Net Income and Return on Capital (1 yr. avg.) RATINGS ... · PDF fileasset management...

Transcript of Net Income and Return on Capital (1 yr. avg.) RATINGS ... · PDF fileasset management...

FINANCIAL INSTITUTIONS

CREDIT OPINION1 August 2017

Update

RATINGS

New York Life Insurance CompanyDomicile New York, New York,

United States

Long Term Rating Aaa

Type Insurance FinancialStrength

Outlook Stable

Please see the ratings section at the end of this reportfor more information. The ratings and outlook shownreflect information as of the publication date.

Contacts

Laura Bazer 212-553-7919VP-Sr Credit [email protected]

Kripa Thapa 212-553-8924Associate [email protected]

Scott Robinson 212-553-3746Associate [email protected]

Marc R. Pinto, CFA [email protected]

New York Life Insurance CompanyUpdate following rating affirmation at Aaa stable

Summary Rating RationaleMoody's rates New York Life Insurance Company (NYLIC) and its wholly owned subsidiary,New York Life Insurance and Annuity Corporation (NYLIAC – collectively, New York Life)Aaa for insurance financial strength (IFS). The rating is based upon New York Life's intrinsicstrengths as the largest US mutual life insurer, with a leading position in the US life insurancemarket and a large, profitable in-force block of participating whole life, its strong earningsdiversity and liquidity, good distribution, and excellent capitalization.

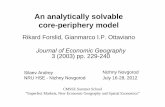

Exhibit 1

Net Income and Return on Capital (1 yr. avg.)

0%

1%

2%

3%

4%

5%

6%

7%

8%

0

500

1,000

1,500

2,000

2,500

2012 2013 2014 2015 2016

Retu

rn o

n C

apital (1 yr. avg.)

Net

Inco

me

Net income (loss) attributable to common shareholders Return on avg. Capital (1 yr. avg ROC)

Source: Moody's Investors Service and Company GAAP Filings

These strengths are tempered by earnings that are somewhat weak for its rating level andmaterial holdings of below investment-grade bonds, alternative investments (e.g., privateequities), and commercial mortgage loans, etc. Other challenges are the slower growthprospects for traditional participating life insurance (which Moody's considers the mostcreditworthy product, relative to higher growth products and businesses) and NYLIC’s sizableasset management business, which, although providing business earnings diversity, has beenunder pressure in recent quarters, in terms of net fund flows. Rapid growth of the assetmanagement business, currently 5% of core GAAP earnings, could put downward pressure onNew York Life's ratings, although this is not what we are expecting.

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

Credit Strengths

» Top-tier position in the domestic individual life insurance business;

» Large block of individual life insurance containing significant embedded profits;

» Productive and well-established career agency distribution force;

» Well diversified investment portfolio, strong liquidity, and outstanding capitalization.

Credit Challenges

» An earnings profile lower than the rating level;

» Material holdings of higher risk assets, including below investment-grade bonds, private equities and alternative investments, aswell as real estate-related investments;

» Challenges in growing its participating business lines;

» Continued maintenance of its strong growth and retention of its agency field force.

Rating OutlookNew York Life has a stable outlook, based on its leading position in the US life insurance market and participating whole life block andstrong capitalization, mitigated by growth in higher risk products and businesses, including asset management.

Factors that Could Lead to a Downgrade

» A downgrade of the US government rating;

» Risk-sharing products sustained below 50% of total statutory reserves (currently at 54%);

» Consolidated statutory-based high risk asset ratio greater than 140%, or NAIC 2-rated securities above 40% of total bonds (at122%, analytically, and 30%, respectively at year-end 2016);

» The company action level NAIC Risk Based Capital (RBC) ratio falling below 400% for more than a short time period or a reductionin capital of more than 10% over a 12 month period;

» Adjusted financial leverage of 20% or more; or earnings coverage consistently below 10x.

This publication does not announce a credit rating action. For any credit ratings referenced in this publication, please see the ratings tab on the issuer/entity page onwww.moodys.com for the most updated credit rating action information and rating history.

2 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

Key Indicators

Exhibit 2

New York Life Insurance Company[1][2] 2016 2015 2014 2013 2012

As Reported (U.S. Dollar Millions)

Total Assets 317,878 301,657 279,502 259,512 254,437

Total Shareholders' Equity 35,483 33,512 33,791 30,262 31,604

Net income (loss) attributable to common shareholders' 1,372 1,486 2,219 1,816 1,999

Total Revenue 27,908 26,127 27,451 24,781 24,709

Moody's Adjusted Rat ios

High Risk Assets % Shareholders' Equity 108.0% 113.0% 104.2% 107.6% 95.4%

Goodwill & Intangibles % Shareholders' Equity 26.2% 27.5% 23.4% 24.2% 16.7%

Shareholders' Equity % Total Assets 9.4% 9.4% 10.4% 10.1% 11.0%

Return on avg. Capital (1 yr. avg ROC) 4.0% 4.7% 6.7% 6.0% 6.3%

Sharpe Ratio of ROC (5 yr. avg) 485.7% 487.1% 518.1% NA NA

Financial Leverage 12.3% 12.2% 12.1% 11.0% 13.2%

Total Leverage 13.5% 13.5% 13.4% 12.5% 14.5%

Earnings Coverage (1 yr.) 11.4x 13.6x 18.5x 16.8x 17.3x

Cash Flow Coverage (1 yr.) NA NA NA NA NA

[1] Information based on US GAAP financial statements as of Fiscal YE December 31

[2] Certain items may have been relabeled and/or reclassified for global consistency

Source: Moody’s Investors Service and Company Filings

Notching ConsiderationsThe spread between NYLIC's Aa2 surplus notes rating and its Aaa IFS rating is two notches, consistent with Moody's typical notchingspread for surplus notes issued by life insurance operating companies.

Detailed Rating ConsiderationsMoody's rates New York Life Aaa for insurance financial strength, which is higher than the Aa1 rating indicated by the adjustedinsurance financial strength rating scorecard. The principal differences are: (a) a focus on, and a very strong market position in, theparticipating life insurance business, (b) a governance structure with a strong focus on the best interests of policyholders/creditors, (c)an emphasis on superior customer value with substantial experience-rated policyholder dividends, and a strong capital position thatdepresses reported profitability metrics.

Insurance Financial Strength Rating

The key factors currently influencing the rating and outlook are:

MARKET POSITION & BRAND: Aaa - LEADING POSITIONS IN A NUMBER OF MARKETS

New York Life has one of the most well-recognized and respected brands in the U.S., and a leading market position in a number ofimportant segments of the industry. According to LIMRA, New York Life was among the largest sellers of life insurance (#2) andfixed annuities in the U.S. (including lifetime income annuities) in 2016 - trends that have continued since that time. New YorkLife is also the leading direct marketer of life insurance, a top long-term care insurance provider, and the largest underwriter ofprofessional association insurance programs in the U.S. Accordingly, we view the company's market position and brand to be in linewith expectations for Aaa insurers and have moved this factor up from the Aa indicated by the scorecard metric.

DISTRIBUTION: Aa - WIDE DIVERSITY OF DISTRIBUTION CHANNELS

New York Life benefits from a diverse network of distribution channels including career agents, independent brokers, banks, direct/sponsored distribution (e.g. AARP), and an institutional sales force. Distribution diversity is one of the broadest among mutual peersand is consistent with a A rating on an unadjusted basis. One of New York Life's key strengths is its productive, 12,000 plus member

3 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

career agency force that is its primary channel for distributing permanent, cash value life insurance products, the company's coreproduct. The controlled nature of the company's career agency channel contributes to New York Life's strong business retentionrates, and its focus on “cultural” market recruitment helps it garner sales from underpenetrated markets (e.g., Latino, Asian, women).The other distribution channels are primarily used to distribute specialized insurance and investment products, such as COLI/BOLI,sponsored life products (AARP and Professional Affinity Organizations), fixed annuities, and investment products and afford thecompany less control over its producers in these channels. However, because of the importance of the career agency channel, weview the company's distribution to be in line with expectations for Aa insurers and have moved this factor up from the A indicatedby the scorecard metric. However, we note that the DOL’s new fiduciary rules, while allowing the sale of proprietary products bycareer agents to qualified plans and IRA's, also raise the cost, litigation risk, and minimum standards for their sale, given its phased-in implemention beginning in June 2017. Even if the standard is ultimately repealed in part, or overall, the levelization and flatteningof agent compensation is likely to remain. This could put pressure on agent numbers at mutuals, like New York Life (although thecompany’s qualified/IRA sales are not that extensive).

PRODUCT FOCUS AND DIVERSIFICATION: Aa - OVERALL RISK PROFILE SUPPORTED BY LOW-RISK BLOCK OFPARTICIPATING WHOLE LIFE

New York Life manufactures and markets a wide range of products for both retail and institutional buyers. The company's principalproduct lines include individual life insurance, individual annuities (fixed, immediate, and variable annuities-VAs), long-term careinsurance, pensions and institutional investment products business, and asset management through its New York Life InvestmentManagement subsidiary. The overall risk profile of the company's product portfolio, which is well-positioned among its competitors, issupported by its large block of participating life insurance, one of the lowest risk products sold by U.S. firms. We note, that like othermutual peers, New York Life uses some percentage of non-par business earnings to supplement its dividend ratio to participating wholelife policyholders; this may not be sustainable over time, leading to lower sales and potentially higher lapses. In addition, generally, theparticipating business is a slower growing product relative to other higher risk products and lines of business (e.g., variable and fixedannuities). Although New York Life has grown its asset management business, both organically and through acquisition (e.g., DexiaAsset Management (Dexia), acquired in 2014), we expect that this will continue to be a relatively smaller business segment in relationto the company's lower-risk life insurance businesses in terms of earnings (i.e., under 10%). It is also one that, in recent quarters, hascome under pressure, due to the market trend from active to passive funds. We maintain the adjusted score at Aa, the same as theunadjusted score, because of the large block of low risk participating life insurance. However, material shifts in the business mix awayfrom participating whole life insurance, significant growth of asset management relative to New York Life’s core insurance businesseswould put pressure on this factor.

ASSET QUALITY: Aa - HIGH RISK ASSET EXPOSURE MOSTLY DRIVEN BY BELOW INVESTMENT GRADE BONDS ANDALTERNATIVE INVESTMENTS

The overall quality of New York Life's investment portfolio is good. On an unadjusted basis, the company's GAAP exposure to high riskassets was about 108% of equity as of December 31, 2016, consistent with Moody's expectations for Baa-rated companies, decreasingfrom 113% in 2015, although somewhat volatile from year to year. Adjusted for additional below investment-grade middle market bankloans (not included in the raw ratio), the ratio rises to about 122%, which is still in the Baa level score. We expect the adjusted ratioto remain in the 2016 range in 2017 and 2018. Approximately 7.5% of cash and invested assets are non-investment grade bonds, andabove average for the industry, although many of these are private placements with covenant and/or collateral protections. Privateswere approximately 45% of the corporate bond portfolio. Most of the remainder of high risk assets are various forms of alternativeinvestments, such as partnership interests in investment funds. Because investment results can generally be shared with participatingpolicyholders, the company substantially reduces its risk of owning these assets. However, under a stress scenario, the overall portfolioinvestment losses would be well in excess of the annual policyholder dividend, and would negatively affect profitability and capital.

At year-end 2016, the firm’s direct and indirect exposure to the retail sector, including bonds, CMBS, and CML within its $28 billioncommercial mortgage loan portfolio (e.g., retail malls), was modest ($8.4 billion), at roughly 3% of invested assets, but mostproperty loans were to top-rated borrowers (Class A/A+), and retail sector bonds were 84% investment-grade. General account creditimpairments – although rising, have been very modest, were at a level of at about 11 basis points in 2016. We expect NYL to remain

4 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

within industry averages (i.e., 20-30 bps per annum) in 2017. Goodwill and other intangibles (primarily reflecting DAC associated withthe sale of the company's stable, profitable life and annuity business) are equal to about 26% of capital, consistent with a Aa rating.

The adjusted score on this factor is raised to Aa from the unadjusted score of A, given the portfolio's strong diversification, the ability toshare investment losses with policyholders, limited exposure to non-agency RMBS, and high likelihood of DAC recoverability. However,material growth of the company's high risk exposures will put pressure on the asset quality score.

CAPITAL ADEQUACY: Aa - RBC RATIO IS STRONG; HIGH QUALITY CAPITAL

New York Life's capital-to-total asset ratio of about 9.4% in the scorecard suggests a Aa score, but we believe that the NAIC RBCratio is a better indicator of the company's capital adequacy. The company’s consolidated year-end 2016 NAIC RBC ratio was 550%(company action level), a level commensurate with Aaa-rated companies on an unadjusted basis, and comparable with that of 2015(RBC was 549%). Total Adjusted Capital (which includes half the dividend liability) of year-end 2016 of $23.5 billion, is high quality, asNew York Life does not use captive reinsurers to boost its capital adequacy. However, under a situation of severe stress, RBC would belower, due to significant investment losses. The adjusted score for capital adequacy is Aa, the same as its unadjusted scorecard becauseof the good quality of New York Life's capital and the company's flexibility in adjusting dividends on its sizeable participating wholelife business, as well as other risk sharing mechanisms in its various other products, which mitigate some of the impact of investmentlosses in times of severe stress.

PROFITABILITY: Aa - POLICYHOLDER DIVIDENDS AND STRONG CAPITAL POSITION DEPRESS NOMINAL PROFITABILITY

New York Life's historical profitability performance, as measured by its five-year average return on capital (ROC) sub-factor scoreof 5.6%, unchanged from 2015, has been below our expectations for a Aaa-rated company (i.e., aligns with an A sub-factor score).However, this is due, in part, to New York Life's excellent capital position (which depresses reported return on capital measures) andalso due to an emphasis on superior policyholder value, which reduces profitability through policyholder dividends that are treatedas operating expenses. Although a portion of policyholder dividends is economically equivalent to shareholder dividends for a mutualinsurer, under GAAP accounting these dividends are considered expenses, and thus depress the company's reported ROC, whereasshareholder dividends do not impact ROC for a stock company. ROC on a similar accounting basis would raise the company’s ROCtoward the Aa-level, which is the reason we raise the adjusted score to Aa for this factor. Statutory net income recovered to $1.1 billionin 2016, after being skewed by the acquisition of John Hancock’s closed life block in 2015 (net income of $257 million).

The Sharpe Ratio of ROC, at approximately almost 486%, has remained in the Aaa-range, given the relative stability of earnings.The company’s earnings should continue to be driven by its large block of in-force participating whole life insurance in 2016, whichcontinues to dominate its overall core earnings profile. Over the longer term, we expect earnings growth to continue to come largelyfrom the fixed annuity and third-party investment management businesses, although equity market volatility may depress earningsfrom asset management if these trends continue in 2017. The par life block also continues to experience single-digit earnings growth.

LIQUIDITY AND ASSET/LIABILITY MANAGEMENT (ALM): Aaa - STABLE LIABILITIES AND STRONG LIQUIDITY

The results of Moody's 2015 year-end liquidity model for New York Life were consistent with a Aa rating – the same as the unadjustedscore for this factor. However, ALM at New York Life is greatly enhanced by the large amount of very stable participating business onthe company's books, which effectively allows the company to share some of its inherent risks with its participating policyholders,and also benefits the company's liquidity profile. The company's liquidity profile is further bolstered by a relatively liquid generalaccount investment portfolio and approximately $16 billion in holdings of cash, short term investments, and U.S. Treasury and agencysecurities at December 31, 2016. We expect the company’s liquidity to show similar strength in 2017. New York Life is one of thesmaller number of companies that continue to issue funding agreement-backed notes (about $16.5 billion of liabilities at Q1 2017).However, we believe that the program is well managed and that these exposures are well matched, from both a duration and from acash perspective - the latter as issues approach maturity.

For the 12 months following 31 March 2017, New York Life had approximately $18.5 billion of nominal institutional investmentliabilities, including GICs, non-putable funding agreements, funding agreement-backed notes (FANIPs) and FHLB borrowings maturing.To service these maturing liabilities, the company has cash on hand and maturing investment grade bonds. As of 31 March 2017,unencumbered cash and short-term investments amounted to approximately $2.4 billion, unused credit facilities totaled about $1.25

5 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

billion and investment-grade bonds maturing over the next twelve months amounted to approximately $11.8 billion (although creditfacilities may be unavailable in times of stress).

We recognize the stability of the majority of the company's liabilities as well as the substantial liquidity available in the investmentportfolio. Therefore, we have moved the adjusted score on this factor to Aaa, from the unadjusted scorecard result of Aa.

FINANCIAL FLEXIBILITY: Aa - LOW FINANCIAL LEVERAGE, BUT MUTUALS ARE UNABLE TO ISSUE EQUITY

On a GAAP basis, the company's financial leverage was 12.3% as of year-end 2016, and total leverage, which excludes Moody's equitycredit treatment for the company's surplus notes and includes operating debt, was 13.5%. The company's nearly $2 billion of surplusnotes receive 25% equity credit in accordance with Moody's hybrid methodology, which is factored into the adjusted financial leveragecalculation. We expect adjusted leverage and total leverage in 2017 to be in the same range as year-end 2016. The adjusted financialleverage and total leverage metrics are consistent with Aaa ratings.

Average earnings coverage of 15.5x over the past five years is consistent with the metrics expected for Aaa-rated companies. However,because competitive pressure has been depressing one-year coverage ratios from the 16x-18x range since 2014, we expect the five-yearratio to decline over time, as well, albeit still in the high Aa-Aaa range. We also expect New York Life's adjusted financial leverage willremain below 20%. However, as a mutual company, New York Life's lack of ready access to the public equity markets somewhat limitsits financial flexibility. As a result, we have lowered this factor score to Aa from the unadjusted score of Aaa.

Exhibit 3

Financial Flexibility

0x

2x

4x

6x

8x

10x

12x

14x

16x

18x

20x

0%

2%

4%

6%

8%

10%

12%

14%

16%

2012 2013 2014 2015 2016

Earnin

gs Coverage (1 yr.)

Leve

rage

Financial Leverage Total Leverage Earnings Coverage (1 yr.)

Source: Moody's Investors Service and Company Filings

Other ConsiderationsNew York Life has a very strong commitment to serving its policyholders, and writes primarily business that provides risk sharing withits customers through dividend-paying products. Its branding and consumer marketing is tightly linked with its participating productfocus and commitment to policyholder value and financial strength.

Considering its generally conservative investment philosophy, together with its emphasis on the sale of dividend-paying products,New York Life presents very conservative business and financial profiles, and the company's management does not stray from its corepolicyholder oriented principles, which align well with creditor interests.

Although some aspects of the company's credit profile are directly captured by the key rating factors, the additional benefit from thecompany's deeply ingrained focus on financial strength, policyholder value, and overall conservative management philosophy results ina one-notch uplift, raising the company's IFS rating to Aaa from the adjusted scorecard rating of Aa1.

Liquidity AnalysisNew York Life's debt consists of two issues of surplus notes, $992 million and $998 million, maturing in 2033 and 2039, respectively.In addition to its own direct debt, New York Life's subsidiary, New York Life Capital Corporation (NYL Capital) issues commercial paper.NYL Capital benefits from explicit support from its parent (albeit only to maintain its tangible net worth at at least $1). Its $2.5 billion

6 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

commercial paper (CP) program is rated Prime-1 (P-1) and the program is available for spread arbitrage opportunities and occasionallyused for liquidity management.

The average amount of CP outstanding in Q2 2017 was approximately $504 million, with a maximum of $504 million outstandingduring the quarter, and approximately $504 million outstanding as of June 30, 2017.

NYL Capital Corp's CP program is backed by a $1.25 billion five-year bank credit facility which matures in April 2021. The bank facilitydoes not contain a material adverse change (MAC) clause, and the financial covenants in the bank facility are not restrictive and arequite manageable for the company.

ProfileNew York Life Insurance Company (New York Life) and its affiliated entities provide individuals and businesses with life insuranceproducts, annuities, long-term care insurance, pension products, mutual funds, and a variety of investment products and services.

According to the Life Insurance Marketing and Research Association (LIMRA), New York Life was among the largest sellers of lifeinsurance products in the US for the year ended 31 December 2016. In addition to NYLIC, the other principal US life affiliate in thegroup is New York Life Insurance and Annuity Corporation (NYLIAC).

New York Life’s primary asset management subsidiary is New York Life Investment Management Holdings LLC (NYLIM). IncludingNYLIM’s affiliates, the company had approximately $538 billion in assets under management, as of 31 December 2016.

Historically, New York Life participated in the global insurance market, with operations in Asia (China, Hong Kong, India, South Korea,Taiwan and Thailand) and Latin America (Mexico and Argentina). Beginning in 2010, it began the process of divesting itself of most ofthose operations, and now focuses on its US and Mexican insurance and investment operations.

7 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

Rating Methodology and Scorecard Factors

Exhibit 4

Financial Strength Rating Scorecard [1][2] Aaa Aa A Baa Ba B Caa Score Adjusted Score

Aa Aa

Market Posit ion and Brand (15%) Aa Aaa

- Relative Market Share Ratio X

Distribut ion (10%) A Aa

- Distribution Control X

- Diversity of Distribution X

Product Focus and Diversificat ion (10%) Aa Aa

- Product Risk X

- Life Insurance Product Diversification X

Financial Profile Aa Aa

Asset Quality (10%) A Aa

- High Risk Assets % Shareholders' Equity 108.0%

- Goodwill & Intangibles % Shareholders' Equity 26.2%

Capital Adequacy (15%) Aa Aa

- Shareholders' Equity % Total Assets 9.4%

Profitability (15%) Aa Aa

- Return on Capital (5 yr. avg) 5.6%

- Sharpe Ratio of ROC (5 yr. avg) 485.7%

Liquidity and Asset/Liability Management (10%) Aa Aaa

- Liquid Assets % Liquid Liabilities X

Financial Flexibility (15%) Aaa Aa

- Financial Leverage 12.3%

- Total Leverage 13.5%

- Earnings Coverage (5 yr. avg) 15.5x

- Cash Flow Coverage (5 yr. avg)

Operat ing Environment Aaa - A Aaa - A

Aggregate Profile Aa3 Aa1

Source: Moody's Investors Service and Company Filings

Ratings

Exhibit 5Category Moody's RatingNEW YORK LIFE INSURANCE COMPANY

Rating Outlook STAInsurance Financial Strength AaaSurplus Notes Aa2 (hyb)

NEW YORK LIFE INSURANCE & ANNUITYCORPORATION

Rating Outlook STAInsurance Financial Strength Aaa

Source: Moody's Investors Service

8 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

© 2017 Moody’s Corporation, Moody’s Investors Service, Inc., Moody’s Analytics, Inc. and/or their licensors and affiliates (collectively, “MOODY’S”). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND ITS RATINGS AFFILIATES (“MIS”) ARE MOODY’S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDITRISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND MOODY’S PUBLICATIONS MAY INCLUDE MOODY’S CURRENT OPINIONS OF THERELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES. MOODY’S DEFINES CREDIT RISK AS THE RISK THAT AN ENTITYMAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGSDO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODY’SOPINIONS INCLUDED IN MOODY’S PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL FACT. MOODY’S PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVEMODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY MOODY’S ANALYTICS, INC. CREDIT RATINGS AND MOODY’SPUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS AND MOODY’S PUBLICATIONS ARE NOT AND DO NOTPROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS NOR MOODY’S PUBLICATIONS COMMENT ON THESUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODY’S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY’S PUBLICATIONS WITH THE EXPECTATIONAND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FORPURCHASE, HOLDING, OR SALE.

MOODY’S CREDIT RATINGS AND MOODY’S PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FORRETAIL INVESTORS TO USE MOODY’S CREDIT RATINGS OR MOODY’S PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACTYOUR FINANCIAL OR OTHER PROFESSIONAL ADVISER. ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW,AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTEDOR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANYPERSON WITHOUT MOODY’S PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODY’S from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as wellas other factors, however, all information contained herein is provided “AS IS” without warranty of any kind. MOODY'S adopts all necessary measures so that the information ituses in assigning a credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However,MOODY’S is not an auditor and cannot in every instance independently verify or validate information received in the rating process or in preparing the Moody’s publications.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for anyindirect, special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use anysuch information, even if MOODY’S or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses ordamages, including but not limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of aparticular credit rating assigned by MOODY’S.

To the extent permitted by law, MOODY’S and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatorylosses or damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for theavoidance of doubt, by law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODY’S or any of its directors, officers, employees, agents,representatives, licensors or suppliers, arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCHRATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY’S IN ANY FORM OR MANNER WHATSOEVER.

Moody’s Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moody’s Corporation (“MCO”), hereby discloses that most issuers of debt securities (includingcorporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moody’s Investors Service, Inc. have, prior to assignment of any rating,agreed to pay to Moody’s Investors Service, Inc. for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintainpolicies and procedures to address the independence of MIS’s ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO andrated entities, and between entities who hold ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually atwww.moodys.com under the heading “Investor Relations — Corporate Governance — Director and Shareholder Affiliation Policy.”

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODY’S affiliate, Moody’s InvestorsService Pty Limited ABN 61 003 399 657AFSL 336969 and/or Moody’s Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intendedto be provided only to “wholesale clients” within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, yourepresent to MOODY’S that you are, or are accessing the document as a representative of, a “wholesale client” and that neither you nor the entity you represent will directly orindirectly disseminate this document or its contents to “retail clients” within the meaning of section 761G of the Corporations Act 2001. MOODY’S credit rating is an opinion asto the creditworthiness of a debt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available to retail investors. It would be recklessand inappropriate for retail investors to use MOODY’S credit ratings or publications when making an investment decision. If in doubt you should contact your financial or otherprofessional adviser.

Additional terms for Japan only: Moody's Japan K.K. (“MJKK”) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moody’sOverseas Holdings Inc., a wholly-owned subsidiary of MCO. Moody’s SF Japan K.K. (“MSFJ”) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a NationallyRecognized Statistical Rating Organization (“NRSRO”). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by anentity that is not a NRSRO and, consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registeredwith the Japan Financial Services Agency and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferredstock rated by MJKK or MSFJ (as applicable) have, prior to assignment of any rating, agreed to pay to MJKK or MSFJ (as applicable) for appraisal and rating services rendered by it feesranging from JPY200,000 to approximately JPY350,000,000.

MJKK and MSFJ also maintain policies and procedures to address Japanese regulatory requirements.

REPORT NUMBER 1085717

9 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable

MOODY'S INVESTORS SERVICE FINANCIAL INSTITUTIONS

Contacts

Laura Bazer 212-553-7919VP-Sr Credit [email protected]

Marc R. Pinto, CFA 212-553-4352MD-Financial [email protected]

CLIENT SERVICES

Americas 1-212-553-1653

Asia Pacific 852-3551-3077

Japan 81-3-5408-4100

EMEA 44-20-7772-5454

10 1 August 2017 New York Life Insurance Company: Update following rating affirmation at Aaa stable