Mobile Audience Insights Report - NinthDecimal · Mobile Audience Insights Report Q2 2014 etail...

Transcript of Mobile Audience Insights Report - NinthDecimal · Mobile Audience Insights Report Q2 2014 etail...

Mobile Audience Insights Report

Q2 2014 Spotlight on Retail

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

Research OverviewMobile Path to Purchase Trends ...............................................2-5 Mobile Ad Influences on Consumer Behavior ......................6-7 Mobile Ad Effectiveness: LCI™ Analysis .....................................8 Retail Consumer Profiles ..........................................................9-10 Conclusion ......................................................................................... 11

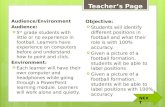

Our Q2 research report focuses on understanding how mobile is impacting consumers’ path-to-purchase behaviors within the retail industry.

Specifically, the report analyzes key trends and important industry insights in consumers’ location and mobile adoption.

Our report delves into several key areas of analysis. The first examines how growing mobile usage is reshaping consumer behavior with

respect to researching and purchasing items across the retail spectrum. The second assesses how timing, proximity, mobile ads, and in-store

engagement affect consumer path-to-purchase decision-making. The third looks at ROI from retail-based mobile ads, using our Location

Conversion Index™ and proprietary data to pinpoint key trends.

Key Findings• Retail mobile ads drove 51% more store traffic than non-retail mobile ads in 2014 (p. 8).

• Smartphones have replaced tablets as the leading mobile device that consumers use to research retail items, with a 110% growth in

usage from 2013 (p. 4).

• Mobile engagement for retail consumers occurs earlier in the path-to-purchase than in other verticals, with 73% engaging with

mobile ads and 81% researching items via mobile before they go on shopping trips as opposed to on-the-go (p. 5 & 6).

• While in-store, 61% of consumers would prefer to receive mobile ads with discounts or sales information, but only 49% are actually

receiving these ads, indicating an opportunity for advertisers to refine their in-store strategy (p. 7).

Source: NinthDecimal, Q2 2014

1

growth in consumers who research retail products via smartphones from 2013$149.99 $74.99

$49.99 $24.99

$14.99 $59.99

Shop Now

110%

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com 2

43%

37%40%

24%

33%

12%

25%

9%

19%

13% 16%

9%14%

11% 10%

7% 6%7%

• Retail consumers use their mobile device to research (37%) and purchase (43%) entertainment-related products more so than any other retail product.

• Retail consumers are less inclined to use their mobile to purchase specialty items (beauty, jewelry, children’s items) than generic items (entertainment, electronics, clothing).

• For all retail categories except jewelry, consumers are more likely to use their mobile to purchase items than to research them.

How Retail Consumers Use Mobile for Research & Purchasing

Electronics Clothing Shoes &Accessories

Entertainment

Research Purchase

JewelryHousehold Items

BeautySporting Goods

Children’s Items

Source: NinthDecimal, Q2 2014

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

Cross-Device Path-to-Purchase Behavior

3

72% research on their smartphone

Of that 72%

Of that 58%

Of that 78%

Of that 66%

Purchase on smartphone

Purchase on tablet

Purchase on laptop

Purchase in-store

58% research on their tablet

78% research on their laptop

66% research in-store

23%

8%

7%

8%

20%

34%

13%

12%

21% 38%

25% 33%

46%

17%

34%

63%

Indicates top purchasing method

Retail Consumer Research Behavior by Device Retail Consumer Purchase Behavior by Device

• Retail consumers who research on their smartphones tend to purchase almost equally across smartphones (23%), tablets (20%) and laptops (21%), whereas consumers who research via laptops and tablets tend to purchase on the same device (46% and 58%, respectively).

• While the majority of retail consumers (63%) who research in-store also purchase in-store, 20% rely on mobile devices (smartphones and laptops) to make their final purchases.

• Approximately 1/3 of retail consumers who research items on their mobile devices or laptops still prefer purchase these items directly in-store.

Source: NinthDecimal, Q2 2014

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

Consumer Preferences for Researching Retail Products

How do you prefer to research retail products?

• Smartphones have replaced tablets as the leading device for researching retail items, with a 110% growth in usage from 2013, while tablet usage has declined 57%.

• While the majority (63%) of consumers prefer to research retail products via traditional online tools (retailer’s/shopping aggregator’s websites), the use of mobile as a research tool is continuing to grow, up 46% from 2013.

• Consumers prefer retailers’ own branded resources over shopping aggregators’ resources – they are 3.5x more likely to research items using a retailer’s mobile site than a shopping aggregator’s mobile site.

Source: NinthDecimal, Q2 2014Source: NinthDecimal, Q2 2014

4

What devices do you use to research retail products?

2013

2014

37%

16%

20%

45%

Tablet

Tablet

Smartphone

Smartphone

45%1%1%2%

3%

7%

8%

15%

18%

Retailer’s Mobile Site

Retailer’s Branded App

Retailer’s Website

Email Notifications

Shopping Aggregator’s Mobile Site

Word of Mouth

Shopping Aggregator’s Website

Shopping Aggregator’s App

Push Notifications& Alerts

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

What is the average lead time for researching retail products via mobile?

Where do consumers engage with mobile to research retail items?

5

Source: NinthDecimal, Q2 2014Source: NinthDecimal, Q2 2014

Before a shopping trip

10

12

19

28

37

45

At Home

At Work

While Commuting

While Shopping

In a Store

During a shopping trip

• 81% of retail consumers use their mobile devices to research items before they before they go on a shopping trip (either at home or at work), as opposed to on-the-go (19%).

• Retail consumers engage with mobile earlier in the path-to-purchase process than consumers in other verticals, beginning research of items over $1000 as much as 45 days in advance.

When & Where Retail Consumers Engage With Mobile Along the Path-to-Purchase

69%

12%

$1 - $49

$50 - $99

$100 - $249

$250 - $499

$500 - $999

$1000+

7%

6%

6%

Item Price Days

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

12%

In the last 30 days, have you purchased a retail product as a result of seeing a mobile ad?

What information are you most likely to respond to in a retail-related mobile ad?

When are you most likely to engage with a retail mobile ad?

6

How Retail Consumers Engage with Mobile Ads

45%

73%

60%

25%

35%36%

21%

7%13%

55%

15%

Before You Shop

Yes

While in a Store

While on a Shopping Trip

No

Discou

nts/

Sales

Giveaw

ays

Produc

t Inf

orm

ation

Produc

t Rev

iews

Direct

ions t

o the

Nea

rest

Stor

e Loc

ation

Style

Tips

Offers/

Infor

mat

ion A

bout

Other

Pro

ducts

I

Might Li

ke

• While the majority of retail consumers are most likely to respond to a mobile ad containing discount or sales information, at least 1/3 of consumers also prefer mobile ads with product reviews (36%) and product information (35%).

• Retail consumers are 6x as likely to respond to a retail-related mobile ad before they shop as opposed to when they are in a store.

Source: NinthDecimal, Q2 2014Source: NinthDecimal, Q2 2014

Source: NinthDecimal, Q2 2014

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com 7

Advice-driven mobile ads

Discount-driven mobile ads

In-Store Mobile Advertising: How Advertisers Can Increase Engagement

• Retail consumers are 37% more likely to respond to discount-driven mobile ads than advice-driven mobile ads while in-store.

• 61% of retail consumers want to receive mobile ads with discounts while in-store, but only 49% are actually receiving them, indicating a huge opportunity for mobile advertisers to refine their mobile ad strategy.

• Similarly, 42% of consumers want in-store ads telling them which items are on sale, while only 28% actually receive them.

A Coupon for a Discount on Items in that Store

Notification of What Items are on Sale

Store Reviews Product Reviews Style Tips Comparison Pricing from Competing Retailer

Product Recommendations Based on Past Purchases

49%

61%

28%

42%

17%

13%

20%25%

8% 7% 9%

20%

12%10%

Retailer-initiated Mobile Engagement Consumers’ Preferred Mobile Engagement Source: NinthDecimal, Q2 2014

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

Mobile Ad Effectiveness: How Do Retail Ads Affect Drive-to-Location?

8

• Retail mobile ads drove a 51% greater lift in store visits than all other 2014 mobile ads.

• Consumers exposed to retail mobile ads visited stores 65% more than the control group of consumers who didn’t see the ads.

20

Audience MatchedControl LCI™

Exposed Audience LCI™

40

60

80

100

120

140

160

GeneralPopulation LCI™

Audience MatchedControl LCI™

Exposed Audience LCI™

GeneralPopulation LCI™

20

40

60

80

100

120

140

160

180

200

Lift in store visits for non-retail mobile ads

Lift in store visits for 2014retail mobile ads

Increase from control group

Increase from control group

Increase from general pop.

Increase from general pop.

Lift instore visits

100 100117

193

106

12821%

65%

28%

93%

51%

Source: NinthDecimal, Q2 2014 Source: NinthDecimal, Q2 2014

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com 9

Consumer Brand Engagement: Where Retail Shoppers Are Using Their Mobile Device

Non-retail venues:

Where do retail consumers engage with their mobile device the most?

Retail venues:

33% 31%5% 3%

8% 7%

9%

10%

13%

18%

17%

26%20%

Entertainment Venues Banks/Credit UnionsAuto Beauty Salons

Clothing Restaurants & CafésElectronics

Hotels/HospitalitySporting Goods Other

Colleges & UniversitiesBig Box Retailer Gyms

Source: NinthDecimal, Q2 2014 Source: NinthDecimal, Q2 2014

• The top retail venues where consumers connect with their mobile devices are clothing stores (33%), big box retailers, (26%) and electronics stores (18%).

• Approximately 1/3 of retail consumers engage with their mobile devices while in restaurants & cafés (31%), followed by gyms (20%), and colleges & universities (17%).

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com 10

Understanding Today’s Consumer: Profiles of Electronics & Fashion Shoppers

Electronics Consumer Profile

Demographics:Demographics:

Male Male

$50-$75K $75-$100KAverage HHI: Average HHI:

Average Age: Average Age:

25-34 35-44Female Female

Fashion Consumer Profile

61% 31%39% 69%

Top venues where they use their mobile device: Top venues where they use their mobile device:

Source: NinthDecimal, Q2 2014Source: NinthDecimal, Q2 2014

Electronics consumers are also: Fashion consumers are also:

GreenConsumers

HealthEnthusiasts

CasualDiners

Fine-DiningEnthusiasts

Do-It-Yourselfers

ParentsBusinessTravelers

LeisureTravelers

SportsEnthusiasts

EntertainmentEnthusiasts

Students AutoIntender

42% 45%

31% 32%

28% 27%

21% 25%

19% 18%18%

14%

Mobile Audience Insights Report Q2 2014 Spotlight on Retail

Source: NinthDecimal, Q2 2014NinthDecimal.com

Q2 2014 Mobile Audience Insights ReportThe Q2 2014 Insights Report highlights recent mobile market audience usage trends for advertisers to apply to their mobile strategies and campaigns. This quarter focused on the retail industry.

NinthDecimal is the leading mobile audience intelligence platform building the most comprehensive understanding of people by connecting their digital and physical lives. Our audience data is built on 1 trillion data points from over 1 billion devices, allowing us to create hundreds of customized audience segments with the scale to drive meaningful business results.

NinthDecimal’s precision, scale, and advanced data science allow us to build the most accurate understanding of audiences, providing clients with actionable intelligence and massive campaign reach. Our core capabilities differentiate us from any other player in the industry:

• Precise audience intelligence – We build audiences with location as the foundation, and manage this data with the most accurate and precise approach in the industry.

• Audience scale – With 1 billion profiled devices and 1 trillion data points from these devices, we provide relevant, recent data to create marketable moments to drive campaign success.

• Top-tier measurement and performance capabilities – We are the only company able to measure incremental lift in foot traffic per campaign. Our audience precision delivers a 4x lift in campaign performance over other mobile targeting approaches.

• One audience and one integrated solution – Unlike with other mobile platforms, we help marketers reach the same audience across display, video, online, and programmatic media channels.

MethodologyNinthDecimal’s Mobile Audience Insights Report research is based on data compiled from a survey of 1,511 randomly selected mobile users, as well as the billions of data points from NinthDecimal’s proprietary mobile audience intelligence platform. Location Conversion Index™ measures ROI by finding the normal visit rate for the general population, then comparing it against audiences both exposed and not exposed to mobile campaigns in order to measure incremental store visits.

The survey data was collected from May - June 2014 while the platform data was analyzed throughout Q2 2014. The Mobile Ad Effectiveness Benchmark results were from 1H 2014.

11