Mazda Boigermany

-

Upload

cardinaleway-mazda -

Category

Automotive

-

view

1.397 -

download

3

description

Transcript of Mazda Boigermany

Thailand : Detroit of AsiaThailand : Detroit of AsiaBy..By..

Mr.Ninnart ChaithirapinyoMr.Ninnart ChaithirapinyoVice ChairmanVice Chairman

The Federation of Thai IndustriesThe Federation of Thai IndustriesToyota Motor ThailandToyota Motor Thailand

Today’s topicToday’s topic

I.I. Where are we? Where are we?

II.II. Where will we go? Where will we go?

III. How will we go?III. How will we go?

IV. Why Thailand?IV. Why Thailand?

I. Where are we?I. Where are we?

1.1 Circumstance Change in Market1.1 Circumstance Change in Market

Topics ’70 ’90 ’00 ’05 ‘10

Auto Policy by

Government

Movement of

Automotive Industry

Car Manufacturer

Trend

• Local content regulations• Ban for CBU vehicle import

• Deregulation of Local content

• Tariff reduction

• Free competition

25% local Content requirement

Increase of local

content to 50%

Abolishment of local content

FTANegotiation

AFTA Tariff reduction

to 0%

Regulation Deregulation Higher competitionLiberalization

Vehicle Assembly Asian Car Global Car

Country Competition Regional Competition Global Competition

Company PC 1 TON P/U CV TOTAL1. TOYOTA 200,000 200,000 50,000 450,000

2. ISUZU - 180,000 20,000 200,0003. MITSUBISHI 50,000 100,000 20,200 170,2004. AUTO ALLIANCE (Ford& Mazda)

2,700 132,300 - 135,000

5. HONDA 120,000 - - 120,0006. GENERAL MOTOR 20,000 95,000 - 115,0006. NISSAN 33,200 66,400 2,400 102,0008. HINO - - 28,800 28,8009. DAIMLERCHRYSLER 16,300 - - 16,30010.YMC Assembly 12,000 - - 12,00011. BMW. 10,000 - - 10,00012. VOLVO 10,000 - - 10,000

TOTAL 474,200 773,700 121,200 1,369,100

1.2 PRODUCTION CAPACITY IN 20051.2 PRODUCTION CAPACITY IN 2005

P/U Ratio = 58%Local Content = 80-90%

P/C Ratio = 33%Local Content = 30-70%

1.3 Market ratio1.3 Market ratio

ForeignJoint Venture

LOCAL SUPPLIERS

Pure Thai 354

ThaiMajority

68

ForeignMajority

287

LEs

SMEs

Assemblers12 Companies

Tier 1709 Companies

Tier 2&31,000

Companies

1.4 Industry structure1.4 Industry structure

16% 8%

GDP EMPLOYMENT

Auto Auto IndustryIndustry Auto IndustryAuto Industry

Contribution of Auto Industry to Thai EconomyContribution of Auto Industry to Thai Economy

Manufacturing SectorManufacturing Sector

612

750

928

327

411

459

584

389434

525 559

158

449533

626

409

144

571

485589

363

296

218262

229

332

233180

42

175152130

6614821

0

100,000

200,000

300,000

400,000

500,000

600,000

700,000

800,000

900,000

1,000,000

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005(1-7)

Production Sales Exports

Unit1.5 1.5 Production, Domestic sales and ExportsProduction, Domestic sales and Exports

(Ranking compared with other products)

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

2001 2002 2003 2004 2005(1-7)

Million US$Million US$

No.1 Computer 9,320No.2 Vehicles & Parts 5,681

No.4 Rubber 3,432No.3 Circuit Board 4,974

No.5 Plastic 3,132

1.6 Thai Export Value1.6 Thai Export Value

Country NO. Productions NO. Sales

U.S.A. 1 11,907,588 1 17,294,805JAPAN 2 10,515,698 2 5,844,327GERMANY 3 5,530,129 4 3,563,860CHINA 4 5,056,715 3 5,061,180KOREA 5 3,470,119 14 1,091,577SPAIN 6 3,011,010 8 1,891,383FRANCE 7 2,756,920 7 2,473,312CANADA 8 2,669,961 10 1,575,590

BRAZIL 9 2,206,189 9 1,578,775UK 10 1,856,057 5 2,957,200MEXICO 11 1,567,337 13 1,114,099INDIA 12 1,511,171 12 1,343,779RUSSIA 13 1,392,646 11 1,376,273ITALY 14 1,060,171 6 2,522,737THAILAND 15 928,081 17 626,026TURKEY 16 820,135 16 757,092

1.7 World Productions & Sales Ranking in 20041.7 World Productions & Sales Ranking in 2004

and will celebrate One Million

Productions in December

In 2005In 2005 Thailand will rank No.14 in

Production and No.17 in

Domestic sale

1.8 Productions, Domestic Sales and Exports in 20051.8 Productions, Domestic Sales and Exports in 2005

Production, 1,180,000

Domestic Sale,

680,000 Export, 500,000

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

2005

Company 2005 (units)

TOYOTA 150,000

MITSUBISHI 100,000

FORD & MAZDA 65,000

GENERAL MOTORS

50,000

ISUZU 50,000

HONDA 40,000

OTHERS 30,000

TOTAL 500,000

EXPORT FORCAST 2005FORCASTING, 2005

II. Where will we go?

Detroit of Asia’s TargetDetroit of Asia’s Target

Being 1 ton P/U production base of the world

Being the production base of motorcycle

Being the production base of OEM and REM parts

Production 1.8 million units with export 40% in 2010

III. How to go?

3.1 AHRDPAHRDP(Automotive Human Resource Development Project)(Automotive Human Resource Development Project)

Objective : To enhance competitiveness in term of price, quality and delivery: To Improve the following: - Engineering capability - Mould & Die-making capability - Manufacturing capability (Plastic/ rubber, Casting, Machining,Stamping)

(Joint project among Jetro, JCC,TAI, FTI)

3.2 R&D and Training Fund3.2 R&D and Training Fund

R&D TRAINING

FUND

Car assemblerswithdraw for • Oversea & Domestic training • Scholarship• R&D

90%90%

10%10%

SMEs withdraw for • Training • R&D

SOURCE OF FUNDSOURCE OF FUND• CAR ASSEMBLERS• PART MAKERS

100%100%

R&D and Training fund will be managed by term committee

THAILAND(Pop ~ 64.8 million)

AMERICA(Pop~292 million)

BAHRAIN(Pop 0.9 million)

BIMSTEC

AUSTRALIA(Pop ~ 20 million)

CHINA(Pop~ 1,300 million)

PERU(Pop~ 28 million

INDIA(Pop~ 1,000 million)

JAPAN(Pop~127 million)

NEWZEALAND(Pop ~ 4 million)

AFTA(Pop ~ 500 million)

To expand additional

market

3.3 Free Trade Agreements3.3 Free Trade Agreements

10 % increaseIn export

15%

0%

0%

2%

4%

6%

8%

10%

12%

14%

16%

2004 2005

30 % increasein export

5%

0%

0%

1%

1%

2%

2%

3%

3%

4%

4%

5%

5%

2004 2005

Tariff reductionTariff reduction

Tariff reduction

Tariff reduction

3.3 Free Trade Agreement : Australian Tariff Reduction

The opportunities for Automotive IndustryThe opportunities for Automotive Industry

I. Enhancing trade in vehiclesI. Enhancing trade in vehicles

1. The Australian and Thai vehicles are complementary. There are global platform

similarities and both use the right hand drive format.

2. Thailand is a centre for light commercial vehicles production (Detroit of Asia).

3. Australia has a competitive advantage in large car production.

4. The trade expansion would be expected to affluent rise as a result of the tariff reduction.

The opportunities for Automotive IndustryThe opportunities for Automotive Industry

1. There will be trade exposure potential for exports and sales under TAFTA.

2. Improving the economies of scale via production increases as well as cost

reduction from cheaper raw material ex: steel, copper, aluminum etc.

II. Enhancing trade in Auto componentsII. Enhancing trade in Auto components

The opportunities for Automotive IndustryThe opportunities for Automotive Industry

1. Enhancing in the service in the area of training, technology transfer, Design & Engineering Alliance, Mold

& Die making or plastic injection ,etc.2. Labor and services are able to move easier under the

TAFTA. Leading to export engineering, design and technical expertise.

3. There are motor vehicle service, repair opportunities in the aftermarket sector and also auto part reconditioning .

4. BOI offers more privilege for the auto industry.

III. Enhancing in Services and InvestmentIII. Enhancing in Services and Investment

Japan-Thailand Economic Partnership AgreementJapan-Thailand Economic Partnership Agreement

I. AutomobilesI. Automobiles

80% 75% 70% 65%Passenger car Exceed 3,000 cc. 60%

2005 20092007 20082006

Passenger car less than 3,000 cc.

Renegotiation will commence on a date to be agreed upon before signing

A political declaration on automobile will be issued at the time of signing JTEPA

Japan-Thailand Economic Partnership AgreementJapan-Thailand Economic Partnership Agreement

II. Auto partsII. Auto parts

The tariff rate will be reduced to 20% and maintained before eliminate in 2011

Tariff over 20%

Tariff at 20% and below

The tariff rate will be maintained and eliminated in 2011

Sensitive (5 items)

The tariff rate will be maintained and eliminated in 2013

Japan-Thailand Economic Partnership AgreementJapan-Thailand Economic Partnership Agreement

III. Iron and steel productsIII. Iron and steel products

Some products will be eliminated on the effective date.The others will be abolished, at latest, by the first day of the 11th year after the entry into effect.For some specific hot rolled coils and plates, zero tariff quota scheme will be established and theirQuantity will be reviewed annually.

IV. Why’s Thailand

4.1 Nine Government policies in 20054.1 Nine Government policies in 2005

1. Poverty Eradication Policy2. Human development policy and quality of life3.3. Economic restructuring policy to create equilibrium Economic restructuring policy to create equilibrium

and competitivenessand competitiveness4. Natural Resources and Environmental policy5.5. Foreign policy and international economic policyForeign policy and international economic policy6.6. Policy on the development of the legal system and Policy on the development of the legal system and

good governancegood governance7. Policy to promote democracy and civil society

process8. National security policy9. Policy according to directive principles of

fundamental state policy

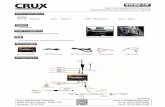

ANNUAL PRODUCTION CAPACITY

1.2 MILLION UNITS

< JAPAN >Toyota+ R&D CenterHonda + R&D Center

Isuzu,Mitsubishi,Mazda,Hino, Nissan,

< EUROPE >Citroen, Peugeot,Volkswagen

,BMW, Volvo ,Daimler

< USA >Ford + Asia Pacific HQs GM + Asia Pacific HQs

Chrysler

4 4.2 Global Brands in Thailand4.2 Global Brands in Thailand

America 2 persons / unit

Japan 2 persons / unit

Malaysia 5 persons / unit

Singapore 6 persons / unit

Thailand 10 persons / unit

Philippines 30 persons / unit

Indonesia 60 persons / unit

Vietnam 300 persons / unit

Possibility for expansion potentialPossibility for expansion potential 4.3 Car ownership4.3 Car ownership

Government

Political stability liberalization policy Attractive government

incentives

Infrastructure

Good & Massive infrastructure network( Electricity ,Telecommunication , Air ports , Ports )

4.4 Why Thailand4.4 Why Thailand

Market Considerable market size Large production base for pick up truck Gateway to 500 million people of ASEAN

Supplier

Rich pool of supporting industries Good access to raw materials Cheaper parts manufacturing cost

4.4 Why Thailand4.4 Why Thailand

People

Abundant of quality labor forces

Language proficiency Hospitality and friendly attitude

Amenity

Delicious foods and fruits Attractive tourist places Plenty of golf courses

4.4 Why Thailand4.4 Why Thailand

1. Mirror Set

2.Glass set

4.5 Low Cost & Competitive Market4.5 Low Cost & Competitive Market

3.Stamping part

4. Insulator Set

4.5 Low Cost & Competitive Market4.5 Low Cost & Competitive Market

5.Rubber Set

6. Interior Set

4.5 Low Cost & Competitive Market4.5 Low Cost & Competitive Market

DIESEL GASOLINE

7. Engine Set

4.5 Low Cost & Competitive Market4.5 Low Cost & Competitive Market

INSUFFICIENT COMPONENTS PRODUCED IN THAILANDINSUFFICIENT COMPONENTS PRODUCED IN THAILAND

• Passenger Car Engines• Fuel Injection Pumps*• Transmissions• Differential Gears• Injection Nozzles*• Electronic Systems• Electronic Control Units• Turbo Chargers*• Substrates for Catalytic

Converters• Anti-Lock Brake Systems• Training Service• Design & Engineering • Mould & Die Making• Plastic injection

Opportunity to Opportunity to invest invest

in Thailand!!in Thailand!!

4.6 Opportunity for Auto Industry4.6 Opportunity for Auto Industry

* New investment

PARTS MANUFACTURERED IN THAILANDPARTS MANUFACTURERED IN THAILAND

• Engine- Diesels, Motorcycles

• Engine Components- Starters, Alternators, Pumps, Filters, Hosed, Gears, Flywheels

• Body Parts- Chassis, Bumpers, Fenders, Hoods, Door Panels

• Brake Systems- Master Cylinders, Drums, Disc, Pads, Linings

• Steering Systems- Steering Wheels, Gears, Columns, Pumps, Linkages

• Suspensions- Shocks, Coils, Ball Joints

• Transmissions- Gears, Casings, Rear Axles, Drive Shafts, Propeller Shafts

• Electrical / Electronic- Alternators, Starters, Speedometers, lamps, Motors, Flasher Relays

• Interiors / Exteriors- Seats, Mats, Weather Strips, Console Boxes

• Others- Windshields, Seat Belts, Radiators, Wheels, Compressors

4.6 Opportunity for Auto Industry4.6 Opportunity for Auto Industry

BRIGHT FUTURE

GOVERNMENT

SUPPORT

EFFORT OF THE

PRIVATE SECTOR

POTENTIAL BUSINESS GROWTH FOR NEW/EXISTING

INVESTORS

PRODUCTION

VOLUME INCREASE

100%

LOCALIZATION

+ +

THAILAND

4.6 Opportunity for Auto Industry4.6 Opportunity for Auto Industry

Vielen vielen DankVielen vielen Dank