Money Market vs Loanable funds Market · 2016-12-17 · Money Market vs Loanable funds Market This...

Transcript of Money Market vs Loanable funds Market · 2016-12-17 · Money Market vs Loanable funds Market This...

Money Market vs Loanable funds Market

This market refers to the Money Supply (M1 and M2). The Money Supply curve is vertical because it is

determined by the Fed’s (or central bank’s) particular monetary policy. On the X axis is the Quantity

of money supplied and demanded, and on the Y axis is the nominal interest rate. A tight monetary

policy (selling of bonds by the Fed) will shift Money Supply in, raising the federal funds rate, and

subsequently the interest rates commercial banks charge their best customers (prime interest rate).

On the other hand, an easy money policy (buying of bonds by the Fed) shifts Sm out, lowering the

Federal Funds rate and thus the prime interest rate.

You should also know why a tight money policy is considered contractionary and why an easy money

policy is considered expansionary monetary policy. Higher nominal interest rates resulting from tight

money policy will discourage investment and consumption, contracting aggregate demand. On the

other hand, an easy money policy will encourage more investment and consumption as nominal rates

fall, expanding aggregate demand.

Money Market vs Loanable funds Market

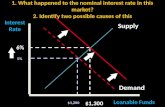

Loanable funds represents the money in commercial banks and lending institutions that is available to

lend out to firms and households to finance expenditures (investment or consumption). The Y-axis

represents the real interest rate; the loanable funds market therefore recognizes the relationships

between real returns on savings and real price of borrowing with the public’s willingness to save and

borrow.

Since an increase in the real interest rate makes households and firms want to place more money in

the bank (and more money in the bank means more money to loan out), there is a direct

relationship between real interest rate and Supply of Loanable Funds.