Mutual funds as monitors: Evidence from mutual fund...

Transcript of Mutual funds as monitors: Evidence from mutual fund...

Mutual funds as monitors: Evidence from mutual fund voting

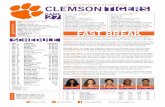

Angela Morgana,*, Jack Wolfa, Tina Yanga aCollege of Business and Behavioral Science, Clemson University, Clemson, SC, USA

Abstract

We address whether mutual funds act as effective corporate monitors through the proxy

voting process. We examine 212,620 voting decisions made by 1,794 mutual funds from

94 fund families for 1,047 shareholder proposals voted on between July 2003 and June

2005. We find that mutual funds vote more affirmatively on wealth-increasing proposals

and that funds’ voting approval rates are significantly higher than those of other investors

for beneficial resolutions. Additionally, funds may not always vote consistently within

fund families and the characteristics of the fund may influence its role as monitor. Funds

also support proposals targeting firms with weak governance. Finally, fund voting

approval rates significantly impact whether a proposal passes. Our findings provide

strong support for mutual funds being effective monitors.

JEL classification: G32; G34; J33

Keywords: Proxy voting; mutual funds, corporate governance, shareholder proposals

Corresponding author: Angela Morgan, Department of Finance, Clemson University, Clemson, SC 29634. (O) 864 656 4486, (F) 864 656 3748. email: [email protected]

1

Mutual funds as monitors: Evidence from mutual fund voting

Abstract

We address whether mutual funds act as effective corporate monitors through the proxy

voting process. We examine 212,620 voting decisions made by 1,794 mutual funds from

94 fund families for 1,047 shareholder proposals voted on between July 2003 and June

2005. We find that mutual funds vote more affirmatively on wealth-increasing proposals

and that funds’ voting approval rates are significantly higher than those of other investors

for beneficial resolutions. Additionally, funds may not always vote consistently within

fund families and the characteristics of the fund may influence its role as monitor. Funds

also support proposals targeting firms with weak governance. Finally, fund voting

approval rates significantly impact whether a proposal passes. Our findings provide

strong support for mutual funds being effective monitors.

JEL classification: G32; G34; J33

Keywords: Proxy voting; mutual funds, corporate governance, shareholder proposals

1

1. Introduction

The role of the mutual fund as monitor is unclear. Their large ownership stake and

investment sophistication suggest that mutual funds should be effective monitors (Pound,

1988). However, due to free-rider problems and liquidity concerns, mutual funds (as well

as other institutions) have been accused of taking the easy way out by selling their shares

instead of undertaking costly monitoring (Bhide, 1993). Given their growing ownership

of U.S. stocks, mutual funds could have a major impact on their portfolio firms if they

choose to be effective monitors; as of 2006, mutual funds owned more than 25% of all

U.S. stocks (Investment Company Institute 2006 Fact Book). In this paper, we provide

new evidence on the role of mutual funds as corporate monitors by studying an

observable action of mutual funds – their proxy voting decisions. Besides private

negotiations (which are largely unobservable) and unloading shares, proxy voting is the

most direct action that mutual funds can take to influence management’s actions and/or

the firm’s corporate governance. Therefore, examining mutual fund voting decisions

provides direct evidence on the funds’ role as corporate monitors.

Using recently available data, we examine fund voting decisions on 1,047

shareholder-sponsored proposals for meetings taking place between July 2003 and June

2005. We compile 212,620 voting decisions made by 1,794 mutual funds from 94 fund

families. We provide new evidence on four important questions. First, do mutual funds

exercise their voting power as effective monitors? Second, do funds’ characteristics

influence their effectiveness as monitors? Third, are mutual funds more likely to support

proposals targeting firms with weak governance? Last, do mutual funds’ voting decisions

significantly impact voting outcomes?

2

We find that while funds, on average, are likely to vote against shareholder

proposals, they do appear to support those proposals that may increase shareholder

wealth. Specifically, mutual funds tend to vote more in favor of board, governance, and

compensation proposals than environmental and social proposals. They also vote more

affirmatively for ISS recommended proposals and proposals that the prior literature has

identified as having a significant valuation impact on a firm such as declassifying the

board or repealing a poison pill. These trends are even more noticeable when we compare

the approval rates of mutual funds to those of the other shareholders. Mutual funds have

lower overall approval rates; however, if the proposal concerns important aspects of

corporate governance or targets a potential agency conflict such as golden parachutes or

poison pills, then mutual funds vote more affirmatively than other voters. In other words,

mutual funds act more like monitors than do other shareholders.

We also find that funds do not always vote consistently within fund families and

that the characteristics of the fund affect its effectiveness as a monitor. Although there is

some evidence that fund families coordinate voting decisions at the family level, we find

that funds within the same fund family do vote differently from each other and that the

divergence is more apparent for complex issues or issues that could potentially have a

large impact on firm value. Additionally, social funds, funds with lower turnover and

expense ratios, and funds with larger percentage holdings in the targeted firm are more

likely to vote for shareholder proposals. Mutual funds are also more likely to vote

affirmatively for proposals when targeted firms have weaker corporate governance (firms

with higher Gompers, Ishii, and Metrick G-index, larger boards, fewer independent

directors on the board, and lower levels of institutional holdings). Last, we find that

3

mutual fund voting has a significant impact on the success of shareholder proposals –

higher support by funds leads to a greater likelihood of passage of the proposal.

Our paper makes several contributions to the literature. While the prior literature

has examined the relation between voting outcomes and institutional ownership, these

papers provide only indirect evidence since they are constrained by using aggregate

institutional ownership holdings as a proxy for institutional monitoring. We are able to

provide direct evidence on mutual fund voting by using the actual mutual fund voting

decisions. Further, by directly studying the observable action of proxy voting by mutual

funds, our results contribute to the debate of whether mutual funds serve as effective

monitors and how their voting decisions impact the growing movement of increased

shareholder activism. Several working papers have focused on the increased levels of

submissions of shareholder resolutions and the subsequent success of some proposals on

issues such as majority voting, declassifying the board, and expensing stock option (Cai,

Garner, and Walking, 2006; Guo, Kruse, and Nohel, 2006; Ferri, Markarian, and

Sandino, 2006). Our results suggest that mutual fund voting decisions may play an

important role in the passage of these items.

The rest of the paper is organized as follows: Section 2 examines the role of

mutual funds in the proxy voting process and develops our hypotheses. Section 3

describes the sample and our data. Section 4 examines the mutual fund voting decisions

and Section 5 concludes.

4

2. Monitoring, shareholder proposals, and voting

2.1. Related literature

Separation of ownership and control in large corporations gives rise to agency

conflicts (Berle and Means, 1932). Monitoring of managers by various stakeholders of

the firm is one of the major mechanisms used to control agency conflicts between

managers and investors (Jensen and Meckling, 1976; Gillan, 2006). Monitoring can take

several forms including monitoring by outside auditors, the board of directors, and

shareholders themselves. A large body of the research on shareholder monitoring has

focused on monitoring by institutions. Given their size, institutions are likely to hold

larger share amounts than other investor types and are considered by many to be more

sophisticated than other investors (Pound, 1988; Shleifer and Vishny, 1986). Previous

research has used aggregate institutional holdings levels to proxy for the strength of

monitoring by institutional investors and the results on the role of institutional investors

as monitors are not clear (see, for example, Bushee, 1998; Chen, Harford, and Li, 2006;

Gasper, Massa, and Matos, 2005; Hartzell and Starks, 2003; Parrino, Sias, and Starks,

2003).

The role of institutional investors as monitors in the proxy voting process is one

of interest. Proxy voting is a direct action that shareholders can take to exert control over

the corporation. Consequently, institutional investors, given the size of their holdings,

have the potential to play an important monitoring role in this process since, conceivably,

this is an area in which monitors can influence firms to take wealth-increasing actions.

Existing studies on this subject generally show that they vote in a value-maximizing

manner (see, for example, Gillan and Starks, 2000; Gordon and Pound, 1993; Morgan

5

and Poulsen, 2001). However, similar to other research studying institutional investors as

monitors, these papers use aggregate institutional holdings levels to proxy for monitoring

by institutions; hence they face the limitation of relying on inference rather than direct

evidence to draw conclusions on the monitoring role of institutional investors.

In 2002, Harvey Pitt, then chairman of the SEC, took the stance that mutual fund

managers have a fiduciary duty to vote the fund’s proxies in the best interests of

investors, and hence have a legal obligation to reveal those decisions to investors (WSJ,

2002/3/21). The SEC began requiring disclosure of fund voting decisions on NPXs

beginning in 2004.1 Because this disclosure makes proxy voting observable, unlike most

other ways that shareholders can exert influence on managers, it allows for a direct

examination of the role of mutual funds (as one subset of institutional investors) as a

monitor of the firm.

We seek to determine whether mutual funds act as effective monitors by

exercising their voting power in a wealth-increasing manner (i.e., voting for items

expected to increase shareholder wealth and voting against other items). While the

finance literature has often asserted that institutions act as monitors, there is some

evidence that this may not be the case. For example, Bhide (1993) documents

institutional investors’ tendency to sell shares (the “Wall Street Rule”) rather than take

action to create improvement.

We are not the first paper to examine mutual fund voting but we are the first to

examine the role of the mutual fund as monitor. Further, we study two years of proxy

1 The new proxy rules for mutual funds were adopted in Investment Company Act Release No.33-8188 (Jan. 31, 2003). For details, see http://www.sec.gov/rules/final/33-8188.htm On April 14, 2003, the SEC adopted new rule 30b1-4 under the Investment Company Act of 1940 to require that a fund file N-PX by August 31 for 12 month periods ending on June 30 of each year, starting in 2004.

6

voting decisions for 1,794 mutual funds from 94 fund families and analyze voting at the

fund level. Our paper differs from many of the other existing papers examining mutual

fund voting which tend to use one year of data, focus on only the largest fund families,

and/or examine voting at the family level. We believe that our broader sample gives

greater cross-sectional variation and allows us to draw more general inferences on the

role of mutual funds as monitors.

Davis and Kim (2006) study the voting records of 21 fund families and find that

the potential for business ties affects mutual fund voting. Other contemporaneous

working papers examine mutual fund voting. Rothberg and Lilien (2005) describe in

detail the voting policies of the ten largest fund families in relation to 12 shareholder-

proposal types; they find that index funds tend to vote against management more than

stock-picking funds and that families may vote their shares as a block. Ashraf and

Jayaraman (2006) examine voting patterns by the largest ten funds for 24 fund families

and find that funds are more likely to vote for shareholder proposals if the targeted firm

performs well or has antitakeover provisions. Chou, Ng, and Wang (2007) examine

whether fund governance (proxied by Morningstar stewardship grades) influences their

voting patterns; they find that funds with poor governance are more likely to vote in favor

of both shareholder-sponsored proposals and management-sponsored antitakeover or

board-related proposals.

Other studies on mutual fund voting also exist. Cremers and Romano (2006)

examine whether the mutual fund disclosure requirements have impacted funds’

decisions to vote against management; they do not find evidence of this. Amzaleg, Ben-

Zion, and Rosenfeld (2005) study mutual fund voting in Israel; using a sample of 792

7

management-sponsored proposals, they find that the odds of voting against “bad”

proposals is negatively associated with fund holdings and the size of funds.

2.2. Hypothesis development

The role of the mutual fund as active investor and effective monitor is unclear.

Mutual funds are largely concerned with liquidity since investors can redeem their claim

for the market value of the shares of the fund’s assets upon demand. Therefore, it is

probably not surprising that the existing literature finds that mutual funds (along with

other institutions) vote with their feet (the “Wall Street Rule”) rather than intervene when

firms perform poorly (see Roe, 1990; Parrino, Sias, and Starks, 2003). Historically, fund

managers may have felt it was not their role to be active monitors. As a Fidelity

spokesman puts it, “we would expect to vote in favor of management’s proposals most of

the time. When we believe a company is not being well-run, we have the option of selling

our shares (Boston Globe, 2004/9/5).”

There are, however, also arguments in favor of funds being effective monitors. In

some instances, mutual funds hold such a large position in a particular firm that it is

difficult to sell shares when a firm performs poorly without further depressing the share

price. The investment strategies of some mutual funds also prevent them from selling

poorly performing investments. With their substantial voting power, mutual funds are

under increasing pressure to play a more assertive role in the proxy voting process (the

SEC Final Rule, Rel. #33-8188).

In view of these new developments and based on the prior literature, we test the

following hypotheses concerning voting on shareholder proposals to ascertain whether

8

mutual funds exercise their proxy voting power as effective corporate monitors. We

choose to focus on shareholder proposals for three reasons. First, the wide dispersion of

the types of shareholder-sponsored proposals allows us to examine fund voting in

response to a wide variety of issues – some of which clearly increase shareholder wealth

and some of which do not. Second, due to the large body of existing literature examining

these proposals, we can directly compare our results to earlier results that use aggregate

institutional holdings. Focusing on shareholder proposals also allows us to gauge the

impact on fund voting decisions of those factors that earlier literature has found important

in explaining overall affirmative voting levels (such as proposal and sponsor types).

H1: Mutual funds exercise their voting power as effective monitors.

Assuming that proxy voting is an activity of an effective monitor, we should

expect mutual funds to vote affirmatively for shareholder proposals when the proposals

have a potentially positive impact on shareholder wealth. (Similarly, we should expect

them to vote against proposals which may diminish shareholder wealth.) We use three

proxies to distinguish value-increasing proposals from value-decreasing proposals. The

first proxy is the broad category classification of the different types of proposals. We

group proposals into five broad categories - board-related proposals, compensation-

related proposals, other non-board governance-related proposals (governance proposals),

environment- and health- related proposals (environmental proposals), and social- and

economic- related proposals (social proposals). We hypothesize that mutual funds will

vote more affirmatively on board, compensation and governance proposals than on social

and environmental proposals since the former group of proposals is more likely to have a

9

positive impact on shareholder wealth. (Whether specific proposal sponsor types are also

related to wealth increases is less clear; we address whether sponsor types appear to

influence mutual fund support later in the paper.)

Our second proxy focuses on items found by the previous literature to impact

shareholder wealth. Davis and Kim (2006) identify six key proposals that potentially

have the most significant effect on shareholder value: declassifying the board, allowing

cumulative voting, establishing an independent chairman, seeking shareholder input on

golden parachutes, expensing stock option, and repealing poison pills.2 (All of these key

items fall under one of three broad proposal classifications: board, governance, or

compensation.) We call shareholder proposals targeting these items key proposals. We

argue that mutual funds will vote more affirmatively on key proposals than on non-key

proposals.

The third proxy that we use to assess the valuation impact of a proposal is the ISS

recommendation. Institutional Shareholder Services (ISS), a leading proxy advisory firm,

provides detailed analysis of proposals based on their perceived impact on shareholder

value and makes voting recommendations to its clients, including some mutual funds. An

affirmative recommendation by ISS should signal that the proposal should increase

shareholder value.

We use these three measures of quality since no one measure perfectly captures

whether a proposal is value-increasing or value-decreasing. For example, ISS does not

recommend in favor of all of the key items all of the time. Likewise, there are important

items that are not covered under the key item heading. Hence, we draw collective

2 Davis and Kim (2006) partially base their key proposal classifications on Bebchuk, Cohen, and Ferrell (2004) who show that classified boards, poison pills, and golden parachutes have significantly negative valuation effects.

10

inferences about the role of mutual funds as a corporate monitor based on all three

proxies.

H2: The characteristics of the fund itself may impact its effectiveness as a monitor.

While fund families may set some of the fund voting guidelines, mutual funds are

not homogeneous; the goals of the fund as well as other characteristics of the fund are

likely to impact the willingness of the fund manager to act as an effective monitor. Index

funds have restrictive investment objectives, and hence do not have the option to sell

portfolio securities when displeased with management.3 Likewise, funds with longer

investment horizons may find voting with their feet to be less desirable. Therefore, these

funds are more likely to use proxy voting to trigger desirable changes. We use the

turnover and expense ratios to proxy for funds with longer investment horizons.

Mutual funds that own a larger stake in a firm have a greater incentive to

undertake costly monitoring and face greater difficulties when selling their shares.

Therefore, we expect these funds to vote more affirmatively on value-increasing

shareholder proposals and use the percentage of shares that a fund owns in the targeted

firm to proxy for this economic incentive. Black (1990) argues that when an institution

owns stakes in numerous companies, it enjoys economies of scale in analyzing common

issues across its portfolio firms. He further argues that this incentive offsets the

disincentive of collective action problems that cause shareholder passivity. Therefore, we

3 There are 137 index funds in our sample of 1,794 funds. We do not specifically control for index funds through the use of an index fund dummy since this variable is significantly correlated with other variables in our study including the turnover ratio and number of securities held by the fund. If we exclude index funds from our sample, our findings are qualitatively unchanged.

11

include the total number of holdings in our analysis to proxy for this economies of scale

incentive.

Additionally, socially screened (social) mutual funds often have agendas other

than maximizing returns to investors. We would expect these types of funds to vote more

affirmatively for environmental and social proposals including those which might be

considered to be wealth-decreasing. We include a dummy variable indicating whether the

fund is a social fund to examine this possibility.

H3: Mutual funds are more likely to vote for shareholder proposals that target

firms with weak corporate governance.

We hypothesize that, post Enron, mutual funds are more alert to firms that have

poor corporate governance, and hence are likely to vote more affirmatively for

shareholder proposals targeting those firms. We use the Gompers, Ishii, and Metrick G-

index, ownership levels, and board structure to proxy for a firm’s governance structure.

Following prior literature, a higher G-index, larger board, fewer independent directors on

the board, lower institutional ownership, greater officers’ and directors’ ownership, lack

of outside blockholders, and combined CEO and Chairman positions indicate potentially

weak governance (Gompers, Ishii, and Metrick, 2003; Hermalin and Weisbach, 2003).

3. Research design and data collection

3.1. Data collection

Our sample consists of all voting decisions made by mutual funds on shareholder

proposals listed on ISS’s Voting Analytics database for meetings occurring between July

12

2003 and June 2005, subject to data availability of the items described below. (We

choose this time period because the SEC began requiring mutual funds to disclose their

voting records starting with July 2003, and the June 2005 cutoff allows us two years of

complete data.) Voting decisions are made by fund managers and are recorded as one

decision (for, against, or abstain) per proposal per fund.

We collect proposal, firm, and mutual fund level data for each voting record.

Proposal-level data includes proposal description, sponsor identity, ISS voting

recommendation, and the overall voting result for each proposal. We gather proposal and

sponsor data from the annual proxy statements and proposal recommendations and voting

results from ISS. For firm-level data, we gather institutional holdings from the S&P

Security Owners Stock Guide, and officers’ and directors’ holdings, outside

blockholdings, and board-related data from the annual proxy statements. We collect the

Gompers, Ishii, and Metrick G-index from their website. Stock price and accounting data

are from CRSP and COMPUSTAT. After limiting the sample to those observations with

complete proposal- and firm- level data, we have 1,047 shareholder proposals that 356

firms received for the 2004 and 2005 proxy seasons.

For each fund that votes on at least one proposal in our sample, we obtain fund

characteristics including turnover ratios, expense ratios, prior fund performance, fund

size (measured as net assets), and portfolio holdings from the Mutual Funds Advanced

module of Morningstar Principia. (We exclude closed-end and variable insurance funds

not included in this module.) Our final sample consists of 212,620 voting decisions made

by 1,794 mutual funds belonging to 94 fund families.

13

3.2. Sample description

Table 1 describes our 1,047 shareholder-sponsored proposals in detail. We group

the proposals into five broad categories (defined on page 8): board proposals,

compensation proposals, governance proposals, environmental proposals, and social

proposals. In terms of proposal frequency, compensation proposals appear the most

frequently, making up 29.1% of the total number of shareholder proposals. This may

reflect investors’ discontent over executive pay that they perceive as excessive. Indeed,

the number of resolutions proposing limiting executive compensation is 84, making it the

most frequently sponsored item in our study (8.0% of all proposals). Board and

governance proposals combined make up 39.4% of the total proposals. Specific

resolutions that investors are most likely to propose are: declassifying the board (6.9% of

all proposals), repealing a poison pill (6.1%), adopting majority vote for directors (5.9%),

report on political contributions/activities (5.8%), separating CEO and Chairman

positions (5.2%), performance-based compensation (4.6%), and restricting golden

parachutes (4.5%). Five of these proposals are classified by Davis and Kim (2006) as a

key item which is not surprising since proposal frequency was one of the criteria used by

them to define key items.

A number of recent papers examine some of these proposal types. For example,

Cai, Garner, and Walking (2006) study proposals to adopt majority voting, Ferri,

Markarian, and Sandino (2006) study proposals to expense stock options, Gine and

Moussawi (2007) study proposals to repeal poison pills, and Guo, Kruse, and Nohel

(2006) study proposals to declassify the board. Our results provide some background for

14

this growing literature, and show that these issues indeed attract investor interest and, as

we show later, garner support from mutual funds.

A total of 356 firms receive shareholder proposals during our two year sample

period (after controlling for data availability). Since shareholders may target a firm in

both years, a firm may appear in our sample more than once.4 Table 2 Panel A reports

summary statistics for the 510 firm years in our sample. The majority of our sample firms

(239 of the 356) are S&P500 firms which is not surprising given that the literature has

shown that shareholder proponents are more likely to target larger firms (Karpoff,

Malatesta, and Walkling, 1996). Because of the proportion of larger firms in our sample,

the mean total assets of our firms ($52.4 billion) is quite large and may be due to firms

such as Citigroup which has total assets of over $1.5 trillion in 2005. The firms in our

sample experience strong market-adjusted one –year prior stock performance during this

period (11.2% on average). The other financial and governance characteristics of our

sample firms are similar to existing studies except for institutional ownership (mean

69.0%). For example, Linck, Netter, and Yang (2006) report a mean institutional holding

of 34% while Parrino, Sias, and Starks (2003) report a mean of 43%. Given the high

correlation between firm size and institutional ownership (Sias and Starks, 1997), it is not

surprising that our sample exhibits higher institutional ownership.5

Due in part to consolidation in the mutual fund industry, not all of our funds

appear in our sample for both years. (We have data on fund voting decisions for 1,316

4 A firm may receive more than one shareholder proposal in a given year (the greatest number of proposals received by a firm in a year is 15 while the average number is two); however, for purposes of this table, each firm is included only once per year. Likewise, each fund is included in this table only once per year. 5 Yermack (2006) reports a mean institutional ownership of 59%. His sample consists of 237 large Fortune 500 firms, which are arguably more similar to our sample, and hence his institutional ownership level is closer to ours.

15

funds in 2004 and 1,244 funds in 2005.) Table 2 Panel B provides summary information

on the 2,560 fund years in our sample. The average fund family has 15 funds each year

voting on at least one proposal in our sample (maximum is 131) and the average (median)

mutual fund votes on 83 (44) proposals each year (maximum is 557). The average fund

size (measured as net assets) is $1,438 million; the largest and smallest funds are $84,167

million and $0.1 million respectively. Mean fund turnover and expense ratios are 90.3%

and 1.2% respectively. On average, a fund holds 247 securities in its portfolio and owns

0.10% of the firm whose ballot it is voting on. One year fund past performance generally

has been good (21.6% mean and 20.4% median.)

3.3. Proposal types and sponsors

The existing literature has shown that voting returns varies systematically with

sponsor identity (Gordon and Pound, 1993; Gillan and Starks, 2000). Given that sponsor

types affect voting returns, mutual fund managers may also be influenced by sponsor

types. Following prior literature, we classify sponsor types into seven categories:

institutional investors, pensions, unions, religious and environmental groups, individual

activists, individual occasionals, and unknown sponsors. (Some firms in our sample did

not disclose sponsor identity so we classify those sponsors as unknown.)

Table 3 provides summary information on the types of resolutions proposed by

specific sponsor types. Unions initiate more proposals than any other sponsor type in our

sample, making up 23.3% of all the proposals. They are followed by unknown sponsors

(18.3%), individual occasionals (17.0%), and individual activists (13.2%). Different

sponsors clearly show different interests and objectives. Institutional investors and

16

pension funds target most of their proposals at social issues (31.0% and 56.7%

respectively). Unions focus on compensation issues (45.9%), consistent with their labor

agenda. Not surprisingly, the majority of the proposals by religious and environmental

groups are on social and environmental issues (27.8% of all the proposals on these

issues). Individual activists and individual occasionals spread their proposals among

board, governance, and compensation issues.

Our sample shows different patterns than earlier research. For example, Gillan

and Starks (2000) show that institutional investors focus more on governance-related

proposals, such as repealing antitakeover devices. Our findings also contrast with the

perception that pension funds are the leaders in promoting better corporate governance.

One potential explanation for the differing results is that pension funds may have resorted

to private negotiations instead of the more public forum of shareholder proposals to work

out governance issues with the firms.6

4. Analysis of mutual fund voting

4.1. Mutual fund voting decisions

Table 4 provides detailed information on fund voting decisions. Of the 212,620

mutual fund voting decisions in our sample, 26.3% (55,959) are affirmative.7 At a glance,

this statistic suggests that mutual funds do not provide strong support for shareholder

proposals. However, more in-depth analysis reveals that mutual funds vote much more

6 For example, the WSJ reports that, because public pension funds have acquired so much clout as governance champions, firms typically invite them to work out corporate-governance differences in private, avoiding public confrontation in relation to proxy proposals. As a result, unions have overtaken pension funds in initiating shareholder proposals (WSJ, 1994/3/1). 7 Of the remaining voting decisions, 145,332 (68.3% of the total sample) are in opposition and 11,329 are abstentions (5.3%).

17

favorably for the shareholder proposals that may potentially increase firm value. For

example, funds vote affirmatively on 38.4% of governance, board, and compensation

proposals, compared to 5.9% of environmental and social proposals. This result is

consistent with our first hypothesis and with mutual funds’ stance that they are not the

arbitrators of social or political disputes.8 Similarly, we find evidence that funds appear to

vote more favorably for key proposals (denoted with a * in the table) and those proposals

receiving an affirmative ISS recommendation, again suggesting that they can distinguish

between wealth-increasing and decreasing proposals.

Comparing Table 4 with Table 1 indicates that items appearing the most

frequently also receive the highest level of fund support. This is especially true for board,

governance, and compensation proposals. Assuming proposal submission frequency

proxies for shareholder interest on an issue, this result also suggests that mutual funds

vote in the interest of investors. An exception to this link between proposal frequency and

voting decisions is confidential voting, which only appears four times on a ballot, but

receives affirmative fund voting decisions 78.5% of the time. (Confidential voting was

proposed with greater frequency during the time periods studied in earlier research

(Strickland, Wiles, and Zenner, 1996; Gillan and Starks, 2000).)

We witness a shift in proposal submission momentum and support for majority

voting during our sample period. Majority voting appears nine times on the ballot in 2004

with only 4.2% of the voting decisions in favor; in contrast, it appears 53 times in 2005

and receives fund support 61% of the time. Our findings are consistent with a movement

8 Mainstream fund managers (compared to managers of social or green funds) argue that they reject social or political proposals because these proposals are ordinary business decisions, not board-level matters. Further, they do not believe that such proposals are in the best economic interests of the firm (Boston Globe, 2004/9/5).

18

toward the support of majority voting - some shareholder and legal institutions have

recently endorsed majority voting over plurality voting.9 Cai, Garner, and Walking

(2006) also find a significant increase in the frequency of the majority vote proposals and

firms adopting this practice from 2004 to 2005.

In summary, our results support our first hypothesis that mutual funds exercise

their voting power in a manner consistent with being an effective monitor. They support

shareholder proposals and vote against management when they believe the proposal may

have a positive effect on firm value.

4.2. Mutual fund voting approval rates versus the voting approval rates of other voters

Since our objective is to examine whether mutual funds are effective monitors, we

compare mutual fund approval rates to the approval rates of the rest of the voters. If

mutual funds are no more effective at monitoring than other investors, then we should not

find any significant differences. The fund approval rate is calculated as the number of

shares that funds voted affirmatively divided by the total number of votes cast by the

funds.10 Approval rate of other voters is calculated as the total number of affirmative

votes minus affirmative votes cast by mutual funds all divided by the total number of

votes cast minus those cast by mutual funds. Since voting approval rates by mutual funds

are likely to be correlated with those by other voters, we use a paired difference test to

9 For example, the Council of Institutional Investors (CII) issued a policy supporting majority voting in 2005 and the American Bar Association issued a paper with legal recommendations for implementing majority voting in 2006. 10 Unlike mutual fund voting decisions which are done on a one decision per fund per proposal basis, a mutual fund’s voting approval rate for a given proposal is based on the number of shares held by the fund. We are examining aggregate mutual fund voting approval rates here.

19

statistically compare mutual funds to other voters. (Our results remain the same if we use

a Wilcoxon test.) Results are reported in Table 5.

Consistent with the existing literature, we find that shareholder proposals do not

garner strong investor support (Gillan and Starks, 2000). Mutual funds vote less

affirmatively overall than do other investors (26.2% versus 27.8%). However, funds do

appear to vote more favorably for potentially wealth-enhancing resolutions. We find

higher fund support for board and governance proposals versus other investors and lower

support for compensation, environmental, and social proposals.11 Indeed, we see the

largest difference in the approval rate on governance proposals between mutual funds

(63.0%) and the rest of the voters (49.2%) than on any other type of proposal breakdowns

that we construct. Mutual funds are also more likely than other voters to support key

items and ISS recommended resolutions (60.7% versus 50.4% and 53.2% versus 47.3%

respectively). Regardless of which proxy for proposal quality that we use (proposal

classification, key items, or ISS recommendation), mutual funds appear better able to

discern and more willing to vote for higher quality (i.e., value-increasing) proposals.

Approval rates related to sponsor types also vary. First, proposals sponsored by

individual activists receive much higher levels of support from mutual funds than from

the remaining voters. This may be due to this type of sponsor proposing mainly

governance and board proposals. Second, mutual funds tend not to support proposals

sponsored by religious and environmental groups, institutional sponsors, and individual

occasionals with approval rates being lower than other voters on these proposals.

11 This result for compensation proposals may be due in part to the wide breadth of the types of compensation proposals. If we examine proposals on golden parachutes and stock option expensing separately from the other compensation proposals, we find that mutual funds vote much more affirmatively on these two key items than do other voters (60% versus 52% for golden parachutes and 62% versus 52% for expensing options).

20

In summary, we find that mutual funds do vote differently than the rest of the

voters.12 The differences in voting patterns support our hypothesis that mutual funds act

as effective monitors by selectively voting for those proposals that are most likely to

enhance shareholder wealth.

4.3. Determinants of mutual fund voting decisions

4.3.1. Mutual fund voting decisions and fund family voting policies

We examine whether fund families vote in a coordinated manner in order to help

determine whether fund characteristics may impact voting decisions. If voting decisions

are coordinated at the fund family level via standardized voting policies, as reported by

prior research (Downes, Houminer, and Hubbard, 1999; Rothberg and Lilien, 2005), then

the characteristics of the individual funds should not matter. However, some anecdotal

evidence shows that individual funds have discretion in how they vote either because the

guideline at the family level is too general or because the situation related to the proposal

and the targeted firm is complex necessitating that the voting decision be made at the

lower fund level (WSJ, 2006/12/22). To ascertain how much discretion individual funds

potentially have, we analyze variation in mutual fund voting decisions within the same

fund family. This is an important issue and has direct implication on the validity of our

research design, which studies the determinants of mutual fund voting at the individual

fund level instead of at the family level. Results are reported in Table 6.13

12 Since the other investors include other institutional investors, such as pension funds, which may also act as monitors, our results should actually be biased toward not finding any significant differences between the two groups. 13 We exclude three fund families that each have only one fund with proxy voting disclosure.

21

We study the dispersion of fund voting decisions within the same fund family by

the proposal items profiled in Table 1. We find a large divergence in fund voting

decisions within the same fund family. For all of the proposals examined, at least one

family experiences funds within the family voting differently from each other. Animal

welfare is the most agreed upon proposal with only nine out of 91 fund families

exhibiting differences in voting decisions among their funds. Poison pills and golden

parachutes exhibit the lowest family voting consensus. Of the fund families that vote on

poison pills (golden parachutes), 73 (71) out of 88 (86) exhibit differences in voting

decisions among their funds. However, most funds in those fund families vote in favor of

the proposal (74.7% (65.2%) of the time).

In general, we are more likely to see divergence in fund votes within the same

fund family for board, governance, and compensation issues than for environmental and

social issues. Hence, the findings are consistent with the notion that funds may exercise

greater discretion when voting on more complex issues or issues that could potentially

have a larger impact on firm value. In summary, these results support our conjecture that

some mutual funds exercise voting discretion at the individual fund level, which poses

the question of what factors drive some funds to vote differently than others. We address

this in the next session.

4.3.2. Mutual fund voting and fund and firm characteristics

We have shown that mutual funds do appear to effectively use the proxy voting

process by identifying and voting for shareholder resolutions that are potentially wealth

increasing. In this section, we test our hypotheses by examining fund voting in relation to

22

proposal quality, fund characteristics, and firm characteristics in multivariate analysis.

Since we wish to examine the factors driving the fund voting decisions, our dependent

variable is whether or not the fund votes in favor of a proposal. We control for proposal

quality by using dummy variables for proposal types, whether the proposal represents a

key item as defined in Davis and Kim (2006), and whether the proposal receives an

affirmative ISS recommendation to distinguish between potentially value-increasing

proposals and value-decreasing proposals.

Since we wish to examine whether fund characteristics influence voting and since

we found in Section 4.1 that funds do not always vote unanimously across fund families,

we also control for mutual fund characteristics. We include turnover, expense ratio, the

fund’s holdings in the targeted firm, the number of total securities held by the fund, and a

dummy variable for whether the fund is a social fund.

To test our hypotheses on fund voting in relation to firm characteristics, we

include in the regressions variables found to be important in earlier literature including

ownership structure (officers’ and directors’, institutional, and block holdings), G-index,

board size, the percentage of the outside directors on the board, and a dummy variable

denoting combined Chairman and CEO positions. We include dummies for sponsor

types, fund size, one-year fund past performance, firm size, and one-year firm past

performance as control variables. We also include a 2005 year dummy to control for the

possibility of a time trend and run fixed effects for fund families since some voting

23

decisions may be standardized at the family level.14 All test statistics are based on robust

standard errors.

We run three logistic regressions. The first regression examines what drives a

fund to vote for a proposal for the complete sample (Model 1), while the second and third

regressions look specifically at what factors influence the voting decisions for proposals

that ISS recommends in favor of (ISS recommended) (Model 2) and proposals that ISS

recommends against (ISS non-recommended) (Model 3).15 We make this distinction

between ISS recommended and ISS non-recommended items since simply voting for a

proposal does not necessarily indicate that a fund is voting in a manner consistent with

being an effective monitor given that not all proposals are likely to positively impact

shareholder wealth. These regressions are shown in Table 7.

Consistent with our earlier findings, we find that mutual funds are likely to vote

favorably for Davis and Kim (2006) key items and items recommended by ISS. Further,

funds are more likely to support board, governance, and compensation proposals than

other proposal types. The marginal effects for these factors are among the largest reported

in the table. This is to be expected since these are our proxies for proposal quality

(whether the proposals will impact shareholder wealth in a positive manner). Sponsor

type also appears to play a role in voting – religious sponsors always receive lower voting

14 We lose 93 observations from two fund families due to fund family fixed effects. For one family, all funds always vote for shareholder proposals while in the other family all funds always vote against shareholder proposals. 15 We run several robustness checks (not shown) which include the following. We run the regressions omitting all but one of the proxies for proposal quality (proposal classification, key items, and ISS recommendations). We use alternative definitions of key items including one which replaces cumulative voting with majority voting and another which adds majority voting to the six key items defined by Davis and Kim (2006). We also use the Davis and Kim key items instead of the ISS recommendations as alternative divisions for Model 2 and 3. We also try including a dummy variable for unknown sponsors. Regardless of the robustness check, our results remain qualitatively the same.

24

support while the other sponsor types appear to play differing roles depending on whether

we are examining ISS or ISS non-recommended resolutions. (Our base case is individual

occasionals and unknown sponsors.) For example, ISS recommended proposals by union

and pension sponsors tend to receive negative vote decisions from funds while ISS non-

recommended resolutions by these same sponsor types are likely to receive affirmative

decisions. We also find some evidence that the proxy year may matter – proposals

submitted during 2005 are not as likely to receive affirmative fund voting decisions as

those proposed in 2004.

We also find evidence that, even after controlling for family coordination, fund

characteristics impact the mutual funds’ voting decisions (and ultimately their role as

monitors). Fund turnover and expense ratios are both negatively related to the likelihood

of voting in support of a proposal suggesting that funds with longer investment horizons

may be more likely to act as monitors. When a fund owns a larger stake in the firm, it is

also more likely to vote for shareholder proposals (Model 1 and 2), which is consistent

with funds with larger financial stakes in the targeted firm being more willing to take an

active stance. Consistent with the argument of economies of scale (Black, 1990), funds

holding a larger number of securities vote more affirmatively for shareholder proposals.16

Social funds are more likely than other funds to vote for proposals (both ISS

recommended and ISS non-recommended) which is consistent with their voting in line

with their social agendas. Fund size and fund past performance are also both negatively

related to voting for a proposal; this result on performance suggests that funds with poor

16 There is a strong correlation between a fund being an index fund and the number of securities held by a fund. An average index fund in our sample holds 917 securities while a non-index fund holds 192. If we replace the number of securities held by the fund with an index fund dummy variable, we get results similar to those shown here.

25

performance may be looking for ways to increase their performance by pressuring

management to implement wealth-increasing items. Not surprisingly, the marginal effects

of the fund characteristics are lower than the proposal characteristics but are still

economically significant, especially for Model 2.

Firm characteristics also impact mutual fund voting in a manner consistent with

our predictions. Funds are more likely to vote for proposals when institutional and

outside block holdings and the percentage of outsiders on the board are lower and when

G-index and board size are higher. This evidence suggests that mutual funds are more

likely to support proposals which target firms with weaker governance. It also suggests

that funds may be more likely to take on a monitoring role when other monitors are weak

(lower institutional and block holdings and fewer outside directors). Firm size is

negatively related to the affirmative voting decisions which may be consistent with the

coordination/free-rider problem found with larger firms. Contrary to the findings of

Gordon and Pound (1993), who find that overall voting results are negatively related to

past performance, we find that firm performance is positively related to affirmative fund

voting decisions; this result may be due in part to the generally good overall performance

of the firms in our sample. The marginal effects show that many of the firm

characteristics are also economically significant, at least for ISS recommended proposals.

We find some differences between voting on ISS recommended and ISS non-

recommended items other than the differing roles of sponsors already discussed above.

For the ISS non-recommended set (those items unlikely to increase wealth), fund

turnover, fund past performance, fund’s holdings in the firm, board size, and the 2005

proxy-year dummy no longer play a significant role in impacting the fund’s voting

26

decision while outside blockholdings, G-index, and firm past performance now play the

opposite role as before. Thus, there do appear to be significant differences in the factors

(including turnover, fund performance, and fund’s holdings) that lead to voting for

potentially wealth-increasing versus potentially wealth-decreasing items. The marginal

effects of the factors that we hypothesize to impact fund voting are larger in Model 2

(examining voting for potentially wealth-increasing proposals) than in Model 1 or 3.

In summary, we find evidence that mutual funds vote in an effective manner by

supporting potentially wealth-increasing proposals and that both fund and firm

characteristics play important roles in the funds’ voting decisions. Funds with longer

investment horizons (i.e., lower turnover and expense ratios) and with greater holdings in

the firm appear more likely to support wealth-increasing proposals. Funds are also more

likely to support proposals aimed at firms with weaker governance structures.

4.4. Impact of mutual fund voting rates on voting outcome

Mutual funds own a significant portion of the stock of U.S. firms and in many

cases, they may be considered to be the swing voters who determine whether or not a

shareholder proposal will pass (WSJ, 2003/11/10). (In aggregate, mutual funds own

approximately 12.5% of the total shares outstanding of the average firm in our sample

and about 18% of the votes actually cast so mutual funds do not typically control enough

shares to determine the outcome completely on their own.) In this section, we investigate

the impact of mutual fund voting rates on the voting outcome defined as whether or not

27

the proposal passes.17 We run two logistic regressions, one with and one without the

mutual fund approval rate as defined in Section 4.2. The dependent variable equals one if

the shareholder proposal passes, zero otherwise. Following the prior literature and in

view of our earlier results, we control for proposal quality (proxied by proposal types, the

key-item dummy, and the ISS recommendation dummy), sponsor identity, year, and firm

characteristics, which include ownership structure, governance attributes, firm size and

firm performance.18 All test statistics are based on robust standard errors. Table 8 reports

our results.

As Model 2 shows, fund approval rate has a significant impact on whether the

shareholder proposal passes.19 The only other factors that have a larger marginal effect

are officers’ and directors’ holdings (officers and directors typically vote against

shareholder-sponsored proposals) and whether the item receives an affirmative ISS

recommendation. As expected, if a proposal is a key item or is supported by ISS, it is

more likely to pass. Board, governance, and compensation items are also more likely to

pass than other item types. Consistent with prior literature, large institutional ownership

has a positive effect on the success rate of shareholder proposals (Strickland, Wiles, and

Zenner, 1996). G-index is negatively related to the likelihood of shareholder proposals

being passed after including the mutual fund approval rate and suggests that other voters

may not consider the firm’s governance structure to the same extent that mutual funds do.

17 In the US, shareholder proposals are not legally binding. Even if passed by the necessary percentage of votes, management is not required to implement them. We examine whether the vote passes, not whether the item is ultimately implemented. Disclosure of item implementation (or lack thereof) is often lacking. 18 The social proposal dummy is not included in this regression since none of these proposals pass. 19 The adjusted pseudo R-squared of Model 2 is significantly higher than that of Model 1, 0.641 versus 0.497. We also compare Model 1 and 2 using a partial likelihood ratio test, which is similar to the F-test in OLS regressions. The chi-square test statistics is 75.2 (p-value<0.001), again suggesting that fund approval rate is an important explanatory variable for the probability of the shareholder proposal being passed.

28

In summary, our results suggest that mutual fund votes play an important role in

the passage of shareholder proposals. While funds do not generally own enough shares to

ensure passage of the item based on their votes alone, they do appear to significantly

influence voting outcomes.

5. Conclusions

Using recently available voting data, we construct a detailed proxy voting dataset

at the individual fund level for 1,794 funds to examine the role of mutual funds as

corporate monitors. Specifically, we address four important questions: Do mutual funds

exercise their proxy voting rights in a manner consistent with their being effective

monitors? Do the characteristics of the funds themselves influence their role as monitors?

Are funds more likely to support resolutions that target firms with weaker governance?

How do mutual fund voting decisions impact the passage of shareholder-sponsored

proposals?

Consistent with prior literature, we find that mutual funds are more likely to vote

against rather than for shareholder proposals (mutual funds vote affirmatively for only

26% of the proposals in our sample). However, we also find evidence that funds tend to

support proposals which are likely to positively impact shareholder wealth (proxied for

by proposal classification types, affirmative ISS recommendations, and the six key items

as described in Davis and Kim (2006)) – these proposals include ones targeting important

aspects of corporate governance such as adopting majority voting or potential agency

conflicts such as golden parachutes and poison pills. Furthermore, when we compare

mutual fund approval rates to the voting approval rates of other shareholders, we find that

29

while funds vote less affirmatively overall, mutual funds are more likely than other voters

to vote affirmatively on proposals that are likely to increase wealth. This evidence

supports the theory that mutual funds act as effective monitors when exercising their

proxy voting rights.

We also find evidence that fund and firm characteristics influence funds’ voting

decisions. Funds with lower turnover and expense ratios tend to vote more affirmatively

for shareholder proposals. Larger numbers of securities in the funds’ portfolio and larger

stakes in the firm by the funds also lead to a greater willingness to support shareholder

proposals. Social funds, probably due to their social agendas, are more likely than other

fund types to vote for shareholder resolutions. We also find evidence that funds support

proposals targeting firms with weaker governance (measured as higher G-index, larger

board size, and lower institutional holdings). Finally, we find that fund approval rates

have a significant impact on whether a proposal is ultimately passed by shareholders.

Our results are consistent with mutual funds acting as effective monitors through

the proxy voting process. Funds do not support all shareholder proposals – instead they

appear to limit their support to those expected to increase shareholder wealth. Funds are

also more likely to vote in favor of value-increasing proposals than are other investor

types. Finally, we find evidence that both fund and firm characteristics may influence the

voting decision and that fund voting approval rates impact whether the proposal passes.

30

References:

Amzaleg, Y., Ben-Zion, U., Rosenfeld, A., 2005. On the role of institutional investors in corporate governance: Evidence from voting of mutual funds in Israel. Working paper. Ben-Gurion University. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=746024

Ashraf, R., Jayaraman, N., 2006. Determinants and consequences of proxy voting by

mutual funds on shareholder proposals. Working paper. Georgia Institute of Technology. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=962126

Bebchuk, L., Cohen, A., Ferrell, A., 2004. What matters in corporate governance. Olin

Center Discussion Paper No. 491. Harvard University. Berle, A. A., Jr., Means, G. C., 1932. The Modern Corporation and Private Property

(Macmillan, New York, NY). Bhide, A., 1993. The hidden costs of stock market liquidity. Journal of Financial

Economics 34, 31-51. Black, B.S., 1990. Shareholder passivity reexamined. Michigan Law Review 89, 520–

608. Brown, K, November 10, 2003. Vanguard Gives Corporate Chiefs A Report Card. The

New York Times C1. Bushee, B., 1998. The influence of institutional investors on myopic R&D investment

behavior. The Accounting Review 73, 305-333. Cai, J., Garner, J., Walkling, R., 2006. Democracy or disruption: Majority versus

plurality voting. Working paper. Drexel University. Chen, X., Harford, J., Li K., 2006. Monitoring: Which institutions matter?, Journal of

Financial Economics, forthcoming. Chou, W., Ng, L., Wang, Q., 2007. Do governance mechanisms matter for mutual funds?,

Working paper. University of Wisconsin-Milwaukee, Milwaukee. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=972235.

Cremers, M., Romano, R., 2006. Institutional investors and proxy voting: The Impact of

2003 mutual fund voting disclosure regulation. Working paper. http://papers.ssrn.com/sol3/ papers.cfm?abstract_id=924772.

Davis, G. F., Kim, E. H., 2006. How do business ties influence proxy voting by mutual

funds. Journal of Financial Economics, forthcoming.

31

Downes, Jr., Giles R., Houminer, E., Hubbard, R. G., 1999. Institutional Investors and Corporate Behavior. Washington, D.C.: AEI Press.

Ferri, F., Markarian, G., Sandino, T., 2006. Stock options expensing: Evidence from

shareholders’ votes. Working paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id= 590349.

Gaspar, J. M., Massa, M., Matos, P., 2005. Shareholder investment horizons and the

market for corporate control. Journal of Financial Economics 76, 135-165. Gillan, S. L., 2006. Recent developments in corporate governance: An Overview. Journal

of Corporate Finance 12, 381-402. Gillan, S. L., Starks, L. T., 2000. Governance proposals and shareholder activism: The

Role of institutional investors. Journal of Financial Economics 57, 275-305. Gine, M., Moussawi, R., 2007. Governance mechanisms and effective activism: Evidence

from shareholder proposals on poison pill. Working paper. University of Pennsylvania. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=968425.

Gompers, P. A., Ishii, J., Metrick, A., 2003. Corporate governance and equity prices.

Quarterly Journal of Economics 118, 107-155. Gordon, L. A., Pound, J., 1993. Information, ownership structure, and shareholder voting:

Evidence from shareholder-sponsored corporate governance proposals. Journal of Finance 48, 697-718.

Guo, R.J., Kruse, T., Nohel, T., 2006. Undoing the powerful anti-takeover force of

staggered boards. Working paper. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=891534.

Hartzell, J., Starks, L. T., 2003. Institutional investors and executive compensation.

Journal of Finance 58, 2351-2374. Healy, B., September 5, 2004, Mutual Fund Votes Show Limits to Change, The Boston

Globe A1. Hermalin, B. E., Weisbach, M. S., 2003. Boards of directors as an endogenously

determined institution: A survey of the economic evidence. Economic Policy Review 9, 7-26.

Investment Company Institute 2006 Fact Book,

http://www.icifactbook.org/pdf/2006_factbook.pdf Jensen, M. C., Meckling, W. H., 1976. Theory of the firm: Managerial behavior, agency

costs, and ownership structure. Journal of Financial Economics 3, 305-360.

32

Karpoff, J., Malatesta, P., and Walkling, R., 1996. Corporate governance and shareholder

initiatives: empirical evidence. Journal of Financial Economics 42, 365 – 395. Linck, J. S., Netter, J. M., Yang, T. 2006. The determinants of board structure. Journal of

Financial Economics, forthcoming. Lublin, J. S., March 21, 2002. Proxy Voting Is a Fiduciary Duty, SEC Chief Says in

Letter to Group. The Wall Street Journal C20. Morgan, A., Poulsen, A., 2001, Linking pay to performance – compensation proposals in

the S&P 500. Journal of Financial Economics 62, 489-523. Parrino, R., Sias, R., Starks, L. T., 2003. Voting with their feet: Institutional ownership

changes around forced CEO turnover. Journal of Financial Economics 68, 3–46. Pound, J., 1988. Proxy contests and the efficiency of shareholder oversight. Journal of

Financial Economics 20, 237-265. Roe, Mark, 1990, Political and legal restraints on ownership and control of public

companies, Journal of Financial Economics 27, 7-42. Rothberg, B., Lilien, S. B., 2005. Mutual fund proxy votes. Working Paper,

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=669161. Sias, R. W., Starks, L. T., 1997. Institutions and individuals at the turn-of-the-year.

Journal of Finance 52, 1543 – 1562. Shleifer, A., Vishny, R., 1986. Large shareholders and corporate control. Journal of

Political Economy 94, 461-488. Strickland, D., Wiles, K. W., Zenner, M., 1996. A requiem for the USA: Is small

shareholder monitoring effective?, Journal of Financial Economics 40, 319-338. Scism, L., March 1, 1994. Labor Unions Increasingly Initiate Proxy Proposals. The Wall

Street Journal C1. Whitehouse, K., Lauricella, T., December 22, 2006. Voting Records at Mutual Funds:

Still a Hard Read. The Wall Street Journal C1. Yermack, D., 2006. Flights of fancy: Corporate jets, CEO perquisites, and inferior

shareholder returns. Journal of Financial Economics 80, 211-242.

Table 1 Breakdown of shareholder proposal types for meetings occurring between July 2003 and June 2005 This table counts by year, total, and percentage the 1,047 shareholder proposals received by our 356 sample firms for meetings occurring between July 2003 and June 2005. We group the proposals into five broad categories: board proposals, compensation proposals, governance proposals, environmental and health proposals (environmental proposals), and social and economic proposals (social proposals). Proposals that do not fit into those five categories are classified as miscellaneous proposals. * denotes proposal types classified as key items.

2004 2005Board issues

Declassify the board of directors* 39 33 72 6.9%Require a majority vote for the election of directors 9 53 62 5.9%Separate Chairman and CEO positions* 33 21 54 5.2%Provide for cumulative voting* 19 14 33 3.2%Require majority of independent directors on board 9 4 13 1.2%Other board-related proposals 31 24 55 5.3%

Total 140 149 289 27.6%

Compensation issuesLimit executive compensation/report on pay disparity 53 31 84 8.0%Performance-based compensation 11 37 48 4.6%Submit severance agreement (golden parachutes) to vote* 28 19 47 4.5%Expense stock options* 29 10 39 3.7%Submit executive compensation to vote 11 13 24 2.3%Other compensation-related proposals 44 19 63 6.0%

Total 176 129 305 29.1%

Governance issuesSubmit shareholder rights plan (poison pill) to shareholder vote* 48 16 64 6.1%Prohibit auditor from providing non-audit services 11 5 16 1.5%Simple majority vote requirement 7 13 20 1.9%Provide for confidential voting 1 3 4 0.4%Other governance proposals 13 7 20 1.9%

Total 80 44 124 11.8%

Environmental issuesReport on genetically engineered products 11 9 20 1.9%Cigarette/tobacco related 9 10 19 1.8%Report on greenhouse gas emissions 8 6 14 1.3%Report on operational impact of HIV/AIDS, TB, and malaria pandemic 8 5 13 1.2%Environment-related issues 7 6 13 1.2%Other health- and environmental- issues 13 12 25 2.4%

Total 56 48 104 9.9%

Social issuesReport on political contributions/activities 33 28 61 5.8%Code of corporate conduct/workplace human rights 32 17 49 4.7%Animal welfare standards/animal testing policy 5 17 22 2.1%Non-discrimination policy/EEO/diversity report/glass ceiling report 10 10 20 1.9%Prepare a sustainability report 9 7 16 1.5%Other social- and economic- proposals 33 18 51 4.9%

Total 122 97 219 20.9%

Other miscellaneous proposals 3 3 6 0.6%

Total 577 470 1,047 100.0%

Proposal description# Proposals Total (%)

Table 2 Descriptive statistics of firm and mutual fund characteristics This table reports summary statistics for the 356 unique firms and 1,794 unique funds in our sample. Since firms may receive proposals in both years and since funds may vote in both years, we summarize for the two year period firm characteristics per firm year (510 in total) and fund characteristics per fund year (2,560 in total). Financial variables come from CRSP and COMPSTAT. Firm past performance is the market-adjusted, buy-and-hold return for the previous year. Leverage is long-term debt to total assets. We collect officers’ and directors’ holdings, outside blockholdings, and board data from annual proxy statements and institutional holdings data from the S&P Security Owners Stock Guide. Board size is the number of directors on the board. % independent directors on the board is calculated as the number of outside directors over board size. Whether CEO is the Chairman is a dummy variable, which equals one if the CEO is the Chairman of the Board, or zero otherwise. We gather G-index from the Gompers, Ishii, and Metrick website. Mutual fund data (including turnover, expense ratio, and # funds per fund family) comes from the Mutual Funds Advanced module of Morningstar Principia. # proposals per fund is the number of proposals voted on by a fund in a given fund year. Fund size is net assets in millions. Fund’s holdings in the firm is the percentage of the firm’s shares owned by the fund. # securities in the fund is the total number of securities in the fund’s portfolio. Fund past performance is measured as the unadjusted 12-month return as reported by Morningstar. Panel A: Firm characteristics

Mean Median Minimum Maximum

Operating characteristicsTotal assets ($ millions) 52,403 10,771 235 1,484,101Past performance 11.22% 4.92% -70.15% 334.10%Leverage 23.39% 21.71% 0.00% 89.05%Book-to-Market ratio (of equity) 0.424 0.382 -5.541 2.770

Governance characteristicsG-index 10 10 3 17Board size 11 11 5 19% independent directors on the board 73.94% 75.96% 0.00% 100.00%Whether CEO is the Chairman 73.92% 100.00% N/A N/A

OwnershipOfficers' and directors' holdings 7.97% 2.53% 0.00% 98.00%Institutional holdings 68.97% 71.08% 0.07% 98.06%Outside blockholdings 13.37% 10.90% 0.00% 57.08%

Panel B: Mutual fund characteristics

Mean Median Minimum Maximum

# proposals per fund 83 44 1 557# funds per fund family 15 11 1 131Fund size ($ millions) 1,438 244 0 84,167Turnover ratio 90.25% 69.00% 0.00% 776.00%Expense ratio 1.24% 1.21% 0.02% 13.48%Fund's holdings in the firm 0.10% 0.02% 0.00% 1.99%# securities in the fund 247 105 1 6,211Fund past performance 21.59% 20.35% -15.57% 96.31%

Table 3 Distribution by proposal types and sponsor types This table reports the frequency distribution by proposal types and sponsor identities of the 1,047 shareholder proposals submitted for shareholder vote between July 2003 and June 2005. We classify sponsor types into seven categories: institutional investors, pensions, unions, religious and environmental groups, individual activists, individual occasionals, and unknown sponsors. (Some firms in our sample did not disclose sponsor identity so we classify those sponsors as unknown). We classify the proposals into five main broad categories: board proposals, compensation proposals, governance proposals, environmental and health proposals (environmental proposals), and social and economic proposals (social proposals). Proposals that do not fit into those five categories are classified as miscellaneous proposals.

Board Compensation Governance Environmental Social Misc TotalInstitutional 31 29 7 11 35 0 113Pension 14 9 3 0 34 0 60Union 84 112 17 0 31 0 244Individual - activists 51 28 45 0 12 2 138Individual - occasional 54 61 18 9 32 4 178Religious and environmental groups 10 21 1 51 39 0 122Identity unknown 45 45 33 33 36 0 192Total 289 305 124 104 219 6 1,047

Table 4 Percentage of affirmative mutual fund voting decisions and percentage of affirmative ISS recommendations This table reports, in relation to proposal type, the percentage (by year and in aggregate) of affirmative mutual fund voting decisions and the percentage of affirmative ISS recommendations. All together, the 1,794 mutual funds in our sample make 212,620 voting decisions in regards to 1,047 shareholder proposals submitted for shareholder votes between July 2003 and June 2005. * denotes proposal types classified as key items. Panel A: Mututal fund voting decisions

2004 2005 OverallOverall 25.2% 27.7% 26.4% 46.8%

Board issues 39.8% 47.3% 43.6% 74.4%Declassify the board of directors* 90.1% 89.2% 89.8% 100.0%Require a majority vote for the election of directors 4.2% 61.3% 51.8% 85.5%Separate Chairman and CEO positions* 33.6% 34.9% 34.2% 79.6%Provide for cumulative voting* 41.9% 42.3% 42.1% 84.9%Require majority of independent directors on board 33.7% 21.7% 28.6% 61.5%

Compensation issues 27.4% 27.7% 27.5% 46.6%Limit executive compensation/report on pay disparity 2.2% 3.8% 2.8% 1.2%Performance-based compensation 41.2% 33.7% 35.5% 68.8%Submit severance agreement (golden parachutes) to vote* 65.8% 67.2% 66.4% 93.6%Expense stock options* 69.6% 68.7% 69.3% 100.0%Submit executive compensation to vote 26.5% 4.9% 15.1% 33.3%

Governance issues 62.0% 64.8% 63.0% 71.0%Submit shareholder rights plan (poison pill) to shareholder vote* 78.6% 77.7% 78.4% 85.9%Prohibit auditor from providing non-audit services 7.3% 6.3% 7.0% 0.0%Simple majority vote requirement 93.5% 84.6% 87.6% 95.0%Provide for confidential voting 96.6% 77.1% 78.5% 75.0%

Environmental issues 6.2% 5.7% 5.9% 10.6%Report on genetically engineered products 2.8% 1.2% 2.0% 0.0%Cigarette/tobacco related 3.3% 2.1% 2.8% 5.3%Report on greenhouse gas emissions 15.5% 12.6% 14.2% 28.6%Report on operational impact of HIV/AIDS, TB, and malaria pandemic 13.0% 9.3% 11.9% 15.4%Environment-related issues 3.3% 9.1% 6.2% 7.7%

Social issues 5.8% 6.3% 6.0% 15.5%Report on political contributions/activities 3.8% 1.7% 2.9% 0.0%Code of corporate conduct/workplace human rights 6.0% 4.9% 5.5% 12.2%Animal welfare standards/animal testing policy 0.5% 0.5% 0.5% 0.0%Non-discrimination policy/EEO/diversity report/glass ceiling report 18.8% 24.3% 21.4% 55.0%Prepare a sustainability report 20.4% 18.4% 19.5% 88.9%

Proposal description

% Proposals ISS recom. For% Proposals that funds vote For

Table 5 Comparison of mutual fund voting approval rates to the approval rates of the other voters in regards to proposal types, key items, ISS recommendations, and sponsor types This table compares the mutual fund voting approval rates to the approval rates of the other voters. We calculate the mutual fund approval rate as the number of shares that funds voted affirmatively for a proposal over the total number of votes cast by the funds. The approval rate by other voters is the total number of affirmative votes minus affirmative votes cast by mutual funds over the total number of votes cast minus total votes cast by mutual funds. Following Davis and Kim (2006), we classify board declassification, cumulative voting, independent board chairman, golden parachutes, stock option expensing, and poison pills as key proposal items (key items). a, b, and c denote the significance levels of the t-test of the paired differences between the fund approval rate and the approval rate of other voters at 1%, 5%, and 10% respectively.

Fund approval rate

Approval rate by other voters Dif.

Overall 26.2% 27.8% -1.6% a

Proposal typeBoard issues 40.5% 38.4% 2.1% c

Compensation issues 23.2% 27.7% -4.5% a

Governance issues 63.0% 49.2% 13.8% a

Environmental issues 2.7% 9.9% -7.1% a

Social issues 2.7% 11.0% -8.3% a

Whether it is a key proposalKey item 60.7% 50.4% 10.3% a

Non-key item 11.8% 18.3% -6.5% a

Whether ISS recommends ForISS recommends For 53.2% 47.3% 5.8% a

ISS recommends Against 2.5% 10.6% -8.0% a

Sponsor typeInstitutional sponsor 26.5% 30.7% -4.2% a

Pension sponsor 23.6% 26.8% -3.3%Union sponsor 28.0% 30.1% -2.1%Individual - activist 42.6% 35.6% 7.0% a

Individual - occasional 22.8% 26.9% -4.1% a

Religious and environmental group 4.9% 10.4% -5.5% a

Identity unknown 29.6% 29.7% -0.2%

All proposals

Table 6 Analysis of mutual fund voting decisions within and across fund families This table reports summary information on individual mutual fund voting decisions within and across fund families for all the proposal types listed in Table 1, except for the miscellaneous proposals. We report the total number of fund families that voted on a proposal, the number of fund families within which all the funds voted unanimously for the proposal, and the number of fund families within which all the funds voted unanimously against the proposal. For those families where the funds did not vote unanimously, we list the number of fund families, the ratio of these fund families to the total number of voting fund families, and the percent of proposals for which these funds vote affirmatively. We exclude three fund families that consist of only one fund. * denotes proposal types classified as key items.

n (%)% Proposal voted For

Board issuesDeclassify the board of directors* 91 44 5 42 (46%) 75.6%Require a majority vote for the election of directors 86 6 17 63 (73%) 59.0%Separate Chairman and CEO positions* 88 4 17 67 (76%) 48.7%Provide for cumulative voting* 88 6 23 59 (67%) 55.9%Require majority of independent directors on board 75 1 14 60 (80%) 37.7%