on the part of the

developer and the investment shall be refunded.”

Other boosters

Singh says the other important policy initiatives announced by the government include the Real Estate Investment

Trust, Smart Cities, Amrut, the Goods and Services Tax (GST), demonetization and affordable housing being given

infrastructure status. “GST will be implemented by July 1 and work on smart cities has begun,” says Singh. “The

positive impact of demonetization will become more visible in the coming months, and all these factors combined

will continue towards a significantly improved growth graph for the real estate sector.”

Demonetization impact

Srividya says that demonetization affected housing supply and demand in the fourth quarter last year, wherein

the developers held back registration of many projects. However, this was short-lived, says Srividya.

“Housing sales and new launches shot up by 70 per cent in the first three months of the year compared with the

previous quarter,” she says. “The new launches stood at 30,000 units, and the housing sales also jumped to

23,000 units in the first quarter from just about 14,000 in the previous quarter. However, the secondary sector will

encounter certain hindrance due to the massive cash transaction involved, whereas new projects remain

unaffected as all the transaction is facelifted by bank loan and is accountable.”

Although concerns about a slowdown in demand and high debt levels of the real estate developers largely remain

unaddressed, Srividya says the Union Budget had enough stimulants to turn around the sector.

“With affordable housing now gaining infrastructure status, developers will have access to cheaper funds from big

institutions such as insurance companies and pension funds,” she says. “All these measures would improve

liquidity, improve margins and increase the supply of this capital-intensive sector.”

Buyer trend

Srividya says NRIs for long have shown constant interest towards cities such as Mumbai, Bangalore, Delhi,

Chennai. However, tier-two cities are picking up pace and cities such as Pune, Goa, Cochin, Ahmedabad,

Coimbatore, Jaipur, Chandigarh and are drawing attention.

Ajay Nahar, managing director of luxury developer Nahar Group, Mumbai says NRIs are exposed to global

lifestyles, which is giving rise to very high housing aspirations.

“The last couple of years have witnessed a marked increase in NRI investment in the Mumbai residential market,”

says Nahar. “From a contribution of 25 per cent, the NRI segment today comprises almost 35-40 per cent of any

developer’s portfolio.”

Devang Verma, director of Mumbai-based Omkar Group, believes India’s real estate industry is witnessing a

positive shift with the new regulatory framework. “The power a buyer has went up by a few notches and this

positive sentiment is going to continue for some time,” says Verma.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 9

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

EX-DAMAC PROPERTIES CHIEF JOINS SAUDI

DEVELOPER Monday, June 05, 2017

Ziad Al Chaar, the former Damac Properties’ managing director, is assuming the role of chief executive officer at

Saudi Arabia’s largest listed real estate developer — Dar Al Arkan. The move was confirmed via a statement the

latter issued to Tadawul, the Saudi stock market authority, on Sunday.

It was last month that Al Chaar’s resignation from Damac was confirmed, setting off some active speculation as to

where he might go next. Names of prominent Saudi developers were mentioned in this regard, while the more

extreme ones had him even taking on a role at The Trump Organisation.

But informed market sources quickly set to rest such speculation, saying that a CEO’s position had opened up at

Dar Al Arkan, where on May 15 it was announced that the incumbent CEO — Dr Abdul Rehman Hamad Al Harkan

— was stepping down (effective from June 1). His tenure lasted five years. The Saudi developer has a fairly

sizeable portfolio of existing and completed projects, principally in the residential space. But it has also extended

into retail in a big way, most notably by helming the Al Qasr Mall, which opened in Riyadh in June of 2012.

Expansion

At Damac, Al Chaar scripted a close working relationship with the Group founder and Chairman, Hussain Sajwani.

During this period, the Dubai developer set a hot pace in terms of off-plan launches and also moving

simultaneously to expand its interests in hospitality and serviced apartment’s space. There were also golf course

related alliances with The Trump Organisation and Tiger Woods. The period also saw high-rise projects in Saudi

Arabia.

Dar Al Arkan had earlier this year closed of the fourth tranche of a dollar-denominated sukuk programme, raising

1.87 billion Saudi riyals (Dh1.83 billion, $500 million). The order book for the sukuk had opened on April 4. With a

five-year tenor, it matures on April 10, 2022 at a profit rate of 6.875 per cent per annum. “The issuance received

significant interest from international market participants with the order book close to 4 billion Saudi riyals [$1.05

billion],” the developer said in a statement.

The proceeds will be used for its roster of projects in the kingdom. There is also talk that the developer will be

aiming for openings in other Gulf markets, including in Dubai.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 10

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

EGYPT INVESTMENT MINISTER TO SUBMIT

DRAFT INVESTMENT REGULATIONS TO

GOVERNMENT WITHIN A MONTH Thursday, June 08, 2017

Egypt’s ministry of investment will submit draft regulations for a newly passed investment law to the cabinet

within a month, investment minister Sahar Nasr said in a statement on Thursday.

Egyptian President Abdul Fattah Al Sissi signed into law last week long-delayed legislation aimed at easing doing

business and creating incentives to lure back investors after years of turmoil.

The new law is expected to boost badly needed investment by cutting down bureaucracy, especially for starting

new projects, and providing more incentives to investors looking to put money into Egypt.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 11

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

MUNICIPALITY MEETS WITH REAL ESTATE

DEVELOPERS IN DUBAI Thursday, June 08, 2017

Dubai Municipality’s Planning Department recently organised a meeting with real estate developers in the emirate

to discuss procedural improvements in the service of reviewing and approval of major urban projects.

The meeting was organised based on the principle of participation of customers and effective communication

with them regarding procedures to be introduced and to take their views and feedback in order to reach optimal

solutions that achieve the goals of both the parties and contribute to the improvement and development of the

service.

The meeting was also part of the department’s keenness to realise the municipality’s vision of “Building a Happy

and Sustainable City” by achieving its strategic objective of “Sustainable Urban Planning for the Future Dubai” and

establishing its values of participation and happiness through effective communication with real estate

developers in Dubai, who contribute to the city’s growth and development.

The meeting, chaired by Najeeb Mohammad Saleh, Director of Planning Department at Dubai Municipality, was

attended by heads of sections, project coordinators, specialists and planners of the department. The developers

were represented by project officials from Emaar Properties, Dubai Holding, Meraas Real Estate, Meydan, Dubai

Investments and Wasl Properties.

The meeting discussed the requirements of the service to review and approve the major urban projects and the

possibility of adding some requirements that contribute to accelerate the completion of the final stages of the

approvals for these projects and shorten the stages of execution through the creation of layers of accurate

geographical planning data on a permanent basis, which will be linked to smart systems to simplify the stages of

issuing building permits.

The meeting was positive as the developers interacted with the proposals of the Planning Department in addition

to giving suggestions of improvement and development from their perspective as developers in terms of the

mechanism of procedures related to the approval of major urban projects and their relationship with all

concerned bodies.

The Planning Department will study all the proposals that were submitted by developers and will take them into

account to be answered as soon as possible after coordination with the concerned parties from other

government agencies.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 12

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

CLOSURE OF PORTS AND ROAD LINKS

COULD HAVE AN IMPACT ON QATAR’S

CONTRACTING MARKET Monday, June 05, 2017

The restriction on the use of airports, ports and roads in neighbouring countries could present a major challenge

for Qatar’s construction industry affecting the timeline of its preparations for the 2022 Fifa World Cup.

Yesterday, the UAE, Saudi Arabia, Bahrain and Egypt broke diplomatic ties with Qatar and cut off air, sea and land

access to the country over Doha’s support for "terrorist groups aiming to destabilise the region".

Although Qatar is relatively small in size, the major works programmes that have been taking place in the run-up

to the forthcoming World Cup has meant that it is a market that has been attractive both to regional and global

construction companies for many years. Most of the major works programmes have been designed and managed

by global architecture and engineering firms, and many are being delivered by international contractors – often

through joint ventures with Qatar-based companies.

A spokeswoman for Atkins, the British construction consultancy managing several major projects including the

Gold Line of the Doha Metro, said that it was still assessing the implications of the restrictions that have been put

into place, and that its immediate concern was for the safety of its staff in the country.

George Franks, the managing director of Interserve International – the British contracting company that has

stakes in a contracting company and an engineering business in Qatar which employs a combined workforce of

about 11,000 – said the country imports much of its building materials by road from Saudi Arabia.

"There’s going to be an immediate impact on some of the mat¬erials transported by road, and I think that

probably includes quarried materials and precast [concrete] products – the heavier materials that don’t come in

by sea or by air.

”Obviously we need to understand what the other implications are in terms of the movements of people. As a

business that is headquartered in the UAE, it is not going to make it easier for us to visit. We are going to have to

go via other locations." He said that if contractors start to experience materials shortages, then fulfilling contracts

on time could become a problem, with questions then arising as to where the liability for these delays lies.

"Obviously we’re not there yet, and we’re not going to be there over the next few days, but it could bite fairly

quickly if there are some key components we can’t get our hands on or we are having to re-source."

Vasanth Kumar, who earlier this year stepped down from the Qatar-based Arabian MEP contracting business he

cofounded, said that people in Qatar were generally hopeful that the current dispute could be sorted out quickly,

but that "contractors in general are a little scared" because of the effect that port closures could have on gaining

access to equipment.

"A lot of projects are running critical now, because 2022 is coming closer. People are really running for time," he

said. A note by analysts at BMI Research said that it believes that Doha "will make considerable efforts to avoid a

substantial prolongation or further escalation" of the current situation, but if a prolonged spat developed

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 13

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

between Qatar and other GCC states, this could make it more difficult for the country to import materials needed

for World Cup-linked projects, potentially leading to delays.

"That being said, gas-exporting Qatar still has huge fiscal buffers and mainly trades outside the sub-region,

meaning its overall economic stability are not under direct threat from the cooling of GCC ties," the note said."

Source: The National

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 14

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

REGIONAL SOVEREIGN WEALTH FUNDS

LOOK TO INVEST IN REAL ESTATE FOR

LIQUIDITY Tuesday, June 06, 2017

Middle Eastern sovereign wealth funds are targeting real estate investments to generate yields in the low interest-

rate environment and own a liquid asset as withdrawals continue, according to investment management firm

Invesco.

More funds were looking at real estate for its yield-generating qualities for two reasons, said Alexander Millar,

Invesco’s head of Emea sovereigns at yesterday’s launch of the firm’s annual Global Sovereign Asset Management

Study in Dubai.

Low interest rates in many parts of the world mean that fixed-income products are not generating significant

returns, and many sovereign funds have experienced their own reduction in liquidity as withdrawals have

remained stable and the amount of new investment has been shrinking. In such a scenario, real estate

investments are a more liquid form of income-generating asset than either private equity or infrastructure

investments.

Mr Millar said that there is also growing interest in infrastructure investment, despite it taking sovereign funds

much longer to invest in these – four years, on average.

"There’s an awful lot of attractive characteristics to infrastructure investment – long term, illiquidity premium and

long duration cash flows – everything a sovereign investor should be looking at," he said. "But I think what they’ve

discovered is getting from those theoretical characteristics to harvesting them into your portfolio in the real world

has been very difficult to do."

He said that this was due to a "lack of supply" of big infrastructure projects, and the weight of money chasing

them meant that "a lot of these things have been bid up".

"Those that are out there have been quite expensive," he said.

The need for more investment in the US’s underfunded infrastructure sector – and the noises from the Donald

Trump administration indicating that it will be receptive to private investment – meant more funds see potential

in the sector. Just last month, for instance, Saudi Arabia’s Public Investment Fund pumped US$20 billion into a

new $40bn US infrastructure fund being managed by Blackstone.

Meanwhile, the turmoil that took place both politically and economically last year led many sovereign wealth

funds to miss their return targets, prompting them to reassess operations in a bid to plug an ongoing "return

gap".

The slowdown in returns meant that sovereign wealth funds are looking at their own business models rather than

chasing riskier assets, reducing the amount of intermediaries used and internalising control of investment

decisions, according to Mr Millar.

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 15

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

For its report, Invesco interviewed 97 sovereign investors and central bank reserve managers representing $12tn

worth of assets. A sample of 57 sovereign funds found that they achieved average returns of 4.1 per cent last

year, against a target of 6.1 per cent.

Source: The National

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 16

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

EMAAR PROPERTIES PLANS IPO FOR UAE

REAL ESTATE DEVELOPMENT BUSINESS Friday, June 02, 2017

Emaar Properties shares surged by their highest daily amount for more than two years yesterday after the

developer announced plans to float up to 30 per cent of its UAE real estate development business on the main

Dubai bourse.

Emaar shares soared by 8.57 per cent during trading – their biggest daily hike since April 2015 – to close at Dh7.60

on the Dubai Financial Market (DFM).

The flotation is the third for a business unit of Emaar, Dubai’s biggest listed developer.

In a statement to the DFM, Emaar said that the funds raised would be "primarily distributed as dividends to

Emaar’s shareholders", and that the company had made its decision as a result of an internal review of Emaar’s

asset values.

"Over the years we have generated significant returns from our UAE real estate development business and it

continues to be a strong driver of growth for the group," said the Emaar chairman Mohamed Alabbar.

"As Emaar’s other businesses have grown and expanded, we wanted to ensure that investors who value the UAE

Real Estate Development business the most, the foundation of Emaar’s success, can do so dir¬ectly. This will

ensure that the value of this business is properly recognised, thereby enhancing value for all Emaar

shareholders."

Emaar said that real estate sales at its development business in UAE more than tripled to Dh14.4 billion in 2016

from Dh4.2bn in 2012. In the first five months of this year, the business recorded sales of Dh9.7bn, up by 24 per

cent on the same period in 2016.

At the end of last month, the division’s total backlog – representing the value of properties which had been sold

but related revenues had not been recognised – was Dh40bn.

Emaar has been engaged in plans to spin off various parts of its business in the past five years. In 2014, the

company floated its Emaar Malls business on the DFM and in 2015 its Egyptian unit debuted on the Cairo stock

market.

The company had also been widely expected to spin off its hospitality business. However, with room rates across

the city continuing to fall and thousands of new hotel rooms due to be built ahead of Expo 2020, the developer is

thought to have postponed these plans.

The news of Emaar’s plans to float its property development arm comes amid a market slump, following two

years of price declines and an economic downturn caused by lower oil prices.

However, by selling down a stake in its crown jewel unit, Emaar would be able to quickly raise money for further

investment as well as boosting its own share price, according to Sanyalak Manibhandu, head of research at NBAD

Securities.

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 17

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

"With the market already setting a price for Emaar Malls, in which Emaar Properties has an 85 per cent stake, a

market determined price for the UAE property development unit would help boost the market value for Emaar

Properties," said Mr Manibhandu. "Selling down the UAE property development [unit] is equivalent to realising

today the cash flow that would otherwise be realised over a number of years."

Mr Manibhandu added that an initial public offering of Emaar’s hospitality unit would be "unlikely to generate the

sort of returns Emaar management is looking for in the present market". He said the company "might revive the

hospitality unit IPO at a future date when market conditions for hotels in Dubai improve".

Source: The National

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 18

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

DUBAI LAND DEPARTMENT STREAMLINES

BROKERAGE ACTIVITY Wednesday, June 07, 2017

The 5,856 licensed real estate brokers in Dubai together pulled in Dh403 million from transactions in the first

three months, with land sales alone accounting for Dh189 million and property a further Dh176 million. Their

involvement in deals for entire buildings netted another Dh38 million.

The Dubai Land Department is now calling on brokers to become even more transparent in their operations. A

circular was issued by Rera (Real Estate Regulatory Agency) “by which all estate agents’ offices in the emirate are

obliged to verify the accuracy of their property data through the “Dubai Brokers” app,” said Yousuf Al Hashimi, the

Deputy CEO of Rera, which is the regulatory arm of Land Department. “This regulation has been implemented in

order to safeguard the rights of all investors.”

In the recent past, Dubai has raised the bar on how brokers are expected to operate and what they should do in

order to do that. It is in this context that the app was launched for brokers.

What it does is offer up-to-date information on licensed operators and brokerage firms registered with Rera.

The application classifies brokers by measuring their performance indicators and efficiency, which allows

investors to select highly qualified real estate agents who can provide the specific services they require. It

classifies brokers according to the projects they specialise in and the number of transactions completed, as well

as by the details of the properties they handle. In addition, the app features a Dubai map that displays all real

estate units.

In addition, it classifies Dubai based brokers according to their nationalities. “This ensures that investors can

choose the nationality of their broker and guarantee they will be able to access information in their language and

in accordance with their cultural values and needs,” said a statement from the Land Department.

Among the other services users can source from the app, there is one allowing them to verify ownership

certificates by entering the information or scanning the certificate bar code. This speeds up the transaction

process, reduce costs, and minimise the risk of manipulation or fraud.

The app also offers an e-card service for agents, which serves as a “smart” substitute for traditional printed cards.

It can also issue real estate permits.

The app also enables the purchase and sale of property through the establishment of contracts — a procedure

that can be completed through property registrar offices in Dubai. “This reduces the time required to complete

the transfer of ownership, which raises the level of service delivery and customer satisfaction while also reducing

costs,” the statement added.

“We are closely monitoring brokers and focusing on developing proactive solutions to any downfalls in their

performance,” said Al Hashimi.

As of the first quarter, UAE citizens ranked first in terms of number of brokers, followed by Indian and Pakistani

nationals.

Source: Gulf News

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 19

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 20

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

DUBAI MUNICIPALITY KICKS OFF DH30M AL

KHAIL ROAD BEAUTIFICATION PROJECT Monday, June 05, 2017

Dubai Municipality has started a project for the irrigation network and beautification of Al Khail Road from the

Business Bay crossing to the Zabeel 1 intersection at a cost of AED30 million, to be completed within nine months,

said Mohammed Ahmed, Acting Director of Sewage and Irrigation Department in Dubai Municipality.

He added that the project benefits from several factors, namely the unique location and design, which has not

been used previously, and the use of renewable energy sources and recycled materials.

"The project consists of 36,000 meters of pipes, three irrigation system controllers, a reservoir, an irrigation water

pumping station, 240 solar power units, 8,000 lamps and digging 75,000 cubic meters of soil. The agricultural

design components include 400 trees, 80 agricultural basins using solar energy, 11,000 shrubs, 27,000 square

meter of soil mats, about 20,000 square meters of green areas, 35,000 square meters of blue glass and 44,000

pebbles of different colors," said Mr. Ahmed

Source: Emirates 24/7

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 21

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

A CHANGING LANDSCAPE: RESIDENTIAL

DEVELOPMENT IN DUBAI Wednesday, June 07, 2017

Price declines continued in Dubai for residential property during the first quarter, averaging 1 per cent year-on-

year for apartments and villas. While the pace of decline has slowed in comparison to the same period last year,

the continuing declines over the last 18 months have impacted the feasibility of new developments that are now

facing declining profit margins.

Meanwhile, consumer demand continues to shift in favour of communities with existing infrastructure and

amenities, with developer track record becoming a key factor in maintaining price and rent levels. Developers

have begun responding to this reality through differentiation at several levels of their product offering, ranging

from launch price to unit sizes, payment plans, development phasing and more. The era of “build and they will

come” is thus making way for products that are more responsive to end-user demand and catering to a wider

base of buyers, especially those with a longer-term view of Dubai’s potential as a mature real estate investment

destination.

Pricing

The most significant change in residential developments over the last two quarters has been the release of lower-

priced inventory of villas, town houses and the entry of mid-income housing. Projects like Aldar’s The Bridges on

Reem Island, Abu Dhabi, released at Cityscape earlier this year, or Emaar’s Mira town houses in Reem community

in Dubai have targeted a new segment of the market, with starting prices of Dh450,000 and Dh1.75 million

respectively.

According to the Dubai House Price Index by Property Monitor, which tracks residential property prices across the

emirate to derive average sales prices for apartments, villas and town houses, in the first quarter of 2014 the

average residential prices in Dubai surpassed Dh3 million for the first time since 2008, and have since averaged

between Dh2.5 million and Dh3.7 million.

However, in the first quarter this year, the average price of villas and town houses stood at Dh2.2 million as a

result of significant inventory of lower-priced villas with a starting price of Dh1 million. This trend is expected to

continue, with developers beginning to target a new segment of buyers, including those within the Dh7,000-

Dh10,000 monthly income bracket.

Product offerings

Developers are also focusing on more efficient design, optimal unit size mix and amenities that are more closely

linked to end-user demand. Products such as Danube’s Starz Tower in Al Furjan, with furnished apartments that

can be converted from one- to two-bedders, are being targeted towards both investors and end users.

Apart from standard amenities, consumers have also shown an interest in facilities such as visitor parking, 24-

hour maintenance and spacious layout.

Even the unit mix within projects is beginning to reflect buyer demand, with studio, one-bedroom and two-

bedroom units taking the lion’s share of the proportion in most developments. Some recent projects have also

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 22

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

focused on this aspect by releasing only smaller units, such as Select Group’s Studio One in Dubai Marina, which is

a studio-only serviced property targeted at millennials.

Payment plans

As the buyer mix is slowly tilting towards the end-user segment, payment plans have also evolved. A more flexible

payment plan helps developers sell more units quickly and at a higher price per square foot. The downsides are

the delayed receipt of revenue, a greater need to finance construction through other means and an increase in

risk of default. So, for each project, developers need to consider the trade-offs between price, speed of sales,

estimated revenue cash-flow, marketing budget and the availability, cost and effect of having to use alternative

funding options, such as bank loan and equity/joint venture partnership.

Payment plans in the boom years leading to 2008 typically required 80 per cent payment during construction.

Since the real estate price correction following the 2008 global financial crisis, payment plans have become more

attractive to investors, with developers sharing more of the development risk. In the current market, payment

plans vary from a significant proportion during construction, to only a small proportion, say 20-30 per cent, during

construction, with the remainder on completion or over a period following completion.

These include longer-term payment plans such as the five-year plan by Damac for villas in Akoya Oxygen with a 20

per cent down payment and the balance over nine instalments, the 20-80 and 30-70 plan for Select Group’s

Marina Gate Residences I and II, Danube’s 1 per cent or Dh4,500 per month plan for Resortz in Arjan, and special

offers such as the Ramadan offer by Nshama with a 20-80 payment plan.

Launch phasing

Developers are choosing to avoid flooding the market with units that cannot be absorbed and are instead phasing

handover. Historically, project delays were primarily a result of financing issues and extraneous factors impacting

the residential market. However, most delays over the last 12-18 months stem from a conscious, staggered

delivery schedule being set by developers. This tends to act as a supply control mechanism with handovers being

closely aligned and responsive to demand and project sales potential.

The sales launch of off-plan units is also being carried out in a phased manner. For instance, Aldar released two of

the six towers in The Bridges during Cityscape and the third soon after in response to absorption of the first

release.

Marketing strategy

With changing consumer profile and demand dynamics, the marketing strategy for each development also needs

to be differentiated. Creating pre-launch interest around the development and positioning it differently from

existing projects can drive value upwards. To achieve the estimated sale rates and faster absorption, the project

must be marketed with a focus on the unique aspects of its location, amenities, views and design.

Developers from the region are also increasingly participating in international trade events and road shows in

countries like India, Singapore and the UK.

These new developments in the residential market are aided by regulations introduced by the Real Estate

Regulatory Agency to curb deceitful marketing activities and assure homebuyers.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 23

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

MAJESTIC PRINCESS CAPS ABU DHABI’S

LONGEST CRUISE SEASON Tuesday, June 06, 2017

Abu Dhabi’s longest-ever passenger cruise season drew to a close yesterday as the 143,000 tonne Majestic

Princess docked in Abu Dhabi.

Streaming out of the capital’s recently completed glass-fronted cruise terminal building, scores of white-haired

Europeans made their way past Duty Free to lines of waiting buses and taxis, pausing only to check their iPads or

take photographs of the terminal’s huge brass camel statue.

The arrival of a cruise ship this month marks a new first for Abu Dhabi Ports, the company which operates Abu

Dhabi’s shiny new cruise terminal, which usually welcomes ships during the cooler months of the year between

October and May.

"This is the first time that we have received a ship in Ramadan and this far into the summer," said the cruise

terminal manager, Noura Al Dhaheri, making her way between small groups of passengers as she crossed the

huge terminal.

According to Ms Al Dhaheri, the arrival of Majestic Princess’ 2,400 passengers in Abu Dhabi brings the total

number of cruise visitors to the capital this season to 340,000 – up from 230,000 a season earlier.

The dramatic increase is part of a plan by the Abu Dhabi authorities to push up the number of cruise ship visitors

to the city from just 35,366 during the 2006-07 season to 450,000 by 2020 and 808,000 by 2025.

To that end Abu Dhabi Ports opened its 7,500 square metre terminal building in 2015 and the company plans to

open a second linked terminal of the same size in time for the 2018-19 season, when Pullmantur and P&O are

expected to begin operations through Abu Dhabi.

Abu Dhabi Ports also opened a second cruise terminal on Sir Bani Yas island last year.

Cruising around the world is becoming bigger and bigger business as a generation of affluent baby boomers

starts to retire in the West, while new markets such as China continue to open up and advances in technology

mean ships can carry an increasing number of passengers, reducing costs per head.

Worldwide, the cruise industry is expected to show an annual passenger compound growth rate of 6.5 per cent

from 1990 to 2019.

But Ms Al Dhaheri points out that the arrival of Majestic Princess so late into the cruise season is a one-off

necessitated by the fact that the operator Princess Cruises is moving the newly launched boat from Eur¬ope,

where it was built, to its new home port of Shanghai.

The ship is travelling from Barcelona in Spain and has gone through Europe to Aqaba in Jordan and Dubai. After

Abu Dhabi it will go on to India and then eventually end up in China." On such a long trip they need to deploy and

stop for provisions so Abu Dhabi is part of the route," Ms Al Dhaheri said. "And we have been promoting Abu

Dhabi as a destination alongside Dubai to encourage cruise liners to stop in the UAE."

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 24

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

Nonetheless, Abu Dhabi Ports said three cruise companies – Celebrity Constellation, MSC Fantasia and Aida

Cruises – have been using Port Zayed as their starting and finishing point before heading off around the GCC to

ports including Dubai, Muscat and Doha.

Ms Al Dhaheri declined to comment on whether this week’s surprise decision by the UAE, Saudi Arabia, Bahrain

and Egypt to break diplomatic ties with Qatar and cut off air, sea and land routes between the countries would

have an effect on business.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 25

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

DUBAI REAL ESTATE’S INDIA CONNECTION Tuesday, June 06, 2017

Leading developers and brokerages in Dubai are being involved in a series of international marketing initiatives in

response to increasing demand from Indian investors. Some have established sales offices in key cities and have

conducted road shows or joined property exhibitions across India.

Nakheel, for instance, has participated in real estate events and investor road shows in India over the last couple

of years. “We continue to explore further investor events in India,” says Aqil Kazim, chief commercial officer of

Nakheel.

Indian investors already account for more than 11 per cent of Nakheel’s customers, accounting for more 4,500

villas, apartments and land plots with a combined value of more than Dh9 billion. “The fact that Indians remain

the top buyers of Dubai real estate suggests that the currency demonetization in India has had no significant

impact on property investment here,” says Kazim, taking note or recent regulations in India. “One in 10 of our

investors come from India. They have purchased a wide range of our developments, including investments on the

world-famous Palm Jumeirah, where they have spent over Dh1 billion alone.

Deyaar has also made an aggressive push into the Indian market with its participation in events such as the Dubai

Property Show in Mumbai and road shows in New Delhi and Mumbai.

Last year, Indians were involved in property transactions collectively worth Dh12 billion in the emirate, which is

more than 13 per cent of the Dh91 billion total real estate investments, according to data from the Dubai Land

Department (DLD). Indians ranked highest in both volume and value among foreign investors with 6,263 buyers

transacting in Dubai property in the last year.

The Dubai Property Show held in Mumbai saw over 30 developers including Emaar Properties, Dubai Properties,

Nakheel, Damac Properties, Orion Real Estate, Seven Tides International, naming a few, who exhibited their

projects before the Indian audiences.

Danube Properties, known for building affordable projects in Dubai, has opened sales offices in Mumbai, Cochin,

Hyderabad and Delhi. According to the developer, over 75 per cent of its customers are Indians in the UAE and

India. “The UAE and India have been associated with each other for decades now, and as the two countries move

to take their bond to the next level, I am confident that a number of Indians will invest in Dubai and vice versa,”

says Rizwan Sajan, founder and chairman of Danube Group.

Boutique real estate developer Gemini Property, which is planning to participate in property shows in Mumbai

and open a sales office in Mumbai, has been getting leads from a wide mix of customers. “The sales enquiries

show both Indian end users and investors interested in residential, luxury and commercials properties,” says

Sailesh Jatania, CEO of Gemini Property Developers.

According to data from the Organisation for Economic Cooperation and Development (OECD), around 2.8 million

Indians migrated to the UAE between 1995 and 2015, making it the top destination for Indians in the world. “The

middle to upper-middle class from Bangalore, Mumbai and New Delhi invest in UAE, preferably in Dubai because

property has become pricier in India,” says Jatania. “The UAE is one of the first choice for this type of investors.

With Dh3 million getting you a mere 96 sq m of a small apartment in Mumbai, the same amount fetches a cool

145 sq m of property in Dubai.”

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 26

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

In London, the same amount could only buy a 21 sq m for a unit of comparable quality. Apart from the size of the

property, the investment returns are equally attractive for any investor,” says Asanga Silva, deputy general

manager of Sumansa Exhibitions, which organises the Dubai Property Show in Mumbai.

“Apartments in Dubai offer rental yields in the range of 7-12 per cent, whereas it is 3.5 per cent in London, 2.82

per cent in Hong Kong and 2.83 per cent in Singapore,” says Silva, adding that Indians have pumped in a total of

$18.3 billion into Dubai realty since 2011.

“Dubai real estate also offers better amenities at a lower price. If we see the average ticket size for prime locations

in Dubai, including Dubai Marina, Business Bay, Downtown Dubai and others, it is approximately between

$545,000 [Dh2 million] and $1.1 million. The same ticket size in a prime location in India would cost around 5-10

crore rupees [Dh5.7 million].”

As Indian interest in Dubai property continues to grow, Silva holding property shows in India is making sense for

many developers.

“We have done two successful editions of Dubai Property Show in Mumbai with a great feedback from investors

as well as developers,” says Silva. “Now, as a next phase, we are planning to take the show to Delhi. Besides this,

we think that tier-two cities like Bangalore, Ahmedabad and Hyderabad offer some significant potential that must

be explored.

“We are keen on organising road shows for master and sub-developers in these cities to showcase the potential

of Dubai’s lucrative real estate.”

Buyers mix

Indian buyers invest in Dubai from different parts of the world, says Mansi Saxena, marketing director of SPF

Realty. “Our experience has very much been in line with the DLD figures. There is a right mix of purchasers of

Indian origin, whether it is Indians from India or Africa or the UK or Indians living in Dubai. Most of the buyers

who are outside of Dubai fall into the investor category, while the Dubai residents are usually end users or

multiple property investors.”

Saxena digital campaigns have helped create new leads, but on-ground presence through road shows or

experiential events has helped seal the deal. “The on-ground presence provides the much needed human touch,

trust and credibility for a high-ticket investment category,” says Saxena. “India remains a key target market for us

and this year we will focus on tie-ups with key regional players in the country, penetration in other cities and

expanding on-ground presence overall.”

Saxena says the burgeoning Indian diaspora is making Dubai an even more attractive destination for Indians. In

additions, attractive rental returns, high capital returns, straightforward transactions, property-based visas and

the growth of Dubai as an investment hub, especially with the upcoming World Expo 2020, also make Dubai an

easy choice for Indians, she says.

“The demonetization move had a tremendous shock value when it was announced, and clearly some panic was

felt across the Indian diaspora,” says Saxena “However, six months since the move, normalcy has returned.

Demonetization had a short-term effect on the real estate sector in India and that created more demand for

investment in Dubai in that period.”

Wealthy buyers

India is organically growing more rich people. It is home to 101 billionaires, the world’s fourth highest number of

billionaires, according to a new list released by Forbes magazine. The country is home to 264,000 millionaires,

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 27

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

with Mumbai housing 46,000, followed by Delhi with 23,000 and Bengaluru 7,700, according to the New World

Wealth report.

“Indians are getting richer every day with the low-income group now going into the middle class, and the middle

class pushing into the rich,” says Sanjay Chimnani, managing director of Raine & Horne. “Dubai has attracted

several of these newly rich people who are looking for an attractive destination for a holiday or second home or

investment property outside India.”

“A lot of these buyers are looking at property from an investment point of view in Dubai, as the city offers the best

rental returns. The recent introduction of the holiday home segment is further attracting such buyers wanting to

take the dual advantage of holiday home: they can use it for six to eight weeks in a year and the remaining period

it’s an income-generating asset for them.”

Typically, only a small percentage of Indians invest outside the country, “but since our population is so huge, it

becomes significant”, says Chimnani. “The Indians forming a large part of Dubai’s expat population, proximity, the

presence of family and friends, ease of purchasing property and Dubai’s investment haven status all add to

people’s interest towards investing in the emirate.”

Furthermore, Chimnani says the relations between the UAE and India have always been healthy and strong.

“Indian Prime Minister Narendra Modi’s visit to the UAE and the Crown Prince of Abu Dhabi, Shaikh Mohammad

Bin Zayed’s trip to India have seen incredibly favourable press coverage, which has put UAE in the spotlight for

Indians,” he says. “They look at the UAE more positively for investments, business and travel. On the other hand,

for India, it has attracted larger investments into the major infrastructure project.”

For Indian residents in Dubai, especially those recently settled in the emirate, this has given them more

confidence to make a longer-term commitment here. “Since real estate is an emotional decision, all these factors

positively influence the buying decision, converting more tenants towards being property owners,” says Chimnani.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 28

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

CONTRACTOR CONFIRMED FOR

ALANDALUS TOWN HOUSES Wednesday, June 07, 2017

Jumeirah Golf Estates has appointed Progress Constructions as contractor for the town houses and retail centre

of its mid-market community, Alandalus. This means the town houses are on track for their scheduled handover

commencing in September 2018.

“The strong demand seen for these town houses underpins our reputation for bringing the right type of product

to the market at the right price, without compromising on the layout and finishing, and within close proximity of

the Expo 2020 site,” said Yousuf Kazim, CEO of Jumeirah Golf Estates.

Prices for the homes start from Dh1.3 million. So far, two phases have been released, and the third phase is

scheduled for release later this year.

The Alandalus Townhouses comprise 95 two- and three-bedroom homes. The retail centre sits at the heart of the

Alandalus community, which also features 715 apartments. It will also have the master-development’s second

clubhouse and a hotel.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 29

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

DUBAI WASL LAUNCHES BUILDING

CLUSTER FOR HOTEL STAFF Sunday, June 04, 2017

The Dubai-based developer, wasl Asset Management Group, has launched a project in Warsan as part of its

strategic preparations for Expo 2020 by delivering accommodation for hospitality staff.

The Warsan project will have 26 buildings to provide hospitality sector employees with 3,866 residential units

spread over a built-up area of 2.6 million square feet. The units will be distributed between 3,380 shared rooms,

360 studio units and 126 one-bedroom units. This will place the hotel staff living there within easy reach of the

many new properties being developed to meet the demands of Expo 2020.

Ample accommodation

“Dubai is preparing itself to receive an estimated 25 million unique visitors by rejuvenating the city’s fabric and

enhancing its hospitality offering,” Hesham Al Qasim, CEO of wasl Asset Management Group, said in a statement

on Sunday. “But we are also striving to cater to hotel staff by providing them with ample accommodation. This is

of vital importance for the success of Expo 2020, and we are pleased to be addressing this segment of the

market.”

Infrastructure works are in progress and the project is due for completion in October 2020.

The announcement follows wasl’s launch of three hotel projects earlier this year — MGM, Mandarin Oriental and

Hyatt Centric.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 30

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

REAL ESTATE LITIGATION AND

ARBITRATION Wednesday, June 07, 2017

Despite the announcement by the Dubai Land Department (DLD) that there has been an increase in the value of

transactions by 45 per cent in the first quarter compared with the same period last year, the real estate sector’s

recovery is still likely to be slow. A sluggish global economy, regional geopolitical turbulence and depressed oil

prices will continue to affect real estate in Dubai and could result in an increase in the number of realty disputes

as businesses put certain commitments on hold.

However, recent proactive initiatives of the DLD to promote a transparent and professional real estate market

with measurable standards, such as those set out below, will undoubtedly help reduce such disputes.

* The announcement of a proposed new landlord-tenant law that will replace the current one–size-fits-all rental

regulation in April. The new law will contain separate rules for four property categories: residential, commercial,

malls and educational and health care.

* The launch of the mandatory unified lease contracts in March.

* The requirement for permits to be obtained via the Trakheesi system for any announcements related to real

estate property both inside and outside the country pursuant to Circular No. 13 of 2016.

* The acceleration of Dubai’s building classification project in February. Under this project all land plots, villas,

commercial and residential buildings, factories and shopping centres will be registered and surveyed.

* The generous donation of Dh1 million in March from the family of the late Obeid Al Helo to support insolvent,

defaulting tenants who have been convicted during rental proceedings.

Nevertheless, given the general outlook for this year, an overview of the mechanisms available to settle disputes

in Dubai is timely. At the outset, it is important to note that in Dubai there is a desire among parties for amicable

settlement of disputes. Failing such settlement and if no arbitration clause is included in the contract, the dispute

is referred to court.

The court system in Dubai consists of a Court of First Instance, Court of Appeal and Court of Cassation. Court

hearings in Dubai are generally held in public and all court proceedings are in Arabic. However, there is usually

little or no oral hearing. Also, the public cannot inspect the court file. Only the parties to the litigation and their

lawyers have access to these records. As a result, although all proceedings are in theory public, they remain

virtually confidential in practice. In Dubai, judgments of the higher courts are not binding on the lower courts and

each case is decided on its own merits and facts.

Dubai operates under a civil law system and written laws are the primary source of law. Another body of law is

Shariah, which is a body of religious laws and ethical and legal rules. Shariah is founded on familiar concepts of

justice, fairness and equity, and the practical result in commercial matters is often the same as that reached

under many Western law jurisdictions.

Court proceedings

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 31

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

Proceedings are started by filing a claim in the relevant court and payment of court fee. Payment of court fees can

be deferred in exceptional cases. The court fee depends on the value of the claim, and has a maximum cap of

Dh40,000. This fee is payable either on an application for provisional relief, or on filing the main lawsuit.

The claim must meet procedural requirements, including the names and addresses of the parties to the action

and details of the claim. Documents in support of the claim are usually annexed to the claim and must be

translated into Arabic. The court issues a summons to the defendant with a hearing date, a copy of the claim and

any supporting documents filed by the claimant.

Subsequent stages

Once an answer has been filed, the trial is adjourned for the claimant to respond. Further adjournments are given

so that memoranda can be filed by the parties. Once the court believes that the case has been sufficiently

pleaded, it reserves the matter for judgment.

The entire proceeding is based on written submissions supported by documentary evidence. The court usually

appoints an expert to assist it and usually accepts the expert’s report.

Arbitration

As an alternative to court, arbitration has become increasingly popular as a means to settle disputes in the Middle

East and many parties opt for resolution of disputes by arbitration under their contracts. Arbitration is beneficial

when privacy is desired or if specialist arbitrators would be valuable to determining a matter. Arbitration is also

usually faster than court proceedings.

For example, the Dubai Chamber of Commerce and Industry established the Dubai International Arbitration

Centre (DIAC), which is in effect a rebranding of the commercial conciliation and arbitration services that have

been available since 1994. DIAC has issued arbitration rules and maintains a list of arbitrators.

The Abu Dhabi Chamber of Commerce and Industry also has an arbitration centre that has issued its own set of

procedural rules. Foreign arbitration institutions, most notably the International Chamber of Commerce’s court of

arbitration, are often used in large disputes as well. There is also the Dubai International Financial Centre-London

Court of International Arbitration Centre.

It is important to note that there are effectively no rights of appeal available with respect to the merits of an

arbitration award in the UAE. The UAE federal arbitration legislation is currently practiced only in a short section

of the UAE Civil Procedure Code and requires court ratification of arbitral awards. Importantly, the New York

Convention on the Recognition and Enforcement of Foreign Arbitral Awards was adopted by the UAE in 2006 and

allows UAE arbitration awards to be recognised and enforced internationally, as well as allowing foreign

arbitration awards to be recognised and enforced in the UAE, subject to some exceptions..

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 32

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

SOFITEL TO OPEN ITS LARGEST HOTEL IN

MIDDLE EAST Monday, June 05, 2017

Sofitel will open its largest property in the Middle East in 2019, located in Dubai, the company said in a statement

on Monday.

In collaboration with development partner MKM Commercial Holdings LLC, the Sofitel Dubai Wafi will feature 501

luxury guestrooms, ranging in size from 55 square meters to 625 square metres.

The property will also contain 97 studio, one-, two- and three-bedroom serviced residences to be operated on an

extended-stay basis.

Source: Gulf News

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 33

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

SOBHA GROUP LAUNCHES MORE

APARTMENTS IN HARTLAND Wednesday, June 07, 2017

Sobha Group has announced the launch of Hartland Aflux in Sobha Hartland Greens phase three. More than 70

per cent of apartments in phases one and two of the development have already sold out.

Apartments in Hartland Aflux fall under the affordable luxury segment. Hartland Aflux will comprise studios, one,

two and three-bedroom apartments across two buildings. Apartment sizes will range from 468 to 1,378 square

feet.

These new apartments will have views of the Dubai canal with 2.4 million sqft of green spaces and villa

communities around it. This is an ideal project for both investors and end-users. The sizes of the apartments can

be re-configured as per the customer's needs.

Expected completion date is October 2019.

P.N.C. Menon, founder and chairman, Sobha Group, said: "With almost four decades of experience in the Middle

East, we are committed to providing urban living close to the city centre. This project caters to the affordable

luxury segment and offers the perfect home for nuclear families and first time buyers."

Residents will have access to a pool along with a waterfall, jogging track and kids play area on podium level. It also

has retail on the ground floor and an outdoor gym. Apartments on the podium level will have a private garden.

Source: Khaleej Times

Back to Index

DUBAI | ABU DHABI | AL AIN | SHARJAH | JORDAN

© Asteco Property Management, 2017 asteco.com | asteco.com/report_library

IN THE MIDDLE EAST FOR OVER 30

YEARS

Page 34

ASSET MANAGEMENT SALES LEASING

VALUATION & ADVISORY SALES MANAGEMENT OWNER ASSOCIATION

VINCITORE LAUNCHES NEW DUBAI

RESIDENTIAL, RETAIL PROJECT Thursday, June 08, 2017

Vincitore Real Estate Development has announced the launch of its second project in Dubai, Vincitore Boulevard,

following the success of Vincitore Palacio, which was unveiled in 2016.

The new project, located within Al Barsha South's Arjan district, will span over 173,337 square feet and will feature

216 apartments comprising studios and one-bedroom units.