MERGERS AND ACQUISITIONS page 1 SPECIAL FEATURE ... · and autographed baseballs. Why the big push...

Transcript of MERGERS AND ACQUISITIONS page 1 SPECIAL FEATURE ... · and autographed baseballs. Why the big push...

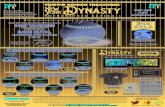

MERGERS AND ACQUISITIONS M&A Auctions: Are You Ready to Sell Your

Company on eBay? page 1

SPECIAL FEATURE: INTELLECTUAL PROPERTY Know It, Own It, Use It: Auditing Your IP

page 5

Giving Patents a Second Look: Inter Partes Reexamination and Patent Litigation Strategy

page 8

An Overview of Trade Secret Protection page 11

FIRM NEWS page 12

EMINENT DOMAIN The Supreme Court and Eminent Domain:

A Backlash Over Kelo page 17

CORPORATE FINANCE Issuers Must Be Aware of New SEC Rules

page 202005

BURTON AWARD

BEST LAW FIRM PUBLICATION

W W W . F A E G R E . C O M

MINNESOTA l COLORADO l IOWA l ENGLAND l GERMANY l CHINA

TRENDS® is published bi-monthly by the law firm of Faegre & Benson LLP. Further details are necessary for a complete understanding of the subjects covered by this newsletter. For this reason, the specific advice of legal counsel is recommended before acting on any matter discussed within.

For the latest legal news, or copies of any article in this newsletter, visit Faegre & Benson online at www.faegre.com. For address and other changes, contact [email protected].

© 2005 Faegre & Benson LLP, All Rights Reserved.

UNITED STATES I ENGLAND I GERMANY I CHINA

WWW.FAEGRE.COM

For cross-border disputes, you need highly knowledgeable legal counsel with global experience. The lawyers at Faegre & Benson have significant experience handling complex international arbitrations around the world.

For more information, please contact Walter Duffy in Minneapolis at

612-766-8412, or Roger Hopkins in London at 011-44-20-7450-7550.

International Arbitration

GLOBAL DISPUTE RESOLUTION

1

Auctions seem to have taken over the world of middle market mergers and acquisitions in recent years. It’s enough to make you wonder if eBay will soon advertise “slightly used high tech company/one owner/mint condition” along with its roster of books, appliances, and autographed baseballs.

Why the big push for M&A auctions? First, sellers are becoming increasingly sophisticated and investment bankers are increasingly targeting the middle market. But perhaps more important is the fact that there are simply lots of buyers competing for deals. Strategic buyers have strong balance sheets to back up their appetite for acquisitions. Private equity buyers have lots of equity capital and willing lenders.

Like other auctions, M&A auctions usually work best with many qualified, interested bidders vying for a desirable asset. But is an auction the right way for you to sell your company? That’s a complicated question, and in this article, we’ll help you answer it. We will first describe the M&A auction process. Then we will describe some of the pluses and minuses of an M&A auction for sellers.

The M&A Auction ProcessIn General. How does it work? In an M&A auction, the selling company hires a financial adviser (usually an investment banker) to design and orchestrate the sale process.

With the seller’s input, the financial adviser develops a list of potential buyers who can be expected to create a competitive process through various bidding stages. Generally the process takes anywhere from four to seven months from hiring a financial adviser to closing the deal (sometimes longer depending on regulatory issues or the buyer’s closing requirements).

Hiring a Financial Adviser. Hiring a financial adviser is the first critical step in the M&A auction process. We always recommend talking to multiple potential advisers. Ask especially about the adviser’s contacts in your company’s industry. Investigate the adviser’s track record and reputation, and check references (keeping in mind that this is challenging while trying to maintain confidentiality). When your adviser calls a potential buyer about your company, you need to be sure the call is answered.

Fees for financial advisers vary greatly. Financia l advisers are usually pa id as a percentage of the total sale price, customarily ranging between .5% and 1.0% for larger deals to 3% or higher for smaller deals. Sometimes a flat fee is used instead. But an adviser’s fee is always very specific to the company and the deal, and there is no particular percentage or fee that makes sense based simply on the anticipated sale price. Interviewing multiple financial

M&A Auctions: Are You Ready to Sell Your Company on eBay?

TRENDS® November 2005

ww

w.faegre.com

mergers &

acquisitions

cont inued

By Bruce Engler and Keith Radtke

Bruce Engler is the head of the firm’s national mergers and acquisitions practice. Keith Radtke is a partner practicing in corporate and M&A law. They may be reached at [email protected] or [email protected].

TRENDS® November 2005

ww

w.faegre.com

advisers for your deal is the only way to confirm you are paying an appropriate fee.

The Book. In a typical auction process, the company and financial adviser will prepare a selling memorandum (known as “the book”). This is a selling document that describes the company, its industry, its financial performance and prospects, etc.

The Data Room. Every auction involves due diligence, usually conducted through a “data room,” which is a comprehensive collection of important documents, contracts and reports relating to the company’s business and finances, corporate history and structure, ownership, taxes, employee benefit plans, material commitments, environmental and regulatory matters, etc.

Until a few years ago, the data room was typically a physical site. More recently, however, “virtual” data rooms, which are maintained online by outside providers (such as financial printers), have become common. Virtual data rooms have many advantages if appropriate security measures are in place, and they are relatively inexpensive as deal costs go (perhaps $15,000 to $30,000 for an average deal).

The Bidders. With the company’s input, the financial adviser develops a list of potential buyers and contacts them. If a potential buyer is interested and signs a confidentiality agreement, then it receives the book. The number of potential buyers contacted can range from a handful to more than 100.

The Bidding. Most M&A auctions involve at least two rounds of bidding. In the first round, bidders submit a non-binding “initial indication of interest,” which is usually a range of purchase prices based on available information. Bidders at this stage will also usually indicate whether they need to finance a deal, and, if so, provide some information about financing sources.

After receiving initial indications of interest, the company and its adviser select bidders for the next round. Qualifying bidders are allowed to conduct more extensive due diligence and to receive a presentation

from company management (if not already provided). Bidders are then asked to submit a non-binding “definitive” bid, as well as further details about financing, timing, and any further approvals required to close the deal. Comments to a draft purchase agreement will likely be required with this bid, as discussed below.

Following this second round, the seller will usually choose a single bidder for final, detailed negotiations over a very short period of time and (the seller hopes) a successful closing. Due to the effort and expense associated with proceeding further, the winning bidder will usually require an “exclusivity” agreement, which precludes the company from dealing with other potential buyers for a limited time. Depending on negotiating leverage, this period will usually last 30 - 45 days, but is often later extended, especially in a financed deal, if satisfactory progress is being made.

The Purchase Agreement. Usually, at some point in the auction process (typically the “definitive bid” stage), bidders will be asked to provide a markup of a purchase agreement prepared by seller’s counsel. In rare cases, bidders may be asked to submit their own draft purchase agreement (which we usually consider a mistake for a seller). The markup of the purchase agreement will reveal many important details of the bidder’s proposed deal. Also, by sending out the same draft purchase agreement to all bidders, the seller is better able to compare proposed contract terms on an apples-to-apples basis (instead of receiving a completely different purchase agreement from each bidder).

Some Variations. Under the right circumstances, sellers may be able to change the typical auction process to their advantage. For example:

Single Stage Auction. In this scenario, a few potential bidders conduct extensive due diligence, mark up a draft purchase agreement, and submit definitive bids. Some further negotiation on price and other terms may occur, and then a winning bidder is selected for final negotiations and

2

TRENDS® November 2005

ww

w.faegre.com

closing. This single-stage process conserves time and energy.

Maintaining Two Active Bidders. To minimize the risk of a winning bidder trying to renegotiate the deal, financial advisers sometimes try to keep two bidders active until a definitive purchase agreement is signed. (The loser’s out-of-pocket expenses are often reimbursed.) In our experience, this format is often discussed but rarely used. Even with expenses covered, the two bidders often feel that the additional due diligence and negotiations aren’t worth the time and effort without exclusivity.

Negot ia t ing P urch a se P r i c e L a s t . Experienced dealmakers know the devil is in the details and the purchase price is only the beginning of M&A deal negotiations. As a result, some sellers require bidders to negotiate a full purchase agreement and all ancillary documents before the bidders submit a purchase price. By doing this, sellers have all the other details worked out before accepting a bid and can move rapidly toward closing. It also precludes bidders from using a better purchase price to negotiate more favorable terms.

3

This process tends to work best in large transactions with a hot property. The transaction costs (legal, accounting, consultants, etc.) in this process are higher for both bidders and seller because of multiple negotiations. But, especially with large, competitive transactions, where the demand is high and transaction expenses are less important, this procedure can work very well for a seller. For example, Faegre & Benson recently represented Target Corporation in the sale of Marshall Field’s and Mervyn’s using this process in deals in which the ultimate purchase prices were $3.2 billion and $1.7 billion, respectively.

Pluses and Minuses of M&A AuctionsIntuitively, most sellers think an M&A auction will fetch the best price. That may or may not be true. Other considerations may also come into play that make an auction less desirable. M&A auctions involve trade- offs, which means that an auction may not be right for your company.

Based on our experience, here are some of the pluses and minuses of the M&A auction process for sellers.

Pluses

+ Ma ximize Pr i ce – under idea l circumstances, maximizes the sale price due to increased competition.

+ Negotiating Leverage – facilitates negotiation of key terms (in addition to purchase price) at a time when the seller has numerous options and greater leverage.

+ Deal Momentum/Sense of Urgency - creates a specific timetable and momentum for the transaction, and a sense of urgency for the buyer, which may increase the likelihood that the deal will close.

+ Third Party Validation – helps to validate the purchase price and other transaction terms, which is particularly valuable when the company has shareholders who are not involved in

mergers &

acquisitions

cont inued

4 TRENDS® November 2005

ww

w.faegre.com

negotiating the transaction but will be asked to approve the deal.

+ Unlikely Buyers – increases the likelihood that unlikely buyers will be uncovered through the process.

Minuses

- Risk of a Failed Transaction – a company may be seen as damaged goods if the auction process becomes known and no acceptable offer is received, or if a winning bidder later backs out.

- Deal Confidentiality – auctions are very difficult to keep secret, which can adversely affect employees, customers and suppliers, among others.

- P r o p r i e t a r y I n f o r m a t i o n C o n f i d e n t i a l i t y – d e s p i t e conf identiality agreements, it is very diff icult to adequately protect sensitive proprietary or other confidential information (for example, financial results).

- Complex Deals Are Tough – it’s tough enough to get bidders to spend time on a relatively straightforward auction. If your story or business is complicated, think twice. Auctions work best with a large number of prospects who think they understand the situation.

- A Bird in the Hand – sometimes the pressure of a possible auction is enough to get a great result from an interested, motivated buyer without an actual auction process. In many cases, a financial adviser can tell you whether the offered price is within a reasonable range based on financial analyses and comparisons, without running an auction process. Under the right circumstances, why jeopardize a bird in the hand for a few in the bush?

- Demanding Process – a full-blown M&A auction is a very intense process that is undertaken while management is still responsible for running the business. It’s a major distraction and can even cause a downturn in your business (at the worst possible time).

- Reluctance of Certain Buyers - certain logical buyers may refuse to participate in an auction and will only negotiate one-on-one. You may lose these buyers in an auction process.

So is an M&A auction right for you? We can tell you with great confidence that ... it depends. You need to weigh carefully the pluses and minuses in the context of your specific situation. An M&A auction will never be as easy as selling on eBay. Depending upon the circumstances, conducting your company sale by auction may or may not be the right decision – you need to understand and accept the trade-offs.

5cont inued

intellectual property

4 TRENDS® November 2005

ww

w.faegre.com

Know It, Own It, Use It: Auditing Your IPBy Jon Asner

Jon Asner counsels businesses on intellectual property protection and technology law. He may be reached at [email protected]

Some estimates suggest that intellectual property today represents anywhere from one-half to two-thirds of the value of all corporate assets. Whether it’s brand equity, trade secrets, proprietary software, patented technology, or innovative methods of doing business, most companies rely on IP assets for at least part of their competitive advantage.

Because IP rights are intangible, however, many companies don’t know what they have, what it’s worth, or even whether they truly own or have protected their “crown jewels.”

Sound crazy? Think about your fresh new corporate logo. Did you get a written copyright assignment from the design firm that created it? If not, chances are, they own the copyrights to the work, not you. How about the consultants that helped you redesign your online fulfillment system – did they sign confidentiality agreements? If not, your trade secret may not be secret anymore. They may be sharing it with your competitors right now.

You’re not alone. Many companies often misunderstand what is required to obtain, maintain, protect and exploit their intellectual property rights or to avoid violating the intellectual property rights of others.

The answer? Often the first step is an intellectual property audit.

Intellectual Property Related Risks. The laws governing intellectual property rights,

including patent, copyright, trademark and trade secret rights, are often complex and counterintuitive. Failing to understand these laws increases the likelihood of lost value and lost opportunities to capture value. If you didn’t obtain a written assignment of intellectual property rights from a third party software developer, for example, you may not own the rights to the custom developed software that you paid tens or even hundreds of thousands of dollars for and that now forms the basis of a significant part of your business. This probably isn’t something that you would like to learn about for the first time in the middle of selling your business or suing a competitor for copyright infringement.

These issues go both ways. A loose approach to IP also increases the risk of violating the intellectual property rights of others and incurring significant liability. Damages in intellectual property cases can be very large – sometimes hundreds of millions of dollars. Injunctions are often available as another remedy in IP cases. Injunctions have the potential to inflict even more pain than a damage award in certain circumstances. For example, an injunction could prevent your company from selling a key product if it is found to infringe another party’s patent.

Benefits of Intellectual Property Audits. An intellectual property audit can help you get your intellectual property house in order and reduce the likelihood of losing IP value yourself or exposing yourself

TRENDS® November 2005

ww

w.faegre.com

6

to liability for infringement. Depending on the scope and nature of the audit, intellectual property audits have a number of potential benefits:

• Determining whether intellectual property policies and procedures are appropriate for supporting the company’s intellectual property strategy

• U n d e r s t a n d i n g w h e t h e r c o r e technologies, products and services are adequately protected

• Improving the process for selecting the most appropriate modes of intellectual property protection

• Enhancing the efficiency and cost-effectiveness of intellectual property protection efforts by helping to focus expenditures (including R&D and legal budgets) based on value, need and return on investment

• Gaining a better understanding of the scope of the IP rights of competitors

• Being better prepared in the event of a sale of a division, subsidiary, select intellectual property assets or even the entire company

• Being better prepared in the event of an acquisition

• Increasing employee awareness of potential intellectual property risks and decreasing the likelihood of liability

• Improving intel lectual property-related internal controls to help bolster Sarbanes-Oxley compliance efforts

Components of Intellectual Property Audits. Although the term “audit” is commonly used, intellectual property audits are quite different from financial audits and do not have formally established procedures and protocols. Rather, the scope and nature of intellectual property audits vary widely. Intellectual property audits usually involve one or more of the following core components: (1) a policy review; (2) a procedure review; and (3) an asset review.

A policy review is the most basic component of an intellectual property audit. A policy review involves evaluating a company’s written policies to generate, identify, evaluate, capture, perfect and protect its intellectual property assets, as well as avoid infringing on the rights of others. Thus, a policy review may include a review of employee handbooks, invention disclosure policies, trademark clearance policies, software usage policies and other similar types of policies. A policy review may also encompass a review of form intellectual property related agreements (e.g., employee agreements, consulting agreements, confidentiality agreements, etc.). Because IP policies and agreements form an essential part of the foundation on which a company’s IP assets are built, a policy review can help you maintain and strengthen your overall IP efforts.

A procedure review focuses on examining a company’s actual practices and procedures and determining whether the reality of how you do business complies with your company’s policies. Some form of procedure review can be very useful in connection with a policy review because it will help your counsel and business people make better recommendations for improving policies by taking into account current business realities, practices and compliance challenges. Moreover, a procedure review can be a worthwhile investment because it can help provide an early warning of potential areas of risk and thus an opportunity to mitigate such risks before they become real headaches.

An asset review is a substantive evaluation of certain intellectual property assets. An asset review might include one or more of the following: (1) an inventory of intellectual property assets; (2) a review to confirm ownership of intellectual property assets; (3) an assessment of the scope of intellectual property rights; (4) an assessment of the degree to which a company’s intellectual property rights protect the company’s core technologies and products; (5) an

TRENDS® November 2005

ww

w.faegre.com

7

intellectual property

assessment of the scope of competitors’ intellectual property rights; (6) a review of key intellectual property related agreements; (7) valuation of intellectual property assets (through engagement of an accounting or valuation firm); and (8) development of an intellectual property strategy in light of the analysis. As with the other IP audit components, the scope of an asset review can be very broad (covering an entire company or division) or very narrow (limited to a particular product, patent or trademark) or somewhere in between.

Scope of the Audit. The initial phase of an intellectual property audit often relates to determining the appropriate scope of the audit. For some companies, a high level policy review may make the most sense when taking into account the associated costs and likely benefits. For others, an in-depth asset review on a particular product line may be more valuable when coupled with a focused policy review and procedure review.

Determining the appropriate scope of the audit should involve a dialogue between key individuals within the company and its legal counsel. These individuals likely will come from a number of departments, such as legal, finance, IT, human resources, marketing and research and development. The ultimate scope should involve consideration of a number of factors, including the nature of the business, the key risks faced by the business, the operational objectives of the business, the likely cost, the size of the business and the maturity level of the company’s intellectual property program.

The Roadmap. Typically, an intellectual property audit will result in a written report detailing counsel’s findings and recommendations. Thus, while intellectual property audits are useful tools to help companies begin to understand the state of their intellectual property protection efforts, intellectual property audits should not be viewed as ends in themselves. Rather, such audits provide a roadmap to guide a company’s efforts to improve its intellectual property protection efforts over time.

“Thus, while intellectual property audits are useful tools to help companies begin to understand the state of their intellectual property protection efforts, intellectual property audits should not be viewed as ends in themselves.”

TRENDS® November 2005

ww

w.faegre.com

8

Businesses that face a l legations of infringement of U.S. patents often try to turn the tables on their accusers by alleging that the asserted patents are invalid and should never have been issued by the Patent Office. Until recently, they usually challenged the validity of the patents in court, letting a judge or jury weigh the patentability of often-complex technology. Less frequently, because of procedural shortcomings, they may have asked the United States Patent and Trademark Office (PTO) to reconsider whether the patents are valid using a process called ex parte reexamination (“EPR”).

Due to recent changes in the law, however, a new way to challenge patents known as “inter partes reexamination” (IPR) is gaining popularity. Unlike EPR, a third party may not only request that the PTO reconsider the validity of a patent, but also may have a voice throughout this PTO process. Consequently, the third party requestor can participate on a more level playing field during IPR as compared to EPR.

But IPR carries substantial risks. Third party requestors need to choose their legal teams and arguments carefully, to evaluate not only the argument with the best hope of prevailing before the PTO, but also the potential impact on future litigation if the patent withstands the challenge.

How It WorksBoth IPR and EPR allow a third party (called the “third party requestor”) to request that the PTO reconsider the validity of a patent based on submitted “prior art” evidence, in the form of printed publications, such as patents, published patent applications, journal articles, and product brochures, that raises a substantial new question of patentability. Although IPR has been around since 1999,the original estoppel penalties of the process were so limiting on the defendant’s options in future patent litigation that few businesses pursued the new approach. However, the law was further tweaked in 2002 to limit the estoppel provisions, resulting in a steady increase in the number of businesses challenging patents via IPR.

“Inter partes” means that a third party has a say throughout the process. This is in contrast to ex parte reexamination, which, as its name implies, involves ongoing communication only between the patent holder and the PTO. Though the third party can request ex parte reexamination and make its arguments in the initial request, the PTO will only communicate with and listen to arguments from the patent holder after receiving the request. A patent holder can also initiate EPR if it unearths printed publication prior art that

Giving Patents a Second Look: Inter Partes Reexamination and Patent Litigation Strategy

By Bill Weimer, Bill Roberts, and John Crimmins

Bil l Weimer and John Crimmins are patent prosecutors, and Bill Roberts is a patent litigator, at Faegre & Benson. They may be reached at [email protected] om, j c r immins @ fae g re .c om, and [email protected].

The firm handled approximately ten percent of inter partes reexaminations filed during 2004.

TRENDS® November 2005

ww

w.faegre.com

intellectual property

9

could undermine the validity of its patent, in the hope of receiving a ruling from the PTO that re-validates one or more of the claims of its patent. Whether initiated by the third party requestor or the patent holder, the ex parte nature of the EPR process provides the patent holder with a distinct advantage, and the patent holder is often in a stronger position to enforce its patent in court at the completion of the EPR process.

In IPR, however, a third party that has identified published prior art that it believes raises a substantial new question about the patentability of an existing patent can not only request reexamination by the PTO but also participate in the process. If the PTO agrees to a reexamination, the third party can offer its own interpretation of the importance of published prior art, and provide affidavits from people with expertise in the area covered by the patent, in order to respond to and refute arguments by the patent holder.

IPR only applies to patents issued from a U.S. application filed on or after November 29, 1999. But otherwise, there is no time restriction on IPR challenges.

AdvantagesFor a third party who has been accused, is under threat, or has serious concerns regarding a claim of patent infringement, IPR offers a number of potential legal and practical advantages over both litigation and EPR.

First, IPR gives a third party requestor a better chance to bring about a determination that the patent is invalid than with EPR. When a third party has a significant stake in this determination, it will put significant time and resources into finding and carefully explaining important printed publication-type prior art – time and resources a PTO examiner does not have during either the original examination process or a reexamination process.

Second, if a third party request for IPR is granted early in the litigation process, a judge is likely to stay the litigation pending the outcome of the PTO’s review. This can

buy a defendant months or years in which to re-work or evolve its technology, if it so chooses. While a stay does not insulate a defendant from continuing liability for damages, the defendant often considers a stay desirable in patent litigation, as it allows the defendant to remain in the market with its accused product for this time, unenjoined, if it so chooses.

In addition, the reexamination process can offer clues regarding the patent holder’s strategy, which can be useful even if some or all of the patent claims are upheld and the dispute winds up back in court. Defendants often fight long and hard in litigation to identify precisely how the plaintiffs have defined their claims, though the patent holder will often hold its cards very close until required to take claim construction positions in a brief (e.g., for the Markman hearing). The IPR process often forces the plaintiff’s hand by requiring it to adopt a position regarding the meaning and scope of its patent claims in order to respond to the challenge.

In order to preserve its patent, the patent holder may be compelled to argue for a narrow construction of its claims or even to narrow its claims by amendment to get around prior art identified by the competitor. These narrowing processes may open a window for the third party to avoid infringement. Similarly, patent holders are under a duty of candor to disclose any relevant prior art during the IPR process ( just as they were during the original examination that led to the patent). The patent holder’s behavior at this stage may provide ammunition for the defendants in any eventual litigation to argue “inequitable conduct” – that the patent holder wasn’t candid or withheld material prior art from the PTO.

Finally, if a challenger wins during the IPR and invalidates the patent, they’ve achieved their goals with significantly less time and cost than would be typical in full-scale litigation, and with less intrusiveness on the daily operations of the business.

cont inued

TRENDS® November 2005

ww

w.faegre.com

10

DisadvantagesBut IPR is no panacea. A defendant that loses in IPR sometimes faces a steeper burden when the dispute winds up back in court.

First, the plaintiff can then go into court and note that its patent has been upheld under another examination by the PTO, which may make it harder for the defendant to challenge the patent’s validity. The plaintiff also has the opportunity during IPR to amend patent claims in a manner that distinguishes the patent from the prior art while still preserving an infringement position. In contrast, the plaintiff has no opportunity to amend patent claims during litigation.

As mentioned earlier, a request for IPR can only be based on printed publication-type prior art and not on non-written forms of prior art such as existing product sales. Furthermore, after IPR, the defendant is generally estopped from relying in litigation entirely on printed publications that the third party submitted or could have submitted as part of its request for IPR. This may tie the defendant’s hands in terms of strategy.

Finally, the IPR process requires the third party to take a position regarding the meaning and scope of the patent claims, and can tempt the third party to argue for a relatively broad claim scope in order to get the claims invalidated by the prior art. But if that tactic is taken and fails, it may wind up being used against the third party during the infringement analysis in litigation, when the third party often argues against a broad claim scope to avoid infringement.

Keys to SuccessAs a result, the decision whether to pursue IPR and how to frame the legal strategy must be part of a careful analysis of the risks and opportunities.

This starts with the right legal team. IPR generally involves a combination of patent litigation experts and patent prosecutors. While IPR is a litigious exercise, the skills of the prosecutor are needed to frame the argument in a way that is most likely to resonate with the PTO examiners. But patent prosecutors aren’t usually experts in litigation, and so the arguments also must be made in the context of a litigation analysis, to make sure that the IPR process does not undermine the defendant’s eventual chances in court.

What to offer and not offer during IPR also involves a sophisticated strategic decision. Given the estoppel provisions, some businesses seek to throw every bit of published prior art they can find at the PTO and hope that something sticks. But the PTO may assess this as a kitchen-sink argument that masks an underlying weakness in the challenge. As a result, prosecutors often recommend emphasizing the prior art that makes the best case with the PTO, even though it may mean leaving out material that won’t be admissible in later court action.

Experienced litigators can often find alternative arguments that rely on material beyond printed publications, of course. Given that IPR only involves printed publication-type prior art, a litigator may successfully argue for invalidity based on compelling public use, on-sale, and other non-printed publication prior art – material that the defendant was prohibited from bringing up during the IPR. In considering an invalidity argument based on such art, the judge or jury would not feel that they are being asked to second-guess the PTO.

Nonetheless, these aren’t decisions that can be easily made after the IPR process. The best time to evaluate the pros and cons of IPR is at the outset of the dispute or even before a dispute arises, with input from experienced litigators and prosecutors. In those circumstances, a business can best weigh the merits of challenging a patent back where it started – in the PTO – and not just in court.

TRENDS® November 2005

ww

w.faegre.com

11

intellectual property

An Overview of Trade Secret Protection

By Randy Kahnke and Kerry Bundy

Randy Kahnke and Kerry Bundy represent clients in complex commercial and intellectual property litigation and dispute resolution. They may be reached at [email protected] or [email protected].

cont inued on page 15

Can you keep a secret?That’s the challenge for intellectual property owners who rely on trade secret protection to secure their sensitive business assets. Unlike patents, most copyrighted works, and trademarks – which must be publicly disclosed in order to seek recourse from competitors who want to steal them – trade secrets have legal value only to the extent that they stay secret.

File a patent on a new chemical or drug, and you can enjoy exclusive legal rights for about 20 years (often less in practical market terms). As long as you keep trade secrets away from prying eyes, however, they last forever. The trade-off? Once they’re out, they’re gone. A no-longer-secret trade secret enjoys essentially no legal protection under trade secret laws.

Just about anything can qualify as a trade secret – formulae, computer programs, business methods, database information, customer lists – basically, any knowledge that has economic value because people such as competitors don’t know about it and could profit from it if they did. It doesn’t necessarily have to be new, different, or unique, as you would expect from patented material and/or even fixed in a tangible form, as with copyrighted works. As long as the information has value because no one else knows about it – and you take reasonable efforts to avoid disclosure – it can qualify as a trade secret.

Pros and ConsNot surprisingly, there are advantages and disadvantages to using trade secret protection to secure different types of business assets. Deciding whether to patent certain technology – or keep it under wraps as a trade secret – is often a tough strategic call. Usually, the decision rests on the type of information that needs to be protected.

Most intellectual property owners find the indefinite time limit of trade secret protection appealing, assuming that the information can be maintained in confidence and not easily replicated in the market. For example, say that the knowledge you wish to protect is a manufacturing process. If you patent the process, you get protection for about twenty years. Even though your competitors know exactly what you’re doing, they can’t copy your process. When your patent expires, however, it’s open season on that technology.

By contrast, if you rely on trade secret protection to secure your process, your protection lasts forever, as long as the process remains secret. However, if a competitor is able to replicate the process (without stealing your information), such as through reverse engineering, they’re free to do so at any time, and there is usually little or nothing you can do about it.

TRENDS® November 2005

ww

w.faegre.com

12

firm news

On Thursday, September 29, the firm hosted 330 women for the fourth annual Women, Wine & Wardrobe event in Minneapolis at Windows on Minnesota in the IDS Center. The event brought together lawyers, clients, judges, and friends from the Twin Cities business

community for an evening of socializing, food, and fashion for a good cause. This year, the event featured fashions from merchants at the Galleria and a broad wine selection from Surdyk’s. The 2005 gathering continued to build the event’s prominence in the Twin Cities, drawing an additional 100 women more than last year’s program.

Each year, Women, Wine & Wardrobe showcases and supports women’s causes. This year’s charitable partner was the Jeremiah Program which assists low-

income mothers with children to complete their educations and achieve economic self-sufficiency. Gloria Perez Jordan, Jeremiah’s Executive Director, spoke to the gathering. (See related article on page 13.)

Special thanks to the 2005 event committee at the firm: Karla Robertson (chair) and committee members (in alphabetical order) Barbara Brown, Kim Curtis, Jolene Cutshall, Tanya D’Souza, Debbie Ellingboe, Page Fleeger, Amy Freestone, Dana Gray, Cate Heaven, Mandi Hill, Jennifer Metz, Kathy Noecker, Kristin Smith and Lori Wagner.

Firm Celebrates Fourth Annual Women, Wine & Wardrobe Event

Home Work

Some of the more than 200 Faegre & Benson volunteers stand in front of the home they are constructing as part of a Habitat for Humanity project. The firm has donated $60,000 and more than 1,600 hours of time from lawyers and staff to building the home.

Minneapolis, Minnesota Denver, Colorado

TRENDS® November 2005

ww

w.faegre.com

13

firm new

s

Faegre & Benson Sponsors $10,000 Venture Showcase Award

BioWest 2005, the Rocky Mountain Region’s premier networking event and trade show for the biotechnology and medical devices industries, has expanded to include the first annual $10,000 Faegre & Benson Venture Showcase Award, to be presented to the winning emerging biosciences company at the Venture Capital program on November 8, 2005.

The award, sponsored by Faegre & Benson, is designed to help support growing biotech companies and provide visibility in front of a high-profile venture capital panel. The BioWest organizers are expecting approximately 10 to 12 companies to participate in the competition.

“This award truly sets BioWest apart from other industry events and is generating a lot of excitement in the community,” says Christine Shapard, director of biosciences and emerging industries for the Governor’s Office of

Economic Development and International Trade (OEDIT). “It’s great to see some of our smaller companies vying not only for the $10,000 prize, but also for the visibility at the region’s premier event for our industry.”

“We’re very excited to be able to assist early stage bioscience companies by sponsoring this award and coordinating the VC track presentations,” says Dr. Richard Nakashima, a biotech patent attorney with Faegre & Benson. “Our firm has a history of supporting not only the large players in the biotech industry, such as Guidant and Roche Colorado, but also working with a diverse group of companies, from the earliest startups to mid-level established companies. Our continuing support of the Colorado bioscience community, such as our sponsorship of this unrestricted Award, is something that we’re very proud of.”

BioWest, an annual event hosted by OEDIT in partnership with the Colorado BioScience Association (CBSA), Fitzsimons, the City of Denver, the Metro Denver EDC and numerous research institutions, takes place November 8 and 9, 2005 at the new Colorado Convention Center. The event, which expects more than 700 attendees, includes 15 expert panels and five breakout tracks on topics ranging from start-up issues and regulatory requirements to international clinical trials, as well as the Annual Awards Dinner.

Dr. Richard Nakashima

Construction will soon begin on a 38-unit facility in St. Paul to provide transitional housing and support for single mothers pursuing college education. Faegre & Benson lawyers have represented The Jeremiah Project in obtaining approvals for the project.

The $11 million facility will provide affordable housing and services such as child care for dozens of mothers with young children. It is expected to open in Fall 2006.

The housing facility received zoning approval from the city council in June. A handful of neighbors then challenged the project in court, seeking a temporary restraining order to put construction on hold. The firm defended the project before Ramsey Court District Judge David Higgs, who declined to issue an injunction and noted that the plaintiffs challenging the project were “not likely to prevail” in their litigation.

Lawyers working on behalf of The Jeremiah Project have included Angela Christy, Bridget Hust, Mary Yeager, and Deb Mackay.

Judge Lets Transitional Housing Project Move Forward

TRENDS® November 2005

ww

w.faegre.com

14

firm news

A series of independent sources have placed Faegre & Benson among the nation’s leading law firms in recent years. Following its top rankings in the Chambers USA directory earlier this year, Faegre & Benson has garnered leading recognition again in the 2006 edition of The Best Lawyers in America (Copyright 2005 by Woodward/White, Inc., of Aiken, S.C.).

Fifty-seven partners from Faegre & Benson are included in the latest edition of Best Lawyers. The listing includes 44 lawyers from the firm’s Minneapolis office, more than any other law firm in the state of Minnesota. The firm also has the most lawyers listed in Minnesota in the areas of Corporate and Real Estate law.

Ten of the firm’s Denver partners, and three of the firm’s Des Moines partners, are also named in the list.

Faegre & Benson partners are listed among the nation’s best lawyers in all of the following practice areas: corporate, mergers and acquisitions, commercial litigation, intellectual property, First Amendment, real estate, labor and employment, antitrust, franchise, employee benefits, construction, health care, financial institutions, bankruptcy, trusts and estates, gaming, tax, natural resources, environmental, and personal injury defense.

Earlier this year, the firm’s Minneapolis office shared the #1 ranking as the leading firm in Minnesota for Corporate/M&A, Litigation, and Real Estate in Chambers USA: America’s Leading Lawyers for Business. The firm’s Colorado offices shared the #1 ranking in Environment and Intellectual Property, and Faegre & Benson was the only law firm in Colorado to be listed among the region’s leading firms in all six of the practice areas ranked by Chambers.

The firm was also named among the top 20 law firms in the U.S. for client service three years in a row by the BTI Consulting Group.

Our Numbers Tell the Story: Faegre & Benson Has “Best Lawyers”

Following a hearing on September 13, Judge Ellen Segal Huvelle of the U.S. District Court for the District of Columbia ordered the Fish and Wildlife Service (FWS) to halt the killing of wolves under permits that were unlawfully issued to state agencies in Michigan and Wisconsin in April of this year.

The ruling came in response to a complaint filed this summer by a team of attorneys at Faegre & Benson, including Sanne Knudsen, Brian O’Neill, Rick Duncan, Betsy Schmiesing, and Colette Routel. Knudsen argued the case on behalf of 13 environmental organizations represented by the firm in the litigation.

This victory comes on the heels of the firm’s success earlier this year in challenging the FWS’s attempt to diminish protections afforded to the gray wolf by down-listing wolves from endangered to threatened status. The group’s active involvement in advocacy for wolf conservation and recovery has been ongoing since at least 1978, when a team of attorneys led by Brian O’Neill successfully challenged Minnesota’s attempt to create a sport hunting season for wolves.

Firm Continues Pro Bono Efforts to Protect Gray Wolf

TRENDS® November 2005

ww

w.faegre.com

15

intellectual property

So the question your business faces is: how vulnerable is your knowledge to being replicated or discovered by others? The answer will shape the kind of IP protection you’re likely to seek.

MisappropriationUnlike patents and copyrights that are governed by federal law, trade secret protection derives primarily from state law. The origins of trade secret doctrine date all the way back to a Massachusetts Supreme Judicial Court decision in 1868, and while numerous courts (including federal courts) have weighed in on specific aspects of trade secret law ever since, no federal civil legislation has ever tackled trade secrets directly. Instead, trade secret laws have been enacted on a state-by-state basis.

Minnesota was the first state to adopt the Uniform Trade Secret Act (UTSA) in 1980, and more than forty other states have since followed suit. The UTSA was adopted in the wake of an increasing reliance by businesses on trade secret protection and a desire to codify common law trade secret principles.

Distilled to its essence, under the UTSA and most state interpretations, the existence of a trade secret is established using a two-fold test. First, you must have knowledge or information that derives independent economic value from not being generally known or readily ascertainable. Second, you must have taken reasonable efforts to maintain the secrecy of the knowledge or information. In that circumstance, the UTSA provides protection by prohibiting the “misappropriation” of trade secrets and providing various remedies, including injunctive relief and damages.

“Misappropriation” covers both obtaining trade secrets through improper means and disclosing or using them without consent. The UTSA also casts a broad net to include not only actual misappropriation (where the theft or disclosure has actually occurred), but also “threatened” misappropriation (which some courts have held to include

events such as a key employee bolting to a competitor and putting a trade secret at serious risk of disclosure).

What kinds of actions or circumstances create the greatest risk for trade secret owners? Consider the following:

• One of your employees or independent contractors who has knowledge of your trade secrets leaves to join one of your competitors

• One of your suppliers or distributors also works for a key competitor

• One of your licensees, customers, business partners, or employees decides to start a competing business

• You disclose your confidential information to a prospective business partner, and the deal falls through

This is not an exhaustive list, just a sample of the many ways in which day-to-day business dealings put your trade secrets at risk of misappropriation.

P rotect i ng You r T rade SecretsHow do you take reasonable efforts to protect your trade secrets? Here are a few key steps:

Put it in writing. Consider keeping a written statement of your trade secret secur ity pol icy. This prov ides two advantages. First, “unwritten rules” may wind up being laxly or inconsistently enforced within the organization. Second, documented trade secret policies provide evidence in court of the seriousness of the company’s efforts to protect its secrets.

Let your employees know. A proper trade secret protection plan should make employees aware of the confidentiality of certain information and, where appropriate, periodically remind them of their obligations to keep that information secure. This would include having employees counter-

An Overview of Trade Secret Protection cont inued from page 11

cont inued

TRENDS® November 2005

ww

w.faegre.com

16

sign written confidentiality agreements. In addition, companies should consider conducting “exit interviews” with departing employees that include a written reminder of their ongoing responsibility to keep trade secret information secure.

Restrict access. “Sorry, that information is on a need-to-know basis.” Where appropriate, keep trade secret information physically separate from nonproprietary information, and restrict access only to those who genuinely require it. Depending on the nature of the intellectual property, this segregation may be as simple as keeping information in a separate filing cabinet, or it may necessitate building an entirely separate and secure facility.

Implement physical security. Consider providing additional security for the information through locked doors, gates, and cabinets. Again, the level of physical security will vary depending on the nature of the information and how the information is used in the business operations.

Consider labeling trade secret documentation. It can be very easy to reproduce, scan, and distribute documents today. Not only should documentation related to trade secret information be treated with special care, but in appropriate circumstances, it may be prudent to label trade secret documents as “SECRET” or “CONFIDENTIAL.” A company may also want to educate its employees who have access to such documents about their status, including the sensitivity of and destruction of trade secret documents.

Extend the security procedures to computer systems. Obviously, trade secrets stored in electronic format are particularly susceptible to theft. The entire subject of information systems security may warrant a thorough review by the organization, to minimize the possibility of external “hacking” or internal security breaches. The same care regarding access and labeling that is extended to physical space or documentation, should extend to computer systems where trade secrets are stored.

Be mindful of third parties. If business associates, prospective customers, or members of the public have access to facilities in which trade secrets are stored or used, take particular care to avoid inadvertent disclosure. This might include accidents (where documents are left carelessly in open view) or even deliberate but unintentional disclosures (such as tour guides or other employees who inform visitors about the project or process within the facility).

Screen speeches and publications where appropriate. Trade secrets often wind up being disclosed unintentionally at trade shows or in magazine articles, publications, press releases, or speeches. Engineers, marketing executives, mid-level managers, and others may exchange ideas with colleagues or share information publicly because they are unaware of its sensitivity. One tool for reducing this risk is implementing a policy of pre-screening all public communications.

Protect yourself with contracts. The nature of many businesses may require a company to disclose its trade secrets to potential buyers, licensees, joint venture partners, or other outsiders. When engaging in these kinds of third-party transactions, consider monitoring the flow of information carefully and documenting the nature of the trade secrets exposed and the specific limited use to which they may be put. This may include specific confidentiality agreements with the third parties.

When properly identified and secured, trade secrets can often be the most powerful of the various forms of intellectual property protection, given the indefinite lifespan they can offer. Trade secret owners can also obtain swift and dramatic relief in court if they act quickly and have taken care along the way to document and follow their trade secret protection plan. But trade secrets are, by their very nature, fragile. A secret only has value to the extent you can keep it a secret.

TRENDS® November 2005

ww

w.faegre.com

17

eminent dom

ain

By Bridget Hust and Leslie Fields

The Supreme Court and Eminent Domain: A Backlash over Kelo

Bridget Hust is a real estate lawyer in the firm’s Minneapolis office. Leslie Fields leads the firm’s eminent domain practice in Colorado. They may be reached at [email protected] or [email protected].

Few U.S. Supreme Court decisions this year are garnering as much national attention as Kelo v. City of New London. This landmark eminent domain case addressed the definition and meaning of the “public use” doctrine under the Fifth Amendment to the U.S. Constitution, which provides that private property may not be taken for “public use” without just compensation. By a 5-4 decision, with Justice Stevens delivering the majority opinion, the Court ruled that the pursuit of economic development to generate tax revenues and other economic benefits for local communities is a “public use” within the meaning of the Fifth Amendment’s Taking Clause.

While not surprising to legal practitioners in this area, the Court’s decision embraces a far broader concept of “public use” than many in the general public believe is appropriate. Many citizens assume that “public use” means “use by the public” (such as roads and schools), and that property can only be taken for private redevelopment if it is “blighted” according to urban renewal laws. Thus the Kelo decision has been widely decried as an expansion of the definition of “public use” that allows private property to be taken for other private use.

In fact, the Kelo decision follows a long line of earlier U.S. Supreme Court condemnation cases, which have consistently been deferential to legislative bodies, such as cities and states, in justifying the use of

eminent domain power. The Court also long ago rejected literal requirements that condemned property be put to use solely for the public, and that condemnations which benefit private parties are per se contrary to the public use clause. In Kelo, the City of New London had been declared a “distressed municipality” by the State of Connecticut due to the loss of many jobs over the years from the closure of the Naval Warfare Center. In response to this dire situation, the City planned to acquire 90 acres to develop an “urban village,” hotels, homes, a conference center, a marina, a new US Coast Guard Museum, and a public park. Although the City was able to buy most of the land for its redevelopment project from willing sellers, it could not come to terms with a few landowners, resulting in the filing of eminent domain proceedings. Following the Supreme Court’s prior decisions, the majority in Kelo deferred to the judgment of the City of New London that the takings were necessary to implement a legitimate plan to spur economic development.

Even the Kelo dissenters acknowledged that the Court has consistently deferred to cities and states regarding public purpose. Indeed, Justice O’Connor, who delivered the dissent in Kelo, delivered the majority opinion in the Court’s last high profile condemnation case, Hawaii Housing Authority v. Midkiff, 467 U.S. 229. In Midkiff, Justice O’Connor

cont inued

TRENDS® November 2005

ww

w.faegre.com

18

wrote that a Hawaii statute transferring private land to other private parties, upon payment of just compensation, satisfied the Constitution’s requirement for “public use” because the purpose was to diversify Hawaii’s land ownership, which at the time was held by a few controlling entities. The Court refused to second-guess the Hawaii legislature, which determined that society was harmed by an oligopoly that inflated land prices and concentrated wealth in the hands of a few.

In Kelo, however, Justice O’Connor found that no harms were being remedied by a transfer of private land to another private party when the sole “public purpose” being achieved was economic development. Both Justice O’Connor and Justice Thomas also referenced the sanctity of the home in their dissenting opinions. Justice O’Connor made special mention of the fact that some of the displaced litigants lived in homes that their families had owned for over 100 years. Justice Thomas, noting prior decisions curbing the government’s right to search homes, wrote that while “citizens are safe from the government in their homes, the homes themselves are not.”

Opponents have cast Kelo as an all-out assault on private home ownership. This fear has sparked a wave of efforts in state legislatures to limit and/or reform the power of eminent domain. According to a recent National Law Journal article, more than 28 states are currently considering passing legislation to either outlaw or make it more difficult to condemn private property for economic gain and private redevelopment projects. Many of these states are also considering making more permanent changes to the law by amending their State constitutions.

The Kelo backlash is a phenomenon few people expected when the Supreme Court first announced its decision in June. Even regulatory takings, also known as inverse condemnation actions, are being viewed in a new light as a result of Kelo. That is likely to be the real story of Kelo’s impact: Even though the court case purportedly expands the definition of public use in order to justify a taking, the backlash may well result in local jurisdictions limiting their own powers of eminent domain.

Those in favor of Kelo argue that the characterization of Kelo as an assault on a citizen’s personal residence is unwarranted. Many in favor of condemning for economic redevelopment projects claim that the right is not being abused and that communities will suffer if states start to roll back their right to take property in reaction to one case. Economic revitalization, they argue, is absolutely necessary to the survival of many municipalities, citing the City of New London’s plight as a perfect example. How valuable is one’s home if it lies in a community that is depressed and economically stagnant, while communities around it are thriving because of private redevelopment projects, especially if one is paid “just compensation” for it?

Regardless, Kelo has unleashed a national debate on the government’s right of eminent domain and a broadscale review of state condemnation laws in general. Because of the backlash, the ultimate result of Kelo may be the opposite of what the case holds, i.e. a curtailing and limitation on state eminent domain powers.

“Regardless, Kelo has unleashed a national debate on the government’s right of eminent domain and a broadscale review of state condemnation laws in general.”

TRENDS® November 2005

ww

w.faegre.com

19

eminent dom

ainMost private redevelopment projects in Colorado are carried out by urban renewal authorities that, by statute, may only condemn property to eliminate blight or blight conditions. Last year, in the much publicized case of Arvada Urban Renewal Authority v. Columbine Professional Plaza, 85 P.3d 1066 (Colo. 2004), the Colorado Supreme Court made it clear that an urban renewal authority lacks both the legal authority and a valid public purpose for taking property, without a proper blight analysis.

The Court also remarked in the Arvada case that an authority could not assume that it could condemn property under an urban renewal plan simply because it was dissatisfied with the property’s economic performance. As stated by the Court, “This characterization far exceeds an urban renewal authority’s power to act pursuant to a municipality’s initial blight determination.”

While the U.S. Supreme Court in Kelo gave great deference to a legislative determination of proper public purpose, Colorado’s Constitution ca l ls the determination of public use a “judicial question” to be made “without regard to any legislative assertions.” Thus, it appears that Colorado courts have greater authority to review public purpose findings than other state courts may. Whether Colorado trial judges will choose to exercise that authority in a post-Kelo judicial environment remains to be seen.

Colorado’s Constitution also states that private property may not be taken for private purposes “except for private ways of necessity and except for reservoirs, drains, flumes or ditches on or across the lands of others, for agricultural, mining, milling, domestic or sanitary purposes.”

In Minnesota, state courts have followed federal courts in interpreting “public use” as “public purpose.” Likewise, Minnesota courts are traditionally deferential to legislative bodies in making a determination of public purpose.

However, the Minnesota Supreme Court has not squarely addressed the question of whether economic development is a valid “public purpose.” In 1998, a Minnesota Court of Appeals held that economic development was a valid purpose, and the Supreme Court declined to review the appellate court’s decision. But in the closely watched and contentious Walser case, 641 N.W.2d 885 (Minn. 2002), the Minnesota Supreme Court split 3-3, unsettling the direction of Minnesota’s eminent domain law.

In Walser, the City of Richf ield condemned residential homes and two large auto dealerships to make way for the new Best Buy headquarters. The City determined the area was “blighted” and needed to be redeveloped. Minnesota’s definition of blight is very broad: dilapidation, obsolescence, overcrowding, faulty arrangement or design, lack of ventilation, light, and sanitary facilities, excessive land coverage, deleterious land use, or obsolete layout, or any combination of these or other factors, which are detrimental to the safety, health, morals, or welfare of the community. Even so, the City of Richfield struggled to make findings of blight. The City found that the area to be condemned created hazardous traffic patterns, and the auto dealerships, which were usable, were not of the highest quality. The appellate court, deferring to the City, upheld the condemnation, but the Supreme Court split over the issue (because one justice recused herself),

Kelo in Colorado and Minnesota

cont inued

TRENDS® November 2005

ww

w.faegre.com

2120

By Sonia Shewchuk and Wendy Mahling

Issuers Must Be Aware of New SEC Rules

Sonia Shewchuk and Wendy Mahling represent clients in public and private securities offerings. They may be reached at [email protected] and [email protected].

On June 29, 2005, the Securities and Exchange Commission adopted final rules under the Securities Act of 1933 related to its securities offering reform initiative.1 The new and amended rules contain the most sweeping regulatory reforms since the concepts of shelf registration and incorporation by reference were introduced in the early 1980’s and will significantly change the registered offering process for issuers and underwriters. The new and amended rules:

• provide greater f lexibility in the registration process;

• liberalize the communications that may be made around the time of a registered offering; and

• codify the SEC’s views with respect

to l iabil ity related to reg istered offerings.

The new rules classify issuers into five categories, and the extent to which an issuer will benefit from the liberalized communication and offering rules will depend upon the category into which it falls. The category of issuer that will benefit the most from the liberalized rules is the well-known seasoned issuer, or WKSI.2 A WKSI is an issuer that is required to file reports under the Securities Exchange Act of 1934, is eligible to use Form S-3 for primary offerings, and either has a public float of at least $700 million or has issued $1 billion of non-convertible securities, other than common equity, in the past 3 years in primary registered offerings for cash.3 WKSIs represent about 30% of all

even though the economic benefits of the development were readily apparent.

The consensus among Minnesota practitioners is that the Kelo decision has not changed Minnesota’s eminent domain law. However, the backlash over Kelo may change the law in the opposite direction. Indeed, a bill was already

introduced in the state’s recent special session to prevent political subdivisions from acquiring real property “for private economic development.” Cities have also jumped on the backlash band-wagon, including a suburb in Minneapolis that is moving to pass an ordinance limiting its own eminent domain power.

Kelo in Colorado and Minnesota continued from previous page

cont inued

TRENDS® November 2005

ww

w.faegre.com

corporate finance

2120cont inued

listed issuers, and registered offerings by WKSIs have historically accounted for a significant amount of the capital raised by listed companies.4

R e g i s t r a t i o n P r o c e s s ReformsThe new rules generally improve the shelf registration process and also create a new automatic shelf registration process for WKSIs. As a result of the new rules, WKSIs can access the market quickly and take advantage of market conditions, modify terms of securities in reaction to investor feedback on a real time basis, and change the method of distribution of securities shortly before an offering. Key aspects of the new automatic shelf registration process include:

• automatic ef fectiveness of shelf registration statements and post-ef fec t ive a mendments , thereby eliminating the timing concern of possible SEC review;

• “pay-as-you go” fees which permit WKSIs to delay paying registration fees until an offering occurs; and

• extremely streamlined requirements for the content of the base prospectus that permit WKSIs to omit additional information from shelf registration statements, such as the description of securities and plan of distribution, so that, in theory, a WKSI’s automatic shelf registration statement could be as short as a couple of pages.

Although not as groundbreaking as the automatic shelf registration procedures, the new rules also provide enhanced flexibility in the shelf registration process for all seasoned issuers, including WKSIs, as follows:

• issuers may register unlimited amounts of specific securities and will no longer be limited to registering an amount of securities that they believe they will sell within two years of the initial effective date of the shelf registration statement;

• the information that may be omitted from the base prospectus and provided later in connection with an offering was clarified and, in some cases, expanded (such as the ability to exclude the identity of selling securityholders in connection with the registration of re-sales of restricted securities);

• a prospectus supplement (as opposed to a post-effective amendment) may be used to make material changes to a registration statement, including to the plan of distribution;

• issuers will now be able to use a shelf registration statement immediately after effectiveness without concern for “convenience shelf” issues; and

• restrictions on “at-the-market” equity offerings have been eliminated.

One of the offering reforms will benefit unseasoned issuers. Under the new rules, reporting issuers who have filed at least one 10-K and are current in their Exchange Act reporting obligations can incorporate by reference their previously filed (but not subsequently filed) Exchange Act reports into registration statements on Form S-1.

The new rules also generally provide that “access equals delivery” with respect to final prospectuses.5 As a result, in most cases a paper copy of a final prospectus will no longer be required to be delivered to an investor so long as certain filing and notification conditions are satisfied.

Communications During the Offering ProcessThe new rules provide greater flexibility to issuers to communicate before and during a registered offering and significantly liberalize the rules related to “gun-jumping.” All issuers will benefit from a bright line rule that permits communications of any type more than 30 days before the filing of a registration statement so long as the communication does not refer to a registered offering and reasonable steps are taken to prevent the further distribution of the communication in the 30 days

TRENDS® November 2005

ww

w.faegre.com

22

before filing.6 In addition, the new rules provide a safe harbor for regularly released information during the 30 days prior to filing a registration statement:

• all reporting issuers may continue to communicate regularly released factual business information and forward-looking information consistent with past practice; and

• all non-reporting issuers may continue to communicate regularly released factual business information to persons, such as suppliers or customers, other than in a capacity as investors or potential investors.7

Other rules address communications made in electronic road shows, media publications and web postings.

One of the most innovative changes under the new rules is the adoption of the “free writing prospectus” as a permissible means of communicating in writing with investors and others without violating Section 5 of the Securities Act. Free writing prospectuses include communications such as emails, faxes and other written and electronic media, and potential uses of a free writing prospectus include distributing term sheets and providing information about material developments and logistical information about the offering to investors.

• WKSIs may freely use free writing prospectuses at any time during the offering process, including before a registration statement has been filed, and are not required to precede or accompany the free writing prospectus with a preliminary prospectus.

• Seasoned issuers may use free writing prospectuses once the preliminary prospectus or shelf reg istration statement is on file with the SEC and likewise are not required to precede or accompany the free writing prospectus with a preliminary prospectus.

• Unseasoned issuers and non-reporting issuers may use a free writing prospectus after filing a registration statement. The preliminary prospectus must accompany or precede the free writing

prospectus and, in the case of an issuer making an initial public offering, it must include a price range.

A free writing prospectus must contain a prescribed legend and will generally need to be filed with the SEC if it is prepared by or on behalf of the issuer, contains material non-public information provided by or on behalf of the issuer, is distributed in a manner designed to provide broad dissemination or comprises the f inal terms of securities offered by the issuer. Free writing prospectuses will be subject to liability under Section 12(a)(2) of the Securities Act.

The new rules also expand the types of information that may be included in public notices after a registration statement has been filed8 and liberalize the rules relating to the research coverage that may be provided throughout the offering process.9

Liability Issues Related to the Offering ProcessThe SEC also used the new rules as an opportunity to clarify and impose its views on liability relating to key points and persons in the securities offering process.

Under the new rules, the time of sale is the time during the offering when issuers and underwriters should assess whether the information conveyed to investors was accurate and complete for purposes of liability under Section 12(a)(2) under the Securities Act; information conveyed after the time of sale (including information provided in a prospectus delivered after the time of sale) will not be considered.10 The SEC’s clarification of this issue is significant because it will require offering participants to more thoroughly document and assess the information that was available to investors at the time of sale. The SEC also clarified that an issuer will be a “seller” of securities for purposes of Section 12(a)(2) even if the investor buys the securities directly from an underwriter.

In the context of a shelf takedown, the new rules clarify that information contained in a prospectus supplement is part of the

TRENDS® November 2005

ww

w.faegre.com

corporate finance

23

registration statement for purposes of Section 11 liability11; however, the SEC has made it clear that this does not change the determination of when information is conveyed to a purchaser for purposes of Section 12(a)(2) liability. The new rules also provide that issuer and underwriter liability will be assessed at time of a shelf takedown.

Additional Information about the New RulesThe SEC’s adopting release is a voluminous 468 pages and, as a result, the information provided above is only a brief summary of the securities offering reforms. For more information about the reforms and an analysis of their impact on securities offerings, please consult the article SEC Adopts Significant Securities Act Reforms at http://www.faegre.com/articles/article_1654.aspx that was prepared by our Securities Offering Reform Task Force.

Footnotes

1 Release Nos. 33-8591, 34-52056 (July 19, 2005). The reforms apply only to registered offerings and do not impact private placements, 144A offerings or Regulation S offerings. While the new and amended rules also apply to certain matters relating to foreign issuers and asset-backed securities issuers, this article will only address matters that affect domestic unstructured issuers.

2 The other four categories of issuers include:

• seasoned issuers, which are reporting issuers eligible to use Form S-3 for primary offerings;

• unseasoned issuers, which are reporting issuers that are not eligible to use Form S-3 for primary offerings;

• non-reporting issuers, which are issuers not required to report under the Securities Exchange Act of 1934, and include voluntary filers and issuers that are making initial public offerings; and

• ineligible issuers, which include reporting issuers that are not current in their Exchange Act reports ( w i t h

some exceptions), blank check issuers, shell companies and penny stock issuers , l imited par tnerships in certain circumstances, and certain other issuers. See Rule 405.

3 In addition, “ineligible issuers” are precluded from WKSI status.

4 Release Nos. 33-8591, 34-52056, 25-28.

5 Rule 172.

6 Rule 163A.

7 See Rules 168 and 169.

8 Rule 134.

9 Rule 137.

10 Rule 159

11 Rule 430B.

TRENDS® November 2005

ww

w.faegre.com

24

TRENDS® November 2005

ww

w.faegre.com

There has been much discussion recently about the possible permanent repeal of the federal estate tax. However, recent events appear to have made repeal much less likely now than it was just a year ago.

Although the federal estate tax is scheduled to be repealed in 2010 under the federal Tax Relief and Reconciliation Act of 2001, the tax will then be reinstated in 2011. In effect, the 2001 Act gave the government a 10 year window to find a permanent solution.

As the Republican Party gained strength in both the Senate and House since the Act was passed, permanent repeal appeared possible. The House passed permanent repeal in 2004, and the Senate was scheduled to vote on repeal September 6 of this year. But, in the wake of Hurricanes Katrina and Rita, the Senate vote was postponed.

The repeal bill will most likely be taken up again in early 2006, but the likelihood of its passing seems to have decreased. Popular support for the repeal of the estate tax remains relatively strong. However, with the cost of the hurricane relief effort added to the mounting costs of the war in Iraq and the ever increasing federal deficit, budgetary concerns will make repeal, and its estimated $75 billion dollar cost, more difficult to accomplish.

In the end, a compromise that falls short of full repeal seems most likely. The results of such a compromise are hard to predict. An estate tax exemption somewhere between $3.5 million and $5 million seems probable. It is more difficult to estimate what the top tax rate might be, as predictions vary anywhere from 15% to 50%. One thing is certain, the current state of the law makes expert advice a must.

25

USA INTERNATIONAL Dial “011” before number

MINNEAPOLIS 2200 Wells Fargo Center 90 South Seventh Street Minneapolis, Minnesota 55402-3901 Phone: 612.766.7000 Fax: 612.766.1600

DENVER 3200 Wells Fargo Center 1700 Lincoln Street Denver, Colorado 80203-4532 Phone: 303.607.3500 Fax: 303.607.3600

BOULDER 1900 Fifteenth Street Boulder, Colorado 80302-5414 Phone: 303.447.7700 Fax: 303.447.7800

DES MOINES 801 Grand Avenue Suite 3100 Des Moines, Iowa 50309-8002 Phone: 515.248.9000 Fax: 515.248.9010

LONDON 7 Pilgrim Street London EC4V 6LB England Phone: 44.20.7450.4500 Fax: 44.20.7450.4545

FRANKFURT Main Tower, Neue Mainzer Strasse 52-58 Frankfurt am Main, 60311 Germany Phone: 49.69.631.561.0 Fax: 49.69.631.561.11

SHANGHAI Shanghai Centre, Suite 425 1376 Nanjing Road West Shanghai 200040 China Phone: 86.21.6279.8988 Fax: 86.21.6279.8968

For the latest legal news, or copies of any ar-ticle in this newsletter, visit www.faegre.com