Minnova - Lac Shortt Mine

description

Transcript of Minnova - Lac Shortt Mine

CASE PREPAHATION CHART

CaseTiue: F\$t$ c)"! fr Gri L+,( frt.rdtrY\i sf F*I. SHORT CYCLE PROCESS II.

Name Position

who: <A{qfi *Gdt>dn 5q$f ,

whar: 8.4 \ g*}?i';'* cF r\.i"or g- ?

SFa*net?i \ri f.l A'.r{$ys3whv: KUV,f L&i gw&ra[l G*incs,

when: \5 ef

Case Difficulty Cube

How, { t ., V ,, 7 -lAnalytical Conceptual Presentation

II. LONG CYCLE PROCESS

A, lssue(s)

lmmediate Basip

1, FqCAnrs;*)$r 1. CA 0if $L2- 9V*n$lit-\\ 2. {zip-oG\wivG*s. fu.&\g..'5 s. g\e{rb;.'d

qrra."R {tpf;:I *"rSL'}nrug-q-"qb*{

B. Case Data Analysis

}.H \g&fr@rrr?ft{-{asR

Ps-$s?

:F; 1,&[Lrr&.*1''{*tz${rBhrrbe-

*K$tffyq='ffinrr-case Assign rnent: qd *L\rSm&" %{ P&q S ; e r{LoNc cYcLE PHorggisp,a&b; "-

C. Alternative Generation

1. E{ t *r*g)srv ^l Wt^z.3. e^\ \t\f *>

D. Decision Criteria

1, b$ c* )cz.}t'a-a ) \5"*lo3' LtYBUrluu# +F ACOl?;a'rrdr-

E. AtternJiVt{.€tsment

Quantitative + N C]Gualitative +N +N + nr(Decision gogo ? ? nono ? no@

Preferred Alternative

Predicted Outcorne

hA\ D+ (Wffs l*ilAction & lmplementation Plan

Timing

who (-$* rqi -rG'-,{stoneswhat TUIJ_ tbe {4rw N r}yP: sr'91;- %eS {W \t@,)-'^f&Where .€How s.a L-[ $ !48-{-}v t $g"5Q

\f,s.f&&T* qrr[ S [*Missinq lqfgrryatiq*

As,s$mqtions

b ila-*ffi W**\m.*Gt2e"Te(s.bLs ?sa;r&, &Eg{ara$,}%

^W&.. nilt*V*rl",pSE?u- I A,u *f\-hdE?,E,' e{h i i,b}e b"fLse Ss lrnq-uf r'il e nds'

F.

Atr.

*n\*

Apsv-c?s

{r Erut}nl rn o\?1{t" $rA\t*t{ }p'

tta

%

w

Richard lvey School of BusinessThe Llniversity of Western Ontario Ivny

ProfessorClaude Lanfranconiprepared this teaching note as an aid to instructorsShortt Mine, No. 9-90-8002. This teaching note shoutd nat be used in any

lvey Managementservtce s prohibits any form of reproduction, storage a,material is not covered under authoization from CanCopy or any o.permission to reproduce materials, contact lvey Publishing, lve.university of westem ontario, London, ontaio, canaaa{ runP scases@ ivey.uwo.ca"

Copyrighf O 1990, lvey Management Servr'ces

, Teaching Note

MINNOVA INC. _ LAC SHORTT MI

8-90-802

the case Minnova lnc. - Lacdice the future use af the case.

rialwithouf its writt permission. Thisorganization. To s or request

s, c/o Richard lve slness, The(519) 661-3208; 82; e-rnail

1992-01-30

a recorrunendation on whether totres" The capital budgeting decision

(4t, since the company is curently in a non-t t6at a number of the variables in the situation

s, gold prices, head grade of ore, etc.). This addsGiven the nature of Minnova's mining strategy

considerations become zur important issue in the

4 tr1ffi

CASE SYNOPSIS

John Carrington, seniinvest $ I9 milliinvolves

t at MinnovaanYxisting gold mi

without taxrslon is complicated

Utothei ecision.the eand the sS factors of t litativecase analy

TEACHING OBJECTIVES

The case is a good vehicle for teaching the technical skills of net present value calculations, includingCCA tax shields. Opporhrnity for sensitivity analysis also exists and effectively hightights the risksassociated with decision-making when there is little control overthe significant factors involved. Beyondtechnical skills, the case pushes the studenb to apply professional judgement to the situation, given thatthe net present value of the investment ends up being just slightly below the company's hurdle rate.

Page 2 8-90-802

1.

2"

ASSIGNMENT

Do a size-up of the mining indus$ and of Minnova Inc.'s strategy.

Does the $19 million investrnent in the Lac Shortt Mine meet Minnova's hurdle rate?

Evaluate the risk associated with the investment.

As John Carrington what would you recommend to the Board of Directors?

ANALYSIS

The case discussion should begin with a general size-up of the minittg industy and more specifically,

ofMinnova's mining strategy. The industry is characterizedby high upfront investrnent and long lead

times, both in terms of set up and retums on investment. Mining is, by nature, a risky business, due to

its cost structure and the ever-present uncertainty involved in the related mining decisions.

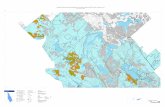

Minnova's particular mining strategy skives to reduce overall costs and discover new deposits to replace

those being exhausted. By conducting extensive exploration of areas surrounding existing mines,

Miffiova has been quite successflrl in finding new nearby deposits. The close proximity of new deposits

to existing mines results in major cost savings since existing mine facilities, equipment, and labor can

be utilized. It is very important that students understand the significance of Minnova's strategy since itwill play a key role in the decision process.

Another point worthy of mention is that students must make the decision on expansion based on the

information available at the time of the case. Incorporating actual results ol for instance, gold price and

exchange rate movements since June 1988, distorts the true environment within which the decision had

to be made.

Net Present Value of lnvestment

Exhibit I presents the calculations of revenues, costs and net operating cashflow from the proposed

investrnent. The cost per tonne of ore mined is given in the case for each of the three years of miningactivity. In calculating the revenues to be eamed, the tonnes of ore mined must first be converted to

ounces of gold (. 148 ounces per torxre) and then multiplied by the expected recovery rate (93 per cent).

This yields the expected ounces of gold bullion which must then be multiplied by the estimated price to

be received (US$450 @$1.22 exchange rate : CDN$549) for the gold.

Exhibit 2 is a time line of all cash inflows and outflows associated with the Lac Shortt Mine investment.

Using a 15 per cent hurdle rate, net present values are calculated both excluding and including taxconsiderations @xhibits 3 and 4,respectively). Both of the scenarios result in a negative NPV; however,

note that no salvage values are given for the fixed assets at the end of the time hor2on. To meet the

nJ.

4.

Page 3 8-90-802

designated rate of return, the salvage value would have to be about $989,000 or 20 per cent of theoriginal cost with no tax considerations, and about $2,000,000, or 41 per cent of the original cost, underthe scenario incorporating taxes. Thus, the proposed investnent only narrowly falls short of meeting thespecified hurdle rate.

Uncertainty

Examining the elements of the quantitative analysis, it is apparent that a number of them are beyond thecontrol of Minnova. Most obvious are the Canadian/U.S. exchange rate and the price of gold bullion.Exhibit 8 of the case illustrates the efient of fluctuations in gold prices and exchange rates since 1980.

Jt As a price takp*gf extemally determined market prices, Mirurova's only strategy is to minimize their{\ costs of production.

t *

In the area ofproduction costs, there is also significant uncertainty. Looking at the original estimates ofthe Lac Shortt Mine, the head grade was anticipated to be 5.30 grams of gold per metric tome, yet todate, the head grade had averaged only 4.99 grams per tonne (see Exhibit 4 of case). The head gradedirectly affects the gold bullion that will be retieved and hence the revenues to be eamed. At aboutCDN$550 per ormce of gold, a slight deviation in actual versus estimated head grade can result in asignificantly different financial outcome. In examining Exhibit 4 fi.rther, the recovery percentage alsoseems to involve uncertainty, although to a lesser extent than the previously discussed head grade.

Risk increases as mining to greater depths occurs because there is less accurate information about goldconcenhation and the conditions of mining that will exist. The result is elements of uncertainty inoperating costs and in the estimate of ore reserves to be found at the greater depth. It would not beunrealistic for these variables to fluctuate plus or minus l0 per cent from the expected levels. Onceagain, this could have a significant impact on the quantitative outcome of the investrnent.

Overall, there is a great deal of risk the investment; however, these risks are inherent in thebusiness of mining. Minnova would face these kinds of risks every time a nfu'l56fiousitfrffi;a must weigh the downside risks against the potential gains to be received if actualresults are close to, or better than, the initial forecasts.

Qualitative Gonsiderations

Given the net present value results @xhibits 3 and 4),John Carrington would rerommend not to proceedwith the Lac Shortt Mine extension if the decision was solely quantitatively based. There are, however,several qualitative issues that merit discussion.

Minnova's mining strategy, as explained in the case, is to conduct exploration of a large radius aroundan existing mine site, in order to find additional ore bodies which can be brought on stream by the timethe existing site is exhausted. This stategy stems directly from the characteristics ofthe mining business;

Page 4 8-90-802

that is, a high fixed cost structure, large up front costs and investrnents in fixed assets, long lead timesfor production, and remote mine locatiors. If additional ore bodies are located, major cost savings resultfor Minnova. The type of exploration described is much more feasible to conduct when there is aproducing mine in the area. Otherwise, the exploration sometimes becomes prohibitively costly.

In the Lac Shortt case, there remains opportunity for discovery of ore reserve deposits in surrounding

unexplored areas. A commitnent to production in the extended mine will allow fi.rther underground

exploration which otherwise might not be explored. This exploration is essential to the continued success

of a mining company, since new reserves must be discovered to replace exhausted ones.

Timing is also a critical issue for John Carrington since intemrptions in mining activity are extremelycostly. This fact eliminates the possibility of extending the investigation of the lower 300 metres toascertain better estimates of the ore body. The upper mine will be exhausted by 1990 so ideally, the

lower mine should be on stream by that time. Given the forecasts in the case, work must begin in thecrxrent year (1988) for production to start in 1990.

CONCLUSION

The Minnova case provides an excellent opportunity to discuss the issue of uncertainties and how these

should be incorporated into the decision process. Certainly sensitivity analysis on the uncontrollablevariables would provide at least a range of possible outcomes under best and worst case scenarios.

Beyond this type of analysis, it is very difficult to quantify risk. Experience in the indusbry, obtainingthe best economic forecasts, and ensuring thorough exploration drilling, all help to increase confidence

in the forecasts; however, the uncertainties will always remain.

Given the dependency on the current economic climate, an interesting question arises: Does the economic

climate invalidate Minnova's shategy and/or planned projects? If gold prices and exchange rates tumunfavorable, what might have been a profitable mine, could quite conceivably become unprofitable.Should the company have different stategies for different operating environments? Once a decision to

mine a deposit is made, the capital invesknent is too great to simply abandon the project in the midst ofits usefirl life. Also timing is often a critical iszue from a cost perspective. It would seem that there willinevitably be both hard times and good times. Hopefully over the long term, using a consistent and

apparently successful strategy (to date), a financially healthy company will emerge.

John Caninglon recommended to go ahead with the $19 million investment at the Lac Shortt Mine.Despite the calculations indicating an unacceptable rate of retum, the decision was made to allow for the

continuation of the aggressive exploration progrirm underway in the Lac Shortt area. As of July 1990,

no confirmed ore deposits had yet been found in the surrounding area; however, surface explorationabout 10 km. away from the Lac Shortt Mine look promising.

The mine extension was successfirlly completed both on schedule and within budget. Further detailed

ldrillinS of the lower 300 metres has indicated less ore reserves than originally estimated; however, a

\ \\\si Qs-n*t ,

$.s,( fe^fL0 \

Page 5 8-90-802

parallel zone of ore deposits has been discovered. Thus the net effect will likely be that total ore deposits

are close to the initial estimates. The fact that a chance discovery of an additional parallel zone willapparently result in a positive outcome, reinforces the issue of unavoidable risk inherent in the invesfrnent

decision.

The price of gold at July 1990 is about US$360 per ounce, significanfly below the estimated $450 per

ounce in the case. Once again, the issue of unconftollable vmiables is highlighted. Actual mining of ore

is jus beginning so other vmiables in the decision, zuch as recovery rate, head grade, and operating costs,

cannot be confirmed.

Page 6 8-90-802

Exhibit t

REVENUE AND COST CALCULATIONS

Production \q %,fr) rGold OunceslTonne t,:5i$,\tS ;

Potential Gold Bullion (ozs.)

Recovery Rate

Recovered Gold Bullion (ozs.)

Canadian $/Ounce ($45A @ ffi.22)

Total Revenue

Cost/TonneProduction

Total Cost

Net Operating Cashflow

1990

330,000tx .148

48,840

x 93o/o

45,421x $549

$ 241936,129

$ 50.05

x 330,0001

s 16,516,500

$ 8,419,629

1 991

360,000tx .148

53,280

x 93o/o

49,550

x $549

$ 27 242,950

s 48.0sx 360,000t

s 17"298,000

s 9,904,950

1 992

195,000tx .148

29,960

x 93'/s

26,840x $549

$ 14,735,160

$ 4A.74

x 195'0001

s 7,944,300

$ 6,790,860

/

,/

Page 7 8-90-802

Exhibit 2

TIME LINE OF CASH INFLOWS AND OUTFLOWS

UI7341988 1989 1990 1991 1992

Invesfments

Preproduction (52,674, t 00) ($ I I ,5gg,500) ($ 1 93,g00)

Fixed Assets (1,3 77,9a0) (2,95a,900) (629,000)

Operating Cashflow

Present Value Factor

$8,419,629 $9,904,950 $6,790,960

(15% hurdle rate) I .870 .756 .658 .572

Page I 8-90-802

Exhibit 3

NET PRESENT VALUE - NO TAX SITUATION

Invesfment

1 988

l 989

1990

Net Present Value fnvesfments

Inflows

r990

t99l

1992

Net Present Value Inflows

Net Present Value / sqe-ef \\sB*

($4,052,000)

($1 4,550,400)

($822,800)

$8,419,629

$9,904,950

s6,790,860

($4,052,000)

(12,658,848)

(.622,A37)

($17 332,885)

$ 6,365,240

6,577,457

3,884.372

s 16,767,069

(s 565.816)

I

"870

.756

"756

"658

"572

Page 9 8-90-802

Exhibit 4

NET PRESENT VALUE - TAX SITUATION

fnvesfmentPreproduction (CCA 100"h)

l ggg ($2,674,100)

l ggg ($ t 1,599,500)1990 ($ 193,800)

Total Preproduction

Fixed Assets (CCA25%)l ggg ($ I ,377 ,900)l ggg ($2,950,900)

1990 ($629,000)

Total Fixed Assets

Net Present Value fnvestments

($ 6,843,454)

(s 4,420,707)

($ 11264,161)

Inflows1 990l99t1992

s8,419,629 x$9,90 4,9A5 x$6,790,960 x

'il.

x.53xlx .5i- x "87ax .53 x "756

XIx .870

x .756

rlL1^ t*L.*,tl.',f {.

.53 x .7 56

"53 x "658.53 x .572

,.}1 i , .,

.f- \u' ' 3

L

j:,{i t! ;l' ,.:lfl

. !r'r :r

*.'0. , tj

X

X

X

x .870

x .756

_ $ 378,449

_ s 130,606

s 1214,t75

$ 10,100,721

/

$ 3,373,577

$ 3,454,252$ 2.058.717

$ 8,886,516

CCA Tax Shieldsl ggg $1,377,900l ggg ($2,950,900t99A ($629,000

Total CCA Tax Shields

Net Present Value Inflows

Therefore

Net Present Value

x "625 x.935rx .625 x.935)x .625 x.935)

($ t|,264,161)s 10,100.721

(s 1.163.440):

x Q + hurdle.t2(1 + hurdle)

2 t-., t\'w.,q \

--. .r/c- L 1..' / b i

.47

.47

.47

(CCA ratel(rate + hurdle)

-,/f xiq' J i.*. f s

lCCA tax shield formula

€,kL5 r 3b5

![[Colette Shortt, John O'Brien] Handbook of Functio(BookFi.org)](https://static.fdocuments.net/doc/165x107/545dff74af795937758b45ed/colette-shortt-john-obrien-handbook-of-functiobookfiorg.jpg)