Minneapolis-St. Paul Industrial Market Investment Trends

description

Transcript of Minneapolis-St. Paul Industrial Market Investment Trends

minneapolis-st. paul industrial marketinvestment trends

Colliers Minneapolis - St. Paul Investment Services Group

JanuarY 2015

Minneapolis-st. paul | investment trends

Colliers international | 1

Colliers Minneapolis - st. paul industrial Group

evan moldesr. associate952 897 7776

eric BatizaVice president952 837 3007

paul BickfordVice president952 897 7732

Brad Bohlman, SIOR

sr. Vice president952 897 7733

lisa Brassassociate

952 837 3053

mike BrassVice president952 837 3054

rob Brasssr. associate952 897 7757

Jay ChmieleskiVice president952 897 7801

Brian doyleVice president952 837 3008

dan FriednerVice president952 897 7863

Jeff JiovanazzoVice president952 897 7878

ryan krzmarzick, CCIM, SIOR

Vice president952 897 7746

nick leviton sr. associate952 897 7843

peter mork, J.D.

sr. Vice president952 897 7772

Brian netzVice president952 897 7736

andrew odneysr. associate952 897 7709

Bill ritter, CCIM, SIOR

sr. Vice president952 897 7743

Jason simeksr. associate952 897 7898

eric rossbachsr. associate952 897 7872

steve nilsson, CCIM, SIOR

Vice president952 897 7899

Colin Quinnassociate

952 897 7768

Joseph owensr. associate952 897 7888

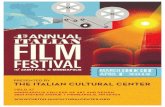

2014 Colliers minneapolis-st. Paul Business Activity

5.01M 29 5423M SFTOTAL SF SOLDUNDER MANAGEMENT INDUSTRIAL

SALE TRANSACTIONSTOTAL SF

CURRENTLY LISTEDINDUSTRIAL LEASING

BROKERS

29.6M

Colliers Minneapolis - st. paul inVestMent serViCes Group

david BerglundVice president952 897 7789

Colin ryanVice president952 837 3093

mark kolsrud, sior, Cpm

sr. Vice president952 897 7790

pia robertsonsr. real estate

analyst952 837 3080

Jordan Weigeltreal estate analyst

952 897 7714

Colliersmsp.com/investmentservices

Cassie durchBrokerage services

assistant952 897 7849

Colliers international is a leader in global real estate services, defined by our spirit of enterprise. through a culture of service excellence and a shared sense of initiative, we integrate the resources of real estate specialists worldwide to accelerate the success of our partners – our clients, professionals, and communities.

We offer a complete range of services to owners, investors and occupiers on a local, regional, national and international basis. the foundation of our service is the strength and depth of our local specialists. our clients depend on our ability to draw on years of direct local market experience

Colliers international / Minneapolis – st. paul is pleased to present this investment tends report to our clients.

this report is intended to equip market participants with information to assist investment decisions by providing a commentary of current market conditions affecting the liquidity of industrial real estate in the twin Cities. the Colliers international Minneapolis industrial sales team has identified a number of headwinds and tailwinds that influenced the local industrial property market in 2014, as well as several factors that may affect Minneapolis’ industrial market in 2015.

We are very proud of where the Minneapolis industrial market stands today and are excited to see the upcoming trends in this constantly-evolving industry.

Colliers international

mark kolsrudsr. Vice president

david BerglundVice president

Colin ryanVice president

B C

Minneapolis-st. paul | investment trends

Colliers international | 1 Colliers international | 2

in number of global Fortune 500 companies operating in the area

in labor force participation1st 2nd in number of Fortune

500 company headquarters per capita

in percentage of population with bachelor’s degree or higher4th

5th 10th in number of Forbes’ largest private companies

StROng LOCaL ECOnOMyThe most pervasive theme contributing to the success of the MSA’s real estate capital markets both in 2014 and 2015 is the strength of the local economy. The Twin Cities jobless rate of 3.8%

(October 2014) is the lowest unemployment rate of any large metropolitan area in the US, according to the Department of Labor, ahead of many cities which attracted significant amounts of foreign and domestic investment activity in 2014 such as Austin, Denver, Houston, Seattle, San Francisco, Washington D.C., and Los Angeles.

A major reason contributing to Minneapolis-St. Paul’s emergence as one of the nation’s strongest economies is the diversification of sectors contributing to the MSA’s gross product. The health of the Twin Cities economy is tied to a number of industries including healthcare, education, information technology, agricultural science, and transportation. Anchoring this diversification are the eighteen different Fortune 500 companies based in Minnesota such as UnitedHealth Group (#14), Target Corp. (#36), Best Buy (#60), CHS, Inc. (#62), 3M (#101), U.S. Bancorp (#140), General Mills (#159), The Mosaic Company (#283), and C.H. Robinson Worldwide (#220) to name a few.

Minneapolis-st. paul | investment trends

Colliers international | 3

industrial investment market trends

Minneapolis-st. paul | investment trends

7.09%

6.56%6.57%

6.92%

5.91%

6.21%

6.30%

Minneapolis-St. Paul

Chicago

Dallas Atlanta

New York/Northern New Jersey

Los Angeles/Inland Empire

San Francisco

6.31%Seattle

6.88%Denver

7.08%Houston

7.02%

Miami*Average Industrial cap rate over the past 4 quarters. Information provided by Real Capital Analytics.

InCREaSE In InStItutIOnaL InvEStOR DEManDDue to competitive pricing, condensing cap rates, and a surplus of capital allocated to

acquiring industrial real estate, many investors were forced to look away from the traditional industrial markets in order to achieve acceptable yields last year. With an unemployment rate lower than the national average, a highly educated and skilled workforce, and per capita income significantly higher than the United States average, the Minneapolis-St. Paul region ranks significantly better than the nation on a number of key investment criteria measures which we expect will continue to make Minneapolis one of the most attractive secondary industrial markets to investors in 2015.

LIMItED SuppLy Of MODERn InDuStRIaL SpaCEOver the last two decades, the bulk of industrial product in Minneapolis-St. Paul was designed

to meet the needs of users in the medical technology industry. These properties usually included a large amount of high-finish flex space, low clear heights, narrow column spacing, inadequate trailer parking, and limited fire/life safety systems. During this period, demand - in the form of rental rates and space requirements - from other industrial users for different product was rarely enough to justify new construction, and these users either adapted their businesses to fit the available space or left the market entirely in search of suitable space elsewhere. This led to a lack of desirable product for today’s industrial users - buildings with little to no finished office space, high clear heights, wide column spacing, cross-docking capabilities, ample employee and trailer parking, and modern fire/life safety systems.

sampling of national industrial Cap rates

Colliers international | 3 Colliers international | 4

Minneapolis-st. paul | investment trends

SpECuLatIvE DEvELOpMEnt InCREaSESThis combination of a lack of modern industrial product, a strong economy with rising rental rates, and increased interest from institutional

investors is driving much of the development in the Twin Cities. Illuminating this is the current boom of speculative development of modern industrial product across the Twin Cities. National industrial real estate players including Duke Realty, United Properties, First Industrial, Ryan Companies, and Liberty Property Trust all are either currently under construction or recently completed speculative projects in the metro. Even lenders recognize the strength of the market and are willing to finance the construction of new speculative space. Including speculative projects and build-to-suit projects, developers delivered nearly 3 million square feet of new industrial product in 2014.

If yOu BuILD It, thEy WILL COMESince the majority of the new industrial product being delivered was built on a speculative basis, potential downside risk exists if there are not enough tenants for all the new space. However, a

number of new domestic and international tenants are being drawn to the Minneapolis- St. Paul market for their Midwest and/or US expansion plans; while many existing tenants are planning to expand their footprint in the market in 2015. One tenant in particular with the power to change the landscape of the industrial property market is Amazon.com. Until recently, the retailer’s growth strategy has focused on occupying space in states which don’t charge its customers sales tax in order to grow its consumer delivery model. Because Minnesota state law requires online retailers with a physical presence in the state to collect sales tax, Amazon has shied away from physically expanding into this market.

Though Amazon is secretive about its real estate plans, the retailer registered with the state to get a tax ID and began collecting sales tax in Minnesota on October 1, 2014, a strong indication the retailer is planning to occupy space somewhere in the Twin Cities. The registration suggests that Amazon could open a data center or tech office in the state and not necessarily a fulfillment or distribution center, however Amazon’s closest fulfillment center is in Kenosha, WI primarily serving the Milwaukee and Chicago markets with its signature same-day or next-day delivery options with its Lexington, KY distribution center currently serving the Twin Cities. Amazon typically locates their fulfillment and sorting facilities in outer-ring suburban locations that offer both access-to and visibility-from one or more major interstates.

Speculation is brewing that Amazon will select a site in the south metro, along the I-35 corridor in 2015. Fueling this speculation is Ryan Companies’ 120-acre site at the intersection of I-35 and Country Road 2 near Elko New Market, in which they are working with the city and the county to study the impact of developing a large industrial park with the ability to construct between 1.5 million and 2 million square feet of warehouse space – large enough to accommodate Amazon’s space needs. From this location Amazon would be able to offer same-day or next-day delivery to nearly 5 million customers from Duluth to Des Moines. A new Amazon distribution center will likely put pressure on other retailers such as Target and Best Buy, both based in Minneapolis, to change how they utilize their supply chains in order to speed up their delivery times to compete with Amazon’s same-day or next-day delivery model likely increasing the demand for additional industrial space around the Minneapolis/St. Paul MSA.

pOpuLatIOn gROWthUnlike shrinking Midwest cities such as Detroit, St. Louis, and Cleveland, the Twin Cities metropolitan area is expected to continue attracting new residents. The seven-county

Minneapolis-St. Paul region is projected to grow by nearly one million people by 2040, almost a 30% increase. With this growth in population, employment growth over the same period is expected to add 550,000 jobs, with nearly 20% of this growth expected to occur within the next five years.

ChIna faCtORChina’s manufacturing cost advantage over the US is quickly shrinking. In 2004, manufacturing in China cost 14% less than the US. Today, China’s advantage has fallen to less than 5%.

Further, according to The Boston Consulting Group, if this trend continues, manufacturing in the US will be cheaper than in China by 2018. Due to value increases of China’s currency, rapidly rising labor wages, decreased productivity and limited automation the cost to produce goods in China is being driven up. Concurrently, falling energy prices in the US are dramatically driving the costs of domestically produced goods down, and since the US leads the world in value of output per manufacturing worker, many corporations are now in the process of “inshoring” many of their operations that had previously been outsourced to other countries. For example, both Ford Motor Company and The Coleman Company have already moved a number of their production operations from China back to the US Midwest. The Twin Cities is likely to benefit from this trend due to many of the reasons outlined herewithin.

Colliers international | 5

Minneapolis-st. paul | investment trends

Colliers international | 5 Colliers international | 6

Buoyed by one of the healthiest local economies in the country, Minneapolis-St. Paul’s industrial real estate market is preparing itself for a strong 2015. Vacancy decreased slightly during the Fourth Quarter of 2014 from 8.8 percent in Quarter Three to 8.6 percent in Quarter Four. Absorption was strong at 812,452 square feet, bringing annual absorption to a robust 2,011,292 square feet. A total of 535,412 square feet of multi-tenant construction was completed during the quarter, and 69 percent of this space was vacant upon completion. We are tracking an additional 3.4 million square feet of space under construction, including both build-to-suit and speculative projects.

Within the existing space market, bulk warehouse properties continue to be the most desired product type across all submarkets; however, office-warehouse and office-showroom assets are gaining momentum. For bulk warehouse product, 32’ clear heights are the ideal, though any property with at least 18’ clear heights is generating leasing activity among the office-warehouse and office-showroom users. Assets with 16’ clear heights or less are receiving less attention from prospective tenants, especially as more modern industrial space is delivered to the market.

Generally speaking, the spread between asking rents and starting rents tightened somewhat in 2014, as both macro- and micro- economic fundamentals improved across the entire market. Additionally, landlords were able to reduce the amount of concessions offered on new leases, and the percentage of existing tenants renewing their leases increased as economic uncertainty has somewhat dissipated among decision makers.

While the construction boom continues, given the demand for materials for other regional projects such as the new Vikings stadium in Minneapolis, lead times are getting stretched out, causing costs to rise. Some materials, like concrete for example, are even being rationed out to builders and material vendors. An improving economy has reduced the number of qualified bids that are received in response to new project proposal requests, as many builders’ resources are already allocated to other projects.

On the heels of a number of new speculative projects being delivered to the market late last year and those projects still under construction, leasing and sales activity is expected to be robust in early 2015 as developers look to exit their positions once their property is stabilized. Construction activity is also expected to continue its momentum this year with the announcement of several additional new projects forecasted to break ground in the first two quarters of 2015—despite increasing constructions costs.

It should also be noted that once the majority of the new space currently under construction gets delivered in early- to mid-2015, a strengthening market for landlords could stall with the glut of new space hitting the market. Once this space is absorbed however, which is expected to occur quickly, the scales will likely tip back in the favor of landlords.

submarket Highlights

MaRkEt InDICatORSQ4 2014

vaCanCy —

nEt aBSORptIOn

REntaL RatE

vaCanCy20%

15%

10%

5%

0

2006 2007 2008 2009 2010 2011 2012 2013 2014

9% 8.6%10.4%

13.1% 12.5%11.5% 10.5%

perc

ent v

acan

t

9.4% 8.6%

Q4 aBSORptIOn

300,000

200,000

100,000

0

130,586

199,320155,348

103,447

223,751

Sf a

bsor

bed

airport/Southof the River

Minneapolisnorth

Southwest St. paulEast

West/northwest

nEt aBSORptIOn

3,000,000

2,000,000

1,000,000

0

(1,000,000)

(2,000,000)

(3,000,000)

1,355,744

(928,872)

(2,430,461)

914,877

1,369,692

2006 2007 2008 2009 2010 2011 2012 2013 2014

1,410,063

Sf a

bsor

bed 1,261,325

1,677,707

2,011,292

Minneapolis-st. paul | investment trends

Colliers international | 7

propertY name address/interseCtion CitY suBmarket sF developer

Powers Pointe 8100 Powers Blvd Chanhassen Southwest 140,000 United Properties

Dean Lakes Business Park 169 & County Rd 83 Shakopee Southwest 135,000 Ryan Cos.

Capp Warehouse II 4305 12th Ave E Shakopee Southwest 121,000 Capp Industries

Gateway North Business Center V Hwy. 101 & I-94 Otsego West/Northwest 485,000 Duke Realty

Gateway North Business Center III Hwy. 101 & I-94 Otsego West/Northwest 150,064 Duke Realty

Fedex Distribution Center 12395 Brockton Ln N Rogers West/Northwest 350,000 Scannell Properties

Red Rock Building County Rd 81 & 85th Ave N Maple Grove West/Northwest 320,000 United Properties

North Star Distribution Center 19800 Diamond Lake Rd Rogers West/Northwest 271,500 CSM Corporation

Dayton Distribution Center I 11020 Holly Land N. Dayton West/Northwest 247,004 Liberty Property Trust

Kinghorn Logistics Hub David Koch Ave & Brockton Lane North Rogers West/Northwest 220,000 Scannell Properties

610 Commerce Center Louisiana Ave. N. & 93rd Ave. N Brooklyn Park West/Northwest 202,000 CSM Corporation

Wurth Adams Facility Highway 610 & Highway 169 Brooklyn Park West/Northwest 170,000 United Properties

Launch Park Rogers State Hwy 101 & 147th Ave N Rogers West/Northwest 168,000 Launch Properties

Launch Park Rogers State Hwy 101 & 147th Ave N Rogers West/Northwest 30,000 Launch Properties

North Cross Business Park Highway 610 & Highway 169 Brooklyn Park West/Northwest 176,000 United Properties

INDUSTRIAL UNDER CONSTRUCTION

10

94 94

35E

35E

61

5

100

62

41

55

55

55

77

13 3

13

94

169

169

169

494

35W

12

5212

212

610

694

65

55

1094 97

35E

694 36

61

52

35WRogers

SpringPark

St. Paul

Cottage Grove

InverGrove

HeightsEagan

St. PaulPark

SouthSt. Paul

AppleValley

WestSt. Paul

MendotaHeights Woodbury

Afton

LakeElmo

Oakdale

Maplewood

NorthSt. Paul

LittleCanada

Lauderdale

EdenPrairie

Minnetonka

Hopkins

Wayzata

Deephaven

Greenwood

Bloomington

Rosemount

EdinaRichfield

GoldenValley

St. LouisPark

SaintAnthony

Minneapolis

Medina

Orono

Chaska

ExcelsiorShorewood

Victoria

Chanhassen

Shakopee

MaplePlain

TonkaBay

Mound

Minnetrista

Roseville

White BearLake

VadnaisHeights

GemLake

Centerville

Lexington

Circle Pines

Hugo

Shoreview

ArdenHills

LinoLakes

NorthOaks

Grant

Stillwater

Dellwood

Pine Springs

Willernie

Osseo

Champlin

MapleGrove

Plymouth

NewHope

BrooklynCenter Columbia

Heights

SpringLakePark

NewBrighton

MoundsView

Fridley

Crystal

Blaine

Robbinsdale

Coon Rapids

Brooklyn Park

Dayton

Corcoran

Greenfield

Hanover

Independence

Loretto

Otsego

Albertville

Ramsey

St. Michael

Elk River

Andover

Anoka

HamLake

Columbus

ForestLake

Scandia

West/Northwest

MinneapolisNorth

St. PaulEast

Airport/South ofthe River

Southwest

INDUSTRIAL UNDER CONSTRUCTION

Minneapolis-st. paul | investment trends

Colliers international | 7 Colliers international | 8

duke realty’s Gateway north Business Center in ostego.

WESt/nORthWEStThe West/Northwest has consistently been one of the most active industrial space markets in the Twin Cities. Absorption was strong at 223,751 square feet during Quarter Four, and a total of 529,362 square feet was absorbed for the year. Vacancy decreased from 8.2 percent in Quarter Three to 7.9 percent in Quarter Four. Aside from the significant development activity in Otsego, the submarket’s existing leasing market fundamentals are currently performing similarly to its recent historical trend in terms of space absorption, rent levels, and landlord concessions and incentives. Contract lease rates are landing within 90 percent to 95 percent of asking rates, with a modest amount of free rent (two-three months) and tenant improvement allowances ($15-$20 PSF) being offered on most new and renewal leases with between three and five years of term. In addition, our market professionals have explained that warehouse rents in the West/Northwest submarket still have room to grow, though it is difficult to predict where rents will go if the incoming supply of speculative product outweighs demand. Asking rents for the newest, highest-quality buildings in the submarket are in the range of $10.25 per square foot for office space and $5.25 per square foot for warehouse space.

The West/Northwest submarket saw the completion of a number of new speculative construction projects and the announcement of several new build-to-suit facilities last year. Addressing the lack of suitable product required by many industrial space users that desire to locate operations along the West/Northwest’s I-94 corridor, developers including Duke Realty, CSM, Scannell, United Properties, First Industrial, Liberty Property Trust and Ryan Cos. added over 1.34 million square feet to the submarket in 2014, and there is currently an additional 2.78 million square feet of speculative and build-to-suit projects under construction. For example, Duke Realty closed on three build-to-suit projects totaling over 900,000 square feet for its Gateway North Business Center in Otsego.

In early 2014, Ruan Transportation Management Systems contracted with Duke to build a 300,000 square foot distribution facility that the company began occupying during the Fourth Quarter of 2014. In July 2014, furniture manufacturer Room & Board also committed to Duke’s business park by signing a lease to have a 485,000 square foot facility built to accommodate the company’s growth plans. Lastly, two months after the Room & Board lease was announced, another furniture manufacturer—Blu Dot—announced it too will have Duke build a 150,000 square foot distribution center in the park. Blu Dot will be vacating Liberty Property Trust’s 147,610 square foot, ‘Class A’ AMB Distribution Center in Rogers, as they have outgrown the 85,000 square feet of space they’ve occupied there since 2009. Liberty is currently marketing the soon-to-be vacant warehouse space for a net rate of $4.75 per square foot. Both Room & Board and Blu Dot are expected to take occupancy of their new facilities during the first half of 2015. Each new build-to-suit project will feature 24’ or 32’ clear heights and 45’ x 50’ column spacing, as well as state-of-the-art building mechanical and fire/life safety systems. Duke acquired the land in 2006 and planned a 118-acre industrial park with 1.4 million square feet of available space, today they only have about 18 acres and 230,000 square feet remaining for build-to-suit and lease opportunities.

In Brooklyn Park, First Industrial completed two speculative projects totaling approximately 240,000 square feet in the Interstate North Distribution Center. Interstate North Distribution Center II is a 142,290 square foot bulk warehouse building with 32’ clear heights that is about 50% leased to Clearfield, Inc—a Plymouth, MN based designer, manufacturer and distributor of fiber optic products. The second project, Interstate North Distribution Center III, is a 97,000 square foot bulk warehouse building with 28’ clear heights that is 100 percent leased to Goodwill. Both buildings were marketed with $4.95 per square foot net asking rents.

WESt/nORthWESt (COn’t.)We expect about an additional 1.6 million square feet of speculative construction space to deliver to the market in the first half of 2015. United Properties is under construction on their 176,000 square foot North Cross Business Park. This 24’ clear height project is situated between the build-to-suit projects for Wurth Adams and Perbix in Brooklyn Park. Once completed, expected in summer 2015, the three-building business park will total over 400,000 square feet. Also in Brooklyn Park, CSM Corporation is under construction on 610 Commerce Center. Situated near the intersection of Louisiana Ave N & 93rd Ave N, CSM’s 202,000 square foot project will feature 28’ clear heights and is expected to be delivered by March 2015.

Both Launch Properties and Scannell Properties are under construction on 32’ clear height speculative projects in Rogers. Launch Properties’ 168,000 square foot facility is expected to deliver in the Second Quarter of 2015, and Scannell Properties’ 220,000 square foot addition to their Kinghorn Logistics Hub, adjacent to the new FedEx distribution center, is also expected to deliver in the first half of 2015. Another notable project under construction in Rogers is CSM’s North Star Distribution Center. This 271,500 square foot bulk warehouse facility is expected to be completed in the First Quarter of 2015, and will feature 32’ clear heights.

Other significant projects currently under construction in this submarket include phase one of Liberty Property Trust’s Dayton Distribution Center in Dayton, MN. Once completed in Spring 2015, an additional 247,000 square feet of speculative space will be delivered to the market. In Maple Grove, United Properties is constructing the Red Rock Building, a 320,000 square foot bulk warehouse with 32’ clear heights that will be completed in the Second Quarter of 2015.

The additional space that was added to the submarket in late 2014 and the space that is scheduled to deliver in 2015 is already impacting lease negotiations. Our submarket experts are reporting a general increase in deal completion times as firm decision-making has slowed across the board in the submarket. This is likely the result of firms waiting to see how the landscape of the space market in the West/Northwest will continue to change as more new bulk distribution space and more new tenants are added to the submarket. Nilfisk, Archway, and Wow Logistics are all looking for space in the submarket, each with a requirement of more than 200,000 square feet.

Although it is taking longer for firms to make decisions related to their real estate, 75 percent of tenants with expiring leases are choosing to sign renewals. Lease negotiations are most favorable to landlords of showroom space sized 10,000 square feet or less, as this space market has tightened in recent months in the face of increased demand from users wishing to locate near the submarket’s newest tenants. As an example of how tight the showroom market has become in the West/Northwest submarket, several large bulk warehouse vacancies have recently been filled by heavier-finish users due to the lack of suitable high-finish product in the submarket.

MInnEapOLIS nORth/St. pauL EaSt The Minneapolis North and St. Paul East submarkets absorbed 199,320 square feet and 103,447 square feet, respectively during the Fourth Quarter of 2014. The vacancy rate stands at 7.8 percent in the Minneapolis North submarket, up slightly from Quarter Three’s rate of 7.7 percent. Vacancy in the smaller St. Paul East submarket, which includes the Midway area of St. Paul, is also low at 7.7 percent.

Minneapolis-st. paul | investment trends

Colliers international | 9

northern stacks redevelopment in Fridley – phase i site plan

Clearfield inc. relocated from plymouth to First industrial realty trusts inc.’s interstate north distribution Center, leasing 70,711 square feet at the 142,290 square foot property.

Minneapolis-st. paul | investment trends

Colliers international | 9 Colliers international | 10

The completion of several construction projects highlighted the last half of 2014 for the Minneapolis North and St. Paul East submarkets. On the heels of St. Jude Medical’s decision to lease space in a modern building developed by Trammel Crow in Roseville a year ago, a number of developers immediately broke ground on similar product. The most notable of these new projects is the redevelopment of a Superfund site in Fridley. In May 2014, Hyde Development celebrated the groundbreaking of Northern Stacks, a $100 million public/private venture that plans to build 10-12 office/industrial buildings totaling 1.7 million square feet across the 122-acre site that was the home of Northern Pump Company, which produced gun turrets and barrels for the US Navy during World War II. Part of Phase I of the project, the Twin Cities’ largest infill commercial redevelopment project, has already been completed when a 213,000 square foot bulk warehouse property with 32’ clear heights was delivered to the market. Although no lease has been signed, the developer has indicated a high level of interest with four to five prospects and plans to announce a new tenant in early 2015. The entire project is expected to take about four years to complete.

Other projects that were completed in late 2014 include Meritex’s speculative 129,655 square foot Highcrest Distribution Center adjacent to St. Jude Medical’s aforementioned distribution center in Roseville. This facility features 32’ clear heights, and asking rents of $5.25 per square foot plus amortized tenant improvement costs. Also in Roseville, IRET Properties completed the redevelopment of the former Smurfit-Stone Container Corp. site at 3075 Long Lake Road by building a new 220,556 square foot industrial building; 192,000 square feet of which is currently being marketed for lease with asking rates of $10.00 per square foot for office space and $5.00 per square foot for warehouse space. In South St. Paul, Interstate Partners completed Phase II of Bridgepoint Business Park in late 2014—adding an additional 105,000 square feet of speculative office-warehouse space to the submarket.

In St. Paul, a partnership between Interstate Partners and The Port Authority is redeveloping a four-acre site at the Beacon Bluff Business Park on the city’s East Side with a 58,000 square foot building that is expected to be completed in February. Moventas, a Finnish-based designer and manufacturer of renewable technology products will lease about half of the newly constructed space. Also in St. Paul, the St. Paul Port Authority has partnered with United Properties to build on the site of the former Saints Stadium. The plans call for 190,000 square feet of industrial space with 24’ clear height on the 13-acre site. Lastly, CSM Corporation has submitted plans in an effort to secure a building permit for Aveda’s planned 61,200 square foot expansion in Blaine, and aims to break ground sometime in mid- to late-2015.

Leasing activity of existing space within these submarkets is currently within their historical ranges, however, in the long-term, leasing velocity is expected to increase as large chunks of newly constructed space are absorbed. Currently, larger users such as Coborns and Steamworks are both seeking at least 80,000 square feet of space within these submarkets. A number of local and regional tenants are also shopping the submarkets for space requirements less than 80,000 square feet.

In addition to increased construction activity, average asking rents for these newly constructed modern warehouses are pushing pre-recession levels and are in the $4.95 per square foot range plus amortized tenant improvements. Also, we are seeing more long-term leases (10+ years) being signed compared to the same time last year, as an improving economy is allowing users the clarity to execute their long-term business plans. This tightening of fundamentals is also allowing landlords to remain competitive by only offering two to three months of free rent on 10-year or more leases, instead of two to three months of free rent on five-year or less leases.

st. paul’s port authority and interstate partners’ Beacon Bluff redevelopment

Minneapolis-st. paul | investment trends

Colliers international | 11

aIRpORt/SOuth Of thE RIvERThere was steady activity in the Airport/South of the River Submarket as 130,586 square feet was absorbed during the Fourth Quarter, bringing the annual total to 377,258 square feet. Vacancy is currently at 9.5 percent, down from 10.2 percent in Quarter Three.

The small Airport/South of the River submarket may not have generated the headlines its neighboring submarkets made last year, but the space market’s fundamentals remain strong. The spread between asking rents and contract rents remains tight across both showroom and bulk warehouse spaces, as comparable space within the submarket remain hard to find. Asking rents for office-showroom product average about $9.00 per square foot for office space and $5.00 per square foot for warehouse space, with most leases getting executed at about a $0.50 per square foot discount to asking rates. This ratio is also holding constant for newly-built bulk warehouse product, where asking rates are $10.25 per square foot for office space, and $5.25 per square foot for warehouse space. Landlords of desirable product are decreasing rent concessions on new leases, and our team is reporting that about 80 percent of lease renewals being executed in the submarket are starting at base rent amounts that are escalated from the previous term.

In response to the healthy supply and demand conditions within the submarket, developers Scannell Properties and Setzer Properties have announced plans to construct new product in the submarket. Scannell’s project proposes the development of an industrial park, South Logistics Park, on 176 acres of land just east of I-35 in Lakeville that could have enough room to accommodate 2.2 to 3 million square feet of industrial space. Setzer plans to construct a three-building complex for FedEx Freight in Lakeville that will allow FedEx Freight to close one of its two Roseville locations, and address their long-term growth concerns as the new 94,000 square foot facility will have room for 250 jobs as compared to a capacity of 125 jobs in the soon-to-be vacated 131,000-square-foot ‘Class C’ facility on Terminal Road owned by American Realty Capital Properties. In Eagan, Scannell and Dart Transit are both planning to construct industrial space in 2015. So too is United Properties in Inver Grove Heights, where it plans to build the 130,000 square foot first phase of a 450,000 square foot build-to-suit complex. Lastly, Herbert and Associates Inc. has proposed constructing two buildings totaling 113,740 square feet at the intersection of 147th Street West and Flagstaff Avenue in Apple Valley.

Aside from the proposed developments in Lakeville and Eagan, Mendota Heights is also a hub of activity within the submarket, with Scannell and United Properties both completing projects there in late 2014. Scannell built a 71,933 square foot speculative flex building near the confluence of I-494, I-35E and Hwy 55, and United Properties completed a 90,000 square foot project in the city.

One tenant rumored to be looking for space in the submarket has the ability to create headlines and thrust the Airport/South of the River submarket into the spotlight. Speculation is brewing that Amazon.com will select a site in the southeast metro, along the I-35 corridor in 2015. Fueling this speculation is Ryan Companies’ 120-acre site at the intersection of I-35 and Country Road 2 near Elko New Market, in which they are working with the city and the county to study the impact of developing a large industrial park with the ability to construct between 1.5 million and 2 million square feet of warehouse space—large enough to accommodate Amazon’s space needs. If Amazon does indeed occupy space in this submarket, it is expected that other users will want to enter the submarket, and demand for modern industrial space will increase to the point where developers will be able to achieve the rents necessary to construct new product, similar to what the West/Northwest submarket has been experiencing over the last few years.

setzer’s 94,000 sF shipping facility for Fedex Freight in lakeville

SOuthWEStActivity was strong in the Southwest submarket during 2014. Approximately 155,348 square feet was absorbed during the Fourth Quarter of 2014 with a total of 545,735 square feet absorbed for the year. Vacancy in the Southwest remains high compared to the rest of the market at 10.7 percent.

In many ways the Southwest industrial space market mirrors the Airport/South of the River industrial submarket. Very little difference exists between each submarket’s access to major arterial highways, land available for development, and clusters of amenities, resulting in two submarkets that exhibit very similar space market fundamentals. Asking rents are within a tight range depending on product type. Bulk warehouse space with 24’ clear heights is being marketed at an average rate of $4.25 per square foot. For product with 32’ clear heights, the average market lease rate is $4.50 per square foot. Market rent for associated office space within these product types is in the $9.00 - $10.00 per square foot range. Our submarket experts note today’s “average” lease being executed for bulk warehouse space in the submarket is a 50,000 square foot lease, with in-place rents of $8.50 per square foot for office space and $4.00 per square foot for warehouse space. These “average” leases include two to three months for free net rent, with a $15 - $20 per square foot tenant improvement allowance on office space for new lease agreements.

Construction activity in the Southwest during the last half of 2014 was focused mostly on four projects. Both United Properties and Capp Industries are building warehouse spaces in the submarket. United Properties’ project in Chanhassen, Powers Pointe, broke ground as a fully speculative project, but will be 100 percent leased upon completion in early 2015. In December 2014, Federal Package announced it will lease all of the 140,800 square foot, 24’ clear height building. Federal Package expects to move into the new space in the first quarter of 2015, after vacating space it occupies in neighboring Chaska. At the same time, Capp Industries is expected to complete their speculative 32’ clear height bulk warehouse project in Shakopee, Capp Warehouse II, which will add an additional 121,000 square feet to the submarket’s space inventory. Also in Shakopee, Ryan Companies is developing a new 135,000 square foot production and warehouse facility for Bayer CropScience. Bayer plans to transfer operations and personnel from an 115,000 square foot space it occupies less than a mile away, into this new $15 million project by early 2015. Lastly, Kin Properties has added cross docking capabilities to the former K-Mart distribution center it owns in Shakopee, and plans to market the facility as the low-cost alternative in the submarket with warehouse rents less than $4.00 per square foot. The 1.1 million square foot asset features very little finished office space, and will appeal to those users looking to lease 100,000 square feet or more of contiguous space.

Planned construction projects in the submarket are highlighted by Opus’ announcement that they plan to construct the Chaska Creek Business Park, a mixed-use development with some industrial space spread over an 83-acre site.

Minneapolis-st. paul | investment trends

Colliers international | 11 Colliers international | 12

Federal package will lease approx. 100% of united properties’ powers pointe in Chanhassen.

ryan Cos. site plan for Bayer Cropscience’s new facility at dean lakes Business park in shakopee

Minneapolis-st. paul | investment trends

Colliers international | 13

notable sales

SIzE 346,997 SF

OffICE fInISh 2%

CLEaR hEIght 18’

OCCupanCy 100%

CLOSE DatE 12/2014

puRChaSE pRICE $12,900,000 ($37.18 PSF)

BuyER Brennan Investment Group

SELLER Roseville Properties Management Company

NEW HOPE DISTRIBUTION CENTER

SIzE 200,000 SF

OffICE fInISh 2%

CLEaR hEIght 30’

OCCupanCy 100%

CLOSE DatE 11/2014

puRChaSE pRICE $12,018,985 ($60.09 PSF)

BuyER First Industrial Realty Trust

SELLER Dart Transit Company

SIzE 5 Buildings - 161,304 SF

OffICE fInISh 44%

CLEaR hEIght 12’ - 16’

OCCupanCy 84%

CLOSE DatE 12/2014

puRChaSE pRICE $7,800,000 ($48.36 PSF)

BuyER 62NDS2 Westpoint LLC

SELLER Braceline Investments

RAPALA USA DISTRIBUTION CENTER

WESTPOINT BUSINESS CENTER

SIzE 5 Buildings - 826,924 SF

OffICE fInISh N/A

CLEaR hEIght 20’ - 30’

OCCupanCy N/A

CLOSE DatE 10/2014

puRChaSE pRICE $45,991,471 ($55.62 PSF)

BuyER Greenfield Partners

SELLER RREEF Funds

GREENFIELD PARTNERS MN PORTFOLIO

Minneapolis-st. paul | investment trends

Colliers international | 13 Colliers international | 14

SaLES aCtIvIty

BuILDIng aDDRESS CIty BuyER SELLER SuBMaRkEt Sf pRICE pRICE pSf DatE

2100 Woodale Dr 2100 Woodale Dr Mounds View

Greenfield Partners RREEF Funds St. Paul East 113,256 $19,594,000 $173 Oct-14

7033 Central Avenue North East

7033 Central Ave Ne Fridley Cummins Power

Generation IncMurphy Warehouse Co West/Northwest 406,000 $18,700,000 $46 Dec-14

Tech West 55 14800 28th Ave N Plymouth AX Tech West LP Onward Investors West/Northwest 106,500 $15,700,000 $147 Dec-14

New Hope Distribution Center 8201 54th Ave N New Hope Brennan Invest-

ment GroupRoseville Properties West/Northwest 375,310 $12,900,000 $37 Dec-14

Rapala USA Distribution Center 935 Aldrin Dr Eagan First Industrial

Realty TrustDart Transit Company

Airport/South of the River 200,000 $12,018,985 $60 Nov-14

300-400 West 86th Street 312 86th St W Bloomington Greenfield

Partners RREEF Funds Airport/South of the River 177,818 $10,300,000 $58 Oct-14

5230 Quincy Street 5230 Quincy St Mounds View

Greenfield Partners RREEF Funds Minneapolis

North 352,598 $8,334,000 $24 Oct-14

Westpoint Business Center

13895 Industrial Park Blvd Plymouth 62NDS2

Westpoint LLCBaceline Investments West/Northwest 161,304 $7,800,000 $48 Dec-14

Vascular Solutions 6464 Sycamore Ct Osseo Vascular Solutions Inc

Investors Real Estate Trust West/Northwest 79,702 $7,200,000 $90 Dec-14

Winnetka Distribution Center

4948 Winnetka Ave N New Hope One Liberty

PropertiesExchange Realty Inc West/Northwest 121,225 $7,200,000 $59 Nov-14

295 Phalen Boulevard 295 Phalen Blvd Saint Paul Health Partners Chris Norgren St. Paul East 77,000 $6,100,000 $79 Dec-14

Phillips & Temro 9700 W 74th St Eden Prairie NorthStar Realty Finance

Brennan Invest-ment Group JV Gatehouse Bank

Southwest 81,119 $6,044,379 $75 Nov-14

Aero System Engineering Inc

358 Fillmore Ave E Saint Paul AIC Ventures Aero Systems

Engineering Inc St. Paul East 49,695 $4,950,000 $100 Nov-14

2100 Old Highway 8 Northwest

2100 Old Hwy 8 Nw

New Brighton

Greenfield Partners RREEF Funds Minneapolis

North 116,416 $4,486,471 $39 Oct-14

International Square 6102-6190 Olson Memorial Hwy

Golden Valley

Gonyea Com-mercial Props Welsh Companies West/Northwest 90,000 $4,300,000 $48 Dec-14

410 Oak Grove Parkway

410 Oak Grove Pkwy

Vadnais Heights Innovize Inc Joanne M

LindgrenMinneapolis

North 71,000 $3,850,000 $54 Dec-14

Future Quantum Graphics

6968-7000 Shady Oak Rd Eden Prairie Quantum

Graphics Inc

The 614 Company - Robert Greenberg

Southwest 60,110 $3,800,000 $63 Oct-14

Encore Park 11300 K-Tel Dr Minnetonka Ronald Leafblad David Bruce Southwest 141,340 $3,705,000 $26 Oct-14

Shady Oak 9995 W 69th St Eden Prairie Linn Star Transfer Artis REIT Southwest 59,538 $3,500,000 $59 Dec-14

2400 Pilot Knob Road 2400 Pilot Knob Rd Eagan 7 Scruples LLC Michael Jones Airport/South of

the River 36,430 $3,300,000 $91 Dec-14

5275 Quincy Street 5275 Quincy St Mounds View

Greenfield Partners RREEF Funds Minneapolis

North 66,836 $3,277,000 $49 Oct-14

1395 Commerce Drive 1395 Commerce Dr

Mendota Heights Sigma Beauty Associated Bank Airport/South of

the River 53,101 $2,920,000 $55 Oct-14

13415 Water Tower Circle

13415 Water Tower Cir Plymouth Stone Source Amerilab

Technologies Inc West/Northwest 49,920 $2,750,000 $55 Oct-14

University Avenue Business Center

7201 University Ave Ne Fridley UABC LLC Wells Fargo Minneapolis

North 47,433 $2,575,340 $54 Nov-14

Bell Tower Commerce Center

201-221 Broadway St W Osseo Opportunity

Advisors Lone Star Funds West/Northwest 64,499 $1,879,568 $29 Oct-14

LEaSE aCtIvIty

tEnant BuILDIng naME aDDRESS CIty SuBMaRkEt Sf LEaSED typE

COKeM International Canterbury Distribution Center 901 W 217th St Shakopee Southwest 119,972 New

PAE 9150 W 217th St 9150 W 217th St LakevilleAirport/South of the River

119,328 Expansion

Process Display Louisiana Distribution Center 7101 31st Ave New Hope West/Northwest 112,000 Expansion

Federal Package Inc Powers Pointe 8100 Powers Blvd Chaska Southwest 140,800 New

McKesson Diamond Lake Industrial Center I 12999 Wilfred Ln N Rogers West/Northwest 90,000 Expansion

Clearfield, Inc.Interstate North Distribution Center

7035-7050 Winnetka Ave Brooklyn Park West/Northwest 70,771 New

Perbix Northcross Business ParkHighway 610 & Highway 169

Brooklyn Park West/Northwest 70,000 New

US AutoForce Pilot Knob Distribution Center 2360 Pilot Knob Rd EaganAirport/South of the River

50,535 Expansion

Team Industries I-94 Distribution Center 22000 Industrial Blvd Rogers West/Northwest 49,729 New

Value Merchandise 12th Avenue Distribution Center 13105 12th Ave N Plymouth West/Northwest 44,200 New

RTI International MetalsSaint Paul Industrial Properties #34

1929-1957 County Rd C2 W Roseville Minneapolis North 36,000 New

Indecomm Global Services Energy Park Corporate Center 1260-1270 Energy Ln Saint Paul St. Paul East 31,720 New

Magazine Distributors Mounds View Business Park - B 5275 Quincy St Mounds View Minneapolis North 28,021 New

HD Supply Maintenance 3800-3900 50th Ave 3800-3900 50th Ave Brooklyn Center West/Northwest 26,359 Renewal

PeopleNet Communications Crosstown Distribution Center 6801-6813 Shady Oak Rd Eden Prairie Southwest 26,284 Expansion

Electric Motor 113 NE 27th Ave 113 NE 27th Ave Minneapolis Minneapolis North 23,930 New

Alternators, Starters & Parts Inc

Mendota Heights Industrial 1475 Commerce Dr Mendota HeightsAirport/South of the River

14,325 New

TSBL Distributing Mendota Heights Industrial 1475 Commerce Dr Mendota HeightsAirport/South of the River

13,300 New

Goodwill/Easter SealInterstate North Distribution Center

7051 W Broadway Ave Brooklyn Park West/Northwest 97,000 New

Goodwill industries will lease all 97,000 square feet of First industrial’s interstate north distribution Center iii in Brooklyn park.

Minneapolis-st. paul | investment trends

Colliers international | 15

Minneapolis-st. paul | investment trends

Colliers international | 15 Colliers international | 16

the above table is summarized data on multi-tenant industrial buildings greater than 20,000 square feet. not included are single-tenant or owner-occupied buildings.

airport/south oF the river Bulk Warehouse 5,365,858 219,735 4.1% 0 4.1% $4.08-$8.72 182,694 392,519 Office Showroom 3,450,779 561,013 16.3% 4,000 16.4% $4.78-$8.85 (52,484) 45,862 Office Warehouse 9,255,313 927,178 10.0% 0 10.0% $4.82-$8.71 376 (61,123)totals: 18,071,950 1,707,926 9.5% 4,000 9.5% $4.74-$8.76 130,586 377,258

minneapolis north Bulk Warehouse 5,130,353 379,242 7.4% 13,300 7.7% $5.00-$8.73 94,644 171,888 Office Showroom 4,345,746 419,910 9.7% 31,947 10.4% $4.83-$10.12 18,785 108,572 Office Warehouse 17,377,137 1,246,762 7.2% 16,630 7.3% $4.60-$8.70 85,891 75,427 totals: 26,853,236 2,045,914 7.6% 61,877 7.8% $4.69-$9.07 199,320 355,887

southWest Bulk Warehouse 5,792,167 771,642 13.3% 71,060 14.5% $5.08-$9.42 (12,744) 44,453 Office Showroom 7,171,981 932,363 13.0% 108,860 14.5% $5.09-$9.40 32,634 261,423 Office Warehouse 15,042,075 1,300,833 8.6% 188,970 9.9% $5.33-$9.24 135,458 239,859 totals: 28,006,223 3,004,838 10.7% 368,890 12.0% $5.20-$9.32 155,348 545,735

st. paul east Bulk Warehouse 9,041,404 588,963 6.5% 0 6.5% $4.36-$9.00 (147,898) (40,015)Office Showroom 2,480,045 306,715 12.4% 21,380 13.2% $4.58-$9.92 12,447 47,238 Office Warehouse 12,364,580 932,252 7.5% 103,714 8.4% $4.81-$9.27 238,898 195,827 totals: 23,886,029 1,827,930 7.7% 125,094 8.2% $4.71-$9.40 103,447 203,050

West/northWest Bulk Warehouse 13,312,527 1,278,492 9.6% 50,583 10.0% $4.48-$9.07 86,881 288,722 Office Showroom 5,654,591 531,051 9.4% 8,966 9.6% $4.98-$9.35 (3,160) 198,709 Office Warehouse 21,458,338 1,384,688 6.5% 39,734 6.6% $4.77-$8.93 140,030 41,931 totals: 40,425,456 3,194,231 7.9% 99,283 8.1% $4.77-$9.05 223,751 529,362 total all markets Bulk Warehouse 38,642,309 3,238,074 8.4% 134,943 8.7% $4.62-$9.13 203,577 857,567 Office Showroom 23,103,142 2,751,052 11.9% 175,153 12.7% $4.93-$9.44 8,222 661,804 Office Warehouse 75,497,443 5,791,713 7.7% 349,048 8.1% $4.86-$8.97 600,653 491,921 totals: 137,242,894 11,780,839 8.6% 659,144 9.1% $4.85-$9.13 812,452 2,011,292

SuBMaRkEt tOtaLSf

DIRECtvaCant Sf

SuBLEaSEvaCant Sf

% vaCant DIRECt

% vaCant W/SuBLEaSE

ytD aBSORptIOn

LOW-hIgh aSkIng RatE

Q4 2014aBSORptIOn

market statistics

Colliers International | Minneapolis-St. Paul4350 Baker Road, Suite 400Minnetonka, MN 55343

www.colliers.com/msp

COLLIERS INTERNATIONAL AT-A-GLANCE

![#1 Adam Why Minneapolis St Paul[1]](https://static.fdocuments.net/doc/165x107/5a6d66777f8b9af2418b54f5/1-adam-why-minneapolis-st-paul1.jpg)