Meet your survivor guides

description

Transcript of Meet your survivor guides

Meet your survivor guides

Keep your hands, arms and feet inside at all times

Caren Alvarado

• Assistance Vice President of Regulatory Affairs and Legal Fairmont Specialty• Over 20 years of experience running compliance divisions for

several large insurance companies• Proud Mother of beautiful twin girls• Loves to redline documents• Tends to be passionate about all things compliance• Enjoys finding creative solutions and thrives on a challenge

Ken Milhous

• President/Founder, Soseus LLC• Over 14 Years experience developing marketing solutions• Over 12 Years experience in travel insurance products• Daddy of two charming kids and two lazy pugs• Loves technology a bit too much• Gravitates towards hazardous objects when mountain biking

What’s the big deal?If you’re not scared, you should be

Compliance is key to success• Compliance is good for brand• Compliance is good for customers• Compliance is good for business• Compliance is good for our industry• Compliance is good for everyone!

Insurance is under scrutiny

• We must evolve guidelines as regulation changes• We must be proactive in discovering issues• We must educate staff and partners• We must stay one step ahead of regulators

Non-compliance is getting ugly• License suspension/revocation• Possible marketing restriction• Fines and Legal Fees• Negative Public Consent orders• Penalties for agents• On-site regulatory examinations• Tarnished brand• More intense regulations

What is advertising?Let’s cover the basics, shall we?

How to spot advertising

• Marketing is any material or media that discusses, describes, depicts or portrays products or features• Any material designed to promote, sell or induce the public

to purchase, increase or modify an insurance policy

Obvious advertising samples• Brochures and sales sheets• Websites• Radio and Television Commercials• Publication ads• Mailings• Telemarketing scripts• Invitation to Inquire

Less obvious advertising samples• Material included with fulfillment to encourage renewal or

buy-up• Webcasts• Prepared sales talks • Social posts and blogs• Lead Generations• Newsletters• Product comparisons

Is everything advertising?

• The distinction is based on the target audience and subject matter of material• Non-advertising examples• Internal communication• Regular agent communication• Customer communication that does not encourage coverage

changes or additional purchase• Material used to train and educate insurer’s employees or agents• General announcement to group members regarding availability of

a plan without a description

Your survivor checklist

Don’t forget this next part, there’s gonna be a quiz

Are disclosures stated?

• Content must provide a fair and accurate description of exceptions, limitations and reductions• Content not intended for public use, that could be misused,

should be properly identified• Content must clearly indicate the specific states the material

is to be used in and/or states not approved

Is it fair & accurate or misleading?• No aspect of advertisement can be untrue, deceptive or

misleading based on information included or omitted• Products should be described as “travel insurance policies”

and no alternate descriptors should be used• Content cannot use uncommon insurance jargon• Content cannot contain statements that describe benefits or

attributes that do not exist• Content cannot contain statements designed to disparage

competitors• Unfair or incomplete comparisons to other products

prohibited

Does it contain deceptive messages?• Content cannot contain words to exaggerate benefits beyond

the terms of the policy – all, full, complete, comprehensive• Content cannot contain words with relative or misleading

meaning – free, no-cost, inexpensive, low cost• Content cannot contain phrases that exaggerate insured’s

well-being – worry-free, peace of mind, guaranteed• Content cannot contain phrases that describe applicability of

exceptions or reductions – only, mere, just, minimum

Price Transparency

• There is increasing complexity within the travel industry• This is an area of continuing evolution in the travel industry• States are challenging the way the industry has always

operated historically• Travelers expect more information and choice• Increased area of concern among regulators and the industry

as a whole

Is it free of high-pressure tactics?• Cannot use content that would induce purchase through

force, fright or threat, explicit or implied• Cannot use undue pressure to recommend the purchase of

insurance• Cannot communicate that bad things will happen if someone

does not have insurance

Is the insurance type and insurer identified?• An advertisement that fails to state clearly the type of

insurance coverage being offered is prohibited• The name of the actual insurer must be stated• Any invitation to contract must include a form number of the

policies advertised• Any information regarding the company’s ratings must be

accurate and up to date• Material cannot use a trade name, group designation, name

of parent company, division of insurer, service mark, etc without disclosing the name of actual insurer

Is it free of “opt out” requirements?• No acceptance by default allowed – customers must not

have to explicitly opt-out of a particular feature or service• Mechanisms for allowing must be a opt-in• Customers must make affirmative selection of insurance• “Opt Out” insurance is illegal in the travel insurance industry• Considered an unfair method of competition and deceptive

insurance practice

Are endorsements compliant?• Testimonials and endorsements must be genuine• Content must represent the current opinion of the author• Content must be applicable to the insurance marketed• Content must be accurately reproduced• Content must be current• Statistics must be accurate and current and include cited

sources

Game time!Who’s gonna be voted off the island?

With our insurance you will ______…have peace of mind.…rest easier and vacation better.…have some added comfort.

We can provide you ______

…with worry-free travel.…travel with less worries.…guaranteed safe travels.

When you travel ______

…things will go wrong.…bad things will happen.…the unexpected may happen.

Buy from us and get ______

…comprehensive coverage.…a plan to help protect your needs.…financial security.…the extra protection you need.

We offer ______

…the biggest money-saver.…affordable rates.…rates that may be more affordable than you think.

Thanks for participating!

You get to stay on the island.

Start with the basicsWax on, wax off… soon you’ll be a black belt

Create a compliance checklist• Define your compliance criteria and be sure to include:• Contact information• Pricing• Disclaimers/disclosures• Product specifics• Opt-in (not opt-out)• Insurer/underwriter information

• Be sure to add your own compliance criteria

Website audit

• Schedule regular reviews to stay in compliance• Keep record of high-risk pages• Verify new content against checklist• Tip: Print each page and mark-up as reviewed to ensure no

rock goes unturned• Tip: Create boilerplate messaging• Tip: Keep history of pages• Tip: Create matrix of type of content and pages

Caution pitfalls ahead

Keep calm, we’ll show you the way

Potential mobile pitfalls

• Reduced screen sizes mean less content• Reduced screen sizes can hide or move content• Difficult to read or access downloadable files• Flipping between mobile and non-mobile pages

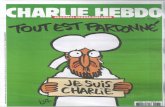

Potential social issues

• What if your post is shared (re-posted)? By an agent? By a consumer?• Do your social messages include a method for viewing

compliance information?• What happens when a customer posts a review or compliant

that includes inaccurate information?• Remember that your post is out there forever!• Is your Facebook page compliant?

Potential SEO/SEM issues

• META Tags• Not easily reviewed – difficult to audit• Not updated often enough

• Text ads• Limited messaging• Possibly managed by third-party

• Banner ads• Rotating messages• No disclaimers

Other potential pitfalls

• What happens when a server goes offline?• Do you need to be ADA (AODA) compliant?• Do you have compliant desktop apps or mobile device apps?• Are your outbound emails compliant?

What are we going to do!?

Breathe deep.

Keep it simple!

• White space is your friend• Simplify your message• Less is more• Create boilerplate messaging• Create a single place for disclaimer information that can be

used by social, email, ads, etc

Get creative

• Use this as an opportunity to refine your brand strategy and leverage new messaging that may be more effective• Use compliant friendly questions like “What kind of travel

insurance are you looking for?”• Promote less-compliant touchy features like “compare insurance

plans” or “award-winning customer service”• Try capturing brand message using creative writing like “Don’t

forget to pack your travel insurance”

• Remember… less copy may require less disclaimers and minimize your exposure

Track, review and document

• Schedule routine reviews• Keep record of META information, ads, social history, etc• Remove old online assets no longer in use• Review ads with your ad manager• Be ready for regulatory review