MEXICO’S NORTHERN ECONOMIC CORRIDOR November, 2014.

-

Upload

caroline-harper -

Category

Documents

-

view

226 -

download

0

Transcript of MEXICO’S NORTHERN ECONOMIC CORRIDOR November, 2014.

MEXICO’S NORTHERN ECONOMIC CORRIDOR

November, 2014

US Trade with Mexico

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013$0

$100

$200

$300

$400

$500

$600

$700

Canada China Mexico Japan

$ b

illio

ns

In 2013, 48 cents of every $1 of US-Mexico trade crossed at a Texas border POE by truck

3Footer Text

2008 2009 2010 2011 2012 2013$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

-

500,000

1,000,000

1,500,000

2,000,000

2,500,000

3,000,000

3,500,000

4,000,000

Total U.S.-Mexico Trade TX truck crossings

Tra

de

Val

ue

($ m

illio

ns)

Nu

mb

er o

f cr

ossi

ngs

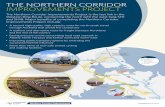

Mazatlán-Matamoros Highway

Mazatlán-Matamoros Highway

Mazatlán-Durango section:

• 140 miles long• 115 bridges• 61 tunnels

Mexico’s six-year national infrastructure plan: $316 billion

Mazatlán-Durango Highway: $2.2 billion

Predictions: Travel Times

New, reduced travel times

Improved access to Midwest and East Coastmarkets

Durango, MX Torreón, MX

Monterrey, MX

Pharr, TX Nogales, MX

Mazatlán, MX to:

2:30 hours 4:35 hours 7:40 hours 10:10 hours 16:00 hours

Travel Distances

Destination of Mexican Truck and Rail Imports

US Region

US POE West South Midwest Northeast

Nogales, AZ 41% 7% 48% 4%

Brownsville, TX 4% 68% 22% 6%

Hidalgo, TX 7% 66% 23% 3%

Laredo, TX 12% 44% 38% 6%

Predictions: Economic and Trade Effects

Increased traffic to the Lower Rio Grande Valley, especially for produce

– 62% growth of produce truckloads in Texas predicted by 2020

– Lower Rio Grande Valley is predicted to receive 59% of these new truckloads

– Shortage of agricultural inspectors at the border will be a challenge

Potential for increased economic development in regions surroundinghighway

Traffic Estimates

Baluarte Bridge– 2,000 vehicles per day

Mazatlán to Durango portion– 3,000 vehicles per day (1st year)– 6,500 vehicles per day – Eventually will handle 4 times as many vehicles as it did

before Shift from Nogales to Hidalgo

– 24,000-48,000 trucks

Surrounding Mexican States

Sinaloa– Top agricultural producer in Mexico– Performs well on socioeconomic and human development indicators– High crime rate compared to other Mexican states

Durango– State economy is agriculture based, but Durango is not a significant

producer on a national level– High poverty rate and low human development indicators– High crime rate compared to other Mexican states

Zacatecas– Is in the top ten of agriculture producing states in Mexico, but exports

less than most states– Has one of the highest poverty rates and lowest earnings per capita in

Mexico– Higher than average perception of insecurity, crime rate is similar to

national average

Surrounding Mexican States

Crime is an issue All the following

states had higher than average murder rates, and lower than average perceptions of highway safety:– Chihuahua– Coahuila– Durango– Nuevo Leon– Sinaloa– Tamaulipas– Zacatecas

Surrounding Infrastructure

Port of Mazatlán– Cannot accommodate Panamax

Ships– Handles only 2% of Mexican

Pacific cargo– Dredging is planned, but there

have been difficulties andLázaro Cardenas is still expected to be the major port on the Mexican Pacific coast

Rail infrastructure from Mazatlán to Matamoros is deficient

Tolls

Five axel truck from Mazatlán to Durango: $US 110 (140 miles) Nine axel truck from Mazatlán to Matamoros: $US

300 (720 miles)

Preparations in Arizona

• Arizona‒ $220 million

improvement for Nogales POE lane expansion

‒ Investment in trade corridors, especially highways

Preparations in Texas

Texas– Increase of traditional and cold storage facilities in the Valley

• Four projects for cold storage in Reynosa• Additional cold storage being built in McAllen• Conversion of dry storage to cold storage in Pharr• Produce companies shifting offices to McAllen• Texas International Produce Association (TIPA) has seen 80% increase in

membership

– Marketing to attract more traffic to the Valley, especially refrigerated goods

– Potential purchase of an Electron Beam Sterilization machine to extend produce shelf life

Conclusion

Mazatlán-Matamoros is an engineering feat Unclear whether surrounding Mexican states will

increase production or exports Crime, safety, and high tolls are issues in Mexico Produce imports from Mexico are increasing in

Arizona and Texas, and both states seek to be competitive

QUESTIONS?