Momentive Performance DIP analysis May 2014

-

Upload

john-sweeney -

Category

Documents

-

view

17 -

download

2

Transcript of Momentive Performance DIP analysis May 2014

Research Update:

Momentive Performance MaterialsUSA Inc. Debtor-In-Possession TermLoan Rated 'BB-' Point-In-Time

Primary Credit Analyst:

Cynthia M Werneth, CFA, New York (1) 212-438-7819; [email protected]

Secondary Contact:

Paul J Kurias, New York (1) 212-438-3486; [email protected]

Recovery Analyst:

John W Sweeney, New York (1) 212-438-7154; [email protected]

Table Of Contents

Overview

Rating Action

Rating Framework Summary

Rationale

Related Criteria And Research

Ratings List

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 1

1323697 | 300614293

Research Update:

Momentive Performance Materials USA Inc.Debtor-In-Possession Term Loan Rated 'BB-'Point-In-Time

Overview

• We have assigned our point-in-time 'BB-' rating to thedebtor-in-possession (DIP) term loan facility provided to MomentivePerformance Materials USA Inc., a subsidiary of Momentive PerformanceMaterials Inc. (MPM), a specialty chemicals and materials producer thatis currently operating under the protection of Chapter 11 of the U.S.Bankruptcy Code.

• A DIP issue rating reflects our view of the likelihood of full cashrepayment through the company's reorganization and emergence from Chapter11 and can be enhanced if we believe the debt is likely to be fullyrepaid from the liquidation of its collateral if the company cannotsuccessfully reorganize.

• Our DIP issue rating for MPM incorporates our 'B+' assessment of thelikelihood of full cash repayment through MPM's reorganization andemergence from Chapter 11. We then applied a (one-notch) enhancementbased upon our assessment of recovery prospects in a liquidation scenarioto reach the 'BB-' issue rating.

• We consider MPM as having a "weak" business risk profile based onindustry overcapacity, as well as a severe decline in operatingprofitability and underinvestment in recent years, and we regard thecurrent operating environment to be challenging. Even so, no operationalrestructuring is needed, liquidity appears sufficient, and the DIPfinancing is relatively modest compared to the enterprise value. Togetherthese factors support our 'B+' assessment of the likelihood of full cashrepayment at emergence.

• In a liquidation scenario, we estimate implied coverage relative to themaximum DIP exposure of $570 million would be 140%, assuming the $70million standby letters of credit under the DIP asset-backed loan (ABL)become funded/cash collateralized.

• This rating is only valid for the date of publication of this report.• On April 13, 2014, MPM and certain of its U.S. subsidiaries filed avoluntary petition under Chapter 11 of the U.S. Bankruptcy Code. On April14, 2014, the U.S. Bankruptcy Court in the Southern District of New Yorkissued an interim order that authorized the company to borrow up to $430million of the $570 million DIP facilities. It is anticipated that on orabout May 23, 2014, the bankruptcy court will issue a final orderauthorizing access to the full amount under the DIP facilities. The DIPfacilities constitute super-priority administrative expense claim status,which allows the lenders to demand full cash repayment as a condition for

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 2

1323697 | 300614293

the company to reorganize and emerge from bankruptcy. The unrated DIPfacility revolving credit agreement includes the option for it to beconverted to an exit facility. However, we do note that the $270 millionABL DIP revolver facility can only be converted to a five-year exitfacility if certain conditions are met.

• MPM, a developer and manufacturer of silicones, products derived fromquartz, and specialty ceramics, is currently operating in Chapter 11protection via debtor-in-possession (DIP) financing of $130 million undera one-year, $270 million asset-based lending (ABL) facility and aone-year, $300 million term loan facility. The total DIP financing isanticipated to total $570 million, which assumes the company receivestimely approval by way of the final order from the U.S. Bankruptcy Courtfor the remaining $140 million of availability under the DIP ABLfinancing.

• The $270 million DIP ABL Facility (unrated) will consist of a $200million tranche A-LIFO revolver (multi-currency borrowings) and a $70million tranche B-FILO revolver (solely U.S. dollar borrowings).Approximately $70 million of the tranche A revolver will backstop andcash collateralize prepetition letters of credit that support workmen'scompensation, performance, and trade. Tranche A drawings may only be madewhen tranche B is fully drawn. Tranche B revolver availability willsupport modest, albeit additional advances against accounts receivableand inventory as well as advances against machinery and equipment.

• The unrated DIP revolver (tranche A and B) is secured by a priming firstlien on all accounts receivable, inventory, and cash. Tranche B is alsosecured by machinery and equipment attributed to certain foreignborrowers (Germany and Canada). The DIP revolver retains asecond-priority priming lien on all term loan collateral. The DIP termloan is secured by a priming first-lien on all property, plant, andequipment and other assets and a second-priority priming lien on the ABLcollateral of the domestic loan parties. While both the DIP term loan andDIP revolver facility have super-priority administrative expense claimstatus, it is our understanding that the unrated DIP revolver could beconverted to an exit facility if certain conditions are met.

(Watch the related CreditMatters TV segment titled, "What’s Behind Standard &Poor’s Point-In-Time, Debtor-In-Possession Rating On Momentive PerformanceMaterials' Term Loan Facility," dated May 28, 2014.)

Rating Action

On May 15, 2014, Standard & Poor's Ratings Services assigned its point-in-time'BB-' rating to Momentive Performance Materials USA Inc.'s "new money" $300million DIP term loan facility due the earlier of April 2015 or the effectivedate of the company's plan of reorganization. Since the DIP term loan facilityrating is a point-in-time rating, it is effective only for the date of thisreport, and we will not review, modify, or provide ongoing surveillance of therating.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 3

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

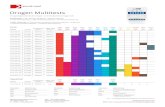

Rating Framework Summary

The rating is established using our global corporate criteria (see "CorporateMethodology," published Nov. 19, 2013, on RatingsDirect) and our criteriaarticle "Principles of Credit Ratings," published Feb. 16, 2011).

Under this approach, we have assessed the credit risk of the DIP loan byevaluating:• The likelihood a company will be able to successfully reorganize andemerge from bankruptcy as a going concern and be able to attractsufficient exit financing to fully repay the DIP financing at emergence.This evaluation forms the anchor for the DIP issue rating.

• The potential for a company to repay the DIP financing through theliquidation of assets, assuming it is unable to successfully reorganizeand emerge from bankruptcy. We assume DIP financing is sufficientlyover-collateralized to be fully repaid in a liquidation analysis and maybenefit from a one- or two-notch enhancement over the anchor score,depending on our estimated level of coverage.

Taken together, a DIP issue rating captures our analytical assessment of theviability (reorganizability) of a company's business and the amount of the DIPobligation relative to the company's value--both as a reorganized entity andon a liquidation basis.

A more complete discussion of the framework for our analysis is provided atthe end of this report in the "Ratings Framework" section at the end of thisarticle.

Rationale

Key elements of our assessment of the company's ability to reorganize andfully repay the DIP loan at emergence include:• Our assessment of MPM's restructuring requirements and challenges;• The company's business position and outlook;• The adequacy of its liquidity during bankruptcy; and• The extent to which MPM's going-concern value exceeds the expected DIPloan exposure.

This analysis includes, among other things, a review of the senior secured DIPand exit ABL credit agreement dated April 15, 2014, the senior secured DIPterm loan credit agreement dated April 15, 2014, the interim order issued bythe U.S Bankruptcy Court dated April 14, 2014, and the company's cash flowforecasts. The DIP term loan credit agreements do not allow the debtors orobligate the lenders to convert the DIP loan to an exit financing; however, wenote the DIP ABL credit agreement allows the company to convert this facilityto a five-year exit facility only upon certain conditions being met.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 4

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

The DIP financing is important to MPM since it will allow the company to rollup letters of credit for counterparties during the pendency of the bankruptcyas well as for liquidity purposes in order for MPM to meet operating andcapital needs during bankruptcy.

MPM's recent bankruptcy filing was prompted by a number of factors, including:• 51% last-12-months EBITDA decline from $492 million (fiscal 2010) to $240million (fiscal 2013);

• The foregoing cash flow decline, coupled with a highly leveraged balancesheet, impaired the company's ability to service its debt obligations;

• A fundamental shift in industry dynamics, i.e., overcapacity, newparticipants and product commoditization; and

• Reduced demand in two key customer segments: (i) silicone: automotive,building, construction and electronics, and (ii) quartz: semiconductorsand electronics.

Our assessment of MPM's weak, but improving, business risk profile leads us tobelieve that the company will remain a viable business upon emergence frombankruptcy.

The following factors support our assessment of a "weak" business riskprofile:• Industry overcapacity;• A severe decline in operating profitability;• Underinvestment in recent years;• No operational restructuring is needed;• Liquidity appears sufficient, and the DIP financing is relatively modestcompared to the enterprise value; and

• Broad-based industry diversification and its position as a globalsilicone producer.

In our view, the DIP financing, as contemplated, provides the company withsufficient liquidity to effectively manage and conduct its business throughoutthe bankruptcy process. It is projected that MPM will pay adequate protectionpayments to its prepetition first-lien and 1.5-lien creditors while fundingworking capital, administrative fees and expenses, and other corporateexpenses. We note the company anticipates emerging after six months inbankruptcy (October 2014), and it projects to have approximately $190 millionof liquidity with nearly one-third of this amount reflecting DIP ABLborrowings. If MPM were to experience very tight liquidity due to a prolongedChapter 11 process or further deterioration in business conditions, it couldupsize the DIP if allowed and/or file an amended motion with the bankruptcycourt that would seek to halt the adequate protection payments being made toits first-lien and 1.5-lien prepetition creditors.

While we believe that reorganization is a more likely scenario for MPM thanliquidation, the operating environment is challenging and a materialdeterioration in operating conditions could make restructuring and repayingthe DIP loan in full challenging. Risks to the operating outlook: include:

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 5

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

• Global silicone capacity continues to far exceed actual demand, whichcould continue to depress prices and result in cash burn; and

• A secular decline in demand for silicone, which we regard as less likely.

In assessing the likelihood that MPM will fully repay the DIP financingthrough its reorganization and emergence, we assumed that:• $300 million would be outstanding under the DIP term loan, reflecting ourassumption that none of the outstanding principal would be prepaid priorto emergence.

• Approximately $100 million to $150 million in DIP ABL cash borrowingswould be outstanding depending on working capital needs and the timing ofinterest payments at the point in time of the company's emergence frombankruptcy. This amount takes into consideration the borrowing base,minimum cash reserves, and other availability limitations pursuant to theDIP credit agreement, and reflects the amount we estimate would bereplaced and rolled up into a five-year exit facility.

• Approximately $70 million of letters of credit under the $270 million DIPABL facility would remain outstanding and undrawn during the Chapter 11proceeding, and the company would replace and roll up these letters ofcredit upon emergence as part of a contemplated five-year exit facility.

We believe the going-concern value of a reorganized MPM at approximately $1.6billion, which represents our estimate of a 6x multiple of $260 million ofemergence EBITDA. As such, this value greatly exceeds the amount of DIPfinancing it would have to repay in full in cash upon emergence. This shouldhelp the company attract exit financing to fully repay the DIP term loan incash at emergence. Going forward, the extent of that coverage cushion remainssomewhat difficult to assess beyond a six-month timeframe (i.e., the company'santicipated time in Chapter 11 bankruptcy). In our view, a certain degree ofuncertainty surrounds what the emergence capital structure would be due inpart to the global volatility in the sectors in which the company operates aswell as the uncertainties relating to MPM's potential cost savings, operatingcost reductions and capital investment requirements.

As previously mentioned, we have assumed that the total DIP ABL and term loanbalance outstanding at emergence would total $400 million to $450 million. Wedo not think that the company will have any drawings against its $70 millionof standby letters of credit issued and outstanding under the ABL revolver. Assuch, this DIP exposure, when taken in its entirety, represents 25% to 30% ofour estimated enterprise value.

A Standard & Poor's rating on a DIP facility reflects our view of thelikelihood of full cash repayment through the company's reorganization andemergence from Chapter 11. A DIP facility rating also typically acknowledgespotential rating enhancement if we believe the assets securing the facilitywould likely result in full recovery if liquidation becomes necessary.

On the basis of the analytical considerations described above, our DIP ratingreflects a 'B+' risk assessment of the likelihood that MPM will repay the DIPlenders in cash in full at the point of its reorganization and emergence from

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 6

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

Chapter 11.

Valuation coverage in liquidation

We assessed prospects for repayment of DIP principal if MPM cannot reorganizeand if the bankruptcy proceeding is converted into a Chapter 7 or Chapter 11liquidation. We believe this is most likely to happen if operating conditionsand the company's competitive position materially worsen and cause the companyto significantly underperform and exhaust all of its liquidity.

Under this scenario, while certain of MPM's silicone and quartz assets andoperations would remain important to the markets it serves, our liquidationanalysis assumes a "fire sale" situation although it is very possible that thesilicone and quartz operations could be spun off separately. For this, weassume EBITDA meaningfully declines to $200 million, and the company's abilityto obtain a fair price on the sale of these two operations is compromised. Assuch, we assume a 4x multiple, compared with the 6x multiple assumed in theabove-mentioned going-concern valuation. The lower multiple is intended toreflect the harsher operating conditions and more significant industryovercapacity inherent in our liquidation scenario which could make thecompany's weaker plants less valuable. This results in a gross enterprisevaluation of $800 million, which is 50% lower than our going concernvaluation.

When taking into consideration these "harsh" assumptions, the liquidationvalue still provides ample coverage of the DIP facility. Implied coveragerelative to the maximum DIP exposure of $570 million would be 140%, assumingthe $70 million standby letters of credit under the DIP ABL become funded/cashcollateralized.

Our liquidation analysis also considered an asset liquidation scenario,although we feel this is a less likely outcome given the company's size andposition in the market. Even so, it provides some context that our liquidationsale valuation is a reasonable floor for the value of the business. Whenassessing the value of the company's working capital and fixed assets on aliquidation basis, with no value ascribed to intangibles and/or goodwill, andnoting the foregoing assumptions, we conservatively estimated the followingvalues: (i) $230 million to accounts receivable; (ii) $220 million toinventory and (iii) $300 million to net plant, property and equipment. Thisresults in a net orderly liquidation value of $750 million against $570million of funded DIP exposure, providing for 1.3x coverage. However, webelieve the value ascribed to the property, plant and equipment would not bereadily realizable and would take longer to convert to cash. Coverage from themore liquid receivables and inventory only would be roughly 80%.

As such, we applied a one-notch enhancement to our underlying risk assessmentof 'B+', which results in an overall DIP term loan facility rating of 'BB-.'

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 7

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

Ratings framework

Because adequate funding is critical to a company's potential forreorganization and emergence from bankruptcy as a viable entity, the U.S.Bankruptcy Code provides incentives for lenders to finance companies operatingunder the protection of Chapter 11. Such post-petition financing is known asDIP financing.

Our criteria for rating DIP financing extended to companies in bankruptcyemploys the conceptual framework developed for bank loan ratings. The analysisfor DIP financing consists of two parts:• The first focuses on timely repayment.• The second focuses on the particulars of the specific transaction and thepotential for recovery of that debt in the event liquidation (a shift toChapter 7) becomes necessary.

Timely payment

In the case of DIP transactions, timely payment of principal occurs throughthe DIP reorganization, its emergence from Chapter 11, and repayment of theDIP financing. Such payment is considered "timely" and in accordance with theterms of the agreement--notwithstanding the possibility of a stated earliermaturity--in keeping with the normal expectations. DIP lenders generally aretied in for the duration of the reorganization process.

This part of the analysis considers the likelihood of reorganization. Afavorable assessment is likely for viable companies, particularly for large,established entities. If the operation is fundamentally healthy, but thecompany is saddled with debt because of an leveraged buyout, arecapitalization, or an overpriced acquisition, its ability to service a moreappropriate debt load via reorganization might be quite strong.

However, if there were any significant doubt about the company's viability orits ability to attract sufficient cash to fully repay a DIP financing at theend of the restructuring process, the result probably would be a lowspeculative-grade outcome. A failed company in an industry with poorfundamentals or with a seriously flawed business model would be a lessercandidate for rehabilitation and refinancing. Given this, a company assessedas having a vulnerable business risk profile based on its restructuring (see"Corporate Methodology") would not be rated higher than 'B+', beforeconsidering potential enhancement for full coverage in a liquidation scenario.

Accordingly, much of the analysis is identical to the fundamental corporatecredit analysis relating to a company in the context of its particularindustry. This analysis focuses on the supply-and-demand forecasts for thecompany's products, its market position, operating history, current cash flow,and ability to operate profitably once it has a manageable capital structure.These factors are much the same as what we would consider in assigning acredit rating to a nonbankrupt company. Of course, the impact of thebankruptcy itself--on the company's business relationships with its customers,its vendors, and its employees--is critical in the case of DIP financing.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 8

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

One important difference between a DIP facility and other instruments we rateis the relatively short time horizon for a DIP transaction (often six monthsto two years), which obviates some of the longer-term considerations factoredinto traditional ratings. In rating a DIP financing, we focus on longer-rangefactors only to the extent they affect the company's ability to reorganize andattract sufficient new capital to fully repay the DIP financing at emergence.

Once the company has filed for Chapter 11 protection, prepetition debt serviceusually is suspended. Obviously, there will be debt service on the ratedfinancing, and there may be other obligations the court has approved forcontinuing payment. If there is secured debt, the company generally willaccrue post-petition interest--even if no cash payments are being made--to theextent the value of the security exceeds the amount of the debt. It isimperative to be aware of any motions that may be filed on behalf ofprepetition creditors to receive payment of their claims and adequateprotection for their position or to otherwise contest the DIP financing. Thecompany may be planning asset sales, store closings, or lease cancellations,all of which could have a bearing on the level of cash flow the company cangenerate and its attractiveness as a viable candidate for fresh financing totake out the DIP lenders.

Collateral and ultimate recovery

The second part of the rating analysis looks at the particulars of thespecific financing and its recovery potential in the event of liquidation. Aswith collateralized financings to nonbankrupt companies, the rating may beenhanced by one or two notches if there is a reliable second way out. Stronglegal protection is a hallmark of DIP lending, and so it would be normal toexpect some enhancement of the DIP loan rating: Thus, the rating is anchoredby the perceived likelihood of reorganization and supplemented by thepotential for recovery through asset liquidation. We analyze collateral with afocus on its ability to retain value through a liquidation process. Aconservative valuation of the collateral should cover the loan by a safemargin. This would be the case if the company entered Chapter 7. Receivablesand inventory often are the collateral supporting typical industrial DIPfinancings. This collateral is among the most liquid types and conservativeborrowing bases typically govern them.

Related Criteria And Research

Related Criteria

• Corporate Methodology, Nov. 19, 2013• Principles Of Credit Ratings, Feb. 16, 2011

Ratings List

New Rating

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 9

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

Momentive Performance Materials USA Inc.Senior Secured $300 Million DIP Term Loan BB- (point-in-time)

Complete ratings information is available to subscribers of RatingsDirect atwww.globalcreditportal.com and at www.spcapitaliq.com. All ratings affected bythis rating action can be found on Standard & Poor's public Web site atwww.standardandpoors.com. Use the Ratings search box located in the leftcolumn.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 10

1323697 | 300614293

Research Update: Momentive Performance Materials USA Inc. Debtor-In-Possession Term Loan Rated 'BB-' Point-In-Time

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P

reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com

(subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information

about our ratings fees is available at www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P

Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any

damage alleged to have been suffered on account thereof.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Copyright © 2015 Standard & Poor's Financial Services LLC, a part of McGraw Hill Financial. All rights reserved.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT MAY 15, 2014 11

1323697 | 300614293