Nestlé India

-

Upload

udita-dasgupta -

Category

Documents

-

view

387 -

download

0

Transcript of Nestlé India

Nestle India:

Economic analysis of the brand

Submitted by: UDITA DASGUPTA

Acknowledgement and declaration:

The project shows an extensive economic analysis of the brand nestle. The study mainly focuses on the demand analysis of the nestle products. The brand holds some huge range of products from the milk products, chocolates and confectionary to beverages and many more. The study discusses about the fmcg line of products and their demands in various parts of the world.

The study has mainly considered the secondary data. The study has considered the total fmcg chain and it is not restricted to any market or product. In case of any limitations, author solemnly seeks for the forgiveness of the reader.

Moreover a lot of research and hardwork is been invetsed in this report and is completely a work of individual effort and no other report ahs any resemblance with this report.

The author would like to snatch the opportunity to thank the people without whom this project would have been a distant dream. Heartiest thank to my teacher Dr. Renita Dubey who has always been with her students to help out with the project when ever required.

sincerely:udita dasgupta

Table of contents

Serial no. List of the content Page no.1. VISION OF NESTLE

2. MISSION OF NESTLE3. INTRODUCTION OF THE

ORGANIZATION4. HISTORY OF THE

ORGANISATION5. PRODUCT LINE OF NESTLE6. DEMOGRAPHIC TRENDS7. FIVE FORCE ANALYSIS8. SWOT ANALYSIS9. MARKET STRATEGY10 INTERNATIONAL STRATEGY11. COMPETITORS12. PROPOSED STRATEGY PLAN

FOR NESTLE13. MARKET STATISTICS

SINCE200514. EARNING, JOINT VENTURE,

ETHICAL AND EFFORTS 15. MARKETING OF FORMULA

16. NESTLE SUPPLY CHAIN, DEMAND FUNCTION

17. CONCLUSION18. BIBLOGRAPHY

Vision of nestle:

“Nestlé's aim is to meet the various needs of the consumer everyday by marketing and selling foods of a consistently high quality.”

Mission of nestle:

“We strive to bring consumers foods thatare safe, of high quality and provideoptimal nutrient to meet physiologicalneeds. Nestle helps provide selections for all individual taste and lifestylepreferences.”

Introduction of the organization:

Nestle is the world's largest food and beverage company. ]Nestle owns several

major consumer brands such as Stouffers, Nescafe, Kit-Kat, Carnation, Nestle

Water, and many others.[2] All in all, 30 of Nestle's products earned 1 billion CHF

or more during 2010, making Nestle a major force in the global food and beverage

industry.[3] Nestle competes with companies such as Uniliver NV(UN),Hershey

Foods(HSY),Kraft Foods(KFT),Cadbury Schiweppes(CGS), and GROUPE

DANONE(DA) in the packaged food market. With only 42% of its food and

beverage sales coming from North America, Nestle is one of the most

geographically diverse of the major food and beverage companies. In FY 2010,

Nestle generated revenues of CHF 104.6B ($121.1B USD) and net earnings of CHF

9.05B ($10.5B USD).

Although it already occupies the top spot in terms of sales, Nestle is attempting to

continue sales and margin growth by increasing the nutritional value of its

products and expanding into new areas of therapeutic foods for people with

various illnesses. The company's stated goal is to transform itself from a food

manufacturer to the world's leading nutrition, health, and wellness company.[ In

2010, Nestle created a subsidiary that will create food-based products meant to

help prevent and treat various medical conditions such as heart disease and

diabetes

Nestlé India is a subsidiary of Nestlé S.A. of Switzerland. With seven factories and

a large number of co-packers, Nestlé India is a vibrant Company that provides

consumers in India with products of global standards and is committed to long-

term sustainable growth and shareholder satisfaction.

The Company insists on honesty, integrity and fairness in all aspects of its

business and expects the same in its relationships. This has earned it the trust and

respect of every strata of society that it comes in contact with and is

acknowledged amongst India's 'Most Respected Companies' and amongst the

'Top Wealth Creators of India'.

The Company continuously focuses its efforts to better understand the changing

lifestyles of India and anticipate consumer needs in order to provide Taste,

Nutrition, Health and Wellness through its product offerings. The culture of

innovation and renovation within the Company and access to the Nestlé Group's

proprietary technology/Brands expertise and the extensive centralized Research

and Development facilities gives it a distinct advantage in these efforts. It helps

the Company to create value that can be sustained over the long term by offering

consumers a wide variety of high quality, safe food products at affordable prices.

Nestlé India is a responsible organization and facilitates initiatives that help to

improve the quality of life in the communities where it operates.

History of the organization:

Nestlé’s relationship with India dates back to 1912, when it began trading as The

Nestlé Anglo-Swiss Condensed Milk Company (Export) Limited, importing and

selling finished products in the Indian market.

After India’s independence in 1947, the economic policies of the Indian

Government emphasized the need for local production. Nestlé responded to

India’s aspirations by forming a company in India and set up its first factory in

1961 at Moga, Punjab, where the Government wanted Nestlé to develop the milk

economy. Progress in Moga required the introduction of Nestlé’s Agricultural

Services to educate advice and help the farmer in a variety of aspects. From

increasing the milk yield of their cows through improved dairy farming methods,

to irrigation, scientific crop management practices and helping with the

procurement of bank loans. Nestlé set up milk collection centres that would not

only ensure prompt collection and pay fair prices, but also instill amongst the

community, a confidence in the dairy business. Progress involved the creation of

prosperity on an on-going and sustainable basis that has resulted in not just the

transformation of Moga into a prosperous and vibrant milk district today, but a

thriving hub of industrial activity, as well.

The Company started milk collection in Moga in 1961 with a collection of 511 Kgs

of milk from 180 farmers. It has substantially expanded its operations with over

85,000 farmers in its own milk district. Nestlé uses local raw materials and

develops local resources wherever possible. Milk Collection Centers with farm

cooling tanks to preserve the quality of milk were established by the Company.

After nearly a century-old association with the country, today, Nestlé India has

presence across India with 7 manufacturing facilities and 4 branch offices spread

across the region.

Nestlé India’s first production facility, set up in 1961 at Moga (Punjab), was

followed soon after by its second plant, set up at Choladi (Tamil Nadu), in 1967.

Consequently, Nestlé India set up factories in Nanjangud (Karnataka), in 1989, and

Samalkha (Haryana), in 1993. This was succeeded by the commissioning of two

more factories - at Ponda and Bicholim, Goa, in 1995 and 1997 respectively. The

seventh factory was set up at Pantnagar, Uttarakhand, in 2006.

The 4 branch offices in the country help facilitate the sales and marketing of its

products. They are in Delhi, Mumbai, Chennai and Kolkata. The Nestlé India head

office is located in Gurgaon, Haryana.

Nestlé has been a partner in India's growth for over nine decades now and has

built a very special relationship of trust and commitment with the people of India.

The Company's activities in India have facilitated direct and indirect employment

and provides livelihood to about one million people including farmers, suppliers

of packaging materials, services and other goods.

Product line of the fmcg

Nestlé India manufactures products of truly international quality under

internationally famous brand names such as NESCAFÉ, MAGGI, MILKYBAR, MILO,

KIT KAT, BAR-ONE, MILKMAID and NESTEA and in recent years the Company has

also introduced products of daily consumption and use such as NESTLÉ Milk,

NESTLÉ SLIM Milk, NESTLÉ Fresh 'n' Natural Dahi and NESTLÉ Jeera Raita. Nestle is

divided into eight units, of which at least four contributed more than 10% to

annual sales. This speaks to not only the company's diverse interests, but also its

strength in each of the respective markets. The four units are as follows.

Dairy products:

Nestlé India has a wide portfolio for Milk Products and Nutrition. Nestlé has a very

clear Charter of ethics and responsible behavior in selling infant nutrition

products.

Milk Products, Nutritional, and Ice Cream was Nestle's largest segment. It includes

the Carnation, Coffee Mate,Dreyer's, and Edy's brands among many others.

Nestle's milk and ice cream brands compete with products such as Brever ice and

store brands. Their nutritional products include Gerber Brand baby food and

Nestle brand yogurts. Nestle's nutritional products compete against brands such

as Dannon Yogurt and store brands. The company's Nutrition segment became

part of Nestle HealthCare Nutrition in early 2011 and will report under this wholly

owned subsidiary in the future.

Nestlé India follows this Charter and also complies with The Infant Milk

Substitutes, Feeding Bottles and Infant Foods (Regulation of Production, Supply

and Distribution) Act, 1992 that guides the sale of infant nutrition products in

India. Nestlé India does not advertise it’s Infant Nutrition products.

List of the dairy products is as follows:

NESTLE EVERYDAY dairy whitener

NESTLE milk

NESTLE slim milk

NESTLE dahi

NESTLE EVERYDAY ghee

NESTLE slim dahi

NESTLE bhuna jeera raita

NESTLE NESVITA Dahi

NESTLE real fruit yoghurt

NESTLE creamy vanilla

NESTLE MILKMAID

NESTLE NESLAC

NESTLE ACTIPLUS

NESTLE stay healthy

Beverages:

Beverages is the second-largest segment after Milk Products, Nutritional and Ice

Cream. Nestle owns several international beverage brands

includingNescafe, Nesquick, Nestea, and Nestle Waters, each of which generated

more than 1 billion CHF in 2007. With more than 400 factories around the world,

Nestle is able to formulate each product to local tastes; "Nescafe" in Switzerland

has a different recipe to the same product sold in the USA. Nestle's strong brand

recognition helps them compete with other brands such as Maxwell house,lipton,

and evian as well as various store brands.

The combination of the recession and upper class consumers' increased

environmental consciousness has lead many customers to cut back on bottled

water in favor of tap water and reusable containers. Industry experts don't expect

bottled water to bounce back anytime soon, and the trend may expand beyond

the US.

Beverages include the very famous NESCAFE instant coffee. NESCAFÉ CLASSIC has

the unmistakable taste of 100% pure coffee and is made from carefully selected

coffee beans picked from the finest plantations, blended and roasted to

perfection. Tag line being “100% coffee.. 100% pleasure...”.

However the other products among the beverages of nestle are:

NESCAFE CLASSIC NESCAFE SUNRISE premium NESCAFE SUNRISE special NESCAFE CAPPUCCINO NESCAFE ICED TEA WITH GREEN TEA NESCAFE ICEDTEA NESCAFE instant hot tea mixes NESCAFE 3in1

Prepared dishes and cooking dishes:

This product line includes the very popular MAGGI. MAGGI 2minutes noodles is

one of the largest and most loved food brands in india. The 2-MINUTE Noodles

range is now available in 6 delectable flavours : Masala, Chicken, Tricky Tomato,

Thrillin Curry, Romantic Capsica, and the all New Guess the Taste Noodles. Each

Pack of MAGGI Noodles also provides Protein & Calcium which are essential

nutrients at all stages of life. 85g of MAGGI Masala Noodles meets 13% RDA* of

Protein and 21% RDA* of calcium for adults.

Nestle's Prepared Dishes and Cooking Aides segment consists mostly of products

that are designed to be ready to eat very quickly, such as microwave lasagna.

[14] Nestle owns brands such as Stouffer's, Lean Cuisine, Hot Pockets, andMaggi.

Nestle has increased the nutritional value of its prepared dishes in order to

compete with products such asDiGiorno, Bertoli, and Kraft Macaroni and Cheese.[15] In 2010, Nestle bought Kraft's frozen pizza business for $3.7 billion.[16] The

purchase added the DiGiorno, Tombstone, Jack's and Delissio brands to Nestle's

stable of products, as well as the license to sell California Pizza Kitchen frozen

pizza. With this acquisition added to Nestle's existing product line, the company

increased its market share to 33% of North American frozen foods

Chocolates and confectionery:

Nestle's Confectionery segment includes confectionery brands include Kit-

Kat and Nestle chocolate. The Nestle Chocolate brand produces famous products

such as Baby Ruth and Nestle Crunch.Nestle's confectionery products compete

with chocolates and candies from Hershey foods and Cadbury

schweppes (recently purchased by Kraft Foods (KFT) and snacks from

manufacturers such as Kraft Foods (KFT), as well as various store brands.

With Kraft Foods (KFT)' purchase of Cadbury in January 2010, Nestle dropped to

the third largest chocolatier.Nestle has its huge range of products in chocolates

and confectionery segment.they are as follows:

NESTLE KITKAT NESTLE MUNCH NESTLE MUNCH POP CHOC NESTLE MILKY BAR NESTLE MILKYBAR CHOO NESTLE BAR-ONE NESTLE MILK CHOCOLATE NESTLE ECLAIRS POLO NESTLE MILKY BAR ECLAIRS NESTLE MILKYBAR CRISPY WATER NESTLE DARK CHOCOLATE POLO-HOLE NEW FASHION

Demographic trends:The market for nestle is targeted nearly all age from young to old people in the

entire six continent. Nestle has served with products like baby products, coffee,

dairy products, boiled water, ice-cream, etc. So the products are very basic in

nature and serve the people from a child to an old man on death bed. The nestle

brand has emerged out to be such a trusted brand, that people all the continents

has faith in this and nestle thus serves worldwide.

Five force model:

Let us consider the five force analysis model of this brand nestle.

New entrants:

The market is completely open and there are so many multinational companies

and domestic companies those who joins the market and exits the market. Thus

there always remains the high pressure in the market and constant monitoring of

the market should be done.

Substitute:

There are so many diversified products of nestle that each segment has its own

substitute. Nestle however is such a brand and the brand positioning of nestle has

been done in such a good manner that it is tough to give nestle a jerk. However

there is always an average pressure on the firm since the market has a free entry

and exit point. However there are so many competitors who create substitutes to

nestle products. They are Britannia, Kohinoor foods, vadilal Ind, Kwality dairy, ADF

foods, and many more.

Suppliers:Nestle has an fmcg product line. Hence whenever the suppliers are concerned,

the few factors that remain very conventional are the contracts with the farmers,

stable suppliers and the other raw material suppliers.

Buyers:The customer demand is something that always needs to be addressed with full

sincerity as any business stands high in the market only on the basis of the

customer strength. The demand issues must be addressed immediately. The

taste and preferences of the customers should be on the priority list of the

company. Innovative ways should be modeled to attract more and more

customers.

Swot analysis:

strength : Their first is that they have a great CEO, Peter Brabeck. Brabeck

emphasizes internal growth, meaning he wants to achieve higher volumes by

renovating existing products, and innovating new products. His explanation of

renovation is that “to just keep pace in the industry, you need to change at least

as fast as consumer expectations.”(Hitt, 2005) And his explanation of innovation is

“to maintain a leadership position, you also need to leapfrog, to move faster and

go beyond what consumers will tell you.” Brabeck has led Nestle into a position to

better achieve the internal growth targets with his. Another strength that Nestle

has is that they are low cost operators. This allows them to not only beat the

competition by producing low cost products, but by also edging ahead with low

operating costs.

Weakness: The main weakness of the LC-1 division of Nestle is that they were not

as successful as they thought they would be in France. The launch in France was

in 1994, but since the late 1980s, Danone had already entered the market with a

health-based yogurt. The second weakness is that LC-1 was positioned as too

scientific, and consumers didn’t quite understand that LC-1 was a food and not a

drug.

Nestle also has multiple critical resources. They have a great research and

development team. James Gallagher and Andrea Pfeifer were the masterminds

behind the research on the La-1 cultures in the LC-1 yogurt. They were also the

two that decided on selling LC-1 as a functional food. This enabled Nestle to

position the product in a way that differentiated it among the other products in

the market. They also have four pillars that Brabeck, Nestle’s CEO has identified

he believes will help their internal growth worldwide. These are operating

excellence, innovation and renovation, product availability, and communication.

One opportunity that Nestle has is that health-based products are becoming

more popular in the world, including in the United States. Consumers are

becoming more health conscious, and realize that living longer isn’t only by luck

and genetics. LC1 has not been introduced in the United States yet. Nestle also

has an opportunity of being even a larger market leader in Germany with LC-1.

Within two years of launching the product in Germany, they had captured 60% of

the market. This was due to the fact that they differentiated the product, and

Germans simply preferred the taste. Another opportunity of LC1 is that, because

they are a market leader, they can introduce more health-based products in

Germany.

A threat to Nestle is the fact that some markets they are entering are already

mature. Danone had an established leadership position in the yogurt market in

France. Since Danone was the first to arrive in the market, they have always been

the market leader there. Also consumers in France liked the taste of LC-1, but

researchers believe they did not repurchase the yogurt because they preferred

the taste of Danone products better. Another threat to Nestle is that there is

intense competition in the United States yogurt market. General Mills’ Yoplait

division is the leader in the yogurt market in the United States. Yoplait has been

the leader for years and is constantly innovating new health products.

General Mills has been a strong competitor of Nestle and they are not short of

experience and strength. One strength that they have is their brand recognition.

One of their main goals has been to deliver brands that consumers trust and value

and they have succeeded. Another strength they have is their distribution. Yoplait

is distributed to more stores in the United States than any other brand of yogurt.

This is one of the reasons why they have been the market leader in yogurt for so

long. Another strength that General Mills has is the fact that consumers simply

know Yoplait is healthy. Yoplait is the only leading brand of yogurt to offer vitamin

D and this vitamin is especially important for adult women.(Yoplait.com) It is not

just a coincidence that Yoplait has vitamin D, but they have purposely added this

vitamin to target female consumers.

General Mills also has some weaknesses. They fact that they are the market

leader in the United States may be hindering them from innovation. They have

been producing Yoplait yogurt for many years, and have offered a series of new

products in the past few years in the nutrition department. Most of these

products however, are very common, and are widely offered in the United States.

The health food industry in the United States has been booming and General Mills

does not offer enough products in the smaller niche markets. They have not

entered into many unknown areas because of their success in the yogurt market.

An opportunity General Mills has is that its Yoplait division is so successful. Yoplait

is the only division of General Mills that is currently earning a profit. They have a

large market share over their main competitors in the yogurt market. Another

opportunity that they share with Nestle is that the health-based and nutritional

food market is booming. They are continually releasing and marketing new

products in these markets and they will continue to do so while the market

continues to yield profits.

The main threat that challenges General Mills is that there is intense competition

amongst the top players in the yogurt and related markets. Nutrition and health is

becoming more and more important to consumers in the United States, and

worldwide. Along with this comes increased competition to gain market share.

Simple supply and demand theories are prevalent in these markets. Another

threat General Mills has is that smaller companies are producing similar products

with the same or added nutritional benefits.

Market strategy:

Nestlé describes itself as a food, nutrition, health, and wellness company.

Recently they created Nestlé Nutrition, a global business organization designed to

strengthen the focus on their core nutrition business. They believe strengthening

their leadership in this market is the key element of their corporate strategy. This

market is characterized as one in which the consumer’s primary motivation for a

purchase is the claims made by the product based on nutritional content.

In order to reinforce their competitive advantage in this area, Nestlé created

Nestlé Nutrition as an autonomous global business unit within the organization,

and charged it with the operational and profit and loss responsibility for the

claim-based business of Infant Nutrition, HealthCare Nutrition, and Performance

Nutrition. This unit aims to deliver superior business performance by offering

consumers trusted, science based nutrition products and services.

The Corporate Wellness Unit was designed to integrate nutritional value-added in

their food and beverage businesses. This unit will drive the nutrition, health and

wellness organization across all their food and beverage businesses. It

encompasses a major communication effort, both internally and externally, and

strives to closely align Nestlé’s scientific and R&D expertise with consumer

benefits. This unit is responsible for coordinating horizontal, cross-business

projects that address current customer concerns as well as anticipating future

consumer trends.

International strategy:

Nestlé is a global organization. Knowing this, it is not surprising that international

strategy is at the heart of their competitive focus. Nestlé’s competitive strategies

are associated mainly with foreign direct investment in dairy and other food

businesses. Nestlé aims to balance sales between low risk but low growth

countries of the developed world and high risk and potentially high growth

markets of Africa and Latin America. Nestlé recognizes the profitability

possibilities in these high-risk countries, but pledges not to take unnecessary risks

for the sake of growth. This process of hedging keeps growth steady and

shareholders happy.

When operating in a developed market, Nestlé strives to grow and gain

economies of scale through foreign direct investment in big companies. Recently,

Nestlé licensed the LC1 brand to Müller (a large German dairy producer) in

Germany and Austria. In the developing markets, Nestlé grows by manipulating

ingredients or processing technology for local conditions, and employ the

appropriate brand. For example, in many European countries most chilled dairy

products contain sometimes two to three times the fat content of American

Nestlé products and are released under the Sveltesse brand name.

Another strategy that has been successful for Nestlé involves striking strategic

partnerships with other large companies. In the early 1990s, Nestlé entered into

an alliance with Coca Cola in ready-to-drink teas and coffees in order to benefit

from Coca Cola’s worldwide bottling system and expertise in prepared beverages.

European and American food markets are seen by Nestlé to be flat and fiercely

competitive. Therefore, Nestlé is setting is sights on new markets and new

business for growth.

In Asia, Nestlé’s strategy has been to acquire local companies in order to form a

group of autonomous regional managers who know more about the culture of the

local markets than Americans or Europeans. Nestlé’s strong cash flow and

comfortable debt-equity ratio leave it with ample muscle for takeovers. Recently,

Nestlé acquired Indofood, Indonesia’s largest noodle producer. Their focus will be

primarily on expanding sales in the Indonesian market, and in time will look to

export Indonesian food products to other countries.

Nestlé has employed a wide-area strategy for Asia that involves producing

different products in each country to supply the region with a given product from

one country. For example, Nestlé produces soy milk in Indonesia, coffee creamers

in Thailand, soybean flour in Singapore, candy in Malaysia, and cereal in the

Philippines, all for regional distribution.

Competitors:

Within the industry of yogurt, there are many players in the market. The most

dominant brand name players inside the United States are Dannon, Stonyfield

Farm, and Yoplait. Yoplait, of General Mills, is the number one yogurt in the

United States. They own 37% of the market share through their different brands,

including the Colombo brand. Stonyfield Farm owns 6% of the market share, and

Dannon is right behind Yoplait taking 31% of the market share. Yoplait is the most

prominent player within the market today. General Mills, Inc. has the leading

yogurt company in the United States. Competing in a $2.9 billion industry, they

contain the highest market share amongst their competitors.

General Mills, Inc. has become one of the world’s most trusted brands since their

birth in 1860. General Mills simply began as a milling company, which began in

the Mississippi River. They started with two flourmills and grew to become one of

the largest, most trusted brands in the world. General Mills has become a

prosperous and diverse company that has strived to provide innovative products

to their customers continually throughout the years.

General Mills has six different strategic business units within their company. It

consists of the Big G, Meals, Pillsbury, Baking Products, Snacks, and Yogurt. The

Big G is the cereal division of General Mills; they hold big name brands such as

Cheerios, Chex, and Total. The Meals division has products like Hamburger

Helper, Progresso Soups, and Green Giant. The Pillsbury division was acquired by

General mills and is the leading company within the refrigerated dough market.

The Baking Products division is the home of Betty Crocker, Bisque, and Gold

Medal products. The Snacks division, who holds the top market positions, has

several brands from Fruit Roll-Ups to Nature Valley. Lastly, the yogurt division

runs Yoplait, the number one yogurt within the industry and Colombo.

General Mills operates internationally mainly through

joint ventures, but also through acquisitions. Throughout the years General Mills

has acquired Pillsbury, which is still in the works, and Green Giant. General Mills

also has several joint ventures throughout the world. General Mills has a 50 –50

joint venture with Nestlé in the cereal division where their products are available

in more than 130 countries throughout the world. General Mills also works with

PepsiCo in a joint venture in the snack division. The successful joint ventures have

allowed the companies to share their resources and capabilities to gain a lucrative

competitive advantage. General Mills functions horizontally using the acquisitions,

mergers, and alliance technique. This allows the company as a whole to gain more

market power and coverage throughout the world.

General Mills is a related-linked company. Out of their six separate divisions, none

of them produce more than 70% of the profits. Every division runs within the food

industry, where the products are sold internationally and to foodservice

operators, retailers and wholesalers.

General Mill’s profit has decreased, but Yoplait has carried the company through

some rough times within the last year. Being one of the only divisions pulling

through with a profit and over exceeding the company’s expectations Yoplait has

really made a name of itself. Yoplait has become the star brand for General Mills,

becoming the new core business for the company. In 2004, Yoplait’s unit volume

grew 10%, which is five times more then the Big G division, who used to be

General Mills core division. Over the past decade yogurt sales have increased on

average 9% per year. But studies have shown that household penetration is very

low, so there is a lot more room for growth.

Yoplait is a first-mover in the yogurt industry. They have offered many new

innovative products to their consumers from Go-GURT to their Nouriche

Smoothies. Within the last year of introducing Nouriche, the product’s sales have

increased by 35%. Yoplait just recently began offering a yogurt that contained

sterols, which is a cholesterol-lowering plant. Yoplait Healthy Heart was

introduced in February of 2005 during women’s heart health month. Yoplait

joined with Cergill, Inc. whom manufactures the plant sterols in a horizontal

alliance. Yoplait healthy heart is the latest addition to their line of yogurts.

The full line of products that Yoplait offers today is wide and diverse. They offer a

yogurt line that consists of the original yogurt, grande, whipped, light, and ultra

light. Yumpsters is a line for younger children, which includes a spoon attached to

their yogurt. Go-GURT has become the yogurt for those that are on the go and

always in a rush, which is also available in smoothie form as well. Yoplait created

the first ever yogurt placed in a tube. Lastly, they offer Nouriche Smoothies, which

are rich in calcium, protein, and fiber. Their products come in many different

flavors and sizes to satisfy their customers.

Yoplait offers their customers a way to live a healthier lifestyle through their

products. Yoplait is the leading brand, which has the largest amount of Vitamin D

offerings in their yogurt compared to any other yogurt brand. They also offer

ways to lose weight, the lower your cholesterol, and how to keep your heart

healthy.

Yoplait has been successful by using the focus business-level strategy. This has

allowed the division to take specific action to attack the specific segments of the

market. The have found niches for each line of yogurt product they offer. Yoplait

has mainly aimed their products specifically at women, children, and dieters.

Yoplait, for the most part, focuses on health to appeal to their consumers, and

has been successful at it. Recently, Yoplait stated that yogurt may help burn fat,

to aim at the diet customers. Yoplait has effectively positioned their products as

being portable and convenient, having a number of different health benefits, and

the flexibility to eat yogurt any time of the day. From their healthy heart products

to their ultra light yogurt to Go-GURT, Yoplait has focused each product to

separate niches of the market to become the leading yogurt brand in the United

States.

Proposed strategy plan for nestle:

Nestlé is one of the largest and most successful food companies in

the world. It has successfully introduced many new products into many different

segments of the food and beverage industry. Nestlé possess a product, LC1, which

is innovative, fairly new in the North American perspective, provides healthy

benefits for the consumer, while offering a new avenue for profits for Nestlé.

Nestlé, with its probiotic cultures found in its LC1 product, has an innovation that

is ripe to be introduced into the North American market. Currently LC1 is

primarily offered in Japan and Germany in the form of yogurts, with great degrees

of success. Unfortunately LC1 yogurts were unsuccessful in a number of European

markets, including France and The United Kingdom.

A LC1 powder was introduced into the American market around 2000. The

powder was designed to be mixed into beverages and foods. It was sold at GNC

stores, primarily focusing on consumers who were already health conscious about

their eating habits. Nestlé used print ads, a direct mailing campaign, a smaller

scale campaign targeted at health practitioners, and heavy Internet advertising

(www.herbs.org/current/nestlesup.html). Overall Nestlé’s LC1 powder went

larger unnoticed by the US consumer, and achieved only minimal results.

In designing a strategy that would effectively place Nestlé at the head of the

probiotic industry in North America market would require several key

components. First would be to decide what areas of the Food and Beverage

industry in which we would like to introduce Nestlé LC1 products. Second would

be to educate the North American consumers as to the benefits that the

probiotics possessed in LC1 brings. A strong marketing and advertising campaign

would accompany this. Third would be to quickly conduct all moves and enter

into each market as quickly as possible to gain maximum market share. Fourth

would be to reinvest all profits, over a predetermined amount of time, back into

operations, research and design, marketing and advertising to solidify consumer

trust, market power and market position. In achieving these components of

success we will be employing the six principals described in the book Sun Tzu and

the Art of Business by Mark McNeily.

The first principal brought forth in the book is to “Win All Without Fighting” or to

prioritize markets and determine competitor focus. Nestlé would need to figure

out what areas of the food and beverage industry they are already operating

strongly in and pinpoint some key products to introduce LC1 into. Nestlé is one of

the largest food companies in the world and offers a wide range of products

across many different areas of the food and beverage industry. Nestlé should

choose to incorporate LC1 into one strong performing product in each one of its

SBU’s. For instance they could introduce it into yogurts through their Dairy SBU,

cereals in their Cereal SBU, into chocolate bars in their Confectionary SBU, power

bars through their Nutrition SBU, baby formulas through their Baby Food SBU, pet

foods through their Pet care SBU, into ice cream through their Ice Cram SBU and

into their drinks through their Beverages SBU. Nestlé should choose one product

in each of these SBU’s to introduce to the market. This way there is wide area of

products with in different areas of the food and beverage industry in which the

LC1 product to bring a profit. So if the LC1 does well in certain areas of the

industry, but not another, Nestlé can shift its focus from the weak product to the

strong product. Introducing it to many different products in many different areas

of the food and beverage industry gives LC1 a better chance of achieving success.

Nestlé, already begin a diversified food and beverage company, has the benefit

being able to explore an option such as this.

Nestlé’s primary competition in introducing these products would be General

Mills. General Mills would offer competition in some areas of the industry but

perhaps could be an ally in others. Nestlé already has joint venture with General

Mills in the cereal industry. These may prove to be beneficial to the introduction

of LC1 into a wide variety of popular cereals that the two companies create and

distribute. But, it may prove to be a hindrance if General Mills wishes not help

due to competition strains that result from other areas of the food and beverage

industry.

The second principal is to “Avoid Strength/ Attack Weakness” or to develop

attacks against competitor’s weakness. A beneficial strength of Nestlé’s attacks is

that the probiotic market in North America is very small. In 1999 probiotics total

sales in North America were $67.2 million

(www.nutraceuticalsworld.com/Sept012.htm). Nestlé would have the benefit of

being a first mover or second mover in the industry. A primary weapon to Nestlé’s

introduction of LC1 products, with their probiotic benefits, would be high levels of

education through advertising and marketing. Nestlé had introduced LC1 in 2000

but to little success. According to Steve Allen, vice president, business

development, Nestlé USA, “Nestlé LC1 was too early for the U.S.; the benefits

were too general and the price/value relationship wasn’t there”

(www.nutraceuticalsworld.com/Sept012.htm). Education and consumer

understanding as to what probiotics are and the benefits they bring is the main

roadblock in LC1’s success.

According to Steve Allen: “What is holding us back in the U.S. is that the consumer

does not really have an explanation for probiotics because there is no vehicle or

preexisting knowledge on which to build”

(www.nutraceuticalsworld.com/Sept012.htm). Because probiotic are a form of

bacteria or a culture, trying to get the North American consumer market to agree

that LC1, a form of bacteria, can help them might prove to be difficult. Nestlé

might first want to focus on athletes, mothers of small children, senior citizens

and any other health conscious area of the food and beverage market in which to

market their LC1 products. Nestlé should highlight to them the benefits of using

their LC1 products, such as having an improved immune system or improved

digestive system. An area that limited LC1 success in other Europeans markets

was that some people viewed LC1 products as away to get better from a sickness,

or as a form of medicine. LC1 products are designed to be a sort of body

maintenance or even enhancement device and taken regularly. Nestlé should

stress the importance of LC1 products being similar to other health oriented foods

like nonfat milk or diet soda, which can and should be consumed daily.

In response to competitor attacks, Nestlé can rely on their reputation in European

and Asian markets where probiotics have being prevalent for a number of years.

LC1 has been widely popular in countries such as Germany, Italy and Japan.

Nestlé, being a first mover in most of these markets, can highlight the fact they

were hugely responsible for the development and creation of probiotic products

and probiotic markets in the world. They were the ones to create an example

which all other in the industry to follow. Nestlé can counter attacks on LC1

products in the North American markets with advertising campaigns that highlight

their success in foreign markets, using real person testimonials to bolster their

positions. Nestlé might also want to employee the help of professional athletes or

movie stars to be spokesmen for their products, in hopes of gaining consumer

support.

The third principal is “Deception and Foreknowledge” or war gaming and planning

for surprise. For this I feel Nestlé should use the implication wheel as a form of

war gaming. Because no other major food brand, including General Mills, has

probiotic products, the weakness that Nestlé would be attacking would the lack of

products that their competitors have to offer in the probiotic market. Nestlé’s first

attack should be to educate consumers to benefits of using probiotic products.

This educational campaign should be backed with scientific support and with

examples of success from the European market. It should be done through

advertisements on television, at prime time and during popular sports events

preferably, through the newspaper coupled with money saving coupons, and on

the internet through links with health food websites. Nestlé should highlight the

fact that while such things as obesity and fast food are slowly decreasing the

healthy and eating habits of North Americans, LC1 provides products that are

healthy, good tasting, which also help improve the body’s functions. It would

beneficial to LC1 success if popular athletes or movie stars were hired to endorse

the products.

Nestlé’s competitors may respond to these advertisements with their

advertisements that may down play or even deny the benefits of using LC1

products. They may play off the consumer’s misconception that all bacteria are

harmful to one’s health in an attempt to stir LC1 success. Competitors may

respond with advertisements that highlight LC1 lack of success in markets like

France or in the United States in 2000. The may wage an anti LC1 advertisement

campaign in hopes of slowing down any market share LC1 may gain from its

advertisement campaign or to support their own probiotic products. In response,

Nestlé should once again shift the consumers focus to their successes in European

markets, along with their history in the market and the breakthroughs in research

they have found to highlight the benefits of probiotic products in the course of

their operations.

Nestlé could use Sun Tzu’s fourth principal, “Shape Your Competition” or

integrate best attacks to unbalance the competition, to throw competitors off.

Because Nestlé is going to introduce LC1 products in several different areas of the

food and beverage industry, they could only advertise products in one or two

markets. Then as competitors design their defense in those particular markets,

Nestlé would unleash their overall product launch across all the predetermined

areas of the food and beverage industry. This should catch competitors off guard,

leaving them unprepared to defend against the scope of Nestlés attack. Nestlé

may choose not to focus a large amount of resources into the introduction of

products into markets in which they tricked their competitors into defend in.

Nestlé should then focus their resource in to markets where they had not

previously hinted they wished to enter into. These markets should be markets

where Nestlé already has strong performing products like their ice cream or

chocolate bar products.

This introduction of products should be done with Sun Tzu’s fifth principal in mind

which is “Speed and Preparation” or ready your attacks and release them. All

actions should be done quickly and following a schedule. Nestlé’s initial hints of

wanting to enter into the probiotic market should be made know to the industry

about one year before actual product launch. Nestlé, through word of mouth and

small advertisement campaigns could hint at the markets and products it was

going to launch with their LC1 probiotic benefits. This would be time would

competitors would take notice and begin mounting defensive strategies. About six

months before product launch, Nestlé should increase the size and scope of their

advertisements, including a specific date as to the launch of LC1 enriched

products. Here is when Nestlé could start employing the help of Professional

athletes or movie stars. Nestlé should emphasizes, in their advertisements, the

universal benefits that their LC1 products will bring to all people, along with the

fact that these products taste the same as similar products in the same category.

About one month to two weeks before product launch, Nestlé should release

advertisement revealing the full scope of the products in which they are planning

to launch. Between two weeks and product launch Nestlé should hold a party of

sorts where they would invite consumers, retailers, distributors, and

manufactures from the food and beverage industry to sample Nestlé’s new LC1

enriched products. This would be done to create a positive word of mouth and

generate interest within the industry. Nestlé then should release all their LC1

enriched products simultaneously across every food and beverage sector.

For at least a year Nestlé should closely monitor all of its LC1 products, noting

which products are performing better than others and in what market sector.

Nestlé should then reallocate resources from poor performers or dogs in the

market, possibly abandoning certain products or markets all together, to support

products that are performing well as stars in their markets. This would follow Sun

Tzu’s final principal which deals with leadership, reinforcing success and starving

failure. Smart leaders know when to put further assets into products and markets

that are performing well and when it would be better to retreat from them.

Nestlé has a well-established management structure that is support by a strong

reputation in the industry. This, along with the fact that Nestlé is introducing

many products into many markets gives them the edge and flexibility to fine-tune

their management, production and sale of their LC1 enriched products.

(Consumption pie of the consumers)

Market statistics since2005:

Net Sales for the Quarter ended 31stMarch, 2005 increased 5.5%

Reported Net Profit for the Quarter ended 31st March, 2005 increased 21.3%

Focus on long term sustainable and profitable growth, market share and

operational & capital efficiencies

• Continued emphasis on Innovation and Renovation to increase Nutrition,

Health and Wellness across product portfolio.

• Launched New MAGGI Vegetable Atta Noodles to provide the benefits of health

and wellness in a pleasurable manner. “Health Bhi. Taste Bhi.”

Mr. Martial Rolland, Chairman and Managing Director of Nestlé India stated, “I

am satisfied with the direction in which the Company is moving. Net Sales for the

quarter were Rs.6135.3 Million and have increased by 5.5% compared with the

same

period of 2004. Net Domestic Sales have increased by 4.9% and Export Sales have

increased by

11.0%.The reported Net Profit for the Quarter is Rs.780.5 Million. This has

increased by 21.3% compared to the same Quarter of 2004. After stripping out

the effect of exceptional items under “Other Income” and “Current Taxes” as well

as excluding “Provision for Contingencies” and “Impairments”, the adjusted Net

Profit for the Quarter increased 14.7% compared to the same quarter in 2004.

EBITDA as a percentage of Net Sales has improved to 22.6% from 20.8% mainly on

account of the cost of milk solids being lower than that of last year, partially offset

by the increase in prices of certain commodities like green coffee and sugar and

higher energy costs. Price increases taken in the second half of 2004 have also

improved the margins.

The reported Net Profit as a percentage of Gross Revenue increased to 12.6%

from 11% in the same quarter last year. During the Quarter, Nestlé India

maintained market share in most categories and launched some new products.

NESTLÉ MUNCH Coconut, with real coconut flakes, was launched at Rs. 5/- to

further enlarge the preference opportunity for NESTLÉ MUNCH, which is the

largest selling SKU in the category. The Company also launched NESTLÉ MILKYBAR

CHOO in strawberry fruit flavour also at Rs.5/-.

During the Quarter, Nestlé India launched MAGGI Vegetable Atta Noodles. An

innovative product and the first of its kind in India, MAGGI Vegetable Atta

Noodles has been developed based on consumer needs and evolving trends for

more whole grain based products. Nestlé India has used the Nestlé Group’s

extensive Research and Development expertise to develop MAGGI Vegetable Atta

Noodles as a new concept for the Indian consumer when they want to include

health and wellness in their foods, in a convenient manner. MAGGI Vegetable

Atta Noodles will provide the dietary fibre of whole wheat to facilitate good

health and wellness in a pleasurable manner and will further strengthen the

MAGGI brand. Progress on the GLOBE initiative was satisfactory and on schedule.

Implementation is planned in the second calendar Quarter of 2005. GLOBE

implementation is likely to adversely impact the cost of nestle india in short run ,

to reap benefits going.

Now the summary of NI’s 2007 full year results below:

• Net sales growth 24%

• Net earnings 31%

• ROE 99%

• Payout ratio 77%

A stronger rural economy, increasing disposable income, and a shift to branded

products will mean higher growth rates for the FMCG industry in the coming

decade. India’s population is over one billion, which means that one in every six

people in the world is Indian. This population is young (70% \below 35 years) and

there is a burgeoning middle class – good demographic tailwinds. Demand for

Nestlé’s products has typically kicked off in a big way in countries where GDP per

capita has crossed the US$1,000 threshold. India’s GDP per capita is around

US$700-800 and growing at 6% per annum. In this respect the ‘plus US$1,000’

market is growing every year and is expected to continue growing for decades.

The Indian consumer’s aspirations are changing. This can be gauged by growing

urbanization, exposure to media, rising ownership of consumer durables and

greater use of credit. Declining birth rates, increasing education of women, and

rising per capita income are all delivering a ‘demographic dividend’. This is

expected to translate into rising consumption of convenience foods and out-of-

home eating. The increasing confidence and changing lifestyle of the Indian

consumer bode well for the long term growth of NI .Nestle market share growing

despite the economic turn down.(2008)

In 2008, the returns of nestle was pretty high and the returns showed an

increasing tend.

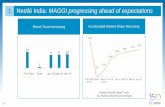

As the above graph shows that the turnover experienced an increasing trend

since 2007 to 2008 even when the recession hit the market.

EarningsIn 2009, consolidated sales were CHF 107.6 billion and net profit was CHF

10.43 billion. Research and development investment was CHF 2.02 billion.

Sales by activity breakdown: 27% from drinks, 26% from dairy and food

products, 18% from ready-prepared dishes and ready-cooked dishes, 12%

from chocolate, 11% from pet products, 6% from pharmaceutical products and

2% from baby milks.

Sales by geographic area breakdown: 32% from Europe, 31% from Americas

(26% from US), 16% from Asia, 21% from rest of the world.

(The nestle market share in the respective year)

Joint venturesNestlé holds 26.4% of the shares of L'Oréal, the world's largest company

in cosmetics and beauty. The Laboratoires Inneov is a joint venture in nutritional

cosmetics between Nestlé and L'Oréal, while Galderma is a joint venture in

dermatology with L'Oréal. Others joint ventures include Cereal Partners

Worldwide with General Mills, Beverage Partners Worldwide with Coca-Cola,

and Dairy Partners Americas with Fonterra.

Ethical and sustainable efforts

In 2000, Nestlé and other chocolate companies formed the World Cocoa Foundation. The WCF was set up specifically to deal with issues facing cocoa farmers, including ineffective farming techniques and poor environmental management (disease had wiped out much of the cocoa crop in Brazil). The WCF focuses on boosting farmer income, encouraging sustainable farming techniques, and setting up environmental and social programmes.

Nestlé is a founding participant in the International Cocoa Initiative (ICI), an independent foundation set up in 2002 and dedicated to ending child and forced labour in cocoa growing, and eliminating child trafficking and abusive labour practices. However, there is little evidence that Nestlé has reduced any of its child labour practices in countries such as the Ivory Coast.

In October 2009, Nestlé announced its Cocoa Plan. The company will invest CHF 110 million over ten years to achieve a sustainable cocoa supply. On 23 October 2009, Nestlé and CNRA (the Ivorian National Centre for Plant Science Research), signed a frame agreement for cooperation in plant science and propagation, with a target of producing 1 million high-quality, disease-resistant cocoa plantlets a

year by 2012. The aim is to replace old, less productive trees with healthier new ones.

Nestlé is launching a Fair Trade-branded Kit Kat in the UK and Ireland from January 2010.[

Marketing of formulaOne of the most prominent controversies involving Nestlé concerns the

promotion of the use of infant formula to mothers across the world,

including developing countries – an issue that attracted significant attention in

1977 as a result of the Nestlé boycott, which is still ongoing. Nestlé continues to

draw criticism that it is in violation of a 1981 World Health Organization code ] that

regulates the advertising of breast milk formulas. Nestlé's policy states that

breast-milk is the best food for infants, and that women who cannot, or choose

not to, breast feed, for whatever reason, need an alternative to ensure that their

babies are getting the nutrition they need.

Nestlé India (NI), with a market cap of US$3.6bn, is the 62% owned listed

subsidiary of Nestlé S.A., the world's leading nutrition, health and Wellness

Company.

NESTLE SUPPLY CHAIN:

Nestlé may be known best for its chocolates, coffee, infant formula and

condensed milk. But it's a lot more complex and sizable than that.

It's the world's largest food company, with almost $70 billion in annual sales. By

comparison, the largest food company based in the U.S., Kraft Foods, is less than

half that size, with $33 billion in annual sales. Nestlé's biggest Europe-based

competitor, Unilever, has about $54 billion in sales.

The real trick: Nestlé gets to its huge size by selling lots of small-ticket items-Kit

Kat, now the world's largest-selling candy bar; Buitoni spaghetti; Maggi packet

soups; Lactogen dried milk for infants; and Perrier sparkling water.

Nestlé operates in some 200 nations, including places that are not yet members

of the United Nations. It runs 511 factories and employs 247,000 executives,

managers, staff and production workers worldwide.

(THE ABOVE FIGURE SHOWS THE SUPPLY CHAIN OF NESTLE)

For Nestlé, nothing is simple. The closest product it has to a global brand is

Nescafé; more than 100 billion cups are consumed each year. But there are more

than 200 formulations, to suit local tastes. All told, the company produces

127,000 different types and sizes of products.

Out of this complexity, Brabeck, Nestlé's CEO since 1997, wanted to bring some

order, at least in how the company operates the businesses that support the

marketing of its vast array of brands, products and factories.

Keeping control of its thousands of supply chains, scores of methods of predicting

demand, and its uncountable variety of ways of invoicing customers and

collecting payments was becoming ever more difficult and eating into the

company's bottom line.

From 1994 to 1999, the amount spent on its information systems went up by a

third, from approximately $575 million to $750 million a year. Those costs were

escalating, while the company was shrinking. Nestlé, under Brabeck, had been

selling off some properties, such as Carnation, that it no longer felt were strategic.

As a percentage of sales, keeping track of what Nestlé was selling, how it got to

market and how it got paid had risen from 1.2% of its $48.1 billion in sales in 1994

to 1.6% of $46.9 billion in 1999.

One of the culprits, according to Olivier Gouin, at the time chief information

officer for the company's business in France, was uncoordinated introductions of

planning and management systems from SAP, the progenitor of enterprise

resource planning software. In 1984, Nestlé introduced its first SAP system. By

1995, 14 countries ran their businesses on SAP. And each implemented the same

software, known as R/2, in a different way. Data was formatted differently. Forms

were handled differently. As a result, the company's costs to maintain the system

were going up, and the process of consolidating reports-to determine overall

financial results-was becoming more difficult, not easier.

Enough was enough. By April 2000, Brabeck, then-chief financial officer Mario

Corti-who a year later would move to Swissair in an attempt to rescue that

company-and Nestlé's entire executive board would back a $2.4 billion attempt to

force its confederation of global businesses to operate as if they were a single

unit.

DEMAND FUNCTION OF NESTLE:

The price of raw foods such as corn, wheat, and dairy can change due to factors

such as weather and demand from other industries. Nestle's ability to pass cost

increases on to consumers will play a big role in their ability to maintain their

current profit margins. Commodity prices have not yet stabilized and continue to

rise. The company has been gradually increasing prices since 2005, foreseeing the

major rise in commodity prices, however it has been combating higher input costs

by reducing the cost of packaging, increasing efficiency, and introducing high-end

products with higher price points.

Nearly all of Nestle's revenues come from sales of food and beverage items. Thus,

changing consumer demand for different types of food and beverage items can

have an impact on Nestle's sales. These changes can be seasonal; for example,

consumers tend to demand more hot beverages such as coffee during the colder

winter months.Long term trends also affect consumer demand. For example, the

National Restaurant Association says that consumers have been demanding

healthier food options when dining out, which reflects the larger trend of growing

public concern for health and wellness in general. Nestle is attempting to take

advantage of trends such as these by putting the "Nutritional Compass", which

prominently displays nutritional information, on over 90% of its products'

packaging, and repositioning itself as a nutrition and health company.

Nestle's creation of the Nestle Health Science company illustrates their

commitment to nutrition, health, and pharmaceutical foods. This wholly-owned

subate food-based products meant to help prevent and treat various medical

conditions. The company will also oversee the Nestle Institute of Health Sciences

which will undertake research aimed at bridging the gap between

pharmaceuticals and food and unraveling the web of connections between food,

drugs, and disease. Nestle's existing Healthcare Nutrition segment will now

become part of the new subsidiary.

Nearly all of Nestle's sales happen outside of Switzerland, but the company

reports its income in Swiss francs. As such, changes in the exchange

rates between the Swiss franc and other world currencies can greatly impact

Nestle's revenue. When foreign currencies depreciate relative to the Swiss franc,

any transactions denominated in those currencies will convert to a smaller

number of francs, meaning less revenue for Nestle. The opposite is true as well,

with a weak franc boosting Nestle's international sales. In order to help minimize

the effect of fluctuating exchange rates, Nestle purchases currency

futures, swaps, forwards, and options.

Recognizing the important of emerging markets, Nestle is investing heavily in

production capacity in new markets, such as South Africa, Brazil, Russia, and India.

Nestle's expects emerging markets to account for 60% of future

growth. Additionally, company has introduced its "Popularly Positioned Products."

These products are lower cost and are priced at a level where poor consumers in

the developing world can purchase them every day. With the explicit goal of

having emerging market sales account for 45% of revenues by 2020, Nestle is

heavily investing in Brazil, Russia, and India from 2010-2012, and encouraging

local acquisitions by their geographic subsidiaries. The company has also

expanded its manufacturing facilities in Africa with new/expanded factories in

Kenya, Zimbabwe, Angola, Mozambique, and other countries. The company plans

to increase sales of locally made products in Africa to 52% in 2012 and 76% by

2016.

Thus the demand function can be given by:

Demand of nestle =function of( weather , demand of raw materials from other

companies, price of the raw materials, substitution effect by the product of the

other company products, competitors pricing strategy, and many more)

(Market share of NESTLE compared to the other companies in competition)

Conclusion:

The food processing business in India is at a nascent stage. Currently, only about

10% of the output is processed and consumed in packaged form thus highlighting

huge potential for expansion and growth. Traditionally, Indians believe in

consuming fresh stuff rather than packaged or frozen, but the trend is changing

and the new fast food generation is slowly changing.At Rs 604, the Nestle stock

trades at nearly 25 times annualized 9mCY04 earnings and market cap to sales of

2.4x. The stock trades at a premium valuation over peers owing to its superior

growth and quality product profile. Nestle is a leader in food processing in India

and given the opportunity of growth along with the parent’s keen interest in

developing its Indian subsidiary, the company is likely to continue being a

dominant force in the Indian FMCG space.

(nestle market all round the world)

Bibliography:

http://nestle.in/nestle_india_landing.aspx

http://www.baselinemag.com/c/a/Projects-Processes/Nestleacute-Pieces-Together-Its-Global-

Supply-Chain/1/

http://www.equitymaster.com/detail.asp?date=02/17/2005&story=5&title=Nestle---A-SWOT-

analysis

http://www.allardpartners.com/upload/documents/allard/case%20studies/NestleAGF.pdf

http://en.wikipedia.org/wiki/Nestl%C3%A9#Marketing_of_formula

http://www.nestle.com/Investors/CorporateGovernance/CodeOfBusinessConduct/Suppliers/

Pages/SuppliersHome.aspx

http://www.wikinvest.com/stock/Nestle_(NSRGY)