Mna Makalah

-

Upload

nicasavio2725 -

Category

Documents

-

view

229 -

download

0

Transcript of Mna Makalah

-

7/21/2019 Mna Makalah

1/11

1. COMPANY OVERVIEW

Merpati Nusantara Airlines is an air transportation service provider, based in Indonesia. It primarily

provides passenger, cargo transportation, and charter flight services. The company offers scheduledpassenger services to more than 25 destinations in Indonesia, as well as scheduled international

services to East Timor and Malaysia. The companys services include booking service, flight

information service, baggage service, seat reservations, travel information services and inflight

services. MNA operates through a fleet of Modern Ark60; Cassa 212; De Havillan Canda-6; and

Boeing 737-500, 737-400, 737-300 and 737-200 aircrafts. Its subsidiaries include PT. Mega Kargo, PT.

Prathita Titian Nusantara, PT. Turangga Titian Nusantara, and PT. Wisata Titian Nusantara. MNA is

headquartered in Jakarta.

2. LIST OF COMPETITOR

MNAS COMPETITORS

LION AIR

GARUDA INDONESIA

CITILINK

SRIWIJAYA AIR

AIRASIA

TIGERAIR MANDALA

BATIK AIR

WINGS AIR

3. CASE OF MERPATI NUSANTARA AIRLINES

Once Indonesias second largest airline, Merpati is now number seven domestically

CAPA >> Aviation Analysis >> November 1st, 2013

Merpati is one of Asias oldest airlines, having launched services over a half century ago in 1962. The

carrier was part ofGaruda from the late 1970s to late 1990s but has been independent since 1997.

Garuda has been transformed over the last decade while Merpati, after an initial period of

expansion around the turn of the century which saw it even launch flights

toMelbourne andPerth inAustralia, has languished. After being Indonesias second largest airline

for a long period, Merpati has seen itsmarket share steadily drop over the past several years.

http://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airports/melbourne-tullamarine-airport-melhttp://centreforaviation.com/profiles/airports/perth-airport-perhttp://centreforaviation.com/profiles/countries/australiahttp://centreforaviation.com/profiles/countries/australiahttp://centreforaviation.com/profiles/hot-issues/market-sharehttp://centreforaviation.com/profiles/hot-issues/market-sharehttp://centreforaviation.com/profiles/countries/australiahttp://centreforaviation.com/profiles/airports/perth-airport-perhttp://centreforaviation.com/profiles/airports/melbourne-tullamarine-airport-melhttp://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airlines/garuda-indonesia-ga -

7/21/2019 Mna Makalah

2/11

Merpatis current annual passengertraffic base is slightly more than 2 million, giving it less than a

3% share of Indonesias domestic market. In 2007 and 2008, Merpati captured over 7% of the

Indonesian domestic market. Over the past five years, Indonesias domestic market has doubled in

size while Merpatis passenger traffic has dropped by roughly 15%.

Lion Air and two other new entrants, Batavia andSriwijaya,quickly expanded after launching in theearly part of last decade and were all larger than Merpati by 2006, based on annual passenger

numbers.Indonesia AirAsia, which is mainly an international operator, became a larger domestic

carrier than Merpati in 2008. Another twoLCCs, Garuda subsidiaryCitilink and Lion regional

subsidiaryWings Air,overtook Merpati in 2012.

Merpati is currently the seventh largest domestic carrier, behind Lion, Garuda, Sriwijaya, Wings,

Citilink and IndonesiaAirAsia.Tigerair Mandala and Lions full-service subsidiaryBatik Air are

currently smaller than Merpati but are new carriers which are growing fast and will probably

overtake Merpati in the domestic market by the end of 2014, assuming Merpati survives.

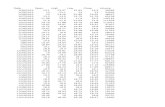

Top 10 domestic carriers in Indonesia ranked by seatcapacityRank Airline Total Seats

1 JT Lion Air 860,978

2 GA Garuda Indonesia 417,590

3 SJ Sriwijaya Air 203,196

4 IW Wings Air 127,686

5 QG Citilink 123,480

6 QZ Indonesia AirAsia 84,960

7 MZMerpati Nusantara Airlines 67,292

8 ID Batik Air 31,500

9 IL Trigana Air 27,662

10 RI Tigerair Mandala 25,200

Source: CAPACentre for Aviation &Innovata

Note: Capacity figures are not exact. Some Merpati small turboprop routes are excluded from the figures.

While there are huge growth opportunities in Indonesias domestic market, which is the worlds fifth

largest with over 70 million annual passengers, the market could benefit fromconsolidation.

Competition is intense andyields are low. Most of the countrys domestic carriers, particularly the

smaller and medium-size operators, continue to be unprofitable.

Batavia, which mainly operated on trunk routes with a fleet of 737s, A320s and A330s, collapsed in

early 2013. Other airlines were able to quickly fill the void. The market would benefit from further

consolidation.

http://centreforaviation.com/profiles/hot-issues/traffic-and-capacityhttp://centreforaviation.com/profiles/airline-groups/lion-air-grouphttp://centreforaviation.com/profiles/airlines/sriwijaya-air-sjhttp://centreforaviation.com/profiles/airlines/indonesia-airasia-qzhttp://centreforaviation.com/profiles/hot-issues/low-cost-carriers-lccshttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/airasia-akhttp://centreforaviation.com/profiles/airline-groups/tiger-airways-holdingshttp://centreforaviation.com/profiles/airlines/batik-air-idhttp://centreforaviation.com/profiles/hot-issues/traffic-and-capacityhttp://centreforaviation.com/profiles/airlines/lion-air-jthttp://centreforaviation.com/profiles/airlines/lion-air-jthttp://centreforaviation.com/profiles/airlines/lion-air-jthttp://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airlines/sriwijaya-air-sjhttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/airlines/indonesia-airasia-qzhttp://centreforaviation.com/profiles/airlines/merpati-nusantara-airlines-mzhttp://centreforaviation.com/profiles/airlines/merpati-nusantara-airlines-mzhttp://centreforaviation.com/profiles/airlines/batik-air-idhttp://centreforaviation.com/profiles/airlines/trigana-air-ilhttp://centreforaviation.com/profiles/airlines/trigana-air-ilhttp://centreforaviation.com/profiles/airlines/trigana-air-ilhttp://centreforaviation.com/profiles/airlines/tigerair-mandala-rihttp://centreforaviation.com/profiles/suppliers/innovatahttp://centreforaviation.com/profiles/hot-issues/mergers-and-consolidationhttp://centreforaviation.com/profiles/hot-issues/yieldshttp://centreforaviation.com/profiles/hot-issues/yieldshttp://centreforaviation.com/profiles/hot-issues/mergers-and-consolidationhttp://centreforaviation.com/profiles/suppliers/innovatahttp://centreforaviation.com/profiles/airlines/tigerair-mandala-rihttp://centreforaviation.com/profiles/airlines/tigerair-mandala-rihttp://centreforaviation.com/profiles/airlines/trigana-air-ilhttp://centreforaviation.com/profiles/airlines/trigana-air-ilhttp://centreforaviation.com/profiles/airlines/batik-air-idhttp://centreforaviation.com/profiles/airlines/batik-air-idhttp://centreforaviation.com/profiles/airlines/merpati-nusantara-airlines-mzhttp://centreforaviation.com/profiles/airlines/merpati-nusantara-airlines-mzhttp://centreforaviation.com/profiles/airlines/indonesia-airasia-qzhttp://centreforaviation.com/profiles/airlines/indonesia-airasia-qzhttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/sriwijaya-air-sjhttp://centreforaviation.com/profiles/airlines/sriwijaya-air-sjhttp://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airlines/garuda-indonesia-gahttp://centreforaviation.com/profiles/airlines/lion-air-jthttp://centreforaviation.com/profiles/airlines/lion-air-jthttp://centreforaviation.com/profiles/hot-issues/traffic-and-capacityhttp://centreforaviation.com/profiles/airlines/batik-air-idhttp://centreforaviation.com/profiles/airline-groups/tiger-airways-holdingshttp://centreforaviation.com/profiles/airlines/airasia-akhttp://centreforaviation.com/profiles/airlines/wings-air-iwhttp://centreforaviation.com/profiles/airlines/citilink-qghttp://centreforaviation.com/profiles/hot-issues/low-cost-carriers-lccshttp://centreforaviation.com/profiles/airlines/indonesia-airasia-qzhttp://centreforaviation.com/profiles/airlines/sriwijaya-air-sjhttp://centreforaviation.com/profiles/airline-groups/lion-air-grouphttp://centreforaviation.com/profiles/hot-issues/traffic-and-capacity -

7/21/2019 Mna Makalah

3/11

Jakarta to Surabaya capacity by carrier (one-way seats per week): 19-Sep-2011 to 14-Apr-2014

Source: CAPACentre for Aviation & Innovata

Jakarta to Bali capacity by carrier (one-way seats per week): 19-Sep-2011 to 14-Apr-2014

Source: CAPACentre for Aviation & Innovata

-

7/21/2019 Mna Makalah

4/11

Jakarta to Makassar capacity by carrier (one-way seats per week): 19-Sep-2011 to 14-Apr-2014

Source: CAPACentre for Aviation & Innovata

Merpati also competes in the Surabaya-Makassar market, which is the eighth largest domestic route

in Indonesia and the countrys largest route which does not touch Jakarta. Merpati has two dailyflights on the Surabaya-Makassar route, giving it about an 8% share of capacity.

Lion, Wings, Sriwijaya, Indonesia AirAsia and Garuda also serve the Surabaya-Makassar route. Lion

and Wings control a dominating 62% share of capacity in the Surabaya-Makassar market.

Other smaller trunk routes Merpati competes on include Surabaya-Bali and Surabaya-Bandung.

These are the only other routes Merpati serves among Indonesias top 30 domestic routes.

While Merpati only serves six of the 30 largest domestic routes in Indonesia, four of them are among

its top 10 routes, which shows the significance that trunk routes still have in generating revenues.

Jakarta-Surabaya and Surabaya-Makassar are its largest two routes, according to CAPA and Innovatadata.

Merpati top 10 domestic routes based on capacity (seats): 28-Oct-2013 to 3-Nov-2013

http://centreforaviation.com/profiles/airports/bandung-husein-sastranegara-airport-bdohttp://centreforaviation.com/profiles/airports/bandung-husein-sastranegara-airport-bdohttp://centreforaviation.com/profiles/airports/bandung-husein-sastranegara-airport-bdohttp://centreforaviation.com/profiles/airports/bandung-husein-sastranegara-airport-bdo -

7/21/2019 Mna Makalah

5/11

Source: CAPACentre for Aviation & Innovata

The trunk routes have not been profitable given the intense competition and Merpatis insignificant

size. But the carrier has continued to serve some to provide links to its regional services, particularly

from Indonesias two largest cities of Jakarta and Surabaya, both of which are located in the westernIndonesian island of Java. Merpatis two largest regional bases are Bali and Makassar in central

Indonesia.

Merpati network map

Source: Merpati

-

7/21/2019 Mna Makalah

6/11

-

7/21/2019 Mna Makalah

7/11

Merpati is Indonesias largest regional carrier by most measures and is now focused on providing a

public service on rural routes that are not commercially viable. Once Indonesias second largest

airline, Merpati has steadily shrunk in size over the past decade and ceded market share as private

airlines grew rapidly. Merpati transported 2.2 million domestic passengers in 2011, making it the

fifth largest airline in Indonesia. It is the only major airline that has recorded traffic declines in recent

years.

Merpati has unveiled a new strategy which envisions growth and restoring some of its former glory.

The carrier tellsAirline Leaderit is seeking to lease 12 737-800s, which it hopes will delivered by the

end of 2013 to replace its ageing 737s as well as pursue growth. The carrier also aims to acquire 20

regional jets, a mix of 50- and 100-seaters which will be used as a combination of replacements for

turboprops and growth.

While Merpati will use the 737-800s to maintain and grow its presence on some trunk routes, the

airline is focused on using these routes to link its hubs and provide connections with smaller

markets. Merpati says growth in its new business plan is focused mostly on the more remote eastern

part of the country. Like Batavia, Merpati is positioned in the middle market, offering frills such assnacks and beverages but an all economy-configuration.

-

7/21/2019 Mna Makalah

8/11

Merpatis expansion, however, may not materialise if it does not succeed in securing new investors

as part of a possible partial privatisation. Given its relatively weak positioning, interest from

investors could be low. With Garuda interested in expanding regionally and having rejected

approaches from Merpati to partner, the latter could face an even smaller future that relegates it to

subsidised regional routes which cannot be viably served by any private carrier. At one point in theirhistory, Garuda and Merpati operated as a merged entity but were split up in the 1990s.

4. PHOTOS

-

7/21/2019 Mna Makalah

9/11

-

7/21/2019 Mna Makalah

10/11

FLIGHT INFORMATION

IATA MZ

ICAO MNA

MAIN OFFICE JAKARTA, INDONESIA

FLEET 39

DESTINATION 84

SINCE 1962

TAGLINE THE AIR BRIDGE OF INDONESIA

Source :http://www.wego.co.id/maskapai/merpati-nusantara-airlines-mz

5. MARKET SEGMENTATION, TARGET MARKET, AND POSITIONING

A. MARKET SEGMENTATION

Merpatis market segmentation are junior staff, public officer, administrative elites,

businessmen, higher staff categories, and travelers.

B. TARGET MARKET

Merpatis target market is focused on providing a public service on rural routes. The

airlines new business plan is focused mostly on the more remote eastern part of the

country.

C. POSITIONING

The term of having Business doesnt mean that they are from the big company so

they can go travelling by planes. Theres a lot of Indonesian business person doing

entreprenuership of a small or medium enterprise. Those kinds of business can be

easily found scattered in every province in Indonesia. So, Merpati positioning as the

airlines to support the inter-province business travelers by providing the Largest

Network and Destinations in Indonesia.

http://www.wego.co.id/maskapai/merpati-nusantara-airlines-mzhttp://www.wego.co.id/maskapai/merpati-nusantara-airlines-mzhttp://www.wego.co.id/maskapai/merpati-nusantara-airlines-mzhttp://www.wego.co.id/maskapai/merpati-nusantara-airlines-mz -

7/21/2019 Mna Makalah

11/11

SEGMENTATION

Business Occasion

Travelers

TARGETING

For business

people,

sometimes they

need to go to the

rural areas andonly Merpati

have them

POSITIONING

inter-province

business

travelers

![[Pesquisa]its mna pratica - byod2012](https://static.fdocuments.net/doc/165x107/58f343441a28ab2d208b45cf/pesquisaits-mna-pratica-byod2012.jpg)