M&M Digest - research.bcsgm.ruresearch.bcsgm.ru/media/qvjfqizg/m-m-digest_290520_eng.pdf · M&M...

Transcript of M&M Digest - research.bcsgm.ruresearch.bcsgm.ru/media/qvjfqizg/m-m-digest_290520_eng.pdf · M&M...

Research www.bcsgm.com

M&M Digest

Kirill Chuyko, [email protected] Oleg Petropavlovskiy, [email protected] Artem Bagdasaryan, [email protected]

29 May 2020 Trump to respond to China’s Hong Kong bill today

Disclaimer: This research report, prepared by the Research Department of BrokerCreditService Ltd [Registered Name: BrokerCreditService Ltd, Registered Number: 1025402459334, Registered Office: 37 Sovetskaya str., Novosibirsk 630099, Russia, BrokerCreditService Ltd is regulated by the Central Bank of Russia and holds FFMS licenses No. 154-04434-100000 of 10.01.2001 for brokerage services, No. 154-04449-010000 of 10.01.2001 for dealing on own account, No. 154-04462-001000 of 10.01.2001 for managing securities portfolios and No. 154-12397-000100 of 23.07.2009 for safekeeping and administration of financial instruments], is ‘non independent research’ and is for information purposes only. Neither the information nor any opinion is intended to be or should be construed as an offer, a recommendation or an invitation to make an offer to buy or sell any financial instrument. No representation or warranty (including future performance), expressed or implied, is made as to its accuracy and reliability. This research constitutes neither investment, legal, tax advice nor other advice and it does not take into account the specific investment objectives, risk appetite and financial situation of anyone who may receive this report and the latter shall not rely on it in making an investment or other decision. Investors should seek their own advice regarding the appropriateness of investing in any financial instrument and suitability of the financial instruments or strategy discussed in this report. In accordance with US SEC Regulation AC, important US regulatory disclosures and analyst certifications can be found on the last page of this report. BrokerCreditService Ltd and/or an affiliate has or expects to receive fees for the provision of investment/corporate banking service for TMK. BrokerCreditService Ltd or an affiliate company may own one percent or more of equity securities of TMK, but does not hold more than five percent of the share capital of TMK. Neither BrokerCreditService Ltd, nor any affiliate has managed or co-managed any public or private offering or acted as a market maker or corporate broker for TMK. BrokerCreditService Ltd acts independently when producing research and does not share draft of research reports or communicate changes in rating or targets to the issuer ahead of publication. © 2020 BrokerCreditService Ltd. All rights protected and reserved.

i

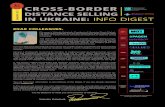

Key M2M valuation metrics M2M Company EV/EBITDA P/E FCFY DY

Steel Severstal 5.6 8.3 4% 7% NLMK 6.6 10.6 7% 7% MMK 4.0 6.7 9% 9% EVRAZ 6.3 12.9 4% 6% Mechel 24.6 neg. neg. 0% Raspadskaya 1.4 4.3 24% 5% TMK 2.2 2.0 51% 13% Ferrexpo 2.3 3.5 26% 6% Base metals Norilsk 6.4 8.7 10% 10% Rusal 7.7 15.0 neg. 3% KAZ Minerals 4.9 5.9 neg. 0% Precious metals Polyus Gold 7.0 9.0 8% 5% Polymetal 6.4 8.7 9% 6% HGM 4.0 5.7 19% 5% Petropavlovsk 2.4 4.5 33% 0% Diamonds Alrosa 6.5 11.0 9% 9%

Source: BCS GM

Key M&M price indicators Spot d/d, % w/w, % m/m, % CNYUSD 7.14 -0.0% 0% 1% RUBUSD 70.7 0.3% -1% -3% Iron ore CH, $/t 96.4 1.4% -2% 17% HCC AU, $/t 110 - -7% -5% SSCC AU, $/t 61 0.4% -3% -3% HRC FOB CH, $/t 421 - -1% 6% HRC Dom CH, $/t 508 0.4% -1% 7% HRC B. Sea, $/t 360 - - -2% Billet F.East, $/t 380 - 2.7% 4% HRC, Dom Rb/t 34,269 - -2.5% -6% Rebar RU, Rb/t 25,488 - -0.3% -2% Nickel, $/t 12,120 -0.2% 0% -1% Copper , $/t 5,284 -0.5% 1% -5% Aluminum, $/t 1,501 -0.2% 2% 2% Zinc, $/t 1,919 -0.7% -2% -1% Gold , $/oz 1,718 0.2% -1% 1% Platinum, $/oz 821 0.4% -2% 5% Palladium, $/oz 1,920 -0.8% 0% -29% Silver $/oz, 17.4 0.1% 1% 14% Diamonds, $/ct 107 - - 0%

Source: Bloomberg, Metal Expert, BCS GM

Coronavirus outbreak

Source: Coronavirus-monitor, BCS GM

Iron ore futures bounce back, turbulence to remain. Steel related futures are in strong growth territory today with iron ore up 6% and coking coal up 3% – such positive sentiment looks speculative to us. The real market pricing remains volatile and today may add fuel to the fire – Trump is preparing to announce a response to China’s Hong Kong bill today. Such measures are likely to further increase tensions between the world’s key trade players. Nevertheless, we admit that the mood and investor sentiment remains optimistic – negative news flow and risks may easily be overlooked or offset by other positive factors.

Macro

Trump to announce new China policies on Hong Kong issue today India’s auto sales plunge in March, next to zero in April

Steel Chinese demand cools, but CIS billet prices stable MMK refused right to declare bankruptcy – Just a formality Gazprom certified Kazakhstan’s KSP Steel’s OCTG pipes

Base metals

LME aluminum inventories at three years highs

Precious metals

Polymetal’s core shareholder assets worth $110mn frozen in Cyprus

0

25

50

75

0

500

1,000

Jan 20 Feb 20 Mar 20 Apr 20

New cases in RoW over last 5 days w/w(thousands, lhs)New cases in China over last 5 days w/w(thousands, lhs)Recovered/deceased over the week (rhs)

M&M Digest

29 May 2020

2

Change Swaps assessment Global (daily data) Spot d/d, % w/w, % m/m, % 3mo, % Jun20 3Q20 4Q20 1Q21 Iron ore, China CFR 96.4 1.4% -2% 17% 13% 95.3 90.9 85.4 81.5 Hard coking coal, Australia FOB 110 - -7% -5% -32% 108 110 116 130 Hard coking coal, China CFR 120 - -6% -3% -30% Semi-soft coking coal, Australia FOB 61 0.4% -3% -3% -29% Fut price, Sep 2020, CFR China Semi-soft coking coal, China CFR 69 - -3% -1% -28% US$/t CNY/t d/d,% Scrap, CFR Turkey 253 0.6% 1% 2% -9% HCC 144 1,028 0.3% HRC - China FOB 421 - -1% 6% -7% Iron ore 93.2 665 5.8% HRC - China domestic 508 0.4% -1% 7% 1% HRC 443 3,164 2.7% HRC - Europe ex-works 458 0.0% -1% -6% -14% Rebar 455 3,250 2.1% Russian, export (wkly, updated Monday) US$/t w/w, % m/m, % 3mo, % Fut price v fwds (Sep20/3Q) HRC - FOB Black Sea 360 - -2% -26% Ch. CFR Fut/fwd Fut/spot Fwd/spot Slab - FOB Black Sea 343 3.9% 5% -21% HCC Not Comparable 0% Billet - FOB Far East 380 2.7% 4% -7% Iron ore 2% -3% -6% Russian local, ex-VAT (wkly, updated Monday) US$/t Rb/t w/w, % m/m, % 3mo, % Prem/(disc) to import parity HRC - domestic ex-works average 485 34,269 -2.5% -6% 0% HRC 29% Rebar 2% HRC - retail prices, Moscow 486 34,375 -1.2% -4% -4% Prem/(disc) to export parity Rebar - domestic ex-works average 360 25,488 -3.7% -5% -7% Coal 26% Iron ore 6% Rebar - retail prices, Moscow 386 27,292 -0.3% -2% 5% China HRC (BOF) gross profit margin Sections (mix) - domestic ex-works average 494 34,957 0.0% -5% 3% Spot 2019 av 2018 av 2017 av Sections (mix) - retail prices, Moscow 524 37,056 - -1% -1% 15% 15% 28% 23% Coking coal blended mix, ex-works 101 7,114 - -2% 5% China rebar (EAF) gross profit margin Iron ore concentrate, ex-works 67.9 4,800 - 0% 0% Spot 2019 av 2018 av 2017 av Scrap, Urals region 188 13,300 -9.2% -10% -18% 31% 29% 26% 27%

Source: Metal-Expert, Bloomberg, BCS GM Base and precious metals prices (daily data) LME d/d, % w/w, % m/m, % ShFE d/d, % w/w, % m/m, % LME/ShFE LME Copper, $/t 5,284 -0.5% 1% -5% 5,412 0.4% 1% 2% 98% LME Nickel, $/t 12,120 -0.2% 0% -1% 12,428 0.9% 1% 0% 98% LME Zinc, $/t 1,919 -0.7% -2% -1% 2,021 0.9% -1% -1% 95% LME Aluminum, $/t 1,501 -0.2% 2% 2% 1,629 1.4% 1% 4% 92% Inventories base metals (daily data) LME d/d, % w/w, % m/m, % ShFE d/d, % w/w, % m/m, % Total d/d % Copper, kt 264 -0.4% -3% 3% 239 - 0% -37% 0% Nickel, kt 234 -0.3% 0% 1% 53 - 0% -3% 0% Zinc, kt 103 -2.7% -3% 6% 156 -0.6% -3% -18% -1% Aluminum, kt 1,493 -0.0% 2% 11% 437 -0.7% -4% -36% 0% Precious metals prices (daily data) LME d/d, % w/w, % m/m, % ShFE d/d, % w/w, % m/m, % LME/ShFE Gold ($/oz), LME 1,718 0.2% -1% 1% 1,704 0.9% 0% 2% 101% Silver ($/oz), LME 17.4 0.1% 1% 14% 16.8 1.9% 3% 15% 103% PGM (daily data) LME d/d, % w/w, % m/m, % NYMEX d/d, % w/w, % m/m, % LME/NYMEX Platinum ($/oz), LBMA/NYMEX 821 0.4% -2% 5% 863 -2.0% -3% 7% 95% Palladium ($/oz), LBMA/NYMEX 1,920 -0.8% 0% -29% 1,904 -4.2% -4% -1% 101% Metal holdings ETFs d/d, % w/w, % m/m, % 3M 6M 9M 12M 24M Gold holdings, mn oz 99.9 0.1% 0% 5% 15% 21% 25% 41% 39% Silver holdings, mn oz 729 0.2% 0% 8% 18% 19% 14% 41% 36% Palladium holdings, mn oz 0.44 0.2% 0% 2% -23% -29% -24% -30% -55% Platinum holding, mn oz 3.17 0.1% 0% 5% -9% -5% 0% 7% 26% Diamonds BBG w/w, % m/m, % 3mo, % Latest sales results, $ mn Rough diamonds, $/ct 107 - 0% -2% Company Revenue m/m y/y Polished diamonds, $/ct 5,717 - 0% -7% Alrosa 16 -90% -95% Cutters margin -6.9% -0.0% 0% -5% De Beers 355 -36% -28%

Source: Bloomberg, SMM, BCS GM

US-China trade war timeline US tariffs China tariffs Date Description Duties Imposed % of 2017 imports Duties Imposed % of 2017 Imports 23.08.2018 US and China impose second phase of $50 bn tariffs $50 bn 10% $50 bn 38% 24.09.2018 US imposed 10% tariff on $200 bn of Chinese exports. $250 bn 50% $110 bn 85%

09.05.2019 US imposed 25% tariffs on $200bn of China’s imports, threaten tariffs on another c$300bn goods $250 bn 50% $110 bn 85%

23.08.2019 Tariffs on $200bn of Chinese goods may be raised to 30% $250 bn 50% $110 bn 85% 01.09.2019 China imposed 10% tariffs on $75bn of US goods $360 bn 72% $110+ bn 85%+ 01.09.2019 US imposed 15% tariffs on $110bn of China’s goods from 1 Sept $360 bn 72% $110+ bn 85%+ 13.12.2019 US to lower tariffs on $120bn of Chinese goods to 7.5% $360 bn 72% $110+ bn 85%+ 14.02.2019 China halved tariffs on $75bn of US goods $360 bn 72% $110+ bn 85%+ 18.02.2019 China to grant tariff exemptions on additional US goods $360 bn 72% $110+ bn 85%+

30.04.2020 US formulating L-T plan to punish China for the C-virus epidemic, potential measures include sanctions and cancelling US debt $360 bn 72% $110+ bn 85%+

Source: Media, BCS GM

M&M Digest

29 May 2020

3

Macro

Trump to announce new China policies on Hong Kong issue today – Bloomberg. The President said that he is “not happy with China” regarding recent developments in Hong Kong in response to a question as to whether the US would remain in the ‘Phase 1’ trade deal with China signed in January.

At this stage, measures are likely to be only in the political space, with no major impact on trade or capital flows. However, increased tension is certainly a negative for the global economy and lack of progress on trade is a risk to the M&M space, especially steel, which is a higher beta sector.

India’s auto sales plunge in March, next to zero in April – Argus. March auto sales fell by a third y/y to 1.4mn vehicles, while in April key producers – Tata Motors, Maruti Suzuki, Mahindra, Hyundai, India and Nissan India – recorded no sales at all. The sector represents 10% of steel consumption in the country.

April is rather historical at this stage – most of the damage to steel consumption is already done and recovery is key. We bet on a slower recovery vs market expectations and see strong risks for the sector going forward.

Steel Chinese demand cools, but CIS billet prices stable – Kallanish. Healthy demand from Asia (ex-China) supports overall demand, while mills have sold out their monthly volumes and can wait a week or two without engaging.

Lower demand for semi-finished products in China, given the hike in EAF production, is among the risks for steel prices in the short-term.

MMK refused right to declare bankruptcy – Just a formality – Interfax. The right to bankruptcy was introduced by the government on 1 April to help businesses survive the C-Virus quarantine measures.

This is a purely technical issue and more a PR/GR statement on behalf of MMK. The company has a solid financial position and enjoys good profitability – its bankruptcy is beyond the realm of reality thanks to low costs of production and profitable local sales.

Gazprom certified Kazakhstan’s KSP Steel’s OCTG pipes – Interfax. The term of the certificate is two years. KSP Steel is Kazakhstan’s first OCTG pipe plant launched in 2007 with existing seamless pipe capacity of 270kt, expandable to 350kt. The capacity includes 50kt of compressor, 150kt casing and 150kt of oil and gas line pipes.

The certificate does not mean that the new supplier will send all its products to Russia, but is still an illustration of rising competition in the domestic seamless pipe market. We note that there were 3 other projects in Russia within the next 2 years (Severstal-Tenaris JV, OMK and ZTZ) that may potentially add c40% to the capacity of a market that has largely no growth.

Base metals LME aluminum inventories at three years highs – Bloomberg. The increase, led by the US market, hit 0.5% to 1.5mt.

The rise reflects the current quarantine measures and future outlook for the metal price depends on how quick demand will recover – a risk for the whole M&M space.

M&M Digest

29 May 2020

4

Precious metals Polymetal’s core shareholder assets worth $110mn frozen in Cyprus – Vedomosti. The decision was a protective measure, given the ongoing legal case between Alexander Nesis’ ICT Group and United Wagon Company, covering some deals in 2015-18.

We doubt this will have any major implications on Polymetal, whose shares may be partially frozen, but clearly not all of them, given the relatively small size of the frozen assets.

Recent M&M reports Under Review: KAZ Minerals – COVID headwinds cloud future (20 May) Downgrade: Gold – Shine fades as rally loses steam (13 May) Upgrade: TMK – On the way to ‘non-public’ (9 Apr) Trade Idea Closed: Long PLZL/POLY basket (50-50%) – Closing on Stop Loss (17

March) Trade Idea Opened: Long PLZL/POLY (50-50%) – A perfect risk-off Basket (13

March) Under Review: Steel Sector – S-T, ruble helps; L-T, potentially a ticking bomb

(12 March) BCS / ICEF Insight: Metal Scrap – Revolution is Now! (30 Jan) Trade Ideas Closed: Short SVST, NLMK, MMK – Bounce in export prices

removes domestic downside; L-T view intact (5 Dec) Marketing Feedback: M&M – Sell Steel call fully confirmed and clear (1 Nov) Insight: National Projects – Overstated steel myth (24 Oct) Downgrade: Steel prices collapse – All Sells again (23 Oct) Preview: Steel 3Q19 IFRS – Mixed numbers (15 Oct) Update: Ferrexpo – TP cut on legal risks, Sell affirmed (8 Oct) Site Visit: Polymetal – Albazino-Amursk ... More value to come (7 Oct) Downgrade: TMK – ZTZ hits again, seamless pipes at risk now (4 Oct) Trade Idea Opened: Short MMK – Another Short on highest exposure to local

steel collapse (3 Oct) Trade Ideas Reiterated: Short SVST & NLMK – HRC FOB slumps 5% w/w, local

price collapse is around the corner (30 Sep) Trade Ideas Opened: Short SVST & NLMK – Domestic prices to slump 15%+ ...

P/Es to reach highly unattractive levels (18 Sep)

M&M Digest

29 May 2020

5

Export prices, FOB Black Sea, $/ton Domestic prices, $/ton

HRC prices, $/t Rebar prices, $/t

Coking coal prices, $/t Iron ore prices, $/t

Scrap prices, $/t China steel margins, $/t

Flat steel monthly consumption in Russia, mt Long steel monthly consumption in Russia, mt

Source: Metal Expert, Metal Bulletin, BCS GM

200

300

400

500

600

700

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

Rebar HRC

200

300

400

500

600

700

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

Rebar HRC

200

400

600

800

1000

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20Domestic Export Global average

200

300

400

500

600

700

800

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

Domestic Export Global average

507090110130150170190

50

100

150

200

250

300

350

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

Australian FOB Russia ex-works

20

40

60

80

100

120

30507090

110130150170

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

China CFR Russia ex-works

100

200

300

400

500

Jan-

13Ap

r-13

Jul-1

3O

ct-1

3Ja

n-14

Apr-

14Ju

l-14

Oct

-14

Jan-

15Ap

r-15

Jul-1

5O

ct-1

5Ja

n-16

Apr-

16Ju

l-16

Oct

-16

Jan-

17Ap

r-17

Jul-1

7O

ct-1

7Ja

n-18

Apr-

18Ju

l-18

Oct

-18

Jan-

19Ap

r-19

Jul-1

9O

ct-1

9Ja

n-20

Apr-

20

Domestic Turkey (US imports)

-10%

0%

10%

20%

30%

40%

Jan 14 Sep 14 May 15 Jan 16 Sep 16 May 17 Jan 18 Sep 18 May 19 Jan 20

HRC - BOF Rebar - EAF

1.4

1.6

1.8

2.0

2.2

2.4

2.6

Jan 14 Mar 14 May 14 Jul 14 Sep 14 Nov 14

2016 2017 2018 2019 2020

0.9

1.0

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1.8

1.9

Jan 14 Mar 14 May 14 Jul 14 Sep 14 Nov 14

2016 2017 2018 2019 2020

M&M Digest

29 May 2020

6

Apparent steel consumption in China vs. Yuan appreciation, y/y Monthly steel net exports in China, mt

Chinese FDI, y/y change % Chinese fixed asset investment growth, y/y

Chinese Manufacturing PMI China: Housing under construction vs. investments in real estate

Iron ore inventory at ports, mt Steel inventory at Chinese warehouses, mt

China air quality index (wgt’d avg 5 major steelmaking cities,

c50% of steel output) Estimated share of EAF steelmaking in China

Source: Bloomberg, BCS GM

-20%-15%-10%-5%0%5%10%15%20%25%

-10%

-5%

0%

5%

10%

Jan 12 Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

Yuan, y/y Consumption, y/y

0

2

4

6

8

10

12

Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20

-20%

-10%

0%

10%

20%

30%

40%

Jan

10

Jul 1

0

Jan

11

Jul 1

1

Jan

12

Jul 1

2

Jan

13

Jul 1

3

Jan

14

Jul 1

4

Jan

15

Jul 1

5

Jan

16

Jul 1

6

Jan

17

Jul 1

7

Jan

18

Jul 1

8

Jan

19

Jul 1

9

Jan

20

-30%

-20%

-10%

0%

10%

20%

30%

40%

Feb06

Nov06

Aug07

May08

Feb09

Nov09

Aug10

May11

Feb12

Nov12

Aug13

May14

Feb15

Nov15

Aug16

May17

Feb18

Nov18

Aug19

30

35

40

45

50

55

Nov 15 May 16 Nov 16 May 17 Nov 17 May 18 Nov 18 May 19 Nov 19 -20%

0%

20%

Jan 14 Jul 14 Jan 15 Jul 15 Jan 16 Jul 16 Jan 17 Jul 17 Jan 18 Jul 18 Jan 19 Jul 19 Jan 20

Space under construction, ytd y/y

Total investments in real estate, y/y

60

80

100

120

140

160

Mar 10 Mar 11 Mar 12 Mar 13 Mar 14 Mar 15 Mar 16 Mar 17 Mar 18 Mar 19 Mar 20 -10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

0

5

10

15

20

25

30

Jan 17 May 17 Sep 17 Jan 18 May 18 Sep 18 Jan 19 May 19 Sep 19 Jan 20

Long Flat Total change w/w

0

50

100

150

200

250

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2016 2017 2018

2019 2020

0%

2%

4%

6%

8%

10%

12%

14%

16%

Feb14

Jun14

Oct14

Feb15

Jun15

Oct15

Feb16

Jun16

Oct16

Feb17

Jun17

Oct17

Feb18

Jun18

Oct18

Feb19

Jun19

Oct19

Feb20

M&M Digest

29 May 2020

7

Copper LME price vs inventories (kt) Nickel LME price vs inventories (kt)

Zinc LME prices vs inventories % Aluminum LME prices vs inventories

Gold price vs gold-silver ratio % Platinum & Palladium prices vs Palladium-Platinum ratio

Gold price vs SPDR gold holdings, mn oz Gold price vs LT real average interest rate

Rough vs polished diamonds prices, $/ct

Cutters margin vs rough diamonds price index

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

0100200300400500600700800900

Jan 10 Jan 11 Jan 12 Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

Shanghai stocks (kt) LME stocks (kt) Copper $/t

$7,500

$9,500

$11,500

$13,500

$15,500

$17,500

0100,000200,000300,000400,000500,000600,000700,000800,000900,000

Apr 15Oct 15Apr 16Oct 16Apr 17Oct 17Apr 18Oct 18Apr 19Oct 19Apr 20

Shanghai stocks (kt)

LME Stocks (kt)

LME nickel $/t

$4,000

$5,000

$6,000

$7,000

$8,000

$9,000

$10,000

0100200300400500600700800900

Jan 10 Jan 11 Jan 12 Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

Shanghai stocks (kt) LME stocks (kt) Copper $/t

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Jan 10 Jan 11 Jan 12 Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

Shanghai stocks (kt) LME stocks (kt) Aluminum ($/t)

65

75

85

95

105

115

125

135

1,100

1,200

1,300

1,400

1,500

1,600

1,700

1,800

Jan 17 May 17 Sep 17 Jan 18 May 18 Sep 18 Jan 19 May 19 Sep 19 Jan 20 May 20

Gold ($/oz) Gold/Silver

0%

100%

200%

300%

400%

200

700

1,200

1,700

2,200

2,700

3,200

Jan 10 Jan 11 Jan 12 Jan 13 Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

Platinum Palladium Palladium/Platinum

15

20

25

30

35

1,0001,1001,2001,3001,4001,5001,6001,7001,800

Jan 14 Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 Jan 20

SPDR gold holdings, mn oz (rhs) Gold, $/oz (lhs)

-1.00%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

0200400600800

1,0001,2001,4001,6001,8002,000

Jan 00 Jan 03 Jan 06 Jan 09 Jan 12 Jan 15 Jan 18

Gold, $/oz LT Real Average (>10Y)

5,500

6,500

7,500

8,500

9,500

10,500

11,500

100

120

140

160

180

Nov 12 Nov 13 Nov 14 Nov 15 Nov 16 Nov 17 Nov 18 Nov 19

Rough (lhs) Polished (rhs)

60708090100110120130140150160

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

Jan

06

Jan

07

Jan

08

Jan

09

Jan

10

Jan

11

Jan

12

Jan

13

Jan

14

Jan

15

Jan

16

Jan

17

Jan

18

Jan

19

Jan

20

Cutters' margin (lhs) Rough price index (rhs)

M&M Digest

29 May 2020

8

Extended steel and related products pricing summary Actual prices, $/t Change, %

01-May 1 week 1 month 6 months 1 year YTD 1 week 1 month 6 months 1 year YTD Steel section Russia – domestic retail prices (Moscow traders)

HRC 477 487 490 562 576 577 -2.2% -3% -15% -17% -17%

CRC 539 548 550 650 643 645 -1.6% -2% -17% -16% -16%

Rebar 384 391 391 448 525 527 -1.9% -2% -14% -27% -27%

Sections 494 504 487 568 557 660 -2.0% 1% -13% -11% -25% Russia – domestic producers prices (ex-works average)

HRC 478 491 480 525 563 542 -2.5% 0% -9% -15% -12%

CRC 549 555 533 605 642 606 -1.1% 3% -9% -14% -9%

Rebar 370 374 360 420 482 463 -1.1% 3% -12% -23% -20%

Sections 486 491 479 542 545 635 -1.1% 2% -10% -11% -23% Russia/Ukraine – export prices (FOB Black Sea)

HRC (Rus) 355 368 388 380 488 568 -3.5% -9% -7% -27% -38%

CRC (Rus) 425 440 450 445 550 625 -3.4% -6% -4% -23% -32%

Rebar (Ukr) 375 400 380 408 470 555 -6.3% -1% -8% -20% -32% Global – key markets benchmarks

HRC - US 507 517 582 549 719 713 -1.9% -13% -8% -29% -29%

HRC - China 478 475 468 512 600 659 0.6% 2% -7% -20% -27%

HRC - Europe 580 592 592 607 645 715 -2.2% -2% -5% -10% -19%

Rebar - US 659 664 692 667 766 617 -0.8% -5% -1% -14% 7%

Rebar - China 527 527 520 563 646 693 0.0% 1% -6% -18% -24%

Rebar - Europe 400 413 385 420 475 565 -3.0% 4% -5% -16% -29% Semi-finished products, Export prices

Slab - Black Sea 328 328 320 335 468 505 0.0% 2% -2% -30% -35%

Slab - Far East 358 358 338 370 465 510 0.0% 6% -3% -23% -30%

Billet - Black Sea 338 350 325 365 423 520 -3.4% 4% -7% -20% -35%

Billet - Far East 360 365 350 393 445 520 -1.4% 3% -8% -19% -31% Other non-raw materials, Producer prices (ex-works)

Pig iron 277 280 273 331 430 318 -1.1% 2% -16% -36% -13%

Coke (Siberian region) 165 167 160 216 230 276 -1.1% 3% -23% -28% -40% Export prices

Pig iron 317 304 319 370 370 363 4.3% -1% -14% -14% -13%

Coke 245 245 245 245 290 345 0.0% 0% 0% -16% -29% Raw materials, Domestic prices

Iron ore concentrate 64 64 63 83 86 48 -1.1% 2% -24% -26% 34%

Iron ore pellets 74 75 73 91 112 65 -1.1% 2% -19% -34% 14%

Coking coal concentrate (mix) 97 98 92 112 148 143 -1.1% 6% -13% -35% -32%

Thermal coal (TR grade, 6k/t) 28 28 27 35 34 36 -1.1% 2% -22% -20% -24%

Scrap (Urals region) 198 198 179 187 232 230 0.0% 11% 6% -15% -14% Russian export prices

Coking coal concentrate (CFR China) 153 153 153 153 153 153 0.0% 0% 0% 0% 0%

Thermal coal (FOB Far East, 6K Kcal) 63 63 66 69 80 103 0.0% -5% -9% -21% -39%

Thermal coal (Riga, 6K Kcal) 35 38 40 43 45 76 -6.7% -13% -19% -22% -54%

Scrap (FOB Novorossiysk) 215 227 198 215 279 332 -5.3% 9% 0% -23% -35% Global benchmarks

Iron ore - CFR China 84 84 83 85 95 75 0.1% 2% -1% -11% 13%

Hard coking coal - FOB Australia 109 119 138 133 206 257 -8.0% -21% -18% -47% -58%

Semi-soft coking coal – China CFR 70 73 78 93 107 138 -4.8% -11% -25% -35% -49%

Thermal coal (ARA CIF) 42 45 50 56 60 97 -6.7% -16% -25% -30% -57%

Thermal coal (Newcastle FOB) 52 57 68 69 90 103 -8.8% -24% -25% -42% -50% Ferro-Vanadium – US free market, 70-80% spot 11 11 13 12 22 21 0.0% -18% -8% -51% -46%

Source: Metal-Expert, BCS GM

Traders steel margin, $/t

HRC / CRC Rebar/Sections

2016-now (weekly) 2009-now (monthly) 2016-now (weekly) 2009-now (monthly)

Source: Metal-Expert, BCS GM

-100

-50

0

50

100

150

Jan-

16

Jul-1

6

Jan-

17

Jul-1

7

Jan-

18

Jul-1

8

Jan-

19

Jul-1

9

Jan-

20

HRC

CRC

-100

-50

0

50

100

150

Jan-

09

Jan-

11

Jan-

13

Jan-

15

Jan-

17

Jan-

19

HRC

CRC

-100

-50

0

50

100

150

Jan-

16

Jul-1

6

Jan-

17

Jul-1

7

Jan-

18

Jul-1

8

Jan-

19

Jul-1

9

Jan-

20

Rebar

Sections

-100

-50

0

50

100

150

Jan-

09

Jan-

11

Jan-

13

Jan-

15

Jan-

17

Jan-

19

Rebar

Sections

Research Department +7 (495) 785 5336 Head of Research

Deputy Head of Research, Equity Deputy Head of Research, FI Head of Production Kirill Chuyko [email protected] +7 (495) 213 15 26

Slava Smolyaninov [email protected] +7 (495) 213 15 02

Maria Radchenko [email protected] +7 (495) 213 15 35

Mark S Bradford [email protected] +7 (495) 785 53 36 (ext. 14681)

Chief Economist Vladimir Tikhomirov, PhD [email protected] +7 (495) 785 53 36 (ext. 14911)

Market Analysis Mark S Bradford [email protected] +7 (495) 785 53 36 (ext. 14681)

Fixed Income Maria Radchenko [email protected] +7 (495) 213 15 35

Head of Russian Product Olga Sibiricheva [email protected] +7 (495) 785 53 36 (ext. 14618)

Equity Strategy Slava Smolyaninov [email protected] +7 (495) 213 15 02 Kirill Chuyko [email protected] +7 (495) 213 15 26 Yulia Goldina [email protected] +7 (495) 213 15 07 Vasiliy Mordovtsev [email protected] +7 (495) 213 15 86

Oil & Gas Kirill Tachennikov [email protected] +7 (495) 213 15 04 Vasiliy Mordovtsev [email protected] +7 (495) 213 15 86

Financial Services Elena Tsareva [email protected] +7 (495) 213 15 37 Veronika Yan [email protected] +7 (495) 785 53 36 (ext. 10475)

Metals & Mining Kirill Chuyko [email protected] +7 (495) 213 15 26 Oleg Petropavlovskiy [email protected] +7 (495) 213 15 03 Artem Bagdasaryan [email protected] +7 (495) 213 15 08

Retail & Utilities Dmitriy Skryabin [email protected] +7 (495) 213 15 09 Maria Lukina [email protected] +7 (495) 213 15 36

Industrials & Real Estate & Fertilizers Anastasia Egazaryan [email protected] +7 (495) 213 15 39

TMT Maria Sukhanova [email protected] +7 (495) 213 15 05

Yuri Golban [email protected] +7 (495) 213 15 06

Yakov Yakovlev [email protected] +7 (495) 213 15 94

Anastasia Boyko [email protected] +7 495 785 53 36 (ext. 18546)

Global Equity Markets Alexey Gil [email protected] +7 495 785 53 36 (ext. 17614)

Business Administrator Anna Zhukova [email protected] +7 (495) 785 53 36 (ext. 14803)

Production Team Nikolay Porokhov [email protected] Seb Barendt [email protected] Elena Kosovskaya [email protected] Olga Dontsova [email protected] Anton Ostroukhov [email protected] Tatiana Kurnosenko [email protected] Svetlana Shcheglova [email protected]

Data Specialists Vasiliy Mordovtsev [email protected] +7 (495) 213 15 86 Mikhail Skorina [email protected] +7 (495) 785 53 36 (ext. 12084)

Institutional Sales & Trading (Moscow) +7 (495) 785 5336 (ext. 15048)

Institutional Sales & Trading (London) +44 (207) 065 2023

Institutional Sales (New York) +1 (212) 421 8567

Private Client Service +7 (495) 785 5336 (ext. 15440)

Disclaimer – This report is produced and distributed by BrokerCreditService Ltd. Neither this report, nor information/data provided herein should be considered as an individual investment recommendation. The financial instruments or

transactions mentioned herein may not suit you or your investment profile, financial situation, investment experience, knowledge, investment goals, risk tolerance and return expectations. Investors should independently determine the compliance of a financial instrument or operation with their investment objectives, investment horizon and risk tolerance. BrokerCreditService Ltd (Registered Name: BrokerCreditService Ltd, Registered Number: 1025402459334, Registered Office: 37 Sovetskaya str., Novosibirsk 630099, Russia, BrokerCreditService Ltd is regulated by the Central Bank of Russia and holds FFMS licenses No. 154-04434-100000 of 10.01.2001 for brokerage services, No. 154-04449-010000 of 10.01.2001 for dealing on own account, No. 154-04462-001000 of 10.01.2001 for managing securities portfolios and No. 154-12397-000100 of 23.07.2009 for safekeeping and administration of financial instruments) is not responsible for any possible losses, incurred by the investor, related to any operations/transactions, or investing in financial instruments referred herein. This information does not represent public tender offer, suggestion or invitation to purchase, or sell any securities, other financial instruments, to make deals with them. Information cannot be considered as guarantees or promises of the future return on investments, risk level, amount of costs, breakeven point of investments. Past performance is not a guide to future performance. This should not be considered as an advertisement of securities. Prior to making an investment decision, Investor needs to independently assess the economic risks and rewards, tax, legal, accounting implications of a deal, his or her willingness and ability to accept such risks. The client also bears the cost of paying for brokerage and depositary services, making orders by telephone, and other expenses payable by the client. The full list of tariffs of BrokerCreditService Ltd is provided in Appendix 11 to the Regulations for the Provision of Services on the Securities Market of BrokerCreditService Ltd. Prior to making a deal, you also need to familiarize yourself with: the notification of the risks associated with operations in the securities market; information about the client risks related to making the deals with incomplete coverage, the occurrence of uncovered positions, temporarily uncovered positions; a statement disclosing the risks associated with transactions in the market of futures contracts, forward contracts and options; declaration of the risks associated with the acquisition of foreign securities. Investors should note that any income derived from investments in financial instruments may fluctuate and that the price or value of securities and investments may rise or fall. Accordingly, investors may lose their investment or receive back less than originally invested. Past performance is not a guide to future performance. Foreign currency exchange rates may adversely affect the value, price or income of any security or related investment mentioned in this report. In addition, there may be currency risk if investing in securities such as ADRs or GDRs. Investing in the Russian economy and Russian securities involves a high degree of risk and requires appropriate knowledge and experience. The information and opinions have been obtained from public sources that are believed to be reliable, but no representation or warranty is made by the Company with regard to accuracy. The opinions contained herein reflect the current judgments of research analysts and are subject to change without prior notice. All of the above considered, this report should not be viewed as the only source of information, and the Company, nor its affiliates or employees accept any responsibility or liability whatsoever for any direct or indirect damage arising out of or in any way connected with the use of information contained herein, nor for its authenticity. Investors should note that the Company and/or its affiliates may have or have had positions or derivative positions in the securities or other instruments referred to herein or make or have made a market or otherwise act or have acted as principal in transactions in any of these securities or instruments or may provide or have provided investment banking or consulting services to or serve or have served as a director or a supervisory board member of a company being reported on herein. The Company operates in the Russian Federation. This report can be used by investors on the territory of the Russian Federation subject to Russian law. The use of the report outside the Russian Federation is subject to the laws of the respective country. For distribution within the UK, this research report is intended only for eligible counterparties or professional clients (as defined in the FCA Rules) and should not be communicated to retail clients. This report is distributed in the United States by BCS Americas, Inc., an affiliate of BrokerCreditService Ltd, which accepts responsibility for its contents. BCS Americas, Inc. did not contribute to the preparation of this report and the authors are neither employed by, nor associated persons of, BCS Americas, Inc., nor registered or qualified as research analysts with FINRA. The issuing entity and authors may not be subject to all of the disclosures and other US regulatory requirements to which BCS Americas, Inc. and its employees are subject. Any US person receiving this report who wishes to effect transactions in any securities referred to herein should contact BCS Americas, Inc., not its affiliates. Under SEC Regulation AC, the research analyst(s) as named on the front page of this report certify that (i) the views expressed in this research report accurately reflect their personal views about the subject securities and issuers and that (ii) no part of the research analyst(s)’s compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. This report may not be distributed, copied, reproduced or changed without prior written consent from the Company. Further information may be obtained from the Company upon request. BrokerCreditService Ltd and/or an affiliate has or expects to receive fees for the provision of investment/corporate banking service for TMK. BrokerCreditService Ltd or an affiliate company may own one percent or more of equity securities of TMK, but does not hold more than five percent of the share capital of TMK. Neither BrokerCreditService Ltd, nor any affiliate has managed or co-managed any public or private offering or acted as a market maker or corporate broker for TMK. BrokerCreditService Ltd acts independently when producing research and does not share draft of research reports or communicate changes in rating or targets to the issuer ahead of publication. © 2020 BrokerCreditService Ltd. All rights protected and reserved.