Metro Nashville Investment Summary, Quarter Ending June 30 ... · Real Assets Composite 11.6 12.0...

Transcript of Metro Nashville Investment Summary, Quarter Ending June 30 ... · Real Assets Composite 11.6 12.0...

BOSTON | ATLANTA | CHARLOTTE | CHICAGO | DETROIT | LAS VEGAS | PORTLAND | SAN FRANCISCO

METROPOLITAN GOVERNMENT OF NASHVILLE AND DAVIDSON COUNTY

INVESTMENT SUMMARY

Quarter Ending June 30, 2019

Keith Stronkowsky, CFA, Senior Consultant

Metropolitan Government of Nashville and Davidson County

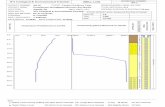

ASSET ALLOCATION VS. TARGET ALLOCATION

As of June 30, 2019Current

Allocation(%)

Policy(%)

_

Total Domestic Equity Composite 14.4 17.0International Equity Composite 11.5 16.0Equity Hedge Composite 6.2 7.0Fixed Income Composite 16.6 21.0Fixed Income Alternatives 19.2 15.0Real Assets Composite 11.6 12.0Private Equity Composite 19.3 12.0Alternative Segment 0.3 0.0Cash 1.0 0.0Total 100.0 100.0

As of June 30, 2018Current

Allocation(%)

Policy(%)

_

Total Domestic Equity Composite 15.7 17.0International Equity Composite 11.7 16.0Equity Hedge Composite 6.2 7.0Fixed Income Composite 17.5 21.0Fixed Income Alternatives 20.0 15.0Real Assets Composite 10.8 12.0Private Equity Composite 16.9 12.0Alternative Segment 0.2 0.0Cash 1.0 0.0Total 100.0 100.0

2 June 30, 2019

Metropolitan Government of Nashville and Davidson County

TOTAL RISK/RETURN

3 Years Ending June 30, 2019

Anlzd Ret Anlzd RetRk

Anlzd StdDev

Anlzd StdDev Rk

SharpeRatio Sharpe Rk

_

Total Composite 10.74% 3 3.52% 2 2.66 1

Policy Index 8.46% 66 6.51% 39 1.08 45

InvMetrics Public DB GrossMedian 8.85% -- 6.84% -- 1.07 --

XXXXX

5 Years Ending June 30, 2019

Anlzd Ret Anlzd RetRk

Anlzd StdDev

Anlzd StdDev Rk

SharpeRatio Sharpe Rk

_

Total Composite 7.72% 1 4.21% 3 1.63 1

Policy Index 5.95% 49 6.67% 39 0.76 41

InvMetrics Public DB Gross Median 5.90% -- 6.97% -- 0.72 --XXXXX

3 June 30, 2019

Metropolitan Government of Nashville and Davidson County

PLAN SPONSOR ASSET ALLOCATIONS

- Alternatives represent the Fixed Income Alternatives Allocation- Global ex-US Equity represents the International Equity Allocation

4 June 30, 2019

Metropolitan Government of Nashville and Davidson County

PUBLIC PLANS PEER GROUP RETURNS

5 June 30, 2019

Attribution Summary3 Years Ending June 30, 2019

Wtd.ActualReturn

Wtd. IndexReturn

ExcessReturn

SelectionEffect

AllocationEffect

InteractionEffects

TotalEffects

Total Domestic EquityComposite 16.4% 14.0% 2.3% 0.5% -0.3% -0.2% 0.0%

International EquityComposite 7.7% 9.4% -1.7% -0.3% 0.0% 0.0% -0.2%

Equity Hedge Composite 7.6% 6.8% 0.9% 0.1% 0.0% 0.0% 0.1%Fixed Income Composite 6.2% 2.3% 3.9% 0.8% 0.3% -0.2% 0.9%Fixed Income Alternatives 10.0% 7.6% 2.4% 0.4% -0.1% 0.1% 0.4%Real Assets Composite 8.8% 6.9% 1.9% 0.2% 0.0% 0.0% 0.2%Private Equity Composite 17.7% 12.3% 5.4% 0.5% 0.2% 0.3% 1.0%Alternative Segment 22.2% 1.4% 20.8% 0.0% 0.0% 0.0% 0.0%Cash 0.7% 1.4% -0.7% 0.0% -0.1% 0.0% -0.1%Total 10.8% 8.5% 2.3% 2.3% -0.1% 0.1% 2.3%

Metropolitan Government of Nashville and Davidson County

TOTAL FUND ATTRIBUTION ANALYSIS

6 June 30, 2019

Metropolitan Government of Nashville and Davidson County

COMPARATIVE PERFORMANCE

International Policy Index is 100% MSCI AC World ex USA

7 June 30, 2019

Metropolitan Government of Nashville and Davidson County

COMPARATIVE PERFORMANCE

Alternative Fixed Income benchmark was changed from LIBOR + 4% to the HY for the Fiscal Year starting 6/30/2015

8 June 30, 2019

Market Value($)

% ofPortfolio

3 Mo(%) Rank YTD

(%) Rank 1 Yr(%) Rank 3 Yrs

(%) Rank 5 Yrs(%) Rank 7 Yrs

(%) Rank 10 Yrs(%) Rank Inception

(%)Inception

Date_

Total Composite 3,353,952,585 100.00 3.22 46 7.20 98 9.32 2 10.74 3 7.72 1 10.06 3 10.66 3 8.66 Jul-91Policy Index 2.85 78 11.34 61 5.30 74 8.46 66 5.95 49 7.95 60 8.82 61 8.15 Jul-91

Over/Under 0.37 -4.14 4.02 2.28 1.77 2.11 1.84 0.51 Total Equity Composite 868,884,674 25.91 3.64 49 17.31 41 5.92 51 12.43 36 6.97 46 11.12 42 11.95 40 7.34 Apr-01

Total Domestic Equity Composite 483,606,308 14.42 4.24 54 20.17 38 8.09 51 16.36 28 11.39 25 14.90 24 15.32 30 8.38 Apr-01Russell 3000 4.10 56 18.71 50 8.98 45 14.02 45 10.19 37 13.79 39 14.67 42 7.66 Apr-01

Over/Under 0.14 1.46 -0.89 2.34 1.20 1.11 0.65 0.72 Large Cap Equity Composite 240,520,907 7.17 5.30 27 21.04 23 8.69 53 16.62 23 11.69 25 15.09 24 15.15 32 7.31 Jul-91

S&P 500 4.30 49 18.54 45 10.42 40 14.19 42 10.71 38 13.98 42 14.70 42 9.90 Jul-91Over/Under 1.00 2.50 -1.73 2.43 0.98 1.11 0.45 -2.59

Mid Cap Equity Composite 110,472,496 3.29 3.29 68 20.75 46 15.97 16 18.86 14 14.00 7 16.84 6 17.13 13 7.92 Jan-08Russell MidCap 4.13 54 21.35 43 7.82 48 12.16 55 8.63 52 13.37 54 15.16 51 8.81 Jan-08

Over/Under -0.84 -0.60 8.15 6.70 5.37 3.47 1.97 -0.89 Small Cap Equity Composite 132,612,906 3.95 3.02 48 18.15 43 1.20 34 13.96 34 8.83 38 13.27 40 14.70 50 11.18 Jul-91

Russell 2000 2.10 63 16.98 52 -3.31 57 12.30 48 7.06 57 11.63 70 13.45 77 9.82 Jul-91Over/Under 0.92 1.17 4.51 1.66 1.77 1.64 1.25 1.36

International Equity Composite 385,278,366 11.49 2.88 64 13.71 64 2.97 24 7.69 88 1.30 88 5.94 91 6.93 87 7.61 Jul-93International Equity Policy Index 2.98 60 13.60 64 1.29 43 9.39 66 2.16 83 6.36 85 6.54 89 5.51 Jul-93

Over/Under -0.10 0.11 1.68 -1.70 -0.86 -0.42 0.39 2.10 Equity Hedge Composite 206,443,757 6.16 2.08 -- 9.82 -- -0.04 -- 7.62 -- 4.54 -- 7.02 -- -- -- 5.51 Jul-11

HFRI Equity Hedge (Total) Index 1.56 -- 9.26 -- 0.29 -- 6.77 -- 3.42 -- 5.67 -- 5.37 -- 3.92 Jul-11Over/Under 0.52 0.56 -0.33 0.85 1.12 1.35 1.59

Fixed Income Composite 555,609,774 16.57 2.57 49 6.10 48 7.13 47 6.21 14 4.98 17 4.85 27 6.30 30 6.28 Aug-91BBgBarc US Aggregate TR 3.08 33 6.11 48 7.87 37 2.31 68 2.95 60 2.62 65 3.90 62 5.73 Aug-91

Over/Under -0.51 -0.01 -0.74 3.90 2.03 2.23 2.40 0.55 Fixed Income Alternatives 644,767,403 19.22 2.16 75 1.34 99 10.31 1 9.96 3 7.71 1 11.27 1 14.91 1 16.86 Jan-09

Fixed Income Alternatives Policy Index 2.58 52 10.16 39 7.62 45 7.55 40 5.28 19 4.97 90 4.76 99 4.75 Jan-09Over/Under -0.42 -8.82 2.69 2.41 2.43 6.30 10.15 12.11

Total Distressed Composite 220,949,150 6.59 1.85 -- 1.70 -- 7.51 -- 9.12 -- 7.35 -- 11.89 -- 15.40 -- 17.33 Jan-09ICE BofAML US High Yield TR 2.58 -- 10.16 -- 7.62 -- 7.55 -- 4.70 -- 6.38 -- 9.22 -- 11.47 Jan-09

Over/Under -0.73 -8.46 -0.11 1.57 2.65 5.51 6.18 5.86 Income Strategies 423,818,253 12.64 2.34 -- 1.13 -- 11.94 -- 10.48 -- 7.97 -- 9.42 -- -- -- 9.51 May-11

Metropolitan Government of Nashville and Davidson County

COMPOSITE ASSET ALLOCATION & PERFORMANCE

Returns are gross of fees.

9 June 30, 2019

Market Value($)

% ofPortfolio

3 Mo(%) Rank YTD

(%) Rank 1 Yr(%) Rank 3 Yrs

(%) Rank 5 Yrs(%) Rank 7 Yrs

(%) Rank 10 Yrs(%) Rank Inception

(%)Inception

Date_

Real Assets Composite 389,018,528 11.60 1.97 -- -0.58 -- 6.80 -- 8.80 -- 8.59 -- 10.15 -- 8.26 -- 7.22 Jul-01NCREIF Property Index 1.51 -- 3.34 -- 6.50 -- 6.89 -- 8.83 -- 9.43 -- 9.25 -- 8.57 Jul-01

Over/Under 0.46 -3.92 0.30 1.91 -0.24 0.72 -0.99 -1.35 Real Estate Composite 280,981,806 8.38 2.48 -- 4.34 -- 13.13 -- 11.31 -- 12.03 -- 12.96 -- 10.54 -- 8.47 Jul-01

NCREIF Property Index 1.51 -- 3.34 -- 6.50 -- 6.89 -- 8.83 -- 9.43 -- 9.25 -- 8.57 Jul-01Over/Under 0.97 1.00 6.63 4.42 3.20 3.53 1.29 -0.10

Infrastructure Composite 30,207,480 0.90 7.09 -- 5.32 -- 9.14 -- 0.22 -- 4.38 -- 5.64 -- 5.44 -- 5.44 Jul-09Private Energy Composite 77,829,243 2.32 -1.37 -- -15.85 -- -10.87 -- 6.77 -- -0.92 -- -- -- -- -- 3.38 Sep-12

Private Equity Composite 646,787,584 19.28 5.48 -- 5.82 -- 21.17 -- 17.73 -- 15.96 -- 15.93 -- 15.60 -- 11.98 Oct-01Russell 2000 2.10 -- 16.98 -- -3.31 -- 12.30 -- 7.06 -- 11.63 -- 13.45 -- 9.37 Oct-01

Over/Under 3.38 -11.16 24.48 5.43 8.90 4.30 2.15 2.61 Alternative Segment 9,060,432 0.27 5.97 -- 12.59 -- 52.78 -- 22.20 -- 16.40 -- 12.08 -- 19.45 -- 19.45 Jul-09Cash 33,380,433 1.00 1.52 -- 2.49 -- 2.70 -- 0.70 -- 0.28 -- 0.36 -- 5.52 -- 5.52 Jul-09

FTSE T-Bill 3 Months TR 0.61 -- 1.21 -- 2.29 -- 1.36 -- 0.84 -- 0.62 -- 0.46 -- 0.46 Jul-09Over/Under 0.91 1.28 0.41 -0.66 -0.56 -0.26 5.06 5.06

XXXXX

Metropolitan Government of Nashville and Davidson County

COMPOSITE ASSET ALLOCATION & PERFORMANCE

Returns are gross of fees.

10 June 30, 2019

Metropolitan Government of Nashville and Davidson County

TARGET POLICY INDEX HISTORICAL COMPOSITION

11 June 30, 2019

Metropolitan Government of Nashville and Davidson County

TARGET POLICY INDEX HISTORICAL COMPOSITION

12 June 30, 2019

Metropolitan Government of Nashville and Davidson County

HISTORICAL HYBRID COMPOSITION

13 June 30, 2019

Metropolitan Government of Nashville and Davidson County

GLOSSARY

14 June 30, 2019

Metropolitan Government of Nashville and Davidson County

GLOSSARY

15 June 30, 2019

Information Disclaimer

• Past performance is no guarantee of future results.

• All investments carry some level of risk. Diversification and other asset allocation techniques are not guaranteed to ensure profit or protect against losses.

• NEPC’s source for portfolio pricing, calculation of accruals, and transaction information is the plan’s custodian bank. Information on market indices and security characteristics is received from other sources external to NEPC. While NEPC has exercised reasonable professional care in preparing this report, we cannot guarantee the accuracy of all source information contained within.

• Some index returns displayed in this report or used in calculation of a policy, allocation or custom benchmark may be preliminary and subject to change.

• This report is provided as a management aid for the client’s internal use only. Information contained in this report does not constitute a recommendation by NEPC.

• This report may contain confidential or proprietary information and may not be copied or redistributed to any party not legally entitled to receive it.

Reporting Methodology

• The client’s custodian bank is NEPC’s preferred data source unless otherwise directed. NEPC generally reconciles custodian data to manager data. If the custodian cannot provide accurate data, manager data may be used.

• Trailing time period returns are determined by geometrically linking the holding period returns, from the first full month after inception to the report date. Rates of return are annualized when the time period is longer than a year. Performance is presented gross and/or net of manager fees as indicated on each page.

• For managers funded in the middle of a month, the “since inception” return will start with the first full month, although actual inception dates and cash flows are taken into account in all Composite calculations.

• This report may contain forward-looking statements that are based on NEPC’s estimates, opinions and beliefs, but NEPC cannot guarantee that any plan will achieve its targeted return or meet other goals.

16 June 30, 2019