Metrojet A321s grounded - AviTrader Aviation News€¦ · Deliveries of the ACJ320neo and ACJ319neo...

Transcript of Metrojet A321s grounded - AviTrader Aviation News€¦ · Deliveries of the ACJ320neo and ACJ319neo...

Read by thousands of aviation professionals and technical decision-makers every week www.avitrader.com

WEEKLY AVIATION HEADLINES

The Russian Federal Transport Agency reported that Russian airline Kogalymavia (branded as Metrojet), has suspended all flights of Airbus A321 jets in its fleet after the crash of one of its A321s in the Sinai re-gion on 31 October 2015. The flight followed a depar-ture from Sharm el-Sheikh Inter-national Airport, Egypt, en route to Pulkovo Airport, Saint Petersburg, Russia.

The agency said in a statement that Metrojet had filed documents showing the suspension, pending checks by the authorities. Metrojet has four A321 aircraft.

Both the flight data recorder and the cockpit voice recorder were re-covered from the crash site on 1 No-vember. Russian Transport Minister Maksim Sokolov and a team of spe-cialist investigators arrived in Cairo to assist the Egyptian investigators in determining the cause of the crash. The flight data recorders were reported to be in good condition.

However, on 4 November, Egypt’s Civil Aviation Ministry Investigators reported that the second black box, which contains the cockpit voice re-corder (CVR), was partially damaged and much work was required to ex-tract data from it.

ADS-B data from online tracking source Flightradar24 has shown indications that pointed to a sud-den attitude change and a potential inflight break-up of the Metrojet Airbus A321. The airline denied the possibility of a technical or mechani-cal failure with the aircraft and sug-gested that some external influence may have come into play.

According to CNN, days after au-thorities dismissed claims that ISIS brought down a Russian passenger jet, a U.S. intelligence analysis now

suggests that the terror group or its affiliates planted a bomb on the plane.

British and U.S. officials said they had information suggesting the Russian jetliner that crashed in the

Egyptian desert may have been brought down by a bomb, and Britain said it was suspending flights to and from the Sinai Peninsula indefinitely.

Several other major European car-riers suspended flights to and from the resort town of Sharm el-Sheikh while security is being reviewed.

Prime Minister David Cameron’s office said British aviation experts had been sent to Sharm el-Sheikh, where the flight originated, to as-sess security before British flights there would be allowed to resume.

At the time of this writing, the inves-tigation was ongoing.

“British aviation experts had been sent to Sharm el-Sheikh, where the flight origina-ted, to assess security.”Prime Minister David Cameron‘s office

WORLD NEWS

The doomed A321 aircraft,

EI-ETJ in August 2014.

Photo: Sergey Korovkin

ISSN 1718-7966 NOVEMBER 9, 2015/ VOL. 515

Metrojet A321s grounded Flights held over plane bomb fears

WOW air to add LA and SFO in 2016 WOW air, the ultra-low-cost transat-lantic airline from Iceland, will begin flying to the West Coast of the United States in summer 2016 with Los An-geles and San Francisco confirmed as their fifth and sixth destinations in North America. The routes will be ser-viced by three new Airbus A330-300 aircraft, the first wide-body planes in the WOW air fleet, which will each carry 340 passengers in a single-class configuration. Service from Los Ange-les to Iceland will be available four days a week and service from San Francisco to Iceland will be available five days a week with connecting flights on to other European destinations.

OAG sells MRO Network business OAG has announced the sale of its MRO Network business. MRO Net-work, part of OAG, provides aviation exhibitions, conferences and publica-tions to the MRO, fleet, financing and leasing sectors. MRO Network has been sold to Penton, a U.S.-based pro-fessional information services com-pany, for an undisclosed sum. Phil Cal-low, chief executive, OAG, says: “Our strategy involves increased focus on our core digital expertise in unrivalled air travel data and intelligence. We oc-cupy a unique position in the market and can provide insight and add value to all aspects of the air travel journey to enable customers to innovate and advance their businesses.”

New distribution partners for LH GroupThe airlines of the Lufthansa Group (Austrian Airlines, Brussels Airlines, Lufthansa und SWISS) are improving their distribution offering together with new partners. The aviation group has concluded important cooperative agreements with major distribution partners from different sectors of the industry. The long-term goal will meet the increasingly individualised and dynamic requirements of distribution partners and business clients.

Intelligently Defining AviationTMwww.gatelesis.comGA Telesis is an Equal Opportunity Employer

LET US GUIDE YOU ALONG

We package a diverse portfolio of products and services to provide integrated aviation solutions and ensure our customers’ success.

THE PATH OF SUCCESS

As a result of our continued growth, we are creating several executive positions in the areas ofSales and Business Development. Please visit us at http://www.gatelesis.com/careersfor more information.

Absolute confidentiality shall be maintained

Executive Career Opportunities

3

WEEKLY AVIATION HEADLINES

El Al selects Trent 1000 engines for new Boeing aircraft

Israeli flag carrier El Al has selected Rolls-Royce Trent 1000 engines to power 15 Boeing 787 Dreamliner aircraft and will enter into exclusive negotiations with Rolls-Royce. The airline is also considering entering into TotalCare long-term service support for the engines.

Pratt & Whitney PurePower engine for Embraer E-Jets E2 begins flight test pro-gram

The Pratt & Whitney PW1900G PurePower Geared Turbofan (GTF) engine for the Embraer E190-E2 and E195-E2 aircraft, successfully com-pleted its first flight initiating the engine’s flight test program. The PW1900G engine model, which was assembled at Pratt & Whitney’s Mid-dletown Engine Center in Connecticut, flew on Pratt & Whitney’s 747SP flying test bed at the company’s Mirabel Flight Test Center, in Mirabel, Quebec, Canada. “The start of engine flight test-ing is an important milestone for us as we bring the E-Jets second generation from concept to reality,” said Paulo Cesar Silva, Embraer Presi-dent & CEO, Embraer Commercial Aviation. “The addition of PurePower engines into our proven aircraft with an award winning cabin provides a compelling value proposition for our customers.”

Boeing forecasts demand in the Middle East for 3,180 new airplanes over the next 20 years

Boeing forecasts airlines in the Middle East will require 3,180 new airplanes over the next 20 years, valued at an estimated US$730bn. 70% of the demand is expected to be driven by rapid fleet expansion in the region. According to the Boeing Current Market Outlook (CMO), single-aisle airplanes such as the 737 MAX will com-mand the largest share of new deliveries, with airlines in the region needing approximately 1,410 airplanes. These new airplanes will con-tinue to stimulate growth for low-cost carriers and replace older, less-efficient airplanes. “Traf-

AIRCRAFT & ENGINE NEWS

fic growth in the Middle East continues to grow at a healthy rate and is expected to grow 6.2% annually during the next 20 years,” said Randy Tinseth, Vice President, Marketing, Boeing Com-mercial Airplanes. “About 80% of the world’s population lives within an eight-hour flight of the Arabian Gulf. This geographic position, cou-pled with diverse business strategies and invest-ment in infrastructure is allowing carriers in the Middle East to aggregate traffic at their hubs and offer one-stop service between many city pairs that would not otherwise enjoy such direct itineraries.” Twin-aisle aircraft will account for a little under half of the region’s new airplane

deliveries over the 20-year period, compared to 23% globally. This is demonstrated by the strong order book and deliveries for the 787 and 777, underlining how Boeing is meeting customer demand in the region by focusing on enhancing passenger experience and improving operating economics and capability.

Wizz Air shareholders approve proposed purchase of 110 Airbus A321neo aircraft

Wizz Air Holdings, the largest low-cost airline in Central and Eastern Europe, has announced that

Airbus sees important market for ACJneo Family in Middle East

Airbus sees an important potential market for its new ACJneo Family in the Middle East, where private jets are well established as business tools for companies, billionaires and governments, helping them to be more productive and efficient. Airbus’ ACJneo Family initially comprises the ACJ319neo and ACJ320neo. The ACJ319neo will fly eight passengers 6,750nm/12,500 km – equivalent to more than 15 hours’ flying time, while the ACJ320neo will fly 25 passengers 6,000nm/11,100 km, or more than 13 hours in the air. The aircraft further capitalise on the Airbus’ modern and innovative family, bringing even more city-pairs within nonstop range. Deliveries of the ACJ320neo and ACJ319neo are due to begin in the fourth quarter of 2018 and second quarter of 2019, respectively. Airbus has already won several sales for the ACJneo Family, including an ACJ320neo for Acropolis Aviation of the UK and an ACJ319 for Alpha Star Aviation of Saudi Arabia.

Airbus ACJ319 main cabin Photo: Airbus

4

WEEKLY AVIATION HEADLINES

shareholders have approved the proposed pur-chase of 110 Airbus A321neo aircraft on Novem-ber 3rd, at a general meeting held at the offices of the Company in Geneva, Switzerland. József Váradi, Wizz Air Chief Executive said: “We wel-come the approval of our shareholders of this important transaction which means we can con-tinue to build on our strong market position in Central and Eastern Europe. The new aircraft will enable us to sustain our cost advantage through cabin innovations, the latest engine technology and other efficiency improvements, while en-hancing our customer offering and experience. The agreement with Airbus also provides signifi-cant flexibility to match our fleet to our growth requirements.”

Emirates Flight Training Academy signs or-der for up to 10 Phenom 100E jets

Emirates Flight Training Academy has signed a firm order for five Phenom 100E business jets, plus options for five more aircraft. Deliveries are scheduled to begin in 2017. The Phenom 100E features the most advanced technologies for the present and future needs of flight training acad-emies. Based on Embraer’s 45-plus years of expe-rience in commercial aviation, the Phenom 100E was designed for high utilization and offers an integrated state-of-the-art cockpit, docile flying characteristics, and low maintenance and oper-ating costs, making it the ideal airplane for pilot jet training. The Phenom 100E is already serving flight schools in the U.S., Finland and Australia.

Airbus’ A350-1000 Trent XWB-97 engine begins flight-test campaign on A380 fly-ing-test-bed

The A350-1000’s new engine – the Rolls-Royce Trent XWB-97 – has successfully made its first flight-test aboard Airbus’ dedicated A380 “Fly-ing-Test-Bed” aircraft. The aircraft took off from Airbus’ facilities in Toulouse and performed a flight of 4 hours, 14 mins during which the en-gine covered a wide range of power settings at altitudes up to 35,000ft. The engine’s operation and handling qualities were evaluated from low speeds to Mach 0.87. The Trent XWB-97 devel-opment engine was mounted on the A380’s in-ner left engine pylon, replacing one of the air-craft’s Trent 900 engines. Commencing around nine months prior to the A350-1000’s first flight, this engine flight-test programme will include hot weather as well as icing condition testing campaigns. The specially enhanced Trent XWB engine produces 97,000lbs of thrust on take-off – making it the most powerful engine ever de-veloped for an Airbus aircraft.

AIRCRAFT & ENGINE NEWS Korean Air finalizes order for 30 737 MAXs, two 777-300ERs

Korean Air has finalized the airline’s order of 30 737 MAXs and two additional 777-300ER (Ex-tended Range) jetliners valued at nearly US$4bn at current list prices. The airline also has options for additional 737 MAXs as part of the order, which was previously announced as a commitment during the Paris Air Show in June. With this order for up to 52 Boeing airplanes, Korean Air becomes Boeing’s newest 737 MAX customer and now has 62 firm Boeing airplane orders on backlog.

Boeing and Korean Air finalize the airline’s order of 30 737 MAXs and two additional 777-300ER Photo: Boeing

Air New Zealand purchases 15 additional ATR 72-600s

National flag carrier Air New Zealand and the European turboprop aircraft manufacturer ATR have signed a contract for the purchase of 15 additional ATR 72-600s. The deal is valued at some US$375m. The airline, which ordered seven ATR 72-600s in 2011, had already exercised all of its five options as well as converting two purchase rights into firm orders. With the arrival of all the firm aircraft, Air New Zealand will operate, by 2020, a total of 29 ATR 72-600s, the third largest fleet of ATR aircraft worldwide. Air New Zealand’s ATR ‘-600’ fleet will progres-sively replace the ATR ‘-500s’, while strengthening the airline’s network and services across the country.

Air New Zealand signs a contract for 15 additional ATR 72-600s Photo: ATR

5

WEEKLY AVIATION HEADLINES

ST Aerospace signs cabin reconfiguration con-tract with Air Canada

Singapore Technologies Aerospace (ST Aero-space) has secured a cabin reconfiguration contract with Air Canada for eight Airbus A330 aircraft. The first A330 will be inducted in the third quarter of 2016, with the last air-craft targeted for redelivery by the end of the first quarter of 2017. For each of the eight aircraft, ST Aerospace will be installing addi-tional premium economy seats in the aircraft

GECAS to lease two new Boeing 737 MAX aircraft to China’s Okay Airways

GE Capital Aviation Services (GECAS), the com-mercial aircraft leasing and financing arm of GE, has signed an agreement to lease two new Boe-ing 737 MAX aircraft to Okay Airways Company. The aircraft are scheduled for delivery in 2018 and are part of GECAS’ existing order book with Boeing. Okay Airways operates a fleet of more than 30 aircraft from its base in Tianjin, provid-ing scheduled cargo and passenger service to domestic and international destinations.

BOC Aviation takes delivery of first two Boeing 787 Dreamliner

BOC Aviation has added its first two new Boeing 787-8 Dreamliner aircraft to its fleet. Both of the wide-body aircraft have been placed on long-term leases to Kenya Airways (Kenya Airways) following the successful Sale and Leaseback transaction between the two companies.

AIRCRAFT & ENGINE NEWS

cabin whilst enlarging the economy class sec-tion. The scope of work will also include the integration of an audio and video on-demand system, and maintenance checks for the entire aircraft fleet. Upon completion of the proto-type aircraft, applications will be submitted for Supplemental Type Certificates from the US Federal Aviation Administration and Trans-port Canada Civil Aviation.

AFI KLM E&M Components China granted EASA certification

AFI KLM E&M Components China, a wholly owned AIR FRANCE KLM subsidiary, was estab-lished in Shanghai in 2013 to repair avionics components and was CAAC-certified in Novem-ber of that year. Recently this year EASA, the Eu-ropean Aviation Safety Agency, also awarded the China subsidiary EASA Part-145 approval under

Airbus to boost A320 production to 60 a month in mid-2019

To match ongoing high de-mand for its bestselling A320 Family, Airbus has taken the decision to further increase the production rate of the Single Aisle Family to 60 air-craft a month in mid-2019. The decision follows thor-ough studies on production ramp-up readiness in the supply chain and in Airbus sites to allow the ramp-up. To enable the ramp-up Air-bus will extend its capacity in Hamburg with the creation of an additional production line. In parallel Airbus will integrate cabin furnishing activities for A320 aircraft produced in Toulouse into the Final Assembly Line in Toulouse, thereby harmoniz-ing the production process across all A320 Family Final Assembly Lines worldwide.

Airbus to boost A320 production to 60 a month in mid-2019

Photo: Airbus MRO & PRODUCTION NEWS

Contact Anne Lee @ +1.415.408.4769

Available Engines for Lease www.willislease.com

CFM56-5B4/P V2533-A5 PW121 (ATR) PW124B PW127M CFM56-7B24/3 CF34-10E6 PW121-8 PW127CFM56-7B24 (NTI) PW4062-3 PW123 PW127FCFM56-5B4/3 V2527-A5 PW4168A PW123E APU GTCP 131-9A GEnx-1B74/75 APU GTCP 331-500B

6

WEEKLY AVIATION HEADLINES

number EASA.145.0721. “This is a very impor-tant certification for us“ said Vincent D’Andréa, SVP Components Product AFI KLM E&M, “espe-cially in view of the strict requirements of Chi-nese airlines that contract work only to shops with CAAC, EASA and/or FAA certification. The approval will be a genuine asset in upcoming tender processes in the quest for increased mar-ket share.”

ATR signs 12-year Global Maintenance Agree-ment with PNG Air

Papua New Guinea’s airline, PNG Air, formerly Airlines PNG, and ATR have signed a comprehen-sive long-term Global Maintenance agreement (GMA) providing a total support package for the airline’s fleet of ATR 72-600 aircraft. The airline has recently received one aircraft, with further six to join the fleet within two years. The GMA contract will run over twelve years and cov-ers a large scope of component overhaul and engineering services. They include repair and overhaul of Line Replaceable Units (LRU), main-tenance of propellers, landing gear and leading edges. The support package also provides pool-ing services at ATR’s base Singapore and on-site stock access at the airline’s home base in Port Moresby. The component supply and logistics will be realized via the ATR facilities in Singapore to and from Port Moresby.

GoAir extends engine contract with Lufthansa Technik

Mumbai-based GoAir has substantially expanded its business relationship with Lufthansa Technik. In April 2014 GoAir had already signed an initial Total Engine Support TES contract, covering a to-tal of 16 CFM56-5B engine overhaul events. The airline has now extended the contract by an ad-ditional 18 engine overhaul events to accommo-date the growth of its fleet, consisting entirely of Airbus A320 family aircraft. The extended contract is already in effect, making Lufthansa Technik the preferred MRO provider for component and en-gine maintenance of GoAir’s growing fleet. GoAir offers domestic passenger services with over 140 daily flights connecting to 22 cities.

ST Aerospace seals landing gear MRO contract with SAS

Singapore Technologies Aerospace (ST Aerospace) has sealed an eight-year contract worth approxi-mately US$25m (approximately S$35m) with one of Scandinavia’s largest airlines, Scandinavian Air-lines (SAS). Under this agreement, ST Aerospace

MRO & PRODUCTION NEWS

will provide a comprehensive range of landing gear repair, overhaul and exchange services for SAS’ fleet of Boeing 737-600/700/800 and Bom-bardier CRJ900 aircraft. This contract extends an existing agreement covering landing gear main-tenance for SAS’ fleet of Boeing 737NG aircraft, which ST Aerospace has been supporting since 2005. This extended agreement reinforces the long-standing partnership between ST Aerospace and SAS, which started a decade ago when ST Aerospace first provided landing gear repair and overhaul services to the SAS’ fleet of MD-80 air-craft, which was later replaced by Boeing 737NGs. Over the years, ST Aerospace also provided en-gine maintenance support for SAS’ CFM56 family of engines, and component support for SAS’ fleet of Boeing 737CG, 737NG, MD-80, Airbus A320, A330, A340 and Bombardier Q400s.

Air France Industries KLM Engineering & Main-tenance and Ramco Systems create The MRO Lab in Singapore

Air France Industries KLM Engineering & Mainte-nance (AFI KLM E&M) has signed a partnership with Ramco Systems which specializes in busi-

ness software systems, especially in the MRO sector, to set up a joint innovation center in Sin-gapore. A team of around ten people will work there on designing and developing innovative, rapid-deployment solutions for strategic areas in the aircraft maintenance industry, benefitting AFI KLM E&M customers all around the world. For over two decades, AFI KLM E&M has been de-ploying its powers of innovation, whether driven by its people on the ground or in dedicated R&D centers, to develop breakthrough solutions in support of its maintenance processes and for the benefit of its clients. Recently, the Group for-mally created “The MRO Lab – Adaptive Innova-tions” program to gather its innovation potential and bring it to the marketplace. This program is part of the Group’s strategy to promote and accelerate its innovation potential, which relies on two pillars: stimulate innovation everywhere across the organization, and partner with in-novative startups and universities in France, in the Netherlands and beyond. The creation of a new joint R&D center with Ramco is a part of this momentum. The MRO Lab Singapore aims to encourage the rapid emergence and diffusion of innovative, high value-added, MRO solutions, in the heart of a fast growing MRO market and

Rolls-Royce and Liebherr-Aerospace announce name of power gearbox joint ven-ture and start of operations

Rolls-Royce and Lieb-herr-Aerospace have named their 50:50 joint venture to develop manufacturing capabil-ity and capacity for the power gearbox for Rolls-Royce’s new UltraFan engine design. The new company, to be known as Aerospace Transmis-sion Technologies GmbH, officially started opera-tions at the site of Lieb-herr-Aerospace in Frie-drichshafen last month. The initial team consists of nearly 30 employees, mainly from the two par-

ent companies and is co-led by two managing directors, Heike Liebe from Liebherr-Aerospace and Dr. Rob Harvey from Rolls-Royce. Rolls-Royce already has significant experience in the use of power gearboxes with thousands of engines already in service and will continue to lead the design definition and design integration of the power gearbox, as well as the testing activities. Liebherr has unmatched production engineering know-how and will manufacture the compo-nents of the power gear drive train in existing Liebherr facilities for the joint venture during the development phase of the power gearbox. The new UltraFan, a geared design, will offer at least 25 percent improvement in fuel burn compared with the first generation of Rolls-Royce Trent engines. The new power gearbox will enable the UltraFan to deliver efficient power over a range of take-off thrusts for high-bypass ratio engines of the future. For the highest thrust engines, each single gearbox will be capable of handling the equivalent horsepower produced by more than 500 family cars.

The new UltraFan, a geared design, will offer at least 25% improvement in fuel burn compared with the first generation of Rolls-Royce Trent engines Photo: Liebherr Aerospace

7

WEEKLY AVIATION HEADLINES

Bombardier previews Global 7000 aircraft flight test vehicles

Bombardier Business Aircraft opened its doors to media as the company showcased the first two Global 7000 flight test vehicles (FTVs) at the Company’s state-of-the-art assem-bly line in Toronto. Bom-bardier is employing the highest caliber technol-ogy throughout the en-tire manufacturing pro-cess for the Global 7000 and Global 8000 aircraft program. The final assembly line in Toronto features a state-of-the-art automated positioning system that moves the wing structure into place for joining with the fuselage. This system uses laser-guided measuring to ensure components of the aircraft are joined consistently and perfectly each time. Laser-guided technology is also a key feature of the final assembly line’s articulated robot drilling. Designed to ensure consistent quality and repeatability, the robot drilling features a tolerance for accuracy and precision within less than one thousandth of an inch. Combining human ingenuity with the most advanced machines, the Global 7000 and Global 8000 final assembly line is a testament to the commitment Bombardier has made to deliver the most advanced aircraft to the market. The Global 7000 and Global 8000 aircraft program is progressing as planned. Flight test vehicles one and two were on display during the event on the high-tech final assembly line in Toronto, and two additional flight test vehicles are in various stages of production and assembly. The program’s integrated aircraft ground tests are also making good progress across 15 facilities.

Global 7000 flight test vehicles (FTVs) one and two on final assembly line in Toronto Photo: Bombardier

in a fruitful innovation ecosystem. The project is also the outcome of an exchange of experience and best practice between AFI KLM E&M and its partner, Ramco, which has extensive know-how in the aircraft maintenance sector.

Aero AT inks deal to build fully-assembled air-craft manufacturing facility

Poland-based Aero AT, Jiangsu Aero AT Aviation Technologies and Changzhou National Hi-Tech District entered into an investment agreement on October 30th, 2015 whereby the aircraft manufacturer will build a facility for producing the six-seat M-20 Mewa business jet in Chang-zhou Konggang Industrial Park. The manufac-turing facility encompasses a total investment of US$150m, including an initial registered capital of US$60m. In May 2013, Aero AT (Ji-angsu) Aviation Industrial acquired Poland’s Aero AT Ltd. outright, becoming China’s first private general aviation firm to own a foreign fully-assembled aircraft maker wholly. In April of this year, Aero AT (Jiangsu) Aviation Indus-trial bought the entire collection of intellec-tual property for the M-20 Mewa business jet from U.S.-based Sikorsky Aircraft’s subsidiary in Poland. The M-20 Mewa is a twin-engine, six-seat, light-duty business jet constructed using advanced metal digital processing tech-nology. In addition to the approval received in 1982 for operation in Europe, the aircraft has received air worthiness certificates from the European Aviation Safety Agency (EASA), the Federal Aviation Administration (FAA) and Airservices Australia. The M-20 Mewa is widely used for private business travel, air rescue, short-distance cargo hauling and mail transport as well as twin-engine instrument flight training and specialized military flights. The first M-20 Mewa is expected to roll off the production line at the facility in 2017, followed by 50 aircraft annually starting in 2018.

MRO & PRODUCTION NEWS Lufthansa Technik Puerto Rico celebrates grand opening of new facility

In a Grand Opening ceremony Lufthansa Technik and the Commonwealth of Puerto Rico have now celebrated the achievement of the operational status of Lufthansa Technik Puerto Rico (LTPR). On the occasion of the arrival of the first A320 from JetBlue Airways, the second launch-ing customer of LTPR, a further overhaul line of the facility was opened on time. Currently, LTPR employs more than 200 people at Rafael Hernández International Airport in Aguadilla. When reaching the final configuration of five overhaul lines in early 2017, LTPR will offer up to 400 highly qualified jobs for local employees. From 2017 on, the company will also offer overhaul services for the Boeing 737 family in addition to the Airbus A320 family.

Lufthansa Technik Puerto Rico celebrates the opening of the new facility Photo: Lufthansa Technik

Airbus Group reports strong nine months results

Airbus Group revenues increased 6% to €43.0bn (9m 2014: €40.5bn), reflecting the strengthen-ing U.S. dollar and a favorable mix at Airbus. Revenues at Commercial Aircraft rose 8% with 446 aircraft delivered (9m 2014: 443 units), in-cluding 19 A380s and five A350 XWBs. Despite lower overall deliveries of 237 units (9m 2014: 295 units), Helicopters’ revenues rose 4% due

FINANCIAL NEWS

8

WEEKLY AVIATION HEADLINES

mainly to higher government programme and services activity. Defence and Space’s revenues were broadly stable despite the de-consolida-tion of launcher revenues with the creation of the Airbus Safran Launchers Joint Venture’s first phase. Group EBIT before one-off – an indica-tor capturing the underlying business margin by excluding material non-recurring charges or profits caused by movements in provisions re-lated to programmes and restructurings or for-eign exchange impacts – rose 8% to €2,804m (9m 2014: €2,590m). Commercial Aircraft’s EBIT before one-off rose 25% to €2,226m (9m 2014: €1,780m), driven by operational im-provement with a strong contribution from the A380 programme. It also reflected some favorable cost phasing, including research & development (R&D) and A350 support costs. Helicopters’ EBIT before one-off was €241m (9m 2014: €241m), with lower deliveries and unfavorable mix offset by services activity and progress on the transformation plan. Defence and Space’s EBIT before one-off increased to €431m (9m 2014: €370m), driven by good pro-gramme execution and its transformation plan.

Bolton Aerospace is a sub-tier supplier of precision machined products whose custom-ers are direct OEM suppliers to commercial, aerospace and defense manufacturers. Bolton Aerospace is characterized by a high degree of flexibility, capable of delivering manufac-turing services ranging from one operation through complete sub-assemblies with com-plex, multi-process parts—all supported by required documentation and certifications. PAS Technologies already operates globally in five locations, including Kansas City, Missouri; Hillsboro, Ohio; Phoenix, Arizona; Singapore; and Romania. Bolton Aerospace in Manches-ter, Connecticut will become the newest PAS Technologies location, enabling the company to broaden its presence and capabilities of-fered to the aerospace market.

Aircastle reports third quarter net loss of US$14.0m

Aircastle has reported a third quarter 2015 net loss of US$14.0m and an adjusted net loss of US$9.7m. The third quarter results included total revenues of US$212.1m, an increase of 19.4%, versus US$177.6m in the third quar-

Aviation Training & Events

Like us on Facebook

Follow us on Twitter

Connect with us on LinkedIn

www.everestevents.co.uk

AviAtion FinAncing SeminAr 25 november, Dublin, radisson Blu royal Hotel

What is happening in aviation finance in the second half of 2015?

Reported EBIT rose 14% to €2,946m (9m 2014: €2,583m), with net one-offs totaling a positive €142m. Net income increased 36% to €1,900m (9m 2014: €1,399m) while earnings per share (EPS) rose 35% to €2.42 (9m 2014: € 1.79). The finance result was €-536m (9m 2014: €-612m) and included one-offs totaling €-156m mainly from the revaluation of financial instruments. (€1.00 = US$1.10 at time of publication.)

OAG to sell MRO Network

OAG, a global leader in aviation data and ana-lytical services, has announced the sale of its MRO Network business. MRO Network, part of OAG, provides aviation exhibitions, con-ferences and publications to the MRO, fleet, financing and leasing sectors. MRO Network has been sold to Penton, a U.S.-based profes-sional information services company, for an undisclosed sum.

PAS Technologies acquires Bolton Aerospace

PAS Technologies has acquired Bolton Aero-space. Based in Manchester, Connecticut,

FINANCIAL NEWS

9

WEEKLY AVIATION HEADLINES

Air Canada reports third quarter net in-come improvement of 61%

Air Canada reported third quarter adjust-ed net income of CAD$734m, compared to adjusted net income of CAD$457m in the third quarter of 2014, an improvement of CAD$277m or approximately 61%. EBITDAR amounted to CAD$1,076m compared to EBIT-DAR of CAD$749m in the same quarter in 2014, an increase of CAD$327m or approxi-mately 44% year-over-year. On a GAAP basis, Air Canada reported record third quarter op-erating income of CAD$815m compared to operating income of CAD$526m, an improve-ment of CAD$289m or approximately 55% from the third quarter of 2014. An operating margin of 20.3% in the third quarter of 2015 reflected an improvement of 6.5% points from the same quarter in 2014. In the third quarter of 2015, net cash flows from operat-ing activities totaled CAD$476m, an improve-ment of CAD$285m from the third quarter of 2014. Negative free cash flow amounted to CAD$90m, an improvement of CAD$102m from the third quarter of 2014. (US$1,00 – CA$1,32 at tine if publication.)

DVB Group publishes nine-months re-sults for 2015

DVB Bank generated consolidated net in-come before taxes of €59.8m (previous year: €72.6m) during the first nine months of 2015, providing financing solutions and advisory ser-vices to its clients in the international trans-port sector. Net interest income decreased by 6.7%, from €62.5m to €151.6m. Thanks to the high volume of new Transport Finance business, interest income rose by 17.6%, from €654.4m to €769.6m. Interest expenses rose by 25.6%, from €491.9m to €618.0m. Allow-ance for credit losses amounted to €62.7m (previous year: €8.5m). Specifically, new al-lowance recognized for credit losses totaled €106.3m, of which €75.7m was accounted for by Shipping Finance, due to the persistently difficult environment in individual sub-seg-ments of international shipping. Conversely, allowance for credit losses of €48.5m was reversed (of which €31.0m in Shipping Fi-nance). Total allowance for credit losses (com-prising specific allowance for credit losses, portfolio-based allowances for credit losses, and provisions) rose to €244.8m, up 11.8% from year-end 2014 (€219.0m). Net interest income after allowance for credit losses of €88.9m was lower than the previous year’s figure of €134.0m. Consolidated net income before taxes declined by 17.6% year-on-year, from €72.6m to €59.8m, and consolidated net income after taxes of €51.3m fell short of the previous year’s figure of €58.1m.(€1.00 = US$1.11 at time of publication.)

767 Freighter leases drive ATSG revenue growth

Air Transport Services Group, a provider of medium wide-body aircraft leasing, air cargo transportation and related services, reported consolidated financial results for the quarter ended September 30th, 2015. Revenues in-creased 3% to US$142.3m, including a 6% in-crease in freighter aircraft leasing revenues. Excluding revenues from reimbursements, third-quarter 2015 revenues increased 6%. Both pre-tax and net earnings from continu-ing operations decreased 34%, reflecting the revenue and expense effects of aircraft transitioning between contracts and sched-uled maintenance activities during the third quarter. Net earnings from continuing opera-tions were US$6.3m, down from US$9.6m in third quarter of 2014. Operating loss carry-forwards for U.S. federal income tax purposes offset much of the company’s federal tax li-abilities. ATSG does not expect to pay signifi-cant federal income taxes until 2017 or later. Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization, also adjusted for the effect of derivative transac-tions) was US$43.7m, down 2% from a year ago. Adjusted EBITDA is a non-GAAP financial measure, defined and reconciled to compara-ble GAAP results in separate tables at the end of this release.

ST Engineering reports comparable year-on-year profit for 3rd quarter 2015

Singapore Technologies Engineering (ST En-gineering) announced financial results for its third quarter ended September 30th, 2015 (3Q2015). The Group posted quarterly rev-enue of US$1.50bn and profit before tax of US$154.7m. These results are comparable to revenue of US$1.55bn and profit before tax of US$151.7m in the same quarter last year. Quarterly net profit after tax (Net Profit) was US$133.3m, up 10% from US$121.3m for the same quarter last year. The Aerospace sec-tor posted revenue of US$506m, up 8% from US$470m a year ago due to higher engines output in the Component/Engine Repair & Overhaul business group that was partially off-set by lower revenue from the Aircraft Main-tenance & Modification business group. Year-on-year profit before tax was flat at US$63.3m due to lower gross profit as a result of fewer airframe maintenance work partially offset by lower finance cost as well as the absence of impairment of an associate.

ter of 2014. Commenting on the results, Ron Wainshal, Aircastle’s CEO, stated “During the third quarter we took decisive measures to ad-dress the challenge presented by the Malay-sian bankruptcy and to accelerate our planned exit from freighter investments. Notwith-standing the resulting impairments, our oper-ating performance was excellent as evidenced by the 14.5% cash ROE and 99.9% utilization results.” Aircastle acquired seven aircraft for US$233m and year-to-date has purchased 32 aircraft for US$1.0bn. The company sold eight aircraft for a net gain of US$15.7m; and year-to-date has sold 20 aircraft for a total net pre-tax contribution of US$38.3m.

WestJet reports record third quarter net earnings

WestJet posted its third quarter 2015 results, with record net earnings of CAD$101.8m (US$78.4m) as compared with the adjusted net earnings of CAD$85.4m (US$65.6m) re-ported in the third quarter of 2014, up 19.2% and 24.2%, respectively, notwithstanding the significant weakening of the Canadian dollar year over year and the softening of the West-ern Canadian economy as a result of the col-lapse in energy prices.

Willis Lease Finance 3rd quarter profits increase as utilization improves to 92%

Willis Lease Finance Corporation (WLFC), an independent jet engine lessor in the com-mercial finance sector, reported its third quarter 2015 net income has increased 163% to US$2.6m compared to US$1.0m in the third quarter of 2014. This follows a net loss in the second quarter of 2015 which totaled US$0.5m resulting from a US$3.1m non-cash write-down related to the part-out of a wide-body aircraft engine. For the first nine months of 2015, net income was US$4.4m compared to US$7.5m for the first nine months of 2014. Average utilization in the current quarter was 91%, a significant improvement from 84% re-ported for the second quarter in 2015 and 81% reported for the first quarter 2015 and 82% in the year ago period. Utilization was 92% at quarter-end, compared to 87% at the end of the second quarter 2015 and 82% a year ago. Total revenues increased 32% to US$57.8m in the current quarter from US$43.8m in the preceding quarter, and increased 27% from US$45.5m in the third quarter of 2014, fueled by the growing lease portfolio, higher portfo-lio utilization and higher gains from the sale of equipment.

FINANCIAL NEWS

10

WEEKLY AVIATION HEADLINES

• Delta reported that October 2015 total system traffic was up 3.5% compared to October 2014, while capacity for the month was slightly down by 0.2%. The load factor for October was up 3.1 points to 86.9% when compared to the previous year.

• Hawaiian Airlines announced its system-wide traffic was up 5.6% compared to October 2014, while capacity rose 5.1%. The load factor for October 2015 was 81.6% the same level as the previous year.

• Alaska reported a 12.3% increase in traffic on a 13.2% increase in ca-pacity compared to October 2014. Load factor decreased 0.6 points to 82.8%. Alaska also reported 88.2% of its flights arrived on-time in October, compared to 87.1% re-ported in October 2014.

• Horizon reported a 1.6% increase in traffic on a 2.5% increase in ca-pacity compared to October 2014. Load factor decreased 0.7 points to 77.9%. Horizon also reported 83.5% of its flights arrived on-time

in October, compared to the 89.6% reported in October 2014.

• IAG traffic in October increased by 16.6% versus October 2014, while Group capacity rose by 13.2% year on year. The passenger load factor for the month was up 2.5 points to 83.4%.

• Norwegian’s October traffic increased by 10% and capacity was up by 2%. The load factor in-creased by 6.2 points to 87.8%

when compared to the same pe-riod a year ago.

• Ryanair reported that October traffic grew 15% when compared to October 2014, while the load factor for the month increased rose 5% points to 94%.

• SAS’ traffic for October 2015 was up 3.9% and capacity increased by 0.8% year on year. The load factor improved by 2.3 points to 76.9% compared to the previous year.

PASSENGER STATISTICS - OCTOBER

AAR Navy vertical replenishment con-tract extended

AAR released that Military Sealift Command (MSC) has exercised a one-year renewal op-tion for its Airlift division to perform vertical replenishment (VERTREP) services for the U.S. Navy’s 5th and 7th Fleets in the Western Pa-cific and Indian Oceans. The one-year renewal is valued at approximately US$14m. The con-tract was awarded to AAR Airlift Group in 2011 for an estimated total value of US$77m, including all options. The contract includes the use of four helicopters, personnel, and operational and technical support services.

Sikorsky completes VH-92A Presiden-tial Helicopter Replacement Program milestones

Sikorsky Aircraft Corporation has successfully completed the VH-92A Presidential Helicop-ter Replacement Program Preliminary Design Review (PDR), completion of the integration and performance testing of mission com-munications system (MCS) components, and Sikorsky’s acceptance of the second S-92A air-craft for the program. On May 7th, 2014, the Navy awarded a US$1,244,677,064 fixed-price incentive engineering and manufacturing de-velopment (EMD) contract with production options to Sikorsky for 21 operational and two test aircraft. Initial fielding is planned for 2020, with production concluding in 2023. Under the contract, Sikorsky will use its in-production S-92 aircraft and integrate gov-ernment-defined mission systems and install

MILITARY AND DEFENCE

Airline Services Interiors, the dedicated interi-ors division of Airline Services Ltd has completed the design and integration of Panasonic’s next generation eX3 In-Flight Entertainment system

OTHER NEWS

B747 new IFE Economy Class Photo: Airline Services Interiors

an executive interior. The PDR, completed on Aug. 21, allowed the VH-92A team to demon-strate the preliminary design for the VH-92A aircraft, including integration of the MCS, and the supporting logistics elements. Completing this step signals that the program is ready to proceed into detailed design (Critical Design Review).

Pratt & Whitney and Multicut A/S sign long-term agreement for F135 compo-nents

Pratt & Whitney has awarded a contract to Multicut A/S to manufacture F135 engine components. The F135 engine is the pro-pulsion system for the fifth generation F-35 Lightning II aircraft. Multicut A/S, a precision component manufacturer located in Vild-jberg, Denmark, has received this award for F135 engine components. This 10-year long-term procurement agreement signals the beginning of a relationship between Pratt & Whitney and Multicut, and positions Multicut well for follow-on F135 opportunities of in-creasing value.

Jeppesen to provide U.S. Air Force with iPad-based electronic flight bag servic-es

Jeppesen, a part of Boeing Commercial Avia-tion Services, and the U.S. Air Force Air Mobil-ity Command signed an agreement to provide iPad-based electronic flight bag (EFB) services for approximately 1,160 Mobility Air Force air-craft, and more than 16,000 related Air Force iPad users. The Mobility Air Force aircraft will be equipped with Jeppesen FliteDeck Pro,

the EFB solution that streamlines the use of navigational information for military fleet programs and commercial aviation operators. Mobility Air Force fleet aircraft that will be equipped with Jeppesen FliteDeck Pro on iPad include C-5, C-17, C-130, KC-10, KC-135 and multiple executive and operational support aircraft. In addition to vector-based Jeppesen terminal charts, FliteDeck Pro includes data-driven enroute content, which is dynamically rendered and de-cluttered for the pilot’s cur-rent needs. Information for all enroute and airport charted features is available, includ-ing communication information, operational notes, current weather conditions and airport runway details.

11

WEEKLY AVIATION HEADLINES

• C&L has welcomed Wes DeMoss as man-ager of C&L’s growing Military and OEM Busi-ness Development di-vision. Wes spent four years developing Hawk-er Beechcraft’s associa-tion with all the major

military contractors, and in 2009 he became Government Business Sales Manager. Wes later joined APPH Wichita, now known as Heroux-Devtek Wichita, as Business Devel-opment Manager. There Wes gained exten-sive experience in legacy and new product development with all the major OEMs.

• C&L Aerospace welcomed Calvin Tuitt as Senior Vice President Business Develop-ment, MRO. Calvin has been in the aerospace and airline industry for more than 25 years, working in sales, marketing and commercial management for Rolls Royce Canada, Pratt and Whitney Canada, ExelTech Aerospace and Discovery Air Technical Services.

• TrueAero has announced the appointment of Ed Blyskal as Director of Business Develop-ment & Marketing. Ed’s vast experience and industry knowledge will expedite the global expansion as TrueAero continues to support A340 and A330 operators worldwide.

AviTrader Publications Corp.Suite 305, South Tower

5811 Cooney RoadRichmond, BC

Canada V6X 3M1

PublisherPeter Jorssen

Tel: +1 604 318 5207

EditorHeike Tamm

[email protected]: +34 (0) 971 612 130

Advertising Inquiries and Customer Support

Jenny [email protected]: + 49 (0) 8761 346 007

For inquiries and comments, please email:

Click here for more aviation events

Recommended Eventsinto the first of 18 British Airways Boeing 747 aircraft. The upgrade, which took nine months to complete, features in all classes of passenger seating from World Traveller (economy) through to First Class. It is anticipated that all 18 Boeing 747’s will be refitted by August 2016. As part of the upgrade, Airline Services Interiors has inte-grated new universal power sockets on every seat in World Traveller Plus (premium economy) together with individual USB sockets to allow customers to power their phones and tablets. The cabin interiors of the British Airways 747s have also been refreshed so they match those on the airline’s new A380 and 787 aircraft and Air-line Services Interiors has developed new fitted seat covers to improve comfort and appearance.

Aeroxchange, the leading business process net-work focused on aviation, and Pentagon 2000 Software, developer of the Pentagon 2000SQL system, have partnered to offer MRO suppliers the ability to seamlessly conduct transactions across the Aeroxchange network and support direct ERP electronic collaboration with over 40 global airlines. The system-to-system connection enables efficient and error free collaboration on purchase-to-pay and repair management pro-cesses. The new Pentagon 2000SQL direct inter-faces for AeroRepair and AeroBuy will offer Pen-tagon customers on the Aeroxchange network a solution to respond to RFQs, acknowledge purchase and repair orders, send and receive shipment notifications, provide status updates and submit invoices to 40 global airlines without ever leaving their Pentagon systems. The Penta-gon integration will help users reduce costs, im-prove service and grow revenues.

The Minister of Investments and Development (MID) of the Republic of Kazakhstan, Asset Is-sekeshev, has signed a Memorandum of Under-standing (MoU) with CAA International (CAAi), the State-to-State advisory arm of the UK Civil Aviation Authority (UK CAA). The MoU sup-ports future collaboration between the UK and Kazakhstan to strengthen the safety oversight of Kazakhstan’s Aviation Regulator, the Civil Avia-tion Committee (CAC). Under the MoU, CAAi has agreed to provide UK CAA expertise and guidance, to help raise the level of effective implementation of ICAO Standards and Recom-mended Practices (SARPs). CAAi will support the development of a CAC transformation plan that will include the separation of commercial ser-vices from regulatory provisions and oversight. CAAi will also support Kazakhstan in aligning its aviation safety regulations to European require-ments and provide assistance to achieve ECAC membership and FAA Cat 1 status.

OTHER NEWS

Wes DeMoss

INDUSTRY PEOPLE

GATE – Gulf Aviation Training Event November 09, 2015 – November 10, 2015 Dubai World Central, Dubai, United Arab Emirates

Aircraft Economic Life Summit 2015 November 24, 2015 – November 24, 2015

Aviation Finance Seminar 2015 November 25, 2015 – November 25, 2015 Radisson Blu Hotel, Dublin

AIR CARGO INDIA 2016 February 23, 2016 – February 25, 2016 Grand Hyatt, Mumbai

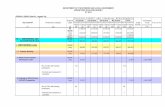

THE AIRCRAFT AND ENGINE MARKETPLACE Page 1 of 4

Aircraft Type Company Engine MSN Year Available Sale / Lease Contact Email Phone

A300-200F Rising Sun Aviation CF6-50C2 141 1981 Now Sale Fred Van Acker [email protected] +1 214-906-5635

A300-200F Rising Sun Aviation CF6-50C2 149 1981 Now Sale Fred Van Acker [email protected] +1 214-906-5635

A319-100 ORIX Aviation V2522-A5 2501 2005 Q3/2017 Lease James Sammon [email protected] +353 871381042

A320 Magellan Aviation Group CFM56-5A1 333 1992 Dec 2015 Sale Bill Polyi [email protected] +1 (704) 504 9204 x202

A320-200 ORIX Aviation V2527-A5 2680 2006 Q4/2017 Lease Cian Coakley [email protected] +353 877760451

A320-200 ORIX Aviation V2527-A5 4603 2011 Q2/2017 Lease Daniel Cunningham [email protected] +353 871774524

A320-200 ORIX Aviation V2527-A5 2642 2006 Q4/2016 Sale / Lease Daniel Cunningham [email protected] +353 871774524

A320-214 Wing Capital CFM56-5B4/P 1767 Now Sale / Lease Ben Jacques bjacques@wngcapital com +353 766025252

Commercial Jet Aircraft

November 9, 2015

A320-214 Wing Capital CFM56-5B4/P 1767 Now Sale / Lease Ben Jacques [email protected] +353 766025252

A320-233 Amentum Capital V2527-A5 3543 2008 Jun 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

A320-233 Amentum Capital V2527-A5 3524 2008 May 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

A321-211 Bristol Associates CFM56-5B3/3 5681 2013 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

A321-211 Bristol Associates CFM56-5B3/3 5733 2013 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

A321-211 Bristol Associates CFM56-5B3/3 5779 2013 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

A321-211 Bristol Associates CFM56-5B3/3 5919 2013 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

A330-200 Wing Capital CF6-80E1A3 655 Q1/2017 Sale / Lease Ben Jacques [email protected] +353 766025252

A330-223 Amentum Capital PW4168A 943 2008 Mar 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

A330-223 Amentum Capital PW4168A 962 2008 Mar 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

A330-223 Amentum Capital PW4168A 979 2009 Oct 2016 Sale / Lease Jack Hynes [email protected] +353 16398125A330 223 Amentum Capital PW4168A 979 2009 Oct 2016 Sale / Lease Jack Hynes [email protected] 353 16398125

A340-300 ORIX Aviation CFM56-5C4 273 1999 Now Sale Cian Coakley [email protected] +353 877760451

B737-300 European Capital Corp. CFM56-3B2 24634 1990 Now ACMI/Wet Lease Iacovos Yiakoumi [email protected] +35722873250

B737-300F ORIX Aviation CFM56-3B2 24710 1990 Q3/2015 Sale Cian Coakley [email protected] +353 877760451

B737-400 World Star Aviation Services CFM56-3C1 24796 Now Sale / Lease Sean O Connor [email protected] +1 415-956-9456

B737-400 Safair Operations Combi Now ACMI only C. Schoonderwoerd [email protected] +27 11 928 0000

B737-700 Amentum Capital CFM56-7B22 34320 2005 Jan 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

B737-700 Amentum Capital CFM56-7B22 34321 2005 Jan 2016 Sale / Lease Jack Hynes [email protected] +353 16398125

B737-800 (5) Wing Capital CFM56-7B26 various Q1/2016 Lease Ben Jacques [email protected] +353 766025252

B737‐86J Aersale CFM56-7B26 30881 Q1/2016 Sale / Lease Craig Wright [email protected] +1 305 764 3238

B747-400 GA Telesis CF6-80C2B1F 28960 1998 Now Sale Stefanie Jung [email protected] +1 954-958-1321

East Africa

g j g@g

B747-400SF Wing Capital P&W 24998 Now Sale / Lease Ben Jacques [email protected] +353 766025252

B757-200 Castlelake RB211-535E4 23566 1986 Mar 2016 Sale / Lease Joe Giarritano [email protected] +1 612 851 3032

B757-200 Castlelake RB211-535E4 23567 1986 Dec 2015 Sale / Lease Joe Giarritano [email protected] +1 612 851 3032

B757-200 Castlelake RB211-535E4 23568 1986 Apr 2016 Sale / Lease Joe Giarritano [email protected] +1 612 851 3032

B757-200 mba aircraft solutions RB211-535E4B 24580 1990 Now Sale / Lease Jacob Agnew [email protected] +1 703 276 3202

B757-222 Bristol Associates PW2037 25157 1991 Q1/2016 Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

B757-222 Bristol Associates PW2037 25322 1991 Q1/2016 Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

B757-222 Bristol Associates PW2037 25396 1992 Q1/2016 Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

B757-222 Bristol Associates PW2037 25398 1992 Q1/2016 Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

B757-222 Bristol Associates PW2037 25698 1991 Q1/2016 Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

B767-27GER Aersale CF6-80C2B4F 27048 1993 Now Sale / Lease Craig Wright [email protected] +1 305 764 3238

B767-200ER mba aircraft solutions JT9D-7R4E 23180 1984 Now Sale / Lease Jacob Agnew [email protected] +1 703 276 3202

B767-375ER Jetran, LLC. 25865 1992 Now Sale / Lease Leo Nadeau [email protected] +1 (512) 294-6727

B777-200ER GMT Global Republic Aviation Trent 892 28533 2004 Q2/2016 Sale/Lease/JV John Leech [email protected] +353 87 944 7164

DC8 Aersale No engines 46094 1969 Now Sale Craig Wright [email protected] +1 305 764 3238

L100-30 Safair Operations Now ACMI only C. Schoonderwoerd [email protected] +27 11 928 0000

Aircraft Type Company Engine MSN Year Available Sale / Lease Contact Email Phone

ATR72-500 Bristol Associates PW127M 950 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

Regional Jet / Turboprop Aircraft

East Africa

ATR72-500 Bristol Associates PW127M 951 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ATR72-500 Bristol Associates PW127M 952 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ATR72-500 Bristol Associates PW127M 980 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ATR72-500 Bristol Associates PW127M 983 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

DASH8-102 Magellan Aviation Group PW121 113 1988 Now Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

DASH8-311 Magellan Aviation Group PW123 266 1991 Now Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

E170 Magellan Aviation Group CF34-8E5 59 2003 Dec 2015 Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

November 9, 2015

May 18, 2015May 18, 2015April 20, 2015www.gatelesis.com

Component solutions you can trust with the world’smost powerful independent rotable inventory

THE AIRCRAFT AND ENGINE MARKETPLACE Page 2 of 4

Aircraft Type Company Engine MSN Year Available Sale / Lease Contact Email Phone

ERJ-135ER Bristol Associates 145176 1999 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-135ER Bristol Associates 145186 1999 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-135ER Bristol Associates 145192 1999 Now Sale Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-135LR Bristol Associates AE3007-A1 145410 2001 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-135LR Bristol Associates AE3007-A1 145413 2001 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-135LR Bristol Associates AE3007-A1 145504 2001 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-145LR Bristol Associates AE3007-A1/3 145208 1999 Now Sale / Lease Ed McNair / Pete Seidlitz bristol@bristolassociates com +1 202-682-4000

Regional Jet / Turboprop Aircraft (cont.)

November 9, 2015

ERJ-145LR Bristol Associates AE3007-A1/3 145208 1999 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-145LR Bristol Associates AE3007-A1/3 145239 2000 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-145LR Bristol Associates AE3007-A1/3 145302 2000 Now Sale / Lease Ed McNair / Pete Seidlitz [email protected] +1 202-682-4000

ERJ-145ER GA Telesis 145035 1998 Now Sale / Lease Stefanie Jung [email protected] +1 954-958-1321

ERJ-145ER GA Telesis 145029 1998 Now Sale / Lease Stefanie Jung [email protected] +1 954-958-1321

Contact Email Phone

Sherry Riley [email protected] +1(513)782-4272

Contact Email Phone

(1) AE3007A1 Now - Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

Company

Multiple Engines GE / CFM / RB211 Now - Sale / Lease GECAS Engine Leasing

AE3007 Engines Sale / Lease

Commerical Engines

Company

Magellan Aviation Group

Multiple Types Sale / Lease

(1) AE3007A1 Now Sale / Lease Bill Polyi [email protected] 1 (704) 504 9204 x202

Contact Email Phone

CF34-8E5 Now - Lease Lufthansa Technik AERO Alzey Kai Ebach [email protected] +49-6731-497-368

CF34-10E Now - Lease

CF34-8C Now - Lease

CF34-3B1 Now - Lease

CF34-3A Now - Sale / Lease

(1) CF34-3A1 Now - Sale GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(1) CF34-8C5/B1 Now - Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

Sherry Riley [email protected] +1 (513) 782-4272CF34-8E(s) Now - Sale / Lease

CompanySale / Lease

GECAS Engine Leasing

CF34 Engines

Magellan Aviation Group

Magellan Aviation Group

(1) CF34-8C5 Now - Lease Engine Lease Finance Joe Hussar [email protected] +1 617 828-3569

(1) CF34-10E6 Now - Lease David Desaulniers [email protected] +1 415 516 4837

(1) CF34-8E5A1 Now - Lease AeroCentury Frank Pegueros [email protected] +1 650 340 1888

Contact Email Phone

CF6-50E2 (multiple) Now - Sale / Lease Commercial Aircraft Services Brian Cooper [email protected] +1 208-899-1915

(1) CF6-80C2B1F Now - Sale / Lease AerSale. Inc. Alan Kehoe [email protected] +353 879 393 534

(1) CF6-80C2B6F Now - Sale / Lease Matthew White [email protected] +353 1475 3005

(1) CF6-80C2A5 Oct 2015 - Sale / Lease Matthew White [email protected] +353 1475 3005

(1) CF6-80C2B7F Now - Sale / Lease Matthew White [email protected] +353 1475 3005

(3) CFM56-3C1 Now - Sale / Lease Wing Capital Ben Jacques bjacques@wngcapital com +353 766025252

CF6 Engines Sale / Lease Company

Willis Lease

(3) CFM56-3C1 Now - Sale / Lease Wing Capital Ben Jacques [email protected] +353 766025252

(1) CF6-80C2B6F Now - Sale/Lease/Exch. TES Aviation Group Bechan Carpenter [email protected] + 44 7795 636 034

(1) CF6-80C2B1F Now - Sale / Lease Fortress Investment Group Tom McFarland [email protected] +1 305-520-2349

(1) CF6-80C2B6F Now - Sale / Lease

(1) CF6-80C2B1F AeroTurbine Elizabeth Peters [email protected] +1 (214) 263-1173

(1) CF6-80C2B6F Now - Sale / Exchange or

(2) CF6-80C2B6F Now - Lease Andrew McCain [email protected] +1 (786) 879-0830

(1) CF6-80C2B6F Now - Sale / Lease GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(4) CF6-80C2B1F Now - Sale/Lease/Exch.

(2) CF6-80C2B7F Now - Sale / Lease

Now - Sale / Exchange

(2) CF6-80C2B7F Now - Lease Engine Lease Finance Joe Hussar [email protected] +1 (617)828-3569

Contact Email Phone

CFM56-3C1 (SV) Now - Sale / Lease TrueAero, LLC Brent Corrie [email protected] +1 561-310-3242

(1) CFM56-5C4/P Now - Sale / Lease

(1) CFM56-3C1 Now - Sale European Capital Corporation Iacovos Yiakoumi [email protected] +35722873250

(1) CFM56-3B2

(1) CFM56-7B27 Now - Lease Engine Lease Finance Joe Hussar [email protected] +1 617 828-3569

(1) CFM56-5B1/P Now - Lease

(1) CFM56-5B4P Now - Sale / Lease Frank Rustmeier [email protected] +49 (0)8025 99360Royal Aero

CFM56 Engines Sale / Lease Company

November 9, 2015

GECASEngine Leasing

THE AIRCRAFT AND ENGINE MARKETPLACE Page 3 of 4

Contact Email Phone

(1) CFM56-5A1 Now - Sale / Lease GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(8) CFM56-5C3F Now - Sale Kevin Milligan [email protected] +1-954-958-1912

(1) CFM56-5B Now - Sale / Lease Eddo Weijer [email protected] +1-954-676-3111

(1) CFM56-7B27/3B1F Oct 15 - Sale/Lease/Exch. AerSale. Inc. Alan Kehoe [email protected] +353 879 393 534

(1) CFM56-3C1 Now - Sale / Lease

(2) CFM56-7 Now - Sale/Exchange CFM Materials Jimmy Hill [email protected] +1-214-988-6670

(1) CFM56-3C1 Now - Sale/Exchange Steven Jefferson [email protected] +1-214-988-6640

Sherry Riley [email protected] +1(513)782-4272(2) CFM56-5A Now - Sale

Commerical Engines (cont.)

GECAS Engine Leasing

CFM56 Engines CompanySale / Lease

November 9, 2015

Sherry Riley [email protected] +1(513)782-4272

(1) CFM56-5C4 Now - Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

(1) CFM56-5B4 Now - Sale / Lease

(1) CFM56-3C1 Now - Sale Orix Aviation James Sammon [email protected] +353 871381042

(1) CFM56-5C4 Now - Sale

(6) CFM56-3C1 Now - Sale/Lease/Exch. Lufthansa Technik Airmotive Irel. Alan Phelan [email protected] +353-87-2786738

(1) CFM56-3B2 Now - Sale/Lease/Exch.

(1) CFM56-3C1 Now - Sale/Lease/Exch. TES Aviation Group Bechan Carpenter [email protected] + 44 7795 636 034

(1) CFM56-7B26/7B27 Now - Sale / Lease Fortress Investment Group Tom McFarland [email protected] +1 305-520-2349

(1) CFM56-7B22 Now - Sale / Lease Castlelake Neil McCrossan [email protected] +44-207-190-6119

(1)CFM56-5C3F Now - Sale / Lease

(2) CFM56-5A Now - Sale GECAS Engine Leasing

Magellan Aviation Group

(1)CFM56 5C3F Now Sale / Lease

(1) CFM56-5B Now - Sale/Lease/Exch. Werner Aero Services Cliff Topham [email protected] +1-703-402-7430

(1) CFM56-7B Now - Sale/Lease/Exch.

Ann Lee [email protected] +1 (415) 408 4769

(1) CFM56-5B4/3 Now - Lease

(1) CFM56-5B4/P Now - Lease

(2) CFM56-7B24/3 Now - Lease

(3) CFM56-3C1 Now - Sale / Exchange AeroTurbine Elizabeth Peters [email protected] +1 (214) 263-1173

(2) CFM56-5A1F Now - Lease or

(2) CFM56-3C1 Now - Lease Andrew McCain [email protected] +1 (786) 879-0830

(1) CFM56-3B1 Now - Lease

Now - Lease(2) CFM56-7B24 (Non-TI) Willis Lease

( )

(2) CFM56-3B2 Now - Sale / Exchange

(1) CFM56-7B22 Now - Sale / Exchange

(1) CFM56-7B Now - Lease

(1) CFM56-3B1 Now - Sale / Lease Jetran, LLC. Leo Nadeau [email protected] +1 (512) 294-6727

(1) CFM56-3C1 Now - Sale / Lease

Contact Email Phone

GEnx-1B74/75 Now - Lease Willis Lease Ann Lee [email protected] +1 (415) 408 4769

Contact Email Phone

(1) JT8D-200 Now - Sale GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(1) JT8D-9A Now - Sale Rising Sun Aviation Fred Van Acker [email protected] +1 214-906-5635

JT8D and JT9D Engines Sale / Lease

GEnx Engines Sale / Lease Company

Company

(1) JT8D-17 Now - Sale

(2) JT9D-7R4D Now - Sale / Lease Hartford Aviation Group Anique Gorman [email protected] +1 914-235-2014

Contact Email Phone

(1) PW121 (Dash 8) Bill Polyi [email protected] +1 (704) 504 9204 x202

(1) PW123B/D/E

(1) PW121 (ATR)

(1) PW127E/F/M

(1) PW150A

(2) JT9D7R4 Now - Sale / Lease Phoenix Aer Capital Bob Gallagher [email protected] +1 727-376-9292

( ) ( ) S / / @

Now - Sale / Lease

Now - Sale / Lease

PW Small Engines Sale / Lease

Now - Sale / Lease

(1) PW124B Now - Sale / Lease

Now - Sale / Lease

Willi L

Magellan Aviation Group

Company

Now - Sale / Lease

(2) PW121 (ATR) Now - Sale/Lease/Exch. David Desaulniers [email protected] +1 415 516 4837

(2) PW121-8 Now - Sale/Lease/Exch.

(1) PW123 Now - Sale/Lease/Exch.

(1) PW127 Now - Sale/Lease/Exch.

(1) PW127M Now - Sale/Lease/Exch.

(2) PW127F Now - Sale/Lease/Exch.

(2) PW124B Now - Sale/Lease/Exch.

PW127F Now - Sale/Lease/Exch. Logix.Aero JC Morin [email protected] +33 647 824 262

PW127M Now - Sale/Lease/Exch.

PW119B RGB Now - Lease Lufthansa Technik AERO Alzey Kai Ebach [email protected] +49-6731-497-368

PW119B Now Lease

Willis Lease

PW119B Now - Lease

PW120A Now - Lease

PW121 (ATR) Now - Lease

PW123B Now - Lease

PW124B Now - Lease

PW125B Now - Lease

PW127F Now - Lease

PW127M Now - Lease

PW150A Now - Lease

PW150 GRB Now - Lease

November 9, 2015

THE AIRCRAFT AND ENGINE MARKETPLACE Page 4 of 4

Contact Email Phone

(2) PW2037 Now - Sale / Lease Castlelake Neil McCrossan [email protected] +44 (0) 207 190 6119

(2) PW2037 Now - Sale / Lease Fortress Investment Group Tom McFarland [email protected] +1 305-520-2349

(3) PW2037 Now - Sale / Exchange AeroTurbine Elizabeth Peters [email protected] +1 (214) 263-1173

Contact Email Phone

(4) PW4056-1 Now - Sale/Lease/Exch. GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(1) PW4056-3 Now - Sale / Lease Bill Polyi [email protected] +1 (704) 504 9204 x202

(1) PW4060/62-3 Now - Sale / Lease

( ) S / @ ( )

Company

CompanySale / LeasePW4000 Engines

Sale / LeasePW2000 Engines

Magellan Aviation Group

Commerical Engines (cont.)

November 9, 2015

(2) PW4056-3 Now - Sale / Exchange AeroTurbine Elizabeth Peters [email protected] +1 (214) 263-1173

Now - Sale / Lease IAI Michael Michaeli [email protected] +972-52-3663068

(1) PW4062-3 Now - Lease Ann Lee [email protected] +1 (415) 408 4769

(1) PW4168A Now - Lease

(4) PW4056 Now - Sale / Lease Wing Capital Ben Jacques [email protected] +353 766025252

(3) PW4056/60/62 Now - Sale / Lease Hartford Aviation Group Anique Gorman [email protected] +1 914-235-2014

(1) PW4060-3 Now - Sale / Lease AerSale. Inc. Matthew White [email protected] +353 1475 3005

(1) PW4158-3 Now - Sale / Lease Matthew White [email protected] +353 1475 3005

(1) PW4062-3 Now - Sale / Lease Matthew White [email protected] +353 1475 3005

(1) PW4056-3 Now - Sale / Lease Alan Kehoe [email protected] +353 879 393 534

(1) PW4060C-1C

Willis Lease

(1) PW4056-3 Now - Sale / Lease Alan Kehoe [email protected] +353 879 393 534

(1) PW4168 Now - Lease TES Aviation Group Bechan Carpenter [email protected] + 44 7795 636 034

(1) PW4168A Now - Sale / Lease Engine Lease Finance Joe Hussar [email protected] +1 (617)828-3569

Contact Email Phone

(1) RB211-535E4B Now - Sale mba aircraft solutions Jacob Agnew [email protected] +1 703 276 3202

(1) RB211-535E4 Now - Sale / Lease Jetran, LLC. Leo Nadeau [email protected] +1 (512) 294-6727

(1) RB211-535E4 Now - Sale / Lease Castlelake Neil McCrossan [email protected] +44 (0) 207 190 6119

(1) RB211-535E4 Nov 15 - Sale / Lease AerSale. Inc. Matthew White [email protected] +353 1475 3005

(2) RB211-535E4 Now - Sale / Lease Fortress Investment Group Tom McFarland [email protected] +1 305-520-2349

(2) RB211-535E4B Now - Sale GA Telesis Eddo Weijer [email protected] +1-954-676-3111

RB211 Engines Sale / Lease Company

(1) RB211-535E4 /12B Now - Sale/Lease/Exch. TES Aviation Group Bechan Carpenter [email protected] + 44 7795 636 034

(1) RB211-535E4 Now - Sale World Star Aviation Services Sean O Connor [email protected] +1 415-956-9456

Contact Email Phone

Tay650-15 Now - Sale / Lease Jetran, LLC. Leo Nadeau [email protected] +1 (512) 294-6727

Contact Email Phone

(3) Trent 800 Now - Sale / Lease GA Telesis Eddo Weijer [email protected] +1-954-676-3111

(1) Trent 800 Now - Sale / Lease AerSale. Inc. Matthew White [email protected] +353 1475 3005

Contact Email Phone

(1) V2527-A5 Now - Lease Willis Lease Ann Lee [email protected] +1 (415) 408 4769

(1) V2533 A5 Now Lease

Sale / Lease Company

Trent Engines

Company

Company

Tay Engines

V2500 Engines

Sale / Lease

Sale / Lease

(1) V2533-A5 Now - Lease

(1) V2527-A5 Now - Sale/Lease/Exch. AeroTurbine Elizabeth Peters [email protected] +1 (214) 263-1173

(2) V2533-A5 Now - Sale/Lease/Exch. or Andrew McCain [email protected] +1 (786) 879-0830

1) V2533-A5 w/QEC Now - Sale/Lease/Exch. Rolls-Royce & Partners Finance Bobby Janagan [email protected] +44 20 7227 9078

(1) V2527-A5 w/QEC Now - Sale/Lease/Exch.

(1) V2530-A5 Now - Sale / Lease Frank Rustmeier [email protected] +49 (0)8025 99360

(2) V2527-A5 Now - Sale / Lease Fortress Investment Group Tom McFarland [email protected] +1 305-520-2349

(1) V2500-A1 Now - Sale Rising Sun Aviation Fred Van Acker [email protected] +1 214-906-5635

(1) V2533-A5 Now - Sale/Lease/Exch. Werner Aero Services Cliff Topham [email protected] +1-703-402-7430

(1) V2527-A5 Now - Lease Engine Lease Finance Joe Hussar [email protected] +1 617 828-3569

Royal Aero

( ) g j p @

(1) V2533-A5 Now - Sale / Lease

Description Contact Email Phone

A320 Fresh Part-out Now - Sale TrueAero, LLC Raul Miro/Dave Walters [email protected] +1 772-925-8026

A320 Landing Gear with Fresh Tags Now - Sale

737-500 Fresh Part-out Now - Sale

GTCP131-9A (2), GTCP131-9B(2) Now - Lease REVIMA APU Olivier Hy [email protected] +33(0)235563515

GTCP331-200, GTCP331-250 Now - Lease

APS500C14(3), APS1000C12(2), APS2000 Now - Lease

APS2300 APS3200(2) APS5000(2) N L

Aircraft and Engine Parts, Components and Misc. EquipmentCompany

APS2300, APS3200(2), APS5000(2) Now - Lease

PW901A(4), PW901C(2) Now - Sale / Lease

TSCP700-4E Now - Sale

Now - Lease Willis Lease Ann Lee [email protected] +1 (415) 408 4769

APU131-9B, APU 331-500B Now - Sale/Lease/Exch. Logix.Aero JC Morin [email protected] +33 647 824 262

Now - Sale / Lease Phoenix Aer Capital Bob Gallagher [email protected] +1 727-376-9292

Now - Sale / Lease Werner Aero Services Christopher Farrell [email protected] +1 201-661-6819

Now - Sale / Lease

Now – Lease Tradewinds Engine Serv. Brad Pleimann [email protected] +1 954 421 2510

Reliance Aircraft Terry Hix [email protected] +1 512-439-6988

GTCP36-300A (P/N 3800278-4)

737-800 NOSE LANDING GEAR PN 162A1100-5, OH - Now Sale

GTCP131-9A (P/N 3800708-1)

CFM56-5B/5C/7B and V2500-A5 engine stands

(1) APU GTCP331-200 and (2) APU APS 2000

APU GTCP 331-500B

Reliance Aircraft Terry Hix [email protected] +1 512-439-6988

PW901A, PW901C Now - Lease Lufthansa Technik AERO Alzey Kai Ebach [email protected] +49-6731-497-368

(1) CF34-8C - LPT Module Now - Sale

GTCP131-9B, PW901, (2) GTCP36-300, Now - Sale/Lease/Exch. Aeroturbine Rodney Lee [email protected] +1 972-813-1176

GTCP131-9A, (2) RE220RJ, GTCP331-350C, APS3200

737 800 NOSE LANDING GEAR PN 162A1100 5, OH Now Sale

November 9, 2015