Minerva Minerva Harvest Dynamic Navigator Fund ENG Latest1 · 4TH JANUARY, 2016 USD HARVEST GLOBAL...

Transcript of Minerva Minerva Harvest Dynamic Navigator Fund ENG Latest1 · 4TH JANUARY, 2016 USD HARVEST GLOBAL...

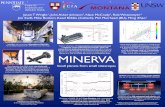

The fund outperformed its benchmark in September as it was substantially underweight EM equities and overweight US equities most of the time and EM equities underperformed DM equities again. This month, what we have observed is that despite the bearish technicals (market could still be capped by the falling 50D and 100D MAs), some of the fundamentals have improved such as EM earnings, EM credit spreads and EM vol. However, the global growth leading indicators are still falling and global PMIs except for the US are also still falling. In addition, global liquidity continues to contract as well. And as long as the Fed is still hiking, the majority of global central banks would have to follow suit. Overall, the bottom line is that yes some fundamentals have improved which is definitely a positive, but there’s still uncertainty. What could be a definitive catalyst for EM? A possible scenario is a slowdown in US growth and inflation near the end of the year or in 1H next year as the impact from the trade war hits the US and the boost from the tax cut fades. This is not saying that the US goes into a recession but just a slowdown in terms of growth momen-tum, still higher than potential but lower than market expectations. If true, the Fed might not tighten as much and would sound more dovish. In this scenario, the dollar could then take a break from going higher, EM currencies could stop depreciating (EM inflation can also stop going higher), and EM central banks could take a break from tightening. In turn, this could then support EM economic fundamentals, earnings and assets.

Fund Manager’s Comment

Historical Performance

Calendar Year Performance

Asset Class Exposure

Equity Geographic Exposure

Fund Statistics

Fund Holdings (Top 10)

This document does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for any investment products or services. Nothing in this document should be construed as advice and is therefore not a recommendation to buy or sell. Past performance is not necessarily a guide to future performance. Investors may not get back the full amount invested, as prices of shares and the income from them may fall as well as rise. Performance shown on this document is for reference only.

Disclaimer

Fund Information4TH JANUARY, 2016

USDHARVEST GLOBAL INVESTMENTS LTD

VGG6148U1066MINHDYN: VI

Launch Date Base CurrencySub-Fund ManagerISIN CodeBloomberg Code

Alpha Beta Std Dev Sharpe Ratio Correlation Best Monthly Worst Monthly Max Gain Max Drawdown Up Period Percent Down Period Percent

The investment objective of the fund is to pursue a positive absolute return, to share the global economic growth and to achieve medium to long-term capital appreciation while protecting investor capital and to develop new carefully considered investment opportunities. The fund targets to generate equity like return during market uptrend, and possibly an outperformance through stock selection, while having the flexibility to overweight on fixed income or other alternative investments during bear market to reduce downside risk.

*40% MSCI AC World + 40% MSCI Asia ex Japan + 20% BAML Global Broad Market Corporate

FUND BMK-0.08 1.09

9.71%0.50 0.96

7.42%-5.41%30.52%-12.90%57.6%42.42%

0.00 1.00

8.57%1.39 0.96

8.21%-4.03%34.68%-4.03%66.67%33.33%

17.56%8.43%5.14%3.07%2.41%2.37%2.37%2.23%2.22%1.89%

MSCI Asia ex Jp Dec18 (Futures)S&P500 EMINI FUT Dec18 (Futures)MSCI Emerging Markets (EM) Index FuturesFTSE China A50 Oct18 (Futures)Euro STOXX 50 Dec18 (Futures)Hang Seng IDX FUT Oct18 (Futures)Anton Oilfield Services Group 9.75% 05-Dec-2020Industrial & Commercial BoC (Macau) Ltd. 2.46% 28-Nov-18Agricultural Bank 2% 08-Feb-2019iShares 20+ Year Treasury Bond ETF

North AmericaEuropeJapanAsia Ex JapanOthers

19.99%5.94%3.39%69.56%1.12%

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

2016/1/4 2016/7/4 2017/1/4 2017/7/4 2018/1/4 2018/7/4

Minerva Harvest Dynamic Navigator Fund Benchmark Index

YTD 2017 2016 Total Return

2018 5.12% -5.41% -3.89% -1.41% -0.62% -2.23% 1.27% -0.85% -0.34%

2017 4.18% 2.50% 2.03% 1.18% 2.33% 0.47% 4.10% 0.84% 0.42% 1.98% 0.82% 1.07%

2016 -5.38% -2.41% 7.42% 0.31% -1.06% -0.02% 4.13% 1.36% 0.91% -1.85% -0.67% -1.99%

Minerva Harvest Dynamic Navigator Fund -8.38% 24.16% 0.16% 13.95%

Benchmark Index* -1.54% 27.62% 8.53% 36.36%

-40% -20% 0% 20% 40% 60% 80%

Equity

Fixed Income

Cash

-28.10% Equity 74.40% Fixed Income 53.70% Cash

Investment Objective

September 2018

Minerva HarvestDynamic Navigator Fund