Partnering to Improve Metro Nashville’s Overloaded Traffic Court

Nashville’s Multifamily Development Pipeline is Among the ...€¦ · Nashville MSA | Housing...

Transcript of Nashville’s Multifamily Development Pipeline is Among the ...€¦ · Nashville MSA | Housing...

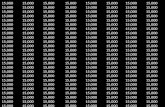

Nashville MSA | Housing Permit Activity

0

5,000

10,000

15,000

20,000

2017201620152014201320122011201020092008

New

Hou

sing

Per

mits

One Unit Permit Multi-Unit Permit

Source: U.S. Census Bureau

Nashville’s Multifamily Development Pipeline is Among the Nation’s Most Active

Research & Forecast Report

NASHVILLE | MULTIFAMILY2nd Quarter 2016

Key Takeaways > Supply totaled 4,899 units at the end of 2Q 2016, more than double the 10-year average of

2,120 units.

> Nashville’s multifamily market absorbed 5,126 units over the last 12 months, the largest volumesince 2010. Central Nashville and Murfreesboro/Smyrna have led the metro in demand overthe past few quarters.

> Nashville’s annual rent growth of 7.2% in 2Q 2016 ranked among the top ten in the nation.

Nashville Multifamily MarketNashville’s development pipeline remains one of the nation’s most active, as robust demand drivers have sustained the region’s ability to absorb new completions. Favorable demographic trends, expanding economy and employment growth have been a boon to the multifamily apartment in Nashville.

At the end of 2Q 2016, work was underway on 50 multifamily properties totaling 12,113 units. Of that total, 7,680 units are scheduled for completion in the next 12 months. Over 40% of these units are located in Central Nashville. Properties under construction include SoBro, Giarratana’s 342-unit apartment in Central Nashville to be completed in December 2016, Alliance Residential Company’s 330-unit Broadstone 8th South, and the 451-unit LC Province that is scheduled to open in September 2017 in Mount Juliet. Nashville’s apartment market recorded average occupancy of 96% over the last five years, leading to increased demand and rent growth levels.

In the year-ending 2Q 2016, transaction volumes totaled $1.4 billion, a 1.9% increase year-over-year. Nashville had the 15th largest volume in the south. Transaction activity yielded an average price of about $116,000 in year-ending 2Q 2016. The average cap rate for YE 2Q 2016 stood at 5.29%, the 15th lowest among the top 100 U.S. metros.

In the coming year, supply is expected to remain in record-high territory, with 7,680 units scheduled to complete within that time frame. Occupancy may decrease slightly and rent growth could slow, yet market indicators suggest that Nashville has the potential to be an outperformer with regards to occupancy and rent growth.

UNITS UNDER CONSTRUCTIONSUBMARKET UNITS

Central Nashville 5,296

West Nashville 1,764

Far East Nashville 1,065

Franklin/Brentwood 962

North Nashville 929

South Nashville 650

East Nashville 569

Murfreesboro/Smyrna 504

Sumner County 374

Southeast Nashville 0

Total 12,113

UNITS COMPLETING IN 12 MOS.SUBMARKET UNITSCentral Nashville 3,695

Far East Nashville 1,065

West Nashville 843

North Nashville 680

Franklin/Brentwood 601

Murfreesboro/Smyrna 504

Sumner County 374

East Nashville 324

South Nashville 320

Southeast Nashville 0

Total 8,406

Multifamily Development - Submarket Rankings

Summary Statistics 2Q 2016 Nashville Multifamily Market

Existing Units 129,492

Quarterly Supply 1,752

Current Occupancy Rate 96.6%

Quarterly Occupancy Change 0.5%

Under Construction (units) 12,113

Monthly Rent $1,085

Rent per Square Foot $1.119

Quarterly Rent Change 2.6%

Annual Rent Change 7.2%

One-Year Forecast

Annual Supply 7,680 unitsAnnual Demand 5,636 unitsAnnual Rent Change 4.6%Occupancy -1.3%

OCCUPANCY

SUBMARKET OCCUPANCY %

North Nashville 98.3%

Southeast Nashville 97.8%

South Nashville 97.3%

Far East Nashville 97.2%

West Nashville 96.9%

Sumner County 96.8%

East Nashville 96.7%

Murfreesboro/Smyrna 95.3%

Central Nashville 94.8%

Franklin/Brentwood 94.2%

MONTHLY RENT

SUBMARKET RATE

Central Nashville $1,592

Franklin/Brentwood $1,411

West Nashville $1,164

Murfreesboro/Smyrna $1,084

Far East Nashville $1,019

South Nashville $992

Sumner County $985

East Nashville $965

North Nashville $917

Southeast Nashville $889

Historical Rental Rates

67

8

910

3

245

1

1. Central Nashville2. East Nashville3. Southeast Nashville4. South Nashville5. West Nashville6. North Nashville7. Sumner County8. Far East Nashville9. Murfreesboro/Smyrna10. Franklin/Brentwood

Submarket Overview - 2Q Rankings

QTRLY RENT CHANGE

SUBMARKET RATE

Franklin/Brentwood 4.6%

East Nashville 3.2%

West Nashville 3.1%

Far East Nashville 3.0%

Southeast Nashville 2.5%

Murfreesboro/Smyrna 2.5%

North Nashville 2.4%

Sumner County 2.0%

South Nashville 1.5%

Central Nashville 0.1%

QTRLY OCCUPANCY CHANGE

SUBMARKET RATE

Franklin/Brentwood 1.3%

South Nashville 1.1%

North Nashville 1.0%

West Nashville 0.8%

Southeast Nashville 0.7%

Central Nashville 0.5%

Sumner County 0.3%

East Nashville 0.2%

Far East Nashville -0.1%

Murfreesboro/Smyrna -1.0%

Source: MPF Research

Historical Occupancy Rates

Source: MPF Research

#5#4#8#5Best City in America

-Travel + Leisure (July 2016)

City Americans Are Moving To - Forbes.com (June 2016)

Best Big City for Jobs 2016 - Forbes (May 2016)

Best Cities for Young Workers - Credit Sesame (May 2016)

$600

$700

$800

$900

$1000

$1100

2Q161Q164Q153Q152Q151Q154Q143Q142Q141Q144Q133Q142Q131Q134Q123Q122Q121Q124Q113Q112Q111Q11

2011 2012 2013 2014 2015 2016

93.8%

94.1%

95.0%

95.6%

95.1%

95.7%95.8%

95.1%

94.9%

95.8%

96.0% 96.0%

95.8%

96.1% 96.1%

95.1%

95.5% 95.5%

96.3%

95.2%

96.6%96.3%

2 Nashville Research & Forecast Report | 2Q 2016 | Multifamily | Colliers International

2Q INVESTMENT ACTIVITY

PROPERTY BUYER UNITS SALE PRICE PRICE/UNIT

The Landings of Brentwood

Steadfast Apartment REIT 724 $110,000,000 $151,934

The Overlook Apartments Passco Companies 452 $52,100,000 $115,280

Opus 29 Security Properties 139 $34,400,000 $247,753

Note 16 Apartments Security Properties 86 $19,300,000 $224,753

The Reserve at Drakes Creek Summit Equity 168 $12,200,000 $72,768

380 Harding Summit Equity 160 $11,300,000 $70,527

Villages of Gallatin Gallatin Leased Housing Associates 64 $4,700,000 $73,438

DEVELOPMENT LEADERS

DEVELOPER UNITS COMPLETED IN THE LAST 12 MOS.

UNITS UNDER CONSTRUCTION

TOTAL UNITS

Giarratana Nashville LLC 146 834 980

Lifestyle Communities 403 451 854

Bristol Development Group 393 392 785

Lennar Corp 0 664 664

Crescent Communities 0 612 612

Source: Real Capital Analytics

Cost of Living Index

Source: Nashville Area Chamber of Commerce

Seattle 140.3

San Francisco 176.4

Los Angeles 140.3

Austin 96.0

Tampa 91.6

Chicago 116.2

Indianapolis 91.1

Nashville 95.2

Atlanta 99.9

Raleigh 90.5

Charlotte 96.4

New York City 227.4

Boston 144.3

Source: FRED Economic Data

Employment/Unemployment

650

700

750

800

850

900

950

May-16Jan-16Sept-15May-15Jan-15Sep-14May-14Jan-14Sep-13May-13Jan-13Sep-12May-12Jan-12Sep-11May-11Jan-11Sep-10May-10Jan-10

Non-

Farm

Em

ploy

men

t

0%

2%

4%

6%

8%

10%

12%

Unemploym

ent Rate

Unemployment RateNon-Farm Employment

Terra House

3 Nashville Research & Forecast Report | 2Q 2016 | Multifamily | Colliers International

Copyright © 2015 Colliers International.

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report.

About Colliers InternationalColliers International is a global leader in commercial real estate services, with more than 16,300 professionals operating out of 554 offices in 66 countries. Colliers International delivers a full range of services to real estate occupiers, owners and investors worldwide, including global corporate solutions, brokerage, property and asset management, hotel investment sales and consulting, valuation, consulting and appraisal services, mortgage banking and insightful research. Colliers International has been recognized and ranked by the International Association of Outsourcing Professionals’ Global Outsourcing 100 for 10 consecutive years, more than any other real estate services firm.

colliers.com

554 offices in 66 countries on 6 continentsUnited States: 140 Canada: 31 Latin America: 24 Asia Pacific: 199 EMEA: 108

$2.5billion in annual revenue

2billion square feet under management

16,300Professionals and staff

MARKET CONTACT:Janet Miller CEDC FMCEO & Market Leader+1 615 850 [email protected]

REGIONAL AUTHOR:Katie Barton CPRCDirector of Research+1 615 850 [email protected]

Colliers International | Nashville523 3rd Avenue Nashville, TN 37210

+1 615 850 2700 www.colliers.com/nashville